First Nordic Metals (FNM.V): Sweden’s Largest Gold Deposit, Agnico Eagle Backed, Huge Gold Targets & Funded For >30,000 m of Drilling in 2025

Dec 18, 2024

This article will discuss the opportunity that I see in First Nordic Metals. It has become my largest gold junior holding so consider me biased. There will be a lot of (my) subjective opinions, high-octane speculation and forward looking statements. I do not have a crystal ball. As always I am simply trying to guesstimate what is, what might be, and compare that to the Price I am paying today in order to get a sense of the Risk/Reward quality. I cannot guarantee the accuracy of the information in this article so, as always, do your own due diligence. Valuations and share prices of companies mentioned may vary due to the fact that it has taken me weeks to write this and meanwhile stock prices/valuations jump around. Most importantly never invest in anything just because someone else has. If you don’t personally understand, and see a (good) case in a company, do not invest. Assume that I may buy or sell shares at any time without notice. You need to know why you bought, why you are holding and/or why you are selling yourself Without internal conviction you will inevitably do what we all do when we do not know why we bought or hold something: Buy high, and sell low, as soon as some Price Volatility shows up (which happens a lot).

To fully appreciate the Risk/Reward of this story I believe one needs to understand Investing, Basic mining economics, Basic exploration/geology, Sweden as a mining jurisdiction and the Swedish capital markets, and to first and foremost be aware of, and be well read up, on the story. As I will go through all angles, all cumulative opportunities imbedded in the case that I can see, this will be an extensive article that has taken me around a month to put together. All in all I think First Nordic Metals offers one of the most unique, asymmetrical bets in the gold junior space that I have seen in the last 9 years. I hope you will find it interesting regardless if you share my conclusions and views…

(Given the length of the article I will simply start off by simply trying to summarize all the angles that I see in this case and then I will go into much more detail later.)

My Case in Short

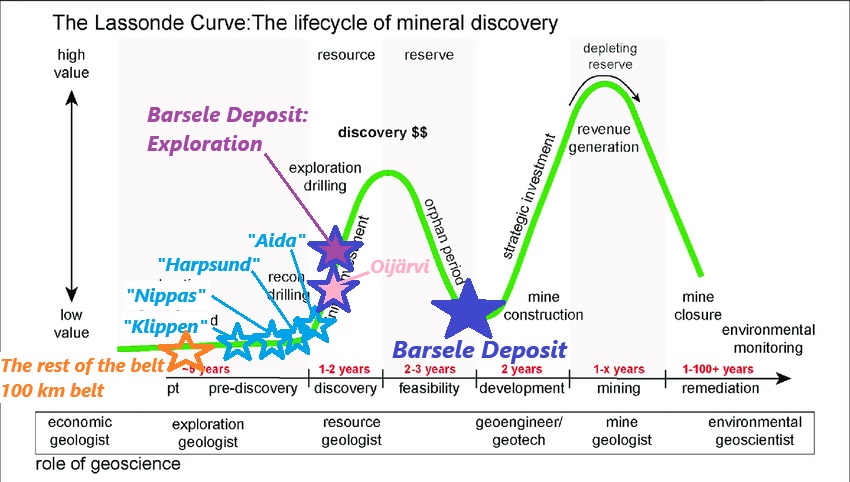

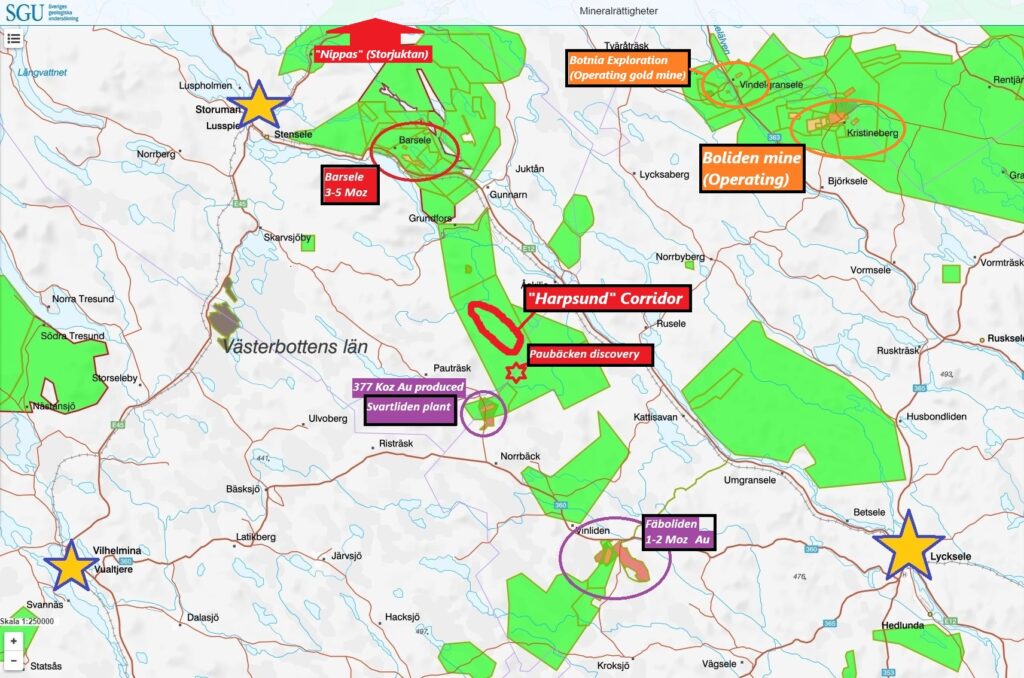

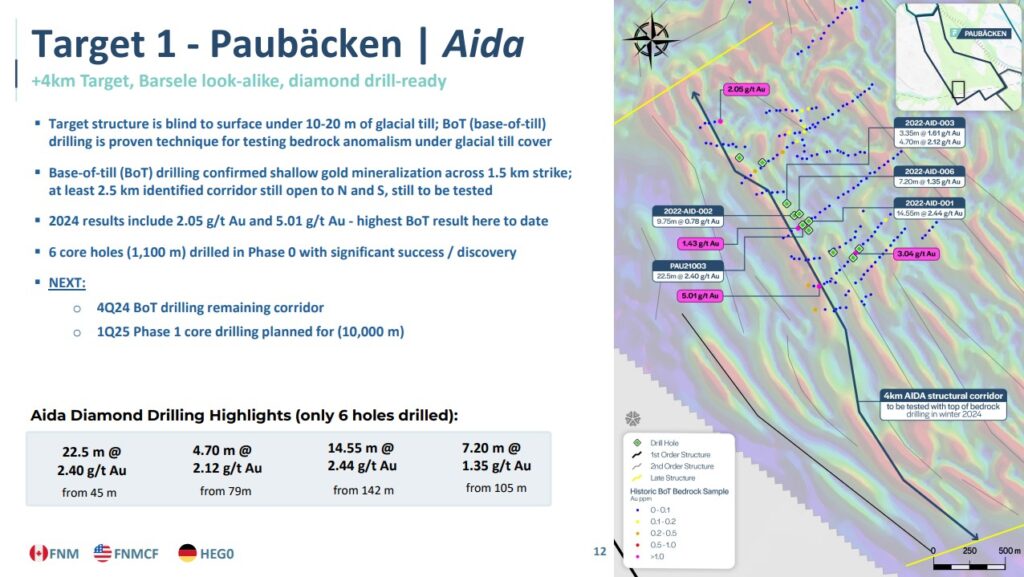

The current version of the Barsele gold project is worth many times the current MCAP of the company. As I will show later on I think the Barsele gold deposit will be a “Young Davidson” type of mine (Long lived and very profitable for Alamos Gold). This is the “margin of safety” that also translates to Probable Upside in my book thanks to the company’s share price not reflecting this value at all. If Barsele alone underpins multiples of the current MCAP, then by definition everything else is “free optionality” or “risk free upside”, from a valuation standpoint. On the optionality/upside front there are multiple, major factors. One is the Oijärvi project which is one of the best gold projects in Finland in my book. It has 300 Koz of AuEq resources from just 17,000 m of drilling and has only been drilled down to 215 m. This is a project that has been worked on and owned by Agnico for a very long time but is now 100% owned by First Nordic. I can see a spin out scenario, plus more drilling success, that would have that spin out reach a MCAP that is higher than the current MCAP of First Nordic. Then there are two very large soil anomalies in Sweden (“Harpsund” and “Nippas”) that have footprints that are actually larger than the soil anomaly at the Barsele deposit. Obviously I consider both to have multi-million ounce gold potential. Then there is the “Aida” discovery within the Paubäcken project which has delivered hits of 22.5 m @ 2.40 gpt and 14.55 @ 2.44 gpt from only 6 drill holes (1,100 m in total). Those grades and widths look very similar to the early holes out of what would become the Barsele discovery (29 m @ 2.1 gpt). On that note it was actually the Aida discovery that allegedly got Taj over the fence in terms of joining Gold Line (Now part of FNM) as the new CEO.

The Assets

- “Barsele” Gold Deposit (Sweden) – Currently 45% ownership

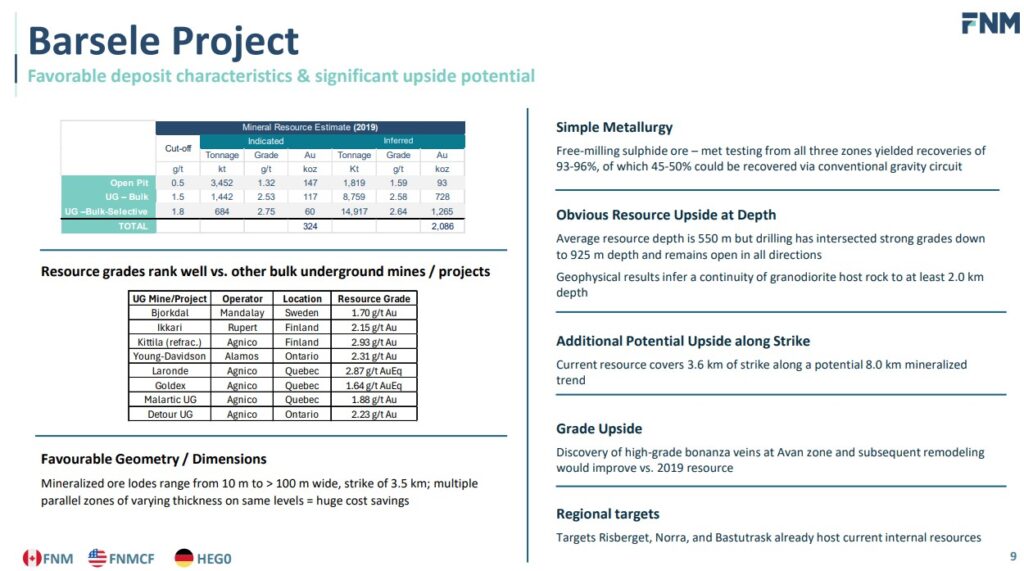

- 2.4 Moz resource based on a $1,300 gold price

- 3-5+ Moz potential (Resource would already be at 3 Moz if a $1,700 gold price was used in the 2019 study)

- Free Carried and Operated by Agnico Eagle ($60 B MCAP)

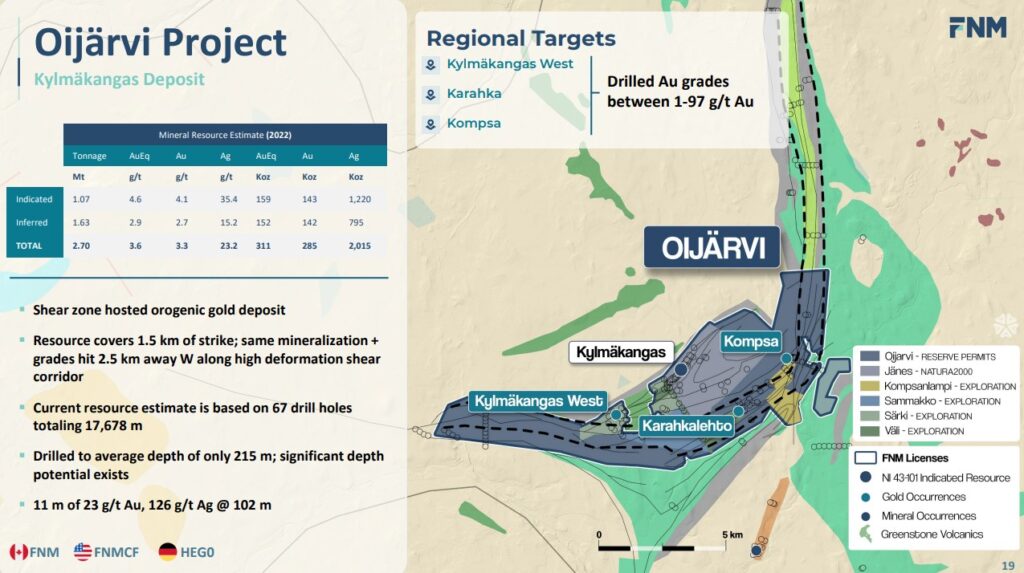

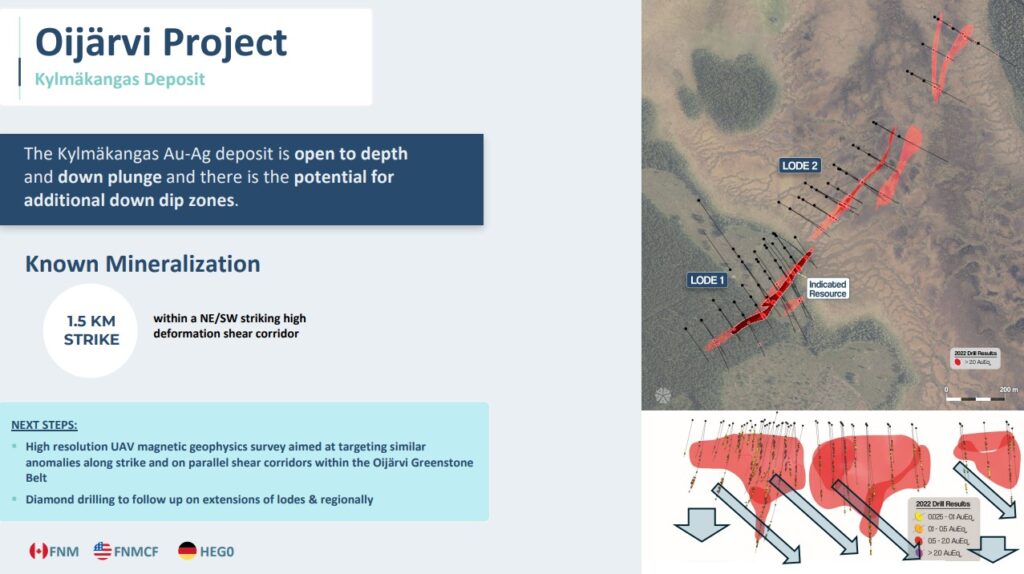

- “Oijärvi” gold belt (Finland)

- 300 Koz from just 17,000 m of drilling and wide open (100% owned)

- Spin Out/Monetization potential

- “Aida” discovery (Sweden) – 100% owned

- 22.5 m @ 2.4 gpt after just 6 holes (Barsele discovery hole was 29 m @ 2.1 gpt)

- 10,000 m drill campaign set planned to start in Q1, 2025

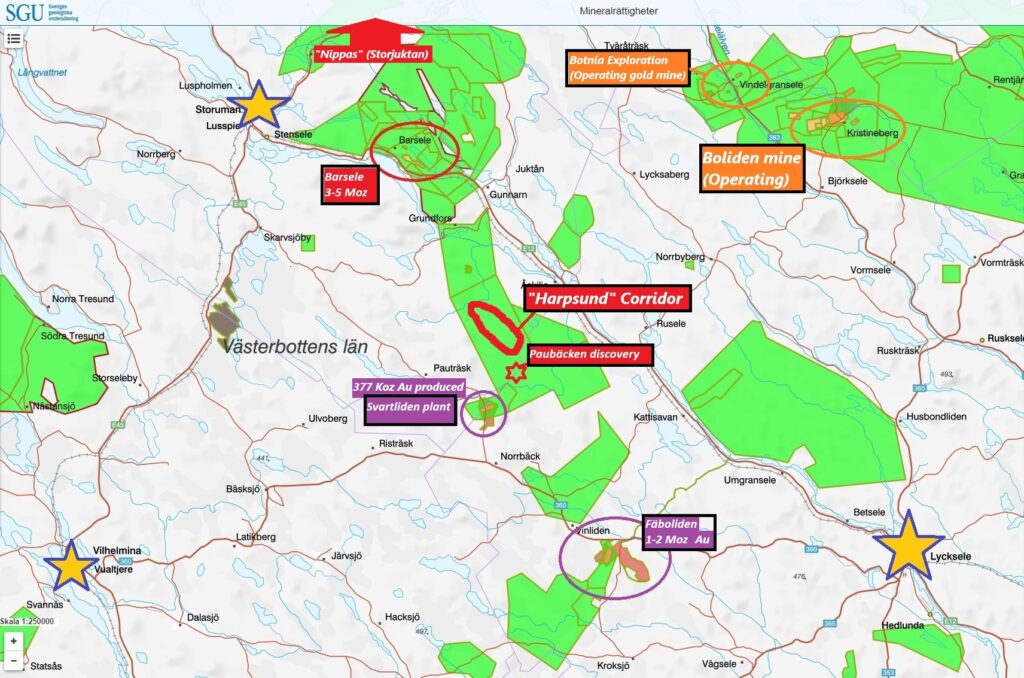

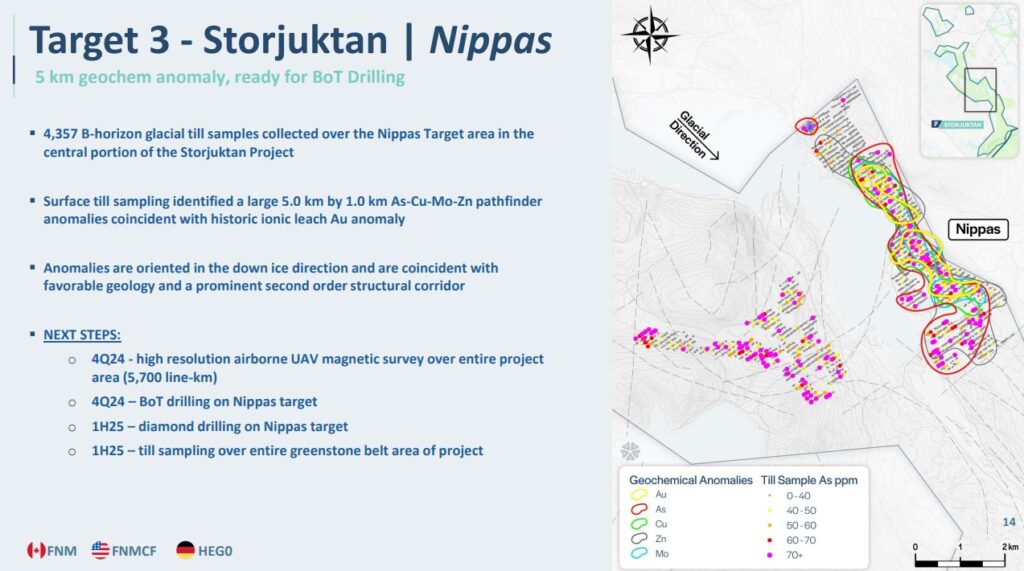

- “Nippas” target (Sweden) – 100% owned

- 5 x 1 km anomaly

- 5,000-10,000 m drill campaign planned H1, 2025

- “Harpsund” target (Sweden) – 100% owned

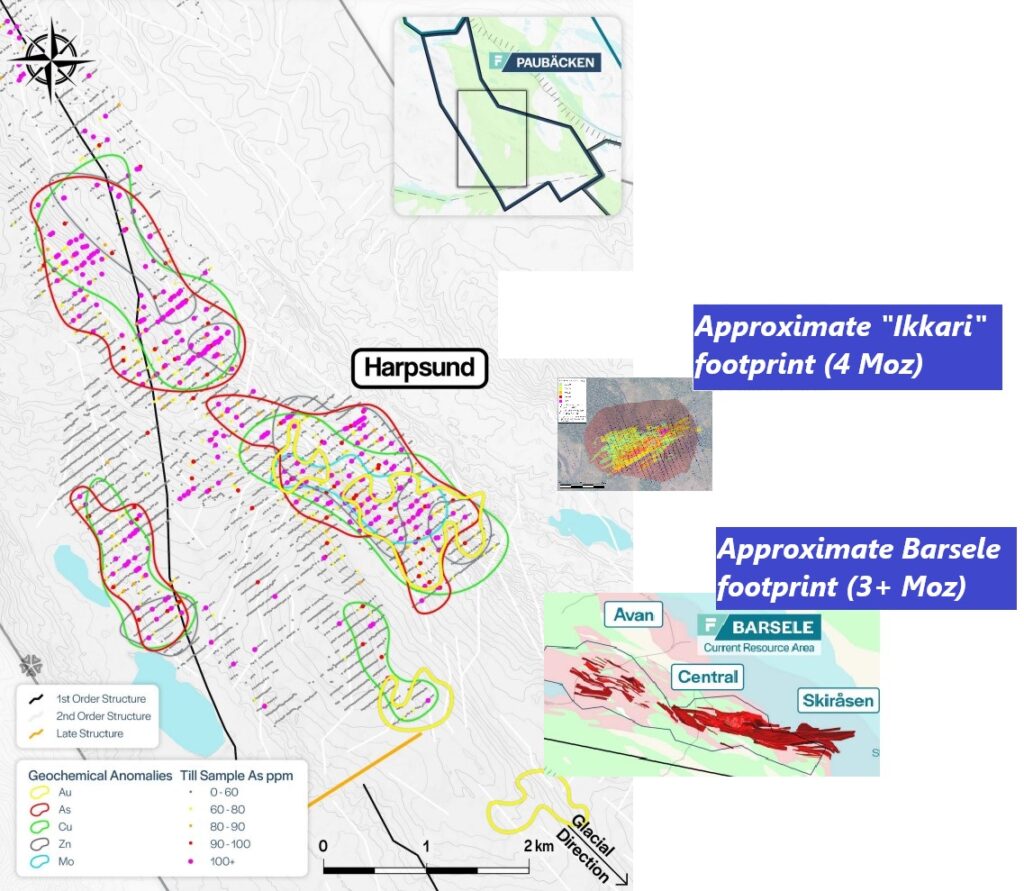

- 5.5 km long corridor

- 5,000-10,000 m drill campaign planned H1, 2025

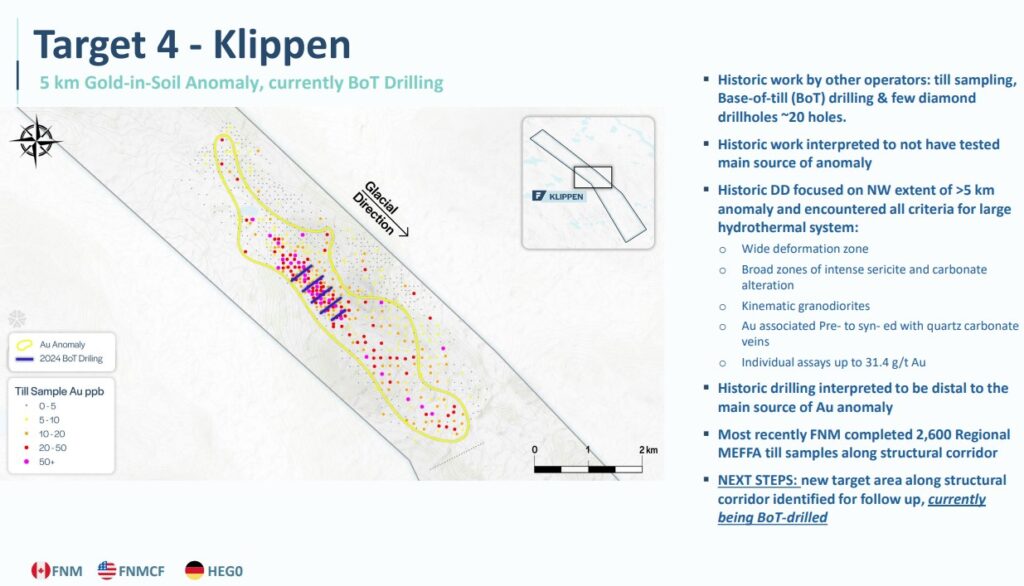

- “Klippen” target (Sweden) – 100% owned

- Drilling TBD

- Rest of the 104,000 Ha land package in Sweden

- District targets outside the “Kylmäkangas” deposit at “Oijärvi” (Finland)

The Price

- MCAP: ~C$92 M (at $0.35/share)

- Cash: ~$12 M

- Enterprise Value: ~$C80 M

I think First Nordic already has one of the best gold deposits in the world not 100% owned by a major mining company. First Nordic has some of the best exploration targets of any gold junior I am aware of. First Nordic’s flagship project has been drilled, studied and prepared by the best gold major in the world who still has a team working full time on it.

I personally do not know a single junior that is this undervalued, relative to its interest in what I would say is a Tier 2 (possibly Tier 1) mine, with as much free upside potential as First Nordic. This is basically the reason why First Nordic is my largest gold junior holding.

In my opinion the 45% interest in the Barsele deposit is worth multiples of the current Market Cap of the entire company. Therefore all the exploration potential in the Barsele deposit, the Barsele project, the rest of the enormous land package in Sweden which already includes the very large targets; “Aida”, “Harpsund”, “Nippas” & “Klippen”, as well as “Kylmäkangas” deposit and the “Oijärvi” project in Finland comes for free and therefore becomes “risk free” upside at face value…

And some parts of that free optionality across the 100% owned ground will be tested by up to 30,000-40,000 m of fully funded drilling in 2025. Oh and there are some absolutely massive targets that will be tested as you will see later on in the article. Then there might be upside surprises from a Swedish Listing and potentially a deal with Agnico Eagle on Barsele to jack up the excitement even further.

Suffice it to say I think First Nordic might go from being one of the most boring, high quality junior stories in the space between 2019-2023 to one of the most exciting highlights in 2025 and beyond:

Lets just say it makes perfect sense to me why the CEO just added 1,000,000 shares, for $330,000 at $0.33/share, in light of what I just described.

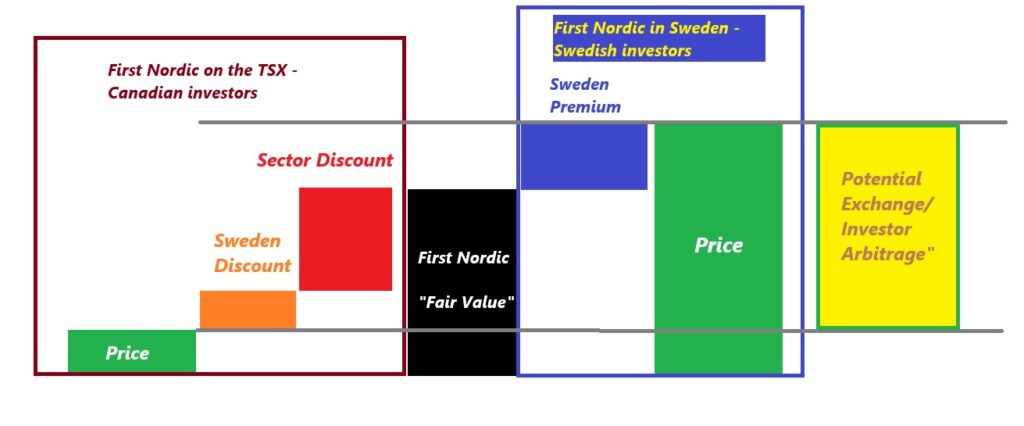

Not only are the fundamentals, Price vs Value, and most importantly Risk/Reward as good as I have maybe ever seen in a gold junior but as a shareholder of First Nordic Metals there is also an almost unique situation/catalyst that has nothing to do with fundamentals but which might have more impact on Price than any one catalyst…

And that is First Nordic Metals listing in Sweden. I will go through the potential impact of this at the end of the article. Lets just say that this might be THE big elephant in the room, which one could only really appreciate if you have knowledge/experience of how retail invest in Sweden. Well I do… So finally being Swedish has finally granted me an edge that no North American analyst or investor could use. I think First Nordic is in a unique position to potentially benefit from the mother of all “exchange arbitrages”…

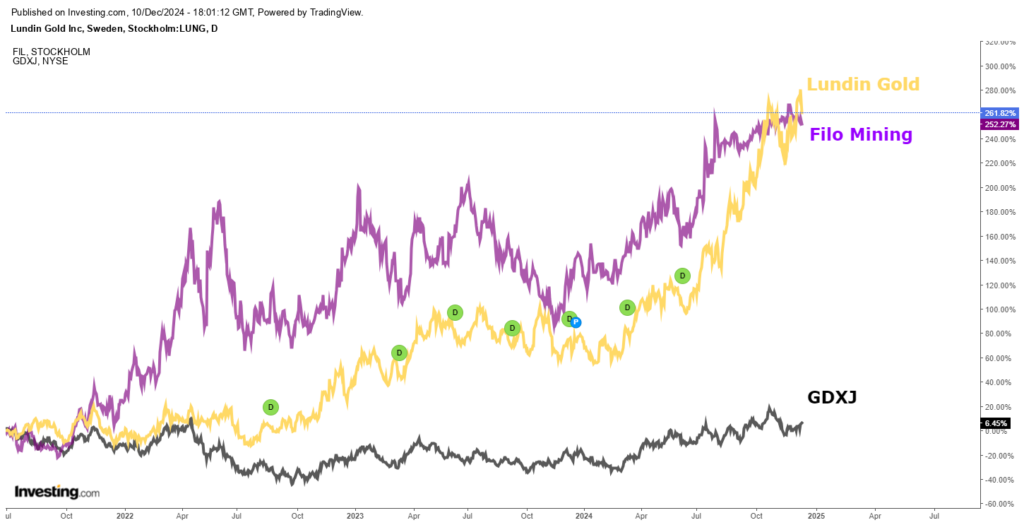

In Short: Swedes invest in stocks more than almost any other country on earth but the vast majority will only buy stocks listed in Sweden. Swedes also love to speculate in mining, and like everyone else on earth they prefer to invest in Swedish Projects, listed on the Swedish exchanges (And almost no Swedes buy anything in Canada). The thing is that there are almost no such companies to invest in. The only two actual gold miners that are listed in Sweden is Lundin Gold and Botnia Exploration. To give you an idea how big of a difference this can make: Newmont’s TSX ticker is held by #255 accounts with my Swedish online broker and the number for Barrick Gold is #448…

How many accounts hold Lundin Gold’s Swedish ticker just with my Swedish broker?… #16,006.

Hence I think one of the biggest Catalysts for First Nordic is not related to fundamentals but rather opening up Sweden’s largest gold project to its ideal target audience:

I’m pretty sure a lot of people will not even open this article simply because they see “Sweden” in the title (Their loss). Again, I will expand much more on this near the end of the article.

My Expectations/Plan

I bought in heavy because I think First Nordic in its current form should go up say >200%, just to start getting in line with its peers given the quality of the Barsele deposit, and that I cannot come up with any probable scenario which would make the value less than the current price. The Probable Return and Low Risk is the main factors for my investment size. If/when it gets listed in Sweden I think it has the potential to put a Premium instead of a Discount on all fundamental value, current, and future. If/when First Nordic would achieve 100% ownership of Barsele, list in Sweden, prove that Barsele is 5 Moz, while making one or more discoveries then I really think it could be trading for billions with the help of the Swedes. Lastly, I think Oijärvi has the potential to deliver significant value relative to the price I am paying today.

To me this is currently a HODL story where I think a very good return is a question of when. Not if. The assets are also such high quality that I think one could theoretically just hold it into a natural exit which would be an acquisition by a larger company. This is such a rare project portfolio that I believe there is a long list of mid tiers, and maybe majors depending on the exploration success, that would love to own First Nordic’s assets in Sweden.

With the above said I cannot rule out that I might need to start taking some profits say 100% higher from here, because while my expectations are 200%-1,000%+ with time, my position would already be so absurdly large that I would probably have a hard time sleeping. If I had a much smaller position I would probably not take profits until at least I see 200% returns or I find something cheaper.

This should be a >$300 M company today in my opinion.

My Base Case Scenarios

- Negative Returns: Low risk

- Probable Returns (6-12 months): 200%+

- Potential Returns (2-5 years): 1,000%-2,000%

- Natural Exit (M&A): Probable

… These are MY PERSONAL guesstimates and there are no guarantees of anything in life.

One of the latest, and in my opinion best, presentations by First Nordic Metals:

Start of The Detailed Overview

- TSXV ticker: FNM

- First Nordic Metals Website: LINK

- A Recent Webinar Recording (Very good): LINK

- Grizzle Commodity 1×1 Live Interview: LINK

- First video case on FNM: LINK

Setting The Scene

Gold miners have never made more money than they have been doing lately. This of course means that the gold business itself has never been more valuable. And that also means that undeveloped gold mines (ounces in the ground) have never been more valuable at face value. Yet, the pricing of gold assets is a far from being historically high. Especially the gold developers/advanced explorers that have projects that have a good chance of actually becoming Operating Gold Mines are extremely attractive to me right now (Especially if they are in tier 1 jurisdictions where I think I get to keep the value). The retail investor is nowhere to be seen and frankly almost nobody cares about this sector right now. This enormous dislocation between sentiment (Price) and the Value of a gold mine is of course the very definition of a Value Investing opportunity. The whole, simple idea is that one buys Stuff for less than it is worth and then at some point in the future one sells it when Price and Value have merged. Yet, this is of course not something most people stick to, even if they keep telling themselves that they are Value Investors. Like clockwork the whining and belly aching always ramps up as soon as the recent price trend is down. I seldom see anyone applauding a higher price to value gap. In fact, at the end of the day, the vast majority of people treat juniors like a random trading sardine such as Dogecoin, where short term Price direction is the only focus. And why wouldn’t they believe that? >90% of content on finance and mining twitter is focused on what direction the next short term price move is… “If everyone is focusing on that then it must be the most important thing of course”.

Anyway, I don’t buy/sell based on where I think Price will go in the short term. I don’t care much about macro at all except that I think real assets are historically undervalued in light of what is happening (record debt, difficulty to get mines permitted, electrification etc etc).

First Nordic Metals is in my opinion an almost uniquely good case from a Risk/Reward perspective. Risk/Reward is of course the trade off between risk taking and potential reward. Typically one would expect that the potential for high returns comes with a lot of risk etc. But that is, in my opinion, not necessarily the case. The simple reason for this is because a retail driven sector can take prices to such absurd levels that most of the risk has been overly discounted already.

“Give me free optionality and I’ll make you a millionaire” – Pierre Lassonde

The quote above has stuck with me and I try to remind myself of it all the time. The idea is that it is hard to lose if there is very low downside risk (“Margin of Safety”) that comes with “free” upside risk. “Free optionality” is what I think First Nordic has in spades and is a major reason why it is an unusually large position for me as well as for the HODL-folios.

Before we dig in lets consider what “Margin of Safety” really is. The way I view it is tangible value that is higher than what one is paying for it (The more tangible the better). Just because a junior mining company has ounces in the ground doesn’t necessarily mean it has tangible value. There are plenty of 1-2 Moz deposits in the world that will probably never become mines so in those cases the $/oz can theoretically be $1 and it would still not have margin of safety (and will trade up and down like trading sardines with the sector as long as they are around). Meanwhile a 1 Moz gold deposit that is producing with high margins might have a very tangible value of $400/oz for example.

Now lets look at the different investment factors…

The Margin of Safety is extremely good

- Tier 1 jurisdiction: Barsele, Sweden

- Sweden’s corporate tax rate: 20.6% (One of the lowest, if not the lowest corporate tax rate of all 1st world countries)

- Sweden ranks in the top #5 in the World on the “Rule of Law” index

- Extremely good infrastructure (Highway, Railway & Powerlines to project)

- Extremely low energy costs (Lowest in Europe, Hydro Power: “Green”)

- Sweden produces >60% of the world’s Underground Mining equipment

- Barsele gold deposit: Multimillion ounce, Agnico Eagle drilled/worked/studied deposit in hand

- The current resource was done in 2019 and used a gold price of only $1,300/oz

- In other words it only included rock that should still be economic at $1,300/oz (Today gold is >$2,700/oz)

- Using a $1,700 gold price the resource is already at 3 Moz.

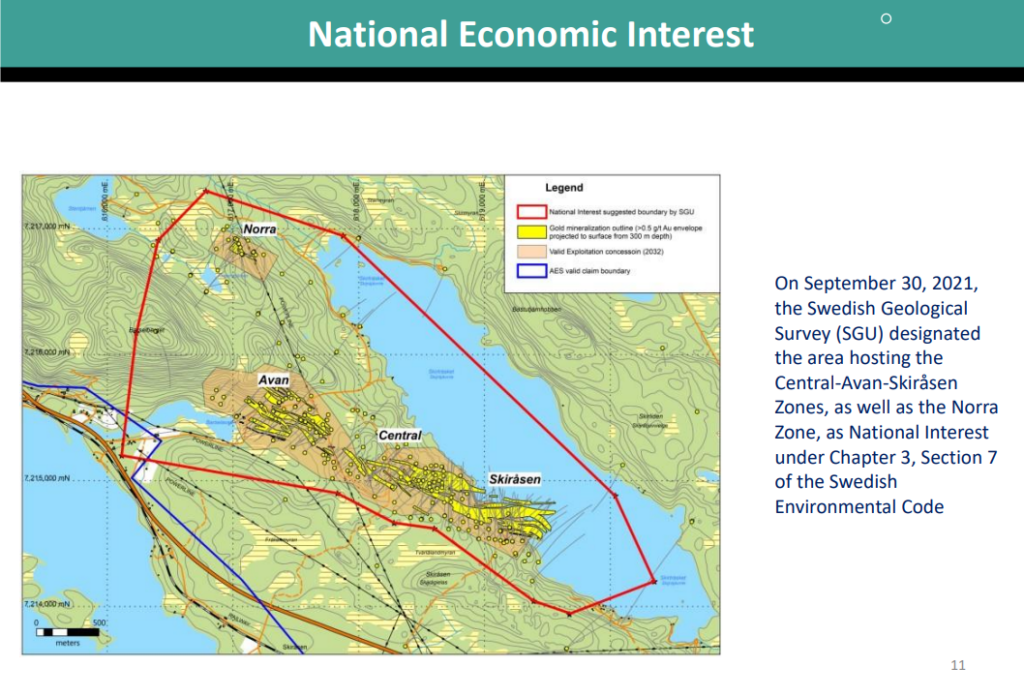

- Barsele has been designated to be of National Economic Interest to Sweden by The Swedish Geological Survey

- 9 years of Agnico Eagle quality preparation work

- Water sampling

- Flora/fauna studies

- Metallurgical studies

- Community engagement

- Etc etc

- Pro mining communities (Vilhemina, Storuman & Lycksele which surrounds Barsele)

- Company has ~$12 M in the treasury

The “free” exploration upside potential is extremely good

- 100 km land package with extremely good infrastructure in the “Gold Line” belt of Sweden

- The “Aida” discovery at Paubäcken

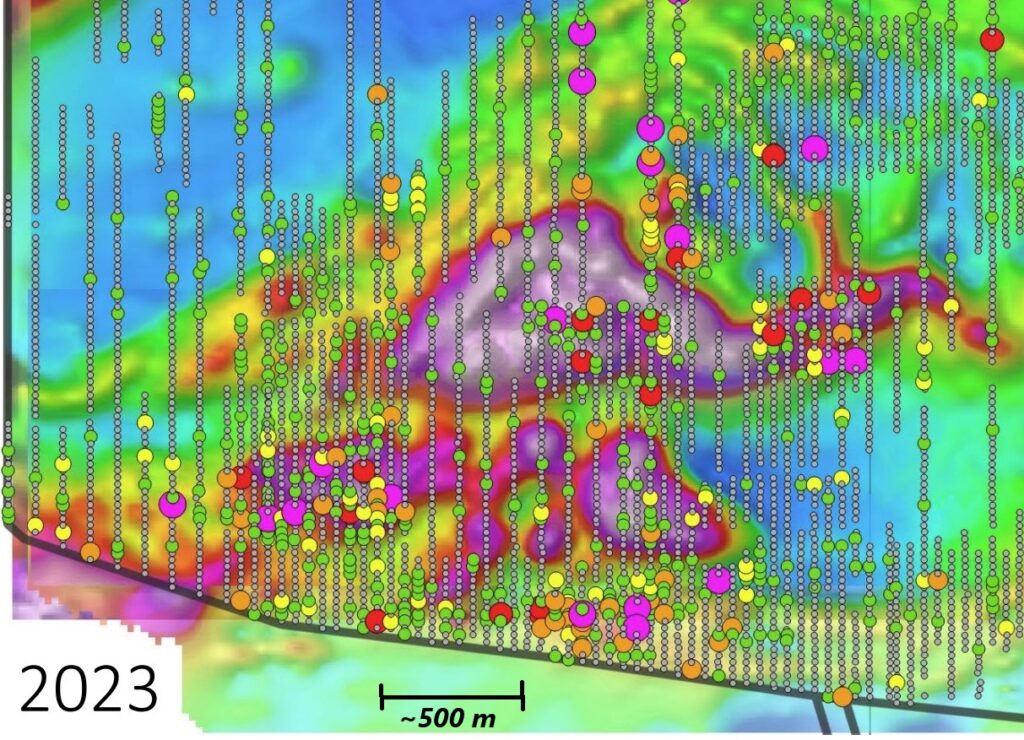

- Several multi-kilometer scale soil anomalies are already delineated at “Storjuktan” & “Paubäcken”

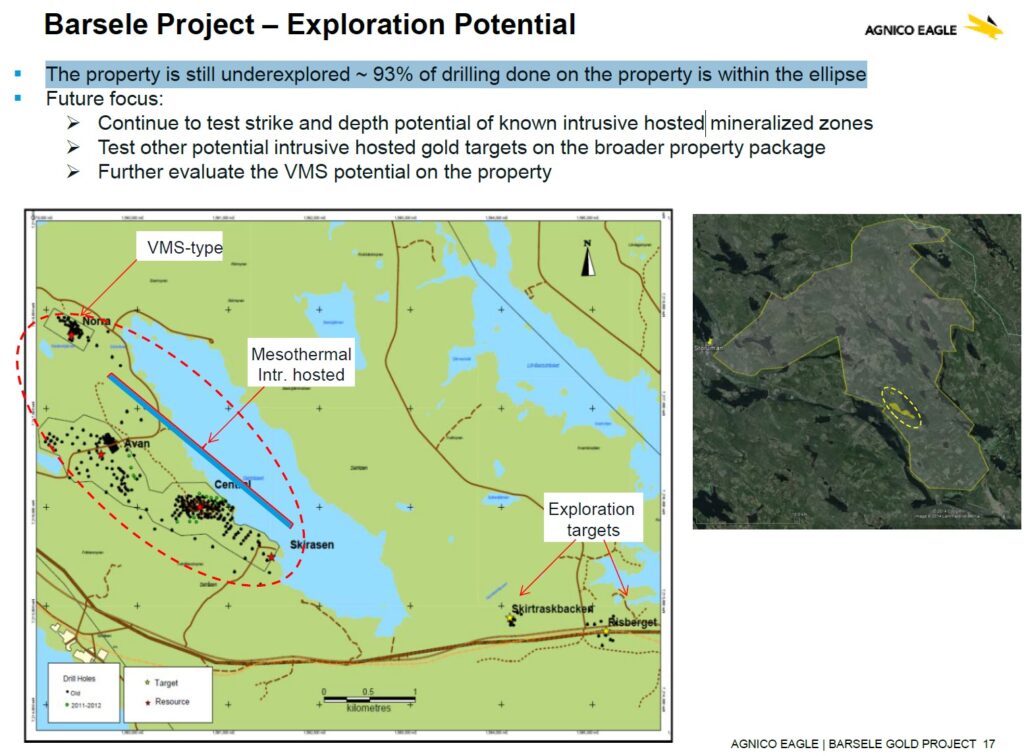

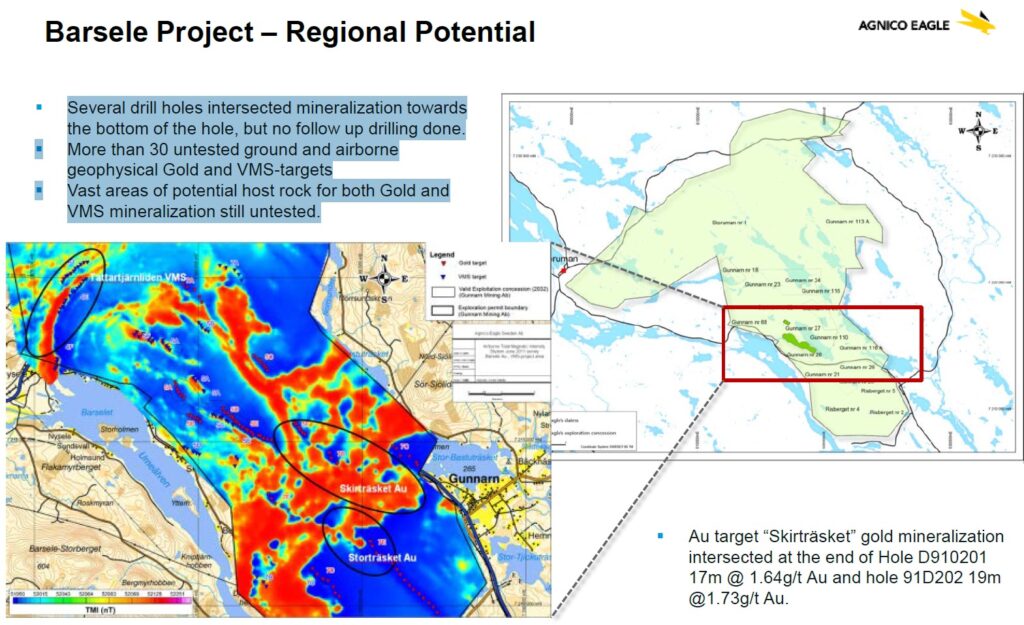

- 30 Agnico Eagle delineated orogenic gold and VMS targets within the “Barsele” project

- The “Klippen” target

- Any other targets which might materialize after an extensive soil sampling campaign across the beslt

The “free” bonus upside in Finland

- 300 Koz in an Agnico Eagle drilled resource from just 17,000 m of drilling

- Highest grade gold (Eq) deposit in Finland with 4.6 gpt AuEq Indicated grade

- The deposit is wide open and has only drilled down to an average depth of 215 m

- Strike length suggests at least 750 m depth potential (50% of strike)

- Rest of the 20,000 Ha belt to explore as well

Vote of Confidence

- Insider Ownership: 21% (Pre-financing)

- Agnico Eagle Ownership: 13.3% (Pre- Financing)

- Increased their stake few months ago

- CEO Taj Singh added 1,000,000 shares in the recent financing done at $0.33/share for $330,000

- CDO Adam Cegielski added 500,000 shares in the recent financing done at $0.33/share for $165,000

Usually you have to pick one…

Either you have a Jr with a good, mature project that is somewhat fairly valued (known) with subdued upside potential. Or you have potential for high upside but with considerable risk (Exploration company without a mineable deposit in hand). So pretty much every gold junior is either trying to find something worth mining or has something worth mininga already. The former is of course very risky and the latter is often somewhat fairly priced. When I happen to find a junior that already has something very worth mining yet is still remarkably mispriced, AND has some of the highest exploration potential around that comes for free, I go big.

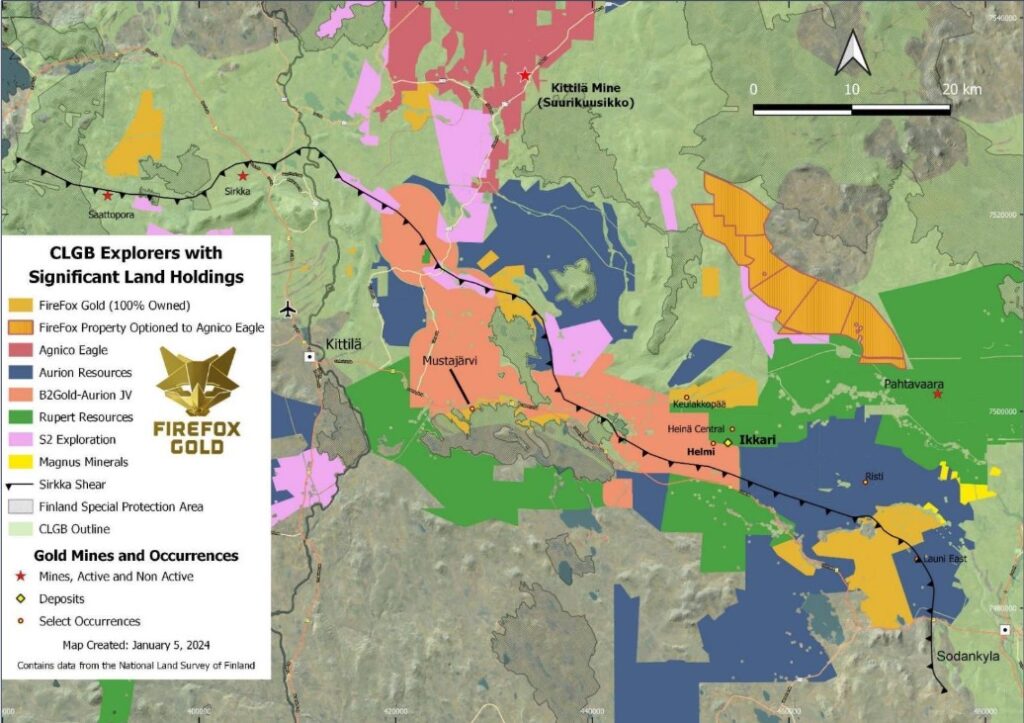

Rupert Resoures which has the 4.2 Moz Ikkari gold deposit in Finland has a MCAP of $940 M. I think Barsele will catch up, and surpass, that resource number in time. Just using Ikkari’s $1,700 gold price for the resource and Barsele is already at 3 Moz today and unlike Ikkari it is very much wide open still. And when it comes to exploration upside I would take First Nordic over Rupert because Rupert does not have a 100 km continuous land package with multi-kilometer anomalies that are even larger than Barsele’s. It makes absolutely no sense for First Nordic to trade below 10% of Rupert Resources… Would one rather own 10X First Nordic Metals, or one Rupert Resources, if one had $940 M to spend?

My bet is simply that a value discrepancy this large will not last. I am not saying that for example Rupert is overvalued. I am saying that I think First Nordic is unfathomably undervalued.

Other examples would be Canadian listed/focused juniors with MCAPs of $10-$40 M with early stage exploration projects (without resources). Any of them would be incredibly lucky to prove up a deposit like Barsele and it would take them many years and tens of millions of dollars to do it (Many placements). And they do not have 9+ years of prep work on the project done by the best gold major in the world. Nor do they typically have as large land packages, as good infrastructure, access to extremely cheap power, nor as many large bonus targets as First Nordic. Basically it would take them several placements, years and an incredible amount of lot of luck to catch up to First Nordic.

Expected & Possible Catalysts Next 1-12 Months

- Swedish Listing

- This can turn out to be a very big deal since there are almost no serious gold juniors listed and Swedes love to speculate in mining

- 30,000-40,000 m of drilling across 100% owned targets:

- “Aida” target

- “Harpsund” target

- “Nippas” target

- “Klippen” target

- BOT and Soil sample results from multiple projects and known targets

- I expect some known targets to grow and new targets to emerge

- If BoT hits it is de-risking the project / increasing the probability of drilling success

- Belt scale geophysics results

- Possible consolidation of the Barsele project

- If so, expect drilling at Barsele as well shortly after

- Possible monetization of the Oijärvi project

Chief Development Officer (CDO) Adam Cegielski touching on upcoming catalysts:

Blue Sky Scenario (Highly Speculative)

- First Nordic lists in Sweden and gets rightfully promoted as the “King of Gold” in Sweden

- Swedes have a history of speculating in Swedish listed mining companies (Some Swedish Jrs are absurdly over-valued today compared to TSXV)

- First Nordic does a deal with Agnico to get 100% ownership of the Barsele Project from Agnico.

- First Nordic proves that Barsele alone is a >5 Moz gold deposit

- First Nordic proves up at least one additional discovery at for example Aida, Nippas or Harpsund that pushes the realistic camp resource potential to 6-10+ Moz

- First Nordic show that one could have a production hub at Barsele with one or more satellite deposits to feed a larger mill

- Example: 170+ Koz/year from Barsele, 100 Koz/year from satellite deposit A, and 100 Koz/year from satellite deposit B = 370+ Koz/year

- This is assuming there are no additional Barsele sized deposits (or larger) discovered

- Example: 170+ Koz/year from Barsele, 100 Koz/year from satellite deposit A, and 100 Koz/year from satellite deposit B = 370+ Koz/year

- Oijärvi gets spun out

- Oijärvi proves to host 1+ Moz of high grade gold and gets a >$100 M MCAP for starters

If all the above happens in the next 1-5 years and gold is not down terribly then I am open to the possibility of getting incredible returns as a shareholder from this price level. Theoretically the blue sky scenario could of course be even higher, like making 1-3 additional Barsele type discoveries, while also proving that the Barsele project hosts 5-10 Moz alone. But that is not something I think one should take to the bank. And it is not needed since the beauty of the case is simply that any and all exploration potential basically comes “risk free” anyway from a valuation stand point. If they are not able to find a single additional ounce there is already a deposit worth mining at Barsele today. And given how extremely conservative Agnico Eagle is one can be assured that the gold is there.

If this is closer to a 100% owned 5-10+ Moz camp in 3-5 years, and listed in Sweden, then I would not be surprised to see a $2-$4 B Market Cap (assuming they have not been bought already).

Risk/Reward

I consider First Nordic Metals (“FNM”) to be one of the most asymmetrical bets that I know of. If FNM is not able to discover a single additional ounce, within the 100 km land package, then the High Quality, Free Carried, multimillion-ounce Barsele deposit will still underpin at least a few multiples of the current MCAP in my opinion. If one considers that to be true then all potential upside becomes “risk free” at face value. And there is a lot of potential upside. More than in most gold juniors around actually.

The last time I saw a junior that I considered to be this cheap with almost uniquely good Risk (Low)/Reward (High), was a nickel/coper/PGM juniors called Magna Mining at $0.33/share, two years ago:

(I actually included this after someone told me that he had not seen me “pound the table” this hard since Magna Mining)

Another way to look at it is to consider Barsele to be a scratched (Money spent and risk taken) lottery ticket that came up with a prize value of X. One can buy the prize for say 30% of X while getting a whole host of additional “lottery tickets” with company making potential for free. Basically the exploration potential across the 100 km Gold Line belt, within and round Barsele, and Oijärvi comes as a “Free Roll”. Nowadays it is pretty much only these highly asymmetrical Risk/Reward stories that I take unusually large positions in.

Now lets take a more detailed look on the fundamentals…

The Margin of Safety

#1 The Barsele Gold project

- 3-5+ Moz of gold with grades above many other profitable, bulk, underground gold mines (Already at 3 Moz using a gold price of $1,700 according to technical study)

- Agnico Eagle quality due diligence, preparation work, drilling, community engagement, metallurgical studies & geological understanding etc

- Extremely good infrastructure

- Highway next to the project

- Railway next to the project

- Powerlines literally running over the deposit

- Extremely low energy costs

- Hydro power (green)

- Pro-mining Communities (Vilhelima, Storuman & Lycksele)

- Very Low Corporate taxes

- Sweden: Tier 1 jurisdiction that is one of few jurisdictions, especially in the West, that are getting more pro mining

- BHP (A$200 B) acquired Ragnar Metal’s Nickel project in Sweden last year

- Very recently it was announced that Atalaya Mining (C$857 M) is entering the Skellefte/Boliden belt (Same area of Sweden as Barsele)

- The EU has also made some pro-mining legislations

The Barsele Gold project is a Young Davidson type bulk, underground gold deposit that at $1,300 gold contains at least 2.4 Moz. At $1,700 the resource is already at 3 Moz making it the second largest undeveloped gold project in all of Scandinavia. Like Young Davidson I believe this is a future high quality, high margin gold mine that I would expect to have an AISC of around $1,000 per ounce. A small, underground gold mine to the east of Barsele is making money on 1.5-1.7 gpt while Barsele enjoys underground grades of around 2.7 gpt.

Suffice it to say Barsele should be a highly economic gold mine on par with Young Davidson which Alamos Gold paid $950 M for in 2015 (When gold was around $1,200). In terms of Margin of Safety for a gold junior this is about as good as it gets. Not only should it be an incredibly robust project but Barsele has also benefitted from 9 years of Agnico Eagle quality preparation work (Water studies, community/stakeholder engagement etc etc). Adam Cegielski, the CDO, even said that the project really is at almost a “PFS” stage in light of how much data has been collected. There is no junior on planet earth that has as high standards as Agnico Eagle and most junior do not have the bandwidth or access to capital in order to even do this kind of work like the best in class. Agnico is the world’s best gold miner and everything they do is with gold MINING in mind. They do not take shortcuts, unlike most juniors, because they would be shooting themselves in the foot given that they go into a project with the intention of them being the ones to potentially operate it one day. The value of this is something that does not show up in a presentation but should be seen as incredibly valuable. Again, this project has seen the highest quality preparation work for mining that is possible in this space. Assume no stone has been left unturned by the world best gold miner.

“Since mid-2015, Agnico Eagle has done trenching and structural mapping, compiled geophysical data, carried out downhole geophysical surveys, and done hyperspectral diamond core scanning, environmental studies and community relations work.” – Agnico Eagle

A lot of the preparation work done by Agnico might be up to PFS stage quality but one big reason for the under-appreciation of Barsele and First Nordic is because Agnico has never put out an economic study on the project. So when I was doing due diligence I finally decided to do a rough estimation of what I think the CURRENT version of only Barsele could be worth (LINK to that video).

To make a long story short I got a post-tax NPV of over C$1 B at 1,800 gold using a 5% discount rate (on a 100% basis). If that was not conservative enough I also plugged in a scenario with UG mining costs higher than Ikkari and an 8% discount rate. Then I still got a NPV of above C$800 M at $1,800 gold on a 100% basis (With a 45% interest amounting to over C$350 M). At spot gold using a 5% interest rate the NPV is well over C$2 B.

Below is a more recent screenshot from my spreadsheet. The share count is not updated for the current placement and I have used a bit higher operating costs than Ikkari overall. Anyway, you can see the assumptions that I used. I will stress that this is of course only a crude estimation and reality will of course differ (positively or negatively). Still I think my assumptions are reasonable and just knowing that the Björkdal mine has pretty decent margins, while Barsele is much higher grade, kind of cements the fact that Barsele should be incredibly economic in its current form:

(I recommend you do your own calculations and don’t use this as gospel)

I am pretty certain that if there was a typical junior type PEA out on this project the price of the company would not be this low, because the incredible value of Barsele would be too obvious, to the marginal investor. So basically the lack of an economic study today is a big reason for the opportunity today in my book. And of course I expect Barsele to become a 5+ Moz deposit as well.

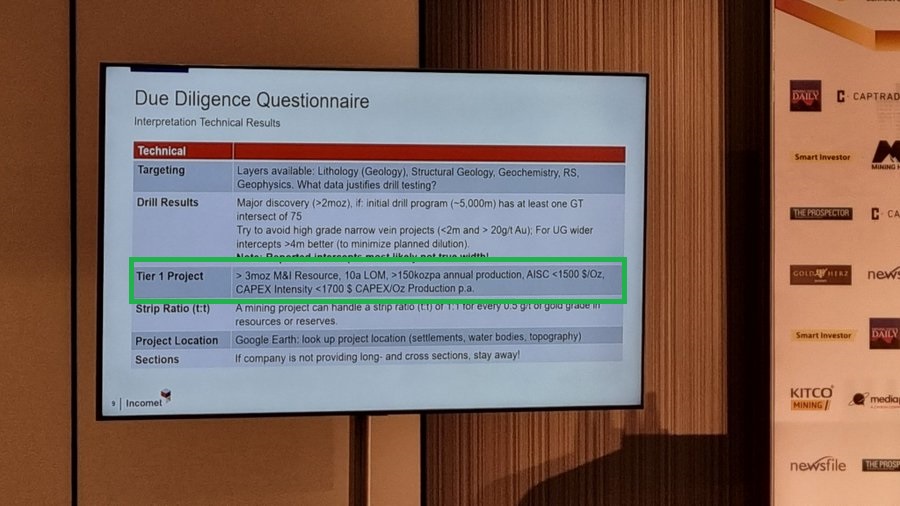

Tier 1 Deposit?

I recently saw a tweet by “Pete Panda” which included a slide from Incomet’s live presentation down at Deutsche Goldmesse. In their presentation they describe their criteria for a project to be a “tier 1 project”:

Suffice it to say I strongly believe that the Barsele deposit alone will meet all those “tier 1 project” criteria and then some. I do not know many juniors that have a tier 1 project, by Incomet’s definition, in hand while also controlling an entire belt with multiple major targets to be drilled. I simply do not know a single junior with this combination of high quality Margin of Safety with high potential Exploration Upside to boot (If anyone knows one contact me).

Agnico Eagle’s Position

I thought I would touch a bit of how I see Agnico’s role in FNM and the Gold Line belt.

What is important to note is that Agnico Eagle is today the third largest gold producer in the world when it comes to output and the second largest gold producer in the world when it comes to Market Cap. The Agnico Eagle of today has a Market Cap of $58 B. When Agnico went to work on Barsele Project in 2015 the company had a Market Cap of circa $5 B. In other words Agnico has grown by over 10X since they put their stamp of approval on the Barsele Project. And with that kind of growth the threshold for projects to be worth their time has of course gone up immensely while they consider themselves to be a “regional miner” and not a “global” miner…

“One of our prior CFOs used to say; ‘We are the sleep-easy at night gold stock’ and we do this strategically by focusing on two criteria… The first criteria is geologic potential. We want to be in places where it has the geologic potential to operate multiple mines for multiple decades… And the second criteria is political stability… The political stability to operate multiple mines over multiple decades.” Agnico 2024 – Source

First of all lets just point out the obvious which is that Agnico Eagle consider Sweden to be one of few jurisdictions that fit their “political stability” criteria and Sweden has gotten even better as of late. Second of all, we have to acknowledge that one high quality mine that could produce up to 200,000 ounces per year would certainly move the needle for the $5 B Agnico Eagle of 2015, but would be much less impactful for the $58 B juggernaut it is today…

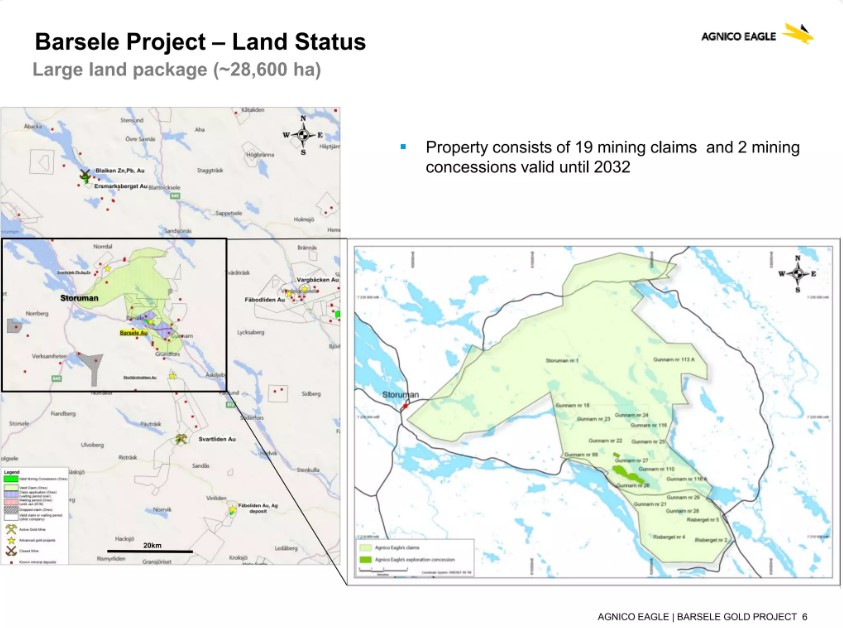

As the quote above suggests: Agnico Eagle wants to own entire districts/regions where they could discover and operate multiple mines for multiple decades and it has to be in tier 1 jurisdictions. That is a pretty tall order to say the least. Back in 2015 when they did the deal with Barsele Minerals the company “only” acquired interest in the quite large Barsele Project and the Barsele Gold deposit that came with it:

(Slide from a 2016 Agnico Eagle presentation)

While that is a large project at 28,000 Hectares it is not an entire region aka most of the Gold Line belt. Thus one can understand that finding multiple mines within this project might be a stretch (albeit not impossible given the amount of targets that exist). So as Agnico Eagle grew the need for larger mines and regional opportunities grew…

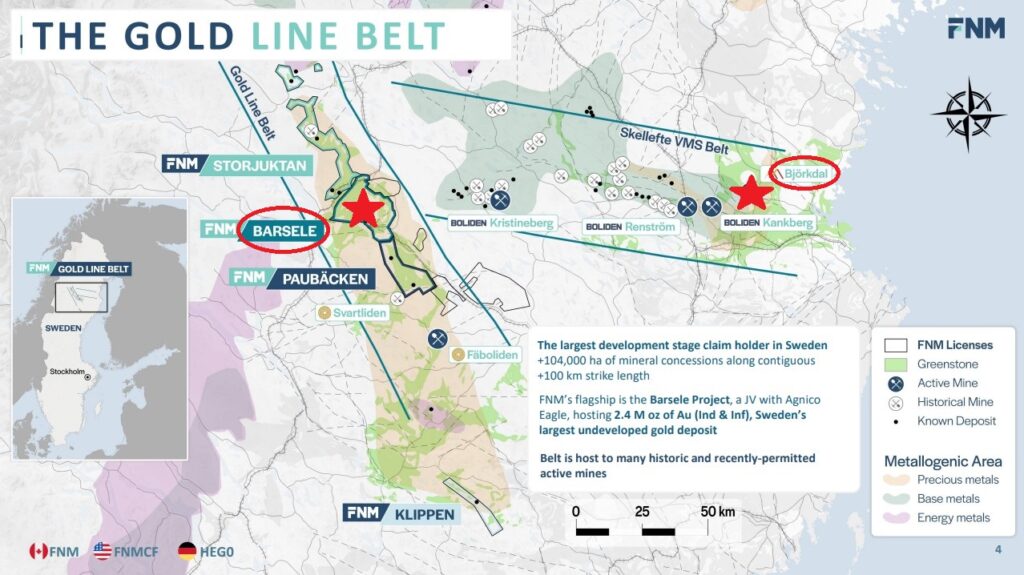

Meanwhile there was a company called Gold Line Resources which controlled the “missing pieces” of the Gold Line belt to the north and south along strike from the Barsele project:

The synergies from combining these two companies land packages are beyond obvious. So I bought both Gold Line Resources, and later on Barsele Minerals, in order to get interest across the prospective parts of the Gold Line belt (and maybe some indirect synergies). Things started to get really interested when I saw Taj Singh, of Discovery Silver as well as GT Gold fame, come in as a CEO in Gold Line Resources. Remembering that Taj took Discovery Silver from around a $10 M MCAP to a >$700 M MCAP I instinctively assumed that he saw something that the market didn’t (or didn’t appreciate). And not long after Taj joined Gold Line I got the news I had been waiting a long time for:

Dec 13, 2023:”Barsele and Gold Line Announce Merger to Create Scandinavian Focused District-Scale Gold Exploration & Development Company” – Link

All of a sudden a new company was formed, which was later to be named “First Nordic Metals”, that not only had a significant interest in the crown jewel of the belt (Barsele) but also 100% interest directly on strike to the north and south:

“District-Scale Exploration Portfolio in Sweden – Combined exploration portfolio totalling over 104,000 hectares across 41 semi-contiguous exploration permits will be one of the largest license packages in Scandinavia. The commanding land position will cover the majority of the underexplored and highly prospective Paleoproterozoic Gold Line greenstone belt and covers more than 100 km of strike length of the regional Gold Line structural corridor.”

Now there was a mining company that controlled an entire region, aka an Agnico Eagle sized land package, but it was not Agnico Eagle who controlled it. And the potential within said land package started to come into vision some months later…

On June 10 of 2024, a few months after the merger was finally completed, we got the first news release that touched on the district potential within the 100% owned ground:

“First Nordic Identifies New Large, Cohesive 5 km Gold Anomaly at Storjuktan Project, Gold Line Belt, Sweden” – Link

On June 17 of 2024, even more large scale potential was announced, but this time from the “Paubäcken” project:

“First Nordic Identifies New Multi-Kilometric Gold Anomaly and Returns Highest BoT Drilling Grades to Date at Paubäcken Project” – Link

These were a material news items in my eyes and my conviction grew even stronger in terms of the blue sky exploration potential across the belt. The market however did not care much which I wasn’t really surprised by as the sector has been pretty much left for dead.

Then on July 15, less than a month after the exploration update, the following news hit the wires:

“First Nordic to Complete Acquisition of its 100%-Owned Greenstone Belt in Finland and Welcome Agnico Eagle as a Shareholder”

So we learned that First Nordic completed their acquisition of the “Oijärvi Project” project from Agnico Eagle (An acquisition that was initialized by Gold Line Resources). How did they reimburse Agnico Eagle? Well, First Nordic paid Agnico Eagle the whole sum of $8.2 M, in shares of First Nordic (And this is on top of the circa C$3 M that had already been paid in cash to Agnico)…

And with that “trade” First Nordic became the 100% owner of a second gold project, and Agnico Eagle not only increased their exposure to the Barsele Gold Project, but ALSO got significant interest in the rest of the 100 km belt for the first time as a new 13.3% shareholder of First Nordic.

I read this transaction as Agnico Eagle tipping their hat and acknowledging that First Nordic’s land holdings have the potential to deliver a an Agnico Eagle sized prize. The Barsele project alone might host multiple deposits alone, but obviously the odds of finding an Agnico Eagle sized prize (“Multiple mines that can be mined for decades”), greatly increases when the prospective land package greatly increases. I also think it is also signaling a good relationship between the two parties, as well as foreshadowing the possibility of another deal, one where First Nordic will acquire operatorship of the Barsele Project as well. I mean lets face it, it is not like First Nordic needed another project (not even a good, somewhat early stage Agnico Eagle worked project), when they have 100 km in Sweden to explore already. And I wouldn’t be so sure that First Nordic would be the highest bidder in case the Oijärvi project would be put out on auction. But this way Agnico Eagle can get get a foothold in the Regional Gold Line play and First Nordic gets a good, sub-Agnico sized gold project in Finland.

What if you were in Agnico Eagle’s shoes?

I think it makes perfect sense for Agnico Eagle to do a deal with First Nordic on Barsele, sooner or later, and ride the story as a 19.9% shareholder. I mean Agnico Eagle can win in two different ways basically as I see it; A) Either the Gold Line Belt proves to have the potential for multiple mines, that could be mined for multiple decades, and even the $58 B version of Agnico Eagle wants to own it fully. Or B) Agnico Eagle makes their money back and then some via a sale of the Barsele Project and their shares in First Nordic…

In my mind the most efficient way of going about things with the above options in mind is to consolidate operatorship/ownership. First Nordic would be more than happy to prove this is a >10 Moz, multiple-mine district and have Agnico Eagle come in and buy the whole thing for billions of dollars down the line. In order to prove that it would be really good to have one operator with a focused, strategic and holistic exploration strategy. I bet Agnico Eagle would like to get the answer to the “is this Agnico Eagle sized?” question as soon as possible as well. In case First Nordic does get operatorship but their exploration efforts yield poor results, except proving up that the Barsele deposit is at least 4-5 Moz, well then that is at least a great flagship worthy project for a mid-tier gold producer. And in a sale for lets say $1 B Agnico would get a $200 M payday, as a 19.9% shareholder, and both parties walk away as winners.

First Nordic is simply in a much better negotiating position than Barsele Minerals was because First Nordic can leverage the 100% owned ground, including the massive targets, in the Gold Line belt.

Barsele Comparables

They say the best way to appreciate real world economic value is to compare projects to real world mines because for example PEAs can be “manipulated” to show great numbers on paper. Furthermore there is no shortage of junior gold developers who have put (or tried to put) mines into production that looked pretty good on paper but failed to be economic in the real world.

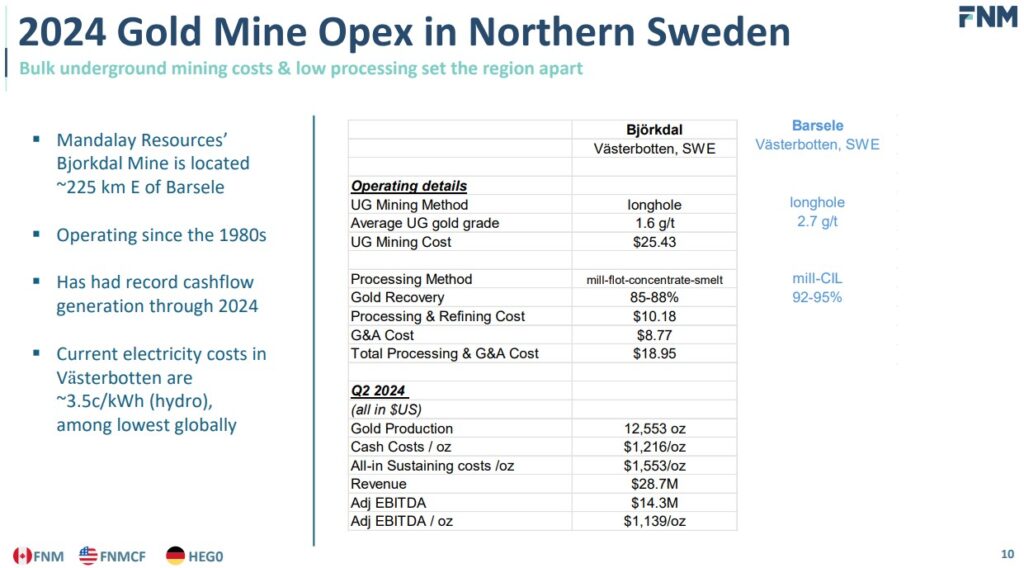

Thankfully we have a highly relevant real world mine to use as a benchmark and that is the “Björkdal” mine which is owned and operated by Mandalay Resources. The Björkdal mine is, just like the Barsele deposit and the rest of the Gold Line Belt, located in the Skellefte area of Sweden (and in the SE2 electricity region):

The Björkdal gold mine is an Underground Gold Mine (Just like Barsele would primarily be) that uses the Longhole Open Stoping mining method (Just like Barsele is expected to do). With an average underground gold grade of only 1.6 gpt, and a production profile of only ~45,000 ounces per year, the mine recently showed record cash flow generation in Q2 with an AISC of $1,553/oz.

Knowing this one can ask oneself how well a gold mine with incredibly wide ore zones, significantly higher grades, significantly higher expected production profile (economies of scale), and possibly even better recoveries than “Björkdal” could do:

I mean think about it. How much cash flow do you think the “Björkdal” mine would throw off if you simply changed the gold grade from 1.6 to 2.7 (+69%),d jacked up the production profile to 150,000-200,000 ounces per year instead of ~45,000 per year, and increased the recoveries to 92%-95% from 85%-88% to boot?

If there is one undeveloped gold deposit that I am confident would actually translate to a great mine as well it would be Barsele. This is why I consider the margin of safety to be extreme compared to most gold juniors. I mean it is not easy to find a multi-million ounce gold deposit to begin with. Very few juniors are able to do that. But to actually find such a deposit that a) Could become a mine (Permitting, infrastructure & community acceptance etc), and b) Could be good mine (Good real life economics thanks to ore body, cost structure, metallurgy, labor costs & favorable infrastructure etc) is like one in a thousand juniors. I mean the vast majority of my gold juniors are made up of companies that do not have gold deposit in hand which is likely to be a good mine anytime soon. Rather they are exploring for one and if I am lucky they will prove that they have one over several years. And then the permitting situation could start for real etc (which would also take many years and is far from a guarantee).

… Yet I have no doubt that a lot of people don’t see a big difference at face value between one 3 Moz deposit and another 3 Moz deposit. Yet one could be completely worthless in real life and another one could very well be worth $1-$2 B.

Lets look at some more crude calculations which suggests that Barsele should actually be one of those very rare gold deposits that actually could be a very valuable mine in real life. In the picture below I have used the real life cost structure of Björkdal for Q2, 2024 and calculated some production scenarios for Barsele assuming a modest 2 Mtpa operation:

… The “Operating Margins” per ounce in these three scenarios:

- US$2,133/oz at $2,700 Gold

- US$1,438/oz at $2,000 Gold

- US$1,239/oz at $1,800 Gold

Heck do your own calculations and a) lower the average grades, and b) increase the costs to be conservative. It still does not change the point that Barsele should be a very high margin mine today. I mean it all makes sense given that Björkdal could pull off an AISC of $1,553/oz, and Adj EBITDA of $1,139/oz, with average grades of 1.6 gpt. And as we know Barsele would start mining at/near surface, have much higher grades, and simpler metallurgy with higher recoveries to boot.

Bottom Line: I expect Barsele to be a very good, high margin gold mine.

The fact that one can currently buy 45% of Barsele and ALL other assets for C$90 M (minus cash) is unreal in light of what I expect the value to be per ounce.

Do I know that Barsele will exactly have the same costs as the other gold mine (Björkdal), which is located in the same part of Sweden, using the same mining technique? No. But it is probably the best data point we can possibly get. Labor quality, labor costs, energy costs and infrastructure advantages etc should naturally be very similar. Besides, the Björkdal mine has been running since the 1980s, and I reckon Björkdal is being mined at depths that are deeper than Barsele’s entire current resource. The shallower the mining, the lower the costs, all else equal.

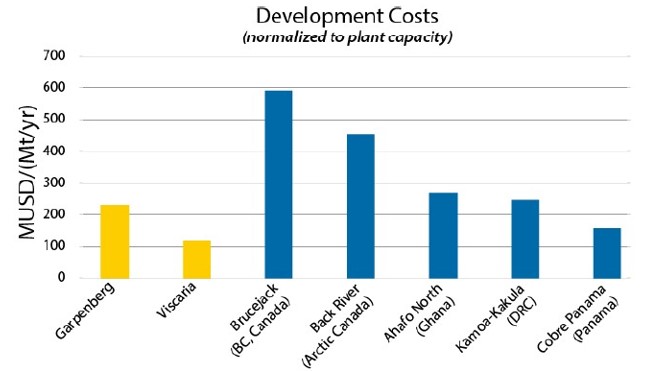

What could it cost to start such an operation and access that kind of cash flow?

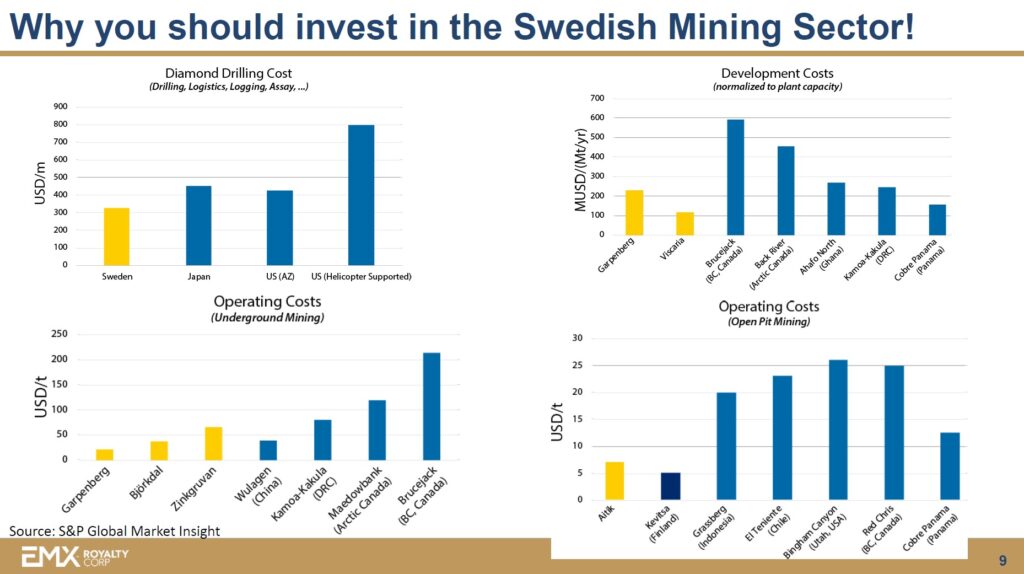

Well Rupert’s PEA includes a 3.5 Mtpa operation and the initial CAPEX was estimated to be US$404 M. That is 75% more throughput than I assumed in my example so it should be less than US$404 M. We can also look at this follow slide done by EMX:

We have two numbers from two different Swedish project. One is Garpenberg which has been operation for a long time and the second one is the copper developer Viscaria which is located in Northern Sweden. If we use Garpenberg’s number I guess a 2 Mtpa operation could have an initial CAPEX of sat US$440 M. Now Garpenberg is a polymetallic mine in Central Sweden mind you. If we use Viscaria’s number I guess the initial CAPEX would be around US$220 M for a 2 Mtpa operation. If we use the Mean of those two numbers we get US$330 M. Anyway you slice it I would argue that Barsele would be pretty cheap to build in light of the expected margins, production and mine life.

While on the topic of low costs and Viscaria…

Viscaria – Copper in Sweden

Viscaria is a copper developer in northern Sweden, with a Market Cap of around C$322 M, and this is their latest resource:

“According to the November 2022 update, the copper-bearing rock resources in the Viscaria area amount to 93 million tonnes, with an average copper grade of 0.88 percent.” – Source

In gold equivalence the resource amounts to 2.9 Moz AuEq with a grade of 0.97 gpt AuEq…

Well this is less than half of Barsele’s resource grade. It must be a strictly open pit operation with those grades right? Wrong. The mine is planned to have a bit of open pit mining but the bulk of the deposit would be mined from Underground (Source):

Okey so we know the average grade is much lower than at Barsele. Even the highest grade zone, which is Zone A, only has a grade of 1.52% Cu which is equivalent to 1.68 gt Au at spot metal prices. This is of course still much lower than the average grade at Barsele. In fact it is close to the very conservative cut-off grade for Barsele(!)

And what is the mining method they intend to use (Source)?

… Same mining method as would be used at Barsele.

This is just another example of how mines that probably would have no hope of being economic in other parts of the world might still work in Sweden. And of course if Mandalay Resources is making money at the Björkdal mine, and Viscaria believes their ~1 gpt AuEq copper mine will work, then what does that imply for the margin potential and value of Barsele…?

Technology, Swedish Manufacturing & Electrical Equipment’s affect on Bulk Mining

I just watched an interesting interview with Sean Roosen who is Chairman and CEO of Osisko Development (ODV). I found the segment where Sean was talking about how technology (mechanization of mining) has led to positive developments for Bulk Mining while it has not really affected “high grade” mining (High grade, narrow width veins). Then he goes on to talk about Osisko Development’s project in BC, Canada where they plan to use bulk mining (longhole), and how a lot of the equipment is expected to be automated/mechanized. They apparently have a Joint Venture with Sandvik, one of the big Swedish mining equipment manufacturers, who can provide “electrics road-headers”. Sean also points out the benefits of having electrical equipment while also having Green, Hydropower as an energy source for the mine. Personally I had no idea that Underground Bulk Mining has become so much more efficient…

Obviously this is music to me ears as Barsele will be an Underground Bulk Mine, Sandvik is based in Sweden, and the Barsele project has access to the cheapest, green hydropower electricity in Europe.

Agnico Eagle and Sandvik are no strangers either and it seems the trend is towards electrification o Underground Mines:

- “Agnico Eagle Fosterville to trial Sandvik LH518B battery-electric loader”

- “Agnico Eagle celebrates Québec’s first battery-electric loader”

- “Sandvik delivers two Artisan A10 battery-electric loaders to Kirkland Gold Macassa Mine in Canada”

- “Agnico’s Kittilä clocks up full year of autonomous haulage with Sandvik”

Apparently Agnico Eagle is also working with another big Swedish mining equipment manufacturer (Epiroc):

“Agnico Eagle Finland placed an order for two Boltec E Battery rigs from Epiroc earlier this year. Epiroc aims to offer its complete range of underground mining equipment as battery electric versions by 2025. “

Suffice it to say that I do not think many of our competitors in the market have any idea how good Sweden is from a mining point of view and how well positioned the Barsele/Gold Line project is. I live in Sweden and I had no idea until I started digging as I was doing research on Gold Line Resources and Barsele Minerals. There are so few serious junior stories focused on Sweden that nobody has had any real reason to look into it. Not only is First Nordic a sleeper but mining in Sweden, especially Northern Sweden, is a bigger sleeper still.

The Barsele Resources is Extremely Conservative

To highlight just how much Margin of Safety there is in the 2019 resource estimate for Barsele consider this:

- The resource study was based on a $1,300 gold price

- = The ounces included should be economic at $1,300 gold

- The resource study assumed higher operating costs than Björkdal’s actual costs and Rupert’s assumed costs for Ikkari

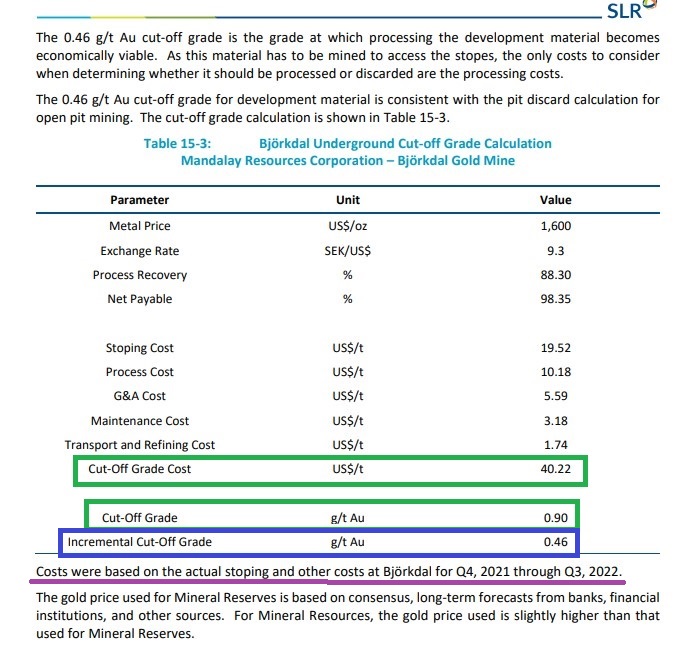

… This resulted in Cut-Off grades for Barsele of 1.8 gpt for “Underground Selective” and 1.5. gpt for “Underground Bulk”.

These Cut-Off grades look ridiculously high Today given that the Björkdal mine is making Good Money on ~1.6 gpt and Viscaria has an average grade of 0.98 gpt AuEq and the highest zone being around 1.15 gpt AuEq. When I re-did the resource calculation, and just changed the assumed gold price from $1,300 to $1,700, it resulted in a 3 Moz total resource with slightly lower grades (Ounces that should be economic at $1,700 Gold). And I was still using with higher Mining, Processing and G&A Cost assumptions than for example Ikkari and Björkdal.

To put things into perspective do you know what Underground Cut-Off Grade Rupert used for Ikkari’s Resource?

… 0.9 gpt.

And this next slide is from Mandalay Resource’s Technical Report on the Björkdal mine which used a $1,600 gold price:

(Colored drawings/underscores added by me)

Suffice it to say the Barsele resource is very outdated and incredibly conservative.

Economic Studies Vs Reality

If you look at many juniors PEA studies almost all of them show to have for example lower costs than most of the real life comparisons that are actually operating. On that note Brent Cook did a presentation at VRIC where he talks about this exact phenomena:

Brent Cook on the dislocation between undeveloped mines, and their economics on paper, versus the real world:

“It is very interesting to me. To say the least. That almost all of them are better than the ones that are operating… That’s not going to happen right… These PEAs and PFSs are always, almost always, way over-optimistic.”

On that note we recently saw a news release from Contango Ore which highlights the fact that most mines will under-perform their cost estimations and perform more in line with real world operating mines (if even that good):

“The Company anticipates that its share of 2025 gold production from the Manh Choh mine will be approximately 60,000 ounces (“oz”) of gold. The estimated AISC for the life-of-mine (“LOM”) is projected to increase to approximately $1,400 per oz of gold equivalent (“AuEq”) sold compared to $1,116 per oz of AuEq sold, as estimated in the Manh Choh Technical Report Summary1 (the “TRS”)” – Source

So let us appreciate the value of having real world data, from a real mine, in the same region of the same country, to help us appreciate what the ACTUAL costs of mining could be for Barsele.

Brent then goes into some factors that he believes are the primary reasons why juniors fail (and investors lose money). I have used his checklist and added my own comments to it below:

As I have stated numerous times in my videos and on twitter over the years and wholeheartedly believe…

Third party validation is one of the most important factors that I can come up with. I am an investor. I am not a geologist, nor am I a mining engineer. And in the gold space I literally do not think there is an entity who’s validation/opinion/expertise/quality of work that I would rate higher than that of the $60 B company known as Agnico Eagle. So if my crude calculations inspired by real life examples suggest that Barsele should be a low cost, high margin mine, then I really should not be paranoid or surprised about that. Why? Because Agnico has the lowest cost, highest quality mines of all the majors. In other words they, more than perhaps anyone else, knows what is required for a project to translate into a great mine in reality. Now the “Problem” for Agnico today is that the company has done so well, and their Market Cap has risen so much, that even high quality 150-200 Koz mines (like Barsele), are getting too small for them. Nowadays the company needs monster projects to move the needle for them…

Oh and if anyone is paranoid about: “Well if First Nordic would be able to get operatorship/acquire Barsele then that means that Agnico does not like Barsele or the Gold Line belt” then I would say: “Why do you think Agnico Eagle came on as a 13.3% shareholder of First Nordic some months ago in exchange for the ‘Oijärvi’ project?”… The deal meant that Agnico increased their exposure to Barsele and also now have exposure to First Nordic’s 100% district scale land package.

Agnico Eagle is THE single best stamp of approval that any gold junior could want or get.

While Barsele alone might not be big enough for Agnico today I think that pretty much any other mining company in the world would love to own the deposit. In 2021 the predecessor company Barsele Miners tried to buy 100% ownership from Agnici. And while this acquisition deal was still pending/live CEO Gary Cope did a public presentation at Deutsche Goldmesse in Frankfurt and stated that; “Barsele’s drawn an incredible amount of interest from Newmont who is waiting, standing by to go see it”(Link). It is also worth noting that back then Barsele Minerals “only” had the Barsele Project, and not the entire Gold Line belt, like First Nordic has today.

In Summary

- If one uses the cost basis for the other underground gold mine in the area (Björkdal) then it implies that Barsele should be a very high-margin gold mine

- Even if costs are quite a bit higher at Barsele, for whatever reasons, it should be a very profitable gold mine

- If Agnico Eagle has interest in a project you already know the quality box is checked by the best miner in the world

- If Agnico Eagle has worked a project you know that the work has been done with the highest quality possible (Way better than what most Jrs would do)

I simply think this is one of the best undeveloped gold projects in the world that is not 100% owned by a large mining company already. Everything suggests that the Barsele deposit alone is a very valuable asset. And not just on paper but one of those rare gold projects that should work very well in reality. I cannot overstate just how rare it is to own a junior that you think is incredibly undervalued and where the value is almost as cemented as you can get in the junior sector.

It can’t be stressed enough how good I think the Risk side of the equation is in First Nordic with Barsele underpinning it:

- Technical Risk: Low

- Jurisdictional Risk: Low

- Pro-mining municipalities: Yes

- Possibility of getting permitted for mining: Very Good

- Barsele designated to be of “National Economic Interest”

Another Comparable: The Young Davidson Mine

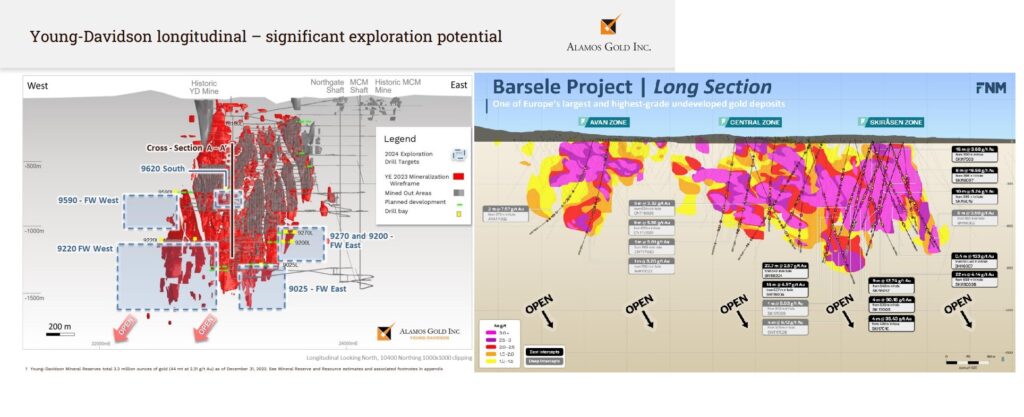

The Young Davidson mine that is owned by Alamos Gold had an acquisition value of $950 M at the depths of the bear market in 2015. That mine is still running and has been delivering substantial cash flow for years. It is a bulk, underground mine with slightly lower grades than Barsele:

A few things to keep in mind when you look at Young Davidson’s impressive numbers and then consider it in the context of Barsele:

- Young Davidson’s UG grade is lower than Barsele’s UG grade

- Young Davidson is being mined at >1 km depth will be a fresh mine starting from surface

- Barsele will have much lower energy costs

- Barsele will likely have lower labor costs

- Canada has a higher corporate tax rate than Sweden

… Do I think Barsele could rival or be even better than Young Davidson? Yes.

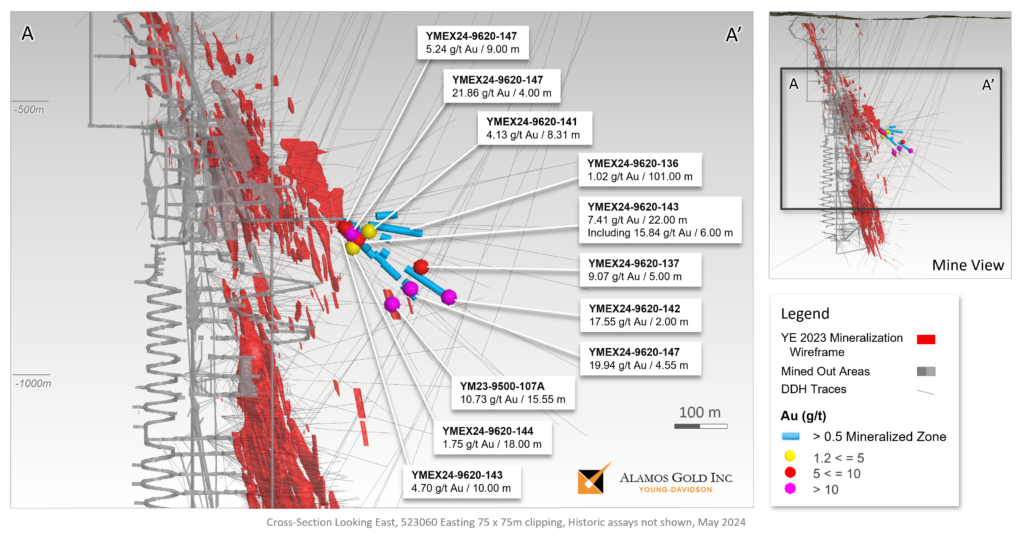

This next picture is not in accurate scale etc but I did it to highlight the “blob of gold” type deposit similarities:

(And as you can see in the left slide Alamos is already mining past 1 km depth with 1.94 gpt average grade as of Q1 2024)

Here is another slide from an old Agnico presentation on Barsele which really shows why Barsele should be a fantastic bulk mine like the other wonderful bulk mines listed earlier:

As I am writing this article a new slide with Cross Sections for Barsele was included in the new presentation deck. Feast your eyes:

(Note the scale)

The zones are so wide that they could be mistaken for a long section. What is blatantly obvious is that this is not one of those typical narrow vein systems that not seldomly fail due to being for example too erratic, nuggety and/or get much more mining dilution in reality than on paper. Nope, this will not be mining veins that are 1 m wide. These widths are monstrous and with that the mining costs go down and risks as well.

Here is a Cross Section from the billion dollar Young Davidson mine for comparison:

… As mentioned earlier Alamos Gold acquired the Young Davidson mine for $950 M in 2015 when the gold price was around $1,200/oz.

Other Valuation Comparables

Newmont recently sold two mines that were non-core to the $70 B behemoth which highlight how much operating gold mines are actually worth today…

One mine was the “Musselwhite” mine which is being sold to Orla Mining for up to US$850 M = C$1.2 B. The other one is the “Éléonore” mine which is being sold to Dhilmar for US$795 M = C$1.1 B.

Musselwhite Mine (C$1.2 B)

- Production: ~208,000 ounces (2024)

- AISC: $1,570/oz (year to date)

- P&P Reserves: 1.5 Moz

- M&I Resources: 0.3 Moz

- Inferred Resources: 0.2 Moz

Éléonore mine (C$1.1 B)

- Production: ~216,000 ounces (2024)

- AISC: $1,914/oz (year to date)

- P&P Reserves: 1.57 Moz

- M&I Resources: 0.4 Moz

- Inferred Resources: 0.3 Moz

Both mines have around 1.5 Moz of reserves with little additional resources. Neither of the mines is a low cost mine (especially Eleonore). Young Davidson is a much better mine than the ones above as per a transaction value of C$950 M, when gold was at $1,200, compared to $2,600 today. I think Barsele will be 5+ Moz deposit with some drilling. I think Barsele will have significantly higher margins than either of those Newmont mines as I showed earlier in the article. I think Barsele will have a production profile of 160,000-200,000 ounces per year.

Basically I think Barsele is going to be a much better mine than both of the above; Higher Margins, similar production profile, much longer mine life because Barsele is a fresh deposit that also starts at surface, and given the amount of targets around the Barsele deposit it can get even higher value from its operation in a Hub And Spoke situation.

… Note that this is me Speculating. But it is speculation based on the many factors mentioned earlier in the article.

I think one of the biggest opportunities in the depressed junior sector can be found in the advanced explorers/developers, that have good undeveloped projects, and are also likely to get them permitted. If a decent-to-good operating mine is worth >$500/oz when in production, and I can buy a good project for $100/oz or less, then I can certainly see considerable upside. Especially when that project is expected to be even better than most operating mines as well as have a high chance of getting permitted.

Future Growth at Barsele

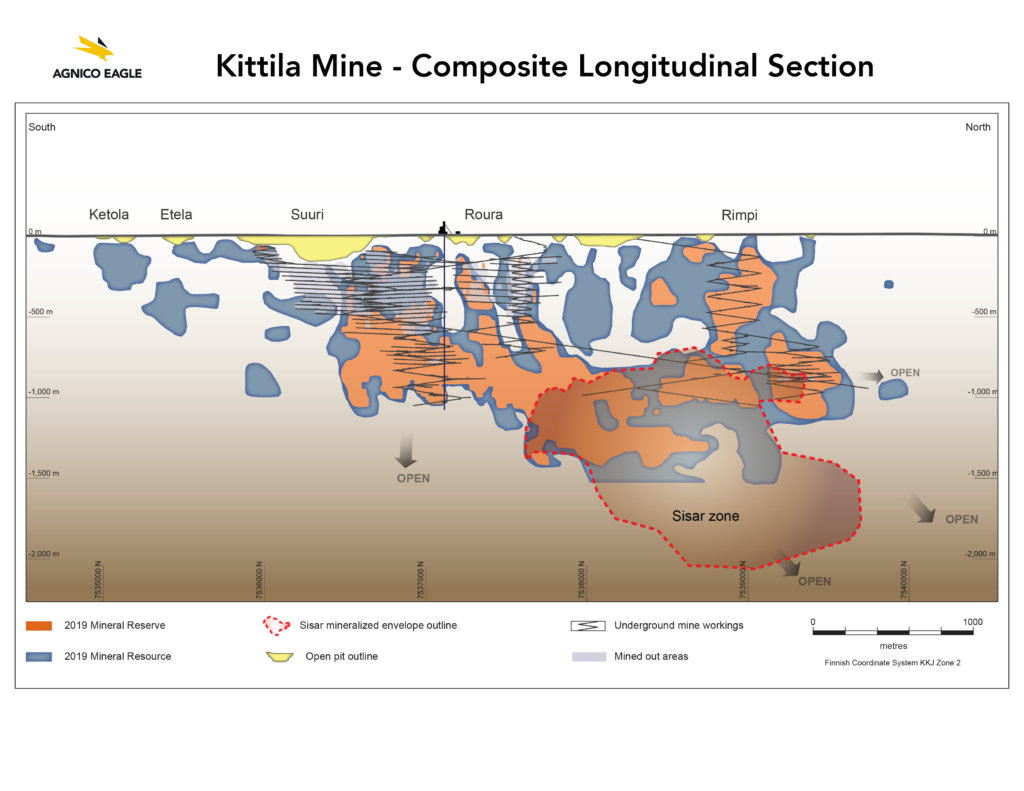

As mentioned before the Barsele deposit is already at 3 Moz if one assumes a $1,700 gold price. That numbers comes from an average resource depth of “only” 550m and the belief is that the mineralization should extend to at least 2.0 km t depth. Many of Agnico’s current bulk, underground mines are down to past 1,500 m today and that includes the Kittilä Gold Mine in Finland. So my belief that Barsele could get to over 5 Moz should not come as a surprise to anyone:

The only limit to the resource at depth is the extend of drilling done so far and nothing would suggest that it will not just keep going.

On that note there has already been a deep drill hole that has confirmed good gold grades down to at least 925 m depth (Average resource depth is 550 m at Barsele currently).

An example of a gold mine that just kept going is the “Kittilä” in Finland where Agnico Eagle is mining past 1 km depth with the resource already having passed 1.5 km as of 2019. And that mine works very well at those depths mining around 4 gpt of Refractory gold (Ps. I have heard a rule of thumb is Processing Costs of $30-40/t for refractory ore vs. $10-12/t for free-milling sulphide ore):

And given that the rock type appears to be the same at Barsele down to at least 2km depth I can see Barsele evolving like Kittilä… That once it is in production it could run for decades. With that said it is not only the obvious potential at depth to consider, but also the potential along strike, such as to the west of the 2019 resource (edge) of the “Avan” zone:

(Yellow shapes shows the 2019 resource)

Or how about the potential over at “Risberget” where gold is already confirmed but a) Not included in any resource and b) Barely drilled:

Not only “Risberget” but also “Norra”, and “Bastutrask” are targets that already host current internal resources. These resources have never been made public by Agnico Eagle.

In Summary

- The Barsele deposit should be a very profitable mine like Alamos Gold’s “Young Davidson” mine (Or the “Björkdal” mine on steroids)

- My guess is AISC of $1,000-$1,200

- The Barsele deposit could probably become a 5+ Moz deposit and have a mine life of at least a few decades

- My guess is a production profile of 150,000-200,000 ounces per year without satellite deposits

- The Barsele deposit is already a highly mining worthy deposit today in my book (Real margin of safety)

- The Barsele deposit has local support, extremely good infrastructure, extremely low energy costs and is located in a tier 1 jurisdiction

- The Barsele deposit has been studied, and been prepared for mining by Agnico, for 9 years and counting

How many juniors out there can say they have the same quality in terms of Margin of Safety?

How many juniors out there have a continuous 100 km land package, with extremely good infrastructure, in a tier 1 jurisdiction?

How many juniors have had Agnico Eagle do Agnico Eagle quality work, on their flagship deposit, for 9 years?

… I do not know a single junior that can say that. Hence why I think First Nordic’s combination of low risk and high potential upside is pretty much unique in the gold junior space. It is certainly one of the best cases I have come across since I started in 2015. I find it absolutely remarkable that not more people seem to be aware of the story. I see quite high risk stories out there, selling at half First Nordic’s MCAP already, that have hordes of followers.

A Deposit Derives its Value From “Becoming a Mine”

Everybody wants a good mine in a tier 1 jurisdiction (Hence why such projects get a premium). There are however a lot of challenges to overcome for a project to become a mine. You have to for example have;

- A deposit worthy of building a mine on

- Infrastructure (CAPEX & OPEX)

- Location

- Social license/Community acceptance

- Politics

- Permits

First of all there are few actually good projects out there. And there are not many good projects that have all of the above, or are close to having all of the above, and are also in a tier 1 jurisdiction. I can come up with a few very large deposits that should be great operating mines but that are in very remote areas. There are some very large projects with good infrastructure but that are seeing huge resistance from locals. If one made a discovery today it might easily still be ten years or more from production even if most boxes were checked because water studies etc require time-series spanning years (And one can’t simply spend money to make it go faster). In short it is bloody hard today to find and build a good mine in a tier 1 jurisdiction where they would get the most value (And not have a “Cobre Panama” debacle). The amount of juniors in tier 1 jurisdictions that check all, or even most of the boxes, is as short as can be.

I think that is why we are seeing gold producers buying other gold producers in tier 1 jurisdictions (No permit risk or waiting time) first. Today I am not sure if there is even a single junior producer with a good mine in a tier 1 jurisdiction left. I only know a few juniors with good projects, that are close to being build ready, that have not yet been acquired (and they have $800 M to $2 B Market Caps typically). What I am trying to say is that great projects, that are located in tier 1 jurisdiction which also have a good chance of being built, are very valuable.

Not only do I believe that the Barsele deposits is one of the best undeveloped gold projects in the world that is not 100% owned by a major mining company but I also think that Barsele checks most of the “Can this be a mine?” boxes:

Infrastructure

… It pretty much cannot get better than this. The project enjoys world class infrastructure with a highways and a railway literally passing by the deposit. It took be two hours to get to site from Stockholm. It took me 1-hour to fly from Stockholm (Arlanda airport) to Lycksele airport and then it took me 1-hour by car on the highway to get to Barsele.

The electricity costs are some of the lowest in the world here thanks to the abundance of Hydro Power plants (Sometimes they are even negative due to surpluses):

There is literally no place in all of Europe where one would have lower energy costs than where Barsele and the Gold Line belt is located. Below is a tweet that was posted on December 11 that shows a map of expected electricity prices for tomorrow across the EU, when neither the sun is shining, nor the wind is blowing. Apparently this phenomena is called “Dunkelflaute” and electricity prices are expected to go through the roof (In hindsight we know they did indeed go through the roof except for Northern Sweden). Anyway, you can look at the numbers yourself and note that I have circled the electricity region where Barsele is located:

… You could literally not ask for a better place to discover a future mine from a cost/margin point of view.

There is a powerline that literally goes right over the deposit. Furthermore the Swedish Geological Survey (“SGU”) has designated an area that encompasses both the Barsele Gold Deposit as well as the Norra VMS Deposit to be of National Economic Interest to Sweden (Also note the Orange shaded areas around the Barsele deposit and the Norra VMS deposit which are “Granted Exploitation Concessions” aka Mining Permits):

Basically the “National Interest” designation is a recommendation that nothing should be done in that area that would hinder the future extraction of minerals/metals (The building of a mine):

(Google translated from the SGU website)

Barsele might be in an unusually good position when it comes to infrastructure and energy costs but Sweden overall is already a low cost jurisdiction to begin with:

(Slide by EMX)

“… I talked about the corporate taxes but the actual costs of doing exploration and development are extremely favorable as well. You got access to low cost power… Some of the cheapest power in the world… 3 cents per Kwh because of all the hydro that is available there… It’s amazing…. Again a great place to work and be able to advance and progress projects along.” – Taj Singh

How many tier 1, Western jurisdictions do you know that is also a low cost jurisdiction when it comes to both drilling, building and mining? Usually you have one or the other. You probably get low costs in Africa but it is still Africa. If I wanted to actually make money in mining I would want a long lived mine in Sweden where costs and corporate taxes are low and rule of law is high.

- Want low CAPEX?

- Build a mine in Sweden.

- Want low OPEX?

- Operate a mine in Sweden.

- Want to drill projects cheaply?

- Explore for a mine in Sweden.

- Want low Taxes for your mining company?

- Operate a mine in Sweden.

- Want to keep your project?

- Have the mine in Sweden.

… Not only is Sweden a low cost jurisdiction (which increases margins/value per ounce all else equal) but it is also a low tax jurisdiction (which increases the value of the margins all else equal). If that was not enough already it is also a tier 1, western jurisdiction where you get to keep a long lived asset.

Just like junior miners tend to have a trade-offs in Risk/Reward (If I want the potential for high reward I usually need to accept high risk and vice versa) there also tends to be trade-offs for jurisdictional value. The low cost jurisdictions like some countries in South America and Africa tend to come with political uncertainty, threats of nationalization, and high taxes etc. The “tier 1” jurisdictions, from a rule of law and stability point of view, tend to come with high labor costs, lack of infrastructure in the more remote areas, and local resistance (“NIMBY:ism”) etc. There are NOT many jurisdictions on earth that have the benefits, and not the detriments, that typically comes with either type of jurisdictional type. Quebec, Canada might be the closest thing to the Barsele region of Sweden that I can think of but I think Quebec still has higher costs and higher taxes.

Basically I don’t think there is a single place on earth I would rather own a long lived gold mine than in Sweden if my goal was to maximize value derived from it.

… All the above obviously has a very high impact of the Actual Value of a mining venture. With that said I do not think this is reflected in the price of First Nordic at all yet and that is probably one of the biggest opportunity drivers as I see it. It is not only a relatively new story (under the radar), but story is also located in maybe the best jurisdiction there is, that almost no one in the junior mining sector knows anything about (lack of experience/references = neglect/under-appreciation).

While on the subject of Sweden as a jurisdiction I would also like to point out that Sweden is currently one of few Western countries where the current government is pro mining:

Even more positive stuff has come out as recently as December 12:

Below is a recent (google translated) quote from Jordanfonden:

“The upcoming new mining law in Sweden, which is expected to see the light of day shortly, is expected to open up easier licensing and faster getting up and running” – Source

Furthermore The Jordanfonden had this to say about First Nordic, The Barsele Deposit, and their view that Barsele should have no major problems when it comes to being allowed to get built and thus monetized:

(Translated as best I could from Swedish)

“The beauty of the Barsele deposit is that it is on land that was earmarked for mining by the government, so there are no problems with either the reindeer herders (THH: The Same people) or the residents, who are all positive that activities will start to give the locality jobs. JF perceives it as documenting 2.8 million oz in the ground via the work that has already been done.

This is thus a gold company that can already show that it has extractable volume of gold in the hill – no talk of “exploring” for gold. JF met the company at the mining fair at the Sheraton in September..”

The municipalities of “Lycksele”, “Storuman” and “Vilhelmina” are all pro mining. Many in the mining space are probably familiar with the term “NIMBY” as in “Not In My Back Yard”. Well these three municipalities have stated they WANT mines in their backyard. Why is this relevant for Barsele? Well, these three are the very three municipalities that cover Barsele and the Gold Line Belt…

I have marked the capitals of the three municipalities with yellow stars in the picture below:

The Barsele mine would create a lot of jobs and has been prepared, planned and worked on by…. Agnico friggin Eagle… For over 9 years. And with the recent collapse of Northvolt, the big battery manufacturer in the Skellefteå area, this region suddenly needs a lot more jobs to be created.

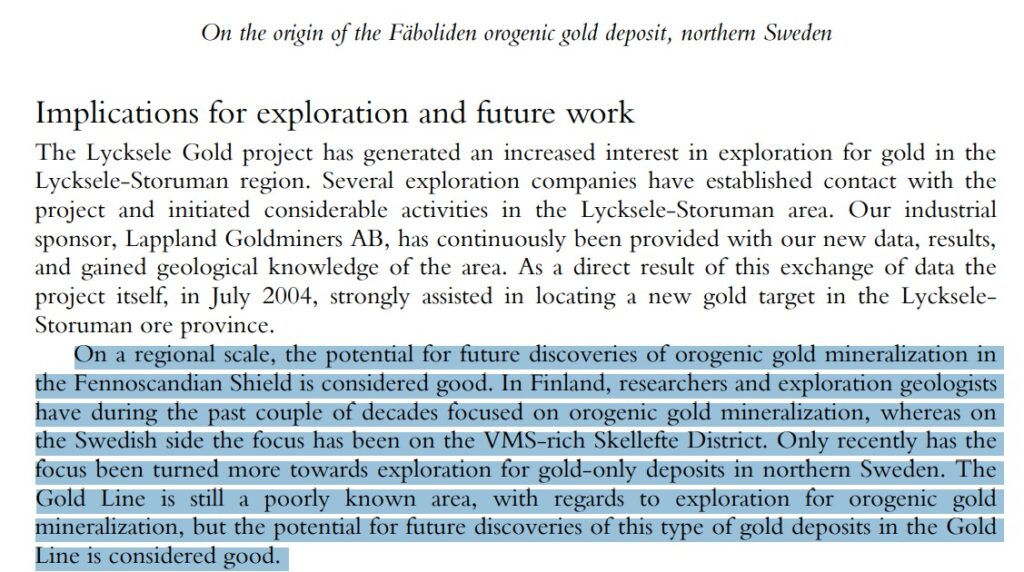

The “Free Optionality” in Sweden

Unlike Canada, there as barely been any exploration for gold in Sweden. At least from a modern stand point:

Finland which has been considered to be a new fronteer of gold exploration lately, with discoveries popping up here and there, is still considered to be more explored than Sweden. The picture below is from Aurion Resources and shows what happened once a few juniors started exploring this greenstone area in earnest:

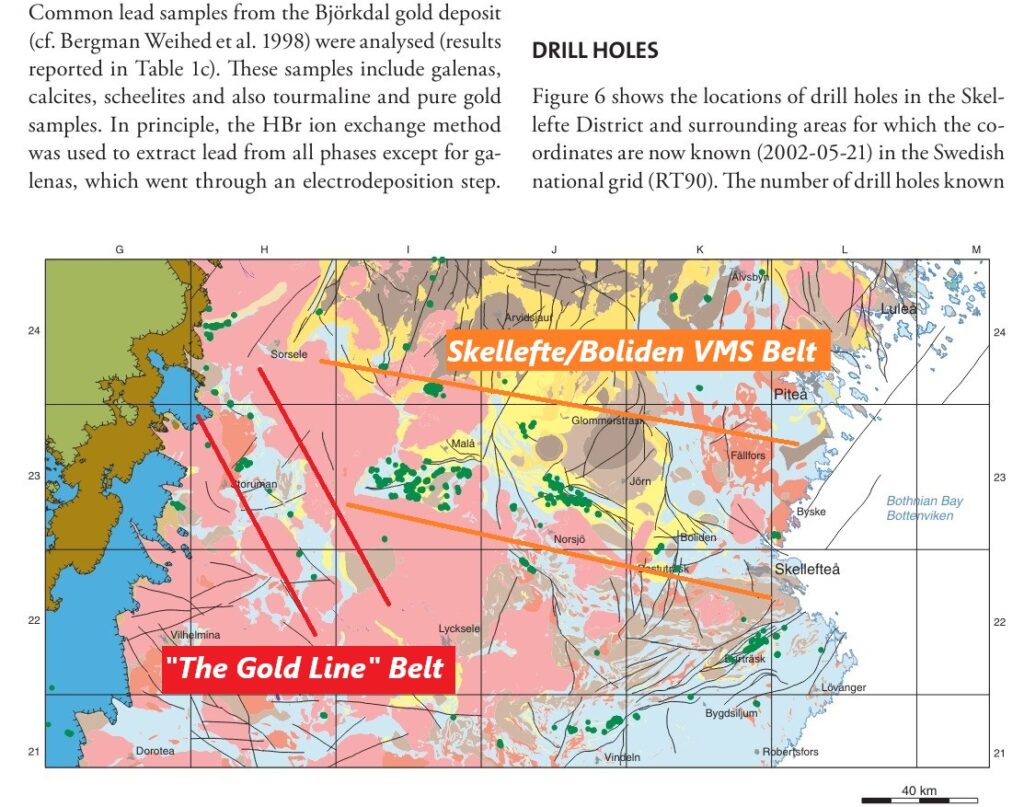

As 0f 2002, this is all the drilling (Green dots) in the “Skellefte” area, according to the national drill hole database:

(Note the only handful of green dots in the entire Gold Line greenstone belt)

… Most of the green dots (known drill holes as of 2002) were located in the “Skellefte”/”Boliden” VMS Belt which hosts some 30+ historic and currently operating mines in total. With >100 years of production and exploration one can definitely say that the Skellefte belt has seen a lot more exploration than the Gold Line belt. With that said, it was just announced on November 19 that the C$857 M company “Atalaya Mining”, is moving into Sweden:

Note that one of the two projects is a very large land package in the Skellefte belt. And here is a snippet from the company’s news release about the deal:

… If Atalaya believes that one of the longest mined, and most explored (in one way or the other) mineral belts in Sweden is ripe with opportunity due to the lack of exploration using modern exploration techniques, what does that say about how under-explored the Gold Line belt is…?

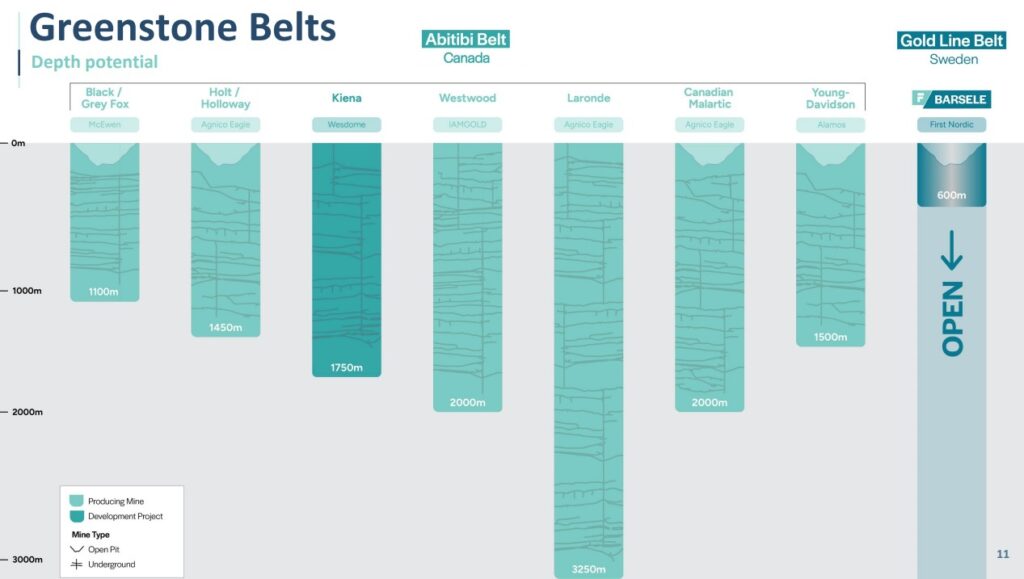

Nowadays you usually have to go to some really sketchy countries and/or to very remote areas in first world countries in order to have a shot at finding an undiscovered/under-explored gold gold district. So either one typically needs to take on a lot of jurisdictional risk or technical risk. In First Nordic’s case you have a very underexplored greenstone belt, in a tier 1 jurisdiction, with extremely good infrastructure and low costs to boot. If this was a non-remote greenstone belt in Canada, there would have been hundreds of thousands of meters of drilling done already, and there would likely be 6-10 companies sharing a 100 km stretch of land like in Abitibi:

(I added some of the multi-kilometer targets that are known so far in the Gold Line belt)

… I see juniors tout a sub 3,000 ha land package as “district scale” so maybe one should call First Nordic’s land package “regional scale”.

When Gold Resources Line ONLY had the 100% owned ,grassroot exploration ground north and south of Barsele, the company traded up to a valuation of $70 M (in a hotter jr sector) on the back of the “Aida” discovery holes. That might sound like a lot but again it is rather unique situation for a junior to control such a large, underexplored ground, with multi-kilometer targets. If one appreciates the value of owning one of the least explored greenstone belts, with extremely good infrastructure in a first world country, then one has to appreciate that nothing of this is priced into the stock when one accounts for the known Barsele deposit and the Oijärvi project/deposit.

What is a 100 km belt worth?

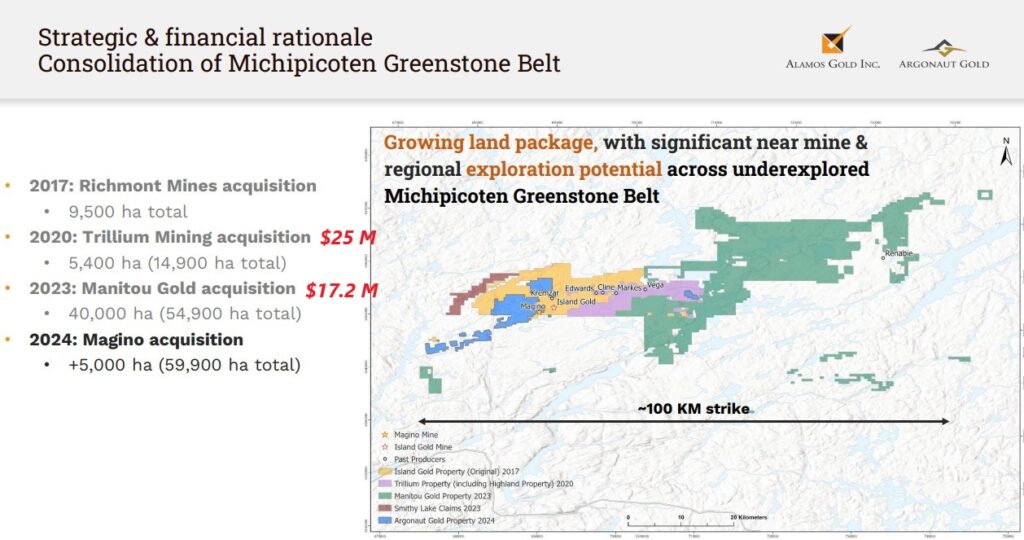

Alamos Gold had to acquire four companies, over many years, to put together a land package of 100 km of continuous strike. And Alamos paid $42.5 M just for the two juniors that had a combined 45,400 ha of grassroot ground:

… First Nordic has 100 km of strike as well but the grassroot ground comes with some very large, obvious targets already. And better infrastructure etc. The big miners seem to put a lot of value on large, coherent land packages that can allow for multi-decade mining and a lot of synergies. This move by Alamos is right out of Agnico’s playbook.

In the more advanced Finish gold rush you have multiple juniors, mid tiers, and even majors sharing a strike of less than 100 km:

(Note the scale bar)

Ps. Sweden has much cheaper holding costs than Finland.

What is 100 km of continuous strike, in an under-explored greenstone belt, with several large targets worth…?

To mining companies such as Agnico Eagle and Alamos Gold it appears to be worth quite a bit. In the case of First Nordic I do not think this is reflected at all when you subtract the underlying value of the Barsele deposit. My base case is that First Nordic will be acquired one day, and whoever might end up buying it will certainly account for the land package, when coming up with a number they are comfortable paying. I mean this is one of the more obvious price-to-value gaps aka opportunities in the case. Buying value for free, that someone (an actual mining company) will value, and pay up for later…

When Alamos bought Manitou Gold they paid a 95% premium to the market price. This of course means that, whatever price the marginal investor thought Manitou was worth at the time, Alamos thought it worth at least 95% more to them. And again, if we believe that the natural exit for First Nordic will be a sale to a mining company, our job is to appreciate what the market does not appreciate right now… But that a mining company will appreciate, and pay us for, later.