THH – Novo Resources (NVO.TO): “One can do a lot with ~$100 M”

In light of the transformational transaction, in regards to Novo set to become debt free and very cashed up as the sale of New Found Gold shares gets wrapped up, I thought it would timely to sum up my current view of the story. Note that this article is a snapshot in time and that it assumes the full completion of the sale and canceling of debt. Also note that these my personal opinions (Ps. Assume I am biased since I own shares and the company is a banner sponsor!)…

What is Risk/Reward?

Any stock can go to zero. That is the limit to the downside assuming no leverage of course. The cheaper something gets in absolute terms less and less is required to move the needle. When almost nothing is priced in the risks to the upside go up by default. When little to nothing of any upside scenarios are priced in it tends to coincide with incredibly bad sentiment (capitulation). The negative share price trend is expected to be stretched out to forever and people feel like anything good happening would be a miracle.

Recent “signaling” events

- Sumitomo Corporation converts Egina interest to 1.36% interest in Novo

- Executive Co-Chairman Michael Spreadborough buys 100,000 shares in the open market on May 18, 2022.

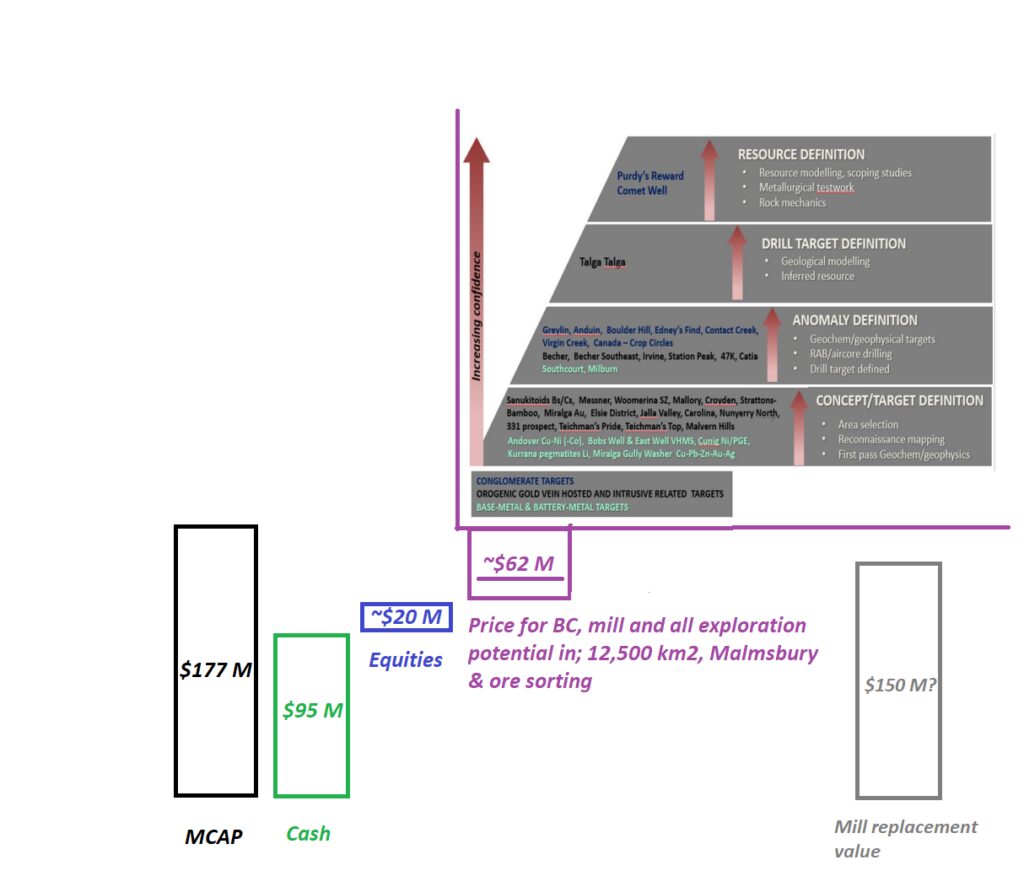

Snapshot picture:

- MCAP (@ $0.72/share): C$177 M

- Cash (Post NFG sale): ~C$95 M

- Other equities (Personal guesstimate!): ~C$20 M

- Debt (Post NFG sale): 0

- A mill and camp (Sunk costs rising with inflation):

Note that with the rising inflation worldwide there are currently a lot of developers who have seen the CAPEX for building mines blow out. In other words it would probably cost a lot more to (re)build the Golden Eagle Mill today than just a few years ago… Food for thought.

Risks:

Underperforming (net money losing) production from the Beaton’s Creek deposit since start up. Rising labor costs, tight labor market, rising costs for stuff overall and debt. Still awaiting permits for Beaton’s Creek fresh material.

Risks now vs Risks then:

Before the NFG sale Novo had some $20 M in cash and some $50 M in debt. When the NFG sale is complete and the debt paid off the company should have a cash position around $95 M and no debt. In my book risks have gone down significantly even though the BC operation itself has not changed… Yet. It is quite hard for any company to go bankrupt any time soon with zero debt and over $100 M in cash and equities. Furthermore I think it goes without saying that cancelling out all debt and getting a $95 M cash injection gives a lot more tools and breathing room to meet any and all challenges versus having debt and a much tighter budget. Unfortunately the sale of NFG obviously means that Novo shareholders will not be able to ride along the success at NFG anymore. In other words we traded indirect upside potential for a considerable reduction in direct risk as well as a reduced risk of diluting our direct upside.

Not all turnaround stories are created equal…

Take Pure Gold Mining for example. That is a conventional start up story (It has even seen 2.5 Moz of historic production to boot) that has seen a lot of start up problems. The company is currently raising over C$30 M by issuing over 266 million shares. This story might turn around but current shareholders are obviously seeing heavy dilution before that might happen… Novo will have three times that amount of cash to work with thanks to Quinton getting Novo into New Found Gold very early on. Furthermore Pure Gold Mining still has a considerable amount of debt, if I am not mistaken, unlike Novo.

Novo

- ~$95 M in cash (and equities on top)

- Debt free

Pure Gold

- >$30 M via emitting 266,000,000 additional shares

- A lot of debt

Both are turnaround stories but have completely different risk profiles for shareholders both to the upside and downside. Even if Pure Gold is successful the upside has been incredibly diluted (and might need even more dilution). Furthermore it has a lot of debt which makes bankruptcy risk very real even in the short term. Novo will have no debt (no risk of bankruptcy in the short term) as the NFG transaction closes and debt is paid off, will have a much longer runway (time), and will have a lot more tools (cash). In fact, at face value, Novo will potentially be one of the most cashed up juniors in the entire junior space. If it takes $30 M to turn around BC, or do whatever to stop the current bleed, then the future would be very bright since there would be no dilution (unlike Pure Gold).

I would also point out the upside scenarios difference between Novo and Pure Gold. Pure Gold has the “Puregold Mine” and the upside potential comes from finding more lode gold. Novo on the other hand has more types of, and amount of, targets than any junior around really. So not only does Novo look a lot less risky but one also gets a lot more upside potential “free of charge”. And the more upside potential, which is not priced in, the more costly dilution becomes by definition.

I would say that the Risk/Reward proposition in Pure Gold Mining and Novo Resources are worlds apart at face value for starters. Night and day. Yet, if I am not mistaken, the “all knowing” Mr Market puts an implied Enterprise Value (Expected MCAP + net debt) of over $200 M for Pure Gold Mining versus less than half of that for Novo. When you account for the risk and upside potential differenced it looks beyond absurd (to me at least).

Upside risks:

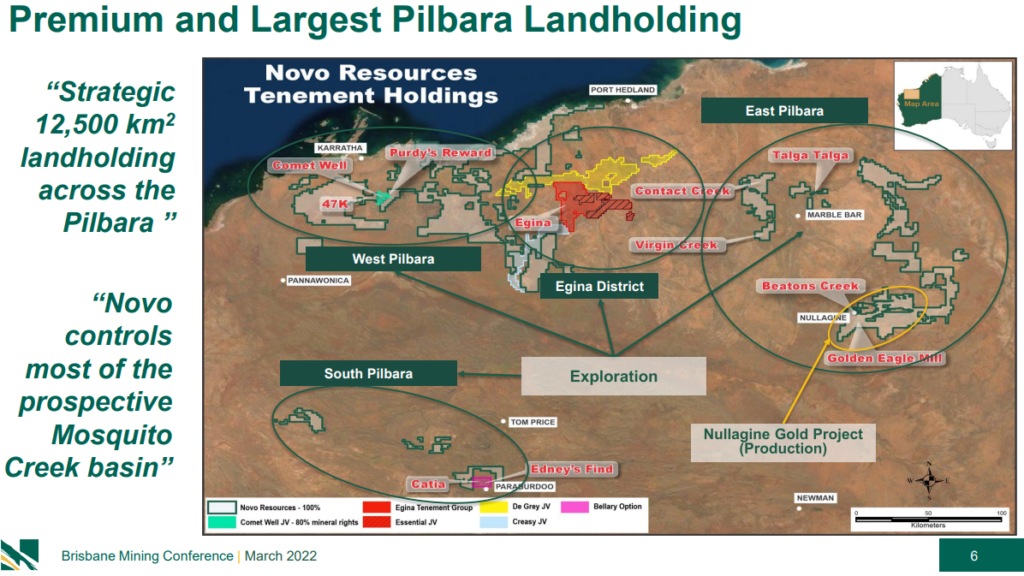

To me the case for Novo has always been about the exploration potential across the 12,500 km2 land package and not a production story solely about Beaton’s Creek (which is, and has been, the focus of Mr Market for quite some time now). Anytime sentiment is bad, whether it be sector or company specific, the focus always gets skewed towards the Risk side of the Risk/Reward calculation. This is why so few investors/speculators can stomach buying “low” since all they see are the risks. In good sentiment times, with a backdrop of rising prices, the opposite happens. People project a good past infinitely into the future, the focus gets skewed to the Reward side in the Risk/Reward calculation, since people get greedy instead of fearful.

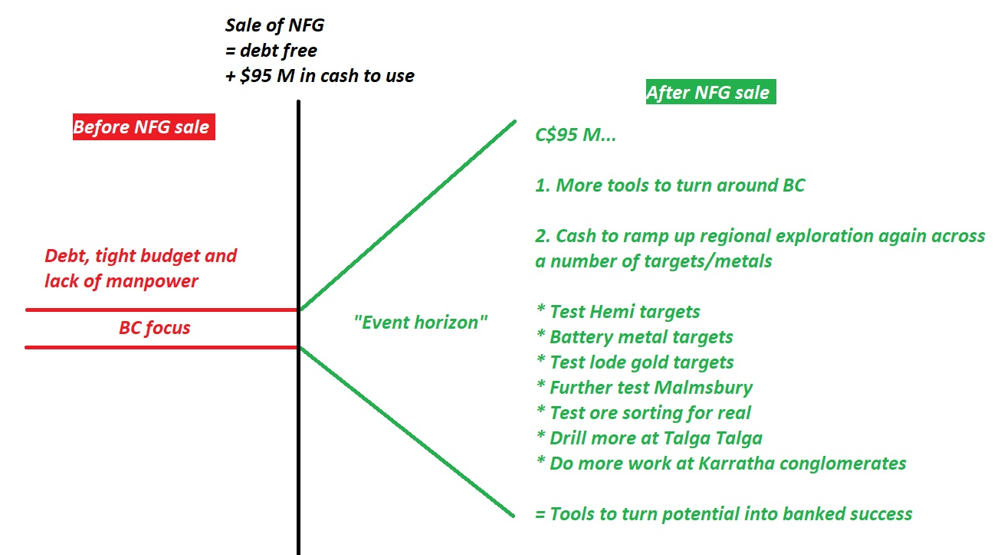

With almost $100 M in cash Novo will be able to go from just playing defense (all focus/money on BC) to play offense again (Exploring etc). Thus I see the NFG sale as highly transformational in more ways than just the reduction in risk. Novo will be able to get back to the real reason why the company amassed the 12,500 km2 land package in the first place which is to try and unlock all the inherent potential within it:

In my opinion Novo will go from playing with one and a half hands tied behind its back to playing the exploration game with more (free) hands than ever before…

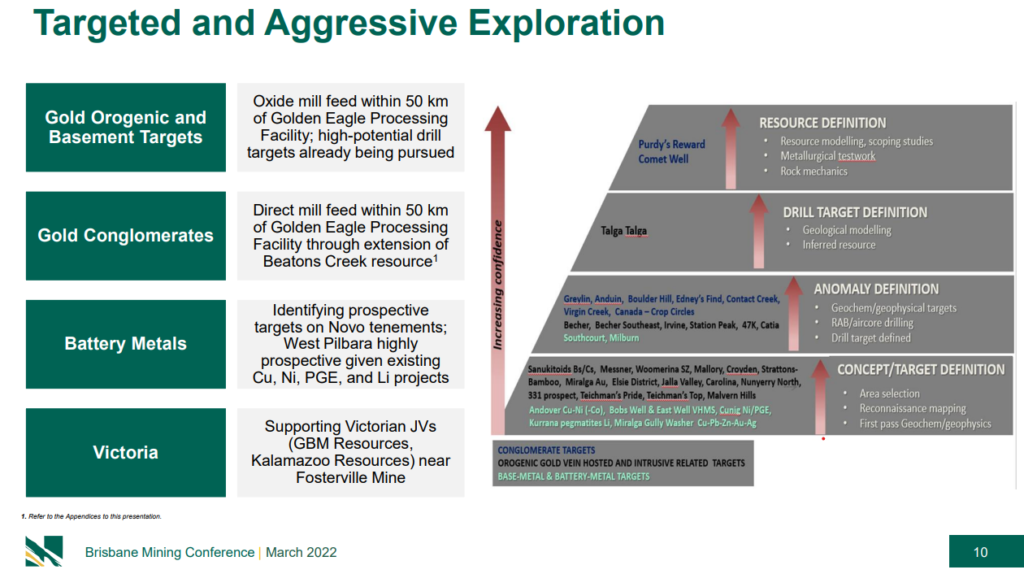

With ~$95 M in cash the following slide is therefore “suddenly” coming into play again for real (Long have I waited!):

… Maybe, just maybe, this is what has gotten Sumitomo and Michael Spreadborough a bit excited as well.

Some will of course scoff at the idea of Novo going after other metals such as Nickel, Copper and Lithium as well but for anyone paying attention especially Nickel and Lithium prices have been going absolutely bananas. To me it would make little sense not to test targets with obvious “smoke” related to any metal that has gone up considerably in price. I mean the whole point of having an immense land package in the first place is because it brings with it more potential pretty much by definition. If deposit X containing metal Y would be 3X more valuable today than just a few years ago, due to a surge in price, it greatly hikes up the Risk/Reward of exploring for it. Why? Because success is worth 3X more while the risk/cost of exploring has stayed fairly the same.

What can all that cash be spent on and what can we buy for ~C$62 M at the moment?

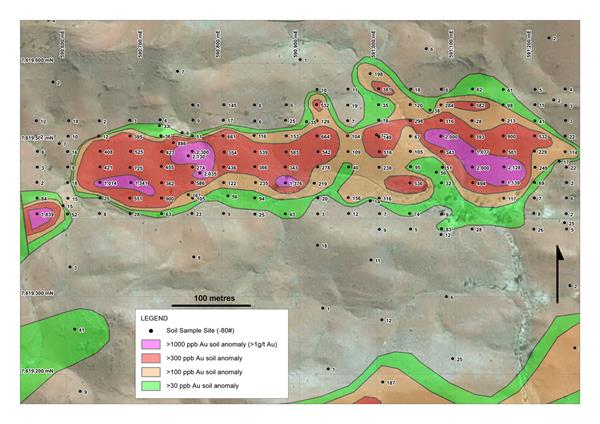

The “Nunyerry” prospect:

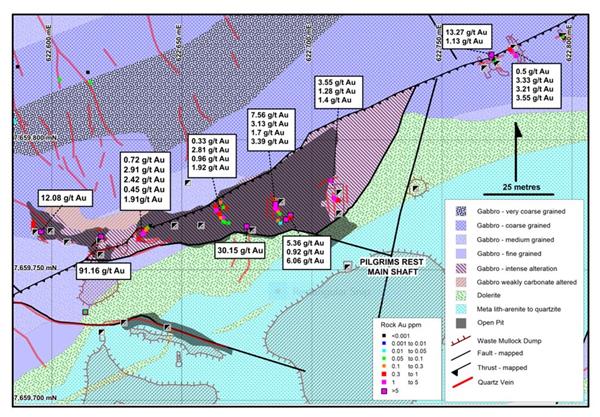

The “Pilgrims Rest” prospect:

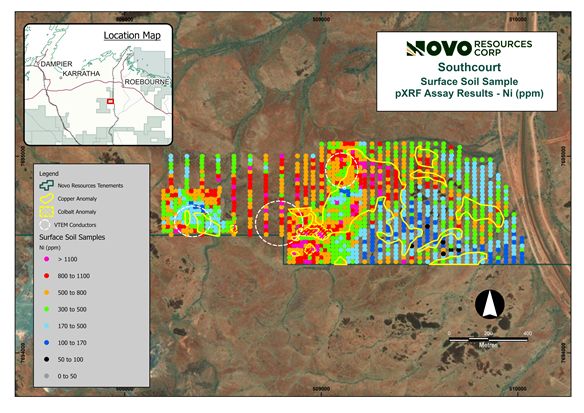

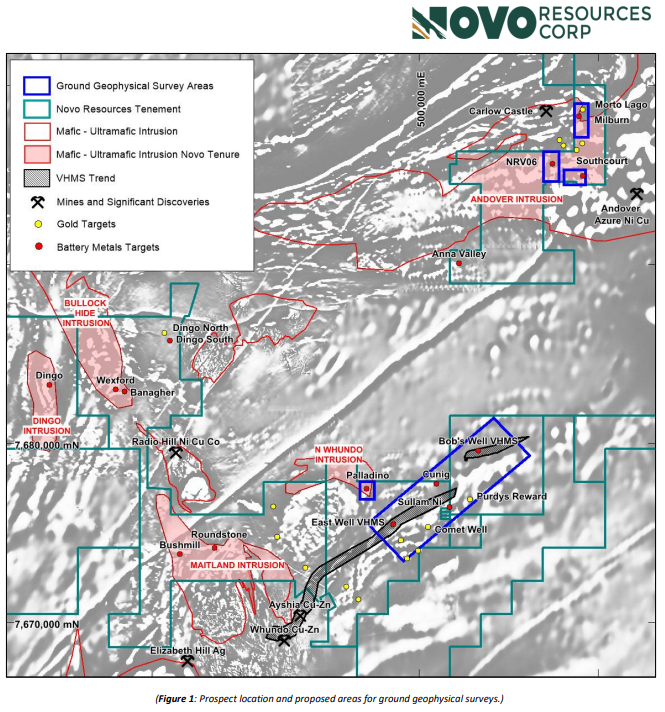

Nickel target between Azure and Artemis:

Note that this Nickel target is tucked in between two confirmed Nickel targets (Azure Mineral’s and Artemis) so this would not need to be a standalone operation which lowers the critical threshold for success. In the wake of the broad sell of in juniors, Azure Minerals currently has a Market Cap of A$90 M, and Artemis has a Market Cap of A$50 M.

Additional gold and battery metals targets in the broader area

Novo recently announced that the company’s battery metals exploration program is ramping up, with geophysical surveys already underway in preparation for a significant drill program to commence in Q3 2022:

What the odds of the company finding something significant is I have no idea. All I know is that I don’t think any chance of success is priced in and thus there is little to no downside risk in terms of value in my book. Thus if they do not find anything the cost would simple be the exploration cost and a pretty immaterial valuation cost.

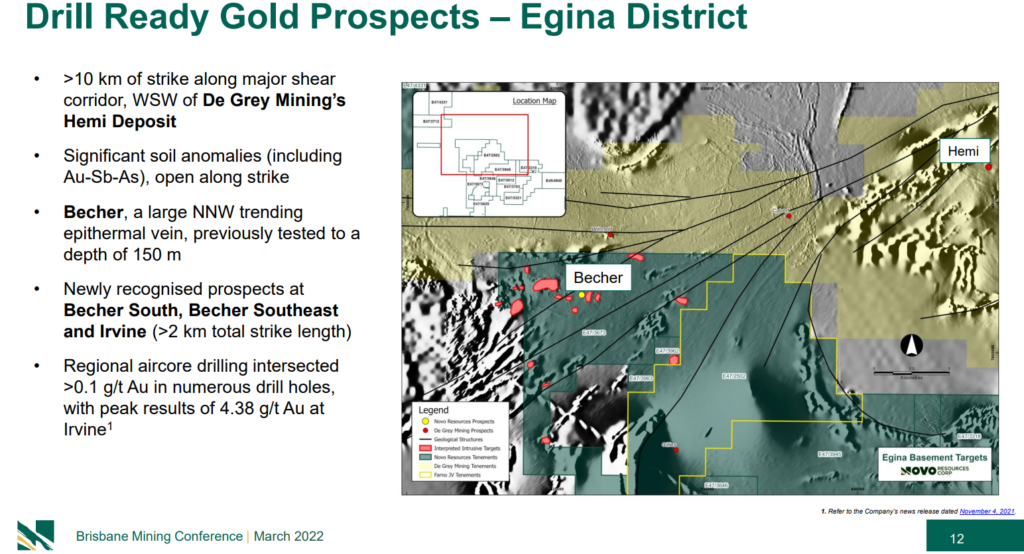

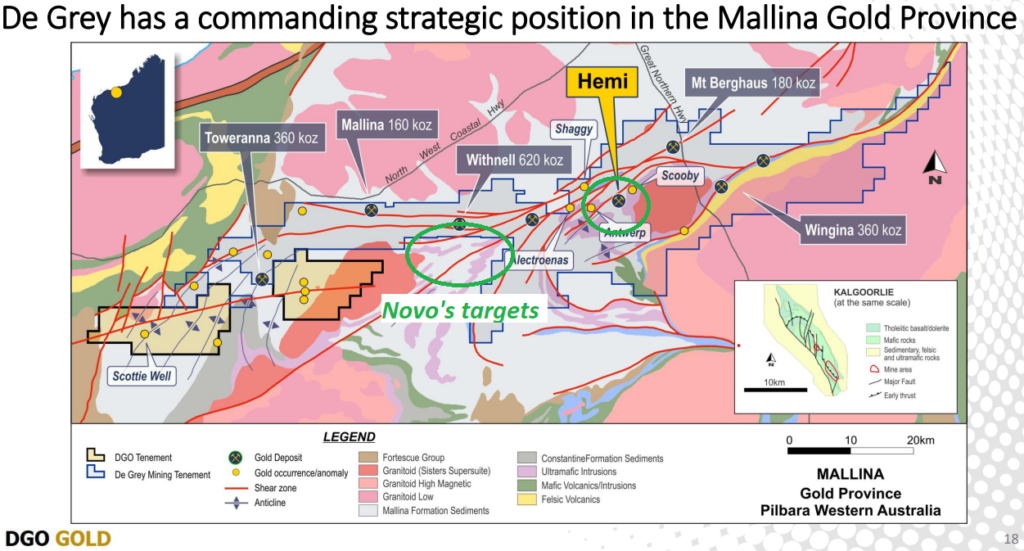

Egina: “Hemi” style targets:

DGO Gold which has a material stake in De Grey Mining (Hemi discovery) just got an offer from Gold Road Resources to be acquired for $308 M (April 04). In this next slide from DGO I have circled Novo’s targets that lie on trend from Hemi:

What are these targets worth? No idea. But we know De Grey Mining had a Market Cap of A$1.85 B last I checked. Lets say there is even a 1% chance of finding something similar than one could say these targets have an implied value of A$18.5 M. Double that chance to 2% and the implied value could be said to be A$37 M etc (Excluding any potential dilution).

Food for thought: What do you think Novo could get for those tenements if they wanted to sell or JV them?

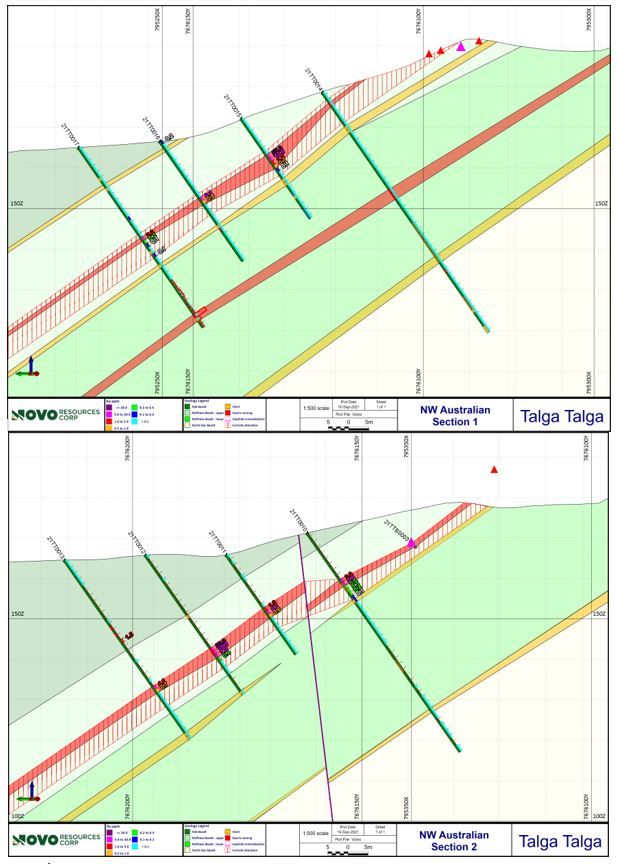

Talga Talga:

The Talga Talga prospect is located north of Novo’s Nullagine production facilities and north-east of Calidus Resources operations. It is a nuggety lode gold prospect which Novo put a few holes into last year: “High Grade Gold Intersected in First Drill Program at Talga Talga Gold Project”

- Results include 3 m at 25.5 g/t Au from 28 m, and 3 m at 23.3 g/t Au from 11 m at the NW Australian prospect

- These are significant drilling results from Novo’s expanded orogenic and brownfields exploration program

- A corridor of mineralized structures approximately three kilometres long has been defined, with the majority of the trend ready to be tested by drilling

Talga Talga might one day provide additional mill feed to the Golden Eagle mill. Especially if ore sorting works well on this nuggety gold system. Whatever the risk adjusted value might be it is not priced in anyway.

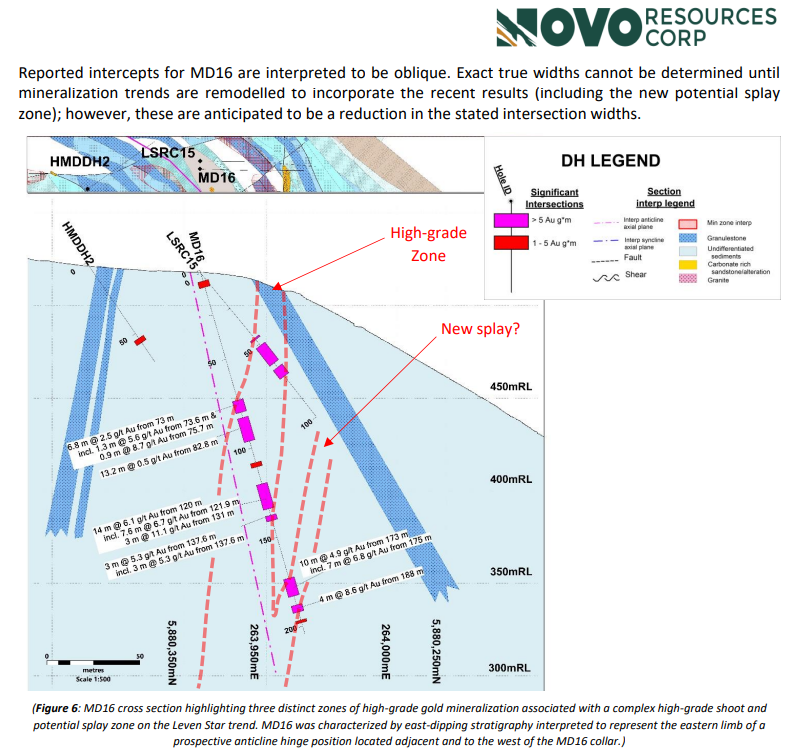

“Malmsbury”

The maiden drill campaign at the Epizonal (“Fosterville” type) gold target in Victoria has yielded encouraging results:

The best intercept from this limited, first pass, drill campaign assayed 6.1 g/t Au over 14 m (downhole length) and the same hole might have discovered a new splay zone as well:

There are a couple of more holes yet to be reported on and the second phase of drilling is expected to commence either this year or the next:

“The work program moving forward will involve a larger second phase of drilling in 2022 – 2023 in addition to an IP survey to help define sulphide rich target zones and enhanced quartz veining within the granite (IRGS) target corridor, in addition to delineating disseminated sulphide haloes around various high-priority gold reef targets. Further expansion of systematic soil geochemistry, mapping and rock chip sampling is also scheduled.” – Link

Epizonal gold systems can be notoriously nuggety and complex. Just look at how closely spaced New Found Gold’s drilling is. At one spot the company might drill 1 g/t Au and just a couple of meters away they might get a bonanza intercept. Will Malmsbury end up being a “mini Fosterville” or better? Who knows. What I do know is that I think I am paying some C$62 M for all potential in Malmsbury and all other of Novo’s targets/projects.

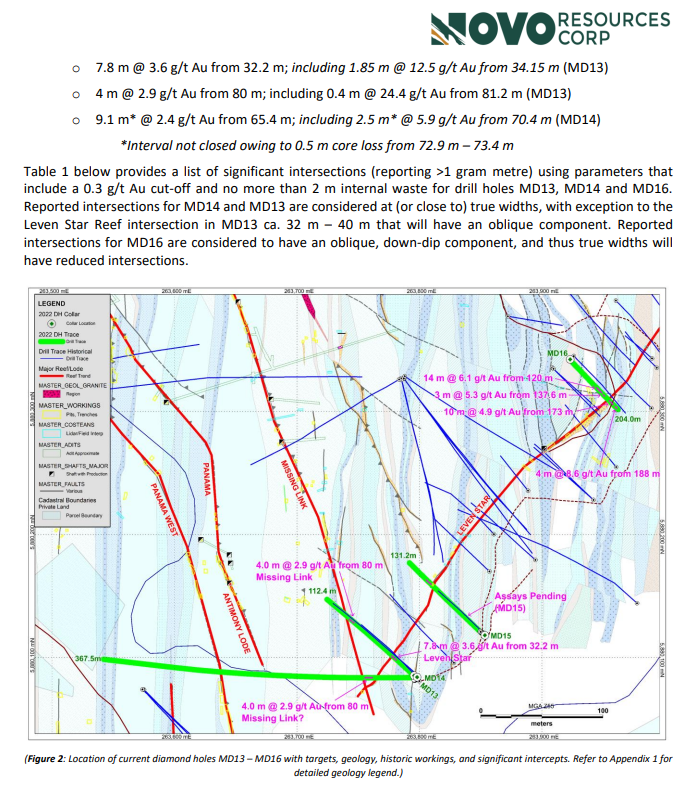

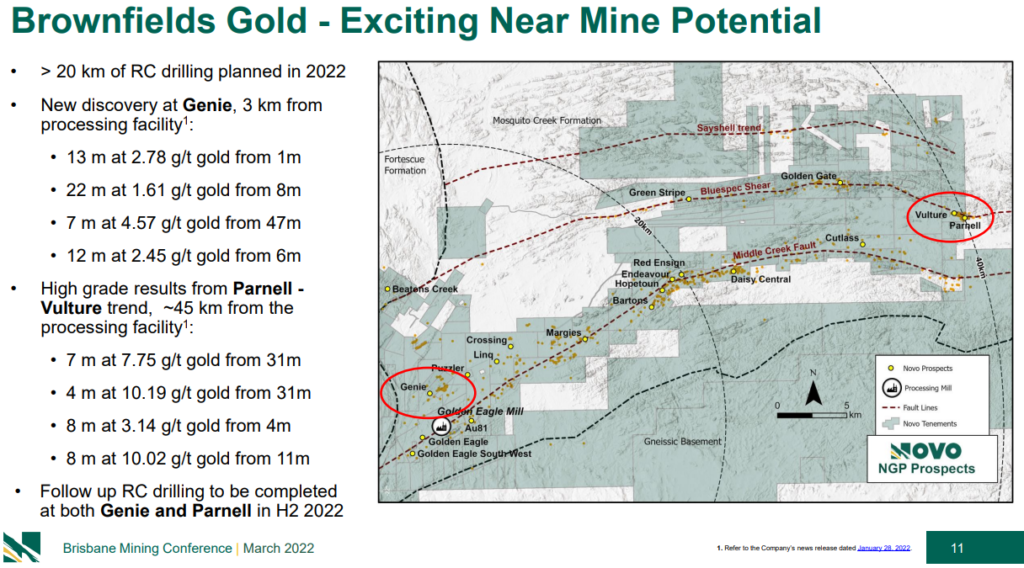

Brownfield exploration near the Golden Eagle Mill

I don’t think it would be a stretch to think that Novo might be able to drill up a couple of hundred thousand ounces of hardrock, oxide gold (similar to what Millennium was once mining profitably):

… With a fully built and operating mill nearby any ounces found in the slide above should be a lot more valuable than for a junior explorer that might be >10 years away from being able to put any ounces through a mill. Oh and since the mill is already a sunk cost (increasingly so with the rise in inflation) one probably does not need to find too many ounces at any particular target and yet deem it worthy of development. Compare that to having no mill where one might need to drill up at least a couple of million ounces in order to even think about building a $100-$200 M mill.

Conglomerate/Lag Gravel Gold

Well the conglomerate and lag gravel targets have not gone anywhere. The potential unlocking of said targets is probably highly dependent on ore sorting however. With so many conventional targets nowadays this has basically gone from THE story (When Novo was at a >$1 B Market Cap) to a “free option” nowadays. In other words I think one could literally erase all conglomerate and lag gravel potential and Novo would still be cheap. With that said I think there is a reason why the company has kept the huge land position (which costs money). My suspicion is that it is not because they like burning cash on upkeep but rather because they do not think the fat lade has sung just yet. Anyway, ore sorting will probably be the thing to watch when it comes to the conglomerate/lag gravel story as always.

To summarize

The sentiment is still so poor that most people (aka the market) focus almost exclusively on risks. In the case of Novo that risk is considered to be the Beaton’s Creek operation. Therefore the market is so far completely unwilling to price in any upside potential. As a result the underlying Value and Potential of Novo has been going up while Price has not. This creates an increasingly favorable Risk/Reward picture.

Note that I still expect Beaton’s Creek to underperform a while longer but I also think that it’s more than priced in already. I am not saying the stock can’t react negatively to further underperformance from Beaton’s Creek but what I am saying is that I think Novo has become way too cheap due to the exaggerated risk focus in light of the huge reduction in risk + ways to now unlock the vast upside potential. The Risk/Reward would be completely different if we a) Would not be debt free, b) Would not have close to $100 M in cash, c) Did not have a built mill, and e) Did not have additional equity positions in other companies.

As I see it I am currently, at face value, paying around $62 M for

- The mill ($150 M sunk costs?)

- Every known and unknown target within the 12,500 km2 land package

- And several should be tested this year

- Malmsbury

Betting against Novo at these prices means one expects that after spending >$95 M they will a) Not have turned around BC, AND b) Not have made any meaningful discovery at all, AND c) Not have deployed the cash in any meaningful way (like investing in NFG)…

Somehow I see that as rather unlikely.

Food for thought:

If Novo is NOT cheap that means one believes that no one would pay more than $62 M for the Golden Eagle Mill, the interest in Malmsbury and all targets within the slide below (including the conventional Hemi targets which are on trend from a deposit valued at $1.8 B, battery metals targets near Azure, Talga Talga, all Mosquito Creek deposits and ground around Blue Spec which Calidus paid A$19.5 M, the land which Marc Creasy had been sitting on for decades before vending it into Novo in exchange for an increased stake in the company, and any potential value creation in the case that ore sorting works for any and all deposit types etc etc etc) if everything was sold TODAY:

If the market agreed with our views at all times there would be no way to beat the market.

“Markets can stay irrational longer than you can stay solvent.” – John Maynard Keynes

Closing Thoughts

My main strategy is a pretty simple one: Buy shares of companies that I think are undervalued, which provides an attractive Risk/Reward profile, and then wait until the Price to Value gap closed and the Risk/Reward picture worsens. I don’t care what the stock or company has done in the past except if it helps projecting future value. I once sat on a ten bagger in Novo Resources because I start buying shares around the lows on 2016/2017. That was a lot more luck than skill if I had to guess. Today the Enterprise Value of Novo is back to what it was back in 2016/2017…

And back then the company only had the Beaton’s Creek deposit, a much smaller land position, barely any cash and no mill. Either Novo will be unable to create any meaningful value before $100 M are spent or this second black line will break one day (perhaps similar to 2016/2017 if we are “lucky”):

… And back during the lows of 2016/2017 I wouldn’t say Novo was blatantly cheap despite the severe correction in Price. Today I would say Novo is blatantly cheap thanks to the severe correction in Price. Another big difference is that back then the junior sector was much pricier overall whereas today pretty much the whole sector is selling for fire sale prices along with Novo. In other words I think there is more competition for my money due to the fact that there are bargains everywhere today (Hence why I am much more diversified today). Anyway, I have recently averaged down in Novo for myself and some family members portfolios I help manage due to Price having fallen a lot farther than the Expected Value in my personal opinion…

As I personally see it right now:

… And of course a currently net negative cash flow operation via the Beaton’s Creek deposit which Mr Market puts all focus on.

Ps. Keep in mind that that the share price of mining companies can get hit when there is broad market panic like we have seen in the last couple of weeks. I wouldn’t be totally surprised to see some blatantly undervalued juniors go down 50% from here, before hopefully sling-shotting higher, if the panic in the broader (often overvalued) markets gets worse… Or the sector might have bottomed last Friday… Who knows.

There are no guarantees. Only Risk vs Reward.

Just because I continue to bet some of my money on Novo does not mean you need to. I simply think that if anything goes right I could hopefully make some good money from these levels (or maybe I won’t). If you don’t see a case you should never invest.

Note! I cannot guarantee the accuracy of the content in this article. I own shares of Novo Resources and the company is a banner sponsor. Therefore consider me biased, do your own due diligence and always make up your own mind. Never invest money you cannot afford to lose. Always assume I might buy or sell shares at any time. Junior miners are very risky and can be very volatile (especially during market panics). I do not share in your profits or losses.

Best regards,

The Hedgeless Horseman

Great article Erik! I knew there must have been a reason I owned all these shares 😉

Thanks Marc!

May the coming years be better than the last.

Best regards

Another awesome article Horseman!

Thanks

Thanks Greg!

Best regards

Greatly appreciate your fine articles. However, no mention of Humphries leaving and the reasons for that?

Hi Fred,

I don’t know the reasons so I don’t want to speculate. One obvious reason is that they thought they needed change and for the better.

Best regards

Novo does not need more projects. The market is not rewarding Novo for the projects they have. Why would the market reward Novo for buying more projects? Novo needs to get their core projects kicking off positive cashflow then look for opportunities. In other words, do not buy more project just because you have money. Be a real production company and kick off positive cashflow, do selective exploration (rare earth minerals), hold off on buying more projects and start buying back shares. At the current market price, Novo’s cost of capital is sky high and the share price reflects it. Novo should only buy new projects with a high share price. The company with the lowest cost of capital always wins.

As illiquid as Nove share price is, a $10 million share buyback (14 million shares at current price) would change the perception of the shares and the company.

I agree with you that Novo’s risk/reward ratio looks great. I recently bought 100,000 shares and will buy more. If Novo starts buying more projects, I will sell the shares.

I agree with the share buyback decision. I’ve reached out several time to the company to offer insight into why this would be super valuable for all shareholders right now, and why they most clearly have some excess cash to put to work. Just a $5-10M program would be impactful at the current valuation (and signal/perception), and with so much cash on hand/incoming this should be an absolute no-brainer. Sadly, there has been no action at the Board on a buyback to date, which concerns me. I find it difficult to find a better use of *some* of the cash proceeds from the sale of New Found than buying back the company’s own stock at present levels.

Secondly, the reason Beaton’s creek is such a critical project, is that it should enable Novo to demonstrate that they do, in fact, have the gold that prior drilling and geological work indicated, at least in one area of their large land holdings. They can drill around the Pilbarra all day long and show indications of metal, but having a mill and mining the area is where the rubber hits the road for these guys right now. I bought into Novo with the thesis that they could become a real producer and graduate from being in the “junior explorer” tier. They are trying to do this, but it’s not going very well, and it’s discouraging that production is slow, the mill has been offline multiple times in the past year, and every update on Beaton’s creek is negative. This business isn’t easy and I’m a patient long-term shareholder, but the continued production issues along with the Board’s lack of desire to buy stock at a supposedly dirt cheap valuation (when they have plenty of cash to do so) doesn’t make sense.

It should be easy to make the easy decisions, but this team seems to want to make things more difficult. I don’t get it…

I will further add that Beaton’s Creek is not just another project for Novo. The goal of Beaton’s Creek is to provide sustainable cash flow to enable Novo to continue to explore its land package without risk of dilution, taking on debt, or needing other outside financing. This is why BC is so critical for the future of Novo. Yes, they now have $90M of cash and no debt – this is huge – but if BC is churning out 100k ounces a year for a few years that’s cash flow positive, demonstrates this team has real gold in one of their first targets, and demonstrates that this team is capable at operating a production company (and not just good at drilling holes). Success at BC should not be overlooked – it’s a critical piece to get right that would enable further success at many levels.

Thanks Eric. Looks like we both bought Novo at the same time, before it went up 10 fold. Like you, I never sold, and bought more on the way down. Did you see that QH sold 100000 shares of NFGC last week? He still has 15000 shares. Wonder if he’ll buy more Novo, IRV, LIO, ESK, GOT, ELO, NUG, FFOX?

Again I think I got lucky on that one! All I pretty much understood that the prize could be absolutely huge and that they had some gold in the ground already. It took many months before I even understood what the excitement at Karratha was even about :P. Yes I did see that and I wonder the same thing bonzo!

Best regards

Really good article Erik, keeps everything in focus. Incidentally I heard a commercial on the radio in London the other day offering to buy people’s spare gold…. interesting times !!

I still think the real prize is located 1/2 to 1 mile underground. Think South Africa. The Pilbra was once connected to SA.