Commodity-Type Product

From Tao of Charlie Munger:

We are in a pure commodity business which means miner gets the same price, more or less, for their products.

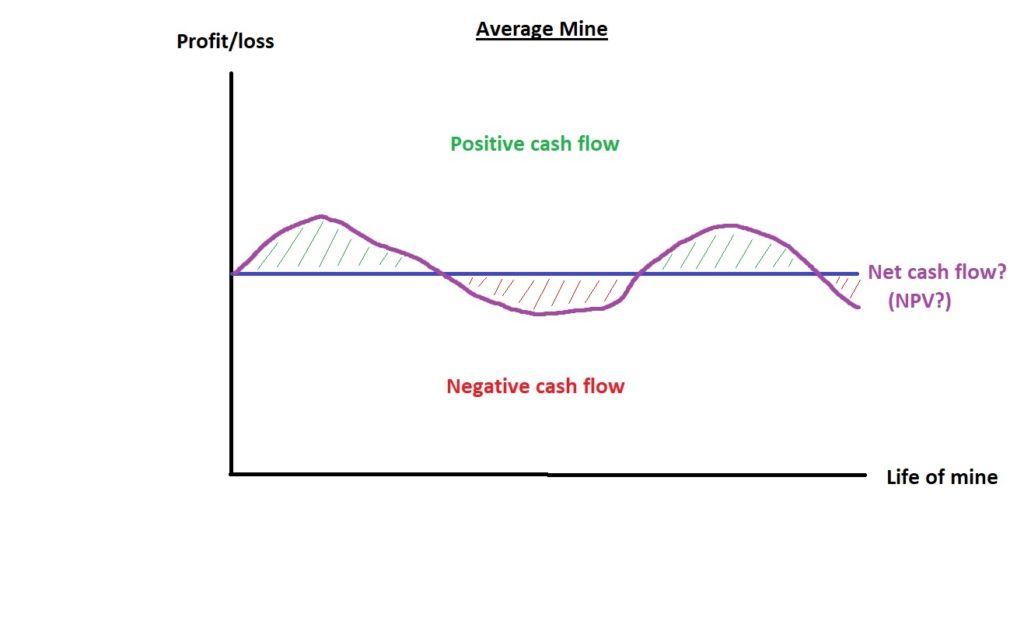

The average miner will do well in the good years, but terrible in the lean years.

All else equal that would perhaps be OK, but in this business the inventory of product is limited and that precious inventory gets depleted in both the good and the bad years.

If there was an average mine that had a mine life of 10 years and produced during a 5 year bull market, followed by a 5 year bear market, then the mine could very well have produced little to no net cash to shareholders before dying of old age.

In that scenario the NPV of the mine would have been negative in hind sight, even if it was a 5 Moz deposit that produced 500,000 ounces per year.

If that wasn’t bad enough it is typical of large miners that want to grow to go out and purchase growth when time are good, and when the bear comes around it will be obvious that the miners paid $3 for every $1 in value at the end of the day (over a full cycle).

Compare how extremely different the value is between these mines:

- Average Mine:

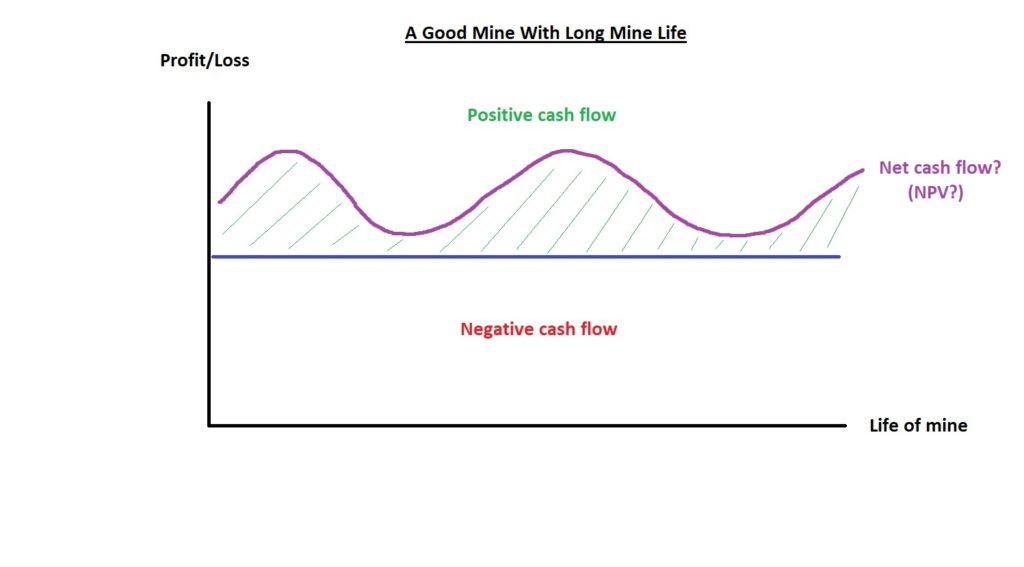

- Good Mine:

The average mine, no matter the size or annual production profile, might have been worth ZERO or close to ZERO at the end of the day.

The good mine might have been worth a fortune at the end of the day.

… The value difference could thus theoretically be infinite even though both are MINES mining the same COMMODITY.

… This excludes any value added benefits from owning a positive cash flowing mine during bear markets when the entire sector is on sale.

The average mine forces you to be a trader, the good mine allows you to be an investor (HODL).

The only way for a miner to be good long term investment is;

- It does not need, or management is disciplined enough, to not overpay growth at a cycle high.

- The miner has a competitive advantage, which only comes from higher margins than the competition in a commodity business.

… Mine life will then act as a leverage to the competitive advantage, since having a competitive advantage will enable the miner to buy assets when no one else can afford, and the more opportunities for this the better.

One inevitable conclusions: Long mine life (more opportunities to be able to buy assets cheap) and a competitive advantage (high margin) is king.

… You might understand why I love the juniors I love.

Excellent!