Novo: “Egina For Dummies” Part 2

Given that the “Egina For Dummies” piece was appreciated I thought I would do a short, easy to understand, follow up article on perhaps the most straightforward gold system in Novo’s vast portfolio…

In the last article I put up some examples of what the operating margin might be for the lag gravels by using the data we have so far coupled with the opinion from an expert who has hands on experience. This one will be a little more in depth and I will start off with the best part, more insights from the CDM (De Beers) veteran…

Who actually “Gets” Egina and Novo?

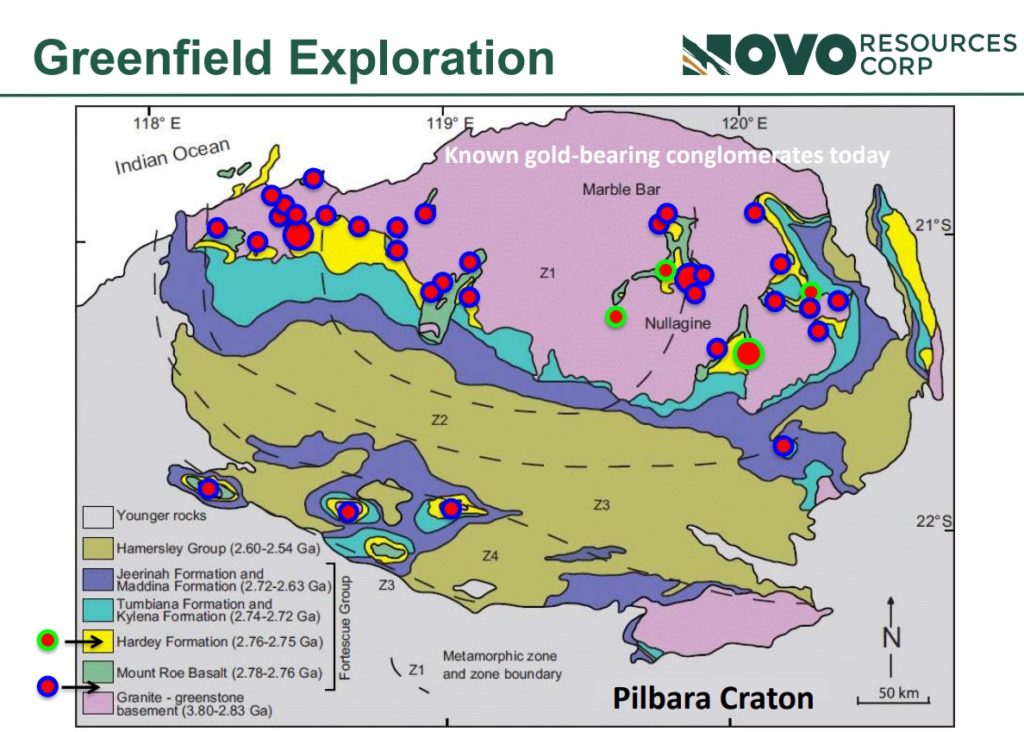

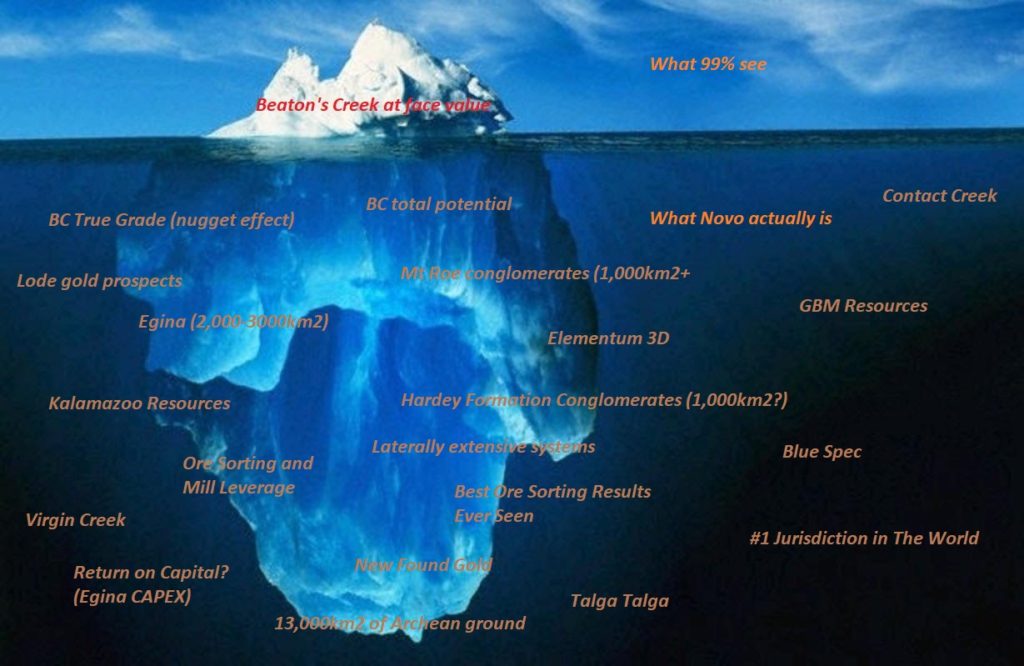

I would argue that 99% of market participants have no idea about what is happening down in Pilbara and have no idea just how many “bullets” Novo has in the chamber or how big the targets are. Most don’t know about it and the few who does know about it does not understand it since it takes weeks of due diligence to even have a shot of grasping the magnitude of the Greater Terrace, Mt Roe conglomerates and Hardey Formation conglomerates which could cover a large portion of the Pilbara Craton.

… $40 B Sumitomo gets it and the another gentleman who might be the authority above all others gets it. I am of course talking about our new friend who had this to say on the “Egina For Dummies” Part 1 article:

Since this gentleman might be one of the few people on earth who actually has first hand experience with a mining venture such as Egina, I jumped on the opportunity to pick his brain further. Luckily for us all, he was willing to summarize his personal case for Egina and Novo as follows:

Erik,

You asked me to tell you what I thought was the potential prize for Egina and Novo Resources.

The potential prize as I see it is a mine with a hundred-year life, huge capital gains for shareholders on the ground floor, many employment opportunities for people in Western Australia, technical challenges and job satisfaction for those that way inclined, opportunities for indigenous peoples to benefit and opportunities for equipment suppliers to innovate. I also see a regular flow of significant dividends in the years to come.

What is my background? I am an eighty-year old Chemical Engineering pensioner with an Economics degree and thirty-four years’ experience in the mining industry, with hands-on knowledge of gold, iron ore, coal and especially diamond mining. I have been an investor in gold mining shares since my first pay check in 1958.

There is so much that appeals to me about Novo which is more than the financial rewards.

The enormity of the scope of the project is mind boggling. I worked at CDM (now Namdeb) on the Skeleton Coast in Namibia for eight years and therefore know about extensive deposits. CDM is the only project in the world that comes close to what Novo is trying to do with their 12 000 km2 of staked claims. Alluvial diamonds were first discovered at Kolmanskop in 1908, and Namdeb is now concentrating on mining diamonds at sea, having virtually exhausted the deposits on land. The rich diamond fields near Oranjemund were only discovered in 1928, or twenty years after the initial discovery at Kolmanskop 270 kms away. I see several distinct mines with different technologies being developed by Novo Resources over the years to work their orebodies. They may only find the richest deposit in a few years’ time.

I always regarded myself as an enterprising risk-taker, not content to follow the way things are done conventionally. The way management is looking at new technology, such as X-ray sorters, at the head of the process, really appeals to me. Their use of Ground Penetrating Radar to delineate richer deposits, seems also to be a new development. There will be hiccups en route, but there will be major technical breakthroughs and it will be a departure from old-fashioned gold recovery technology. All of this appeals to me.

The involvement of Sumitomo was a major coup. Not only do they bring capital to the project, but they bring the Japanese work ethic, which is second to none. I worked with a Japanese engineer from Kawasaki Crushers; he was forced to take three days leave a year if you counted the Sunday in the middle of his holiday. Sumitomo’s contribution in terms of hands-on knowledge, different perspective and board presence will be enormous.

Egina’s location in the First World is a tremendous advantage. Dealing with government, whose first language is English, will make a big difference. Government will quickly realise that it is in their interest to grant permits to enable mining to start and so offer employment opportunities and tax benefits. Also there will be little likelihood of the mine being nationalised.

It is easy to read between the lines and see the enthusiasm of the Novo team under Rob Humphryson. They are attempting so many tasks simultaneously which must demand a big contribution from them. Being part of such a challenging project will also bring its own job satisfaction rewards. On top of that, Australian miners are known for their ingenuity.

Lastly, what I as a shareholder appreciate is the regular feedback of progress at the mine. I do not know of any other mining company which gives information so regularly and willingly as Novo does. Here credit must go to Dr Hennigh, the driving force behind the project. The man’s intellect, leadership, integrity, loyalty, expertise and experience is an enormous asset to the company, and allows me, as a shareholder, to sleep well at night, knowing the best brains in the business are working for me. He has asked me to be patient; I will surely be that.

Putting on my investor’s hat, I see a share which had a euphoric rise in 2017, which is normal when an exciting find is announced. Then it is normal for the share price to fall back as initial exuberance wanes and the hard work starts on the project. Novo fell back to a major line of support under CAD2.00, has now consolidated and I see the next euphoric wave starting soon. As with so many other mining projects, except this one is bigger and better, the share price then rises orders of magnitude above the first wave [HH: First wave hit C$9/share]. This will happen especially soon as the gold price rises and Egina starts production on a small scale.

Those are my humble thoughts.

Kind regards

… Mic drop.

Thumbs up from this gentleman carries more weight than the thumbs up from the $40 B Sumitomo Corporation in my opinion. Why? Because this gentleman has actually lived and breathed large scale mining of exactly THIS type of deposit and at a similar SCALE. Not only that, but he is also well aware and has had hand on experience with ore sorting and understands the economic impact it can have on a vast nuggety deposit such as this. What I would add to that is that ore sorting has come a long way in the last 50 years and I dare say that for example Tomra’s new prototype ore sorter is probably head and shoulders above the machines back then when it comes to efficiency, production rate and cost reduction.

In other words this De Beers veteran is saying that he believes Novo will be worth billions, or tens of billions of dollars, possibly from just the Egina type gravels alone. The market can’t see it yet and that’s fine. There has only been one example of a colluvial deposit with similar scale as the lag gravels around Egina and the rest of the Greater Terrace and this De Beers veteran is one of few in the world who actually lived it. He can appreciate the economic potential more than the rest of us and he has painted a remarkable picture of the future. If you are looking for a junior that has a 1% chance of going up 300% tomorrow on a drill hole then Novo is not for you. If you want a real shot of owning one or more semi-craton wide gold systems, that could have some of the highest margins in the gold space, with a potential 100-year mine life then Novo might be something to start paying attention to. They might not be “sexy” deposits in a typical sense, but they might allow for such extremely simplistic mining and processing method that Novo could quite possibly become the “go to” dividend king in the entire gold space.

Let’s be real… There might be no one who could appreciate the value of at least Egina more than this gentleman. I mean all the data we have at the present time is telling me Egina and the Greater Terrace could be a Wits/CDM sized deposit but with higher margins, but to hear that from perhaps the top authority on the subject is another matter entirely.

I was also fortunate enough to get a few additional insights out of him:

About the early days:

“Incidentally, both German bankers and De Beers board felt that these deposits were a one-day wonder and didn’t want to become involved. Much like the opposition Novo faces from some quarters today.”

Fast Forward:

“When I arrived in 1975, CDM was the most expensive quoted share on the Johannesburg Stock Exchange“

“It was claimed at the time that we had the second biggest fleet of Caterpillar vehicles in the world, second only to the US Army”

“In conclusion, there was no mining operation comparable to the CDM operation. I have visited many mines all over the world, including copper, gold and diamonds, and can vouch that Novo Resources deposit seems to come closest to that of CDM. It is vast, and seems to be shallow with variable grade, most of it unsampled. I can add, that at the time, CDM had been the biggest profit generator for De Beers for many years.”

This is the deposit this gentleman is talking about and actually worked at back in the day:

Imagine owning a “modern CDM” type deposit, in a day and age where “even” 5 Moz discoveries are very rare, average mine life is 10 years, and to top it all off the ore sorting technology has now advanced so much that the new machines show up to 100% recoveries in early testing. If that wasn’t enough, these sorters can process ore for $0.28/tonne and might be the only processing step needed at Egina.

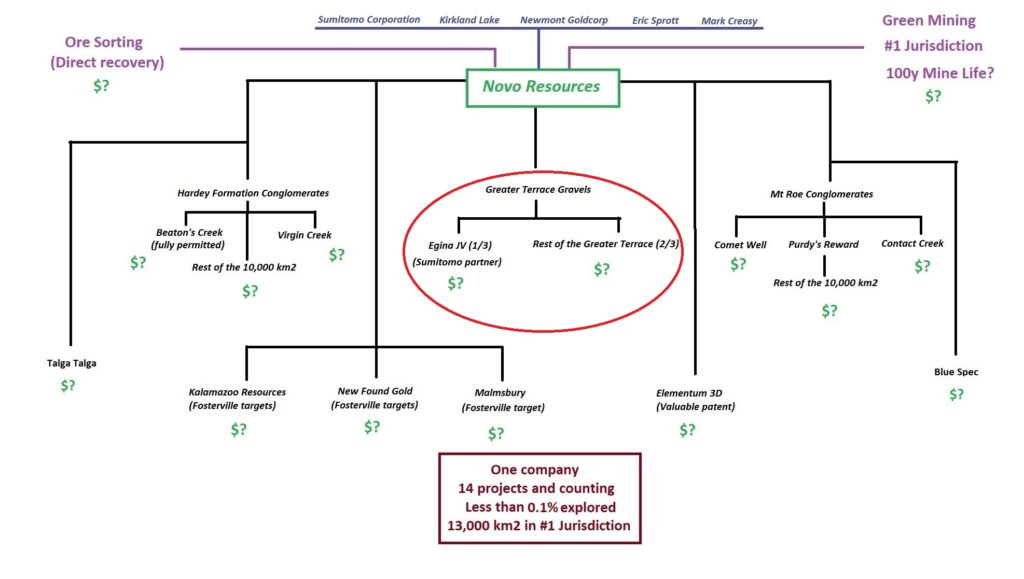

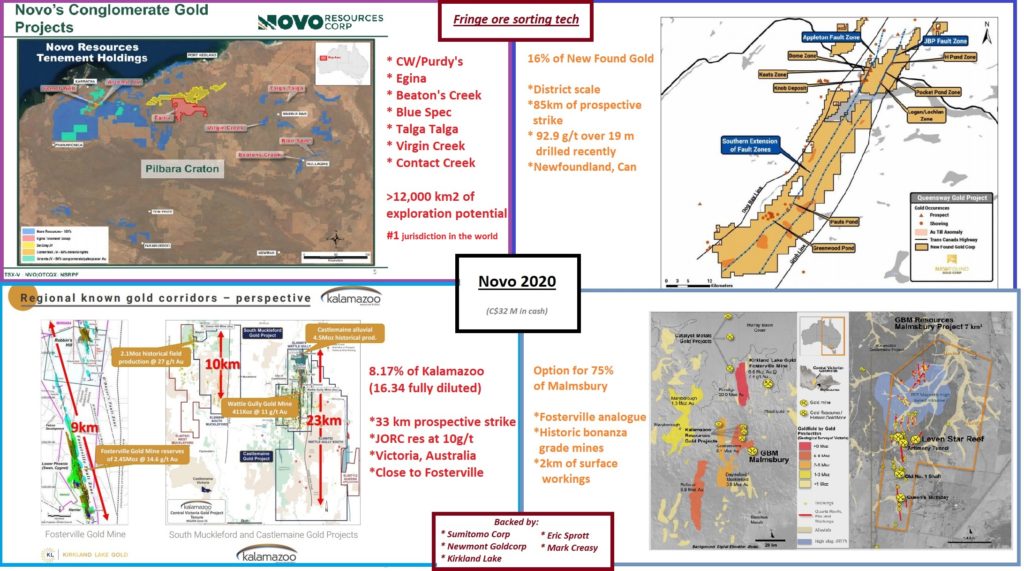

Note that the comments above are only about Egina (Greater Terrace gravels), which is only ONE part of the Novo portfolio:

Time to Crunch Some Numbers

(Prepare for a lot of forward looking statements and a lot of bold speculation)

What revenue do we get from an ounce of gold?

- Current price per ounce of gold in Australia: AUD$2,732

- Current price per ounce of gold in US dollars: USD$1,753 (futures)

What were the grades within the Egina mining lease for these gold bearing lag gravels?

- Swale (main target): 1.7 g/m3

- Margin of swale: 0.5 g/m3

- Anywhere outside of swales: 0.3 g/m3

- … Global Average: 0.83 g/m3

What was Keith Barron’s guesstimate of what it would cost to mine one cubic meter of near surface, loose gravels?

$5 per cubic meter. (lets be conservative and assumes he meant USD)

What is the sorting cost per tonne according to Steinert?

US$0.28 per tonne.

Note that ore sorting alone might be all that is needed to recover most if not all the gold, especially in the higher grade swales, where the mineralization ought to be more nuggety.

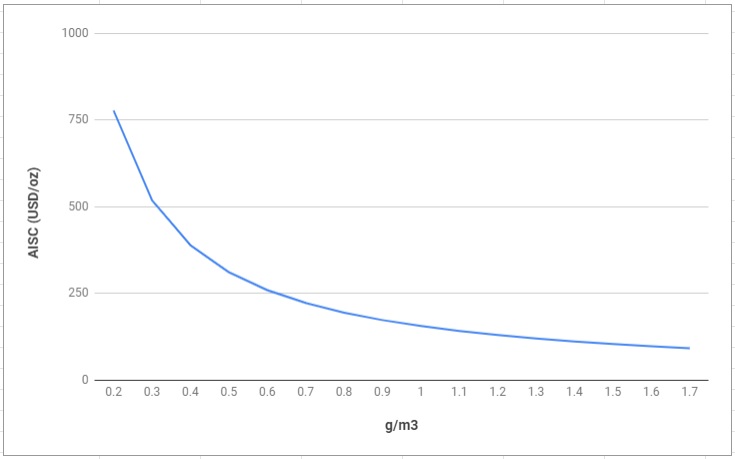

What would the AISC/ounce be in the different zones if we use Barron’s cost estimate?

In the last article I only used operating cash flow examples based on a mining cost that was twice as high as what Ketih Barron thought it would cost to mine but this time around I will include his original cost estimate.

Formula: [31.1/grade * cost to mine one cubic meter]

Egina AISC using Barron’s Cost Estimate of US$5/m3:

- 0.2 g/m3 = US$778 per ounce

- 0.3 g/m3 (Egina Lease, Outside of swale) = US$518 per ounce

- 0.4 g/m3 = US$389 per ounce

- 0.5 g/m3 (Egina Lease, Margin of swale)= US$311 per ounce

- 0.6 g/m3 = US$259 per ounce

- 0.7 g/m3 = US$222 per ounce

- 0.8 g/m3 = US$194 per ounce

- 0.83 g/m3 (Global Average) = US$187 per ounce

- 0.9 g/m3 = US$173 per ounce

- 1.0 g/m3 = US$156 per ounce

- 1.2 g/m3 = US$130 per ounce

- 1.5 g/m3 = US$104 per ounce

- 1.7 g/m3 (Egina Lease, Swale) = US$91 per ounce

- Etc…

Depending on infrastructure needs etc, the AISC might be higher. With that said, I think it looks great even if the costs ended up being 50%-100% higher, especially the swales that could be profitable at many times the guesstimates costs.

Egina AISC (in USD) in graph form based on Keith Barron’s mining cost estimate:

As you can see above, the gold bearing gravel beds could already be classified as a high margin operation when mining grades of 0.2 g/m3, assuming the experienced alluval mine owner Dr. keith Barron is close to the mark. With a grade of 0.3 g/m3 the AISC would already be down to US$518/oz and would be one of the highest margin gold operations in the world. Note that 0.2-0.3 g/m3 is the global average for these types of deposits and while other such mines might be making money, I would doubt that they would have the kind of margins that Egina could possibly have, given that Egina has an extremely favorable characteristics. At a grade of 0.4 g/m3 the AISC estimate gets rather silly in a hurry and at 0.83 g/m3, which is the average of the three zones at the Egina Mining Lease, the AISC had dropped all the way to US$187 per ounce. The swales which are the areas of focus for Novo could see AISC as low as US$91 per ounce with a grade of 1.7 g/m3.

All the above should make it perfectly clear why the semi-craton wide Greater Terrace in Pilbara might host one of the largest, simplest and highest margin gold fields in the world. Not only that, but given the characteristics of the deposit; Flat, at/near surface and seemingly extremely vast, accessible everywhere at the same time, extremely low CAPEX which could see a “mine” form from just a continuous miner, a screener and some ore sorters etc, the up-scaling potential should (could) be unparalleled… And cost “peanuts.

Cumulative Pre-Tax Profit Examples

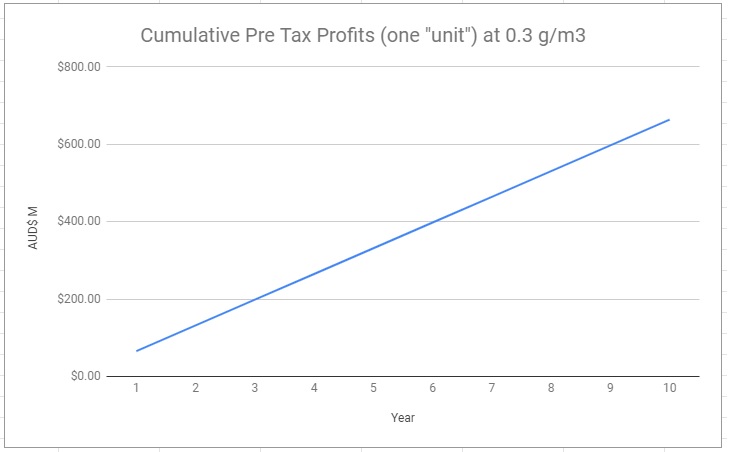

Lets look at what a simple and low cost operation such as this might mean in terms of Pre-Tax Profits potential…

Example 1. Outside of Swales, Assumptions:

- Australian Gold Price: AUD$2,732/oz

- Grade: 0.3 g/m3

- Costs: US$7.5/m3 = AUD$11.6/m3 (50% higher than Barron’s estimate)

- Annual mined area per mining unit: 3 km2

- CAPEX: Couple of millions to a couple of tens of millions

Cumulative Pre-Tax Profits from a single mining unit that mines 3 km2 per year of gravels grading 0.3 g/m3 on average:

Not bad for one low grade “mine” that could cost a couple of millions up to a few tens of millions to get up and running.

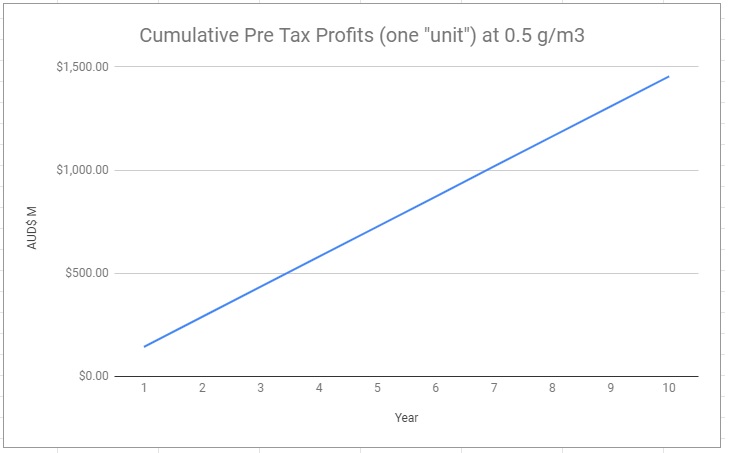

Example 2. Margin of Swales, Assumptions:

- Australian Gold Price: AUD$2,732/oz

- Grade: 0.5 g/m3

- Average bed thickness: 1.5 m

- Costs: US$7.5/m3 = AUD$11.6/m3 (50% higher than Barron’s estimate)

- Annual mined area per mining unit: 3 km2

- CAPEX: Couple of millions to a couple of tens of millions

Cumulative Pre-Tax Profits from a single mining unit that mines 3 km2 per year of gravels grading 0.5 g/m3 on average:

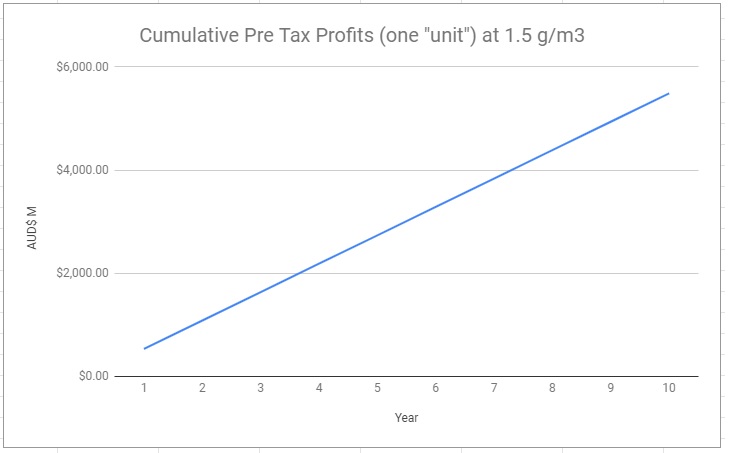

Example 3. Swales, Assumptions:

- Australian Gold Price: AUD$2,732/oz

- Grade: 1.5 g/m3 (note that the Egina swale bulk samples actually graded 1.7 g/m3)

- Average bed thickness: 1.5 m

- Costs: US$7.5/m3 = AUD$11.6/m3 (50% higher than Barron’s estimate)

- Annual mined area per mining unit: 3 km2

- CAPEX: Couple of millions to a couple of tens of millions

Cumulative Pre-Tax Profits from a single mining unit that mines 3 km2 per year of gravels grading 1.5 g/m3 on average:

Note that the theoretical examples [1-3] are A) based on 50% higher costs than Barron estimated, B) only using a single mining unit with 3 km2/year capacity, and C) only includes 10 years which would mean the mining of “only” 30 km2 out of the 2,000-3,000 km2 of Novo’s Greater Terrace ground.

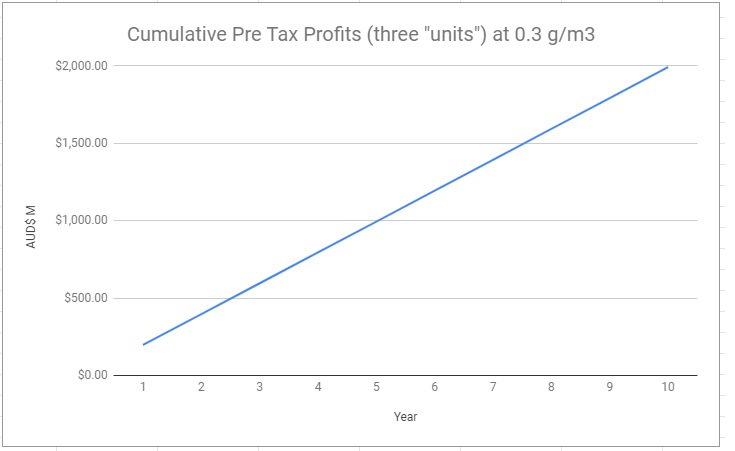

Example 4 Assumptions:

The last example will include a mining scenario where three continuous miners are operating at the same time. I will only use an average grade of 0.3 g/m3 (which is the grade outside the swales at Egina in the example) in order for the cumulative pre-tax profits to not reach another dimension. I hope this example will show the potential earning power of the lower grades areas which are not even the main targets. I trust that readers can figure out what these numbers would imply for scenarios using 0.5 g/m3 or 1.7 g/m3 on your own.

- Australian Gold Price: AUD$2,732/oz

- Grade: 0.3 g/m3

- Average bed thickness: 1.5 m

- Costs: US$7.5/m3 = AUD$11.6/m3 (50% higher than Barron’s estimate)

- Annually mined area: 9 km2

- CAPEX: A few tens of millions

Cumulative Pre-Tax Profits from three mining unit that mines 9 km2 per year of gravels grading 0.3 g/m3 on average:

I find the notion of that kind of potential earning power coming from just three mining units that would cost some tens of millions working a deposit with an open ended mine life. The return on capital would obviously be bonkers even at the low grade areas outside the higher grade swales.

For perspective:

- Newmont Corporation

- Market Cap today: US$54 B

- Average annual Pre-Tax Profit (2017-2019): US$1.841 B

- Barrick Gold

- Market Cap today: C$70 B

- Average annual Pre-Tax Profit (2017-2019): C$2.956 B

- Agnico Eagle

- Market Cap today: US$16 B

- Average annual Pre-Tax Profit (2017-2019): US$274 M

- Kinross Gold

- Market Cap today: C$13 B

- Average annual Pre-Tax Profit (2017-2019): C$499 M

- Novo Resources

- Market Cap today: C$550 M (C$0.55 B)

- Average annual Pre-Tax Profit: TBD

Lets reverse engineer and see how many km2 of swales grading say 1.5 g/m3, with costs 50% higher than Barron’s estimate, is required to reach at least Kinross Gold’s Pre-tax profits (just for fun):

Assumptions:

- Australian Gold Price: AUD$2,732/oz

- Grade: 1.5 g/m3

- Average bed thickness: 1.5 m

- Costs: US$7.5/m3 = AUD$11.6/m3 (50% higher than Barron’s estimate)

- … km2 needed to be mined to get C$499 M in cumulative Pre-Tax Profits: 3.04 km2 of gravels.

A single continuous miner might be able to do close to 3 km2 per year, but lets say it takes two units. If that’s the case then we are talking about reaching C$13 B Kinross Gold’s 3-year rolling Pre-Tax Profit average by investing in two continuous miners, screeners and some ore sorters etc. We would in this scenario “only” need to find 30 km2 of 1.5 g/m3 swales within our 2,000-3,000 km2 land package in order to have a “Kinross operation”, at just Egina, with a mine life of 10 years. All that from 1-2 mining units. Note that this is on an undiluted basis and that Sumitomo is earning into a 40% stake in the area of the Greater Terrace (Egina) we are currently working on.

I could be off by 50% and it would still be a surreal result. Lets just say that unconventionally simple mining, with unconventionally cheap and efficient processing (ore sorters) could lead to unconventionally high earning power. It just goes to show how difficult the conventional mining business is. Most miners don’t make that much money and the gold sector is tiny compared to most. But, if there were to come a long a superior business model, then that could be worth quite a lot…

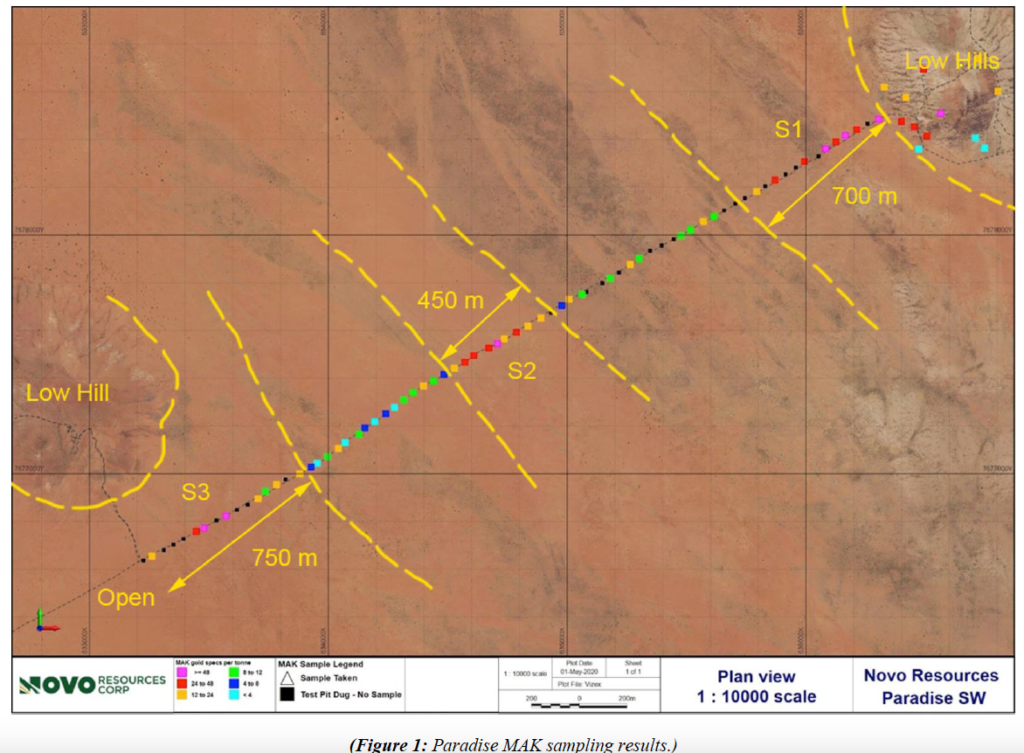

Tip of The Iceberg

At the Paradise prospect in Egina we are already up to a cumulative Swale width of 1.9km with approximately 1.7 km of likely lower grade (0.3 g/m3?) material in between. If these swales at Paradise would grade 1.7 g/m3 on average, like the large bulk samples within the Egina Mining Lease showed, then the swales found so far at Paradise could result in cumulative Pre-Tax Profits of AUD$785 M to the Novo/Sumitomo joint venture assuming they were “only” 2km long. That would in turn only make up 3.8 km2 of land and could possibly be mined in only 1-2 years by a single unit, once a commercially viable “mining unit” is operational.

Note that Novo has already identified 20 additional high priority targets around Egina which they plan to explore during this field season alone.

Consider that Novo’s current Market Cap is currently CAD$550 M and we might soon have a mill for the high grade, open pit, Beaton’s Creek deposit to boot. Personally I think Beaton’s Creek value alone might cover Novo’s current Market Cap, or more, for reasons described HERE and HERE.

Can you say dividend potential?

What would the CAPEX requirements be for such a mining venture? Tighten a few screws? Replace a bolt or two? There are no pits to deepen. There are no ramps or shafts to deepen. There are no new mine faces to be accessed. There are no huge mine fleets, plants or mills with a million parts to maintain. Think about it. If one “mining unit” can pay for multiple new mining units in short order then the need for CAPEX would be abyssmal. Pretty much every major cost that any other mine must suffer each year could be non existent at Egina. I guess Keith Barron did say it best when he said; “This will be like owning a bank” and he should know since he owns one of these, albeit a smaller version…

Oh and I am sure that this notion is something that the $40 B Sumitomo Corporation has thought about as well. They are businessmen after all, that live and breathe the concepts of cash flow, IRR, Return on Capital and margins every day.

Another unique thing with a deposit such as this is that there could potentially be no real bottlenecks except for permitting. Where a conventional open pit or underground mine would see the usual bottlenecks such as how many dumpers could pass each other in a ramp or on a pit track, there would be no such bottleneck at Egina given that the “mine face” is accessible everywhere, at all times and at the same time. One could put a continuous miner (a “mine”) at point A and then have another continuous miner (another “mine”) start chomping gravels 10 meters away and so fourth. Furthermore, where any conventional mine starts suffering from a decrease in “marginal utility” as the open pit or underground mine gets deeper, when the hauling distance for ore gets increasingly longer, there would be no such effect at Egina really. In other words, there is no real reason for the first ounce to have higher margin than the millionth ounce since the millionth ounce ought to be as close to surface and easy to recover as the first ounce. All of these factors will impact should impact the economics of Egina and the rest of the gravels beyond Egina in a favorable way relative to any conventional mine whether you want to believe it or not.

Again, I’m not ecstatic about Egina and the much larger Greater Terrace because it’s the “sexiest” gold field on earth, but rather because it might host the world’s simplest mine(s) in the future with possibly some of the most profitable ounces in the world. It might be the polar opposite of the very high margin Fosterville mine in that it’s not bonanza-grade lode gold found 1km+ deep in the ground but instead a low-grade colluvial placer deposit found right at surface. What it lacks in grade it should more than enough make up in simplicity and cost of mining.

Mine Life, Capacity For Innovation and Simplicity of Mining

Then we have the scale and potential mine life. Even the best conventional mines in the world does not have a mine life much longer than 10 years. After that, the gravy train stops and respective operator needs to find a similarly good mine and get it up and running just to stand still. Then add the fact that no conventional mine or ore body is exactly the same and would need years of drilling, modeling, economic studies and then a few hundreds of million in CAPEX to boot. Not only that, but with so many moving parts the margin for error is very low. Mines can suddenly stop due to water issues, ventilation issues, rock falls, gas leaks, chemical leaks or a thousand other problems. Then compare that with a guy driving a slow moving continuous miner right at surface, in the middle of nowhere (Egina is pretty much unpopulated), with a train of ore sorters that just take in gravel and directly spits out gold. No chemicals needed. No cyanide needed… It would be the GREENEST commercial mining operation in the world. No big mill needed. No big plant needed. No large workforce needed. Perhaps almost no water needed. No thousands of moving parts that could go wrong at any time. When Novo has optimized the first “mining unit” they could theoretically then just copy/paste it and set up as many “mines” as they want to (and/or are allowed to)…

Heck not even I might be able to screw up such a simple operation, and believe me that’s saying something.

A high margin, cash flowing, dividend making operation is what most people dream of. Well at least I do anyway. On that note it really isn’t just the sheer potential earning power of these Egina gravels that attract me but the potentially extreme mine life as well. As I said earlier any conventional mine has a very real and often brutally short mine life. This could be shortened even further when management of marginal mines choose to “high grade” their deposits. This can lead to ore that would be economic to mine at higher gold prices being impossible to mine due to changes in the mine plan when a company chooses to specifically target the highest grade portions of a deposit. This is a decision that often leads to ounces being permanently lost almost no matter what the gold price environment is in the future.

Enter Egina.

Not only does mining at one place not affect the ounces at any other place, but given how best practices and ore sorting will continue to evolve, I would expect the operating costs to actually trend lower over time. Why? Because a) there is no decrease in margin of utility as explained earlier, b) I expect technology including ore sorters to only get better and faster, c) Said technological advances can readily be incorporated due to the fact that the deposit is easily accessible everywhere at the same time. Furthermore, where conventional mines have conventional life spans, the deposits off the West Coast of South Africa have been mined for over a 100 years and CDM was De Beers flagship mine.

Summing Up and Looking Ahead

What is described in this article and by the veteran from CDM (De Beers) is not the potential for a tier 1 mining operation at Egina. What is described is the potential for an extremely low CAPEX tier 1 mine that could be copy/pasted and multiplied over a semi-craton wide area with a mine life of 100+ years. THEN we add the 10,000 km2 or so of potential for Mt Roe conglomerates (Comet Well, Contact Creek etc), Hardey Formation conglomerates (Beaton’s Creek, Virgin Creek etc), lode gold (Talga Talga, Blue Spec etc) and all the other prospects we know about at this EARLY stage:

And then there of course is a chance that Kalamazoo Resources, New Found Gold and/or GBM Resources finds a new Fosterville type deposit or two. Oh and lets not forget about Elementum 3D which we own about 10% of, who just got a patent accepted, which prompted our Egina partner Sumitomo Corporation to invest in the company. Elementum’s customers include NASA, Lockheed Martin and General Electric to name a few behemoths.

The average junior miner has one project which has a slim chance of ever becoming even a half assed mine. Very very few will be fortunate enough to find one high quality mine with lets say a 15 year mine life. That’s it.

Novo on the other hand controls around 13,000 km2 of THREE DIFFERENT LATERALLY extensive gold bearing systems, which includes a CDM look alike that alone could have a potential mine life of 100+ years, in addition to the multiple stakes in Fosterville hunters. This is not only me saying that such potential is on the table, but a former manager of CDM (De Beers).

If Novo get their hands on a mill then I think Novo’s current Market Cap will be pretty much covered by the earning power of the high grade, open pit Beaton’s Creek deposit and you get everything else, including Egina for free. This is the kind of risk/reward that I don’t think any other gold junior even comes close to… High margin of safety with by far the largest upside potential of any junior gold miner. While most juniors have one flagship project, Novo has tens of projects.

Furthermore I think Beaton’s Creek alone could do around C$70 M in FCF per year and that the system has multi million ounce potential.

… All of the combined potential in all of the above is currently priced at a meager C$550 M.

… So yeah, in I think the CDM/De Beers veteran’s comments are not far fetched since I think we’re not even close to fair Expected Value ATM…

“Novo fell back to a major line of support under CAD2.00, has now consolidated and I see the next euphoric wave starting soon. As with so many other mining projects, except this one is bigger and better, the share price then rises orders of magnitude above the first wave. This will happen especially soon as the gold price rises and Egina starts production on a small scale.”

If a high quality junior hits it out of the park, then you might own A great mine. If Novo hits it out of the park, then you might own one or more 100-year LEGACIES, in the #1 ranked jurisdiction on the planet. Whereas your average junior has one conventionally sized bullet in the chamber, Novo has three semi-craton wide gold systems, three Fostervilles, Elementum 3D and a Chairman dead set on amassing the largest empire of tier 1 assets the space has ever seen, under one umbrella. In other words, C$550 M buys you an entire portfolio of shots at tier 1 (and beyond tier 1) assets. Like getting 14 (and counting) exploration stories in one vehicle. I pretty much view Novo as having the upside of 10+ high quality juniors combined while being almost entirely backstopped by a single, fully permitted project called Beaton’s Creek:

… If things go well we might very well be a gold producer and have proven the whole Egina blue sky concept before the 2020 field season is over.

Personally I think Novo is the cheapest gold stock on the exchange because 99% of people still only see 1% of the real story.

Note: This is not investment advice. Always do your own due diligence. I am not a geologist nor am I a mining engineer. This article is highly speculative and it’s just my opinions. Novo is my largest position and the company is a banner sponsor.

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My Channel

Wonderful piece,thank you Erik. I think i should be able to open my wallet and buy you a drink at some point in the future.

Thank you Andrew :). Hopefully I will be able to afford a drink but hoping for a celebration party down in Australia in a year or two!

SHHHHHHHHHHHHH!

Erik-great work,much appreciated.It presents a well organized framework of thought on Novo.Ive listened to as many of Quentins talks and comments that I have been able to find but your organization of ideas and observations is first class and very much welcomed.Thanks again My family has held Novo shares since Quentin Hennigh first organized the company and Beaton’s Creek was at that time the main profit center which was planned to be developed.I have been contemplating selling points with my predictions of price increases over the years.Your analysis is a very welcome and practical contribution which provides perspective.Thanks again.

Thank you Martin! Novo consumes a lot of time and energy for me. Sometimes I need to re-listen to a QH interview multiple times in order to pick up everything and understand how every piece fits. I often get an “aha” moment and need to go back to some older interviews just because I suddenly got something that I know the man talked about many months ago. There are no guarantees it will play out like I think and hope but if I’m somewhat on the right track then this should be a very early stage of Novo. Hopefully it will still be growing in 10-20 years which would be very unusual since almost every miner is already declining or is close to it… Growth sure is precious when large deposits are found more infrequently be every passing year.

Erik

Yes,I understand ,or imagine that I do,your need to keep re-reviewing a potential choice among other possiblbilities and the,sometimes,when viewed retrospectively,becomes a partially dawning process that often,becomes instinctively habitual and thus accompanies the re-evaluation and that cumulative weedingout thought process of the facts and developing facts on the ground that lead to a tentative but developing insight resulting organization in your excellent and outstanding work.It is very good,very helpful,very well organized.Thanks again.I am re-reading Part 1 and 2.

Personally,I recommend investments only in the three safe mining zones or jurisdictions,Australia,Canada and the US with the exception,that I have followed Eric Sprott in some recent silver investments in Mexico(not all).For me I start with the man in charge,the “operating brain” and then his his organization and past history and to a certain extent,his luck.

Erik-I do not think that fewer large deposits are found each year,this is a misconstrued oft repeated belief.I would say that we are on the verge of new and very large scale discovery’s,perhaps some so large that they, might be termed “ massive “based upon rethinking of exploration and the application technological innovation. Examples: Novo in Australia,and perhaps Newfound,Freegold Ventures also in Newfoundland,Seabridge Gold in Canada etc.

Corrzection:Freegold I believe is in Alaska

Thank you Eric for your on-going very PERSUASIVE presentations on Novo !

You’re welcome! Fingers crossed that I’m in the ball park at least!

and great summary of the Novo potential, they need to start trial production to up the share price to $6 Cad to convince KL to exercise 14,000,000 warrants at $6 Cad by 9/6/2020 for $84,000,000, can QH do it….is millennium minerals mill the answer..time running out. Also HH, to retain shareholders of Novo, your thought on $/gold dividends by Novo

ATM I am agnostic. Cash dividends will mean it can be used to buy more Novo. Gold dividends (like a gold bank) would give Novo holders some added inflation protection and some added beta to gold. The thought of Novo stackpiling gold that is not needed for selling to cover costs is intriguing.