Buying Cheap And Waiting is All You Really Need to DO

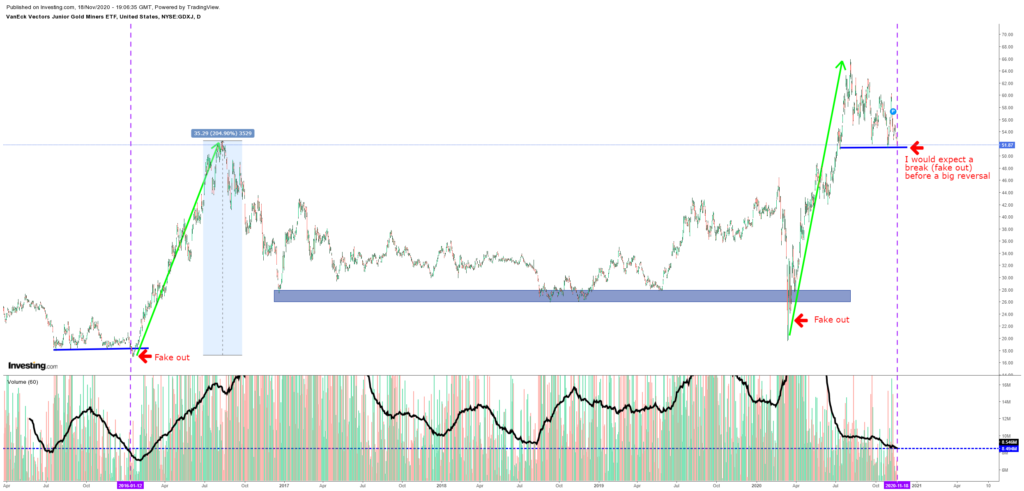

Flashback to 2015/2016: Portfolio went down 48% in just a few months during the bottom grind. During the next 8 months it went up 500% and the return over the 11 month period was 212% even though I obviously didn't pick the exact bottom. #Perspective #Gold #Silver pic.twitter.com/hlWMfYsRWy

— TheHedgelessHorseman

(@Comm_Invest) November 18, 2020

Moral of the story:

I just knew the juniors were cheap even before my portfolio went down 48% further and I increased my buying relentlessly on the way down while most people parted with their shares of companies at beyond fire sale prices (like we are seeing right now). Then all I had to do was wait for sentiment to change (as it always does and always will). Buying severely undervalued companies is half the battle (perhaps the hardest part). Then one simply has to sit on ones ass and do nothing until the pendulum swings. Notice how I did a lot of buying not anywhere near the bottom, as evidenced by the 48% drop, but that it worked out extremely well in the end with a 212% return in less than a year. This would not have happened if I a) Sold my undervalued stocks to someone smarter than me, b) Did not increase my buying when more and more people panicked instead, and c) Did not have the fortitude and patience to then just HODL for almost a year…

It might sound very easy but per definition it is very hard to do. I bring this up because there is a smorgosbord of extremely undervalued juniors out there today. Given the current price of gold and silver I might go so far as to say that there might be better bargains out there today than in 2015/2016 on a risk/reward basis. Thus, I am fully invested and have been increasing my purchases in most of the stocks that have just become cheaper while nothing negative has happened in terms of company fundamentals. If price decreases while value does not it just means that a bargain is getting even better and the future returns will be better.

The fact that COVID and the assay labs have slowed down most companies in terms of news flow has resulted in a lot of gifts. Just think about it; Does the geology and value of a company change if the results takes say 2 months longer to come out? Of course not. Despite this simple truth many have been sold off because most investors are impatient and nervous. Other peoples mistakes can be your opportunity.

I see the gold, silver and mining bull as inevitable which makes it a lot easier to buy for me personally. I mean if company X is trading at $1, and I wholeheartedly believe it WILL trade at $4 one day, then it becomes really easy to get greedy and buy when it falls to $0.50. If I instead had low conviction, was nervous, panicked and impatient etc then I might sell everything at $0.50 because “It might go to $0.25!”. Well, it might also turn around at any point in time and if conservative fair value is much higher than where it is trading then you’re trying to pick up pennies in front of a steamroller. I simply can’t afford to say no to high conviction opportunities where I see lets say at least 100%-200% upside from a given level just because I am afraid it might get cheaper tomorrow and the future returns might go to 300% instead. Even 50% returns in a 12 month period is a superb result.

Be mentally prepared for things to get cheaper and make sure you understand what is happening:

Price is decreasing while value is not. Don’t start to think that the “market is right” all of a sudden and that for whatever reason the value has decreased and risks have increased just because a stock might go down 20% in a week. More than likely nothing at all has changed in such a short period. Same goes for 20% up of course. Assume that the market is totally clueless at all times and trust your own due diligence as well as judgement… This can be VERY hard to do during a panic but it is what will make the biggest difference to your returns in the long term.

Patience:

If you KNOW you bought something undervalued then all you can do is wait. There is no point in looking at your portfolio every day. It’s just a waste of time. It’s better to buy cheap, check up now and then to see if something has changed (fundamentals, price vs value etc) and just be productive with other things instead. YOUR JOB is finished as soon as you have done your due diligence and made a decision to buy. You looking at a screen doesn’t make the company work faster, the results to get better/worse or the stock to revalue quicker. When you buy a company you are buying a piece of that company’s labor and value creation skills. Let them work while you do something productive instead…

That is the perfect storm in terms of personal value creation: Work for/on yourself + Other people working for you at the same time without you needing to do anything

In 2016 there was abysmal volume during a multi month zig-zag grind that was followed by a short break of support which created the final flush from already fire sale prices. Given the valuations in the junior sector I would say we are well into fire sale territory already. And with volume being abysmal again, while we are nearing an obvious support zone, I think some larger players might do the same trick… Break support and have the last weak hands part with their shares before we embark on an epic rally again. Just a guess…

I simply have a hard time seeing miners getting much cheaper than this. There is such an enormous amount of money on the table (alpha) that I gotta believe that some large players soon can’t wait to pounce. Even if there is 20% additional downside it is peanuts compared to where we will go to the upside in time. Anyway, I am prepared and I remember how a 48% downdraft turned into a 212% pay day in less than a year.

Note: This is not trading or investing advice.

Great post! I would love to see much needed for a lot of investors. My PF lost almost all the gains, I’m still in the green teritory but I’m prepered to go red , hopefully not 45%:) As I did my DD I chose to buy juniors insted of buying just physical gold and silver. I knew they can go easily 50-200% up and 50-75% down. But there is a BIG difference in knowing something and experiencing something.

I would like to add one thinkg. November is the first month this year when we have outflow from gold ETFs. I guess if majority of PM investors buy physical gold or silver it should accelerate and pump up the next leg up in this bull market. I’m not talking that all of us should buy several gold ounces or monsterboxes of silver coins. Nevertheless one should have at least 5-10% of investment in physical PM. So if someone has 10k USD in the juniors should definitely buy 20-40 American Silver Eagle Coins or 2-4 Silver Bars of 10oz.

Can’t buy anymore, I am fully invested. Wish I could. chris

It would be nice if NuLegacy finds a 60 million oz gold deposit while the other juniors go down 50%. Then I could sell NULGF@25 and buy the cheap ones.

Amen to that Bonzo