First Nordic Metals (FNM.V) – Condensed Investment Case

Since I might have gone a bit overboard with my 70+ page long manifesto on First Nordic Metals I finally did what many asked me to do… Write a much more condensed case. Well I have tried and here goes.

(Note that is not investing advice! It is also my largest gold junior holding, and I have added shares up to $0.58, so consider me naturally biased and do your own due diligence. I share neither your losses or returns.)

For C$130 M you get…

The Barsele Gold Deposit (FNM 45%/Agnico Eagle 55% – Operator, Free Carrying)

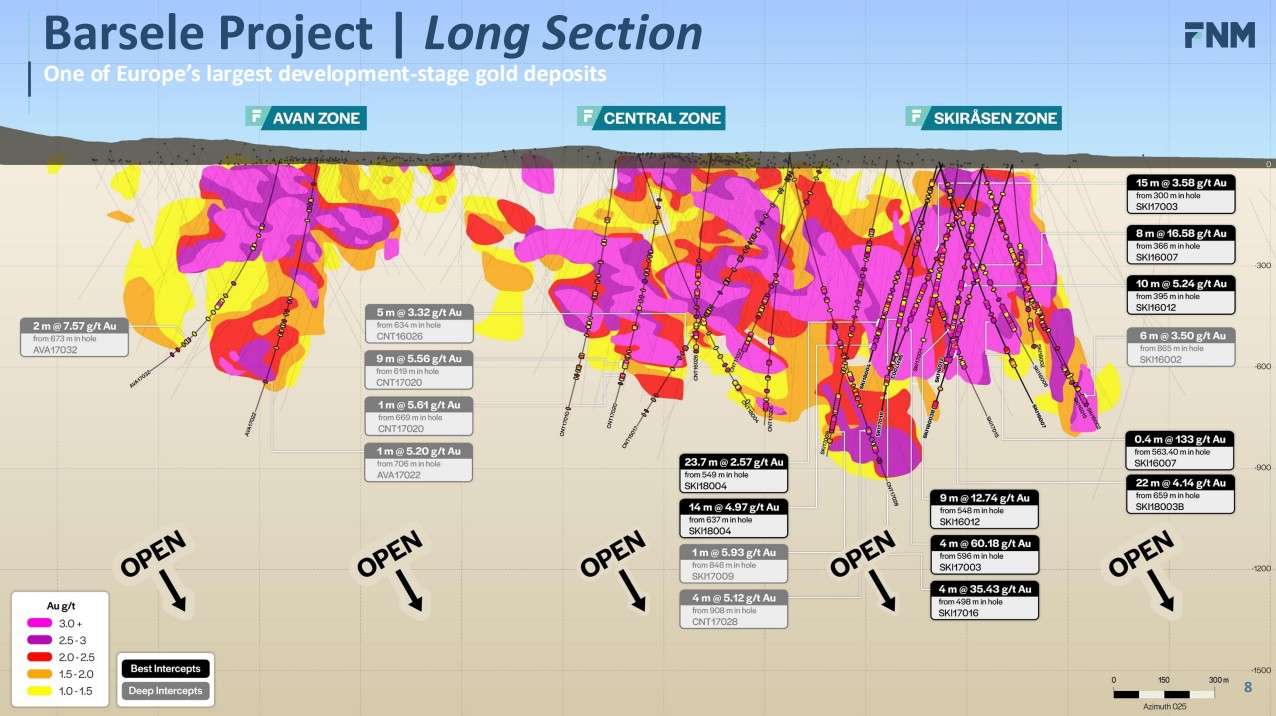

- 2.4 Moz in resources assuming a gold price of $1,300/oz according to the 2019 MRE (Already at 3 Moz today if one uses a $1,700 gold price instead)

- Young Davidson (Alamos Gold, $950 M transaction value in 2015 when in production) lookalike with potential for >5 Moz

- Second largest undeveloped gold deposit in the Nordics and the largest one in Sweden

- Mineralization starts at surface (And outcrops in Agnico’s Exploration Trench)

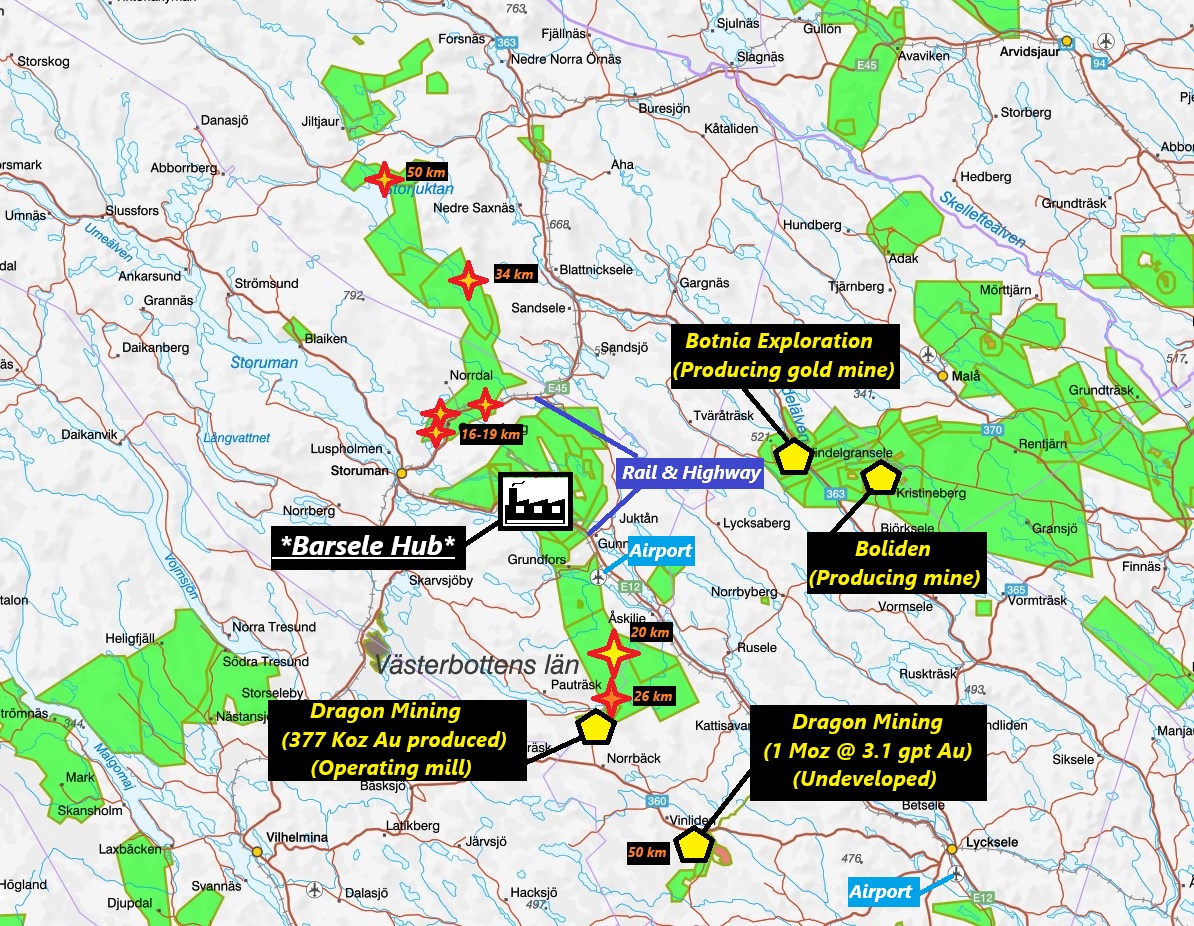

- Extremely Good Infrastructure

- Railway, Highway, smelters & city centers nearby

- Located in an Area of Sweden That Has The Lowest (Hydro) Power Costs in All of Europe

- Powerlines run through the project

- Pro Mining communities surrounds the project

- Several operating mines in the region and one new gold mine started last year

- Exceptionally De-Risked For a Project in a Tier 1 Jurisdiction (including from a permitting stand point)

- Processing Concession (“Mining permit”) in hand

- The deposit received a “National Economic Interest” designation by the Swedish Geological Survey (“SGU”) in 2021

- It is a recommendation that nothing should be done in the deposit area that would hinder a mine getting built

- 10 years of drilling (165,936 m), research- and preparatory work done by Agnico Eagle

- Metallurgical, Hydrological, archeological, and Flora/Fauna studies have already been done etc

- … On that note I seem to recall someone making a cheeky remark whilst on a site visit that “this is the most studied gold project in the Nordics”

- 10 years of community work done by Agnico Eagle

- The Current Government in Sweden is The Most Pro-Mining Government in Over 30 years

- The current government overruled a NON-pro mining municipality in northern Sweden to get a mine going (First time it has ever been done)

- Lower Cost (drilling, mining and labor) and Lower Tax Jurisdiction (20.6%) Compared to Most First World Countries

- The nearby “Björkdal” Underground Gold Mine is making money on 1.6 gpt and Barsele is significantly higher grade and has better metallurgy

- Said mine has been in production for decades so it is not “fresh”

- The nearby “Björkdal” Underground Gold Mine is making money on 1.6 gpt and Barsele is significantly higher grade and has better metallurgy

… The Margin of Safety in First Nordic comes from owning 45% (Free Carried by Agnico) of the above with a gold price of $3,000/oz.

If one considers how much time, money, energy and luck it would take to replicate all of this it kinda shows just how much sunk costs one is buying. If one started with a $10 M MCAP company today here it would take up to 10 years, countless financings (dilution events), getting someone of the calibre of Agnico Eagle to do all the work, while also needing the results to be as good as they have been (Actually finding a Tier 2 deposit which is rare).

Blue Sky Potential: Barsele at 5 Moz + A Gold Camp = Tier 1 Project Potential

- For starters the Barsele deposit could very well grow to 5 Moz or more since the avg resource depth is 550 m and these systems can go to 1-2 km+ depth

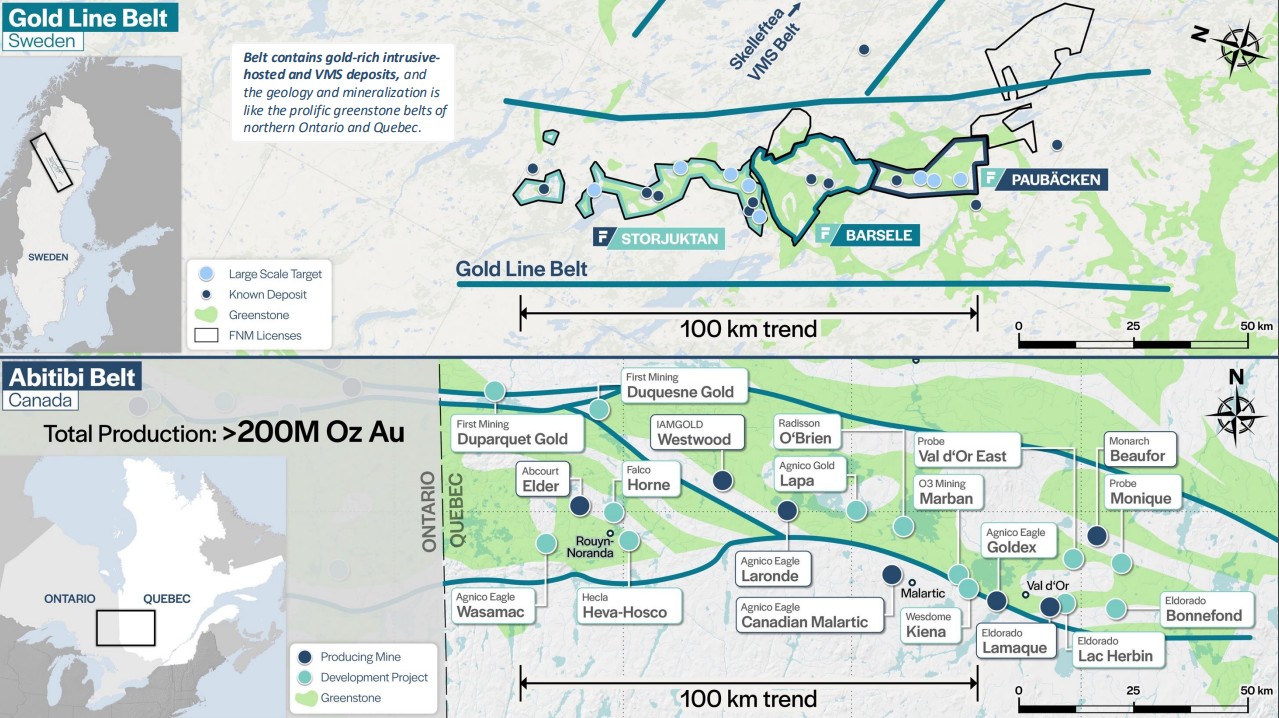

- +104,000 ha of mineral concessions along contiguous +100 km strike length across the Gold Line Greenstone Belt

- Several multi-kilometer soil anomalies already identified

- Global >10 Moz potential in my book just judging by the amount of, and scale of, targets (Tier 1 potential)

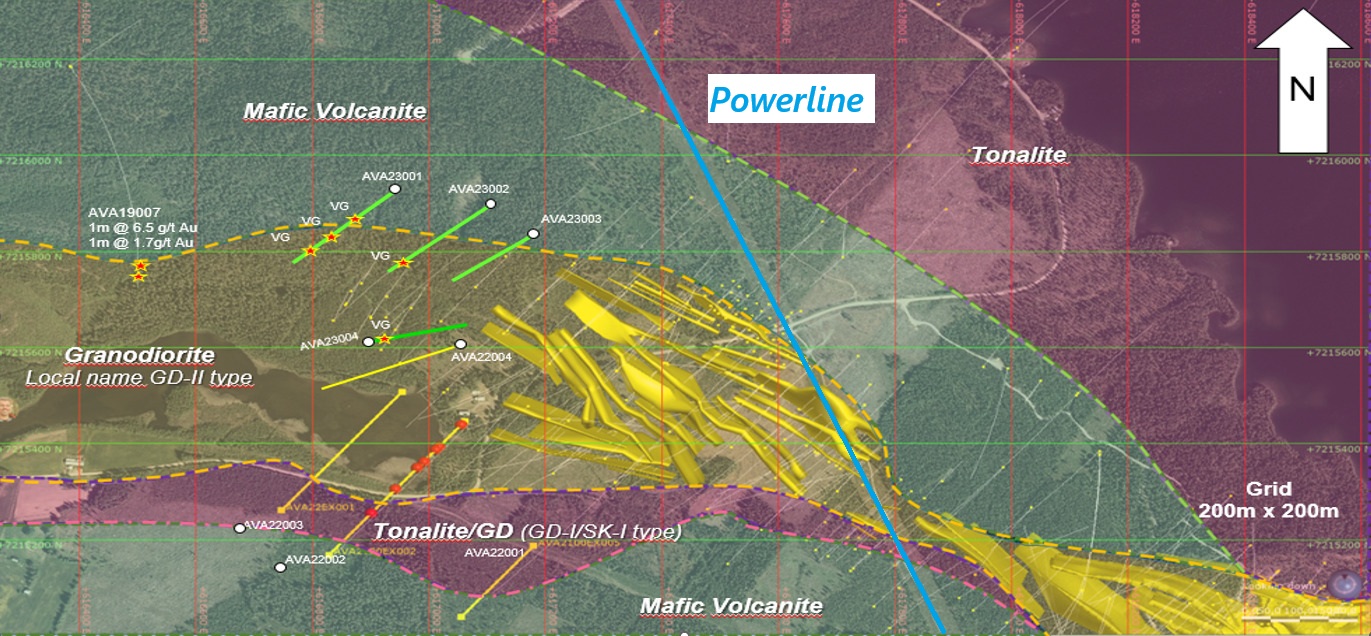

- One discovery “Aida” which produced a Barsele type discovery hole (22.5 m @ 2.40 gpt Au) from a “blind” drill campaign of only 6 holes.

- Currently being drilled in a 5,000-10,000 drill campaign

- Believed to be a 4 km long corridor of interest and up to 3 km of strike will be tested

- Potential to be a “game changer”

- All targets are within a few kilometers from roads and powerlines

- Exploration can be done year round

- Up to 30,000 m of drilling is planned across the belt in 2025 (And has already started at Aida)

… All this potential comes “risk free” if one believes, like I do, that the Barsele deposit is worth more than the current Market Cap already. If Barsele is the Bird (“Hub”) in the hand then there is potential for many Spokes to boot:

FNM’s Land Package With The Barsele Deposit and Known Targets/Deposits Marked (In blue and light blue):

A Possible Hub And Spoke Scenario:

(Red stars = Known, big targets)

…It is extremely rare for a Junior to have a continuous, 100 km long, land package in a Tier 1 jurisdiction with extremely good infrastructure. In some of the famous Greenstone belts of Canada there are many companies sharing 100 kms of strike. In the much more remote Greenstone belts of Canada there might be some cases of Junior with such land packages but of course a big reason for them being able to do so is because those areas are so remote (High cost and high thresholds for success). Thus I think it was a genius move when Gold Line Resources and Barsele Minerals merged to create this project package worthy of a major mining company. Personally I think FNM’s asset base is of interest to several Mid Tiers today and if they prove up a discovery or more I think Agnico and other Major Miners would be interested again. In that note Newmont was actually set to go on a site visit in 2021, assuming the predecessor company had been successful in buying the 55% from Agnico, and consolidating the project 100% (And this was when the predecessor company “only” had the Barsele project). Agnico’s 55% ownership of the Barsele project has been the blocker for any other company getting in and is also the reason why the Barsele project has been a sleeper in the last several years (Not much drilling = Boring).

Also note that the threshold for success should be seen as extremely low here as there have been gold deposits as small as 370 Koz, and even 30 Koz, that have recently become actual gold mines. Very much unlike many parts of Canada where one might need to find 3 Moz or more for it to actually be worth developing (and be worth any $). Lastly, if you already have a big deposit at Barsele where a future Mill would likely be located, then all other targets could be satellite deposits (“Spokes”) that feeds one already built Mill (“Hub”). This drastically changes the economics on any new discoveries.

Large Scale Targets

Yes, some of the targets are huge, with soil anomalies that are even larger than the one that led to the discovery of the Barsele deposit like the “Haprsund” and “Nippas” targets:

Btw, there are several more known targets than the two behemoths above and there is still 50% of the entire land package left to sample for even more targets. There is obviously potential for FNM to find one or more multimillion ounce gold deposits, and even VMS deposits actually, in addition to the multimillion ounce Barsele deposit.

Total Risk/Reward Picture

In FNM you get a combination of boxes checked that I have not been able to find in a single other gold junior;

- Tier 1 Jurisdiction

- Tier 2 Gold Deposit that could become Tier 1 (It’s wide open)

- De-risked by Agnico Eagle and designated to be of “National Interest” with pro mining communities etc etc

- Tier 1 Infrastructure and Power Costs

- Tier 1 Land Package With 100 km of strike on a Single Belt With Several Large Scale Targets

- = Tier 1 discovery potential and thus Tier 1 project potential

- 10 Years of Tier 1 Work by Agnico Eagle

… I don’t think I have ever seen a junior working in a Tier 1 jurisdiction where I could get a Tier 2 project on the cheap, while also getting legit Tier 1 exploration potential for “free”. Well at least I have not seen it in the last 9 years. Hence my unusually large investment in FNM (Which also makes me naturally biased). Most investors are still sleeping on this one in my opinion (I mean if this was in Canada I think it would be one of the hottest gold stories around) and I think most of the under-appreciation comes down to lack of knowledge of Sweden and because Barsele has been a sleeper project for the last several years. I have personally heard investors immediately disregard the case from the get-go because they believe a) Barsele/Sweden is not a good jurisdiction and/or b) that Barsele looks too low grade to be economic. Obviously it is my firm belief that both of these assumption are completely false given that Björkdal is making money at much lower grades (And is a smaller, decades old mine), Young Davidson makes a lot of money with slightly lower grades (And its even an old mine with higher costs if I had to guess), and that the resource included ounces that were believed to be economic at… $1,300 gold (Today’s gold price is a bit higher as many will know). And in terms of Sweden as a jurisdiction I think it has become dramatically better in recent years (Just look at how many mines our Vice Premier Minister is visiting lately and how she says Sweden needs more mines) and the Barsele project specifically is pretty much perfectly located (pro mining communities in addition to a pro mining government)… But hey that is what makes a market!

Ps. First Nordic Metals is expected to list on the Swedish First North Nasdaq Exchange next week and Swedes love to invest in mining companies… But only if they are listed in Sweden (The average mining jr in Sweden has more Swedish shareholders than Agnico Eagle) and preferably if their projects are in Sweden as well (Like any other country’s investors). The opportunity here is that while FNM is being punished for being in Sweden by NA investors… Swedish investors would put a premium on that fact for natural reasons. Might the single largest gold deposit in Sweden, and the only significant Swedish gold play overall really, attract some Swedes as they see headline after headline about “record gold prices”?

Judging by the “Account Holders” chart of Lundin Gold, which is the only substantial gold company listed on the Swedish exchange, I would argue that there seems to be some appetite for gold miners in Sweden:

(Avanza is one Swedish online broker and I used Google Translate on their Lundin Gold page)

There is potential for at least three Major Catalysts that I can readily see:

- One or more significant 100% owned discoveries from the 30,000 m (fully funded) drill campaign that started a few weeks ago

- A Swedish Listing which is expected to happen next week on March 21

- Consolidation of the Barsele project

… Of course it would could get really fun if all three were to happen. I have heard quite some people saying they are waiting for #3 to happen so they don’t risk being bored to death by Agnico. Ironically there is obviously potential for FNM to make their 100% owned Barsele type discoveries this year which would be anything but boring. Point #2 is the big wild card in my book. If that one plays out like I hope, preferable with the help of some other good news and a every retail’s dream (a chart that goes upwards), then I don’t know what might happen. I do know that the Swedish investors could very well put a premium on everything already in place and any additional value creation to boot.

I do not have a crystal ball but I am in FNM because I think there is a very good chance this valuation is unsustainably low and I believe that there is $1-$3 B potential for the company from the three points listed above. Obviously I think there is theoretically even higher blue sky potential but I don’t want to arm wave too much about the exploration potential. Also note that there will be dilution on the way to further success.

It can’t be stressed enough how good I think the Risk side of the equation is in First Nordic with Barsele underpinning it:

- Technical Risk: Low

- Jurisdictional Risk: Low

- Pro-mining municipalities: Yes

- Possibility of getting fully permitted for mining: Very Good

- Barsele designated to be of “National Economic Interest”

European Electricity Prices on March 16, 2025

(“SE2” where Barsele and the Gold Line belt is located is market with an Arrow)

Comparables

Founders Metals, C$546 M MCAP (4.2X the Market Cap of FNM)

- Currently owns 51% of the 20,000 ha Antino Gold Project in Suriname

- Pre-Resource but has made what appears to be impressive discoveries

- Talk of “10 Moz potential”

Rupert Resources, C$955 M MCAP (7.3X the Market Cap of FNM)

- 100% ownership of the Ikkari gold deposit (4.2 Moz of Resources including 3.5 Moz of Reserves) in Finland

- Large land package but smaller than FNM

- Other discoveries that look promising

… Would one personally rather own one Founders Metals or 4.2X First Nordic Metals portfolios? Or how about one Rupert portfolio or 7.3X 100 km belts plus 7.3X Barseles with 45% interest? Food for thought. I’m not saying either of the two other companies are expensive or “sells”. I’m just using them to show how cheap First Nordic Metals is.

********************************************************************************

Additional stuff that might be of interest…

Barsele Vs Other Underground Bulk Mines

Barsele’s Exceptional Infrastructure

Zoomed Out

Zoomed In

Zoomed in even further

Young Davidson vs Barsele – Long Sections

Young Davidson Long Section

Barsele Long Section

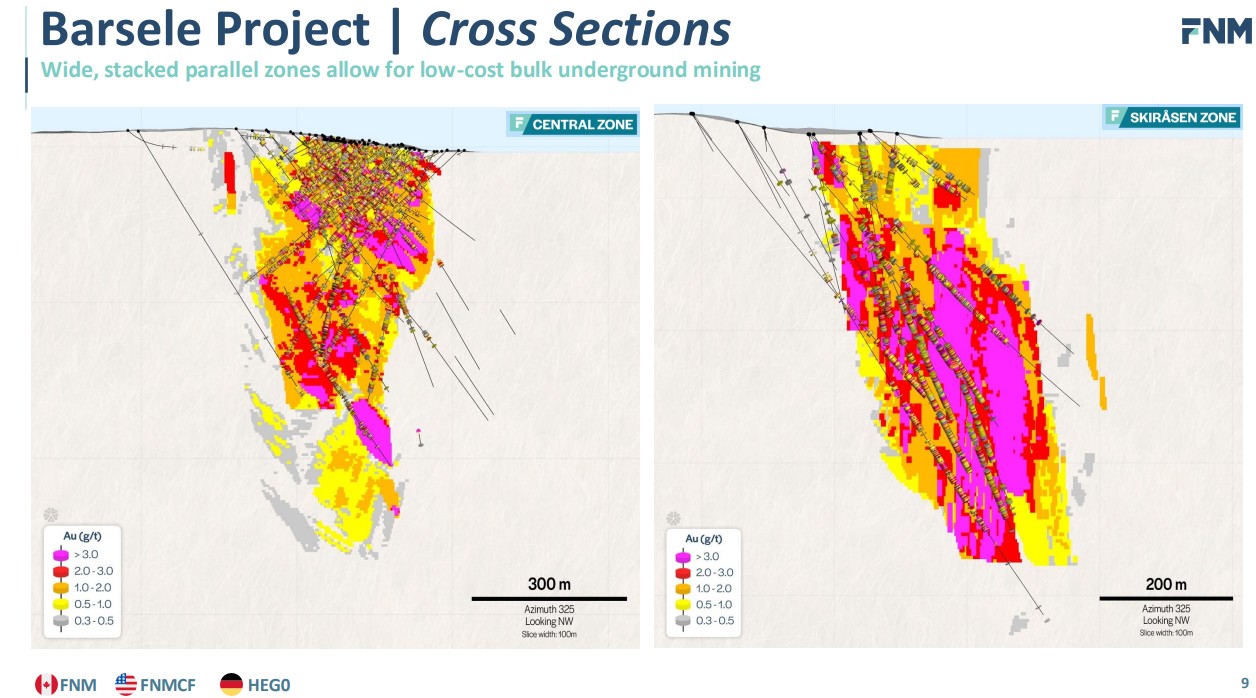

Young Davidsons vs Barsele – Cross Sections

Young Davidson Long Section

Barsele Long Section

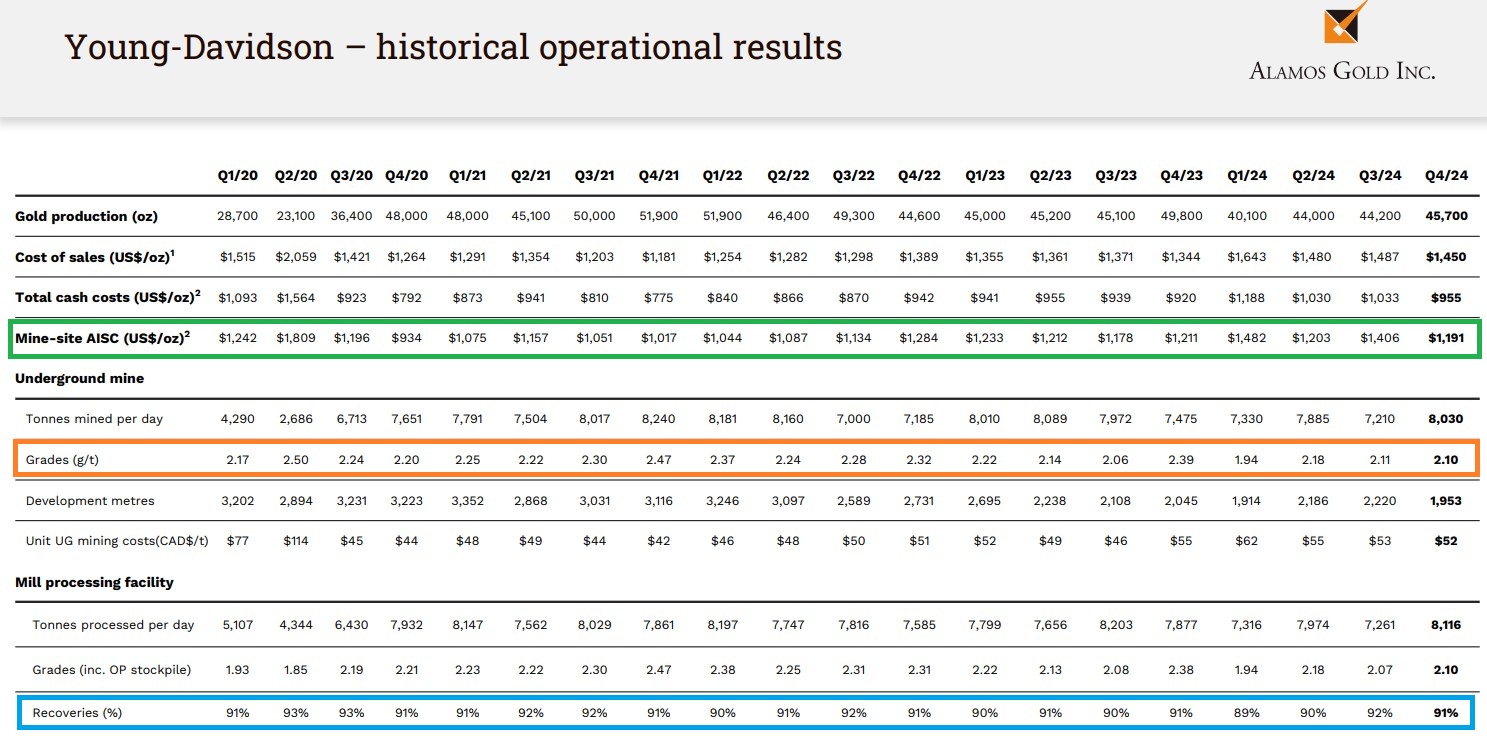

Young Davidson – Operating and Financial Metrics

Note: Not investing advice. I am biased. This is a risky investment. Never invest money you cannot afford to lose. I cannot guarantee the accuracy of the information in this article. Always do your own due diligence!!!