FireFox Gold Corp (FFOX.V): Micro Cap Explorer Who is Currently Drilling in The Hottest Area Play in Finland

Some might be aware of a company called Rupert Resources which is a junior explorer that is exploring for gold in Finland. Earlier this year the company made a discovery and the Market Cap went up more than 550% percent as a result. Now, Rupert Resources already had a decent Market Cap to begin with so the ensuing rise in share price has put the Market Cap at an impressive C$910 M. In other words the company has been very richly rewarded for its new discovery in the Central Lapland Greenstone Belt (“CLGB”), Finland.

Well, there is a junior called Firefox Gold which owns a large swath of land in the very same belt as Rupert Resources and it currently has a tiny Market Cap of around C$13 M (US$ 10 M) and 62% of the shares are in strong hands. With around C$2.1 in cash the Enterprise Value is a miniscule C$11 M (US$8 M) at C$0.16/share.

My Case For FireFox Gold in Short

FireFox Gold is a true high risk/very high reward case. Well, given the incredibly low valuation I’m not sure the typical “high risk” classification is fair, even though it is a grassroot explorer, since I have a hard time seeing it get much cheaper almost regardless of what happens in the short term. On that note I think it’s worth noting that FireFox has turned down all approaches made by larger companies so far which I take as a sign of confidence. I think it also signals how cheap the company really is because I think they could have done a JV or two which would imply quite a bit higher value than the current Enterprise Value. In other words I think the company could totally miss on multiple targets and still be able to do deals that would imply a higher value than the current Market Cap if they wanted to. The company really is that cheap and they got a huge land position in Finland which includes a commanding land position in the hottest region of the Central Lapland Greenstone Belt. The company has several targets already, at different stages, and it was just announced that; “FireFox Gold Initiates Fall Diamond Drilling Program at Finland Projects” and on November 10 we got a NR saying “FireFox Gold Expands its Property Position and Commits to Additional Drilling in Northern Finland”

Given the success of Rupert Resources it suggests that FireFox would be richly rewarded if they find something in Finland. In other words the company needs to be “lucky” once and it could result in a >10 bagger from these levels. Thus, one does not need to have a big position for FireFox to be able to have the potential to make a difference, in case they strike big.

Firefox has a lot of smart institutional investors involved and the technical team is very impressive which includes Quinton Hennigh, Patrick Highsmith (ex Newmont, BHP, Rio Tinto etc), Petri Peltonen (ex First Quantum etc) and Richard Goldfarb who is pretty much THE world expert on Orogenic Gold exploration. CEO Carl Löfberg is a native Fin and is well connected which obviously helps a lot. It is also worth noting that contrary to what some might think FireFox is not a latecomer to the Finland party but actually picked up most of the ground quite early.

Lastly, Finland was ranked as the #2 jurisdiction in the world, just beaten by Western Australia, in the 2019 Frasier Institute Survey.

Bottom Line:

When a company really can’t get much cheaper, the risks are skewed to the upside by default, which translates to fantastic risk/reward. And when one factors in the tight share structure, and the fact that the projects are located in the #2 jurisdiction in the world, the upside potential is rather unique. This heavily skewed risk/reward scenario is why I have bought shares for myself and others. To catch Rupert Resources the Market Cap of FireFox has to go up 70X. To catch its other neighbour, which is another early stage junior explorer called Aurion Resources, it would have to go up over 8X.

Risk is overpaying for something (Buying potential that is priced in already) that ends up not being true. What is priced into FireFox…?

Catalysts:

- Currently drilling

Snippet from the latest news release:

Winter Till Sampling and Drilling

Following the completion of the ongoing diamond core drilling program at its Mustajärvi and Jeesiö Projects (see FireFox news release dated November 3rd, 2020), the Company intends to launch a combined bottom-of-till (BOT) sampling and scout diamond core drilling program at Jeesiö. BOT sampling has been a key discovery strategy in Lapland for exploring beneath deeper glacial sediments, and Rupert Resources has employed it to high-profile success at Ikkari. The FireFox team is excited to deploy this new hybrid BOT – core drilling technology and expects to add significantly to its planned meterage for core drilling during the winter of 2020-2021.

Setting The Scene: An Emerging Gold Belt in Finland

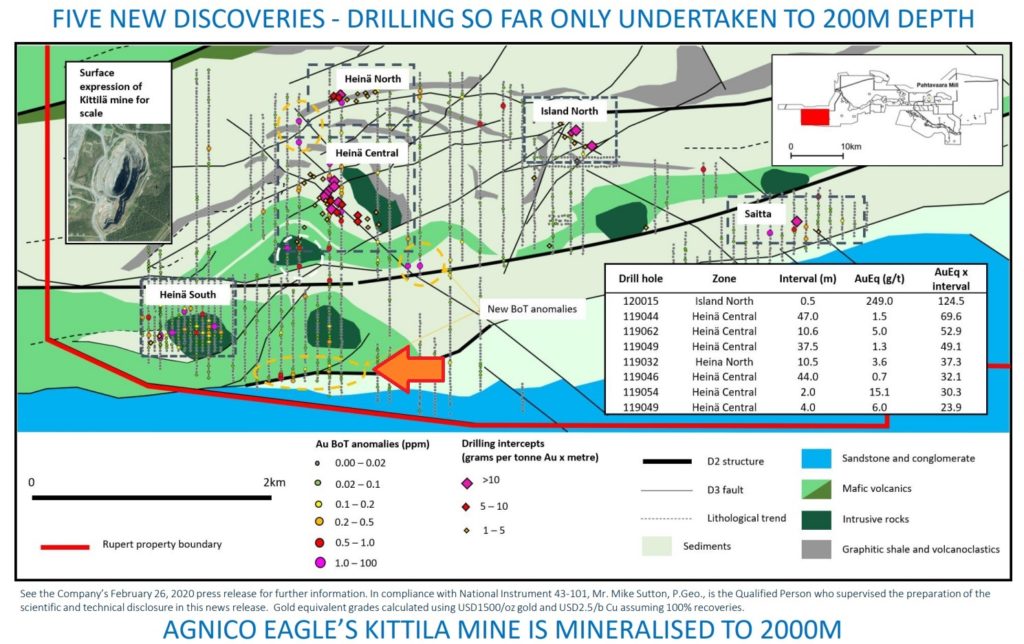

Rupert’s Ikkari discovery NR:

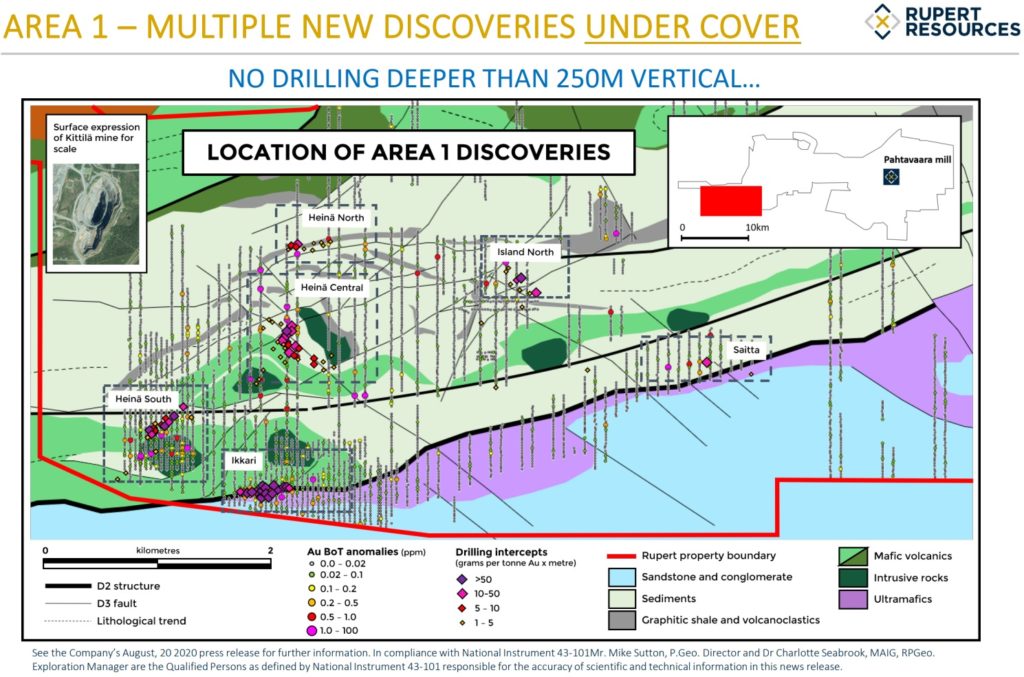

“The Company has drilled a significant gold hosting structural zone at a newly identified target called Ikkari. The target was identified using base of till sampling at Area 1, a 5km long highly prospective section of a regional domain-bounding structure, 20km of which is contained within Rupert’s contiguous land holding”

What it looked like prior to discovery:

… I have added an arrow that points to what started out as just a smallish Au BoT anomaly that contained a few high grade hits. In other words very subtle and not something that might raise many eyebrows. Anyway, fast forward a couple of months and several hundreds of millions in Market Cap and it looks like this:

It’s pretty much that little cluster of drill intercepts at the “Ikkari” target that led to this:

The reasons I am pointing all of this out are:

- A smallish Au in till anomaly can hide something very big

- Rupert Resources shows that success in Finland, which is truly a tier #1 jurisdiction, gets richly rewarded by the market

Enter Rupert Resources

1. Big Picture

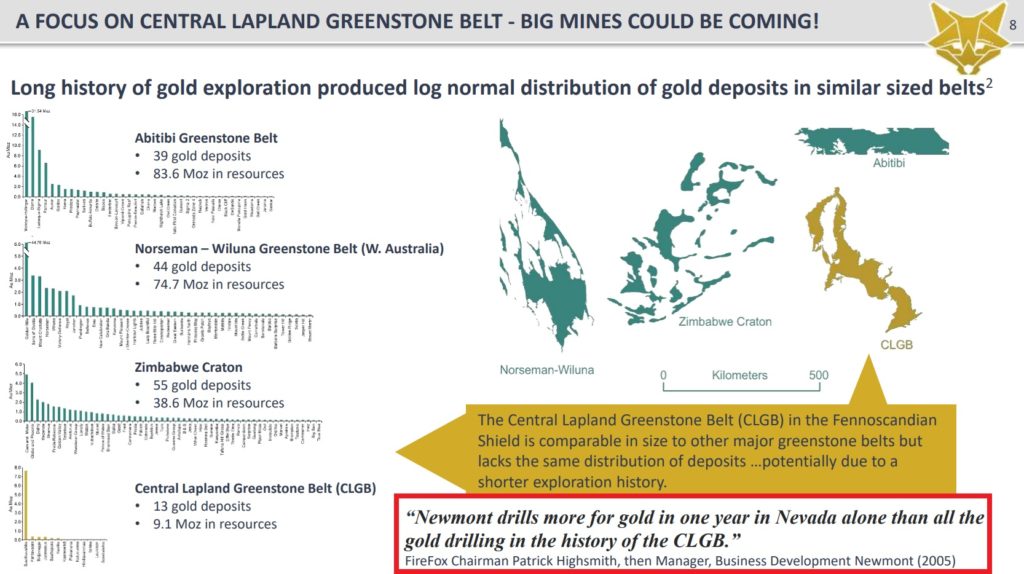

First things first. The Central Lapland Greenstone Belt (“CLGB”) is one of the least explored Archean Greenstone Belts in the world, and by some margin:

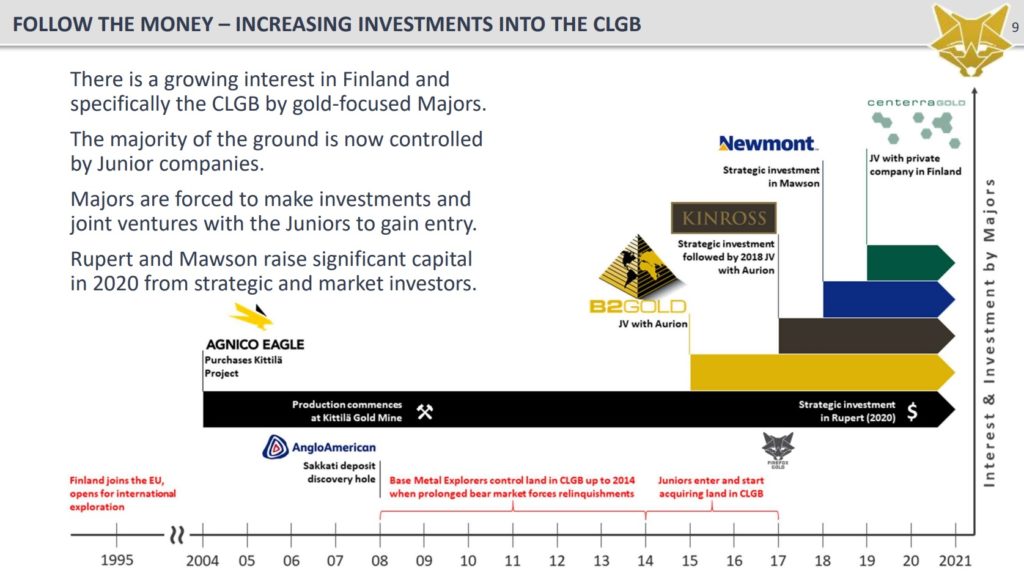

“It has barely just begun” would be a fair statement and things have been heating up in the last couple of years (even before Rupert Resource’s Ikkari discovery):

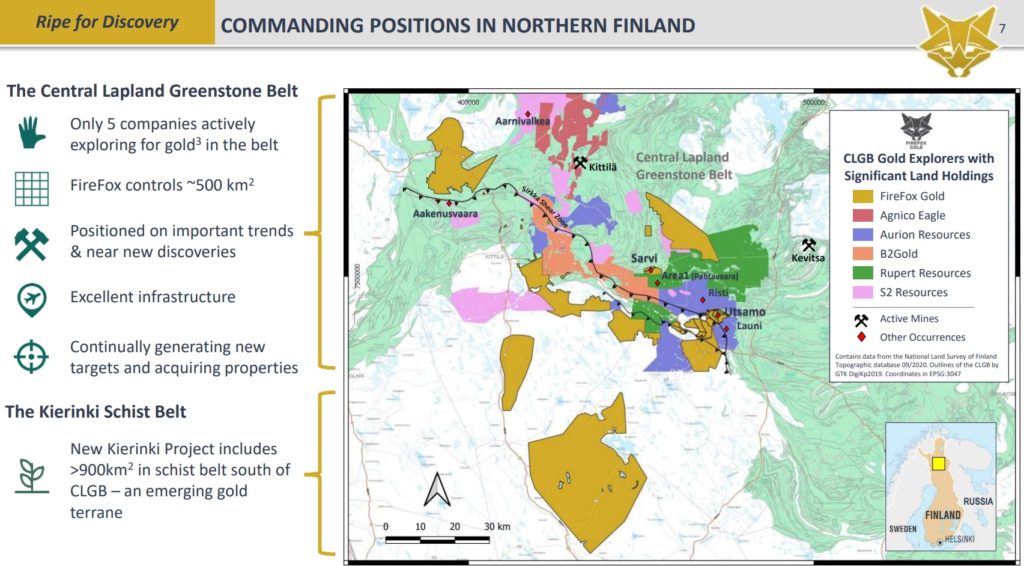

As a result the hottest area of the CLGB is pretty much all tied up with some notable players involved:

In other words we got Agnico Eagle and B2Gold who are directly involved here. On top of that there are public and private companies in the region which have seen majors such as Newmont (from Goldcorp), Kinross and and Centerra take either JV and/or take equity positions in smaller companies. Furthermore the slide above shows that FireFox has a commanding land position in this part of the CLGB.

2. FireFox Projects

2.1 Mustajärvi

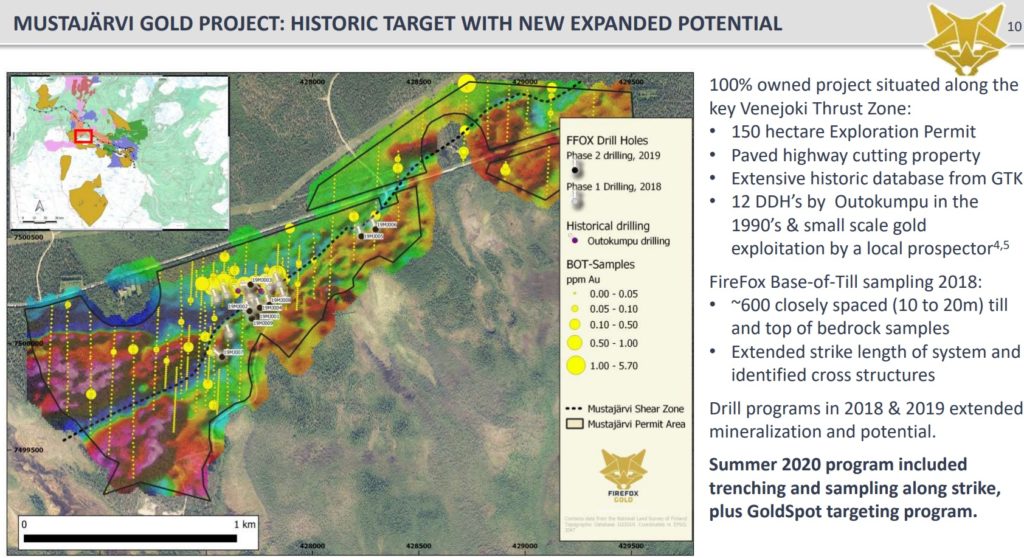

The first project to look at is one of the two where a drill should soon be turning. It’s called the Mustajärvi Project and it has some obvious BOT Au anomalies as well as some historic drilling that hit gold:

It’s obviously one of the smaller projects in terms of sheer claim size but it’s worth noting, again, that the current strike of Rupert Resource’s Ikkari discovery is “just” 550 m. If we take a closer look we see this:

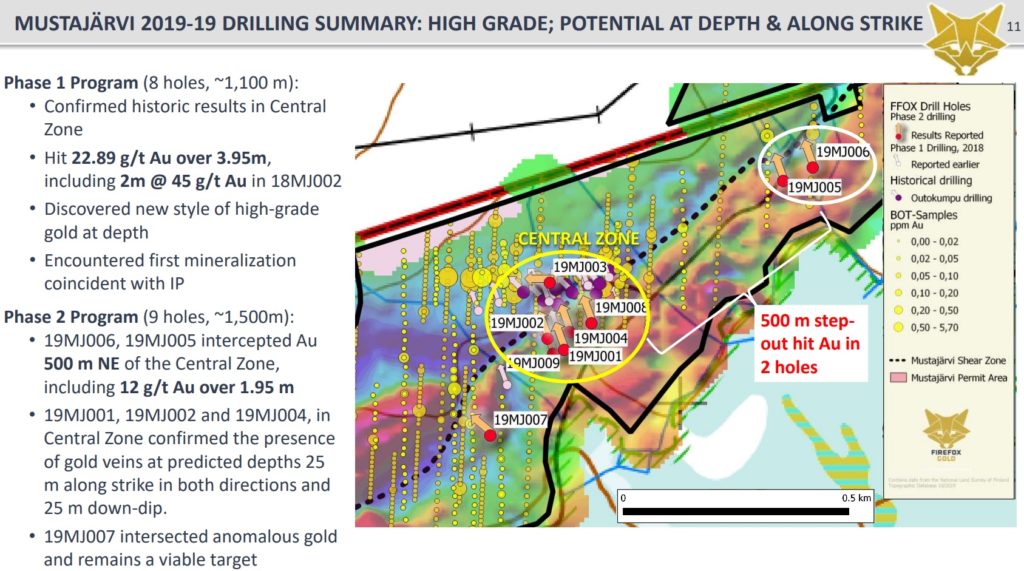

According to the BOT-samples there is obviously something going on here and high-grade gold has been confirmed in limited drilling. The two 500 m step out holes also hit gold. The following statements are from the NR on November 3 and described the drill plan at this target:

(Bold added by me)

“The recently launched drill program will target structural, geochemical and geophysical targets in areas that have not seen drilling in the past. The total amount of drilling planned is between 1,300 and 1,400 metres split between three target areas.

Target area 1 is located in the western part of the license, approximately 900 metres southwest from the known mineralization. The target is associated with a rheologically competent gabbro which offers a strong contrast with the surrounding rocks. The competent gabbro appears to have accommodated deformation by fracturing, and it is located at an intersection of regional structures observed in magnetics, the southwest continuation of the Mustajärvi Shear Zone and northwest-striking D3 faults. This target area is also associated with anomalous gold, tellurium, and bismuth in till.

Target area 2 is located on the northern side (footwall) of the main Mustajärvi mineralization where anomalous till values (elevated gold, tellurium, and bismuth) are closely associated with geophysical conductors parallel and in close proximity to known auriferous lodes. The alteration is interpreted to extend north into metasedimentary rocks known to host gold elsewhere in the belt.

Target area 3 occurs within a structurally complex setting in central Mustajärvi, where the main shear zone deflects, apparently influenced by crosscutting structures of various orientations. It is also coincident with a plunging Induced Polarization chargeability (IP) anomaly and gold nugget anomalies in the down-ice direction. High grade mineralization (up to 45 g/t gold over 2m) at Mustajärvi has been associated with high sulfide intervals that may be expected to yield IP anomalies.”

Will they hit something? I have no idea. I just know that if they hit anything interesting it could lead to interesting times given a) The Market Cap of FireFox and b) What happened when Rupert Resources hit something very interesting. You can find more slides on the Mustajärvi target in the presentation.

2.2 Jussiö

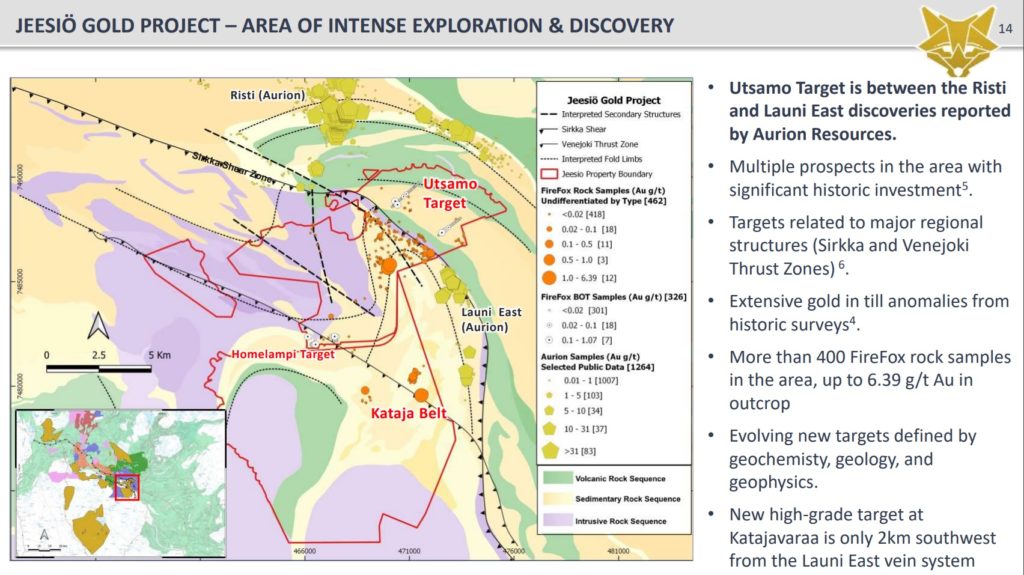

The other project which will see some drilling this fall is the Jussiö Gold Project. It’s a very large project and covers 279 km2 of “the prospective CLGB, proximal to other exciting recent gold discoveries in Finland” as per the NR:

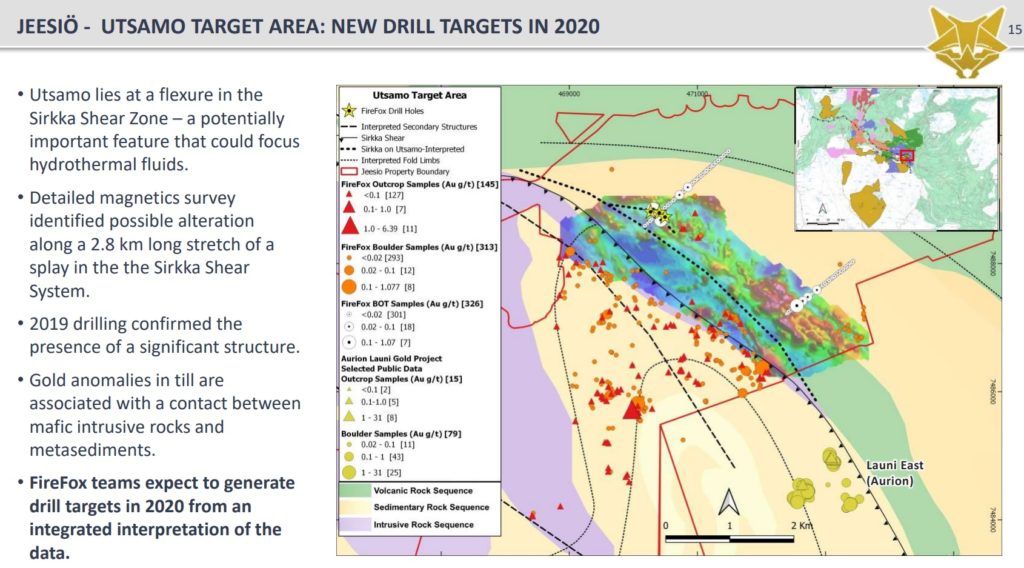

The obvious target at this stage is the Utsamo Target which is located between Aurion Resource’s Risti and Launi East discoveries. If we look closer there is “golden smoke” over a very large area at this target:

Given the size of the ground with anomalous gold values and amount of prospects I assume this target could warrant quite a bit of drilling. I think this will come after more groundwork etc has been done but FireFox plan a modest reconnaissance drilling program this fall:

The reconnaissance drill program is planned to include up to 400 metres in 3 to 4 drill holes in targets at Utsamo, near the Sirkka Shear Zone. Much of the Utsamo area is covered by swamps and thicker glacial deposits, and FireFox plans to conduct base-of-till (BOT) sampling in that area later in the winter. On higher ground to the south, FireFox geologists collected gold-bearing quartz vein samples during 2019 and 2020 in an area that will be the subject of this modest reconnaissance drilling program. The holes planned in this structurally complex area are based on new information from the 2020 UAV magnetics survey integrated with the regional electromagnetics and rock sampling data. The team has interpreted a large-scale fold in the area that hosts Aurion’s Launi gold-bearing quartz veins on the eastern limb and is cut by late faults that appear to control anomalous gold samples collected on the FireFox ground.

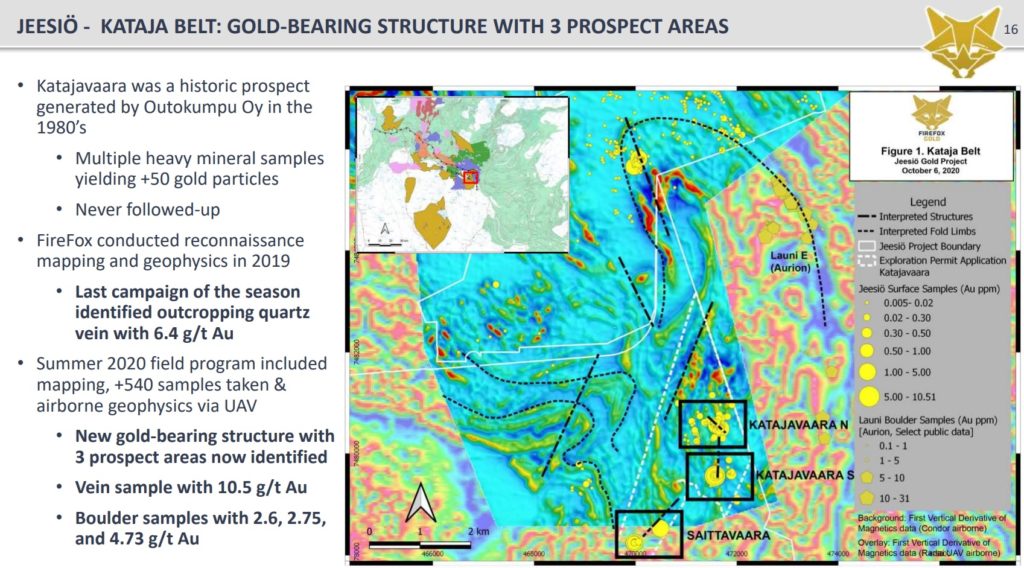

There is also three additional prospects that have been identified, farther to the south, within the Jeesiö Gold Project:

To Sum Up

The Mustajärvi and Jeesiö projects contain an abundance of obvious gold prospects that warrants further work and drilling. If one would take the current Enterprise Value (“EV”) and divide it by “only” the five currently named prospects one would get around C$2.6 M/prospect. And that’s, again, just the five currently known prospects within two of FireFox’s projects.

2.3 Additional CLGB Projects

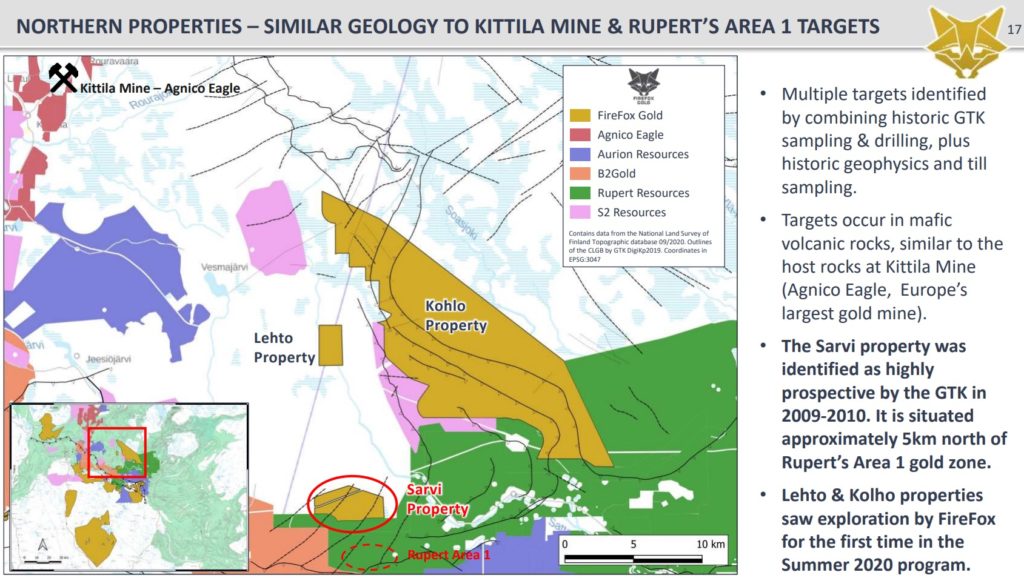

FireFox also has large land holdings to the north of Rupert Resource’s flagship project (which includes Ikkari) and south-east of Agni Eagle’s well known Kittila Mine:

… These are still quite early stage but the address is obviously intriguing and I expect more work to be done at these as soon as possible

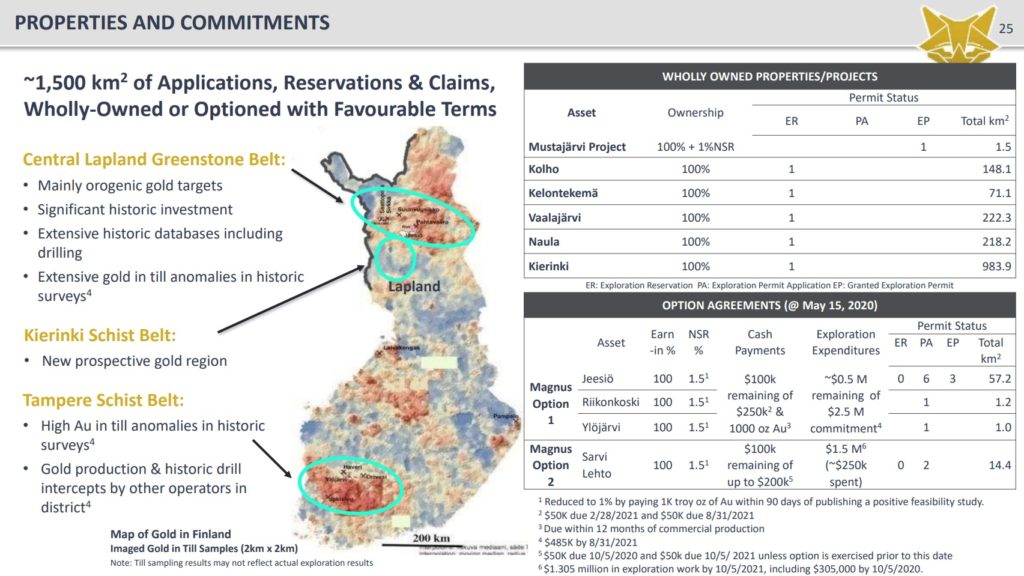

2.4 Total Land Holdings in Finland

FireFox has more projects spread around parts of Finland where gold anomalies have been identified in historic work:

The following is an excerpt from a 2019 NR and it describes the Kierinki Project in the Kierinki Schist Belt:

“The Kierinki Schist Belt is one of the least studied schist belts in northern Finland. The area was first highlighted by the government-sponsored Nordkalott Project in the late 1980´s, when one of the strongest gold-in-till anomalies in Northern Fennoscandia was recorded. In spite of such observations, the Kierinki area has only seen reconnaissance studies by the Geological Survey of Finland and has never before been explored in detail. The results of these reconnaissance studies suggest that the Kierinki Schist Belt shares the geochemical characteristics of the Rompas-Rajapalot area to the south, characterized by high gold and cobalt. The geochemical anomalies at Kierinki are also similar to mineralization associated with the Sirkka Shear Zone in the north, where there is an association between gold and tellurium.”

Bottom Line

FireFox is a true high risk/high reward story since the company does not have any resources at this point in time. With that said it is one of the cheapest juniors I know of that have such a large land package in a tier #1 jurisdiction that also seems to get hotter and hotter on the back of Rupert Resource’s Ikkari discovery. It goes without saying what a C$15 M company could do if they hit anything between “interesting” to “very interesting”. It’s not a stock I think one should bet the farm on, in hopes of potentially getting rich quick, but even a small position in a stock like this could impact ones portfolio greatly if things go well. The best part is of course that no success is priced in which then also means that any success should revalue the stock a lot higher. Given that FireFox could probably JV their large land holdings at any point in time, in deeals which would imply a value much higher than the current Enterprise Value, I see the current valuation as pretty much a cemented floor. I mean in a “worst case scenario” one could probably get ones value (and hopefully ones money) back even if they drill a few targets on their enormous land holdings and don’t hit much. As such I think it is one of the better risk/reward cases out there when it comes to grassroot exploration…

Theoretical scenario:

- Drills some and miss –> MCAP takes a small hit and stays around C$10-C$15 M

- Drills some more and miss –> MCAP still should at least hold around C$10-C$15 M

- Drills some more and miss –> MCAP still should at least hold around C$10-C$15 M

- Hit something very interesting –> Lets say it five bags to $75 M for starters (To reach Rupert it would have to go up 54X in value)

I wouldn’t got so far as to call it a perpetual call option but at the current valuation coupled with interest from majors should but this level as a pretty solid floor even from a pure 100% speculative (potential) stand point. Honestly I am a bit surprised it’s still this cheap given the jurisdiction, address, people involved and Rupert’s success.

Some TA

FireFox has been a real sleeper and the share price looks to be in a major bottoming formation. I would expect a big move (50%-100%) higher once it breaks $0.20/share for real…

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of FireFox Gold in the open market and I was able to participate in the latest Private Placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel