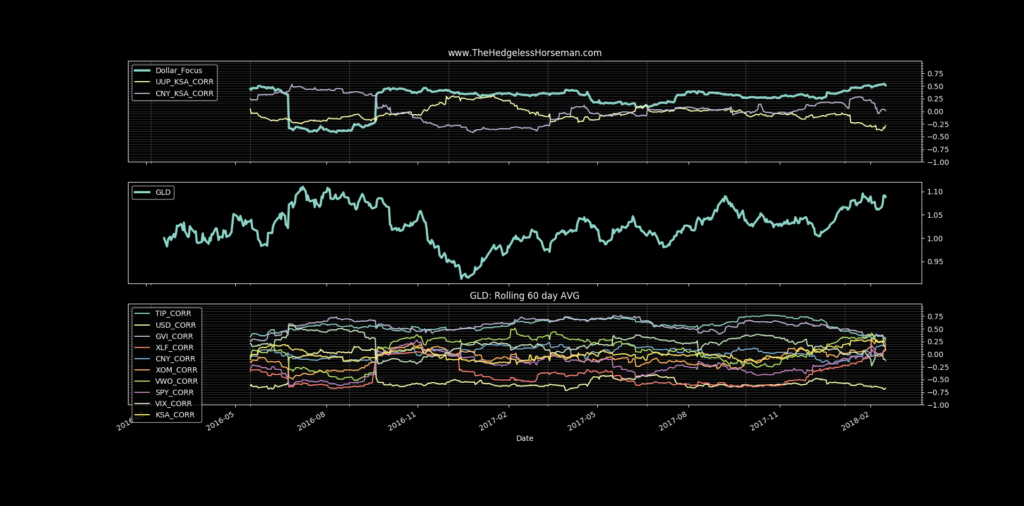

Gold: Rolling Correlations

- The US dollar still rules the day, which opens up for a correction in gold if we get that bounce in the dollar.

- Negative correlation to VIX is still somewhat high.

- Overall, most of the correlations that have at some points been pretty strong (both negative and positive) are still chopping around near the zero line.

- Gold is for the first time more positively correlated with VWO (Emerging markets) than with either TIP (Real rates) or GVI (Bonds).

- It really looks like gold in US dollar terms is currently trading more as a direct currency (anti dollar hard money) than it has for a long time (at least 2 years+).

- Not really following inflation expectations (TIP).

- Not really following bond yields. (GVI).

Some more things to note: https://twitter.com/Comm_Invest/status/965747076201156608

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Don’t forget to sign up for my Newsletter (top right on front page) in order to get notification when a new post is up!