Gold and silver are having one of their best days in quite some time, while the mining indices GDX and GDXJ are underperforming. Why is this…? When gold and silver is up 1.5% and 2.0% respectively, the rule of thumb is for miners to be...

Continue reading » April 11, 2017 admin Gold, Gold & Silver Stocks, Silver, Silver & Guld No Comment Company profile: Dolly Varden Silver Corp. Fully diluted market cap: 20 MUSD (April 10) Fully diluted share count: 43.3M Number of projects: 2 Flagship project: “The Dolly Varden Project” Project size: 8,800 hectare (wholly owned, 2% NSR) Main product: Silver Grade: High (300gpt+) Bi-products: Lead &...

Continue reading » April 11, 2017 admin Gold & Silver Stocks, Horseman's Portfolio 3 Comments With my main thesis that we are in the beginning stages of a precious metal bull market, my portfolio has a slight overweight towards primary silver companies (although few actually have more than 50% of their revenue from silver at these prices). This focus on...

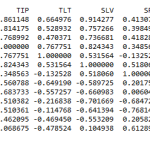

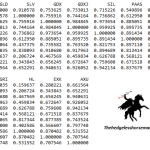

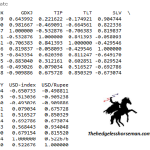

Continue reading » April 9, 2017 admin Gold & Silver Stocks, Horseman's Portfolio No Comment I was interested in examining the changes in cross-asset correlations for the months leading up to the elections versus the correlations after the election, ergo before and after “The Trump Hype” aka “The Reflation Trade”. Additional background reading: “Morgan Stanley: A ‘correlation crash’ is happening in...

Continue reading » April 8, 2017 admin Gold, Gold & Silver Stocks No Comment Gold futures are currently trading just above the it’s very significant 200 Day Moving Average: As you can see in the graph above, the 200 daily Moving Average has been a very important support/resistance point for gold in the last couple of years....

Continue reading » April 7, 2017 admin Uncategorized No Comment Gold & silver are up about 1% on the disturbing news of a US missile launch into Syria. This is an especially dangerous situation since there are Russian military assets on the ground in Syria. In the case of casualties for one of...

Continue reading » April 7, 2017 admin Market Flash No Comment In this post I will present correlation tables for gold and silver along with different mining indices and a few of the most well known “primary” silver mining companies. Correlations for the 5 months leading up to the US election day: Correlations from...

Continue reading » April 6, 2017 admin Gold & Silver Stocks No Comment I decided to add the currency of the worlds biggest or at least second biggest gold consumer, and the biggest silver consumer to my correlation table, namely the Indian Rupee (INR). One would think that the strength of India’s currency, ergo the international purchasing power...

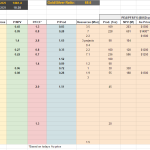

Continue reading » April 5, 2017 admin Silver & Guld No Comment Below is a snapshot from one of my spread sheets I use for comparisons in regards to gold developers and explorers. The valuation data is updated automatically every 2 minutes or so (Gold/silver price, stock price and exchange rate). I may be putting some documents online...

Continue reading » April 4, 2017 admin Silver & Guld 1 Comment I was interested to see what the correlation was between different assets and asset classes during the period from when gold topped 2011, to when it bottomed 2015. I just had to include the Yen (USD/JPY) since more and more people are noticing its seemingly...

Continue reading » April 3, 2017 admin Silver & Guld 2 Comments