THH – Brixton Metals (BBB.V): Simply Too Much Bang For The Buck

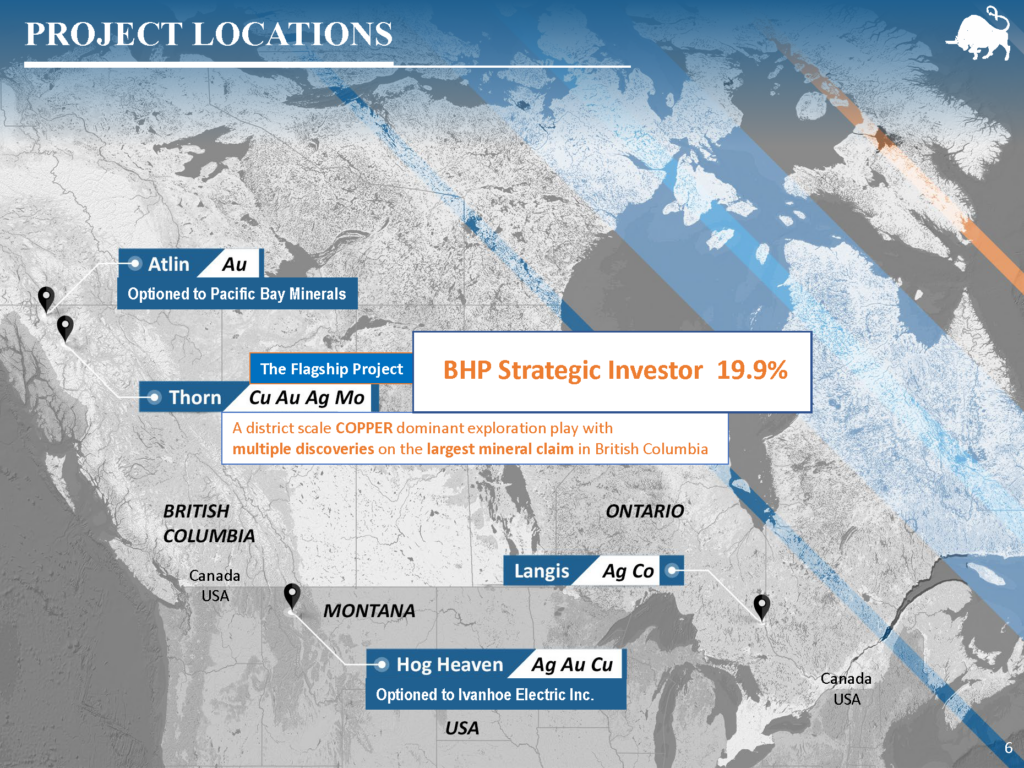

This article will be about Brixton Metals which is a multi-asset junior exploration company which has one of the largest claim blocks in BC, Canada as its flagship project. It also happens to have BHP, which is the largest mining company in the world, as its newest and largest shareholder.

Videos

- Quinton Hennigh on Brixton (May 19, 2023)

- Quinton Hennigh Names Brixton Metals as one of Crescat Capital’s leading Prospects

- Brixton Metals – Thorn Project – Trapper Gold Target – 3D Drilling Model

- Presentation: Brixton Metals – 121 Mining Investment Frankfurt November 2022

Brixton Metals Assets in Short

- Thorn Project (100%)

- Camp Creek: BHP sized copper/moly porphyry target

- >1 x 2 km2 Porphyry target

- 318.3 m of 0.92% CuEq within 821.3 m of 0.38% CuEq

- 365 m of 0.67% CuEq within 967.7 m of 0.38% CuEq

- >1 x 2 km2 Porphyry target

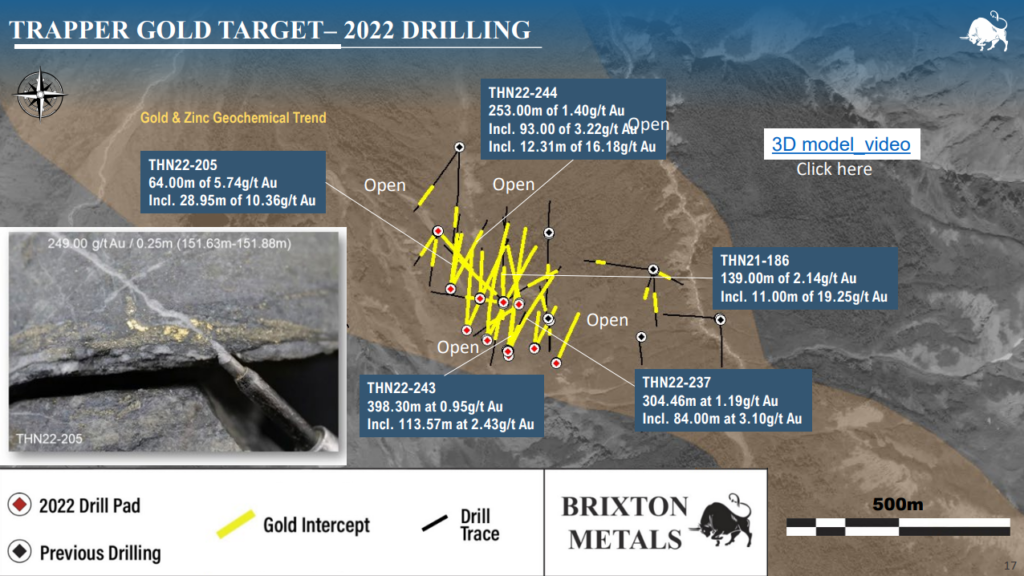

- Trapper: Alkaline Gold System

- 28.95 m of 10.36 gpt Au within 64 m of 5.74 gpt

- 12.31 m of 16.18 gpt within 93 m of 3.22 gpt

- 14 m of 10.70 gpt within 84 m of 3.10 gpt

- I am guesstimating >3 Moz potential

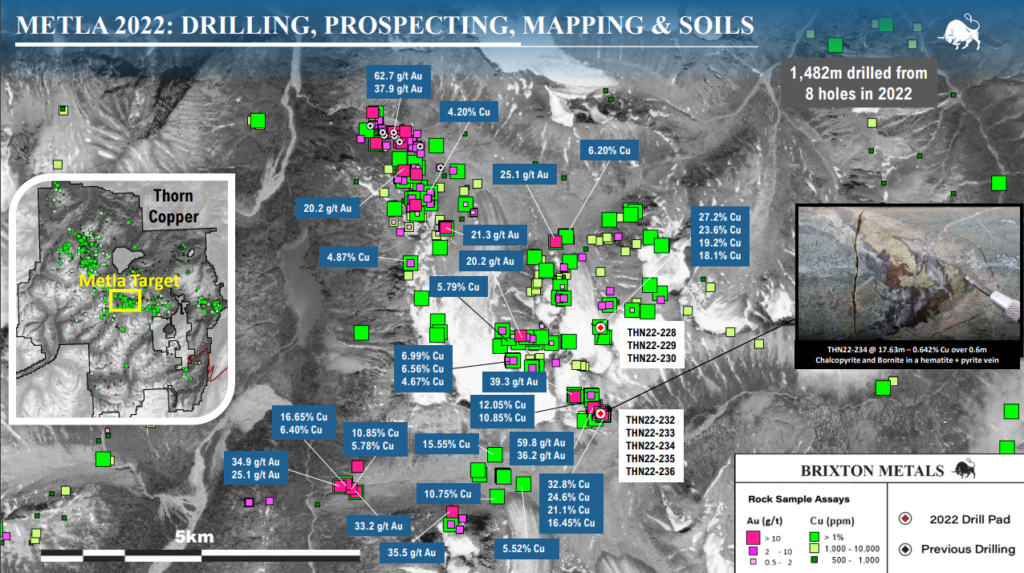

- Metla: Copper/Gold

- Bornite and Visible Gold found at surface

- Up to >30% copper grab samples found at surface

- District scale

- Camp Creek: BHP sized copper/moly porphyry target

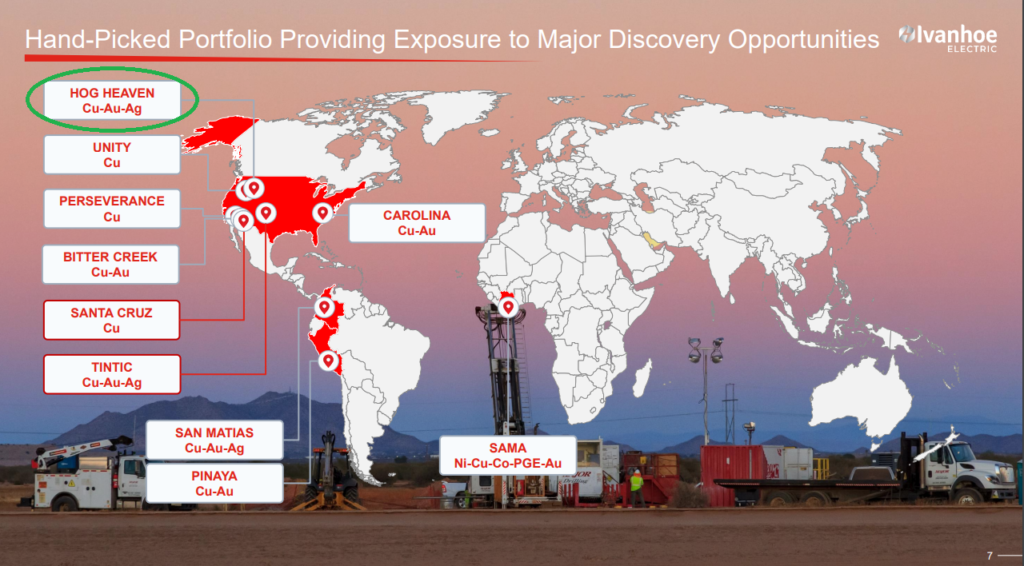

- Hog Heaven (25%-100%)

- Optioned to Ivanhoe Electric ($1.6 B company)

- Atlin Goldfields Project

- Optioned to Pacific Bay Minerals

- Langis – Hudson Bay: Silver, Cobalt Project

- Wholly owned

… This amounts to six “main” targets/projects.

Brixton Metals in Short

- World’s largest mining company (>$250 B) is the largest investor (20%)

- Who surely needs to see potential for a super large prize to get interested

- Brixton gets input from BHP

- Increased chance of technical success

- Earn in with $1.6 B Ivanhoe Electric on Hog Heaven

- Headed by famous “elephant” hunter Robert Friedland

- Ivanhoe are operators so it is one of the best teams in the world exploring at Hog Heaven

- Major signal value

- Increased chance of technical success

- Atlin Goldfields Project optioned to Pacific Bay Minerals

- Camp Creek target could be a monster porphyry

- Trapper Gold target has >3 Moz potential I think

- Metla target has obscenely high copper grades over a large area

- Langis-Hudson project with silver & cobalt

Company Valuation (Basic)

- MCAP (Basic): C$61 M (@ $0.16/share)

- Cash (Basic): C$17 M

- Enterprise Value (Basis): $C44 M (US$ 33 M)

Brixton currently has a Basic Enterprise Value of C$44 M which is what an investor can currently buy all the potential across all these projects currently…

For simplicity lets say Brixton has at least six material, to very material, stand alone projects/Targets. That means potential investors are currently paying either C$7.8 M ($61 M / 6) or C$10.2 M (C$61 M / 6) per project depending on if you use Enterprise Value or Market Cap.

There is simply no way Brixton Metals is not significantly undervalued on a risk-adjusted basis in my personal opinion…

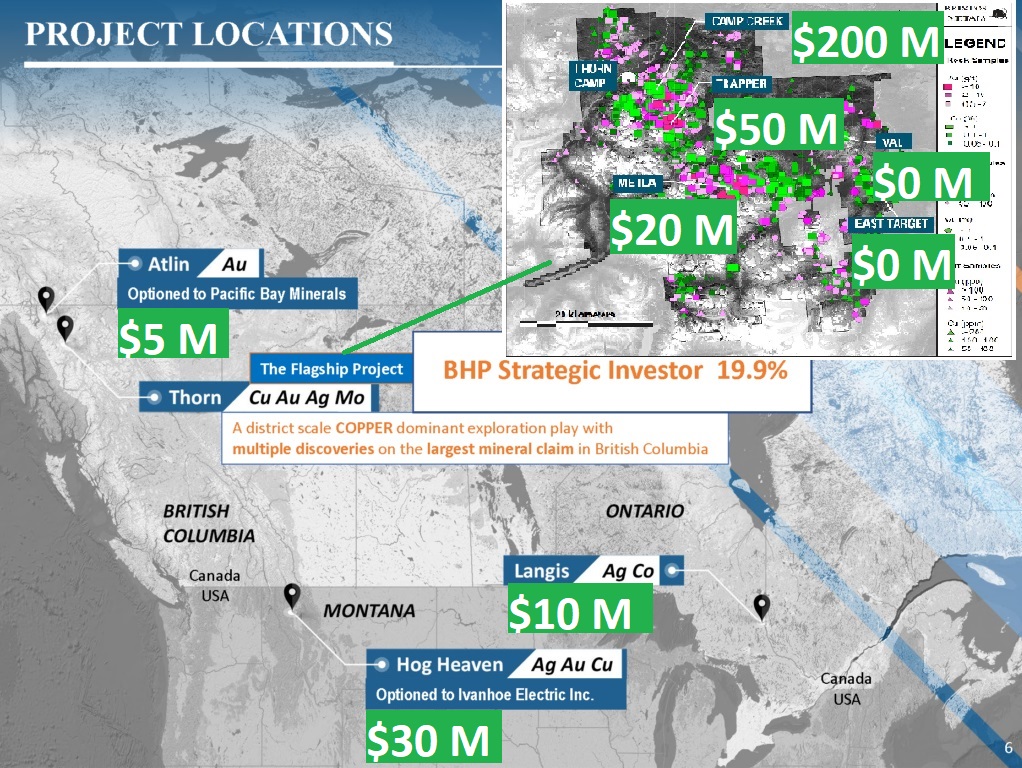

My crude, purely subjective, risk-adjusted Value for Brixton’s six projects/targets:

- “Camp Creek”: C$200 M

- “Trapper” Gold Target: C$50 M

- “Hog Heaven”: C$30 M

- “Metla” + other Thorn targets: C$20 M

- “Langis”: C$10 M

- “Atlin Goldfields”: C$5 M

Total Implied Value: C$315 M

If one wants to be really conservative one could cut the above number by 50% and it would still be multiples of the current valuation of the company.

I would say that the Camp Creek, Trapper and Metla targets have company making potential, with two being discoveries already (Camp Creek and Trapper). Hog Heaven obviously has very high potential to get someone like Robert Friedland (Ivanhoe Electric) interested, and if they find what they are looking for then Brixton would keep 25% of that prize (which could be substantial). I would consider Langis and the Atlin Goldfiealds as minor side projects at this point that do not have company making potential for Brixton. With that said they could be monetized or spun out.

My “High Risk/High Reward” case for Brixton Metals is very simple…

RISK: For Brixton to (technically) fail

- Camp Creek must fail

- Trapper’s current footprint must be all there is

- Nothing significant will be found at Metla or Val

- And Ivanhoe Electric will fail to prove up something significant at Hog Heaven

REWARD: For Brixton to be a significant success

- Camp Creek delivers a BHP sized prize

- Trapper turns into a significant gold deposit

- Ivanhoe Electric proves up a Friedland sized prize

- Metla, Val or other Thorn targets becomes significant discoveries

There is a future where none of these scenarios play out. There is a future where one or more of these scenarios happen. We know that the marginal junior speculator/investor is currently pricing in a very low chance for Brixton to have material success on any target.

My preferred cases are of course no brainers. The no brainer case for Brixton Metals is that the world largest mining company (Market Cap of AUD$224 B/US$140 B) is only interested in world class, super sized projects. And the marginal retail investor/speculator is currently putting a C$44 M (US$33 M) valuation on ALL of Brixton’s many projects and targets. So as I see it either a) BHP is “brain dead” in terms of evaluating the potential or, b) the marginal retail investor is “brain dead” in terms of accurately pricing in what potential BHP sees.

Thorn Project

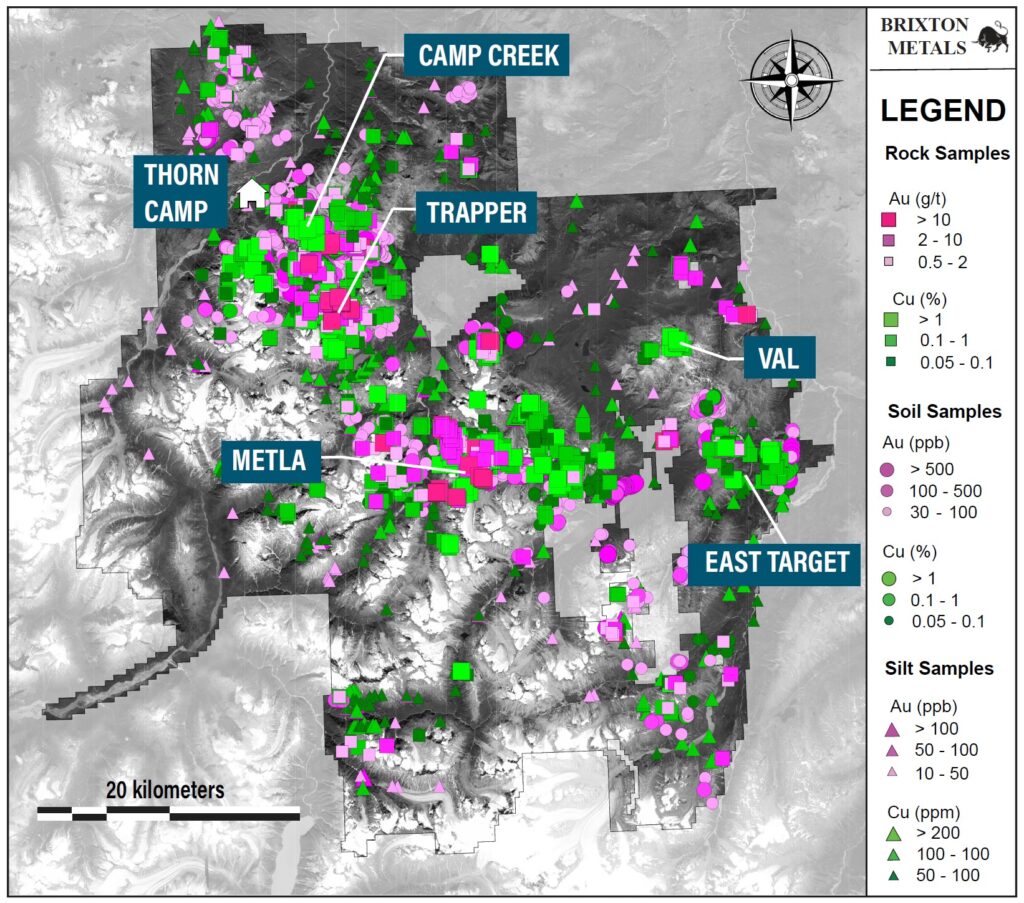

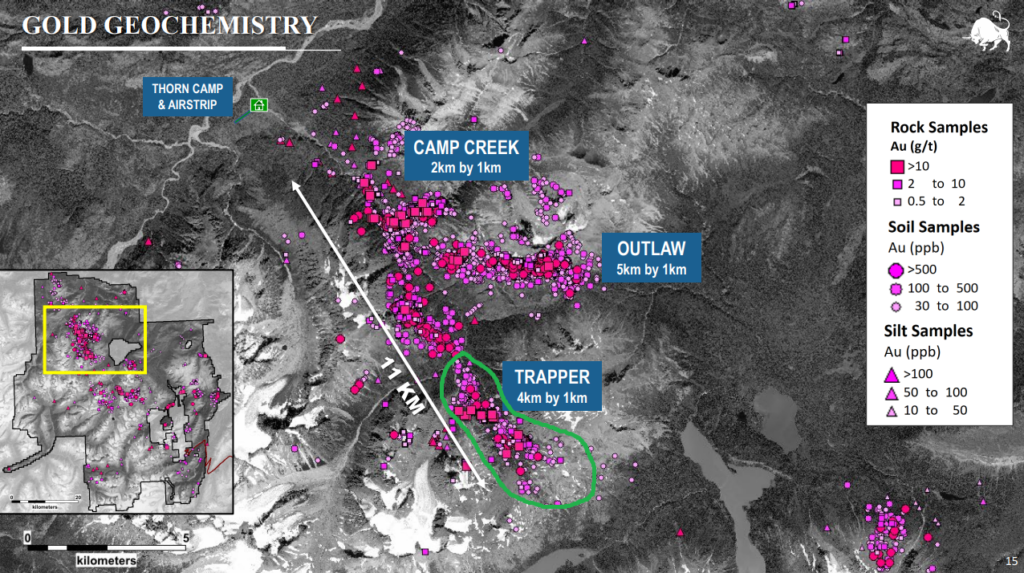

The region scale Thorn Project which alone has >3 major targets, including 2 discoveries and a bunch of other targets along multi-kilometer geochemical anomalies.

(Note the scale bar!)

Gary Thompson was interviewed over at Kereport and had a lot of interesting things to say about Thorn and the different targets. Below I will be adding quotes from Gary when I discuss the different projects…

Greater Thorn Project

“We have identified 14 large scale targets in this project”

“I think we have come to the conclusion that we need to advance multiple targets along the curve rather than focus on one specific target… Because they offer different things”

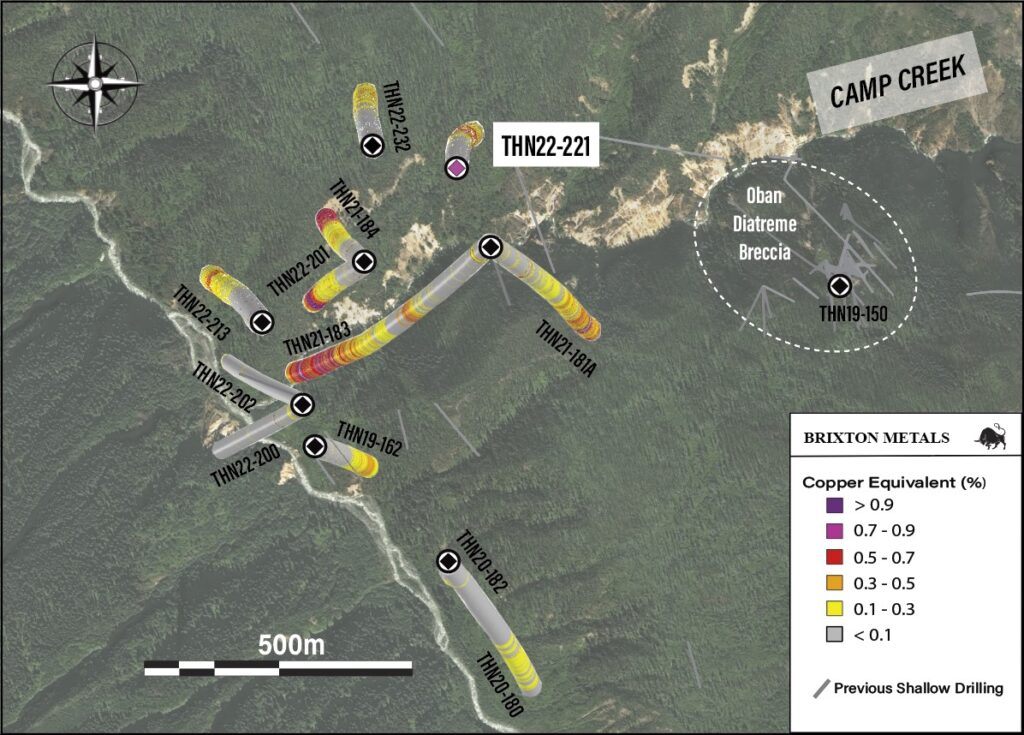

Thorn Project – “Camp Creek” Target

“… I don’t believe we have actually tapped the best hole there… ie the core of the system, based on the geology we are seeing”

“… What that tells us is that we are still on the edge of this system… So we kinda feel that we need to move perhaps more along Camp Creek, up Camp Creek, more eastward… Perhaps towards the Oban Breccia zone… Which is about a kilometer away by the way… We are not talking a small area… The deep drilling that we have done now is around about a 500 m area… Within a target that we see that is about a kilometer wide by potentially 2 kilometers long… So my expectation for 20223 is high… I mean that by the goal, the objective, would be to really try and tap the core of this system… And to deliver we’ll say… A lot of people probably know Filo Mining… We believe we have the potential to drill that kind of hole here… With a similar type of system… Time will tell on that…”

“We want to tap the core… We also want to test the limits… How big is this thing? Is it two kilometers… Wide?… Long? Where is the limits?… That is going to come with more drilling”

My reasoning for the risk-adjusted value I put on Camp Creek…

BHP currently has a Market Cap of A$253 B (US$ 176 B). As such I think it is logical to assume that such an enormous company would need to see a potential prize of at least >C$2 B to make it worth their time, energy and money. If we assume that BHP would need at least a subjective confidence level of 10% then the implied value of the Camp Creek target alone would be C$2,000 M * 0.1 = C$200 M which would be more than three times the current Market Cap of the whole company, and over four times its Enterprise Value. So in this scenario Brixton Metals could be considered to be significantly undervalued just based on the Camp Creek target even if one assumed the chance of success is only 10%.

I think it is also pretty safe to assume that BHP had an idea what the two last holes from Camp Creek (and the holes from Metla) were going to show since I assume they would have had access to both the core and preliminary XRF results before making their investment. Thus I would guess their confidence level is more or less unchanged post latest assay results.

Risk/Reward For Camp Creek

I would argue that if there is a 10% chance of proving up a BHP sized prize (Lets say minimum $2B) then Brixton in incredibly undervalued. If there is a 20% chance then Brixton is extremely undervalued.

Note that a story like that can be extremely undervalued on a Risk/Reward basis while also being highly risky. Even in the “extremely undervalued” scenario the chance of success would only be 20% (with an 80% risk of failue). Thus it makes no sense to bet the farm due to the fact that permanent losses cannot be compounded. With that said the Brixton has more irons in the fire, and while Camp Creek might theoretically have an 80% risk of failure, the overall risk of failure for Brixton as a company is not 80%. Therefore the Risk/Reward is a lot better than in a parallell universe where Brixton ONLY had Camp Creek.

Thorn Project – “Trapper” Target

“… It looks like it is an open pitable scenario… Relatively easy pickings from that perspective… So I see this thing as a potential starter pit for us… What’s the potential?… I mean I would have to say its in the multimillion ounces just from my…. My back of the envelope…”

“… We haven’t closed it off… so where could it go?… What’s the big potential here?… I think next season… I am hoping we’ll have a pretty healthy budget for Trapper as well and continue to expand on the target…”

Given that the Trapper target is pretty remote something substantial must be proven for there to be a “threat” of having an economic mine here. I have talked to some people who guesstimate the “probable” potential in light of the drill done so far to be around ~3 Moz. What grade and endowment that would be needed for this to be a feasible mine worth hundreds of millions or more I do not know. Maybe 5 Moz of 1.5-2 gpt for an open pit deposit or 3 Moz of high-grade in an underground mine scenario? I don’t think the current footprint at Trapper is there right now. But when you consider the hit rate so far, and that the current footprint is just a postage stamp within a multi-kilometer long gold trend, then it starts to look like this could actually turn into something substantial:

Thorn Project – “Metla” Target

“… Metla looks like another whole camp… That is the scale of sort of ten to… Ten to twelve, fifteen kilometer scale… So it is another camp in itself…”

“… The thing that is exciting… Put it this way… I have been on this project now for… I guess since 2010… so twelve years… We have never seen so much bornite as we are finding at Metla…”

“… Basically when you have bornite you have high grade copper but you also have high grade gold…”

(Note the scale bar)

The Metla area shows incredibly high grades of copper and gold across a very very large area. We don’t know where an orebody might be found. We don’t know how big or rich it might be. But we can obviously see an incredible amount of smoke. This might turn out to be anything from nothing at all to a world class discovery in time.

At Brixton’s current valuation I would say there is no valuation risk at all for Metla. In other words if we gave this target a 0% chance of success it would not make Brixton expensive. Thus, I consider Metla to have “risk-free” upside potential.

Hog Heaven – Montana, USA

Hog Heaven is an advanced stage high sulphidation epithermal copper-silver-gold project with porphyry potential and historical production located in the state of Montana, USA.

March 2, 2021: “Brixton Metals and HPX Sign USD$44.5 Million Definitive Earn-In JV Agreement on the Hog Heaven Copper-Silver-Gold Project, Montana, USA” – Source

Brixton Chairman and CEO Gary R. Thompson stated, “We are delighted to have concluded the deal terms with HPX and are excited to see the Hog Heaven Project receive significant exploration spending. In addition to the precious metal potential, we believe that Hog Heaven has the potential to host a significant copper discovery related to the high sulphidation precious metal system, and that the expertise and anticipated investment of HPX is likely to demonstrate that.”

HPX Principal Geologist, Graham Boyd, stated, “We see high potential for further discovery at Hog Heaven. We believe that the past producing Flathead Mine, where Anaconda Copper historically produced high-grade direct-shipping silver-gold ore, is just one part of a much larger precious metals and copper system. Our initial work programs at Hog Heaven starting in April-May 2021 will leverage our talented USA-based team of geoscientists and deploy the world-class Typhoon™ geophysical surveying technology to unlock new discoveries. We plan to follow this work up with a campaign of re-logging and sampling of the well-preserved historic drill core followed by diamond drilling to re-classify the historic mineral resources to NI43-101 compliant standards. In parallel, using the Typhoon IP system, we will search for additional sulphide-rich zones like those that have carried the high-grade precious metal values within this large volcanic-hosted epithermal system. Additional discoveries could significantly expand the historic precious metal resources. Further, the superior depth penetration of our Typhoon system will aid us in the search for the source porphyry copper and gold systems.“

“Brixton Metals Receives Second Cash Payment from Ivanhoe Electric for the Hog Heaven Copper-Silver-Gold Project Earn-In” – Source

Robert Friedland stated, “We are looking forward to further understanding the mineral potential of this high-grade district in our pursuit of critical metals to support the electrification of everything.”

Latest update dated April 5:

“Brixton Metals Provides Update on the Hog Heaven Joint Venture” – Source

Hog Heaven Project Update

Recent work at Hog Heaven has been focused on evaluating the historic drill hole database. This work has included re-logging 14,500m of drill core and assaying 3,600 drill core pulps for processing using current mineral assay technologies. The historic drill core has been selectively analyzed with a handheld Terraspec Halo (NIR & SWIR), a mineral analysis system that allows for the identification and evaluation of alteration minerals and alteration mineral zoning. Additionally, expanded soil, gravity and 3D IP surveys were completed on the property.

Future Exploration Plans for Hog Heaven

The Company understands that Ivanhoe Electric Inc. will continue to compile and create a comprehensive geological model for the property. Geochemical and geophysical anomalies have been identified, and based on these results, drill target identification is currently underway. An exploration drill program is expected to begin this summer to identify potential porphyry copper-gold mineralization. Future work shall be based on the success of the next program.

From Ivanhoe Electric’s January, 2023 presentation:

To sum up Hog Heaven

So far Ivanhoe Electric has paid $1.5 M in cash and incurred over $3 M in exploration expenditures. If Ivanhoe proceeds to earn the full 75%, then there is some US$40 M left for them to pay/spend, and Brixton would also get to keep 25% of the whole project. It is hard to say what the risk-adjusted value is for Hog Heaven but I have used C$30 M for this article which I think is very reasonable given the context. The simple logic being that if one assumes Ivanhoe Electric needs to see lets say a 20% chance of success of finding a 1$ B deposit at Hog Heaven then the Expected (Face) Value is 0.2 * $1 B = $200 M. If Brixton’s stake in that (success) scenario is 25% then Brixton’s piece would be worth 0.25 * $200 M = $50 M today. Discount this scenario by 40%, to be conservative, and you get $30 M.

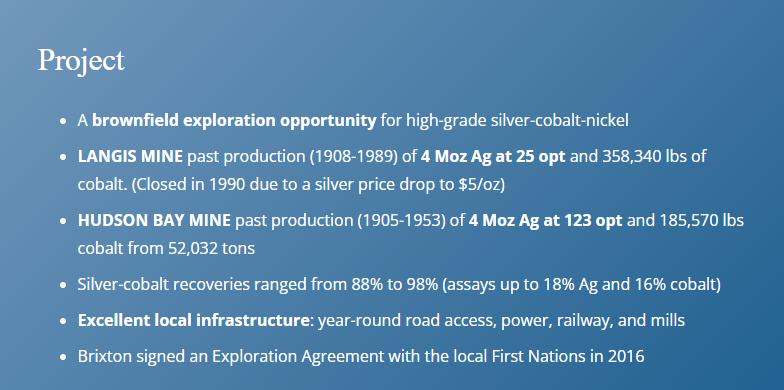

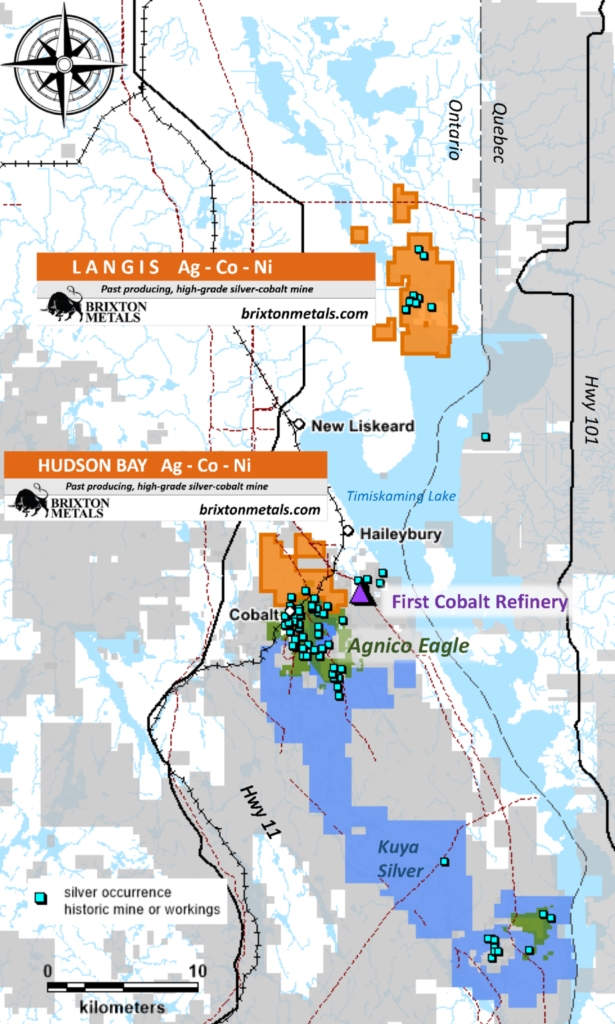

“Langis & Hudson”

The Langis Project is located within the Timiskaming First Nation traditional territory. The project is located near Cobalt in eastern Ontario, 15 km north of Temiskaming Shores and 500 km north of Toronto. Highway 65 runs through the property and many established secondary roads provide year-round access. Power, railways, mills and a permitted refinery are located near the site.

Brixton Metals is exploring for silver, cobalt and nickel within the Cobalt Camp.

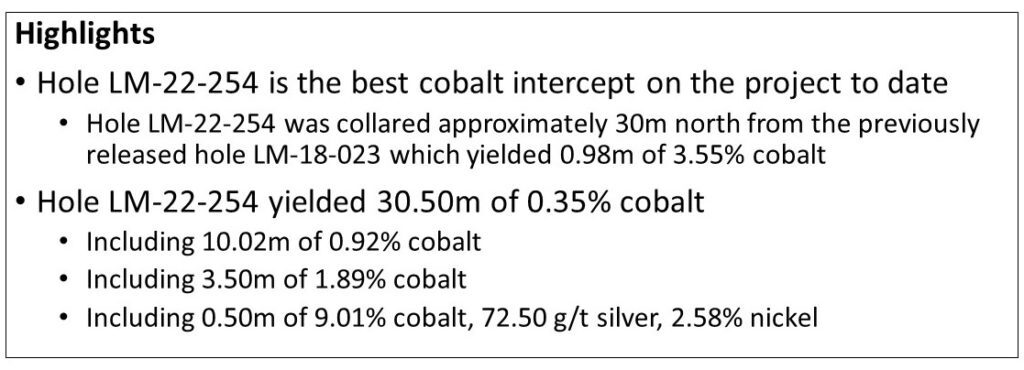

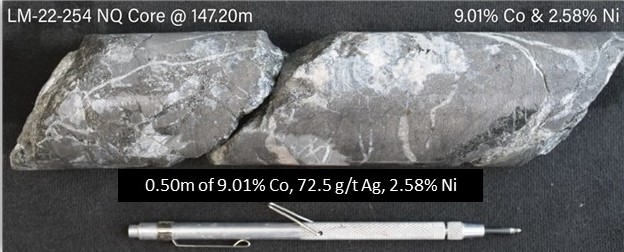

December 13, 2022 – “Brixton Metals Drills 30.50m of 0.35% Cobalt Including 10.02m of 0.92% Co and Including 0.5m of 9.01% Co at its Langis Project, Ontario” – Source

If my calculation is somewhat correct the 0.50 m interval translates into 0.50 m of 85 gpt AuEq on a gross basis.

Langis-Hudson are not flagship projects for Brixton given the success over at the Thorn project but it still has value and I think it will get monetized some way. I have put a C$10 M value on these projects which I think is reasonable and conservative.

Closing Thoughts

Firstly, the world’s largest miner BHP and elephant hunter Ivanhoe Electric have interest in different parts of Brixton. Secondly, Brixton has made what could be a significant gold discovery at the Trapper target which I would assume is outside the scope of BHP’s reason to invest. Lastly, Brixton has many more targets at Thorn and two more projects in Langis-Hudson and Atlin Goldfields…

Assuming BHP had a good idea what the last holes out of Camp Creek would run I consider the case for that target to be wholly intact.

Thus I cannot come up with another conclusion than a C$47 M Enterprise Value for the following is just absurdly cheap:

- BHP sized target(s) at Thorn (Blue sky: >$2 B?)

- Ivanhoe Electric sized target at Hog Heaven (Blue sky: >$1 B?)

- Multimillion ounce gold target at Trapper (Blue sky: >$500 M?)

- Metla and Val targets within the Thorn Project with grab samples up to 32%-50% copper respectively ($??)

- More targets within the regional scale Thorn Project ($?)

- Langis-Hudson ($10 M?)

- Atlin Goldfields ($5 M?)

In poker terms I see the current Price of Brixton as getting to play the “Camp Creek hand” at a bargain while getting to play hands like Trapper, Metla, Langis & Hog Heaven etc for free… Just too much upside potential from the current Price paid in the market in my opinion. I would play hands like this all day, every day, if it would be possibly to ever get such good starting hands in poker.

I would also note that the blue sky scenarios for all of the main targets/projects are still wide open. We know that Filo Mining (Which BHP also took a stake in) hit a Market Cap of $3 B on the back of its phenomenal discovery. Yet said discovery is located at circa 5,000 m altitude on the border between Argentina and Chile. I wonder what half of that size/quality at Camp Creek, which is located in BC Canada, could be worth.

What if Trapper turns out to be akin to large Alkaline Gold Systems like Lihir or Porgera?

What if they make a discovery at Metla and/or Val etc?

Like I discussed earlier I am not “betting the farm” on Brixton. I have a position size that will certainly not kill my portfolio if every project/target for whatever reason turns to crap. But I have a position large enough that it could meaningfully impact my portfolio in case Camp Creek, Trapper, Metla and/or Hog Heaven etc delivers. Oh and I personally believe that although Trapper does not yet have a resource I think it will at least turn out to be 3 Moz given what has been hit so far (subjective, forward looking guesstimation). It is also wide open along a multi-kilometer gold anomaly so I think that will grow with more drilling. In other words I think Brixton has semi-margin of safety already and that it is likely it would have beta once this super depressed sector turns more bullish.

Lastly I would say that we know for sure that Brixton is not pricing in anywhere near a BHP sized prize. So given that the company has just started drilling there is a chance that there will be an “aha” moment this year assuming the drilling is successful. If/when the market goes from super doubtful to “Hey this actually is starting to look like a BHP sized price” then all hell could break lose given the starting valuation. Again, I am not saying that is anywhere near a certainty but if it is even a 30% probability I think Brixton is a steal…

And that potential “aha moment” would jive with a break out of a huge 14-year consolidation pattern given the old adage “The bigger the base, the higher in space”. In other words I think that if Brixton starts getting the recognition, then sooner or later this pattern will break, and it could indicate the very start of a major move:

Note: Not investment advice. I am biased. Do your own due diligence. Junior miners are high risk. Do not invest money you cannot afford to lose. I cannot guarantee the accuracy of the content in this article.