THH – Alpha Exploration (ALEX.V): The A-Team Plans to Test #5 Targets This Year in an Underexplored Region of Africa

Alpha Exploration is one of few African juniors that I own (and the only junior in Africa owned by Crescat Capital). In this article I will try to explain my personal case for the company. Since I really like the story and people involved I decided to help bring exposure to the story by having the company become a banner sponsor. As always, the following thoughts are my personal thoughts, and I absolutely not guarantee that Alpha Exploration will be a success, even though I obviously like the Risk/Reward. You should do your own due diligence and make up your own mind. Since I own shares of the company, and the company recently also became a banner sponsor, you should consider me biased!

My key investing factors for Alpha Exploration:

- The Good:

- The People

- The People

- The People

- Amount of high quality targets

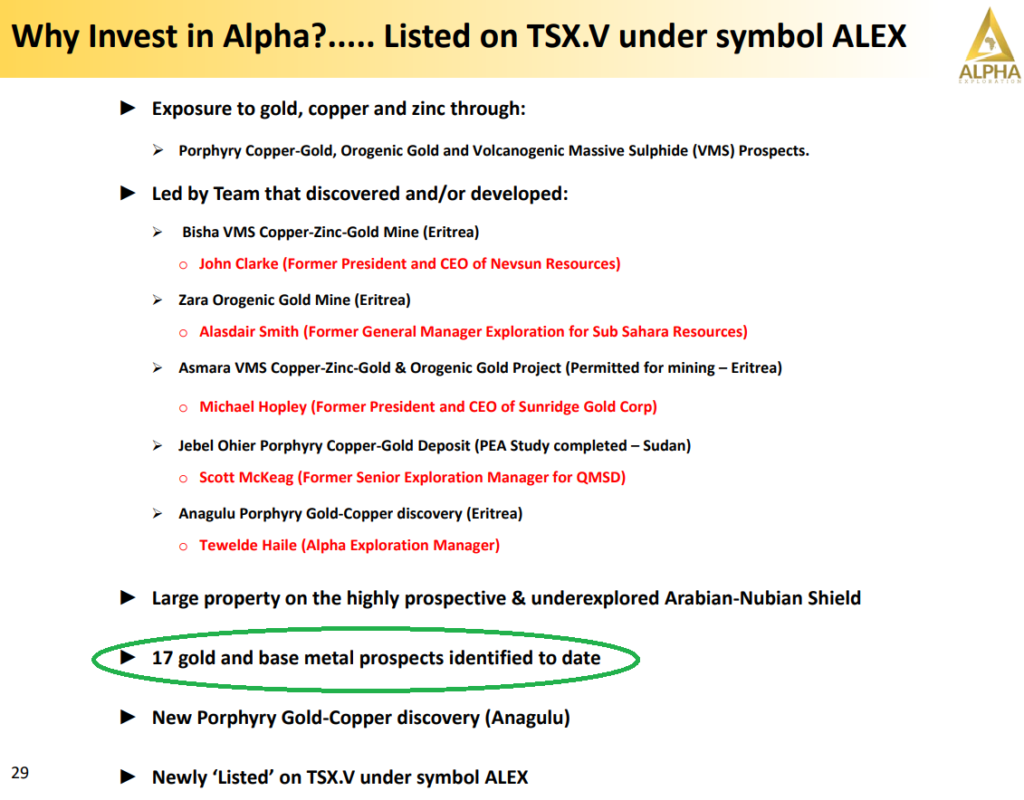

- #17 prospects in total have been identified so far

- Already have a Copper-Gold discovery

- 108m @ 1.24 g/t Au & 0.60% Cu (2.19 g/t AuEQ)

- 49m @ 2.42 g/t Au & 1.10% Cu (4.15 g/t AuEQ)

- Just made a brand new gold discovery to boot!

- 15m @ 5.85 g/t Au

- 10m @ 5.24 g/t Au

- And hit massive sulphide mineralization in their 3 km long VMS target!

- The Bad:

- Eritrea

- The Good in the bad:

- People who have literally made discoveries and sold companies more than once before in Eritrea

- The interesting:

- This is the only investment Crescat Capital has made in Africa(!)

Setting The Scene

Time is the enemy of a bad management team and the friend of the exceptional management team. Bad management create problems and exceptional management teams solve problems and create value. A bad management team will have negative Expected ROI on any money thrown its way (And by extension negative Expected ROI for shareholders) and an exceptional management team will have an exceptional Expected ROI (And therefore positive Expected ROI for shareholders).

Every day, whether I am asleep, on vacation or in a Sauna, some of the best brains in the business will be working on creating value. Said value is created every day and the periodic summations of said value show up in news releases here and there. My strategy is simply to let this exceptional team do what it does best which is figuring things out and hopefully making more discoveries. I simply want to own a percentage of this venture and all possible value that this exceptional team may create. So far I have participate in two out of three financings and have yet to sell a share. Again, my case revolves around catching a ride on their value creation skills, and therefore Time (to do what they do best) is the only rational way to take advantage of it. Sure, one could try and get in after a “blatant barn burner discovery” but given how extremely tightly held the stock is (it basically traded on appointment as Quinton Hennigh likes to say) I think it will be almost impossible to get a meaningful position after the fact. With that said I am not betting the farm since it is still a high risk/high reward story but, again, the quality of the people coupled with the amount of targets makes me think this is more diversified to the upside than majority of early stage exploration plays.

I believe that if I give this company my Time (The word that makes your average speculator shriek) I think there is an above average chance that I will be rewarded, perhaps greatly, in the future. It may be tomorrow, weeks, months or year from now but I think chance of success is positively correlated with Time in a case like this. Exploration is a process of cycling ideas, actions and feedback. A process that takes time and builds on itself (compounds). And the only rational option for an investor that I can come up with in order to take advantage of a case where People is the key value factor is to give them Time. This makes even more sense if one considers the opposite extreme which is to give them no time. If I bought an interest in a venture and held it for a day there would simply be no way for the People factor to work in my. It’s akin to giving me and Rembrandt each a brush, let us paint for one second, and expect to see a vastly different result in quality… “Let the painter paint.”

An exceptional team coupled with high insider ownership allows me to assume the following:

- The management team and shareholders interests are aligned

- The management team knows what makes legitimate targets

- The management team knows what success looks like

- The management team knows how to go “all the way” in Eritrea

- The company will not waste money on sub-par targets or distractions for PR reasons

- … My money will not be wasted

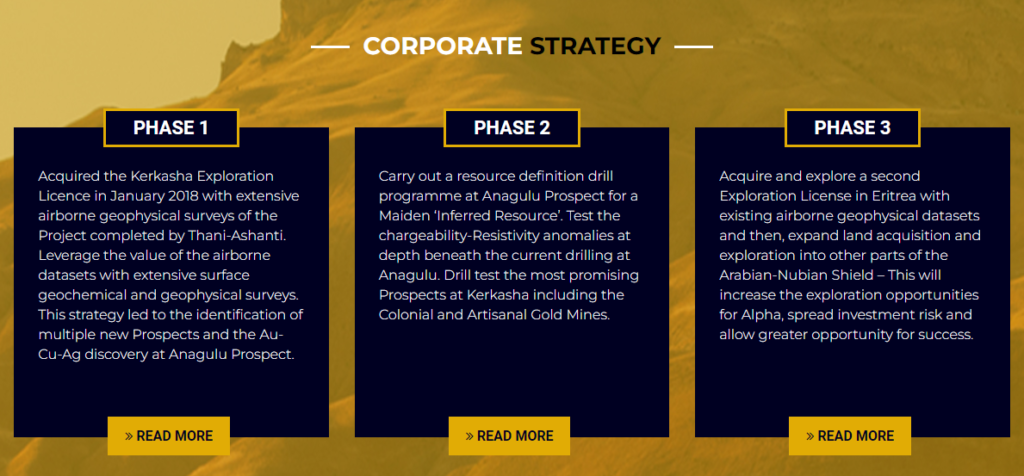

I also like that the team is ambitious and given the team I think they are indeed serious:

To sum up:

- People [X]: Superb team which has been serially successful in Eritrea before

- Long runway [X]: Large land package in “virgin” territory with Elephant potential

- Probable growth [X]: Already made two discoveries with room to grow

- High growth pace potential (ROI potential): Plan to drill #5 targets this year

With an Enterprise Value of around $50-$55 M at $0.74/share that leaves around C$10 M per target of the five that will be tested just this year. When one account for the fact that this team is made up of legit elephant hunters that strikes me as pretty good Risk/Reward. As said earlier it’s like #2 discovery stories, #3 grassroot stories, and any other potential target, and any targets in any new license the company might pick up in one ~C$50 M entity.

The case for Alpha in the words of the company:

… Note that Alpha has made an application for a second license area in Eritrea. And again, given the quality of the team, that would be an immediate bump in the implied value of Alpha.

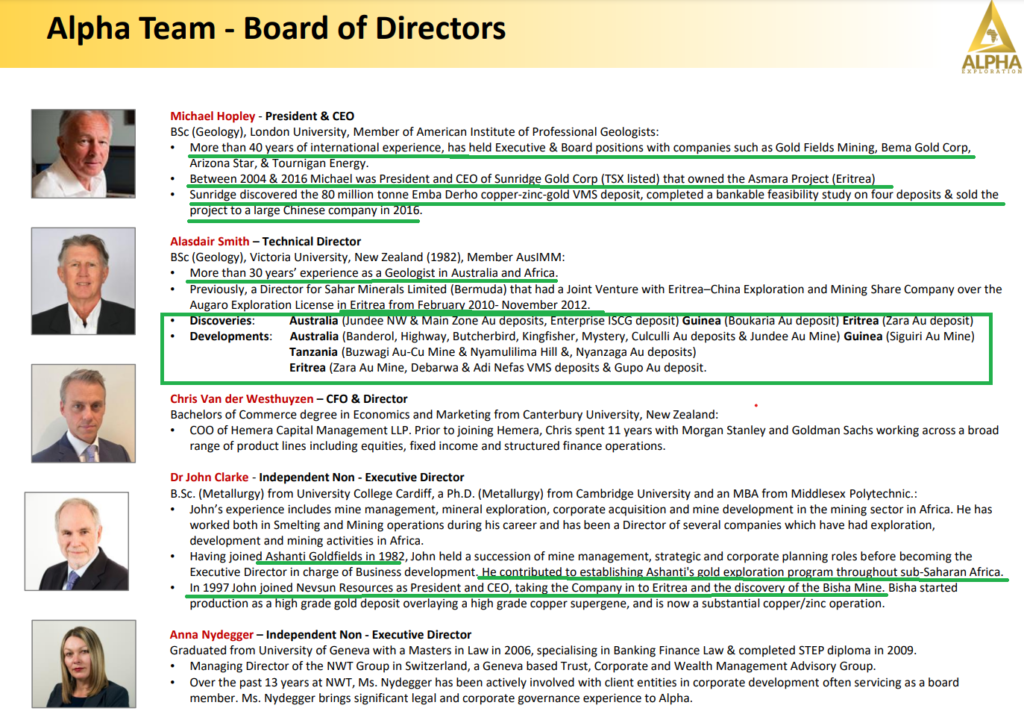

The People

It has an incredibly successful team that includes multiple discoveries and successes that eventually led to take-overs by major miners and a lot of them took place in Africa (Including Eritrea no less!!). In other words this management team has “done it” before in this part of the world and are looking to repeat their previous success stories. I do not believe such people would get out of bed in the morning if they do not have a legitimate shot of doing just that. Therefore I am very comfortable saying that Alpha Exploration has multiple legitimate targets and a legitimate chance of success.

I mean check out these resumes:

… President & CEO Michael Hopley was President & CEO of Sunridge Gold Corp which owned the Asmara Project in… Eritrea(!). This company made a big VMS discovery and the project was later sold to a large Chinese company. Alasdair Smith’s resume is friggin ridiculous. It includes several discoveries as well as several development stage projects (And many in Eritrea to boot!). One could probably drop off Alisdair One also gets an ex President and CEO of Nevsun Resources which is not only one of the most famous junior explorer success stories but it also took place in Eritrea…

To make it even better Management’s ownership of the company comes in at 14.6%. To sum up I think it would be really really hard to put together a better and more suitable team for an exploration story in this specific part of Africa. They a) Know how to explore and find big deposits, b) Know how to go from exploration, to development, and finally how to cash in on success, and c) Know the ins and outs of working in Eritrea. Prsonally I think the people involved makes up some >60% of the case and is why I almost automatically consider my bet to be a “smart investment” regardless of the outcome. Wild success is always the exception but I think these guys have a way better chance than almost anyone in the world in this case (And they have the track record to back it up).

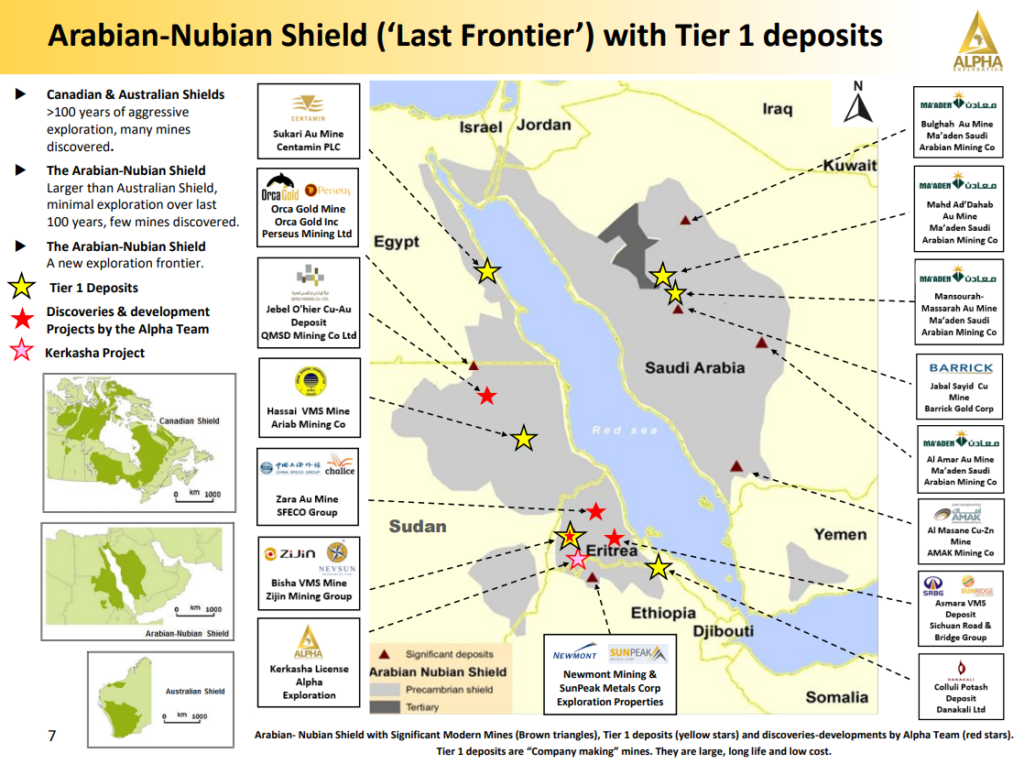

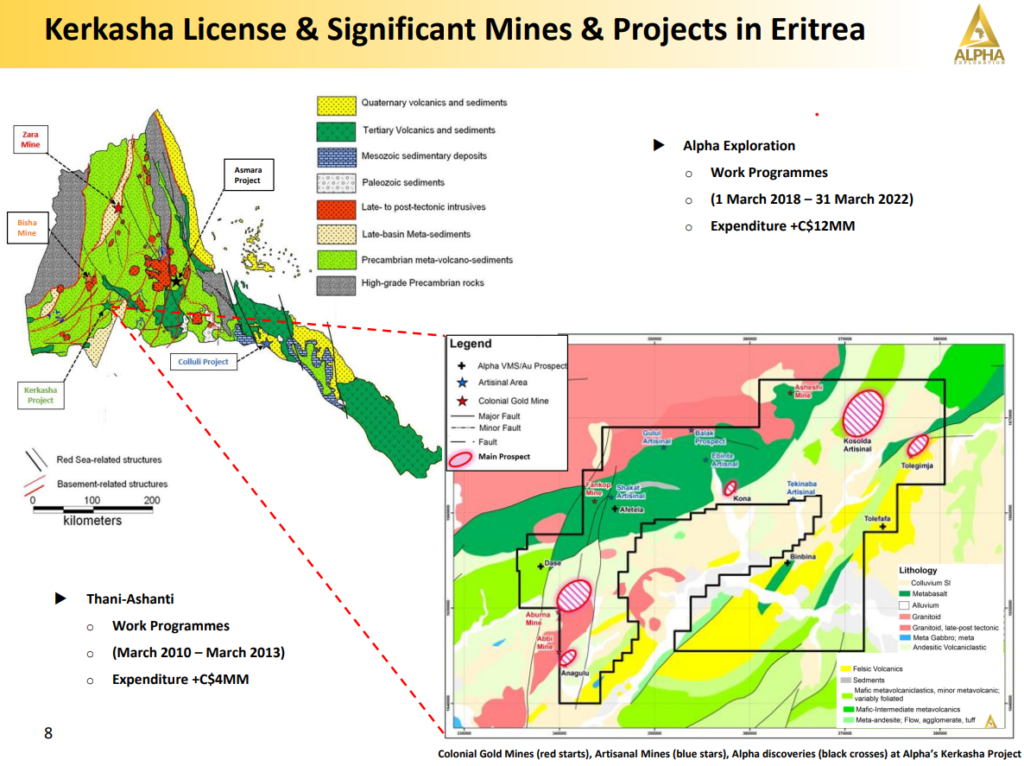

Underexplored Part of The World

The low hanging fruit has been plucked in most prospective regions of the world. If one wants to find “Elephants” without being forced to do 1km long, blind drill holes one might have the best shot in the relatively few regions that are still underexplored. The “Arabian-Nubian Shield” just happens to be such a region:

Again, all else equal, logic would suggest that a junior ought to have a much better chance at finding a tier #1 deposit in a part of the world which has not been fine combed for said tier #1 deposits already:

On that note I just read a new article titled: “Mining Indaba: Robert Friedland: ‘World economy can’t change unless we develop a lot more mines‘”

Snippet from the article:

“Global mining personality and financier Robert Friedland has singled out Africa and the Arabian Shield as the venues where the world’s future-facing minerals and metals will be responsibly produced.“

Further evidence of this region’s prospectivity, is in my opinion, the fact that Alpha Exploration identified several high quality targets so quickly and has already seen success at two of them:

Sheer Amount of High Quality Targets

From a Risk/Reward perspective I really like the fact that the company has so many high priority targets already. Alpha Exploration is kind of “diversified to the upside” as I like to call it. One only needs one target to really work out, and the more legitimate targets a company has, the more shots one gets. One could say Alpha Exploration contains two discovery stories and so far three grassroot stories. I typically stay away from pure grassroot explorers and especially if they only have one legit target since the risks are extreme in that case. In Alpha’s case I am sort of buying two discovery juniors and three grassroot explorers but without paying full price for any (Simply because the market always has a hard time focusing on, and therefore pricing in, the value/potential in more than one target).

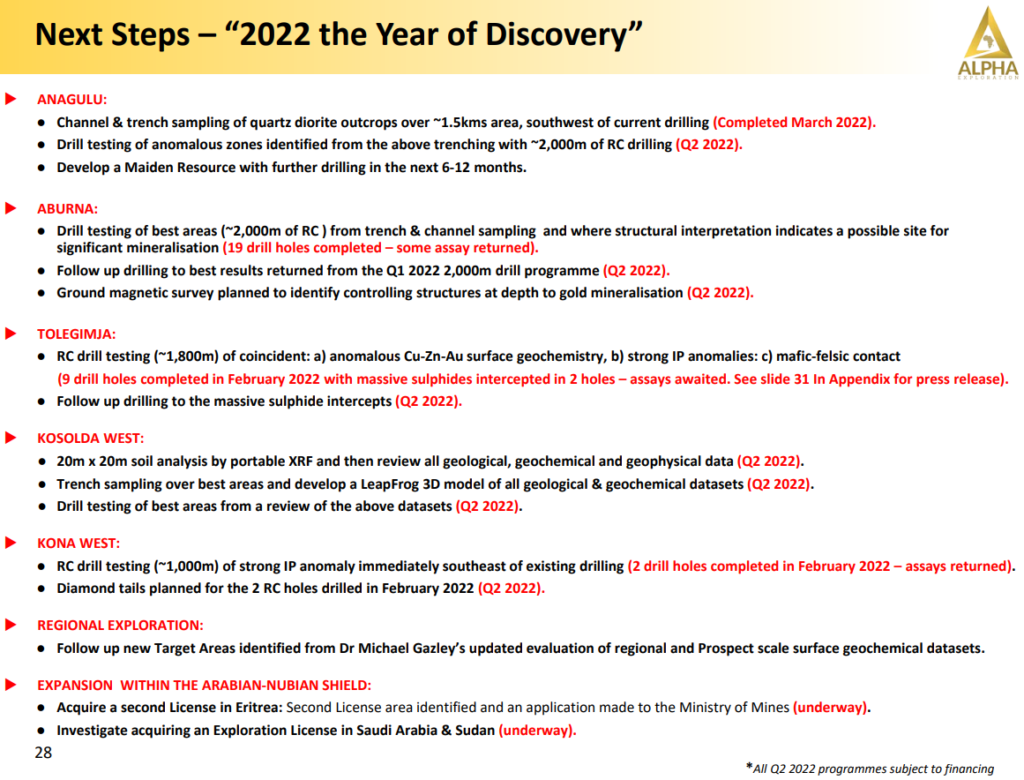

On that note Alpha Exploration plans to drill at least FIVE different targets THIS year:

Lets quickly go through them…

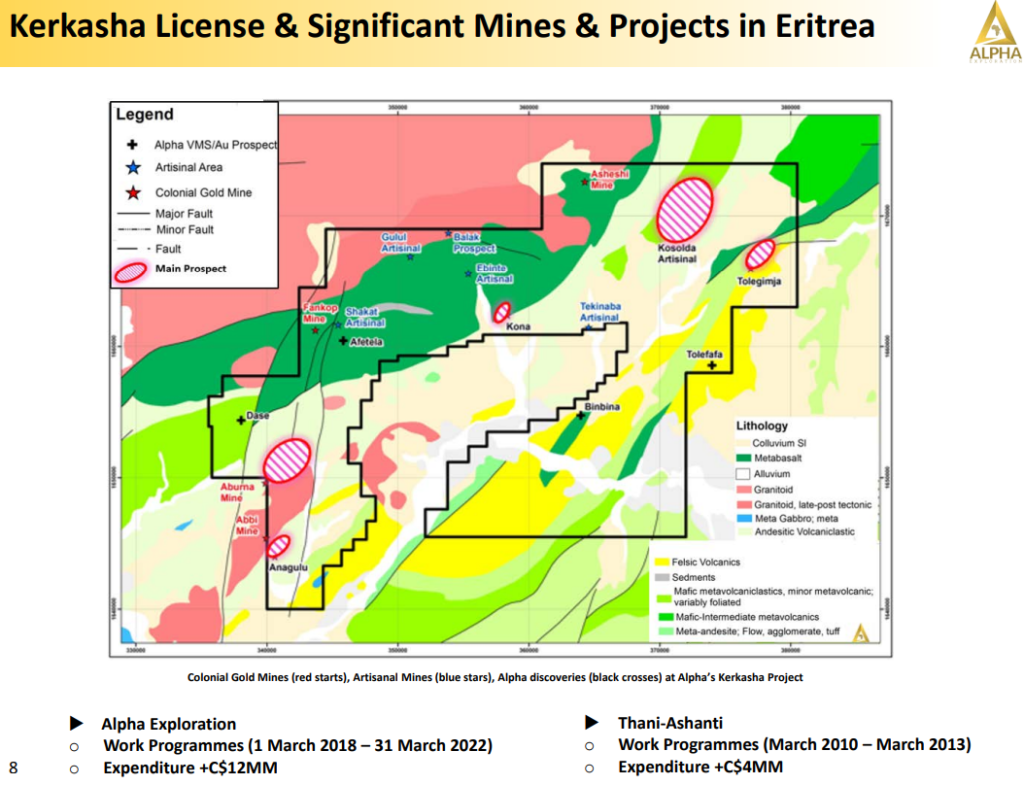

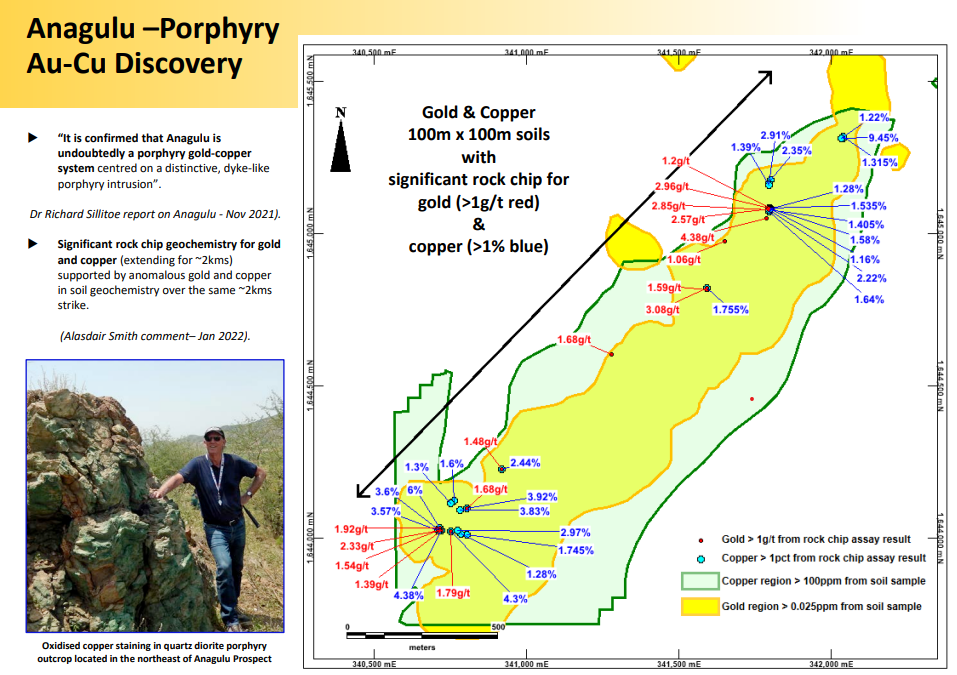

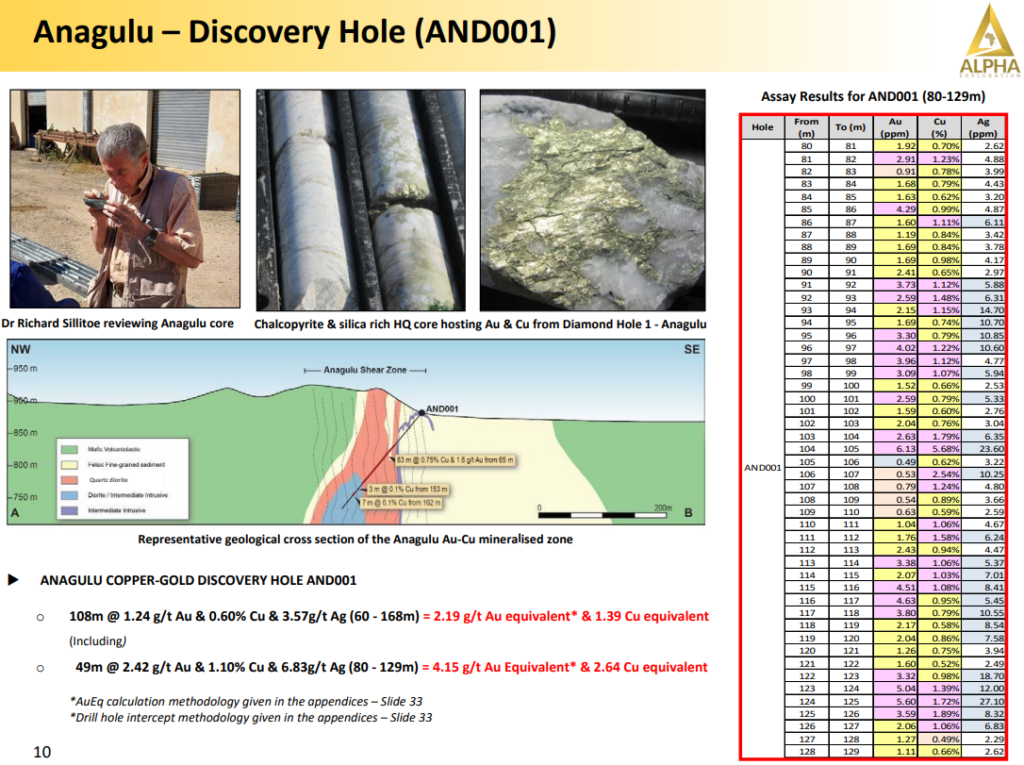

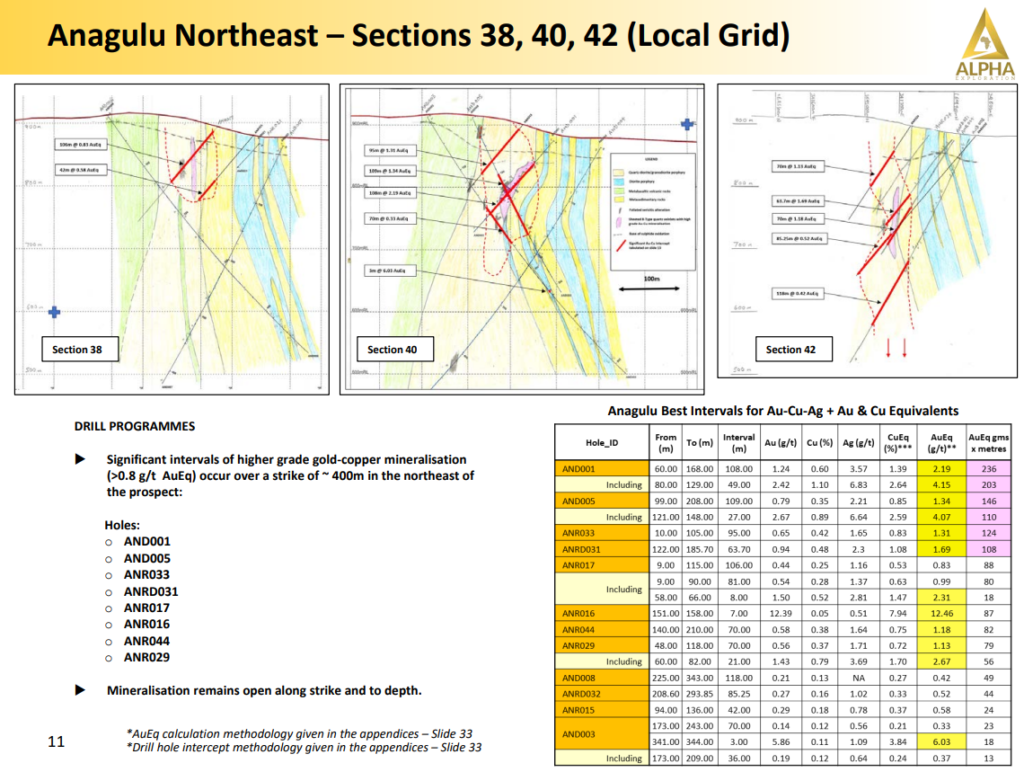

#1 “Anagula” – Porphyry Au-Cu Discovery

This is the first drilled discovery made by Alpha Exploration and the target has an impressive 2 km long Gold + Copper soil anomaly:

The discovery hole AND001 showed very good results and interestingly the gold and copper mineralization was quite homogenous through the entire interval (aka not nuggety):

Other holes with significant mineralization are presented in the slide below. Most of these holes were centered around the original discovery hole:

(Note the AuEQ gram-meter numbers in the column farthest to the right)

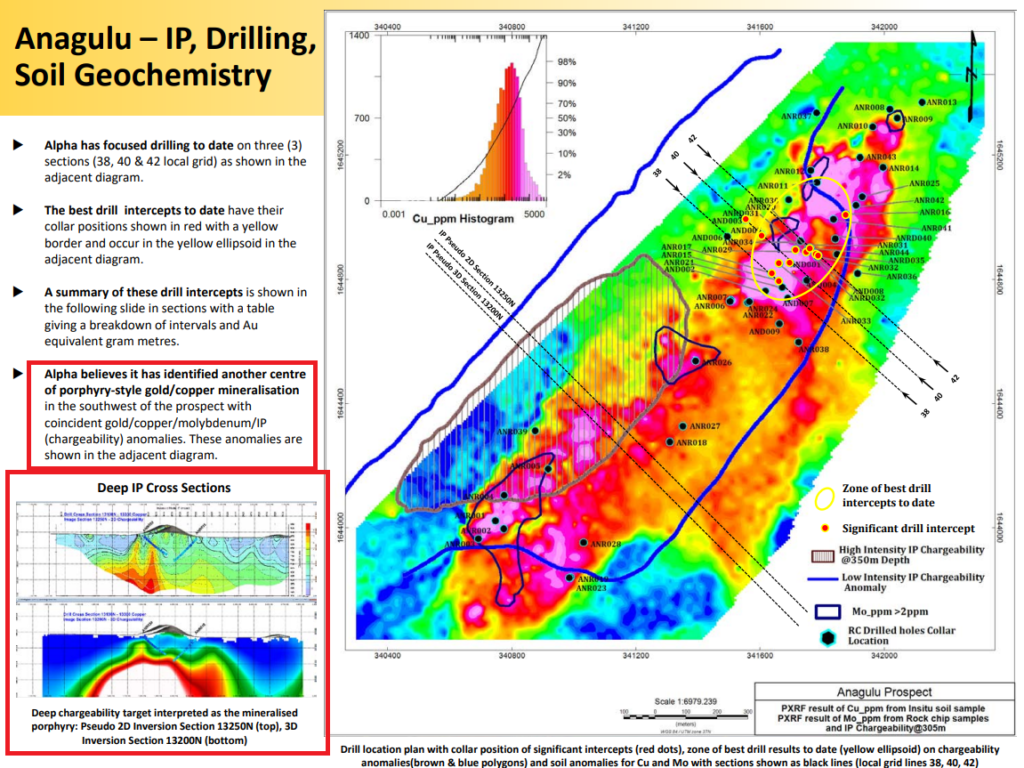

… When you get >100 AuEq gram-meter holes that close to surface one should obviously get excited. With that said this target is a work-in-progress since the company has not yet beet able to prove up a substantial volume of mineralized rock. But since this is literally the A-team they have been busy doing additional geophysics studies and a lot of trenching. The Deep IP study has highlighted a very large target at depth in the south-eastern part of the overall target zone which is believed to be another “centre of porphyry-style gold/copper mineralization”:

… Note the anomalies at depth shown in the bottom left corner and how it appears that any drilling in this area failed to reach said depth. Who knows, maybe there is a larger elephant hiding there. What we know for sure is that there is a lot of smoke on surface and that there have been >100 gram-meter holes drilled in the north-eastern part of that trend. A large high-grade porphyry discovery could probably be worth everywhere from several hundreds of millions of dollars to billions of dollars and this team has already proven they are capable of creating value to that degree in Eritrea. At say C$10 M put per each of the currently known priority targets I would say it is priced like any meaningful success here is slim to none. Even a 10% chance of finding something worth $500 M is still $50 M in implied value (excluding dilution). #50 new trenches have been done at Anagulu and I am looking forward to what might be discovered from this years drilling.

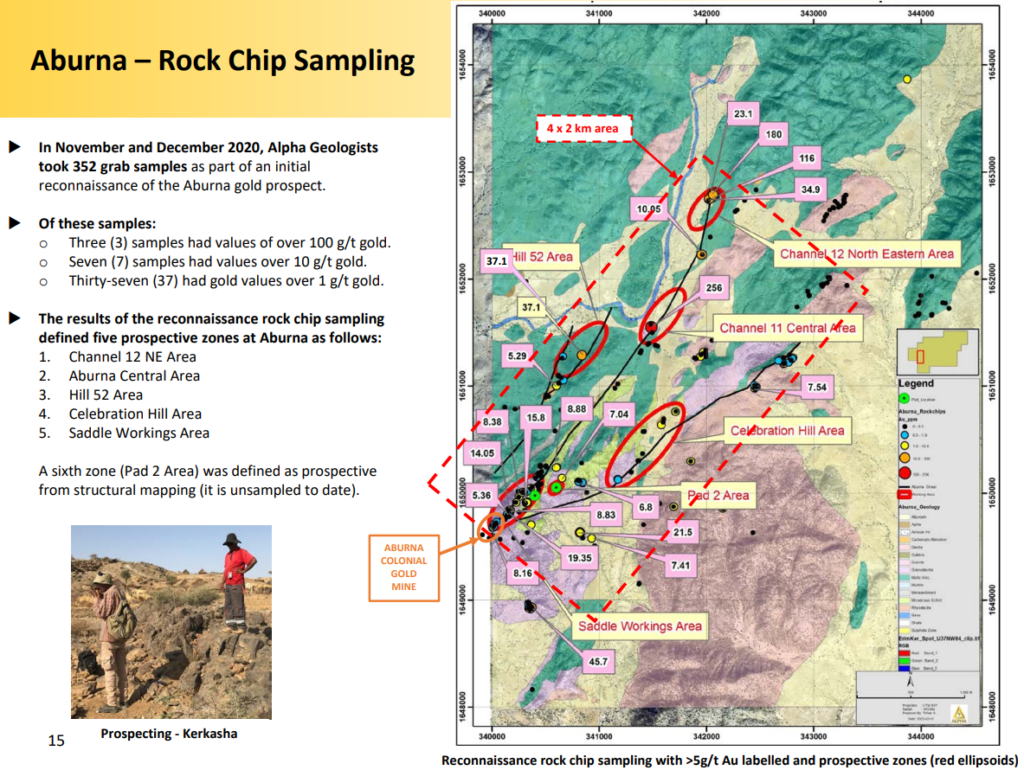

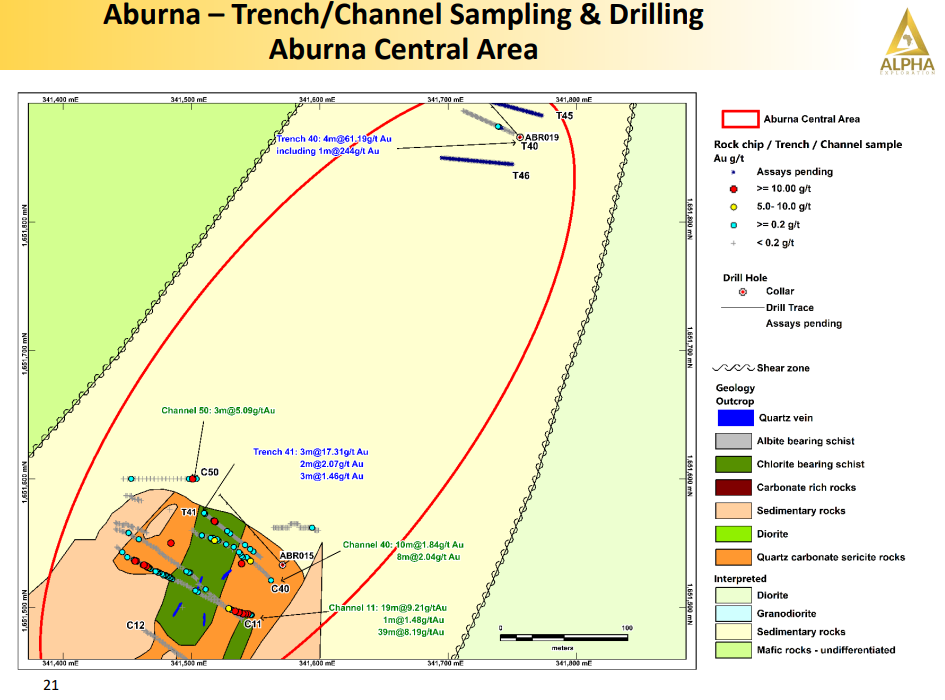

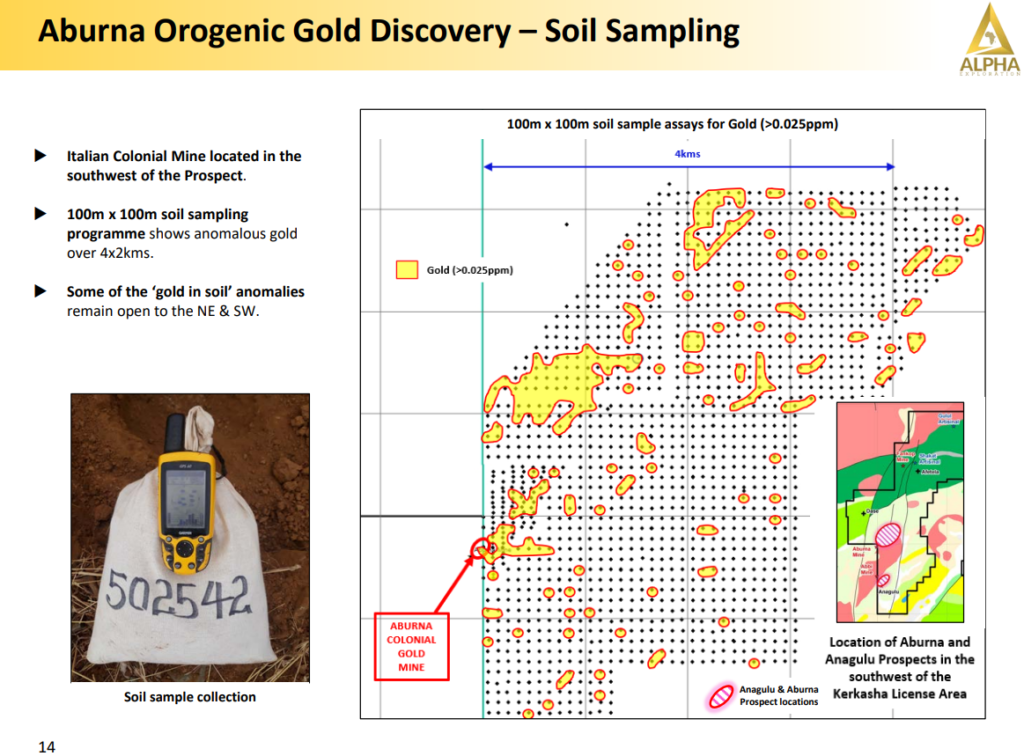

#2 “Aburna” – Orogenic Gold Discovery

Aburna is a massive gold target that also hosts an old colonial gold mine. 100 x 100 m soil sampling has resulted in extensive “golden smoke” on surface:

(Note the scale bar)

#352 rock chip samples have already been taken from the area with a few showing grades over 100 g/t Au:

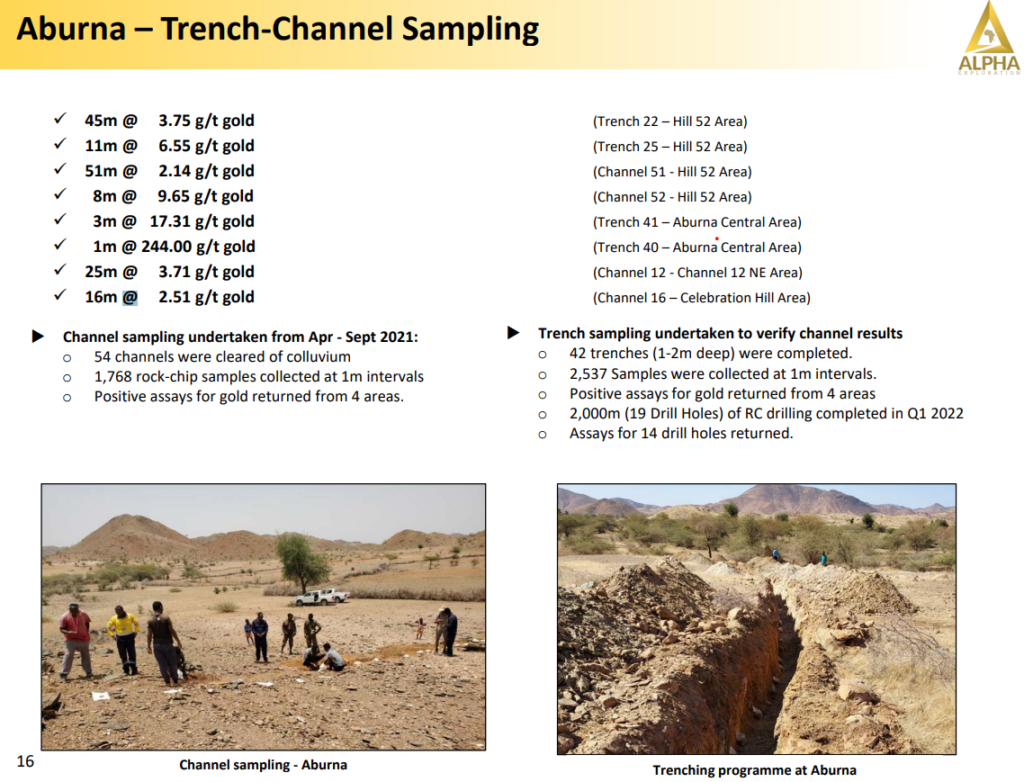

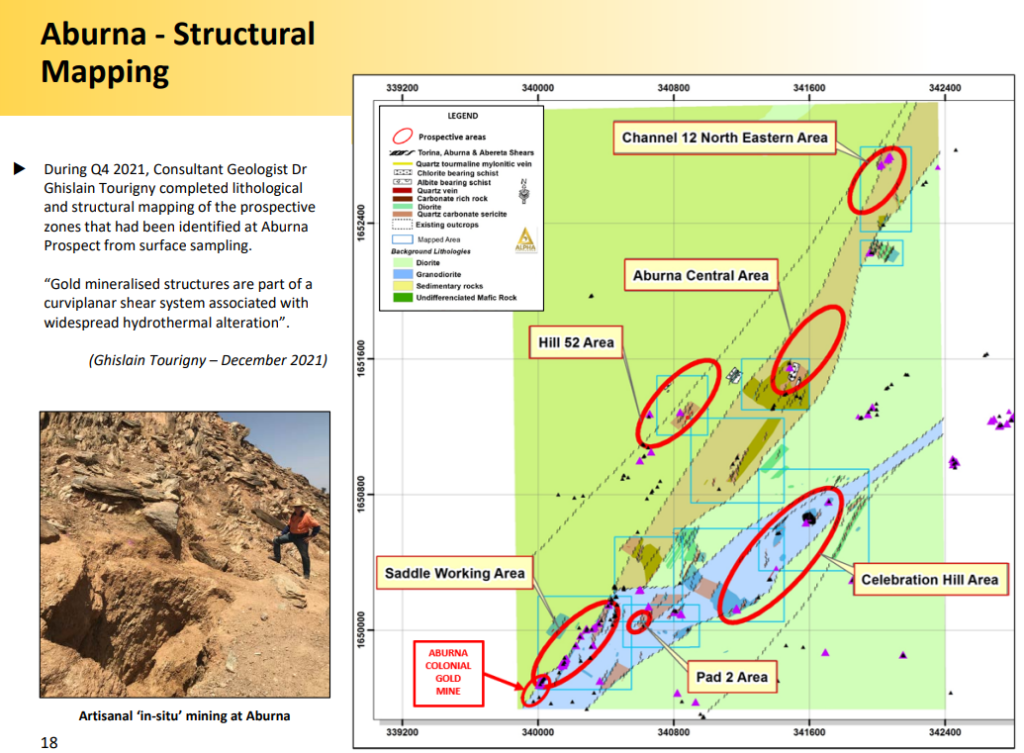

The next phase of exploration was trench and channel sampling in order to get a better grip on where bedrock sources for the gold might be present. Different parts of the large area of interest were tested and it resulted in four high priority areas:

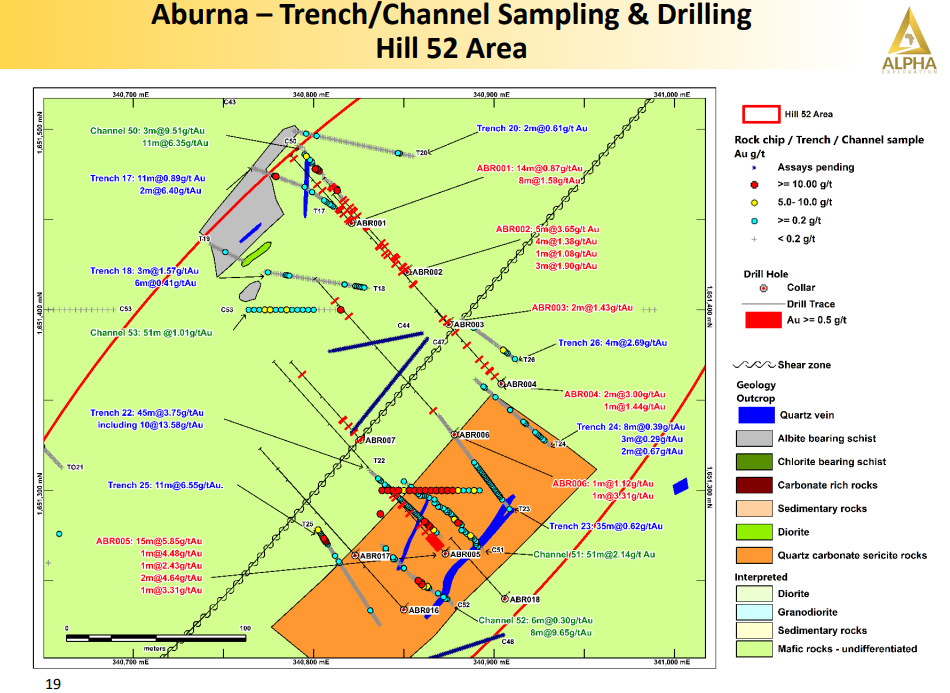

(Note that some of these channel sample results are quite eye popping)

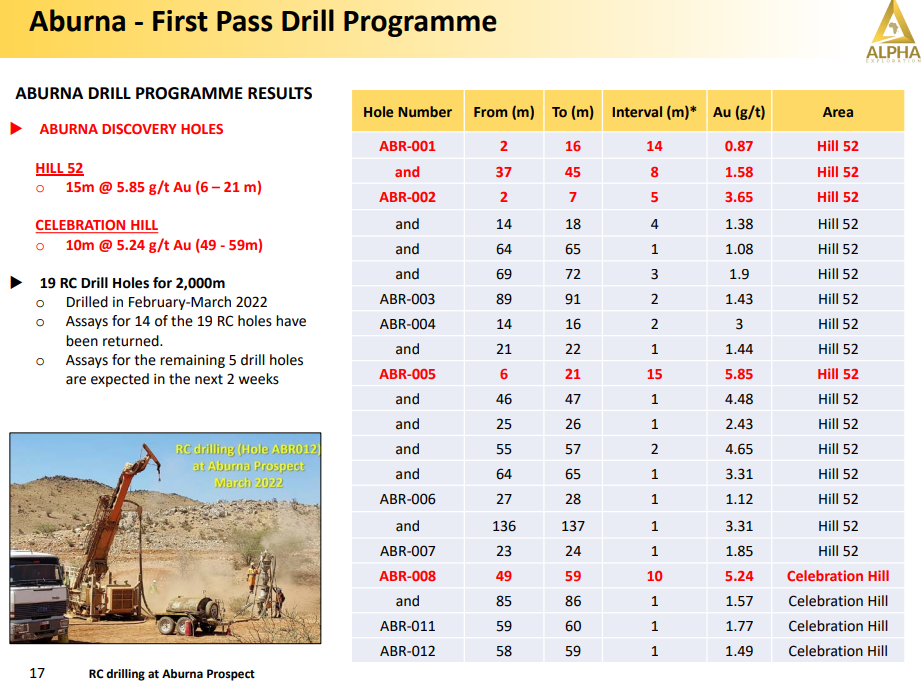

The next step was a maiden drill campaign consisting of #19 RC drill holes for 2,000m. The results from #14 of said drill holes have been returned and are presented below:

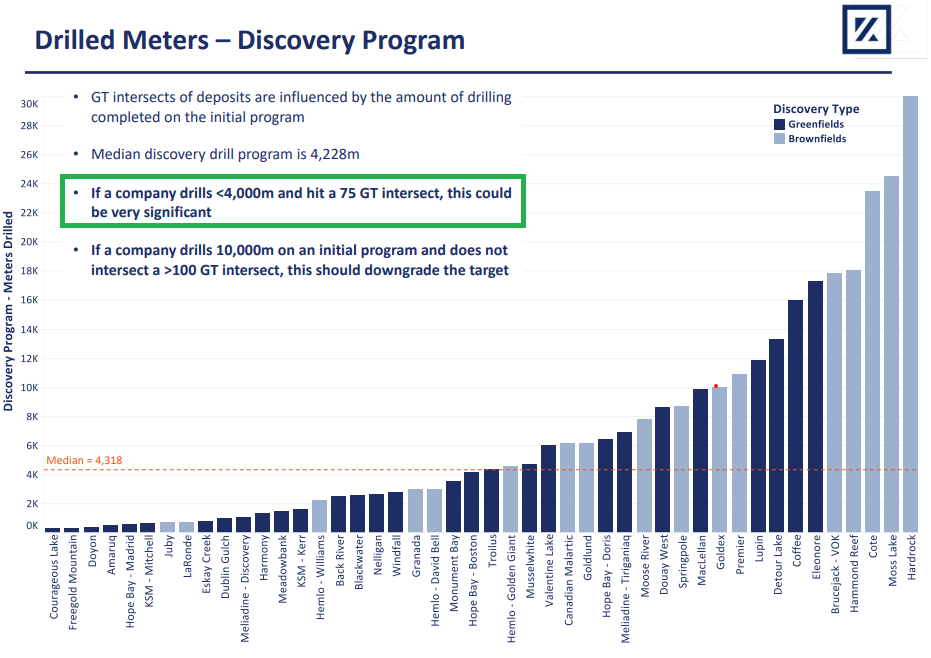

The “Hill 52” and “Celebration Hill” targets produced the best results thus far with the two best hits being 15m @ 5.85 g/t Au (“Hill 52”) and 10m @5.24 g/t Au (“Celebration Hill”). What makes it better is that these holes hit mineralization at very shallow levels (Starting at 6m-49m down hole respectively). Furthermore I always keep the Kenorland Discovery Study in mind while looking at early stage results nowadays. And as per the study a hit of 15m @ 5.85 g/t Au = 87.75 gram-meters with under 4,000 m drilled (Alpha has so far only drilled 2,000m combined across these targets) is a very good sign:

It’s worth noting that “Hill 52” and “Celebration Hill” are around 1 km apart from each other:

Producing gram-meter hits up to 52 and 88, at two different targets this early on, is a great start. Again, logic dictates that the company has either been very lucky or they might possibly have tagged two robust systems already. Note that there is a lot left to explore given that trenches, channels and drilling activities have only covered parts of the high priority areas thus far. Take “Hill 52” as an example:

This is what CEO Michael Hopley (Ex Gold Fields, Bema Gold & Sunridge gold etc) had to say about the early results out of Aburna:

“Michael Hopley, Alpha President & CEO said, “We are very encouraged with these initial drill results from Aburna, particularly because of the very large size potential of the prospect indicated from earlier trenching over approximately 4 km by 2 kms. The results to date show impressive widths of strong gold mineralization in two areas of interests at Aburna – Hill 52 and Celebration Hill. Now that these areas have demonstrated possible economic grade mineralisation is present, further drilling will focus on determining the strike extent and width of mineralisation.”

And here we have Quinton Hennigh of Crescat Capital discussing these early stage results:

I like this slide for “Aburna Central Area” which highlights that they are still just “scratching the surface” at these many targets:

You didn’t think were done right? No sir. There is a lot more meat on this company…

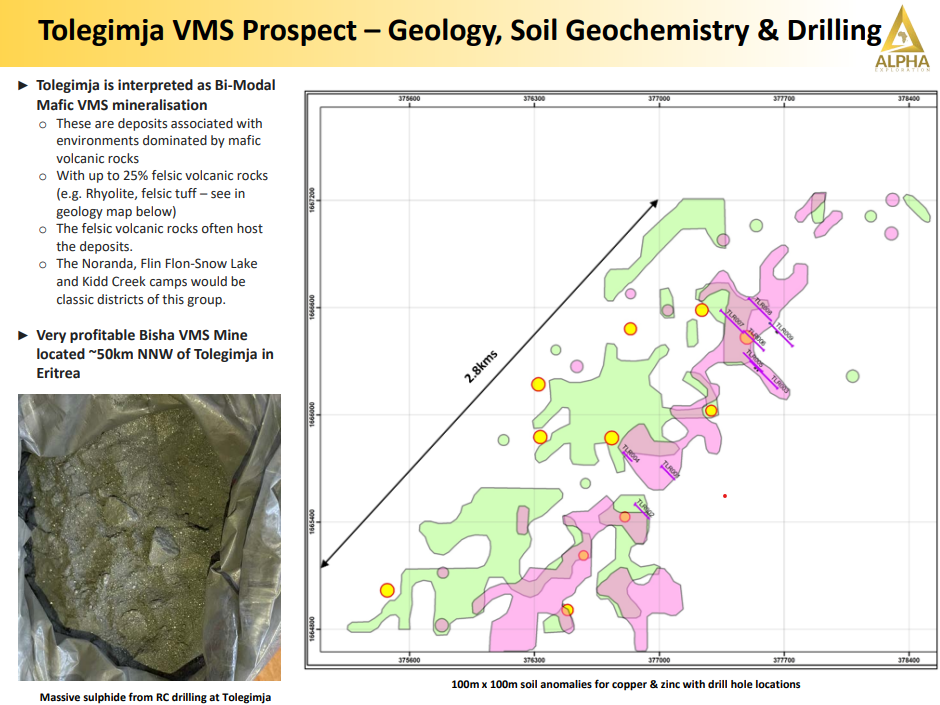

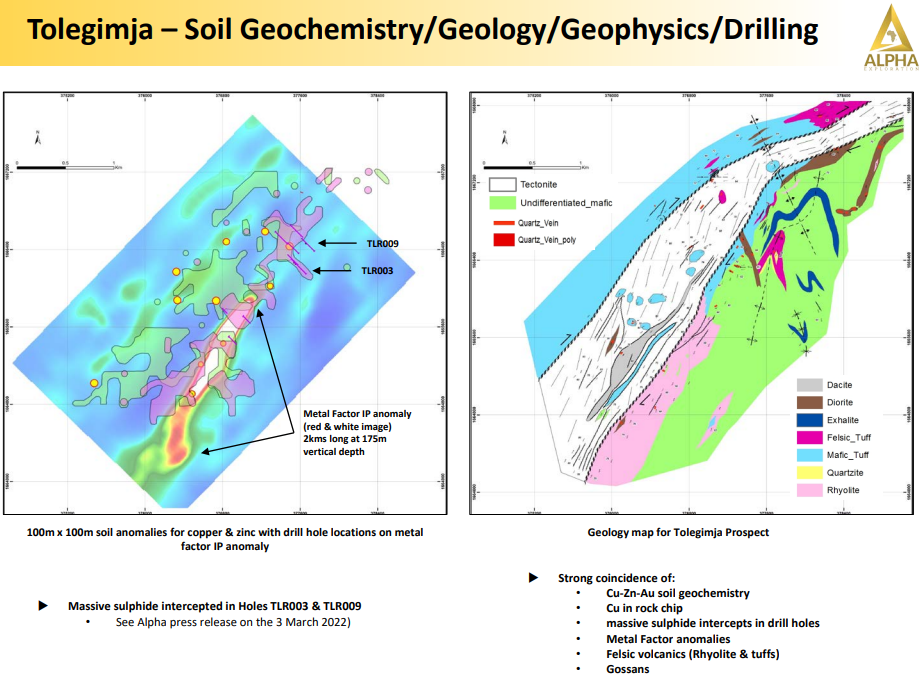

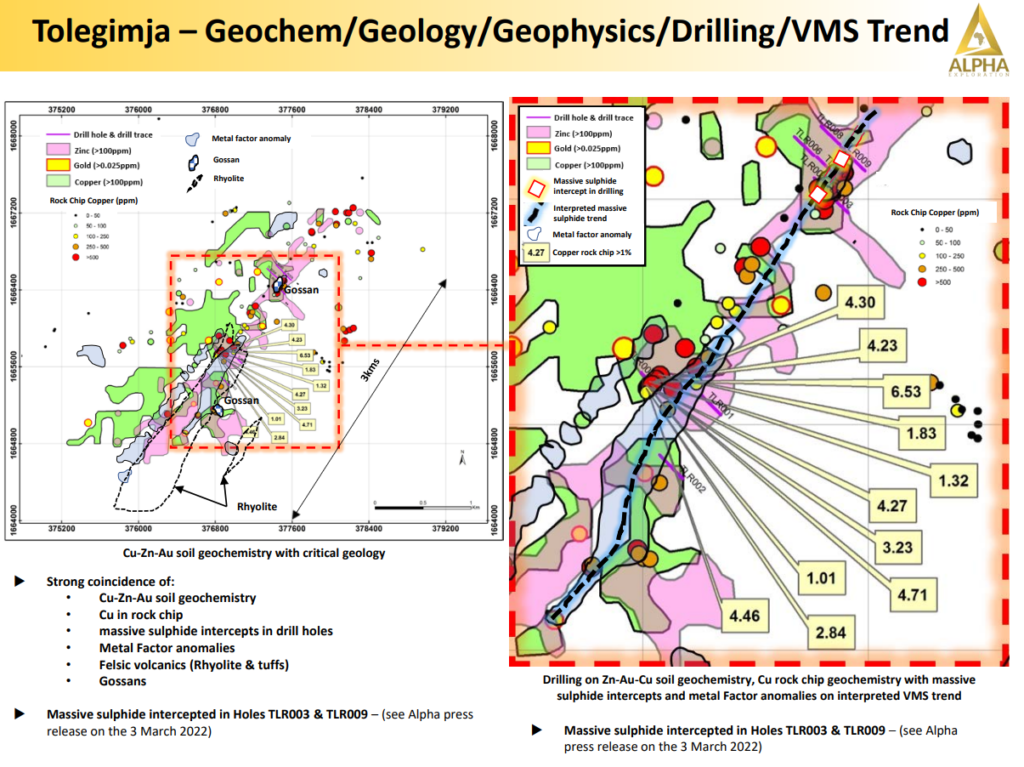

#3 “Tolegimja” – VMS trend

Tolegimja is an approximately 2.8 km long trend of anomalous copper and zinc:

Encouragingly the geophysics line up with the soil anomaly (left picture below):

As is highlighted in a previous slide the world famous Bisha mine, which is also a VMS deposit, is located some 50 km away from “Tolegimja” in Western Eritrea. The Bisha deposit was first discovered by a Canadian junior named Nevsun Resources. In 2018 Nevsun was the target of a takeover battle between Lundin Mining and China’s Zijin Mining. In the end Zijin Mining’s bid of C$1.86 B prevailed and the company was gobbled up. It is worth noting that one of Alphas directors, Dr John Clarke, has the following on his resume:

“In 1997 John joined Nevsun Resources as President and CEO, taking the Company in to Eritrea and the discovery of the Bisha Mine. Bisha started

production as a high grade gold deposit overlaying a high grade copper supergene, and is now a substantial copper/zinc operation.”

The company recently completed an initial drill campaign at Tolegimja, consisting of 9 RC holes for 1,862m, and holes TLR003 and TLR showed “massive sulphide type mineralization”:

(Note the footprints of anomalous zinc/gold/copper and the percentage-level copper chip samples)

Here is Quinton Hennigh discussing the drill campaign at Tolegimja:

I don’t know what they might find at Tolegimja but it sure looks like there is at least a chance it could host a significant VMS system. This article is already getting lengthy so I will just briefly touch on high priority targets #4 and #5…

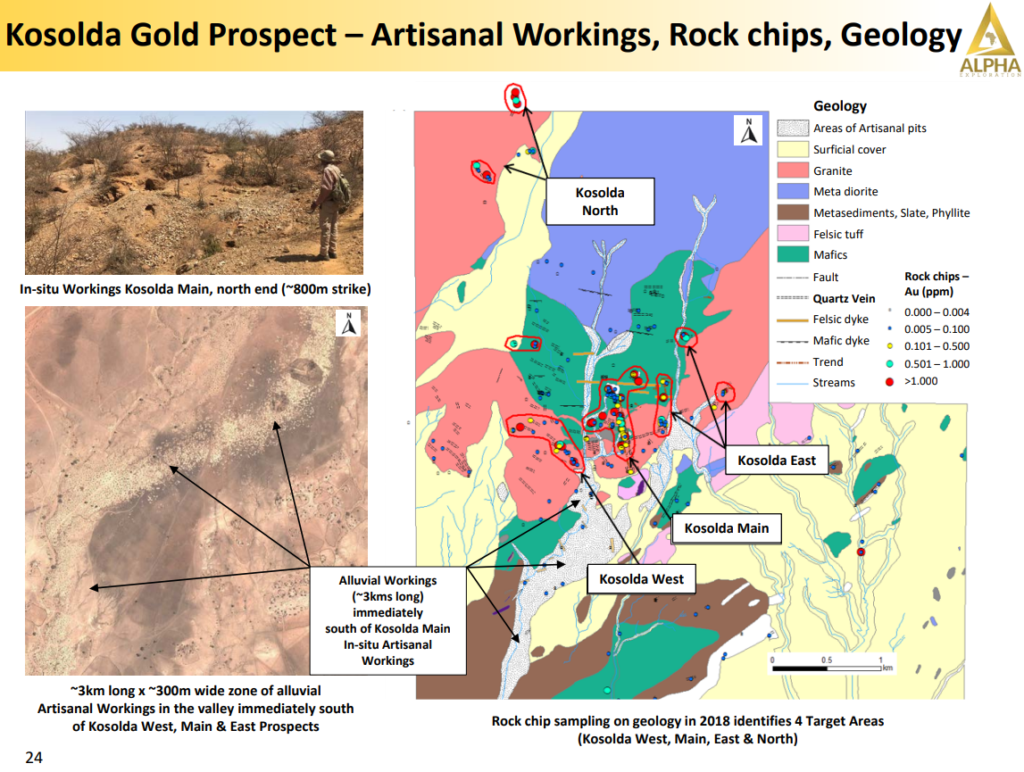

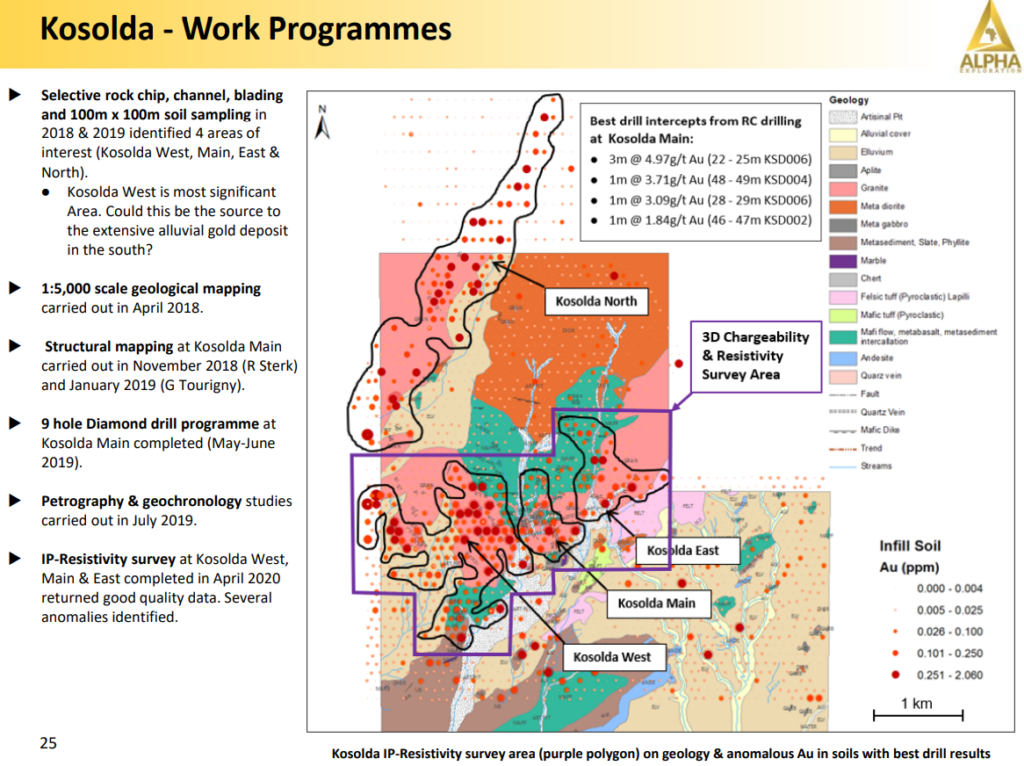

#4 “Kosolda” – Gold Prospect

Kosolda is another target where there has been a lot of historical gold workings (both alluvial and bedrock mining). In fact, the footprint of the alluvial workings is 3 km long and 300 m wide, and there are currently four main targets that have been identified:

Only 9 drill holes have been done at this very large target and there is a lot of work planned for 2022 which includes soil analysis, trenching and finally drill testing the most promising areas:

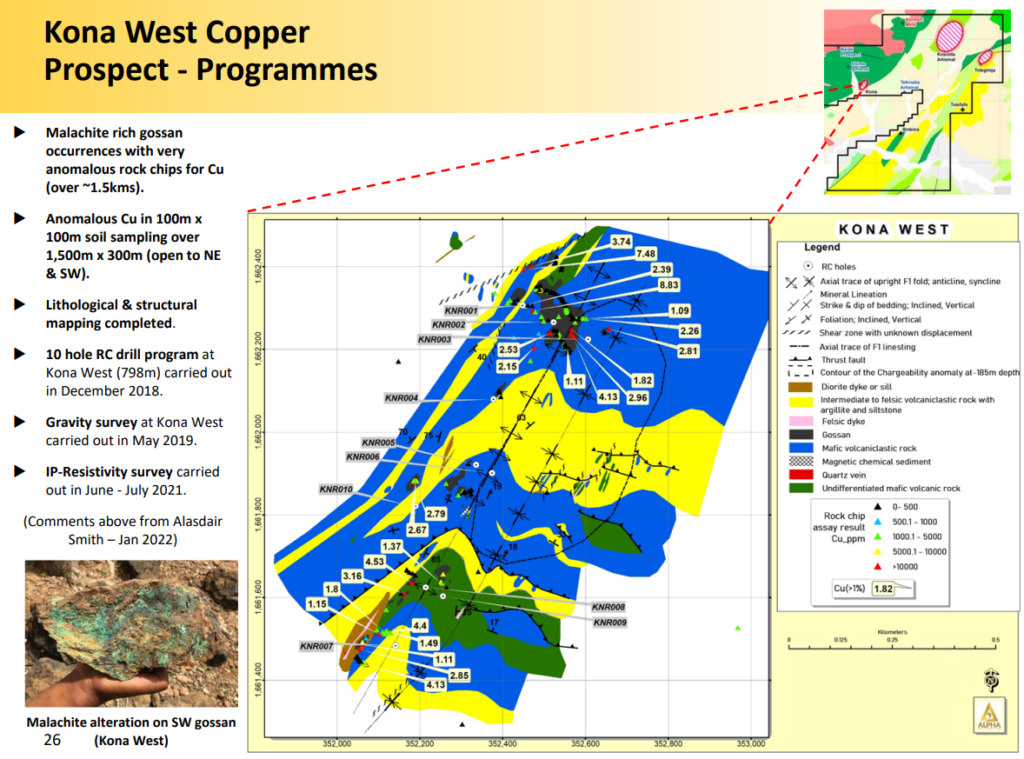

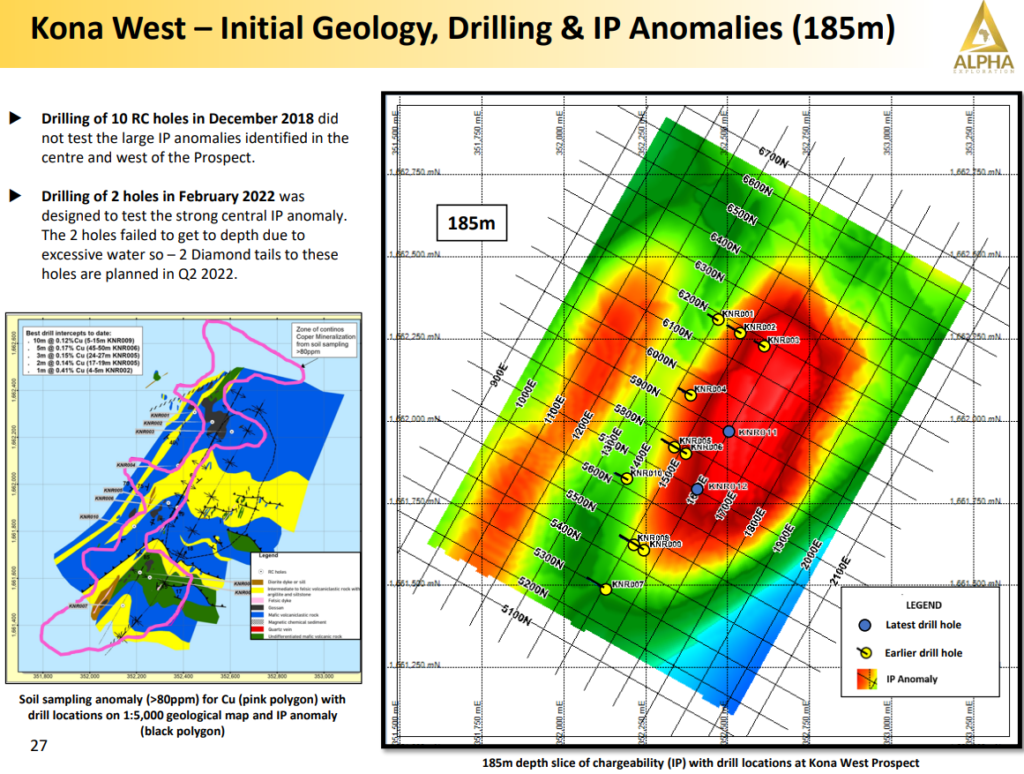

#5 “Kona West” – Copper prospect

Kona West is a target with Malachite rich gossan occurrences with anomalous copper rock chip samples over 1.5 km of strike:

10 RC holes have been drilled here but the belief is that they missed the target. Two follow up RC holes were drilled but these holes are believed not to have been drilled deep enough to reach the target. The plan right now is to extend these two holes with diamond drilling in Q2 2022:

…. So there you have the five main targets that will be followed up on by the A-team in 2022. Given the team I automatically conclude these could all be company makers since they would not spend time on them if they believed otherwise. What the chance of success is in terms of finding one or more deposits that would see this team follow up on their previous successes I do not know. What I do know is that the Enterprise Value of the company is around $50 M and that is covering #5 known high priority targets (including #2 discovers) and 17 gold and base metal prospects in total that have been identified to date:

As mentioned at the start of the article Alpha does not have the typical Margin of Safety but has two discoveries and given the amount of targets/prospects I see it as being “diversified to the upside”. If you have #2 discoveries, #3 additional early stage targets, #17 prospects overall, and have applied for more land, then the odds of proving up something material is obviously way higher than for a company that had one small land package with one target (one shot).

All in all this is what is on the menu for shareholders in “2022 the Year of Discovery”:

Note that in this freshly minted presentation it says that the company will also “investigate acquiring an Exploration License in Saudi Arabia & Sudan a the bottom. I really (really) like great management teams that are empire builders for the simple reason that I love growth stories that allow for HODL:ing. I the team was bad then time is my enemy and HODL:ing makes no sense. If there are no ambitious plans and growth prospects then HODL:ing becomes pointless.

To sum up

Alpha Exploration has pretty much all the ingredients needed for a high quality growth case where one could theoretically buy shares and then just forget about the shares for a couple of years. Either they will be down or perhaps up a lot. The case does not have classic “Margin of Safety” but the company does have two discoveries and a very large pipeline for potential growth (And might get hiked up even more if they acquire more prime ground). Thus I consider it to have probable growth as well as being “diversified” to the upside which could be seen as a probabilistic form of “Margin of Safety”. The negative is of course that it is in Eritrea but given the people involved, who knows, maybe it’s even less risky than the average junior in Canada in reality (in some way, shape, or form).

I have a long term HODL position in Alpha and have participated in two Private Placements. I really like the Risk/Reward from these levels so I have kept all my shares and added a few more in the open market over the last couple of weeks. Note that the stock is thinly traded so in a way HODL:ing becomes almost the default strategy since it would be hard to trade (Never invest money you need anytime soon in a thinly traded stock). The stock being thinly traded, and tightly held, of course also means that it might move a lot in either direction.

Personal strategy

HODL until the prospects for material growth tapers off either via testing all targets or the company becoming so richly valued that moving the needle becomes hard.

Personal expectations

I expect the company’s chances of having material success goes up with time. Thus I think I think there is a fair chance that I could be up a lot on this stock if I check back in 12-24 months etc.

Note: I am not betting the farm on Alpha Exploration. If it does what I think it can then I will get a nice boost to my portfolio. If for whatever reason the story fails then it will not have a material affect on the portfolio. Remember, a stock can only go down 100%, but it can go up a lot more than 100%.

This is not a buy or sell recommendation. I am not a financial advisor. Junior mining stocks are volatile and risky. Stocks can go to zero. Never invest money you cannot afford to lose. I cannot guarantee the accuracy of the content in this article. Assume I may buy or sell shares at any time. Always do your own due diligence and make your own opinion. Assume I am biases since I own shares and the company is a banner sponsor.

Best regards,

The Hedgeless Horseman