THH Case – Stillwater Critical Minerals (PGE): A “Platreef” analogue in the US backed by Glencore and exploration run by the Ex Head of Exploration for Ivanhoe Mines

This article hopes to explain why I recently invested in a company called Stillwater Critical Minerals. It will contain my personal views, speculation and forward looking statements. I cannot guarantee the accuracy of the information so do your own due diligence as always. Never invest money in a company just because someone else has done that. One needs to personally understand and “see” a case otherwise one will end up making mistakes when volatility comes (Like buying high and selling low instead of the opposite). I have bought shares in the open market and I was happy to have the company come on as a passive banner sponsor as well. Thus consider me twice biased.

At least half of the article is a look at the medium to longer term fundamentals for Nickel and PGMs and it is a long article. Thus I will be starting off with presenting the “Too long; Didn’t read” version of the case, followed by a look at the macro environment for the metals, and ending with going over the Stillwater West Project itself.

TL;DR

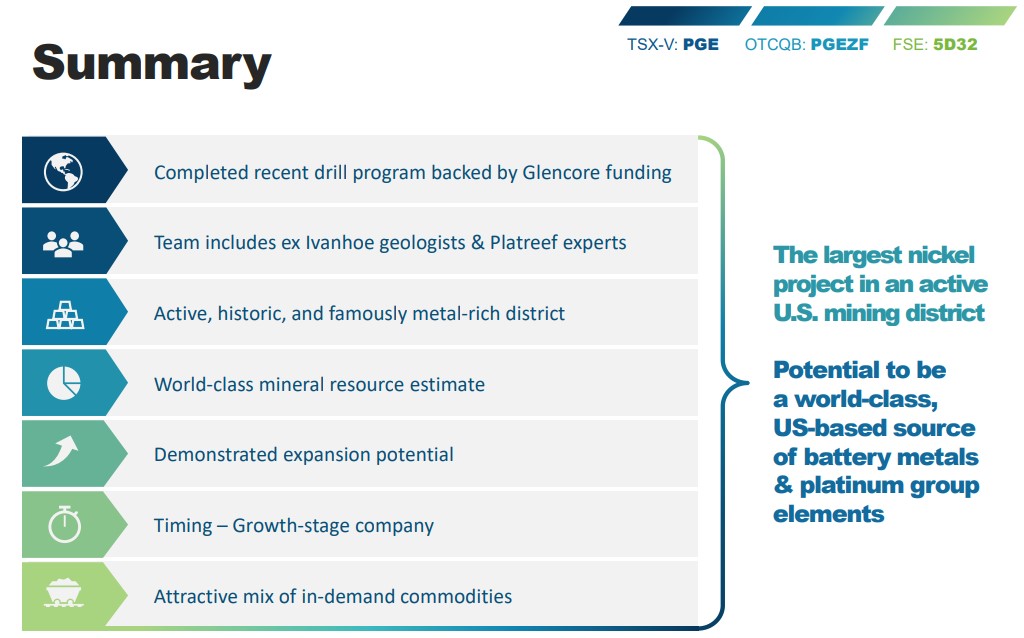

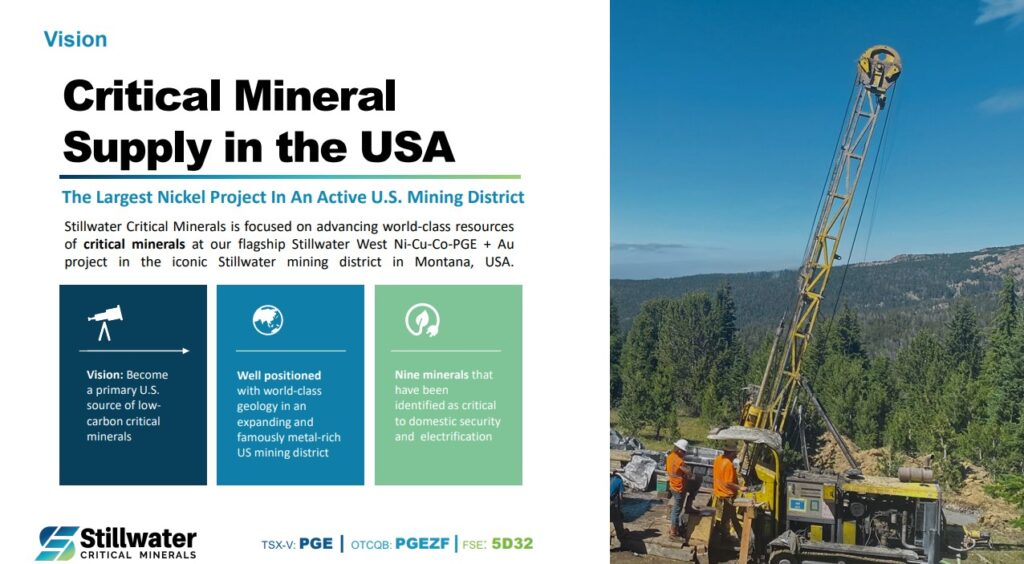

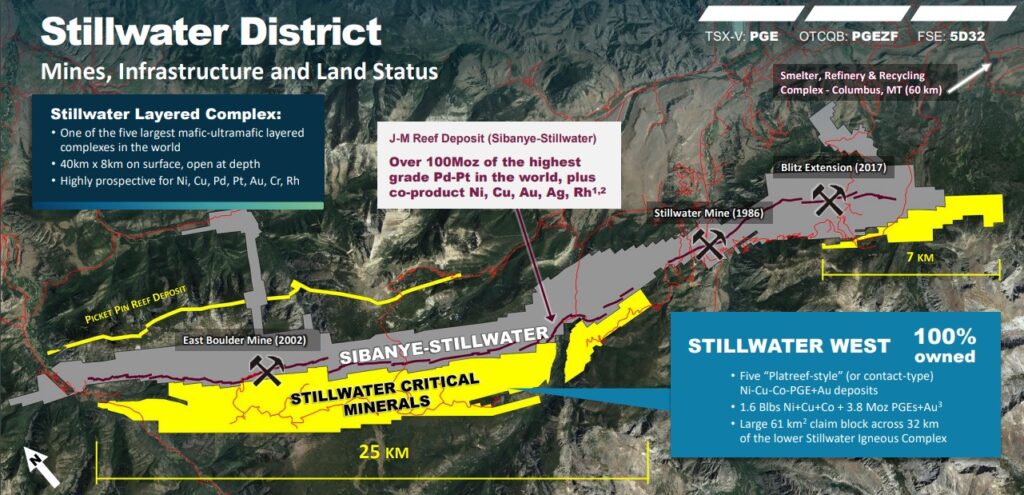

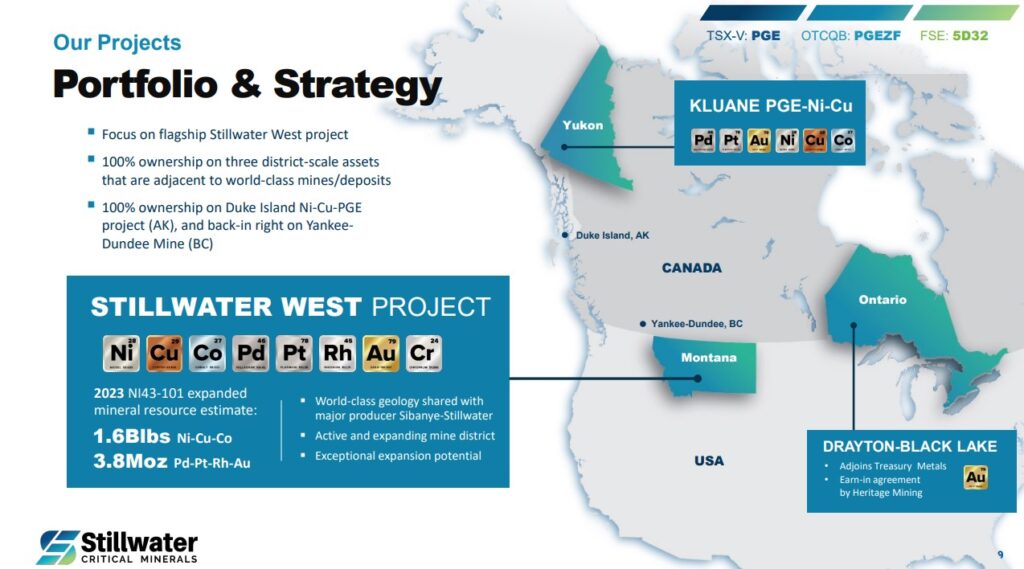

Major mining companies and major non mining companies from around the world are buying stakes in North American nickel juniors left and right. Stillwater Critical Minerals is a junior with a large, nickel dominant, polymetallic deposit in the Stillwater mining district in the US. The company has a district scale land package and the geological setting is believed to be analogous to Ivanhoe Mine’s giant Platreef deposit in South Africa and there is potential for a string of similar deposit types along a 25 km trend. Stillwater Critical Minerals was able to attract an investment (at a big premium) by a C$78B giant called Glencore (Almost as large as Barrick Gold and Newmont Mining combined), as well as people from Ivanhoe Mines (including the ex Head of Geology and Exploration who now runs the exploration for Stillwater), and is currently “given away” for a price of C$28.7 M at ($0.145/Share) by a depressed Mr Market.

“This funding makes clear that domestic supply of nickel is a (United States) national security priority,

– ” Talon CEO Henri van Rooyen said in a statement.

With Stillwater Critical Minerals I have basically bought a stake in what could end up being a large, strategic, long lived, asset that hosts a total of six different metals, making up 96% of the gross metal value, deemed to be critical/strategic to the world’s largest economy (and military) for just C$28.7 M. What makes Stillwater somewhat unique is that the entire United States only has one primary nickel mine which is scheduled to close in two years and the only other project that was supposed to be in the pipeline was Talon Metal’s project but they are having problems with the locals. Stillwater’s project is located next to Sibanye-Stillwater’s operations in a mining camp with >100 years of mining history. Lastly, I get a shot at buying a future Platreef type monster but in a tier 1 jurisdiction that also happens to view almost all the metals, particularly nickel, so critical that even the US Defense Department has thrown money on it (nickel). I mean it’s almost hard to fathom that the United States which is not only the largest economy with a GDP of over US$23 Trillion, but also the largest military in the world, will soon find itself with not a single domestic, primary nickel mine.

And it is important to remember that regardless of how the EV trend and/or battery chemistry develops in the future the United States will keep using a lot of Nickel for many reasons. By the way, EV sales in the United States hit a record in 2023.

Stillwater Critical Minerals in Short:

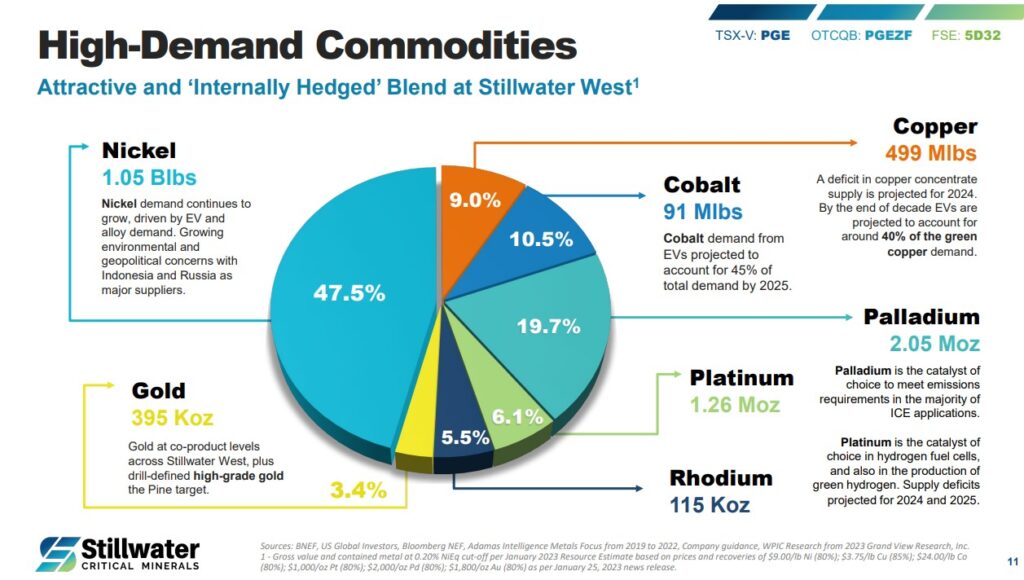

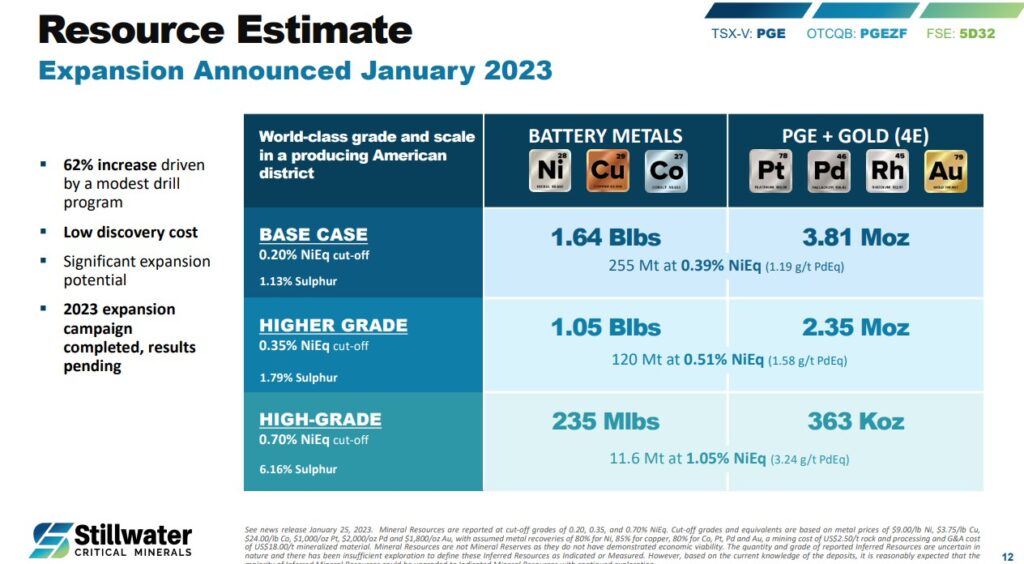

- Margin of Safety: 1.64 Billion pounds of “Battery Metals” + 3.81 Moz PGE + Gold (as of last resource update)

- Growth Potential: Extremely high as suggested by being able to attract the ex Head of Geology and Exploration from Ivanhoe Mines

- Blue Sky Potential: Extremely high as suggested by C$78 B Glencore (about as big as Barrick and Newmont combined) investing in the company

- Unique Strategic and Critical advantage: The only (large) primary Nickel project in an active mining camp, within the world’s largest economy that also supports the largest military power in the world. The US only has a single primary nickel mine (scheduled to be closed within two years) with no visible pipeline. Furthermore the current resource has six metals (out of seven in total) that are on United States Critical Minerals Lists.

- Skin in The Game: Insiders own 20% of the company

- Internally Hedged: The diverse metal suite makes the deposit internally hedged as around 50% comes from nickel and the other 50% comes from six other metals

- Macro: Nickel/PGM supply destruction ongoing in the West and the possibility of currently artificially low prices thanks to Russia dishoarding these metals (If so, can’t do it forever). Other positive drivers would be ongoing “Greening” and sadly continued war (re-arming).

Price: C$28.7 M

In short I see Stillwater as an extremely asymmetrical bet which could go from ~C$28.7 M to… zero or… Well… Whatever valuation which would indicate it could move the needle for a Glencore sized company over the coming years. The valuation of the company today looks surreal to me in light of what I will discuss in this article. I feel like I am buying a potentially very valuable and downright strategic asset for the United States supply chain for almost nothing.

The value proposition in the words of the company:

Risks

Well they already have success and the current resource is not going anywhere. What could make the current Market Cap of ~C$30 M look expensive? I don’t know. If they found nothing more and/or Nickel, Copper and PGMs became worthless now and forever so the resource stays worthless forever(?). As always metallurgy is an important component and especially for polymetallic deposits. Thankfully Glencore is probably the best entity in the world when it comes to evaluating such deposits. Lastly the permitting can of course be challenging despite it being in an active mining camp, and hosting a bunch of critical metals for the US, but that bridge will probably not be crossed for a few years yet. Until then I see mainly “assay risk”, but again, they already have a resource and I don’t see how this won’t grow.

Blue Sky

Rick Rule was recently asked, on the back of his uranium bets now paying off, what the “Next uranium” is. He went on to explain that he likes Platinum, Palladium and Nickel companies right now. My dream scenario over the next few years is 1) Nickel and PGMs start their next bull runs which lights a fire in those juniors again, b) Stillwater proves that they really have a monster, and c) The strategic/critical nature of having this particular suite of metals in the US really pays off (grants, partnerships etc) which helps limit dilution for investors and possibly speed things up.

Upcoming catalysts include:

- Results from 2023 resource expansion drilling (none reported to date)

- 2024 funding and exploration/expansion plan

- Updated resource estimate

- Updates from non-core assets:

- Drayton-Black Lake where Heritage Mining has drill results pending (high-grade gold in Ontario)

- Kluane – Yukon critical minerals asset

- Updates from carbon sequestration studies

- Beginning of PEA-level work, including metallurgy

Setting The Scene

Recommended reading/listening on Nickel and PGMs

- The Race To Secure North American Nickel Supply

- ‘I believe every automaker is here’ – Sibanye-Stillwater CEO on mining shows and car manufacturers

- Nickel Supply Tightness Ensures a Pivotal Year for Investors

- Nickel Price Rebound – Supply Cuts & Rising EV Demand

- Perfect Storm Brewing for Nickel Prices in 2024 as Demand Booms & Supply Squeezes

- “The Nightmare Facing the Global West” – John Kaiser

- ‘Having critical supply in hostile hands has become quite problematic’ – Canada Nickel’s Mark Selby

- Edward Sterck: Platinum on Track for Record Deficit, Price Catalysts Building

- Wyloo’s perspective on the Nickel Market

- The Journey of Nickel – Glencore

- Indonesia facing ‘devastating’ impact of nickel mining pollution – BBC News

The price of nickel is down substantially from the short squeeze highs of 2022. Unsurprisingly the sentiment has turned from pretty good to absolutely terrible. I mean even the median gold junior is trading at around 52w lows and that includes a) a gold price of >$2,000/oz and b) gold being one of the most popular sub sectors in the metal space. Now given that much fewer people are familiar with nickel, coupled with a decline (negative price trend) in the nickel price, it makes total sense why the retail driven market could create some ridiculous bargains in this sub sector. Almost nobody is capable of buying in a downtrend. Price vs Value is an afterthought…

The more brutal the downtrend has been the more positive I become for the simple reason that commodities are forever cyclical and thus ever changing. And the worse the past the larger potential there in the next positive wave.

So while Mr Market (the marginal retail investor) is suggesting that for example nickel (and PGMs) l in North America is almost worthless, and that prices will never go up, it does not line up at all with what the big players are doing. Just recently we saw Agnico Eagle and even Samsung SDI invest in a nickel junior called Canada Nickel Company (And Anglo American invested in the company before this). Obviously Samsung is not a retail investor that has a time frame of tomorrow but rather a manufacturer that thinks about the next decades perhaps. Furthermore, as many will know, Agnico Eagle is a Gold Major. So one has to wonder just how attractive nickel in North America might be in order for a gold company to branch out from its core business. By the way, Canada Nickel Company has a huge, , high capex, low grade, BFS-stage deposit in Canada and is at the time of writing trading for C$274 M. Before I even completed this article we got yet another Major mining corporation purchasing exposure in a nickel junior. This time it was FPX Nickel (C$77 M Market Cap at time of writing), that also has a huge low grade deposit, which received an investment of $14.4 M by Sumitomo Metal & Mining. FPX already has a MOU with the Japanese giant JOGMEC and last year the Finnish stainless steel producer Outokumpu made an investment of $16 M into the company.

(CNC presentation)

These very large corporations are obviously seeing something in the future, which is not visible to the retail investor, nor showing up in the current marginal price of nickel.

On that note I would urge you to listen to this very recent interview with Mr Contrarian himself, Rick Rule, and his thoughts on Platinum, Palladium and Nickel now being some of his favorite bets. The title of the interview is“Rick Rule: I Was Early on Uranium, Here’s Where I’m Looking Next”.

On Platinum and Palladium

“… But there are things that investors dislike because they have disappointed them. Investors had high hopes for Platinum and Palladium… They were disappointed…”

“… There is an artificial downturn in Platinum and Palladium prices…”

“… Investors don’t know why there is a down turn… They just know there is so they hate Platinum and Palladium… I love hate…”

“… The fact that people are selling off Platinum and Palladium deposits outside of Russia and outside of South Africa means I’m a buyer…”

On Nickel

“… Laterite Nickel production has increased a lot and the Russians are selling nickel… So the Nickel prices collapsed… So everybody who was just hyper excited about Nickel as a battery metal three years ago wishes they’d never learned to spell the word…. Umm nothing has changed… The outlook in two years is radically different than the outlook today so a high quality Nickel deposit somewhere in the world is something I would look at.”

In an even more recent interview published on January 29 he said the following about Nickel, Platinum and Palladium:

“It’s interesting that you mentioned Nickel… The Nickel space is going to be a very good place to be in a year and a half… The price is depressed for two reasons… Well three reasons… One was very high expectations three years ago… Nickel was going to supplant everything else in batteries so the world went crazy for Nickel… But there were a lot of lateritic Nickel particularly in the Philippines and Sulawesi, Indonesia…”

“This increase in production will not continue and may decrease…”

“I just few over Southern Sulawesi myself… Looked down at the Nickel fields there… And the environmental devastations… Don’t confuse me with a ‘bleeding heart’ but the environmental devastation was absolutely unbelievable… It cannot continue… It will not continue… Indonesian people will start shooting government officials if the degradation of Sulawesi continues at the level it is occurring today… It is disgraceful.”

THH: On that note:

“Indonesia’s bid for EV nickel supremacy is doomed to failure” – January 19, 2024 – The Telegraph

“… The Chinese are just nuking… Nuking tropical jungle in Indonesia to mine Nickel laterite… It’s a disaster…” – Robert Friedland

Rule continued: “…The second reason why I think Nickel price will rebound is that we are going through 1990 Revisited which is to say that the Russians need money… And the Russians are selling everything they have in the cupboard that they can raise cash with… Biggest Nickel producer in the world outside of Indonesia is of course Russia… Norilsk… You may remember or you may not remember… 1990, the last time the Russians were broke… They by themselves crushed the Nickel price, the Platinum price and the Palladium price… And the diamond price as well… By dishoarding… Fast forward it seems that the Russians need money… They are wholesaling Nickel, Platinum and Palladium… Look at the charts…”

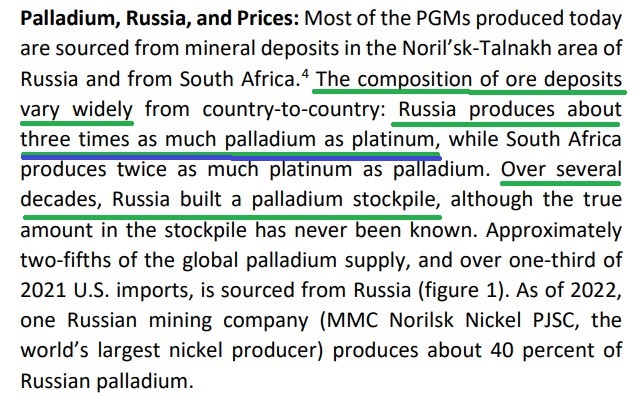

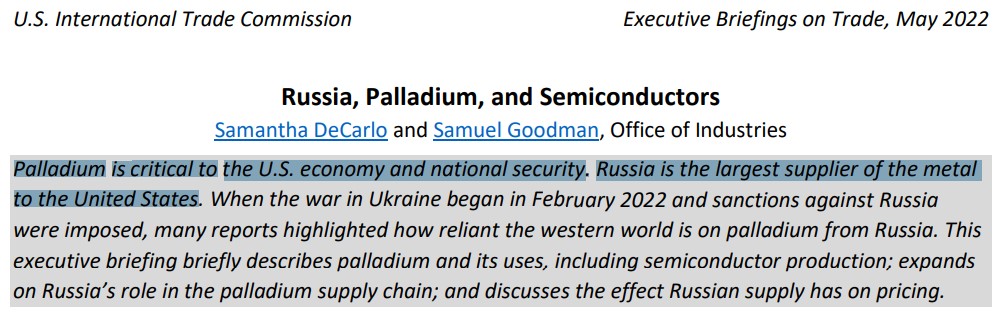

THH: On that note I would urge you to look at how Palladium has declined a lot more than Platinum in the last couple of years and ponder this section from a 2022 document by the U.S. International Trade Commission:

And on February 5 this article titled “South African platinum industry could shed up to 7,000 jobs to cut costs” was published:

Rule continued:

“… At some point in time… In 1990 it took about 20 months… The Russian cupboards will be empty… They will be wanting to sell but they will have nothing left to sell… The selling pressure will abate and the price will rebound…”

“So I am very attracted to the Nickel sulfides…

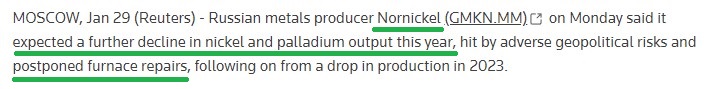

“You look at the various operations being shut down in Australia… What you are seeing there is supply destruction… And you’re seeing supply destruction in the face of a circumstance where the new supply additions will not keep pace… They won’t keep pace… I think too… I don’t know this to be the case because I can’t get information out of Russia anymore… But I suspect that the big Nickel producer in Russia, Norilsk, is not able to make the Sustaining Capital investments necessary to maintain production at prior levels simply because the Kremlin needs money from any source possible… Mr Putin has a choice between money for bullets and bread or Sustaining Capital investments… What do you think a politician like Putin would choose?… I don’t know but I have a suspicion…”

THH: On that note here are a few sections from a very fresh Reuters article dated Jan 29, 2024:

“… So I’m… Not right now… But I am very bullish in the two to three year time frame about all of… Nickel, Which folks are beginning to hate… Platinum, which they already hate… And Palladium, which they are learning to hate.”

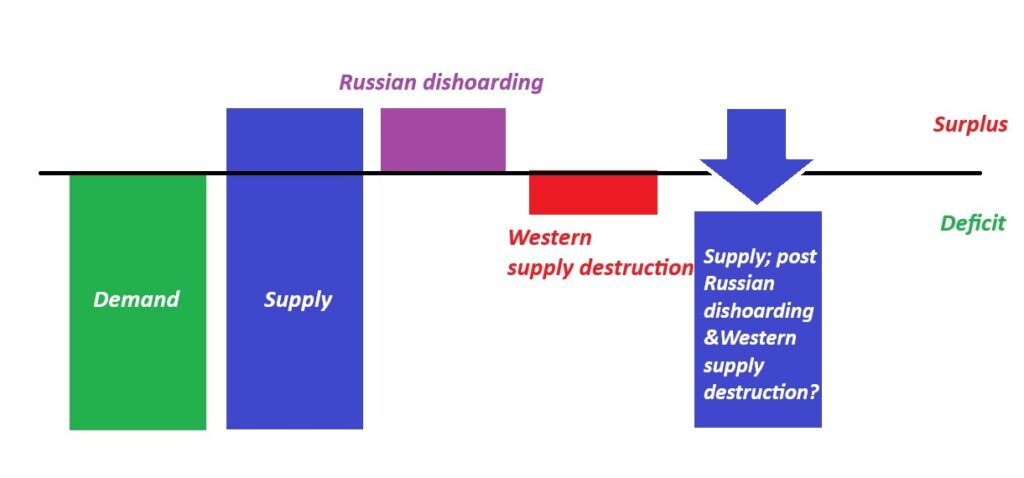

To visualize what Rick Rule is proposing is that there has been “artificial” selling pressure put on Nickel, Platinum and Palladium thanks to Russia dishoarding their metal inventories for the war effort. If this is the case then that is obviously a “one off” supply shock since they will run out one day. Furthermore we are also seeing Western supply destruction with mines being shut down which will shrink the continuous supply from production. This can make one wonder what could happen to the Demand and Supply picture once the potentially ongoing selling pressure from Russian dishoarding has abated and some Western mines have shut down operations:

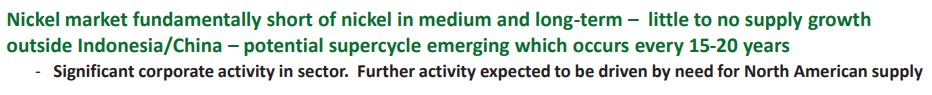

… The above does not include a longer term scenario where Indonesia, which is by far the largest producer of Nickel, is eventually forced to dial down their extremely environmentally unfriendly production pace. And to be clear, the Nickel/PGM juniors are currently not pricing in that any of this is happening or has a chance of happening.

If you want to learn more about the human and environmental costs of Indonesian Nickel mining I would urge you to watch this 9 minute video titled: “Nickel Unearthed: The Human and Climate Costs of Indonesia’s Nickel Industry”

For some added context this is coming from the same man who for the last few years kept saying that that Uranium prices were going to go higher. And as we can see right now the ones who bet on Uranium, when nobody else did, have been getting rewarded handsomely. Another example of why I don’t think the junior sector is that hard assuming you have the patience to wait for “obvious” bets to pay off (which can be a few years):

(Chart of a random Uranium company I found)

In contrast this is how the “Sprott Nickel Miner ETF” looks right now:

In Summary

- Possibly Russian dishoarding of Nickel, Platinum & Palladium (“Artificial”, temporary boost of Supply)

- Western nickel/PGM mines being shut down (Supply destruction)

- Possibility that Indonesia’s extensive and incredibly damaging nickel production is unsustainable (Future Supply risk)

I would argue that these points, and their implications for the future nickel market, does rhyme with the ongoing frenzy for large, environmentally friendly, Nickel sulphide projects located in North America by OEMs, international mining companies and even a Canadian gold company. These entities are obviously looking years into the future and trying to plan accordingly in contrast to us retail investors have a time horizon of next week. Not only that but they have a significant information advantage when it comes to the inner workings of the global supply chain as well as government policies.

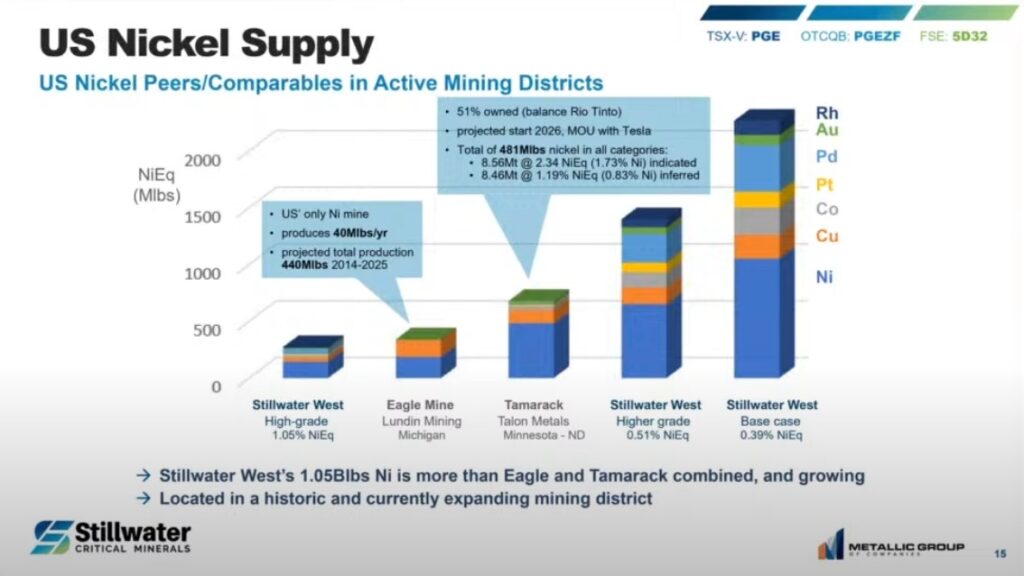

Stillwater Critical Minerals happens to have a large nickel dominant, polymetallic resource adjacent to the famous Sibanye-Stillwater’s mine complex in the US. The project is called “Stillwater West” and is on a very short list which is the list of current and potential supply of Nickel from the US. Today there is only a single, operating, primary nickel mine located within the borders of the >23 Trillion dollar US economy. That would be the “Eagle Mine” belonging to Lundin Mining which is actually almost depleted and scheduled to close next year. There are two other very large nickel deposits in the US that I am aware of. Both are located in Minnesota and at least one is basically blocked until further notice. I personally find it absolutely remarkable that the largest economy on earth only have one primary nickel mine which is closing in two years. Then we have Talon Metal’s “Tamarack” which is 51% owned by Rio Tinto and made a $1.5 B deal with Tesla. Talon unfortunately is having problems with the locals which is probably a major reason why the stock has been on a 3 year long slide.

“The US has very few reserves of nickel, with only one nickel mine in Michigan – the Eagle Mine – which is also expected to wind down production in the next few years.”

US Nickel – Strategic, Critical With Almost no Domestic Supply

As per the quote in the beginning of the article Talon Metals even got a grant from the US Department of Defense (DOD). On that note here are a few interesting snippets from this article:

“A 1954 U.S. DoD report even stated that nickel was, “the closest to being a true ‘war metal.’ It deserves first priority among materials receiving conservation attention.”

Nickel is used for numerous defense and space applications,” explained Dr. Matthew J. Schmidt, associate professor of national security and political science at the University of New Haven.

Apparently, that Pentagon recommendation wasn’t fully heeded, even as nickel has been seen as a metallic “Achilles heel” for modern military production. More recently, its use in batteries motivated a Presidential Determination qualifying it for Defense Production Act Title III funding.

(THH: Talon’s grant from The Department of Defense was almost as large as Stillwater’s current Market Cap)

“This funding makes clear that domestic supply of nickel is a national security priority,” Talon CEO Henri van Rooyen said in a statement.

Yet, as it now stands, the United States has only one operating nickel-cobalt mine with a current, publicly announced life of mine extending through 2026.

Here are some snippets from another very interesting article on Nickel titled “Nickel Closest Thing to a True ‘War Metal’ – by Stan Sudol“:

The metallic “Achilles heel” for any military and navel production has always been nickel

Sudbury was definitely going to be “nuked” by the Russians. At least that was our conclusion back in 1976 when I worked at CVRD Inco’s Clarabell Mill for a year.

We all agreed that if there ever was a nuclear war between the Americans and Russians then there must have been one Soviet “nuke” with our community’s name stenciled on it. We all laughed a little nervously, but there was also some pride in knowing Sudbury was important enough to get blown-up in the first round of missiles.

There has always been a largely ignored umbilical cord link between Sudbury’s strategic nickel mines and the U.S. military-industrial complex. Originally, it was American money and entrepreneurs who built the Sudbury mines and smelters.

“Given the chance, Hitler would willingly have traded the whole Silesian basin, and thrown in Hermann Goering and Dr. Goebbels to boot, for a year’s possession of the Sudbury Basin,” Maclean’s journalist James H. Gray aptly wrote in an Oct. 1, 1947 article about Sudbury.

From the early 1950s to the early 1970s, chronic nickel shortages plagued industrial and military production.

… Obviously a lot of mentions of Sudbury which was the only nickel producing hub in North America at the time and provided up to 95% of the Allies nickel demand. Furthermore, war is back as anyone who reads the news can tell:

And here is a recent interview clip with Ivanhoe Mines’ boss Robert Friedland talking about the demand for copper and metals overall…

While on the topic of China he notes that;

“… Military demand… National Security demand… Demand for militarization is very high.”

While on the topic of the global macro for metals;

“If someone is pointing a gun at you, you need that copper (THH: and nickel etc) to shoot back.”

“We see massive military demand… Europe is re-arming… Japan is re-arming… Taiwan wants to turn into a big porcupine… The United States military is worried about a shortage of 155 millimeter Howitzer shells… What do you think the world’s army is made of?… And in the meantime we have a huge amount of humanity that wants to green the world economy…”

Below are a couple of additional quotes by Robert Friedland in another interview dated October 24, 2023:

“… The other tribe says ‘holy shit’ for National Security… The Army, Navy & Air Force wants these metals for National Defense… We are out of 155 millimeter Howitzer shells…

“… In the Ukranian conflict more conventional explosives have gone off in one year than all of World War II absent the atomic bomb…”

“… And so the intensity of metal demand in conflict is beyond your wildest imagination…”

“… We’re Balkanizing the world economy into two very apparent, opposing camps (THH: East vs West)… We’re tearing the supply chains apart which is insanely inflationary…”

“… War is real world demand… And if you want to green the world economy that is real world demand… So this huge clash is coming between the Army, Navy and Air Force wanting Nickel, Copper, Cobalt, Platinum, Vanadium, Rhodium, Scandium (THH: Bold added for metals found in Stillwater West)… You name it… And the greening of the world economy… And so we are headed for a train wreck here…”

“…The miners have this unbelievable burden… That the whole thing depends on the miners… It’s the revenge of the miners.”

“… We need to mine in the United States… It’s a bit of a panic about this…”

Today January 30, while finishing up this article, this hit the newswires:

… Consider the above and which major corporations have recently made investments in North American nickel juniors. Canada Nickel has Anglo America as a shareholder and recently Samsung SDI (South Korea, Nato “Ally”) made an investment into the company. FPX recently saw Sumitomo Metals & Mining (Japan, NATO member) acquire a stake. And before that this the company already had received an investment from “Major Global Stainless Steel Producer Outokumpu (Finland, Applying for NATO membership) as of last year. On that note, below is a snippet from an Aug 3, 2023 news release by Outokumpu titled “Outokumpu explores options to strengthen its position in the U.S. as a part of phase three strategic preparations“

As part of these phase three preparations Outokumpu is conducting a feasibility study to explore options to expand its U.S. operations to meet the increasing demand for locally produced sustainable stainless steel, which contributes to a strong U.S. manufacturing and defence industrial base.

The following quotes are from a report done by the United States Geological Survey which covers the price history of numerous metals including nickel:

“Like petroleum, nickel is a critical commodity in wartime. Nickel, as well as cobalt, is needed to make superalloys for engines that propel jet aircraft, guided missiles, and some space vehicles”

“Merchant nickel prices traditionally spike in wartime when demand far exceeds supply and frequently rise in times of political unrest and instability. “

“The Korean Conflict is a good illustration of price spiking and distribution controls. During the transition from a civilian to a defense economy, demand for nickel exceeded available supply even though North American nickel mines and plants were operating at full capacity”

“At the same time, the Government also acquired nickel for the national strategic stockpile. The combination of these actions resulted in a severe shortage of nickel for nondefense uses. Shortages continued throughout the conflict despite the addition of significant new production capacity in Canada and the United States and the rehabilitation of a number of older mines and plants. Moreover, the U.S. Government continued to purchase nickel for the strategic stockpile after the conflict ended.”

And again, the list of projects that have any hope of helping the largest economy (and military for better or for worse) to become anywhere near self sufficient when it comes to nickel (and there are many more metals to boot) is short to say the least.

(Stillwater West and peers)

Securing Friendly Supply

We all know Indonesia has massively ramped up production of “pig iron” and that is why almost everyone on for example twitter is bearish on nickel.

“The majority of the growth in nickel production over the next decade will come from Indonesia, utilising its vast nickel laterite resource base, with much of the finance coming from Chinese companies.” – Source

But it does make sense seeing so much activity from majors if The West and US lack domestic supplies. If Nickel is the “closest thing to a war metal” would you not be even more desperate to secure supply that is not coming from within the sphere of your potential “enemy” (who could potentially cut it off when you need it the most)? I think Stillwater is in an almost unique position to be one of few large scale, nickel dominant projects in the US, located in an active mining camp and therefore probably has a good shot of actually getting built (unlike some of the other select few projects).

Now lets look at the top three nickel producers in the world (Source)

1. Indonesia

Mine production: 1.6 million MT

“The nation is actively building out its EV battery industry, and Indonesia’s close proximity to China, the world’s current leader in EV manufacturing, makes for an ideal setup…”

2. Philippines

Mine production: 330,000 MT

“Another country with close proximity to China…”

3. Russia

Mine production: 220,000 MT

Well, it’s Russia.

It should become more and more apparent why Stillwater Critical Minerals is perhaps almost uniquely position in the US today.

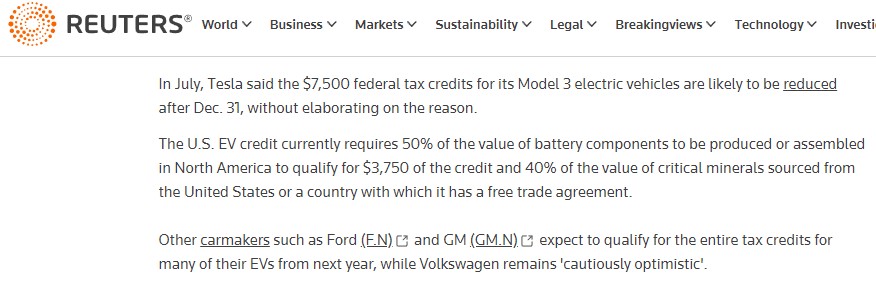

Not only is Nickel and others metals critical for the US as a country but there are more reasons why we see announcements of big investments by car companies in the US and Canada. For example Tesla apparently lost out on up to $7,500 of federal tax credits per car on Dec 31, 2023, because the car batteries did not contain enough metals produced in the US (or countries with a free trade agreement:

That is a large amount of money to lose which could be fixed by securing domestic supply. Now it starts to make even more sense why Tesla did a deal with US based Talon Metals. I also think this is why we are seeing such a frenzy by many different companies to secure off take rights because US/NA sourced Nickel is in this case worth a lot more to companies like Tesla on dollar per pound basis than Indonesian Nickel for example.

Nickel Prices – Unsustainably low?

The following summation is from a very recent interview with Canada Nickel CEO Mark Selby, done by Crux Investor:

*The Capitulation*

Wyloo putting its Mincor operation on care & maintenance which it just bought a year ago. Cassini 1.2 Million tonnes at 3.3% nickel.

BHP in turn is putting its Kambalda concentrator (fed by Mincor) on C&M which effectively cuts out a number of operations paths to market. It also impacts the amount of Mt. Keith concentrate which can be processed because the flash furnace needs to blend feeds.

BHP looking at a write-down on their nickel business (based on reported data, their sulphate plant not producing or selling much, cost pressures across rest of the business) and including their Oz Minerals acquisition and ni.

First Quantum suspending mining at Ravensthorpe (will feed plant from stockpiles to save cash). South 32 reviewing their Cerro Matoso FeNi operation – this is a 40-year-old laterite mine – remember laterites are relatively easy to high-grade.

Majors tend to be behind the curve and the production cuts they announce end up helping create the bottom.

… And the hits to Western supply just keeps coming. Today, on January 31, we received the following news:

… Like what Rick Rule likes to say: “The bear markets are authors of the bull markets”. His thesis and why he is bullish on nickel over the coming years looks to be happening. I remember 2015 when almost every commodity had tanked for quite some time and there were an increasing number of news releases which stated that mines were to shut down. This pretty much marked the bottom for the commodity complex. And after having described how critical Nickel is from a national security stand point (aka if you have enemies you better have domestic nickel supply) it might not come as that big of a surprise that already we are seeing news like this:

“Nickel miners could pay less to mine in Western Australia amid royalty relief crisis talks” /Jan 25 – Source

“Changes to the amount of money miners pay to dig up precious metals in Western Australia have been floated at government crisis talks as the nickel industry bears the brunt of a global price decline.”

“Federal resources minister Madeline King and WA mines minister David Michael met with nickel and lithium industry heavyweights today, pledging state and federal level support.”

Of course the very large mining sector in Western Australia probably have a strong lobbying arm and saving jobs is positive for politicians. With that said I think the fact that, again, having Western nickel supply up and running is absolutely crucial from a geopolitical perspective (Why else would the US Department of Defense give a cash grant to Talon Metals for their US based nickel project?).

In Summary

Not only are nickel prices probably unsustainably low with some Western miners announcing shutting down operations (Something you typically see around bottoms as it means a shrinking of supply) but I also think that there simply is no way that the West (especially the US) could allow the Western nickel sector to fail completely and be long term dependent on “Chinese” supply due to the geopolitical landscape.

“I would say one of the very very few bipartisan issues in the US… That both republicans and democrats agree on… Is about getting China out of the supply chain” – Mark Selby, CEO of Canada Nickel

Furthermore we just saw the following news item hit the wires on January 31, 2024:

“Trafigura-backed nickel mine seeks new partner for bailout“

“Stillwater West” – Critical in more ways than one

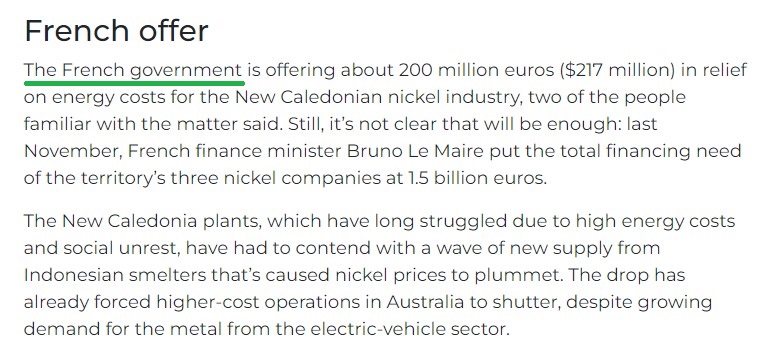

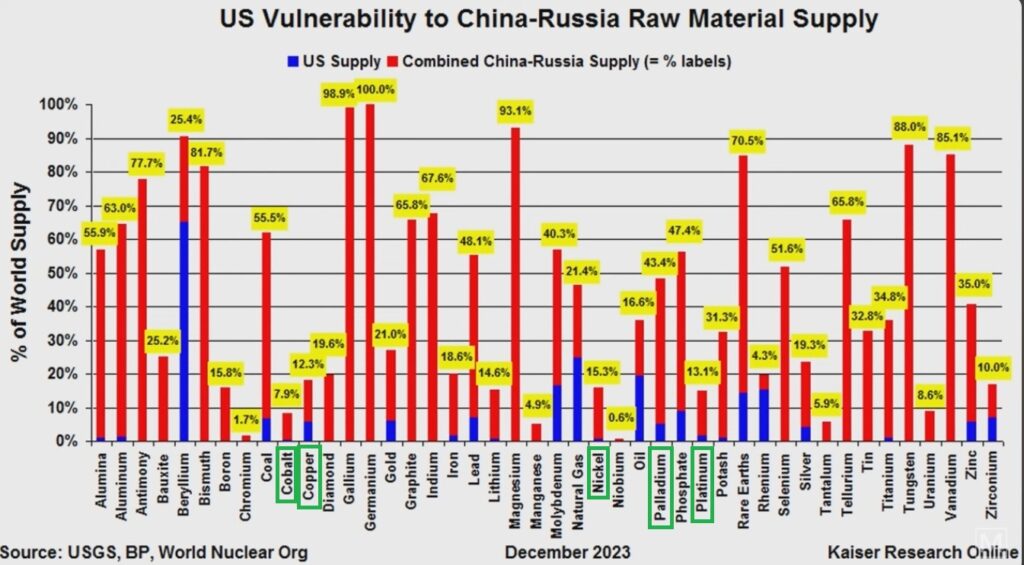

Although nickel makes up the lion’s share of Stillwater’s current resource it also includes several other metals that Russia and China (Not including “vassals”) have varying degrees of chokehold on when it comes to world supply:

All in all, Stillwater’s current resource contains SEVEN different metals and FIVE of these metals are on USGS’s 2022 list of “50 mineral commodities critical to the U.S. economy and national security after an extensive multi-agency assessment.“. The US Department of Energy released their own list in July 2023 which also has copper listed as being critical to the US. The only metals not on the critical mineral list are gold which only makes up 3.4% of the gross value .

In other words 96.4% of the resource’s total gross value comes from (several different) metals that are deemed to be Critical to the United States in one way or the other:

The US thus has several reasons for wanting this asset to move forward given that this resource hits “five to six critical birds with one stone” unlike a non-polymetallic “pure play”.

Palladium is as you can see above the second most important metal at Stillwater West from a gross metal value perspective. Well wouldn’t you desperately want to secure domestic supply of it as fast as possible if you are the United States given who you are relying on currently :

To summarize the Stillwater West project has a couple of things going for it:

- The EV trend which designates the majority of the contained metals as critical for the US

- The re-arming of militaries around the world and active wars which make nickel and other metals critical for the world’s largest military (US)

- The United States’ soon to be completely void domestic nickel production AND lack of pipeline;

“The US has very few reserves of nickel, with only one nickel mine in Michigan – the Eagle Mine – which is also expected to wind down production in the next few years”.

“Proposed new nickel mines in the US, such as Talon Metals’ Minnesota mine, are also facing strong protests from local and indigenous communities. As such, the US government is facing more ire for not making it easier for domestic suppliers to get nickel mine permits.” – Source

(Talon Metals grant announcement from the Department of Defense)

… Enter Stillwater Critical Minerals

The Basic Market Cap is a paltry C$28.7 M at $0.145/share. So if one just looks at the retail set price for the company one would think that Stillwater might be your typical run of the mill junior explorer with some potential and a dream in a sector that will never recover. The thing is that commodity prices and investor sentiment is cyclical. Before the recent crash in lithium it had been one of the most impressive bull markets. Before the recent rise in uranium it had been in a grueling bear market etc. Nickel or any other commodity is no different. Things always changes.

Basically Stillwater Critical Minerals’ valuation suggests that it does not have a) large resource with critical minerals in highly strategic jurisdiction/location, b) a ton of exploration potential to boot, and c) has votes of confidence from Glencore and Ex Ivanhoe Mines people. Obviously the marginal retail speculator who is setting the prices in this sector knows better than Glencore, the US Department of Defense, the former head geo for Ivanhoe Mines and insiders (This is sarcasm if it is not obvious).

One thing to note about Nickel is that unlike Lithium, where almost all of the demand comes from EV, the stainless steel market makes up around 70% of the demand for the metal. In other words the world will need a lot more nickel mines in the future just to take care of the most basic needs for a modern civilization.

Thoughts on The Market

The way I see Nickel juniors right now is that either the market is right that Nickel in North America is pretty much worthless and will be pretty much worthless for the next decade or the marginal retail investor is wrong and this is one of those periods when one can “legally steal” projects that might be worth something to a lot (which one would be lucky to see once in a decade). In the case of Stillwater Critical Minerals one could buy a deposit described as “world-class grade and scale in a producing American district” for C$26.7 M. These are the types of asymmetrical bets, that are only offered in the most severe bear markets, that makes the junior mining sector extremely attractive at times like this. I mean the market is, at face value, pricing in that there is a 10% chance that their project is actually at least worth C$317 M. And that is still not anywhere near a valuation that one would think of when one thinks of “world class” or something Glencore would be interested in…

Votes of confidence

On that note one can ponder what company which would be interested in a project if it indeed is, or has a shot of becoming, a “world class” project? Well maybe a behemoth like Glencore which has a Market Cap of C$78 B and are experts on polymetallic deposits thanks to their involvement in smelting, refining and metals trading? Well wouldn’t you know… Glencore just happens to be the entity that entered Stillwater Critical Minerals as a strategic investor in June of last year at a price of $0.25/share (versus $0.145/share today).

On the people side Stillwater Critical Minerals has been able to attract people with a extensive experience from South Africa’s Bushweld Complex which is thought to be an analogue to what Stillwater is working on. Oh and this includes the former Head of Geology of Ivanoe Mines, Dr Danie Grobler who spent almost 11 years with Ivanhoe Mines:

Danie Grobler is very familiar with Ivanhoe’s Platreef Project (in the Bushweld complex) and it is, again, believed that it is the best analogue to Stillwater’s project. I am no expert on Nickel or Nickel dominant polymetallic deposits so I put a lot of weight on “who cares”. And if a $78B company like Glencore, the ex Head of Geology and Exploration for Ivanhoe Mines care, then I should probably care. Glencore cares it means the project ought to have a shot of being worth billions. If ex Ivanhoe Mines people care it probably means there is a ton of exploration potential etc. It’s just common sense. And to top it off Insiders certainly has skin in the game with a 20% ownership stake. All of these people know infinitely more about the prospects for nickel, mining, geology and everything mining related.

Honestly I don’t think one would even need to read the presentation to figure out that this is probably a “no brainer” Risk/Reward bet at these prices.

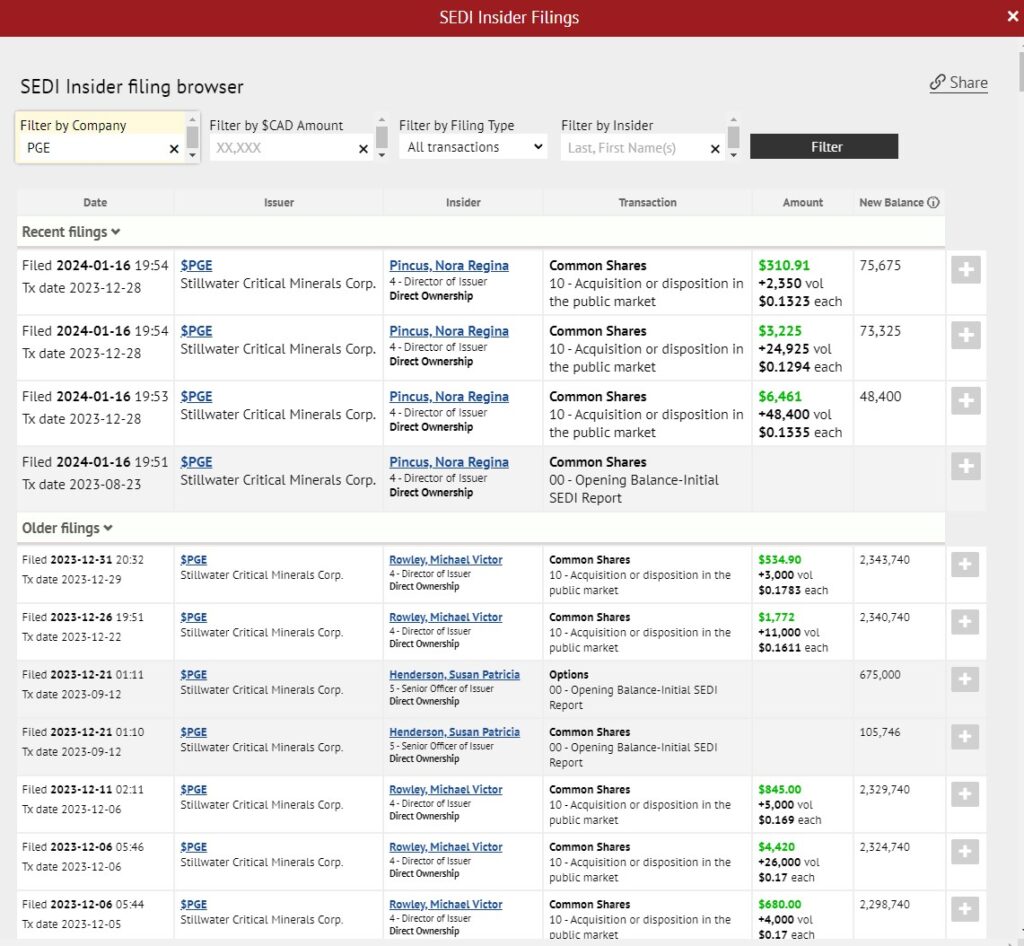

And some have increased their shareholdings recently…

Great bear markets = Great dislocations

- Retail investors , who sets the market price of the juniors, are suggesting that Nickel projects in North America are pretty much worthless and will be worthless for a long time.

- Meanwhile the big/smart money such as Glencore, Anglo American, Outokumpu, Sumitomo, Samsung SDI, Wyloo (Forrest) and even a major gold company are voting with their feet and suggesting that Nickel in North America is certainly of interest

If retail investors are right then nickel will be dead for at least the next say 5 years or more and today’s prices are fair. If retail investors are wrong, and the smart/big money are right, then some of these high quality juniors are grossly mispriced and could lead to substantial gains for brave “contrarians”. Now I am not an expert on Nickel but I would take for example Glencore’s best guess about the future a hundred times over the marginal retail investors “current mood”.

A stock can only go down -100% but upside is theoretically limitless. In Stillwater’s case the maximum theoretical downside is from C$26.7 M to $0 M (-100%) which I view as very unlikely to happen. On the flipside of the coin, what might the upside potential be from C$26.7 M given that an entity with a Market Cap of $87 B is spending time and money on it? I mean what is the bare minimum value potential a company that size needs to see?… Who knows, but a lot more than C$26.7 M at least. I simply think that if I could fast forward the tape a couple of years or more I think Stillwater will either be down (Retail were right) or maybe up >10X (Glencore, Ivanhoe geos et al were right and things went well with the project).

Recapping The Simple Bet

What I am buying:

- Tier 1 jurisdiction; The largest economy in the world, the largest war machine and the main opponent of the Russia/China who directly or indirectly controls/influences the three largest export countries of nickel

- Located in an active mining cap with >100 years of mining history

- A large and relatively high-grade, nickel dominant resource as Margin of Safety (More than underpinning the current Market Cap)

- Potential for very high growth rate as evidenced by their hit rate and rapid resource expansion

- Ex Head of Geology and Exploration for Ivanhoe Mines with experience from Ivanhoe’s Platreef deposit is running the exploration

- Immense exploration potential along a 25 km long trend

- Glencore ($78 B Market Cap) as third party validation by a super major

- A management team with skin in the game as 20% of the company is owned by insiders

- 4 other non-core properties

What I pay for all the above:

- C$28.7 M

My Conclusion:

With an already very large resource and 25 km to explore along strike, while also being open at depth, I view Stillwater Critical Minerals to be a very cheap option on almost “limitless” amounts of strategic/critical/battery metals in the US for C$28.7 M.. With the price tag of C$28.7 M it looks like an incredibly asymmetrical bet to me as I can only lose 100% but think I have a legit shot at >10X returns or more over the next 3-5 years.

Game Theory

Lets play around with some scenarios in terms of possible economic and geopolitical futures…

1. Steady state

The world economy keeps on chugging with the demand for metals going up (Even more so if the Greening of the world economy keeps going). Furthermore the alleged dishoarding from Russia will one day abate and coupled with the mines being shut down it could lead to a very nice rebound in Nickel and PGMs. Longer term there is a possible supply risk from the fact that Indonesian nickel production might be unsustaiable.

2. East vs West conflict escalates

If the tensions rise and war spreads it could lead to a recession which could hamper demand for metals. But this could be more than offset given that the East is the largest producer of nickel and a lot of PGM supply comes from Russia. The risk is therefore that the supply of critical metals like Nickel, Platinum and Palladium that the West is short of will get cut off and all of a sudden the Domestic Demand/Domestic Supply ratio shoots through the roof. This could be exacerbated by the fact that re-arming the military requires a lot of said metals.

3. Recession

If the US and/or world economy goes into a recession but the global conflicts cool down it might lead to a fall in demand for most metals. But that still does not change the fact that the potential “artificial” selling by Russia might abate, mine supply decreased already, and that Indonesian production might not be sustainable in the longer term.

* Internally Hedged

One thing to keep in mind is that a) The majority of demand from Nickel is not coming from EV batteries, and b) Platinum and Palladium is somewhat of a hedge against EVs. So if demand for Nickel in EV batteries keeps on going that could be great. But if the growth from Nickel in EV batteries starts to faulter there is still the lion’s share of demand coming from for example stainless steel and it does not change the fact that the US only has one primary Nickel mine. Furthermore it could mean that Platinum and Palladium sees higher demand instead (and the biggest supplier of Palladium for the US happens to be Russia).

I recently talked to a CEO of another company and we briefly discussed Glencore. He said that he has talked to people at Glencore who stated that polymetallic deposits is what built Glencore because it helped the company weather downturns in a specific metal unlike companies with almost full exposure to a single metal. I think this makes sense as it, all else equal, lower the cash flow volatility and reduces risk. A solid, internally diversified mine might make money in almost all macro environment while a “pure blood” might make a lot of cash one year and then lose money (or god forbid go bankrupt) in case the one and only metal mined is depressed for an extended period of time.

* Flexible

The resource is not only internally hedged via the diversity of metals but this system contains both disseminated low grade mineralization as well as high-grade structures (Like the cross-cutting N-structures that have produced pretty much world class hits like 13.2m of 2.31% Ni, 0.35% Cu, 0.115% Co and 1.51 gpt 3E). So there is the possibility for both big scale bulk mining and/or smaller high-grade mining.

The Project

As should be evident I made this bet primarily by virtue of a) The current price of the company, c) The strategic nature of the metals for the United States and from a global macro perspective, as well as b) Who are betting on the company. Still it is nice to get some slides in on the actual project so the potential scale of it all starts to sink in…

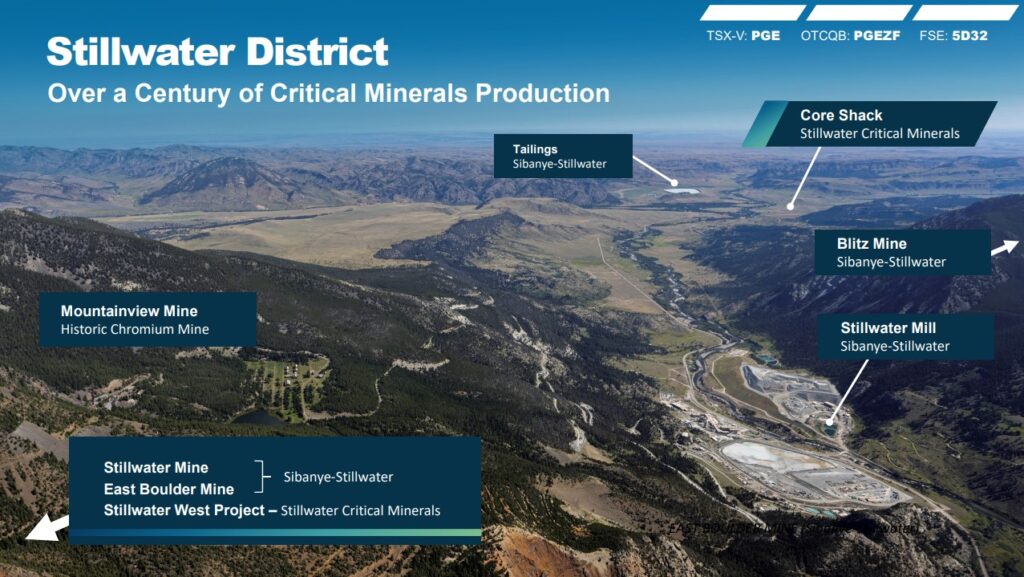

First of all it is located in a producing mining district

“I don’t think people appreciate how hard it is to bring new nickel online” – Wyloo CEO Luca Giacovazzi

Obviously even finding Nickel is hard enough as evidenced by how few nickel juniors there are compared to for example gold juniors. But any deposit is also worthless unless it can actually be mined. To have Stillwater’s project located in an active mining camp and right next to Sibanye-Stillwater’s mines is a big value add in my book:

(Note the scale bar)

Aerial view of the area:

When I look at that picture I start to wonder if Glencore might have entered Stillwater Critical Mineral’s with idea to buy up both Sibanye-Stillwater and Stillwater Critical Minerals one day. It would make a lot of sense given that Stillwater Critical Mineral’s might have the scale and Sibanye-Stillwater the mine facilities. Of course Stillwater Critical Minerals could simply be acquired by its larger neighbor as well. Sibanye-Stillwater is not anywhere near as large as Glencore but its still much bigger than Stillwater Critical Minerals and the potential synergies are beyond obvious.

The Thesis

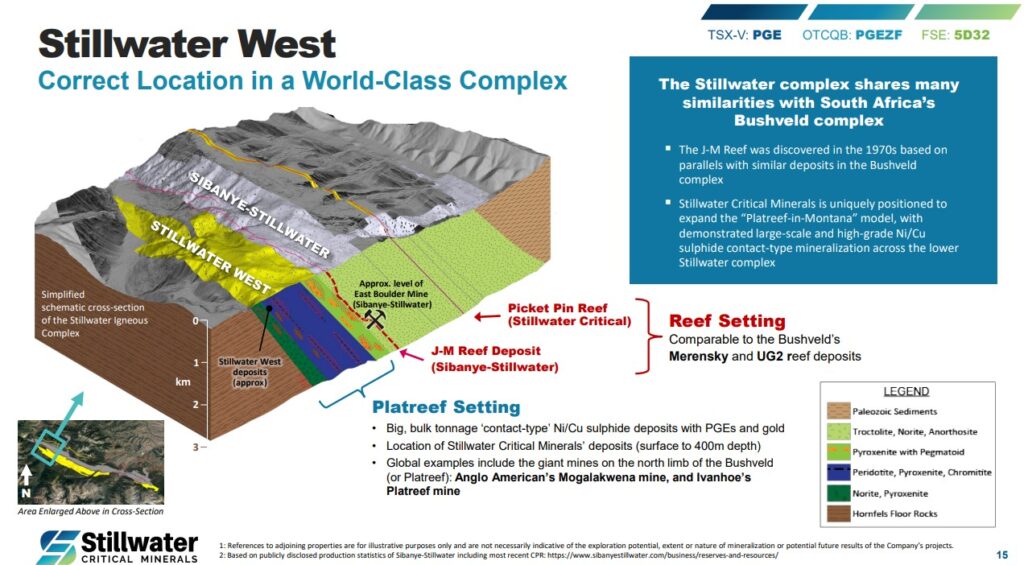

So what attracted the guys from Ivanhoe Mines (and Glencore)? I think they joined for the exploration potential and see the current, albeit already impressive, resource as just the first stepping stone. As discussed earlier the belief is that we are dealing with Platreef/Bushweld style layered mafic-ultramafic complex but this one being located in Montana, US:

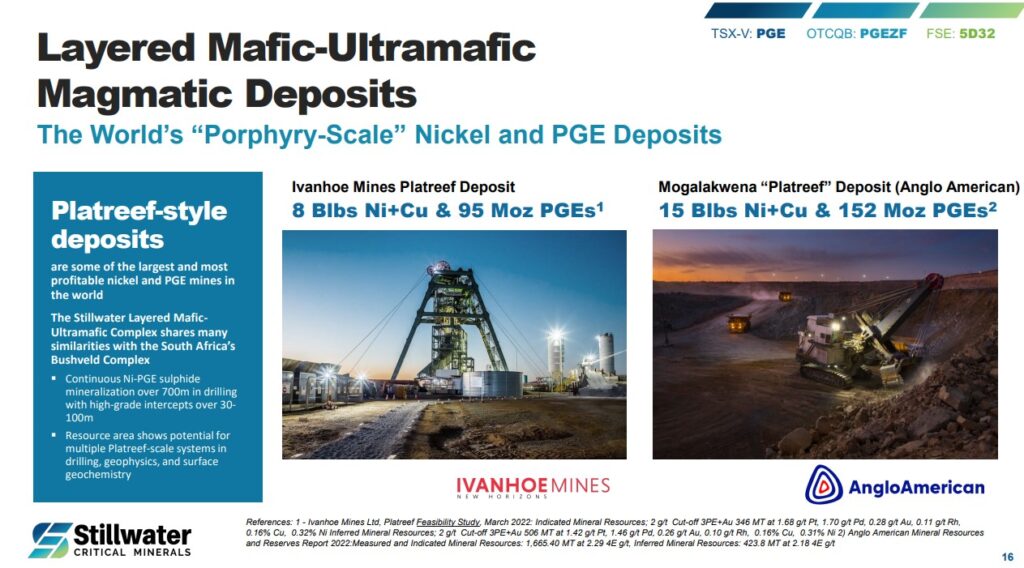

In turn this could mean that there is literally monster potential as evidenced by some deposits in the Bushweld complex (Of course including Ivanhoe’s Platreef deposit where Danie Grobler worked):

Are there any guarantees that it will be obvious that Stillwater will have somethin similar in a few years? No, there are absolutely no guarantees. All we know is the current Market Cap and that is C$26.7 M which means there is basically “no chance in hell” priced in. So if this ends up resulting in something similar as the two deposits above then obviously bettors should be more than handsomely paid given the cost of the bet today. As always I am not looking for guaranteed returns, because there are no such cases, and never will be. I look for bets with incredible Risk/Reward where even a bet with (theoretically) a very small chance of success can be worth it since the payoff more than offsets the risk. And if Glencore and Danie Grobler are in there is certainly a better chance than “no chance in hell”.

Banked Success – Bird in the hand

The last resource estimate was published in January 2023 and it is a quite respectable resource to have as Margin of Safety. This is what we are getting for starters for the sum of C$26.7 M:

So we at least know we get a slice of a 255 Mt resource because that has already been “proven”. But this is probably just the tip of a potentially very large ice berg…

Growth Potential

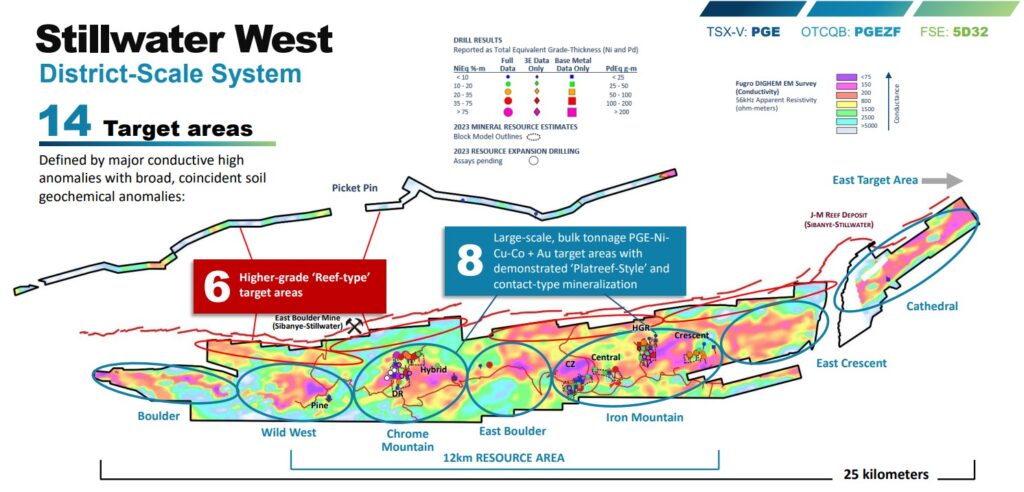

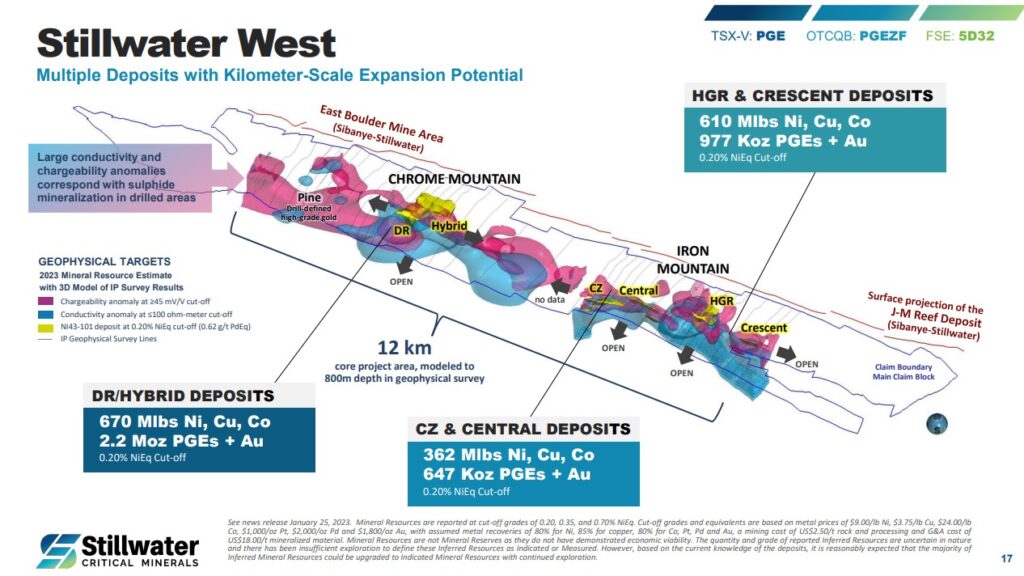

The total resource above is actually made up of several deposits along a 9 km trend that appear to be like pearls on a string:

What you see in the picture above is a 12 km stretch with Chargeability and Conductivity anomalies, in Pink and Blue, with the deposits shown in Yellow. As the slide notes the “large conductivity and chargeability anomalies correspond with sulphide mineralizaiton in drilled areas“. And furthermore they seem to connect! This is obviously a big deal because in the end this could mean that what has been delineated so far is potentially parts of one giant system that could be over 12 km long.

“The deposits are open laterally to each other. They are open to depth. They are open in every direction“

“This is a very big and well mineralizes system”

Platreef Style: But wait there is more…

White Stillwater West is known to be a Platreef anology with it being a “Layered Mafic-Ultramafix Complex”, just like the Platreef deposit, but it has also been discovered to host high-grade, cross cutting mineralized structures UNLIKE the Platreef deposit. So it is a Platreef analogue but with a very welcomed “twist”:

“The drilling in 2023 intersected the N2 and N3 mineralized zones parallel to the N1 zone, previously identified in CM2021-05. N1 showed significant results in previous analyses, yielding 13.2 meters grading 2.89% Recovered Nickel Equivalent. The N series structures are now understood to be part of a series of north-south trending structures crosscutting the layered sequence and Platreef-style mineralization of the Stillwater Igneous Complex.” – Source

These cross-cutting structures highlight the fact that you get both disseminated as well as high-grade mineralization at Stillwater West and it is still very early days.

Below are comments from the CEO from an earlier news release:

Michael Rowley, President and CEO, commented, “Our expanding understanding of high-grade gold and platinum group element mineralization, alongside the wealth of critical minerals that the Stillwater district is known for, highlights the surprisingly underexplored nature of the lower Stillwater Igneous Complex and the potential that exists for the advancement of multiple world-class ore bodies across the 32-kilometer span of the Stillwater West project. – Source

Note that despite the limited exploration of the N-structures so far the early results have been very good. 13.2 meters of 2.89 NiEe is remarkable and highlights the fact that this could probably end up being both a giant lower grade bulk mine and/or a smaller tonnage high-grade mine. I do not think this flexibility is appreciated at all by the market right now.

A lot of Smoke

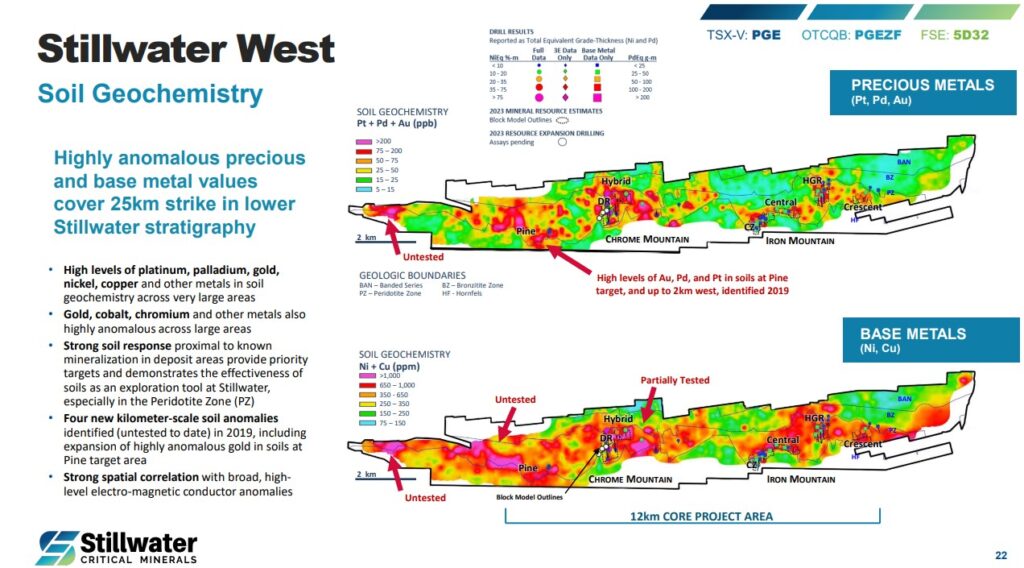

Soil geochemistry results have resulted in “highly anomalous precious and base metal values” along a whopping 25 km stretch of land and specifically the 12 km “core project area” lights up like a Christmas tree:

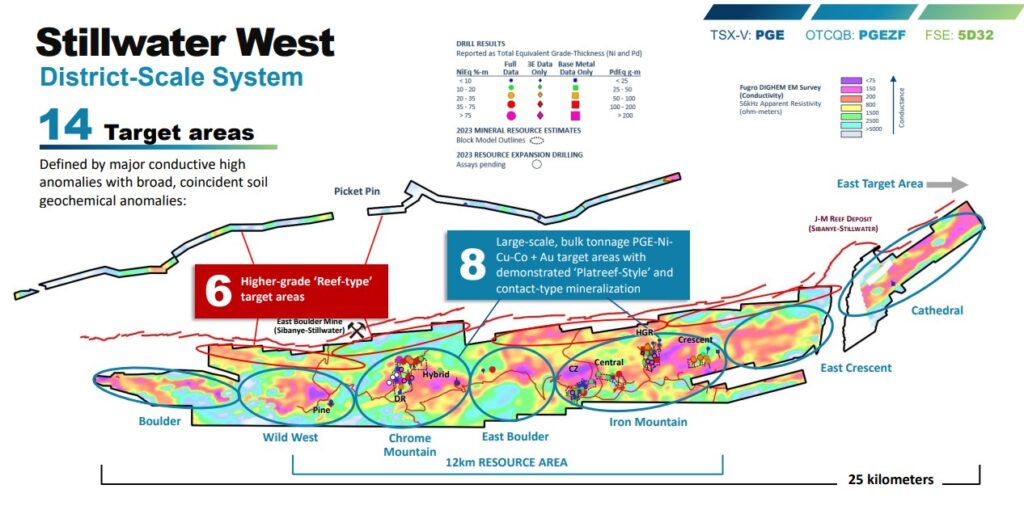

I think the slide above really makes the growth potential sink in given that there has only been limited exploration within a small fraction of those very large anomalies. This is what I would call the definition of a true “district play”. When combining the geophysics with the soil geochemistry results the company generated #14 target areas:

I think it is worth noting that Ivanhoe’s giant Platreef deposit would fit within one of those blue ellipses(!).

Blue Sky 2.0 – The Feeder

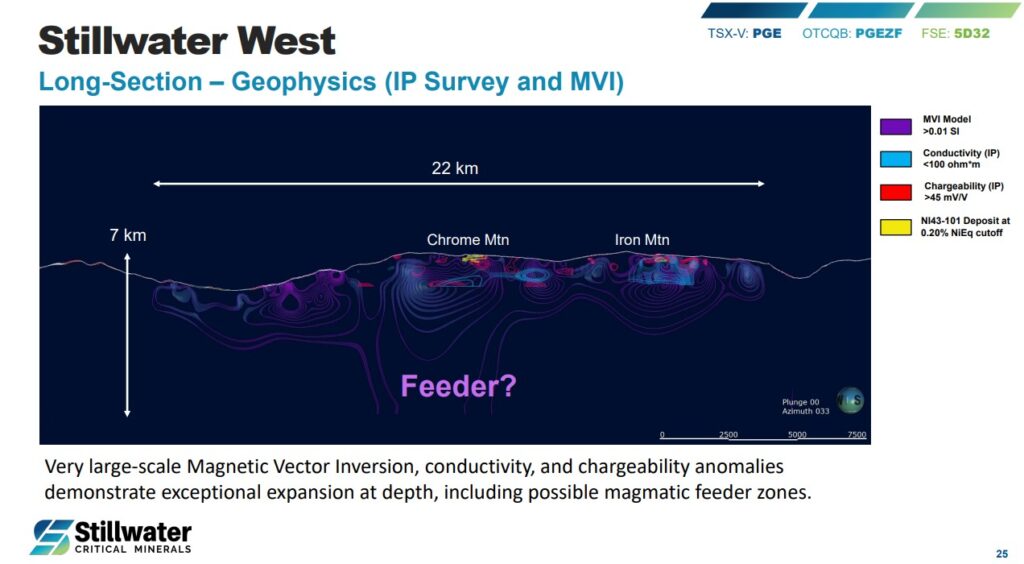

If we’re talking ultimate blue sky potential then I have to present this next slide…

… Based on geophysics the slide above suggests that this massive system, which Stillwater has just done shallow nibbles at so far, might extend to great depths and possibly converge into a giant feeder zone. The current resource, which will get an update this year, fits into those yellow blocks which are barely visible at this scale. Will this turn into an absolute monster the size of several Platreef deposits? No idea, and it would take years. Could they find something akin to a Voisey’s Bay “magna chamber” at depth? Maybe, one can’t rule it out. All I know is that one can buy everything including all the blue sky potential for C$28.7 M right now. Thus the market is giving pretty much all upside for free right now in my book.

In Summary

I think Stillwater West has true elephant potential which could lead to a growth profile that lasts for years if not decades. As I stated in the beginning of this article I see Stillwater Critical Minerals as an incredibly cheap option on almost unlimited potential for several minerals deemed critical for the United States. One could certainly argue that the current Market Cap is not even reflecting the known success. In that case all the upside from here would be “risk free” from a valuation perspective and I like those kinds of bets.

Bonus Projects

As a shareholder you also get partial ownership of wo (three) other projects located in Yukon and Ontario, Canada. What kind of intrinsic value we have here I do not know. I only know that Stillwater is looking to do something with the Kluane project and that Heritage Mining is drilling the Drayton-Black Lake project. So it is worth something, especially in a spin out scenario.

Note: I am biased. This is not investment advice. I am not a geologist. I cannot guarantee the accuracy of the information in this article. I share neither your profits or your losses. Assume I may buy or sell shares at any time without warning. Do your own due diligence and make up your own mind!

Best regards,

The Hedgeless Horseman

took a starter position earlier this week – gosh this market is brain dead…

Yup, and it never knows that it is until it looks back a year or so later and people go “How could it have been so low back then??” 🙂

Eric I read your earlier postings on SCM. I was taken by this company’s land package and location. Next door to a producer and with kilometres-scale conductive anomalies, Glencore in with 9.9% this is looking really good. Your posting today is a great in-depth read and emphasis readers to take advantage of this stock at these prices. I am a shareholder and will patiently wait for an overall resource rebound with SCM being a front runner and direct beneficiary of this.