Jurisdictions: Time to Really Pay Attention?

Setting The Scene

With the world economy and social fabric rapidly declining I have given a lot of thought into jurisdictional risk. For decades at at least the Western World has been rather peaceful and the economies have grown on the back of expanding credit. As a result of that, we haven’t seen any nationalization except for primarily some financial entities during the Great Recession. Furthermore, we have seen a Western World indulging in decadence and creating (IMHO) problems out of nothing due to the fact that humans are used to always “fighting” something. In places like Sweden, where there has not been a war for over a century, people have sought (made up) other battles to fight. The lack of “real” problems led to a fertile soil for Political Correctness to thrive. I remember reading stories about band aids being racist because they are beige and not in all colors that human skin tone can come in. I have read fat people being offended for either not fitting in or surpassing the weight limits of certain carousels. Virtue signaling has become almost an “occupation” and Social Justice Warriors are constantly looking for an “injustice” to fight. None of this (IMHO) nonsense, or at least trivial problems, would get any attention if REAL problems were evident…

Like we are seeing today. A global pandemic coupled with financial and currency markets in turmoil looks to be starting to crowd out the “imagined” problems in the West. Suddenly, we have real battles and wars to fight and the nonsensical battles against the color beige on band aids is starting to look rather trivial.

Food for thought: How many articles about Greta Thunberg have you seen lately compared to 3 months ago?

Macro Scale

We are not unfamiliar to seeing socialist nations in the third world turn to nationalizations in order to try and save a sinking ship. Some well known examples in modern times are the nationalizations in Zimbabwe and Venezuela. Not surprisingly it has not worked as hoped and both countries are worse off than they were before nationalization.

What I have been thinking a lot about lately is what might be in store for investors who are invested in precious metals mining equities now that the over leveraged Western World is getting a margin call. We have housing bubbles and pension bubbles that are just waiting to be pricked in a time when global trade is grinding to a halt and many countries are currently in the greatest flash recession ever seen.

What countries will still be relatively safe going forward?

Are the classical top jurisdictions as safe as always or will it change given that the developed world is the the one which has most to lose if the FIAT bubble implodes?

I mean if you are a poor African nation with little to no access capital markets and the GDP is mostly made up of basic goods like food, which everyone will still need no matter how rich or poor, then that country should be much less affected than a western nation which is built on paper promises (debt).

How was a small farming village in the middle of Africa affected when Lehman went under?

Not much I imagine.

How were people in the developed nations who had a lot of debt and financial (paper) assets affected?

A lot.

So again, what jurisdictions might be relatively good during a potential debt implosion or hyper inflation scenarios in the developed world?

Should the jurisdictions which get a lot of their GDP from producing hard assets be the safest since they might have less to loose than jurisdictions built on services?

Will the US, which is potentially the largest bubble of them all due to the country being accustomed to having the world’s reserve currency, have the most to lose and thus be riskier than “usual” during the end game?

Will countries with a trivial percentage of GDP coming from precious metals mining be safest because there is not much to nationalize or will they be the worst because the mining industry does not have a big lobbying arm?

Will the countries with Central Banks that have little to no gold be more likely to nationalize at least parts of the gold mining industry?

Or will the jurisdictional risks present themselves as per usual?

Lets say gold gets devalued big time. Maybe the central banks of the developed world which have at least some gold have just enough to not want to nationalize parts of the mining industry. And maybe some gold producing third world countries will feel like they just won the lottery and start to greedily nationalize gold mines. Not perhaps because they are hit as hard as the developed nations but because there is an opportunity to make a quick buck.

On that note, we have seen headlines like this in the past:

“African nations should follow Venezuela’s lead and nationalize their energy and mining sectors to secure the resources to fight poverty, Venezuela’s deputy foreign minister for Africa said on Friday.”

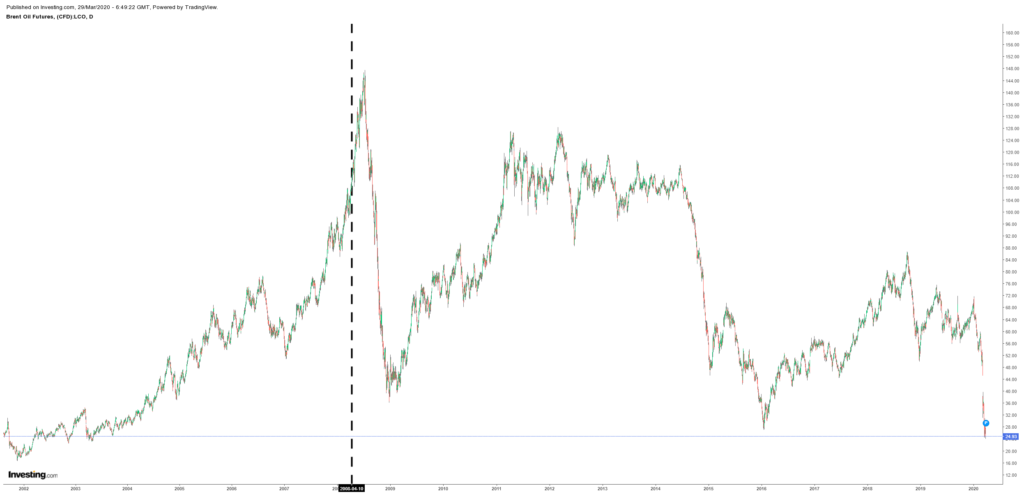

… On April 11, 2008, when Brent Oil futures were trading around $112/barrel for example:

When some governments find themselves suddenly sitting on a lot of indirect riches it seems to be hard to keep their hands in their pockets. The same basically happened in Ecuador when Kinross walked away from Fruta Del Norte in 2013, five years after having spent close to a billion in order to acquire the world class Fruta Del Norte deposit. At the time, Ecuador was pushing for a 70% revenue-based windfall profits tax. A lot has changed since then, including a lower gold price until recently, and Fruta Del Norte is up and running under Lundin Gold’s banner.

I still remember Thomas Kaplan’s relatively recent interview where he talks about the mining industry going “full circle” and that he believes the typical top tier jurisdictions such as USA, Canada, Mexico and Australia are going to get a way higher premium in the future and might even turn into a bubble within a bubble:

Kaplan might very well be right but we are obviously not there yet given the fact that gold miners overall are seeing peak disinterest at the moment. Anyway, imagine a future where gold is over $2,000 and gold miners are very hot since they are making money hand over fist as would be evident in future quarterly reports. Then imagine that the world is experiencing more turbulence than today and we see a flailing nation start to talk about nationalizing at least parts of a gold mine. The market would probably see this as the “writing on the wall” and proceed to sell off any precious metal miners that have operations in the country (better safe than sorry / sell first, ask questions later). If it then is starting to become evident that there is a “gold grab” sweeping certain areas of the world then we could quite possibly see a rush into miners located in jurisdictions where there have been little to no credible mumbling about nationalization… Thus even possibly leading to “bubble” valuations in some jurisdictions. Either way one would want to have the foresight to already be owning miners today, at fire sale prices, located in the jurisdictions that might see bubble valuations in the future…

But again, the question I am asking is what those potentially future “bubble” jurisdictions where investors get to keep their investments might be…?

Here is a LINK to the Fraser Institute’s Annual Survey of Mining Companies for 2019 for what it’s worth.

Micro Scale

I have also thought about the possible implications on a MICRO scale if the world economy continues to go down the drain. This ties back to my prologue about the “decadence” of the West…

Imagine that there is a mine in a (probably) rich western country that has been joining the modern trend of going as “green” as possible. Maybe the local community has been rich enough to say no to the perceived “barbaric and dirty” nature of having a gold mine nearby. Maybe the community has near full employment and everyone has a good standard of living and perceived wealth on the back of inflated house prices etc…

What happens when said community perhaps sees tourism drop close to zero, and the debt/housing bubble imploding, while a lot of people suddenly find themselves unemployed.

Can said community afford to say no the “inconvenience” of having a gold mine nearby with potentially a lot of suddenly high paying jobs?

What did Trump do in order to give a jolt to the US economy?

… He started eliminating red tape and streamlining the project review processes etc for the natural resource industry.

Would it be safe to say that some jurisdictions that have seen very good times and have indulged in catering to the “green lobby” might not be able to afford hampering mining companies to the same degree going forward?

Take New Zealand for example:

“Tourism comprises an important sector of the New Zealand economy, directly contributing NZ$12.9 billion (or 5.6%) of the country’s GDP in 2016, as well as supporting 188,000 full-time-equivalent jobs (nearly 7.5% of New Zealand’s workforce). The flow-on effects of tourism indirectly contribute a further 4.3% of GDP (or NZ$9.8 billion). Despite the country’s geographical isolation, spending by international tourists accounted for 17.1% of New Zealand’s export earnings (nearly NZ$12 billion). International and domestic tourism contributes, in total, NZ$34 billion to New Zealand’s economy every year.[2]”

If an entire industry is in an indefinite halt it means that there will be many people pushing politicians for new jobs and we know a single mine can bring a lot of jobs.

Or how about Fiji:

“Tourism is therefore a critical pillar of the economy. In 2012, it is estimated that gross earnings from the tourism industry was $1.3bn, which is about 17.8 percent of GDP. Visitor arrivals have continued to increase over the past 20 years. In 1993, visitor arrivals stood at 318,874 which increased to 660,590 by 2012, an average increase of around 4.5 percent annually.”

These are just two examples of two different countries that must be experiencing mass lay offs at the moment. The more people that are laid off, the louder the cries for job creating will become, and gold mining is one of few sectors that is actually flourishing right now.

Different type of jurisdictions to think about:

- Good rule of law/Small mining sector: Japan

- Good rule of law/Large mining sector: Australia

- Poor rule of law/Large mining sector: African countries

- Poor rule of law/Small mining sector: Probably some African countries

… How will the different types be affected in a global recession/depression? What are the best places to invest?

I think now is the time to really pay close attention to what paths any and all jurisdictions might take as this global crisis escalates…

Liberation of private business through cutting of red tape etc or the destruction of private business through confiscation/nationalization/outrageous taxes?

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Excellent food for thought…