Stop

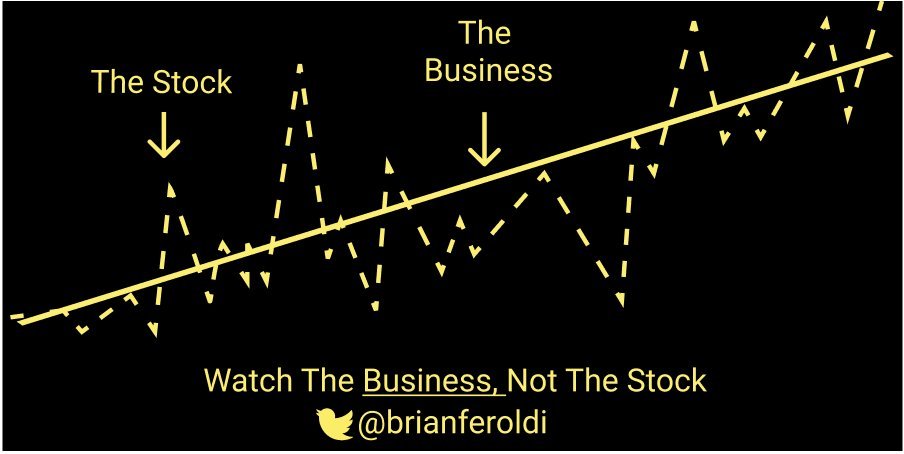

Stop reading so much into the movements of mining stocks during tax loss selling season following a 15 month correction.

Nothing has happened to your favorite junior except that there have been more sellers than buyers which drove PRICE down.

It’s easier to buy obviously undervalued securities if you just assume that the market is clueless and the seller is a troglodyte who will buy back the same shares at the highs.

Ask yourself if you are selling because you think the stock is undervalued or because you are afraid it might get cheaper (price going down)…

During sentiment lows coupled with tax loss selling it will almost always be the latter and as a long term value investor that is the worst reason there is.

The main ingredient for great long term results is to start by buying, not selling, low.

Robert J Moriarty

6:36 AM (2 minutes ago)

to me

I’m proud of him

bob

Easy for you to say, but when I’ve seen this carnage continue since 2008, the sense of being in a Groundhog Day scenario is prescient.

Why aren’t the CEO’s of these mining companies more proactive to combat this perpetual manipulation? I don’t see them taking pay cuts….

It’s only the shareholders who have been left holding the bag.

And when does this BS end? So many PM prognosticators exclaim, oh, when the physical supply of the metals runs dry, we’re off to the races. I call BS.

I’m a small investor trying to invest in what looks like solid companies. But I’ve lost well into 6 digits of my personal money…..

I guess I’m the fool

It doesn’t end. We are investing in manipulated markets. Only problem is that PM investors are in actively suppressed markets while general stock investors are in markets that the Fed is trying to inflate. I guess we are the dummies.

Partly true… gold and silver are indeed heavily manipulated. But the manipulation is also protecting the dollar. Who wants $10.000 gold when the dollar is dead? Thanks to investing in exploration stories all I do know is investing in exploration stories

Tim:

The cold hard truth is that >90% of miners will go up in smoke on a long enough time line. This coupled with record low interest for gold/silver and miners obviously does not help. In other words this sector is crap to begin with on average and we have had a lot of head winds. With that said the long term supply/Demand picture is superb and we are not finding many new good mines. If one get a few stocks correct it could pay for a lot of losers granted one is able to hold on through the inevitable swings.

Best regards