Headwater Gold (HWG.CN): Newmont And Centerra Gold Backed US Focused Explorer Chasing Billion Dollar Prizes

I thought it would be timely to do a short update on one of my longer term cases which is Headwater Gold, the US focused gold explorer. With Trump likely to get back into the white house there might be a chance that the mining sector in the US might get a boost, either from easier permitting, and/or more capital. Personally I am putting more and more emphasis on jurisdictions nowadays and I would consider the US to be in the top given its history of protecting private property. Since this article is about an investment case it will of course include forward looking statements, speculation and everything in between. Consider me biased since I am a shareholder and the company is a passive banner sponsor as well.

Headwater Gold (HWG.CN) in short

- Insiders/management owns 30.8% of the company so they have huge incentive to make good decisions for shareholders

- Newmont is a 8.7% shareholder and is currently earning into the Flagship Spring Peak Project

- Centerra Gold is a fresh 9.9% shareholder.

- The company has #12 Low Sulphidation Epithermal projects: all located in the US

- Flagship “Spring Peak” project is in Nevada: Top tier jurisdiction (Permitting, rule of law & Premium)

- The company has $4 M in cash and the current drilling on the flagship Spring Peak and Lodestar projects are fully funded by Newmont

- The company actually posted a small profit for 2023 thanks to the management fee paid by Newmont

- The Market Cap is currently $15.9 M and this the Enterprise Value is only a mere $11.9 M

- … That translates to a per project valuation of $11.9/12 = $1 M per project

- And said projects were hand picked by people who got Newcrest, Newmont and Centerra Gold to invest so you know they are actually legit projects

- Any one of these could be a company maker and I think they already have one in Spring Peak

Upcoming Catalysts

Shareholders have around 10,000 meters worth of fully Newmont funded drilling to look forward to at Spring Peak/Lodestar and “TJ” is expected to be drilled shortly as well

Lets dig in…

Headwater is in the majority of the “HODL-folios” I manage for friends and family members because I think it is a cheap “fire and forget” kind of case. Not only does it have a discovery with tremendous upside potential given the current Market Cap but insiders own a ton of stock and have been shown to continuously work on finding new project (and discard the ones they are not satisfied with). Nobody has more to gain (or lose) than management and they will do everything in their power in order to see Headwater become a success sooner or later. As always, the only way to capture “Management Alpha” is through time held (of a stock). Oh and given the currently low liquidity, with very few shares up for sale, you pretty much have to have a longer time frame by definition.

And if you are able to attract Newcrest, Newmont and Centerra Gold it goes without saying that you have exceptional geological skill.

I mean when you see two very large gold companies betting on the same Junior you pretty much know by definition that it is a good bet (Albeit “high risk/high reward”)… Unless you are smarter than said companies of course.

I think the above alone is the only “elevator pitch” needed to figure out why it is cheap. Given the size of a project that a major would need it is pretty obvious that something does not add up. The market price is suggesting that there is almost zero chance that Headwater has a single project that will amount to much at all. Now I happen to think this sector is a joke most of the time when it comes to being an “efficient pricing mechanism” and is also why I think the junior sector is ripe with opportunities at sentiment lows. In contrast I don’t think the major miners are ripe with opportunity. Now I don’t like many early stage exploration plays right now but Headwater is an exception. Then again what other juniors have 12 projects, 1 discovery (In Nevada), Newmont Mining, Centerra Gold, very high insider ownership and cash while is selling for C$15 M?

Some Simple Math

To show why it is almost impossible for a junior like Headwater not to be undervalued I will give this example:

(Note that I have used a slightly higher valuation for Headwater because I started this article at a slightly higher Enterprise Value)

Newcrest Mining, now Newmont Corporation, have earn in deals on two of Headwater’s projects. If we assume that headwater only had these two projects it would mean that $13.7 M of potential is attributed to each of the four projects at face value. With a Major the size of former Newcrest (>$15 B) or let alone Newmont ($73 B) they would probably not care about a project with discernable potential of less than $2 B (Certainly Newmont would need projects worth at least a few billion dollars to move the needle). In case Newmont would earn in fully (By completing a PFS on a deposit with at least 1.5 Moz AuEq) into any of the four projects they would get 75% ownership, while Headwater would retain 25% of the project, plus a 1%-2% NSR depending on the project. Note that Headwater would be fully free carried all the way up until that point..

So knowing that conservatively speaking Newmont would need at least to see $2 B potential (In reality it is probably higher than this), and Headwater would retain 25% plus a 1%-2-% NSR (Worth lets say 5%-10% of the project), one could argue that a Newmont type success in the combined Spring Peak/Lodestar district is estimated to be around = $13.7 M / ($2 B * 0.35) to $13.7 M ($2B * 0.3) = 1.96% to 2.28% chance aka “no chance in hell” of finding the bare minimum of what the largest gold producer in the world would need to see…

And that is only if we account for the potential success at Spring Peak/Lodestar and forgetting about the many other projects.

It doesn’t take a rocket scientist to conclude that either Mr Market (The marginal retail investor) or Newmont must be somewhat braindead at face value.

With that said, there was some news out quite recently that stated that:

“The Company has received notice that Newmont has declined to continue exploration into Phase I of the earn-in agreements announced on August 16, 2022 after having met the minimum commitment required expenditure on both”

So Headwater will be keeping 100% ownership in both Midas North and Mahogany since Newmont elected not to continue what Newcrest had started at these projects. Maybe not the biggest chocker given that these two are both pre-discovery grassroot plays still and Newmont being much much larger than Newcrest. If this is necessarily good or bad is up to each investor to decide. Sure, it would be pretty sweet with #4 projects being drilled by Newmont of course, but down the line there is also the possibility that Headwater will drill them themselves and make 100% owned discoveries, at a time when perhaps exploration success is much more rewarded. I am of course implying that I do not think Newmont’s decision says that the projects have no potential since so few scout holes were even drilled.

On that note this is what CEO Caleb Stroup recently said in a presentation when asked what the milestones/catalysts might be for the stock to rerate:

“… Another big one that hasn’t necessarily… Made it through the markets yet… Is… There was a lot o uncertainty when Newmont acquired Newcrest… Whether or not their exploration program would continue in the same spirit as Newcrest set it up to… We have now demonstrated that they are… They are now funding… A bigger round of drilling this year than Newcrest did last year… Between Lodestar and Spring Peak… And we have doubled the land position so I think that sets a pretty clear message… To you know what we are thinking about this district…”

– Source

So again… Either Newmont and Headwater have no idea what they are doing when it comes to evaluating geological potential, or they do, and a depressed Mr Market is simply offering up a grossly mispriced bet.

Lets say Newmont believes that there is at least a 5% chance that Headwater will prove up another ~2 Moz Aurora deposit(s) at Spring Peak in the next 3-5 years and that it would at least be worth $2 B (Pretty much a minimum for Newmont I think). Headwater would in that case have 25% direct interest and a 1%-2% NSR with a combined implied value of 0.3 * $2 B to 0.35 * $2 B = $600 M to $700 M. With a 5% chance o success the risk-adjusted value range would thus be 0.05 * $600 to 0.05 * $700 = $30 M to $35 M which is around 100% higher than the total Market Cap of the company. If a 15% chance of success would be deemed more probable then Headwater could arguably be worth $90 to $105 M today on a risk-adjusted basis (excluding the time value o money).

Note that I am NOT saying that just because I think the market is seriously undervaluing Headwater that one will therefore automatically make a lot of money in Headwater. I am suggesting that an EV of C$13.7 M is way too cheap for one Newmont funded discovery + 10 projects that are 100% owned. And in turn that would mean that in case Headwater becomes a homerun then shareholders could get paid a lot more than they “should”.

What the company is looking for in these #12 projects…

Namely Low Sulphidation Epithermal projects…

I find that quite few investors fully understand these types of deposits but thankfully they can be extremely valuable…

The Silicon Project: Bulk deposit

AngloGold has shown that despite the low hanging fruit in Nevada might have been plucked, there exists potential under cover, as their recent tier 1, >12 Moz Epithermal Silicon/Merlin discovery proves:

Now this is an absolute world class, lower grade, bulk, open pit mineable deposit and there are no guarantees that Headwater will find something similar. Still it shows that there is indeed potential out there to discover new, multi-billion dollar, low sulphidation epithermal projects in Nevada.

SilverCrest’s Las Chispas: Narrow, high grade veins

As I explained in my first article on Headwater Gold I think the company might be especially cheap because almost no retail investor has an idea just how valuable Low Sulphidation Epithermal deposits can be. That is kind of understandable given that the bonanza veins that were discovered got mined, and forgotten, a long time ago. Today there are juniors that are drilling out the remnants of some of these deposits where some bonanza veins were missed and/or the lower grade zones that the old timers could not mine.

But there is at least one recent example of how valuable a high grade Low Sulphidation Epithermal deposit can be and that is SilverCrest Metal’s Las Chispas mine in Mexico:

As you can see in the slide above it is a High Grade, Narrow Vein Underground mine and it is indeed a Low Sulphidation Epithermal System:

Below is a Long Section showing the assay results found in the higher grade zone of the Babicanora Vein:

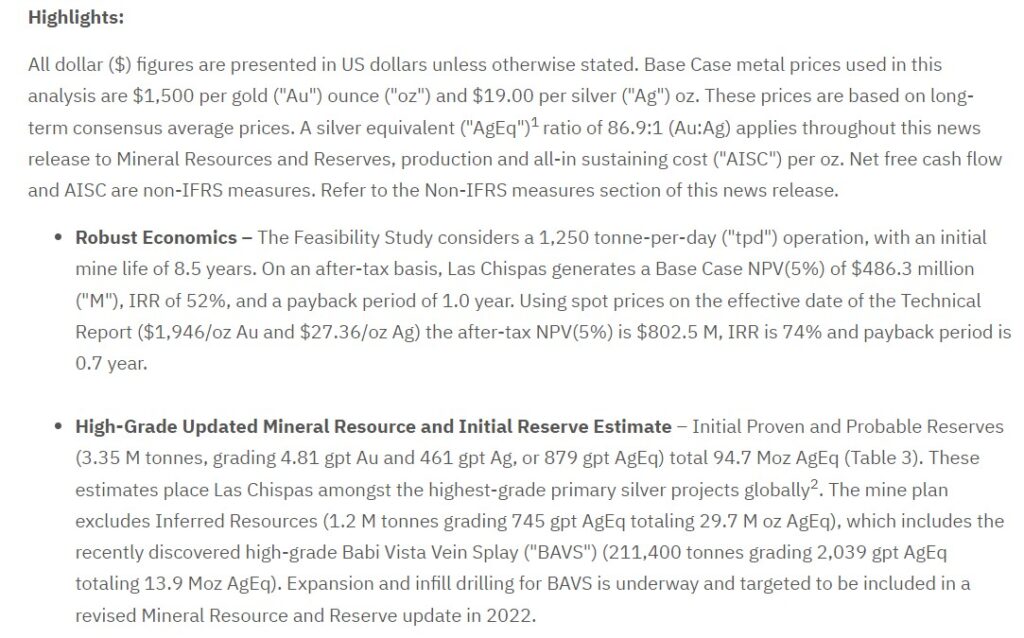

The grades are calculated AgEQ grades based on a Gold/Silver ratio o 75. Today the Gold/Silver ratio is 84. Below are the numbers from SilverCrest’s Feasibility Study done in 2021:

… Note that the economics were done assuming a gold price of $1,500 and a silver price of $19 per ounce of metal. I would also note that the mine plan was based off a Reserve Base that translated to around 1.09 Moz AuEq at the time.

Today the mine has a steady state production of around 10 Moz AgEq per year which roughly translates to 119 Koz AuEq per year and a total Mineral Reserve base of 78.6 Moz AgEq (~936 Koz AuEq). There is obviously exploration potential that could very well increase the mine life significantly but my point is that these low sulphidation epithermal deposits don’t need to be big, and can yet be worth a lot, as evidenced by the recent announced that Coeur Mining is set to acquire SilverCrest Metals for around $2 B:

“Coeur Announces Acquisition of SilverCrest to Create Leading Global Silver Company“

The SilverCrest success and final transaction is a good example of just how valuable these types of systems can be. Las Chispas is not a large volume mine with decades of production on the books and still it ended in a $2 B payday.

Bottom Line

Low Sulphidation Epithermal projects can be worth billions of dollars and success can come in different forms; Big, bulk deposits like Anglogold’s Silicon and/or smaller high-grade like Silvercrest’s Las Chispas. Other examples are the famous Midas and Aurora mines which are located in Nevada.

Make no mistake about it. Headwater is indeed looking for billion dollar deposits.

US focused project portfolio

As mentioned earlier in the article all of Headwater’s projects are located in the US:

As I also mentioned earlier I have gravitated more and more towards first world jurisdictions lately. Partly because the increased turmoil in the world overall seems to have increased fear along with the prices of many metals. In turn the value of any metals deposit obviously goes up and I would really like to keep all the metals that a holding might find…

Besides, there might be no other place on earth where success is valued as highly as in Nevada (Where the first discovery is located). Acquisitions by Orla Mining (Pierre Lassonde) and McEwen Mining (Rob McEwen) of gold juniors in Nevada recently are testaments to this.

Headwater’s Spring Peak Project

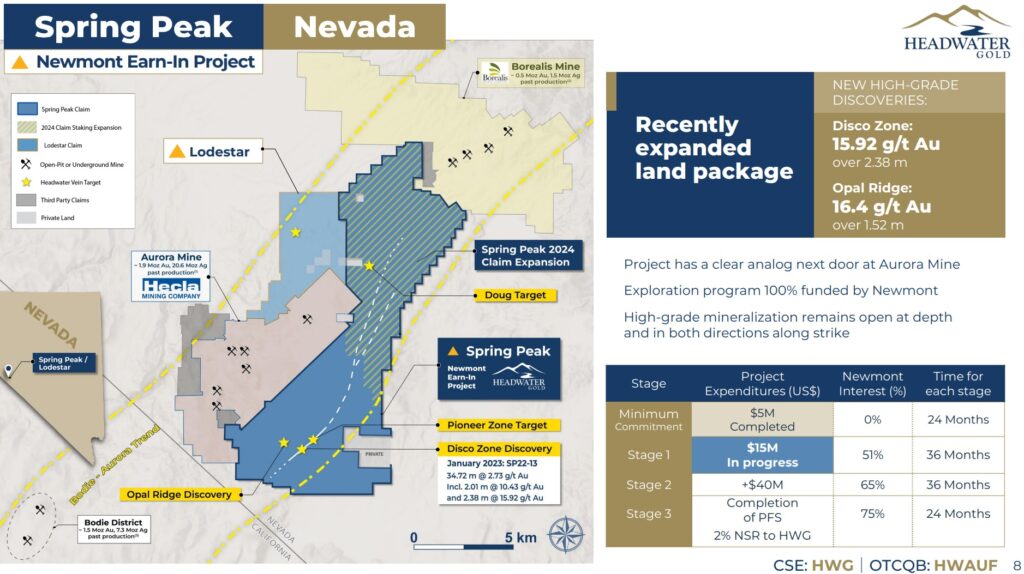

One should consider the Spring Peak/Lodestar projects, aka the Spring Peak District, to be the flagship project given that it is already a discovery and is being funded by the largest gold company in the entire world. I am of course talking about the $88 B behemoth known as Newmont Corporation (who can earn up to 75% interest).

Caleb Stroup: “You know we are looking for big things… We are looking for big gold deposits… For tier one gold deposits in Nevada.” – Source

Headwater has truly amassed a district land position in the Aurora mining district. With the most recent land acquisition the company controls a land package that is around twice the size of Hecla’s Aurora project. North-east, along strike, we find Borealis Mining which is a junior that is backed by Rob McEwen and Eric Sprott…

(Note the scale bar)

You do not necessarily need a lot of strike to find something of significant value and thus there is of course a lot of blue sky potential in the picture above. And this is not a pre-discovery project. No, discoveries have already been made and I expect the company to keep producing good hits:

I think the Spring Peak/Lodestar district certainly has billion dollar potential. Sure, Newmont could earn up to 75% in that case but 25% (+ NSRs) on a potentially Newmont sized project would obviously be a very very big deal or a C$14 M company.

The company recently announced that it has staked two additional 100% owned, and royalty free, low sulphidation epithermal projects in Nevada:

… And with that NR Headwater’s US based portfolio has grown to #12 projects.

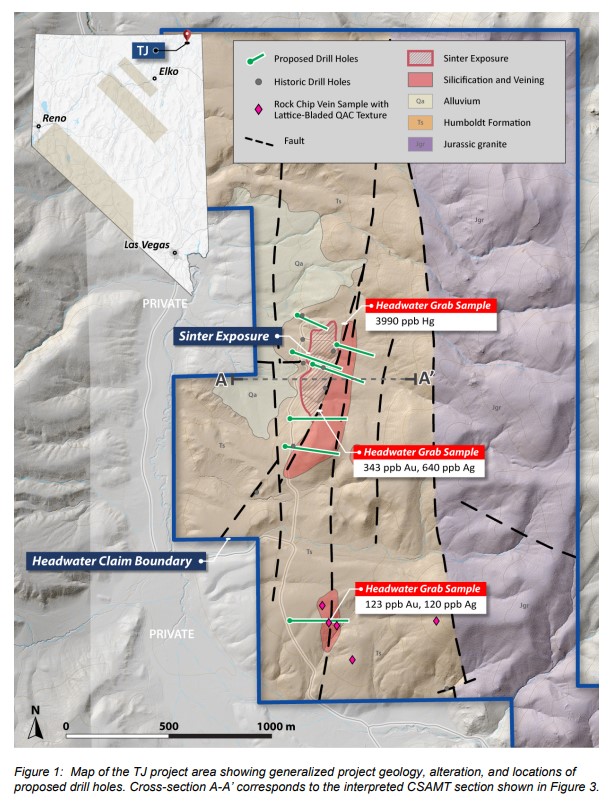

The third most recent addition is the “TJ” project which appears to be a very high priority target as per the latest news release: “Headwater Announces Drilling Plans for the TJ Project, Nevada”

Some snippets from the NR:

Caleb Stroup, President and CEO of the Company, states: “We are very excited for this upcoming drill program at our TJ project. Following the results of our recent CSAMT survey, this project has immediately moved to the top of our list for self-funded drilling. The project shows remarkable similarities to our Spring Peak project, also in Nevada, where we have discovered a new high-grade epithermal vein system.

Again, insiders own a ton of stock and can’t trade, so wherever they put money in the ground needs to have a good reason for it. If I had to guess I would think Centerra Gold mainly got into the company based on their 100% owned projects like TJ since Newmont already has claim to Spring Peak/Lodestar. I don’t know what the chance of success is here at “TJ” but what I do know is that the company would not drill this with Centerra Gold money unless the team thought it had company maker potential.

Threshold For Success

Nevada sports some of the lowest grade open pit, heap leach operations in the world. There are several projects that are making good money on around 0.5 gpt gpt and there are operations with much lower grades than that. One recent example I stumbled on was the Florida Canyon mine that belongs to Florida Canyon Gold Inc (Which is now set to merge with Integra Resources). Anyway the Florida Canyon mine is an open pit, heap leach operation in Nevada which has Probable Reserves of 86.6 Mt at a grade of 0.33 gpt for a total endowment of 930 Koz. Furthermore, according to the company’s website it is also an Epithermal deposit:

“Florida Canyon is a large, relatively young epithermal gold deposit adjacent to an active geothermal system. The close spatial association with the geothermal system has led to a general belief that Florida Canyon is a hot spring-style, epithermal gold deposit” – Source

My point is that even though the prize we are looking for is a multi-million ounce, high grade precious metal system that could be worth a few billion dollars, it is still good to see that one could actually build a mine on both a small tonnage but high grade discovery and/or a larger tonnage but very low grade discovery. Why this is important for shareholders is because it is not necessarily a binary outcome such as “If we don’t find 2 Moz of high grade gold we have nothing”. Ps. There is a certain neighbor a stone’s throw away that also has a spare mill (Hecla).

Upcoming Catalysts

Shareholders have around 10,000 meters worth of fully funded drilling to look forward to at Spring Peak/Lodestar and “TJ” is expected to be drilled shortly as well:

Chart

Not much to say but appears it has broken out of a resistance line…

Note: This is not a buy or sell recommendation. I cannot guarantee the accuracy of the information in this article. Always do your own due diligence. Assume I may buy or sell shares of either company at any time without notice. I own shares of the company and the company is a banner sponsor. That makes me biased!