Cartier Silver (CFE.CN): Just started to drill a big target near Iska Iska

Cartier Silver is a multi-asset junior which recently has turned its eye to Bolivia on the back of the success at Iska Iska by Eloro Resources. On that note the CEO Thomas Larsen is also CEO of Eloro Resources and Bill Pearson who is the Chief Technical Advisor is also VP Exploration for Eloro. Then add the likes of Osvaldo Arce (aka “Mr Bolivia”) and you have the same players that made Eloro go up hundreds of percent on the back of the grassroot Iska Iska discovery. I own shares of the company and I am glad to say that Cartier is also a new banner sponsor. Thus consider me biased!

So Cartier Silver has quite a few assets and that includes iron one in Labrador, Canada, a LSE property in Newfoundland, Canada, the new Bolivian projects and even 2.26 M shares of Eloro Resources:

… Interestingly almost a third of Cariter’s Market Cap is covered by the value of the Eloro Resources shares ($8.8 M). If we remove $8.8 M for the shares, and say $1 M in cash, then we have around ~$23 M left for all the projects at $0.88/share.

So for C$23 M you get the previously listed projects and this team:

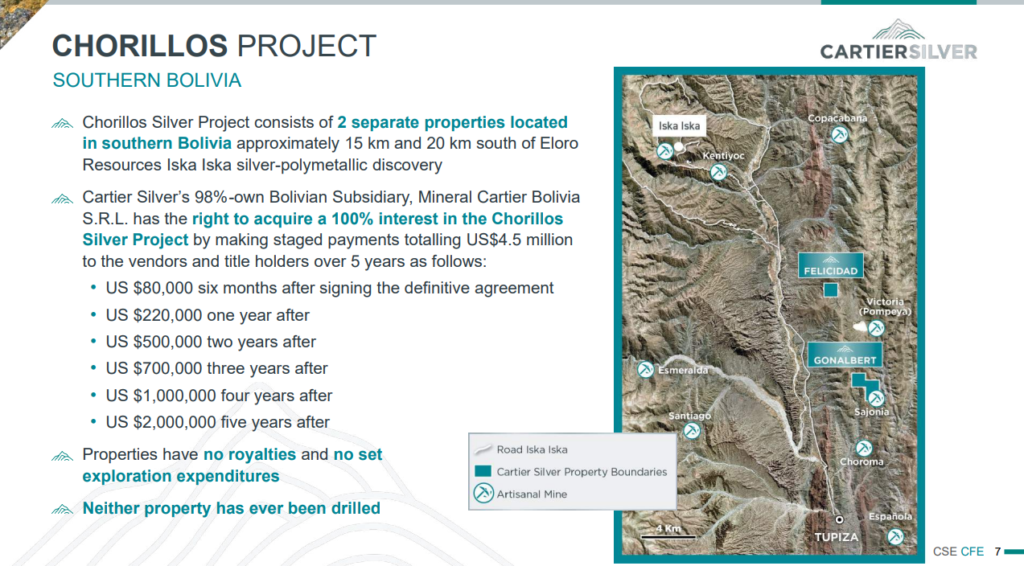

And the projects include this new flagship project called “chorillos”:

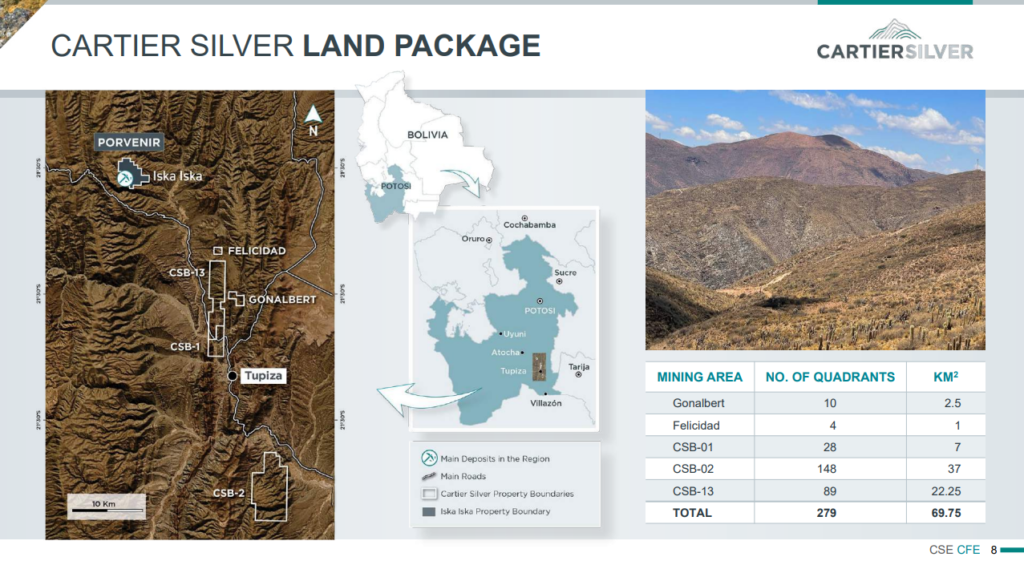

And they include these additional Bolivian projects:

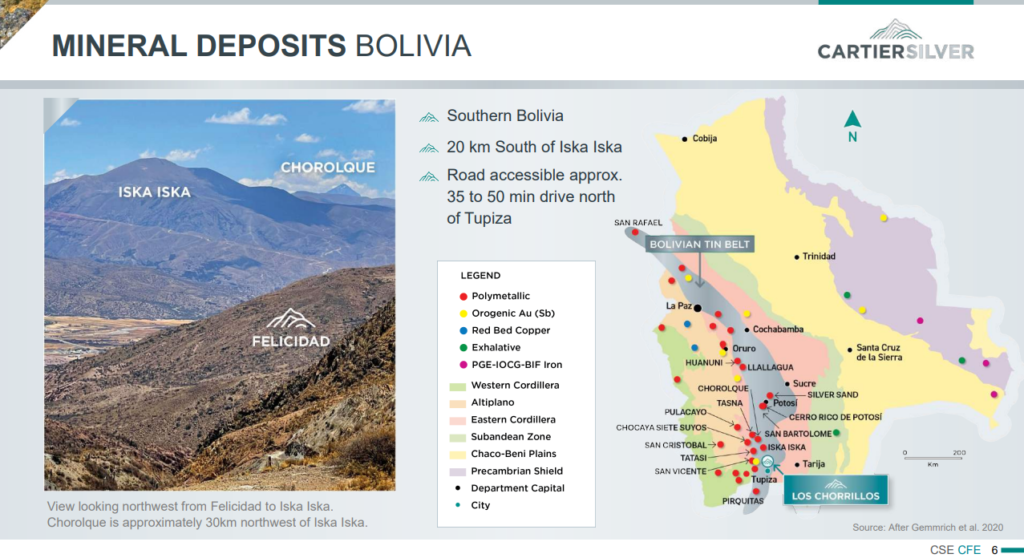

And all of these are located in the very prospective Bolivian belts:

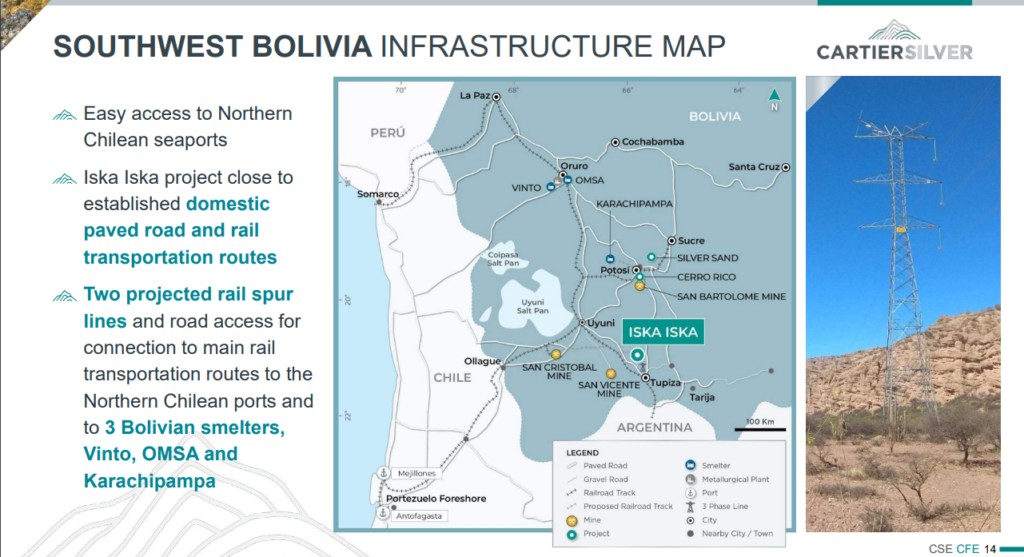

Thankfully the area of interest, which is proximal to Iska Iska, is close to roads and rail transportation routes to Chilean ports as well as Bolivian smelters:

One way to look at Cartier Silver is that one is getting half a share worth of Eloro Resources and a $23 M price tag to ride the Cartier Silver portfolio. Another way to put it is that there is an underlying “Margin of Safety” via Eloro Resources at face value. If Eloro would double in price the current Market Cap of Cartier Silver would be made up of the value of Eloro shares alone.

Oh and while the (legacy) perception of Bolivia as a mining jurisdiction is unflattering to say the least the latest Fraser Insitute Rankings puts Bolivia ahead of countries such as Mexico, Ecuador, Mali, Colombia, South Africa and Even Peru on the “Policy Perception Index”. On that note some will have seen the recent deal announcement from Chinese battery giant CATL:

Chinese battery giant CATL seals $1.4 billion deal to develop Bolivia lithium – Source: Reuters.

LA PAZ, June 19 (Reuters) – Chinese battery giant CATL confirmed a $1.4 billion investment to help develop Bolivia’s huge but largely untapped reserves of lithium, cementing on Sunday a partnership with the government made in January.

The agreement connects CATL, the world’s largest manufacturer of electric vehicle batteries, with Bolivia’s salt flats that are home to the world’s largest lithium resources.

Following a meeting with CATL executives on Sunday, Bolivian President Luis Arce confirmed the commitment to build two lithium plants to extract minerals from the country’s Uyuni and Oruro salt flats…

In essence I think there might be a dislocation between reality and investor’s perception in terms of how bad the jurisdiction actually is today. Bolivia appears to be getting better, albeit from a low starting point, while some more traditional South American jurisdictions are getting worse. Now I am not saying Bolivia is the best jurisdiction in the world but from what I can gather it might be one of the easier places to actually push projects forward. It kinda makes me think about parts of Africa which typically are seen as bad jurisdictions but where a company can actually monetize a deposit (get to build a mine).

Anyway, Cartier Silver has hit the ground running and is already set to drill test their first target in Bolivia. I think this says something about both the team’s ability to execute in Bolivia as well as how easy it can be to get at least some things done in Bolivia…

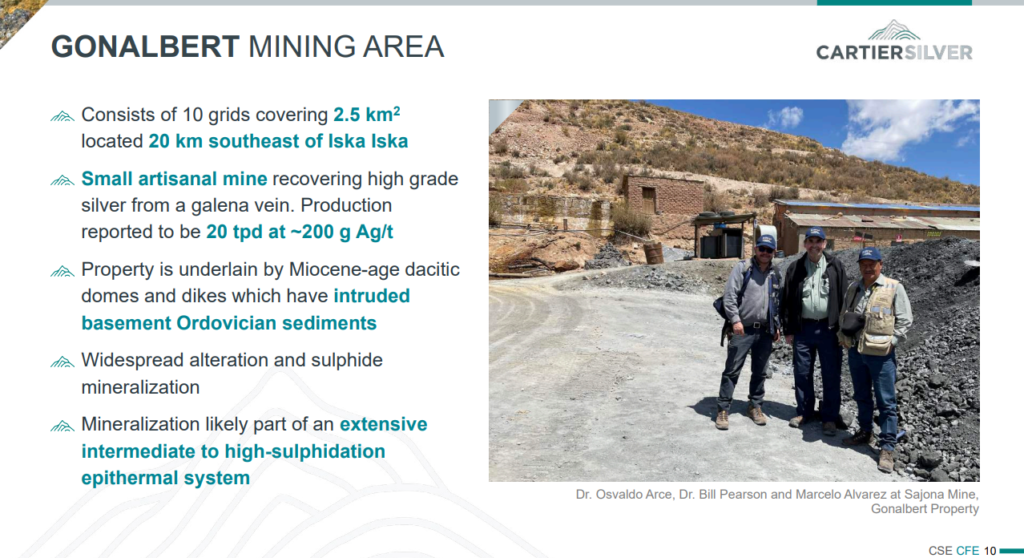

Gonalbert

The Gonalbert target, which is part of the Chorillos project, is first in que to be tested in Bolivia. The area is already confirmed to host mineralization as small artisinal mining has been recovering high-grade silver from a galena vein:

Cartier’s primary goal however is not a vein deposit but a large disseminated deposit similar to Iska Iska:

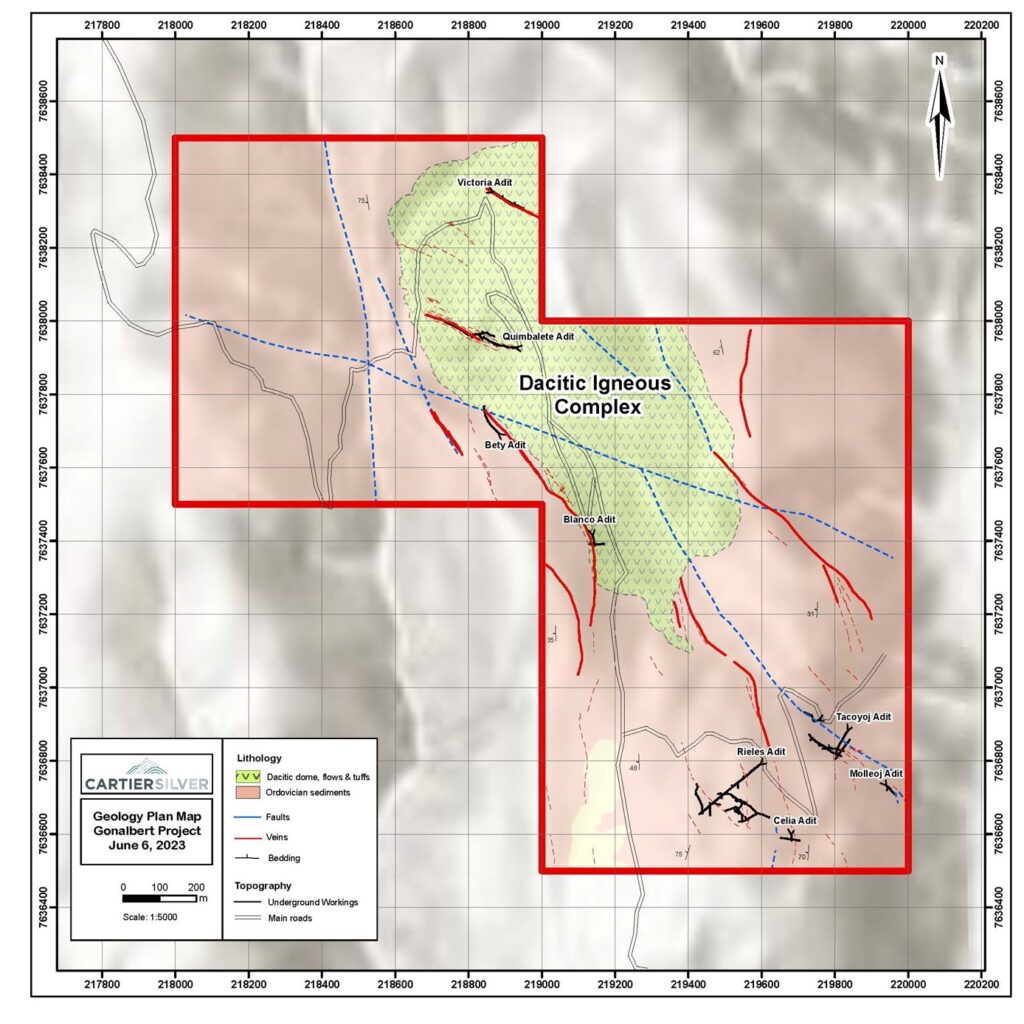

This geological plan map of Gonalbert sure makes me think of Iska Iska in the early days:

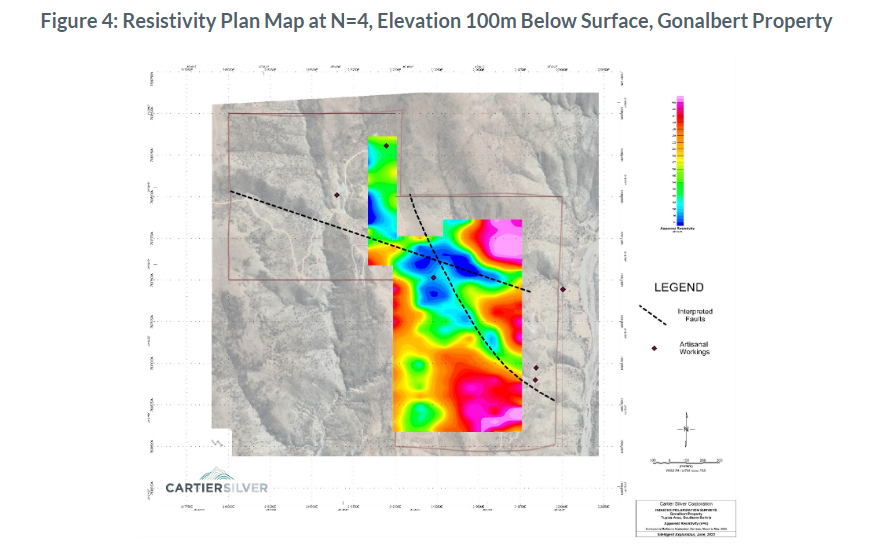

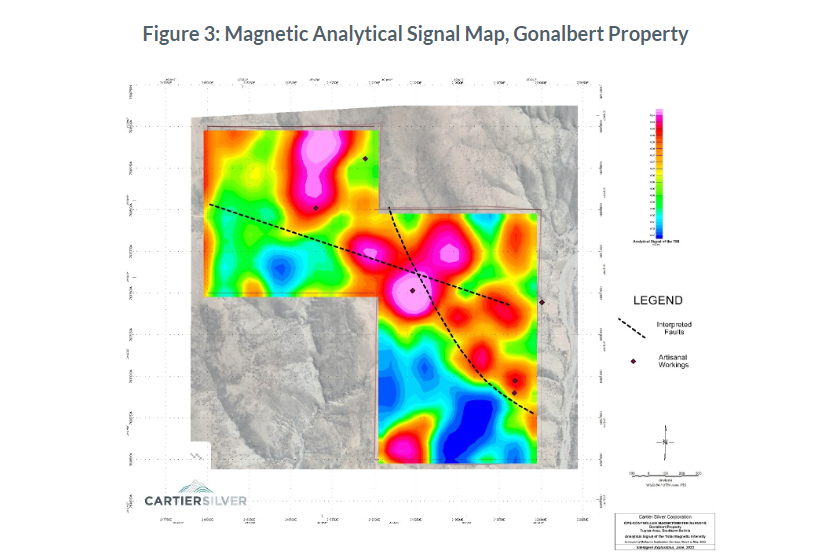

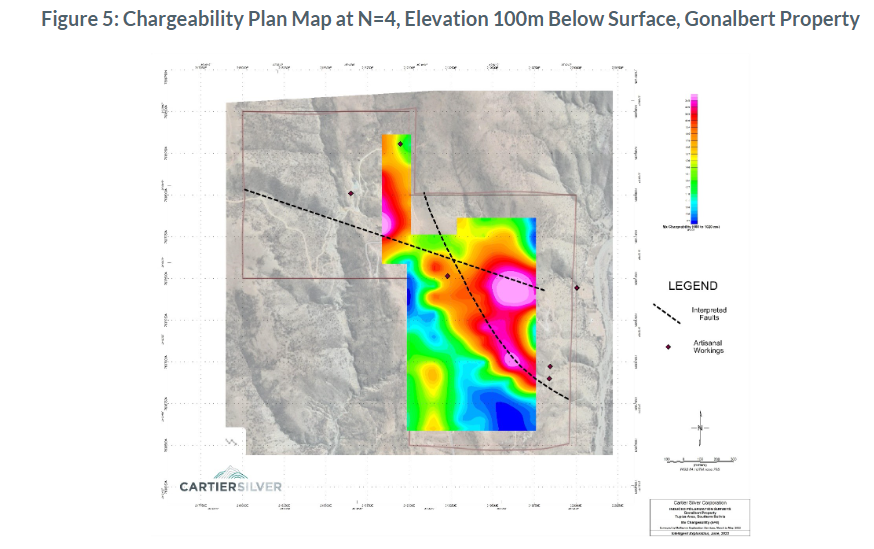

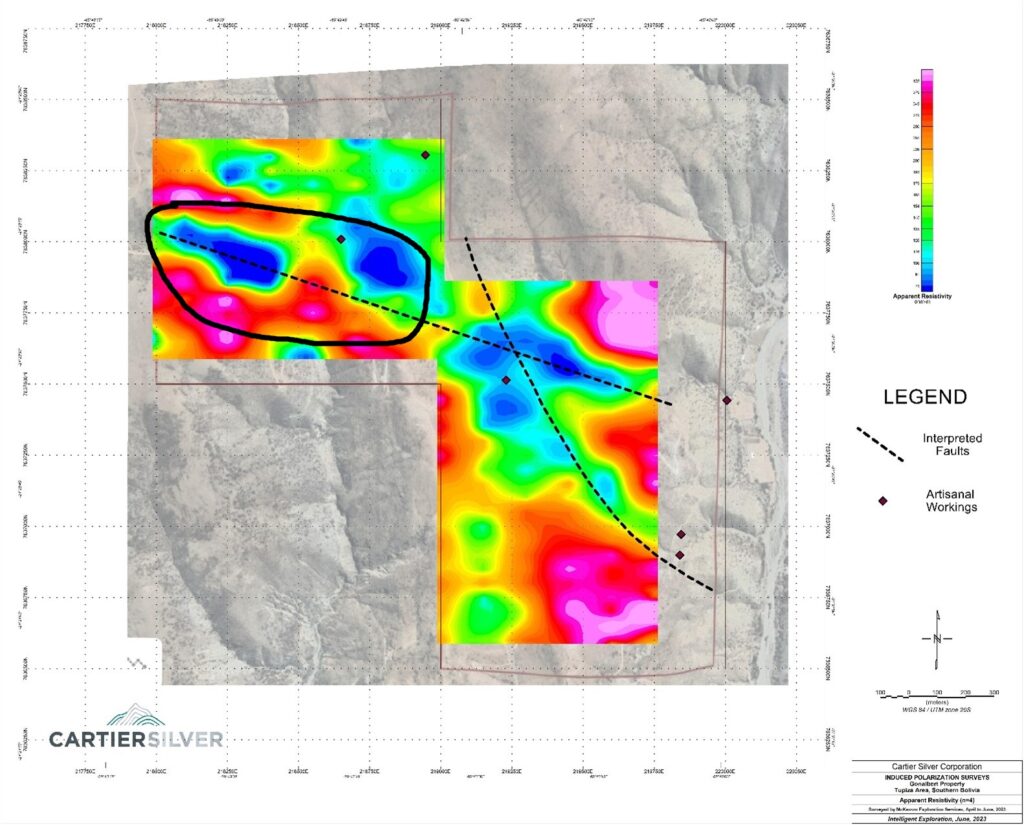

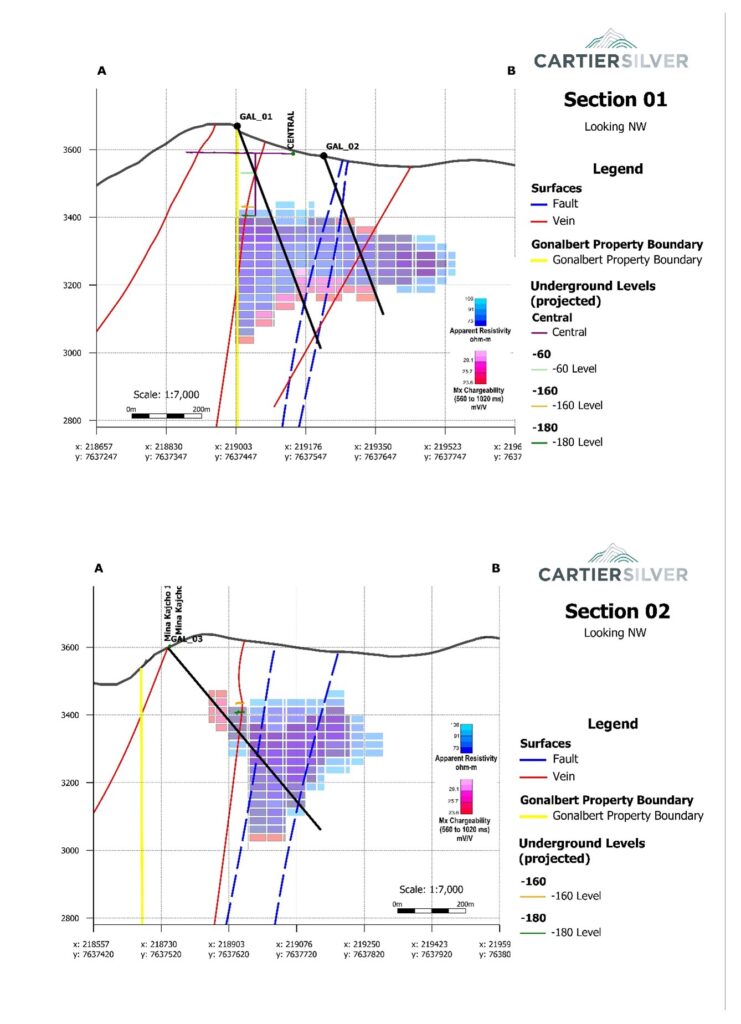

Magnetics, resistivity and chargeability surveys suggest that there might indeed be a large mineralized system located near the intersection of two faults:

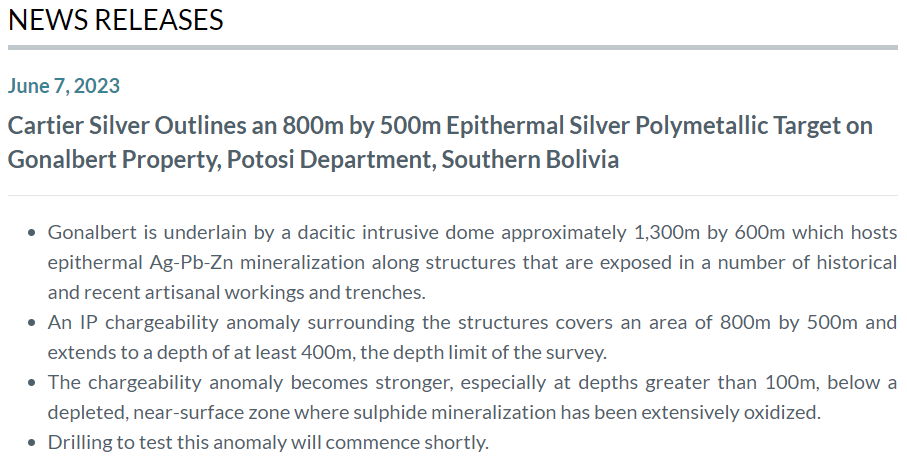

Added context from the June 7 news release:

“Magnetic and Induced Polarization survey data provide the first exploration information to a depth of approximately four hundred meters below where mineralization has been known since colonial times. Previous exploration was limited to surface trenches and artisanal workings. The magnetic map for the property shows that magnetic susceptibility is enhanced near a pair of northwest and north-northwest trending faults that intersect where artisanal mining has occurred for silver, lead and zinc. This close association of the magnetic mineralization with the intersecting faults is defined more clearly on the Analytical Signal (ASIG) map (Figure 3). Micon’s report refers to pyrrhotite in association with the “argentite, galena and zincblende” mineralization so these early results suggest that the magnetic survey may be able to detect the fault-controlled sulphide mineralization directly.”

“An IP chargeability anomaly surrounding the structures covers an area of 800m by 500m and extends to a depth of at least 400m, the depth limit of the survey. Chargeable mineralization coincides with the enhanced conductivity along both fault traces as shown in Figure 5. The chargeability becomes stronger at depths greater than 100m, below a depleted, near-surface zone where sulphide mineralization has been extensively oxidized.”

In summary

Gonalbert appears to host a large dacitic intrusive dome, with a preliminary target measuring 800 m by 500m, based on geophysics and geological work. Given that Gonalbert is not too far off from Iska Iska I for one believe the overall context is making this a large, compelling target. Just like at Iska Iska, the uppermost part of this bulk target, is probably oxidized and relatively barren.

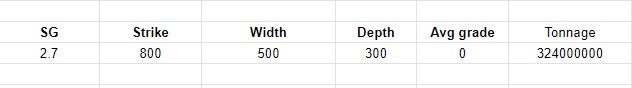

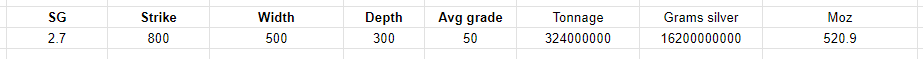

If we do a crude calculation based 800 x 500 x 300 m3, where I use 300 m as the vertical extension (I am subtracting 100 m of potential due to the oxidized cap and limit the depth at the survey limit), the theoretical target becomes impressive:

That footprint would equate to around 324 Mt.

Iska Iska’s “High Grade Zone” runs around >90 gpt AgEq, and if we play with some numbers for Gonalbert and use say a 50 gpt AuEq grade coupled with a 324 Mt target, then the theoretical endowment would be:

Note that all of these crude calculations are extremely speculative and forward looking. Still it makes sense to have some sort of what scale a target might be. Of course given the highly competent team in place I highly doubt they would bother with Gonalbert if they did not see significant potential. Also, they obviously have a lot of “know how” from working at Iska Iska in terms of how to identify polymetallic epithermal deposits in this region.

UPDATE

I had already begun to write this article when we recently got the news release on June 29 titled:

“Cartier Silver Announces Commencement of Diamond Drilling on the Gonalbert Property, Potosi Department, Southern Bolivia”

Initial 5-hole diamond drill program totalling 3,300m will test geophysical and geological targets for epithermal polymetallic Ag-Pb-Zn mineralization in the general vicinity of the artisanal silver mine.

Additional IP/Res surveys in the NW part of the property have added more than a kilometre of additional strike length to the potential mineralized zone.

Tom Larsen, CEO of Cartier Silver, commented: “We are very excited to begin drill testing this promising epithermal polymetallic mineralization target. Initial previously reported geophysical and geological work (see Cartier press release dated June 7, 2023) outlined a target area that is 800m by 500m and extends to a depth of at least 400m, the depth limit of the survey. Additional geophysical work has now extended this target zone a further one kilometre to the northwest. Significantly, the chargeability anomaly becomes stronger, especially at depths greater than 100m, below a depleted, near-surface zone where sulphide mineralization has been extensively oxidized.

… The big thing in this update is of course that the additional geophysical work has extended the target zone by a whopping 1 km:

(Black circle added by me which is supposed to represent the extension)

I would say that the potential prize was already impressive and this latest news release just jacked it up big time. I am not going to redo the theoretical tonnage calculations above but lets just say that the blue sky potential of course more than doubles when you more than double the potential strike length.

As per the news release drilling has already started and the first three holes seem to be going smack into the middle of the geophysical anomalies:

(Note that the depth limits of the surveys are about 400 m so we don’t know how deep the anomalies could actually go)

As always there are no guarantees that any maiden drill campaign will lead to a discovery. It is actually a rare thing to make a new discovery. But in this case I would say the context (artisinal mines, the team’s experience from Iska Iska and the geophysics lining up) makes me think that Cartier has a relatively good shot at producing a discovery hole within the first three tries.

Closing Thoughts

The only thing we know on any given time is the price we are paying for a company…

Today one pays C$33 M (at $0.88/share) for everything that Cartier Silver has. That includes C$8.8 worth of Eloro Resources shares (at $3.88/share) and some cash. Thus there is ~C$23 M left that is supposed to reflect the intrinsic value of the Canadian iron ore project, the gold/silver project in Canada, as well as all the potential in the Bolivian portfolio (which includes the Gonalbert target).

The success at Iska Iska does not only increase the validity of the Gonalbert target but I also think it increases the implied value due to potential synergies between the two. If we get evidence of not one but two very large polymetallic systems I think it would get any majors looking at this area even more interested. From that “positive spiral” leverage perspective it becomes even more interesting that Cartier owns a lot of shares of Eloro.

At the end of the day Cartier Silver is a cheap bet, backed by multiple assets, and run by people who knows the geology of Bolivia very well. If Eloro alone appreciates enough from here the entire market cap of Cartier might get covered. If any of the company’s assets, particularly the Bolivian ones succeed anytime soon, then Cartier could very well end up becoming a multi-bagger. With the maiden drill campaign on Gonalbert expected to start imminently there is potential for fire works in the not too distant future. With the share structure being incredibly tight, as is evidenced by the relatively low average volumes and high volatility, I think the stock has potential to really move if we are lucky.

Like always with high risk/high potential stories I am not betting the farm on any single one. Especially a pre-discovery play. But most pre-discovery plays don’t have ~30% of the Market Cap backed up by shares in another company, multiple assets, nor the quality of people, or exploration targets. As such the downside risk at face value is perhaps not more than -50% versus the upside risk which is open ended. Personally I think Eloro Resources could easily double from the current share price and if that happens then Cartier’s shares of Eloro Resources would be worth around $17.6 M alone.

Cartier Silver is one of #20 (high risk/high reward) stocks that makes up the Gamblore Portfolio.

Amateur TA

I remember when Eloro broke out of a similar wedge a few years ago… Repeat run in Eloro 2.0? Maybe…

Note: I own shares of Cartier Silver and the company is a banner sponsor. Thus consider me biased. I am not a financial advisor and this is not investing advice. I am not a geologist or a mining engineer. Junior miners are risky. I do not share in your profits or losses. I cannot guarantee the accuracy of the information in this article. Assume I may buy or sell shares at any time.

Best regards,

THH