Welcoming a New Partner: Goliath Resources Ltd (TSX-V: GOT)

After watching Crescat Capital’s presentation on Goliath Resources I got very interested in this exploration company that I had personally never heard of before. The next day I had a call with Roger Rosmus who is Founder, CEO & Director of Goliath Resources to learn even more.

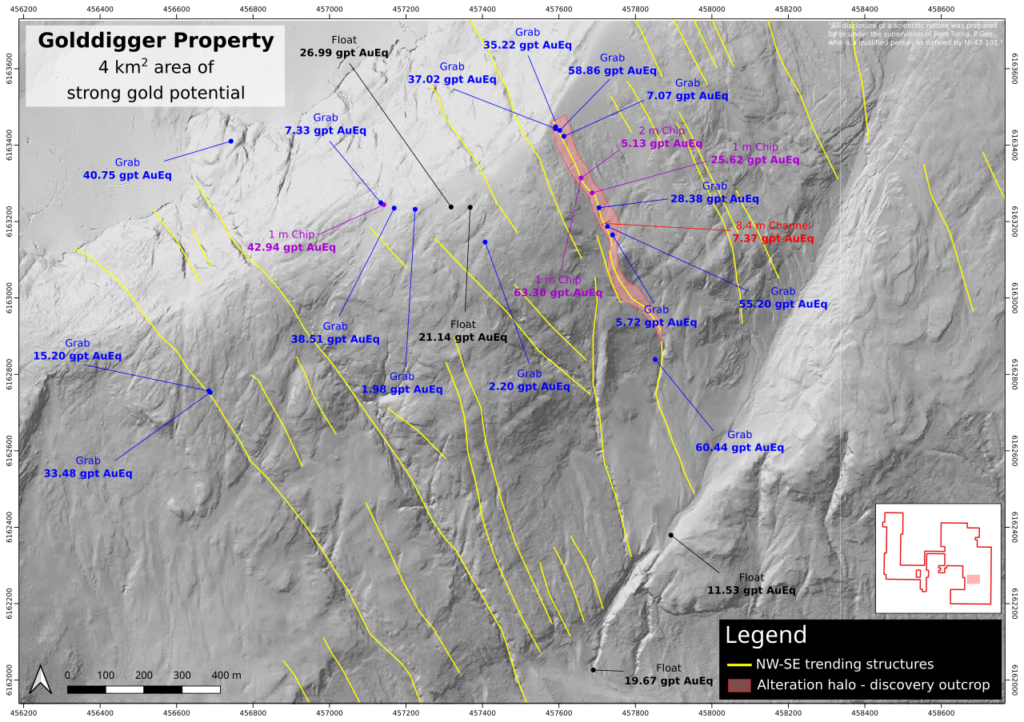

Long story short: The company’s Golddigger project might be one of the best looking early stage projects I have seen in a junior working in a tier #1 jurisdiction and with such a low valuation. I started buying shares within a day from learning this company even existed and was happy to get the company on as a banner sponsor for the win-win.

I think a lot of micro cap juniors would kill for the following conceptual target:

1000m strike X 500m height X 9.84m width X 10.68 g/t AuEq (7.59 g/t Au) with 1000m inferred down dip extension

… It’s not often a junior is able to de-risk inferred dimensions like that via direct sampling of the targeted structure.

Setting The Scene

Crescat Capital (Quinton Hennigh’s) presentation:

… This first conceptual target has the potential for over 1.7 Moz AuEQ as stated by Quinton in the Crescat Capital presentation. First off there is no guarantee that it will prove to be as good as it looks, but there is also no guarantee that the main zone will not extend farther at depth, nor is there a guarantee that there will not be additional zones of value:

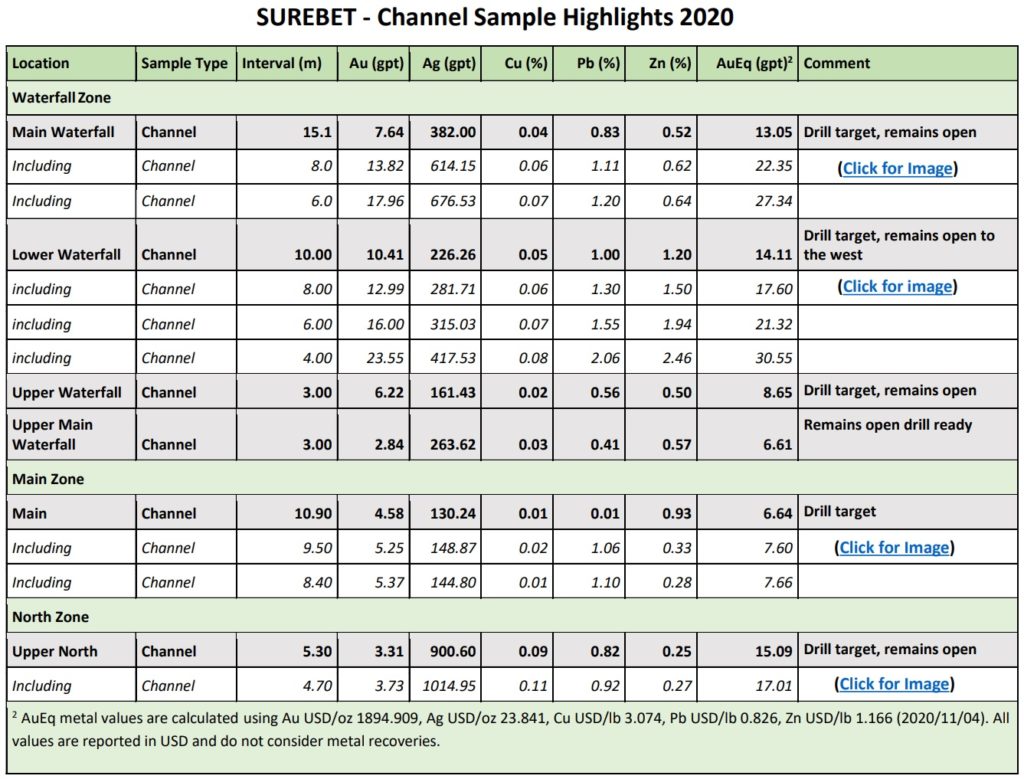

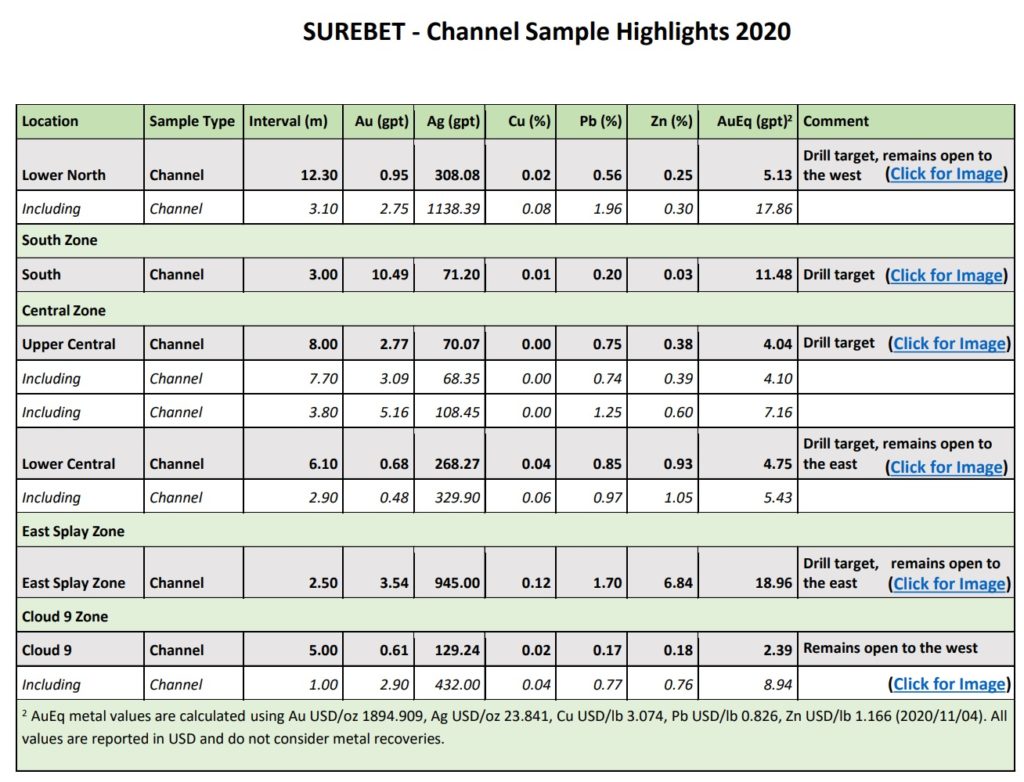

With a Market Cap around US$9 M at C$0.31/share (post financing), and an Enterprise Value of around US$7 M (post financing), I simply see it as a no brainer bet given what is already known about the Sure Bet Zone. One can look up the channel samples etc on the company’s website. Some examples of channel samples taken directly from outcrops along 1km of strike:

… There is obviously something going on here and just from a risk/reward stand point the current valuation looks silly to me since it’s crudely pricing in a 10% chance of finding something worth “even” US$100 M. Given the widths and grades shown on surface this looks like a potentially very robust system that could be quite economic if the thesis plays out. If things go well and the company is able to get similar numbers with the drill bit in the coming spring/summer then I think this will attract a lot of interest. The thought of de-risking a 1-2 Moz target in the heart of the Golden Triangle for starters sounds very attractive. All in all I think Goliath Resources is the company that I might be the lest shocked if it were to turn into a 5-10 bagger within 12 months (This of course assumes that they will get some good hits with the drill).

Even though I think the case (the risk/reward) is pretty obvious just from comparing what is known about the Sure Bet Zone and the valuation of the company I will do a longer piece in the coming weeks.

(Note: This is not investment advice. Always do your own due diligence. Since I own shares and the company has come on as a passive banner sponsor you should assume I am biased and make up your own mind. Junior explorers are very risky and can be very volatile.)

Best regards,

Erik Wetterling / The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

If you are interested in this area, check out CEE.TO/cey.ln Centamin – 15million ounces and an unstable wall that was discovered recently and sent them back to the drawing board. Stock is in the same shape as NVO and the gold hasn’t gone anywhere. If time is of the essence, I think you will find a quicker profit with CEE than with GOT. Time will tell.