Hannan Metals (HAN.V): Discovery of a Very Large Alkaline Gold System And 5 Targets to be Drilled in 2025

I have described Hannan Metals as a “Fire and forget” aka HODL-type exploration story for a while. The simple reason being that the company has a good management team and one of the largest exploration portfolios, and most amount of targets, of any junior I am aware of. Nothing in that department has really changed except there are even more targets today, some of the targets are more de-risked, and the Market Cap have climbed higher accordingly. I thought I would write this article mainly because I think the company is currently in a very interesting position for investors/speculators after the recent trench results from the very large Previsto gold target.

Note that I own shares of the company in my portfolios, as well as other portfolios I help manage, and Hannan is a banner sponsor. So consider me naturally biased and make up your own mind. With that said, lets get going!…

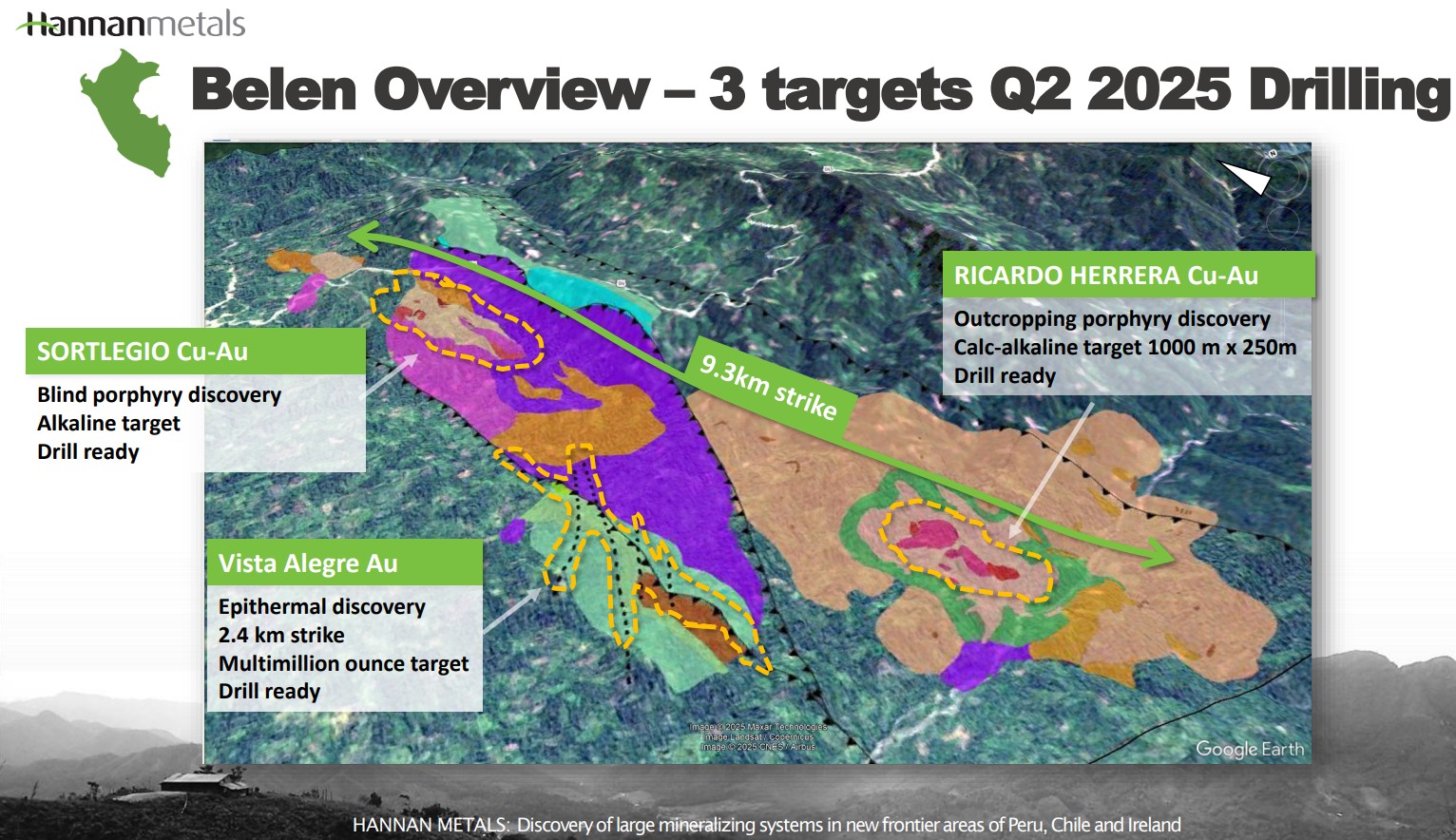

I can see the coming 1-24 months to be very interesting for Hannan Metals. With the massive gold target at Previsto surfacing as the flagship target in the mind of Mr Market I think it opens up some interesting Risk/Reward from here. My expectations are that the gold target will see quite some de-risking efforts, including many more trenches, leading up until the first drilling which could be over a year away. So in a sense it is impossible for that target to get “killed”, until it is drilled, while the first trenches coupled with the very large anomaly suggests that it can get more and more de-risked leading up to it. Furthermore the company recently announced that they have the bulk of the necessary approvals in order to test three targets at the Belen prospect within the greater Valiente project (“Ricardo Herrera”, “Visa Alegre” and “Sortilegio”) on Feb 13. The lack of reaction in the share price on this news, together with the significant reaction to the news from the Previsto gold target, further points to the latter being the main focus of Mr Market. All this together leads me to believe that expectations for the three targets at Belen are considered low since the market doesn’t seem to care much (at least not care much relative to the Previsto Gold target). Thus I see a case where said targets are barely accounted for and could thus provide positively skewed Risk/Reward as it stands now.

If the expected drilling at Belen etc disappoints there is still a good chance that most of the current MCAP is, and could continue to be carried by, the Previsto Gold target. But in case there is any significant success at one or more of the targets it could lead to a new “flagship” target surfacing, or at least increasing the odds of overall success for the company and thus reduce risk, while de-risking the total upside potential (while the immediate share price reaction might be muted as 1+1 often can equal 1.5 in the market).

From a recent news release:

“The convergence of three significant targets – Ricardo Herrera, Vista Alegre, and Sortilegio – within an 8 km by 2 km trend demonstrates the scale of this mineralized system. Having 40 permitted drill platforms positions us to systematically test each target once these final steps are in place, with drilling anticipated to commence in Q2 2025.

“The drilling preparatory work at Belen is going on while we continue to explore the significant Previsto gold find, located 20 km to the northwest, where channel sampling recently identified continuous outcrop of alkalic-type epithermal gold mineralization that included 26.0 m @ 5.4 g/t Au and 27 g/t Ag”.

Expected Catalysts Over the Next 18 Months:

- “Previsto” – Assumed flagship Project, Valiente, Peru

- Continued exploration work (including trenching) in 2025 leading up to expected drilling in 2026

- “Bonus” shots that are planned to be drilled in the meantime through 2025

- “San Martin” (Sediment copper/silver), Peru (Fully funded by JOGMEC)

- “Sortilegio” (Cu-Au), Valiente, Peru

- “Vista Alegre” (Au), Valiente, Peru

- “Ricardo Herrera” (Cu-Au), Valente, Peru

- “Cerro Rolando” (Enriched blanket & porphyry), Chile

… As stated in the intro I think this work program is resulting in a very interesting Risk/Reward picture. I am convinced that the Previsto target is the main target in the forefront of Mr Market’s mind right now given the response to the trench results and because I think so too (The market can usually only focus on one thing at a given time). Also note that the company has more targets than the ones listed above and the list keeps growing as per the most recent news release:

… Hannan really has land positions worthy of a Major and for the company to bee successful they need to prove up at least one significant discovery within their enormous portfolio. My bet is that I think there is a relatively good chance that they will.

The company will probably need to raise money but I don’t think that will be a problem judging by the strength in the share price. I believe there is quite a bit of big money looking at this story right now and Teck is a 9.9% shareholder already. Given that i think the story has gotten better since the last raise I would not be surprised if a strategic like Teck joined in the financing as well.

The Strategy

The simple reason I hold Hannan, and the HODL-folios I manage hold it as well, is that the runway for growth is remarkable and that the company has many shots to take that could make the current share price be higher in the future. The Previsto Gold target alone has billion+ dollar potential in my book and there are more targets than I can remember in addition to that. Why I like cases like this is because they are not centered on trading. The pipeline for potential growth is so large that Hannan could be (hopefully) busy growing for years to come which makes timing & trading less important. Thus I can stick it in the low maintenance HODL-folios and theoretically keep it there for a long time. The only obvious reasons to sell would be profit taking in case the position is growing “too large” or selling at a probable loss if the case failed. The former is a luxury “problem” with no real need for accuracy and the latter should be years out given the amount of targets to test (and the amount of targets to test reduces the risk of a completely failed case). With Michael Hudson (Of Pierre Lassonde backed Mawson Gold/Southern Cross Gold fame) and Lars Dahlenborg (A fellow Swede) running the ship I feel very comfortable that I do not need to second guess the company’s decision and simply let them do their thing. Also, with the involvement of JOGMEC and Teck, you already know what the big boys have put their stamp of approval on the management team…

All in all I think Hannan checks most boxes that I would like to see in a “fire and forget” aka “HODL” case. Since there are no guarantees of anything, and I do not have a crystal ball, I am not “betting the farm” on Hannan. It is one of many cases were I think the Risk/Reward is favorable. This would be a High Risk/High Reward case where I expect to either lose money or make money, potentially quite a bit. Which case it will be is TBD.

The company seems quite tightly held which has enabled the company to usually reflect, and retain, the value communicated in news releases. It also means the stock can sometimes spike up or down for no apparent reason other than someone buying or selling. Thus one probably have to have a stomach for volatility and a longer timeframe than the marginal investor. Since

The Flagship Target – The Previsto Gold Target

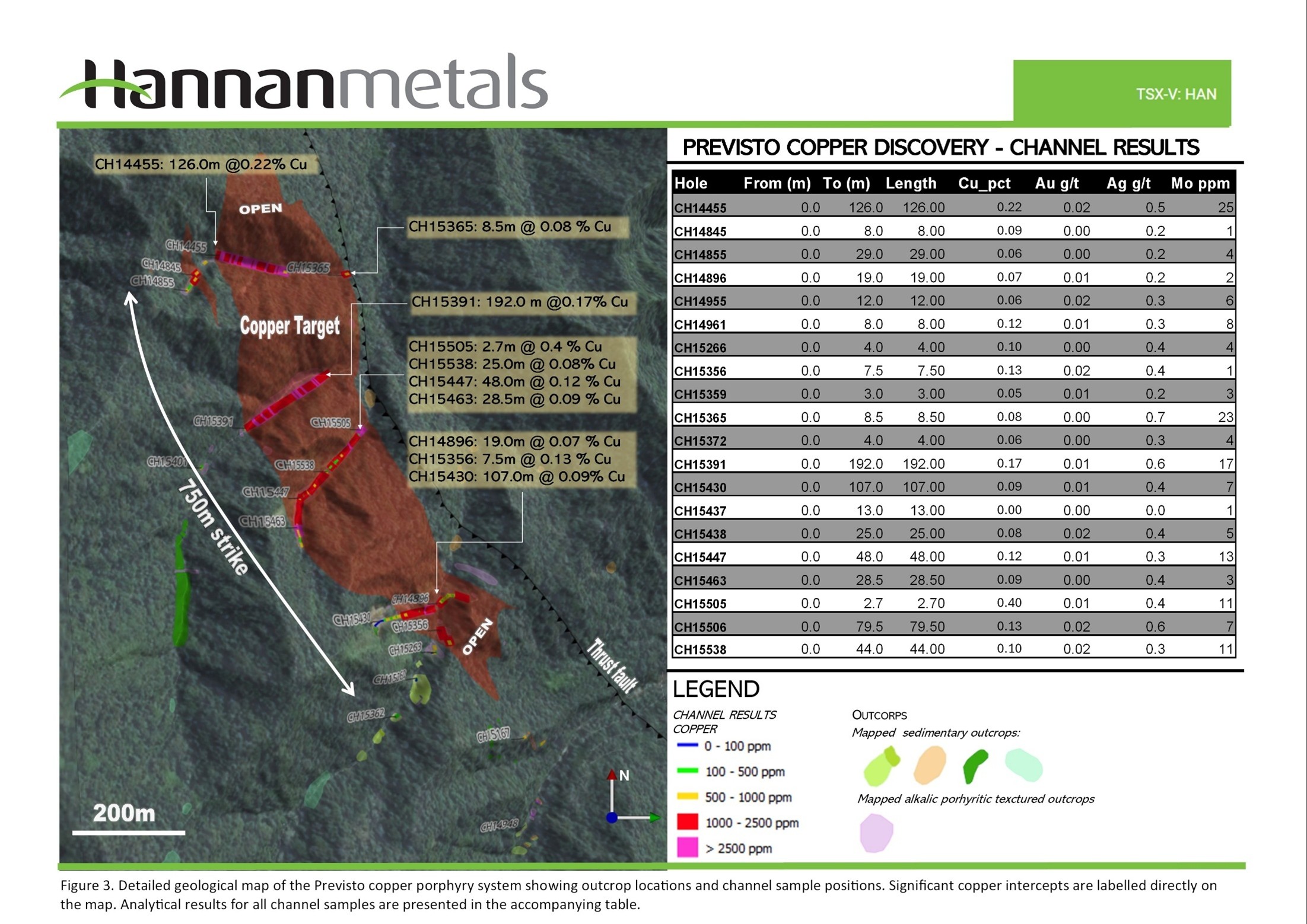

The Previsto Gold target is massive 5 x 5 km2 gold in soild anomaly with a higher grade core that is up to 4 km long and 4 km wide as can be seen below.

Make no mistake, this is gargantuan in scale, and not something one often sees in this space. Now given that is believed to be an Alkaline Gold System the size of the gold in soil anomaly makes sense since these types of gold systems can form some of the largest gold deposits on earth:

(Slide from Lion One Metals)

So we know the pure size of the anomaly, together with the fact that Alkaline Gold Systems are known to have giant potential, means that the Potential of the Previsto Gold target is giant. This of course does not mean that it will be a giant success by default but at least we know that the potential prize is legitimately giant which is more than the average junior can say with a straight face. So while the scale of the soil anomaly was eye-catching, and the stock started to revalue higher as more became aware of it, it was still “just” a giant soil anomaly. Well it did not take long for Hannan to prove that this was not just some freakish case of considerable smoke, but for whatever reason no underlying meat, as the company did the first ever trench sampling smack in the middle of the “middle finger”. The first ever assays taken from the bedrock of the eye-catching soil anomaly proved to be eye-catching as well:

The long trench returned 69.1 m at 2.4 gpt AU and 13 gpt Ag and contained a higher grade interval of 26 m at 5.4 gpt Au and 19 gpt Ag. That 26 m interval thus producer gram*meter numbers of 140.4 gpt from the gold portion alone. The shorter trench measuring 7 m returned an average grade of 1.2 gpt which is good in its own right given that it is right at surface. It is worth noting that all the ends of these trenches were mineralized, so these results were capped by the strike of the trenches, and not necessarily because the mineralization suddenly stopped:

The main north-south channel (CH15486) sampled continuous outcropping alkalic-type epithermal gold mineralization assaying:

69.1 m @ 2.4 g/t Au, 13 g/t Ag and 11 g/t Te (uncut), including:

- 26.0 m @ 5.4 g/t Au, 27 g/t Ag and 21 g/t Te (lower cut 3 m @ 0.8 ppm Au)

The high-grade nature of mineralization is demonstrated by peak assays including:

- 3.0 m @ 12.7 g/t Au, 49 g/t Ag, 43 g/t Te

- 3.0 m @ 11.2 g/t Au, 53 g/t Ag, 36 g/t Te

- 0.7 m @ 16.1 g/tAu, 60 g/t Ag, 48 g/t Te

The channel remains open to both the north (4.8 g/t Au last assay) and south (0.8 g/t Au last assay) and a grab sample of outcrop located 62 m to the SSW assayed 0.8 g/t Au, 7 g/t Ag and 3.8 g/t Te

… Basically the trench appears to show a low grade halo with higher-grade intervals within it. It also appears that only a small section was actually barren.

If I understand things correctly the mineralization is discrete and not readily apparent. The company simply trenched where it was feasible to do so, along a small drainage, in the vicinity of some anomalous soil/rock samples:

“The channels are located at the northern margin of a 4 km by 4 km soil gold anomaly >0.1 g/t Au, with the majority of the anomalous zone remaining untested. The gold mineralization was trenched along a small drainage while the soil samples were collected along ridge lines.” – Link

To put this into perspective they did two trenches, within “just” the northern margin of a 4 x 4 km2 soil anomaly where they had found a rock sample grading 7 gpt and measuring 0.4 m, and produced a 140 gram*meter trench that is open in both directions (Thus the number could very likely have been even higher). That is quite remarkable given that it is pretty much impossible that they just happened to trench the single best slice of the system on the first try. And I mean most grassroot explorers will never be able to produce a trench, or a drill hole result like this, regardless of how many drill campaigns they can put together…

Statistically speaking these results are incredible and I will yet again refer to Kenorland Mineral’s Discovery Study to highlight this. While this was not a typical drill hole, it could be seen as a “horizontal drill hole”, with the benefit of soil/rock samples. Anyway, it is maybe not a totally fair comparison given that the study is based on strict drill holes in the classical sense, but bear with me.

The study offered a few conclusions in light of early stage exploration results (Source):

- The majority of >2 Moz Au deposits have

initial GT intersects >50 GT - The majority of >5 Moz Au deposits have

initial GT intersects >134 GT (i.e. greater than

the median GT discovery intersect) - To capture majority of the >2 Moz deposits, discovery intersect should have

>5m of mineralized rock - To capture majority of the >5 Moz deposits, discovery intersect should have

>10m of mineralized rock - If a company drills <4,000m and hit a 75 GT intersect, this could

be very significant - If a company drills 10,000m on an initial program and does not

intersect a >100 GT intersect, this should downgrade the target

The quality of the results (gram*meters and a lower limit of mineralized width), coupled with the amount of testing (Amount of drilled meters/holes), suggests something in terms of the overall robustness of a system. It goes without saying that the more you drill, the more chances you get to generate a good intersection, since you both get more tries and are working with more information. Even a non-economic deposit, that has seen a lot of drilling, can theoretically produce a >100 gram*meter hole if one knows exactly where there is a pod of good mineralization (or simply drill a hole straight down a zone that might be 1 m wide but 200 m deep). So bascially the earlier a good results happens the better because it suggests that either a) One is extremely lucky to find a spot with good mineralization in a poor system, or b) One has found a very robust system which means one is much more likely to get good drill results without knowing exactly where the “sweet spot” is…

All I will say is that I consider these first ever tests of the bedrock to be highly abnormal from a statistical point of view.

Added Context From The News Release

The identification of a 1.3-metre-wide zone containing crystal-lined irregular cavities indicates that the intrusive body may be minimally eroded.

The outcropping mineralization is weathered, which complicates field observations, and results from detailed petrographic and spectral studies are pending. Locally, a roscoelite-dominated foliated zone hosts the highest grades. Fine free gold can be observed in some hand sample with a hand lens or microscope. The current interpretation suggests the gold mineralization may be controlled by late strike-slip faults with horizontal movement creating extensional structures within a compressional regime, focusing gold mineralization.

Channel samples are considered representative of the in-situ mineralization samples. At this stage true widths of mineralization are not known. Grab samples are selective by nature and are unlikely to represent average grades on the property.

… If the intrusive body has been minimally eroded I take that as a sign that the original size of the prize back when it formed might still be here today. Also it is obviously exciting to see free gold which is probably easy to recover. Lastly, maybe the most important thing is that these channel sample results are considered to be representative of IN-SITU mineralization and NOT some freakish surface enrichment.

Synergies

The most obvious target with stand alone, company making potential in the Valiente district is the Previsto gold target. But the beauty of so many different targets around the gold target is the potential for synergies. Lets say there is a 1-2 Moz Epithermal discovery or a decent sized porphyry discovery to be made but none are large enough, nor high grade enough, to be standalone mines. Well if you have a large, Tier 1 Alkaline gold discovery that will for sure pay for infrastructure etc then I would guess any other discovery nearby will have a much higher chance of getting monetized as well (And there is still potential for these targets to be company makers themselves). Therefore I think the existence of the Previsto gold target increased the risk-adjusted value of all nearby targets:

A closer look at the “Belen” targets that are expected to be drilled in Q2:

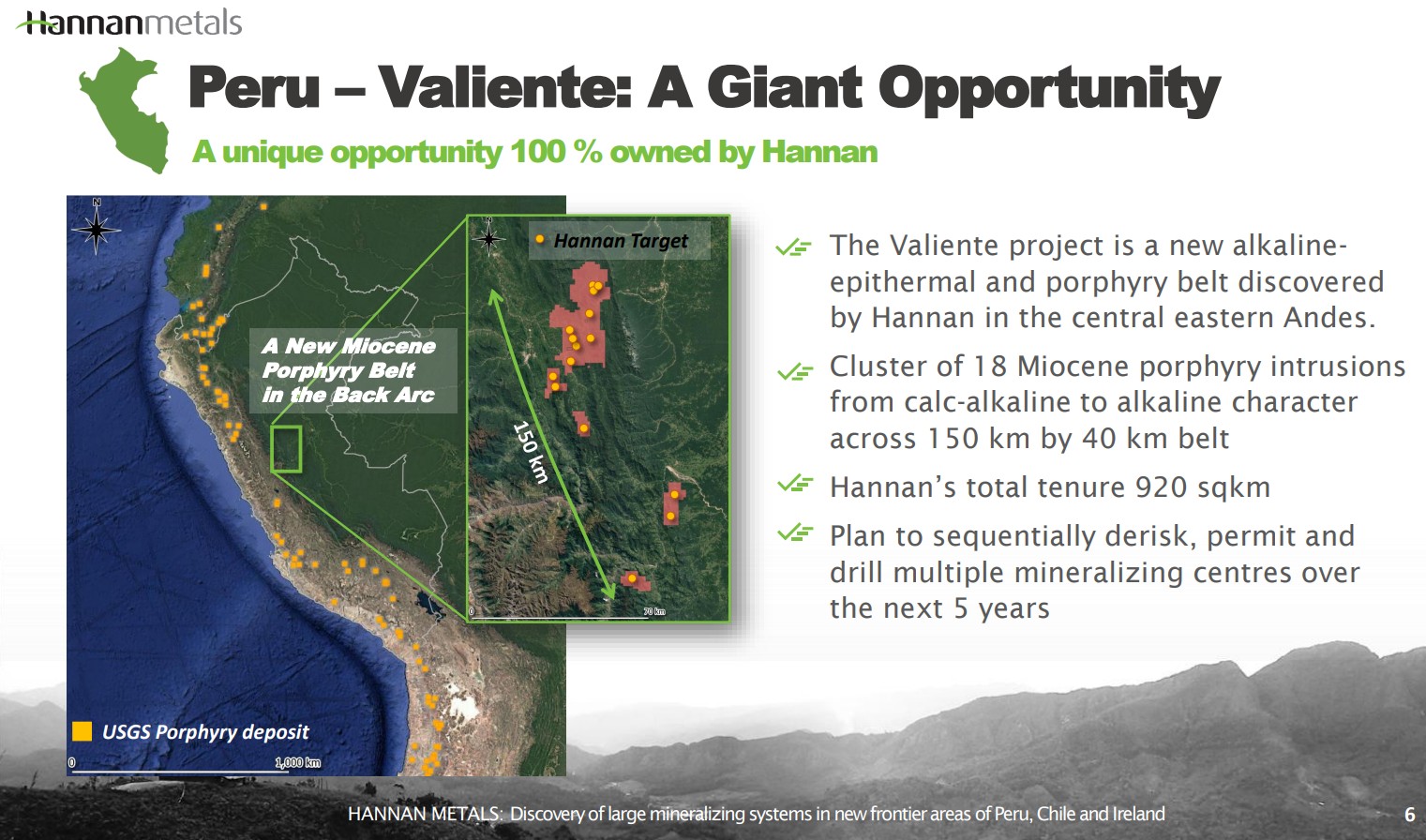

All in all there seems to be 15 targets identified across 920 km2 of ground in this region so far:

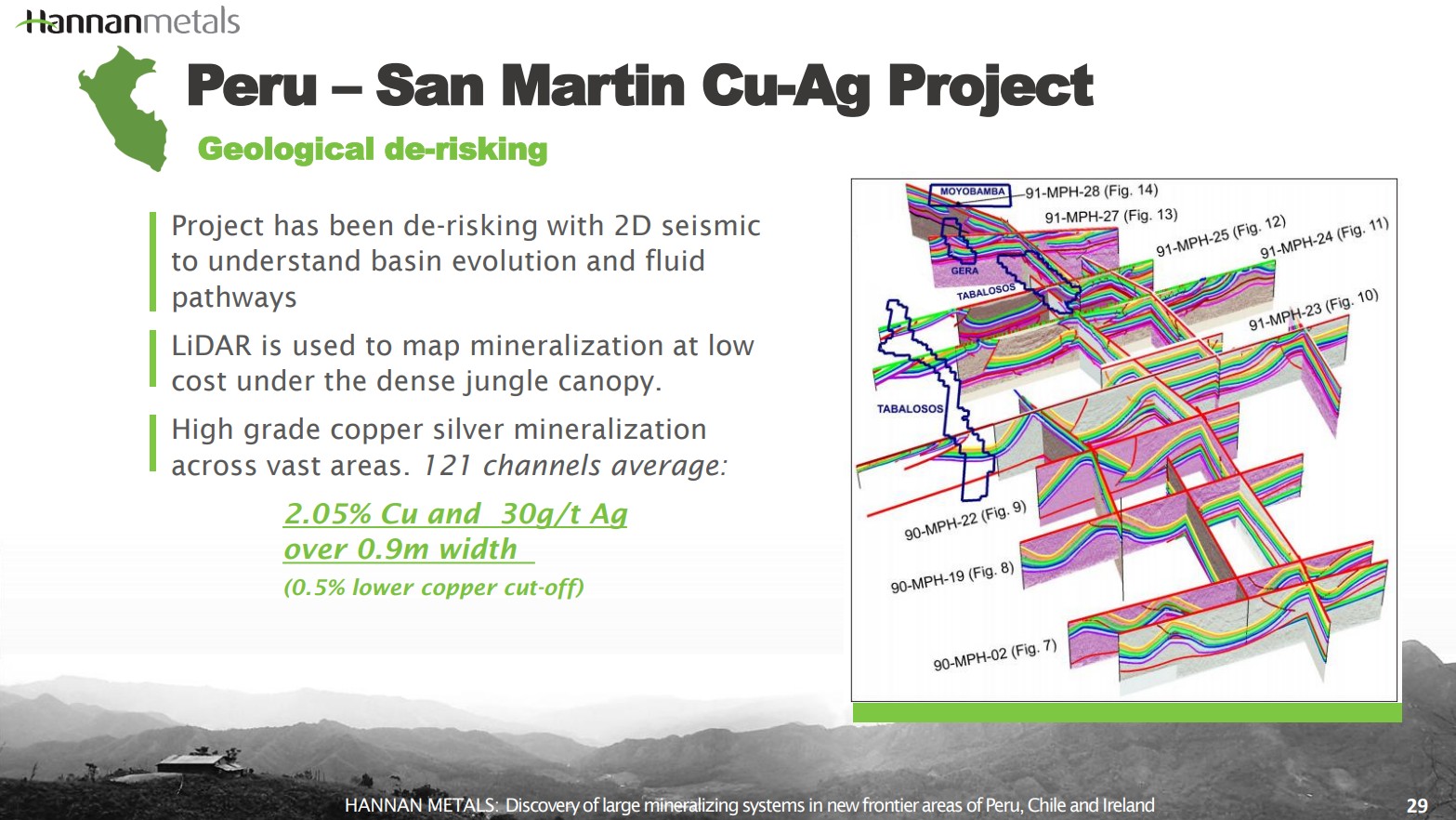

San Martin

The San Marin project is an elephant hunt since the prize is a new Sediment Hosted Copper (and silver) district. You probably know a few famous examples and why they are sought after. Anyway, the Japanese entity JOGMEC also knows the size of the potential prize, and is carrying all the exploration costs and can earn up to 75% of the project:

What the odds are that this will turn into one of those legendary Kupferschiefer/Kamoa-Kakula type mines I do not know. That there is sediment hosted copper/silver mineralization is already confirmed so that is not a question. The question I guess is if the mineralization hangs together over a large area and of course if it can be economically mined… .TBD!

If you want to read up on all the different targets in detail I would urge you to go to the company’s website.

Note: Consider me biased. This is not financial advice. Juniors are risky so never invest money you cannot afford to lose. I share neither your profits or losses. Assume I could buy or sell shares at any time. Do your own due diligence and make up your own mind. Never buy a stock just because someone else owns a stock.