Favorite HODL names with good Risk/Reward

Examples of some juniors that I think have great Risk/Reward and make up most of family portfolio I manage. Emphasis is on #1 Margin of Safety , #2 Probable Growth & #3 Blue Sky Potential, in that order. Basically I see these as “hands off” companies that does not need too much checking up on (but will of course be volatile in any given, shorter time frame).

Nevada King Gold (NKG.V)

An incredible amount of bang for the buck. If even one out of 12 or so projects work this should do well and it is already cheap based on the Atlanta Gold Mine IMO. Tier #1 jurisdiction (Nevada) and management has a lot of skin in the game.

Dolly Varden Silver (DV.V)

High-grade silver and gold in one of the best jurisdictions in the word (BC, Canada). Margin of safety via existing resources and a lot of exploration potential to boot. Cashed up.

Eloro Resources (ELO.V)

Riskier jurisdiction (Bolivia) but one gets rewarded by the immense upside in what looks to be a true world beater Epithermal/Porphyry system. Guessing at least around >300 Moz in “the bank” already with multiples of that in potential left. Incredible Risk/Reward even though it’s a high octane growth story IMO.

Novo Resources (NVO.TO)

Owns a small country in Western Australia pretty much. Shares of New Found Gold and mill to boot. Operating risks with BC having underperformed but the long term exploration potential is unparalleled.

Magna Mining (NICU.V)

Nickel, copper and PGMs in Sudbury Canada. Resource, economic study and a management team that has built a billion dollar company before. Mind numbingly good risk/reward given the valuation.

i-80 Gold (IAU.TO)

Newest addition. Small scale producer with multiple multi-moz deposits in Nevada and a very ambitious growth profile. Also a lot of exploration potential.

Defiance Silver (DEF.V)

Silver, gold and copper in Mexico. Has been slow with news but a lot of meat on the bones. Very cheap based on the sum of its parts. Added bonus from being exposed to three different metals in a big way.

Cassiar Gold (GLDC.V)

Huge land package, two different types of systems to work with (bulk and high-grade veins). 1 Moz starter resource, incredible team, tier #1 jurisdiction, permits and mill on site.

Lion One Metals (LIO.V)

Riskier jurisdiction (Fiji) but cashed up, immense exploration potential, resources, economic study, permits and advancing toward production.

Eskay Mining (ESK.V)

The only pure exploration company among the bunch. Blue sky is so large, with so many targets, that I think it’s so diversified to the upside that it becomes a mathematical margin of safety (albeit not in a classical sense). Tier #1 jurisdiction and an incredible team.

Red Pine Exploration (RPX:V)

Tier #1 jurisdiction, resource, probable growth and a lot of exploration potential.

White Rock Minerals (WRM.AX)

Disgustingly cheap based on the sum of its parts. Multiple projects in multiple tier #1 jurisdictions. Has a mill and loads of exploration potential in USA and Australia.

Personal Expectations

I expect a median return of some 200% within 24 months for the names above by just doing nothing but sitting put. I expect some will overshoot and some might undershoot.

Steady as she goes

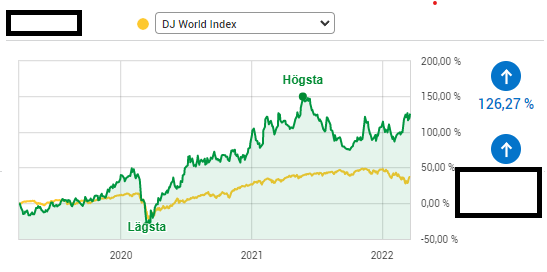

Below is a 3-year chart of one of these low activity HODL portfolios I help manage. Not breaking any speed records but handedly outperforming GDXJ even though juniors are dirt cheap overall at the moment:

… Note that this chart will look boring to most while that is a CAGR of 31.28% which few portfolios will be able to do over the long term. Especially in the mining sector which is more volatile and therefore mentally harder than most… Sitting tight in good juniors overall is IMO the best and easiest way to have good results.

Note: This is not investing advice. I own shares of all companies mentioned and most of them are banner sponsors. Therefore assumed I am biased and do your own due diligence. Juniors are risky and volatile. Never invest money you cannot afford to lose.