THH – Homerun Resources (HMR.V): Two major trends & two major competitive advantages

Note! This will be my first written article explaining why I am invested in Homerun Resources. I briefly discussed the stock first on Yotube. I own quite a bit of shares of Homerun Resources and the company is a (passive) banner sponsor. Thus consider be biased and always do your own due diligence. This article is highly speculative, subjective and includes forward looking statements. There is absolutely no guarantees in investing and any investment can go to zero. I cannot guarantee the accuracy of the content in this article.

I will mostly focus on the inherent competitive advantages that I see Homerun enjoying and why I think it means that Homerun has a pretty good shot at developing a profitable business. The theoretical Blue Sky scenarios are too complex and speculative for me to really be able to quantify in any meaningful way so they will not be of focus.

Recommended reading/listening

- Technology Breakthrough – Homerun Resources CEO Interview with Brian Leeners

- The Future is Here – Homerun Resources CEO Interview with Brian Leeners

- Post on CEO

Two major trends – Two major competitive advantages

Macro Trends

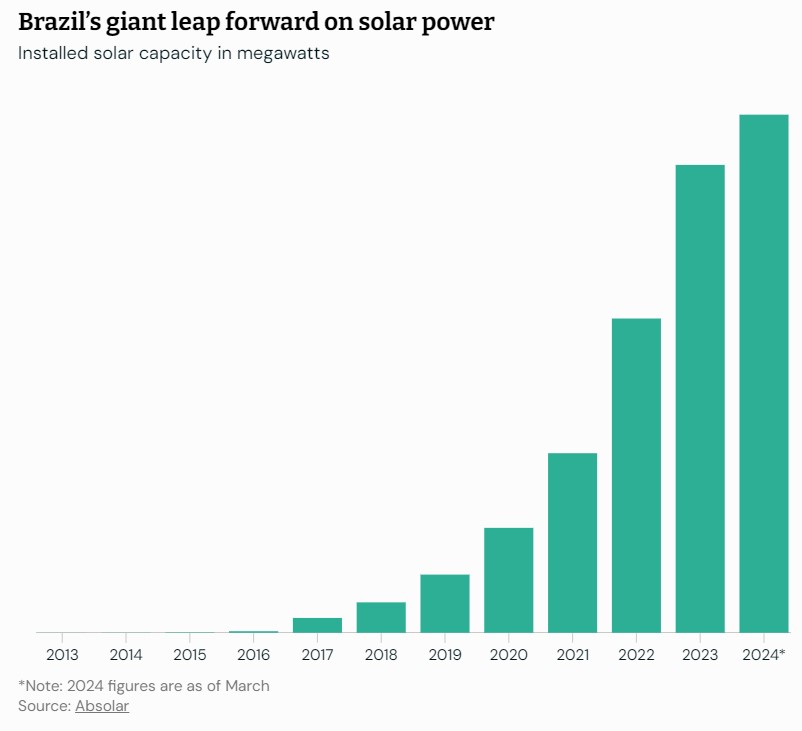

- Global trend towards solar, Green Tech and rise of computing

- Brazil’s big bet on solar and Green Tech

Key value drivers

- Two Major competitive advantages (Higher Margin & Market Share potential)

- Proximity to the booming Brazilian solar & Green Energy sectors

- Exceptionally high grade silica deposits

- Potential break through with (green) laser processing for production of 99.999% silica

- Top of the value pyramid

- LOI with Si&Mex

- I think that alone could be a “company making” deal

- Diversification & Vertical integration (Multiple avenues for upside optionality)

- Several types of end products

- Several partnerships

- Ease of start-up production/cash flow

- The silica sand deposit starts at surface and would be a simple, low cost quarry operation

- Pace of monetization

- I think there could be one or more company making catalysts materializing in just the next 0-18 months

Catalysts

The news flow is expected to be heavy in the coming months and I expect there to be surprises on on top of known catalysts with high potential such as;

- News on the Si&Mex LOI progression

- News on the new Laser processing technique

- First cash flow expected in Q4 of 2024

- ???

The next 0-12 months could be very interesting.

My Case In Short

Why I really like the Risk/Reward opportunity in Homerun Resources is due to several reasons. First of all I think the Risk of total failure ought to be quite low given the inherent Competitive Advantages in the form of a) Proximity to the booming Brazilian solar & Green Tech sectors and b) The exceptionally high purity of the deposits. These two factors alone ought to make sure that Homerun can outcompete many competitors and gain market share, for a multitude of products, while being profitable. I simply don’t see this combination of factors not leading to something that has tangible value.

Assuming the transportation cost alone is a major cost driver for foreign solar glass suppliers it could mean that Homerun can undercut competitors while still enjoying higher margins than most. Add the exceptionally high purity of the deposit(s), which also ought to mean potential for higher margins, and one can surmise that Homerun ought to have a solid foundation to gain market share. Speaking of which I think the recently announced LOI with Si&Mex is proof of the expectations that Homerun could potentially supply the planned 5GW solar production facility with cheaper solar glass compared to other foreign suppliers (Like the Chinese).

As for the upside potential I find it very hard to quantify. I do not pretend to understand all the potential use cases for high grade silica or what the value potential could be in case the green laser processing can be commercialized and/or patented. To sum it up I think there are multiple avenues for upside potential in Homerun already in the works in light of the different partnerships etc. I also think there are many more avenues for upside potential that I don’t even have a clue about. The most important thing is that I do think the Si&Mex LOI will translate to a definitive deal that could make the current valuation of Homerun look cheap. In that case all the other potential, and blue sky potential, becomes optionality I am not paying for anyway. Potential I am not paying for is infinitely better than potential I am already paying for because if I am paying for it to whatever degree it means I am taking on valuation risk.

The Solar Angle Alone…

- Glass and silicon are the largest inputs in solar by weight and value

- Homerun’s silica purity allows immediate use in glass and the company is working on the silicon

- Brazil is betting big on solar and Homerun’s deposit(s) are located in Brazil

- Competitive advantage #1: Proximity to the Brazilian solar industry

- Competitive advantage #2: Purity of the deposit(s)

- … Both margin and “ease of market share capture” advantages

… This to me is the low hanging fruit. The semi-margin of safety that is mostly founded on the simple, inherent, fixed benefits of Location and Purity.

Even Shorter Case

I think Homerun has a pretty low risk of total failure in light of the inherent competitive advantages given the context (Brazil’s Green Bet), has high potential relative to today’s valuation just from the Si&Mex LOI translating into reality, and all the numerous other avenues for value creation would in that case be free optionality. All in all I think the Base Case of selling the silica in its Raw form (a pure commodity business) might alone be enough to have a positive outcome from here. In that case there would be a lot of free upside optionality left, starting with the Si&Mex LOI.

My bet: I think Homerun is worth more than the current Market Cap and could be worth a lot more.

Macro demand opportunity – Brazil

Solar power is booming in Brazil. Can it be a boom for all?

“…Solar is now Brazil’s second-largest source of electricity”

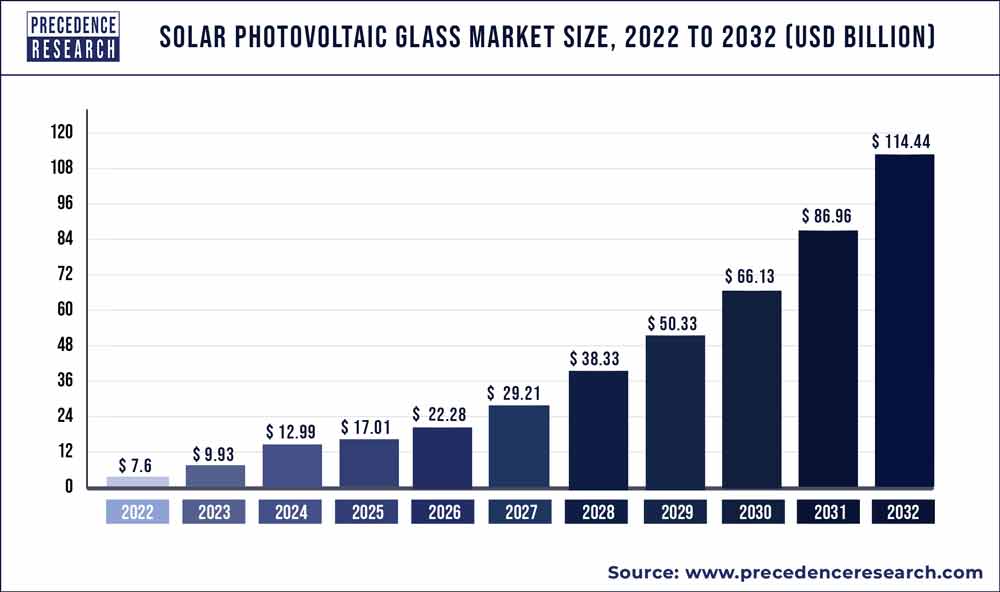

Macro demand opportunity – Solar glass usage

Projected future solar glass demand according to this 2023 report

The Chinese Giant

Proximity – The first major competitive advantage

Any trade where transportation costs make up a significant portion of the cost it naturally means that proximity to a supplier is a natural competitive advantage. If it costs me $100 bucks to dig up a large rock, and it costs another $100 to transport it to my customer, my break-even (lowest accepted selling price) would be $200 per rock. If person A finds similar rocks next door to my customer he has a competitive advantage over me, and can drop prices all the way down to $100, and make me go out of business. Person A can also sell agree to a lower sale price than my $200 per rock because his break-even cost is $100 since there is no $100 in added transportation costs. If person A decided to sell rocks for $145 a piece he would make money, and the customer would get lower input costs relative to doing business with me, who needed to get paid $200 per rock in order to supply it. In other words person A could get as much business as he wants by simply dropping the price at least $1 lower than what my minimum sales price would be and he would still make good money on his business at 25% lower prices than what I was selling for.

Homerun does not only have a starting purity advantage relative to most, but could undercut most if not all competitors, thanks to the shorter transportation distance (lower transportation costs). Location is not something that can be changed. The deposits are where they are and if one is lucky to have a silica sand deposit closer to customers than other silica sand producers it is a competitive advantage all else equal.

If solar glass sells for $1,000/t from China with 50% of it being transportation costs then that could give Homerun a lot of margin optionality. Lets for example say that the Chinese suppliers break-even price is $1,000/t ($500/t to produce the product and $500/t to transport it) and it costs Homerun $500/t to produce the same. Then lets say the transportation costs for Homerun, per tonne of product, is $100. The break-even price for Homerun would thus be $600/t which means that Homerun could undercut the Chinese suppliers all the way down to $600.1/t and still be making money. Any customer ought to happily want to partner with a company that can provide cheaper input prices. Especially if said input is one of the largest cost drivers of the final product…

Solar panels – Mostly Glass & Silicon

‘What’s in a solar panel? By weight, the typical crystalline silicon solar panel is made of about 76% glass, 10% plastic polymer, 8% aluminum, 5% silicon, 1% copper, and less than 0.1% silver and other metals, according to the Institute for Sustainable Futures.’ – Source

CEO, Brian Leeners:

“If you look at a solar cell the two biggest components of that solar cell are polysilicon and the glass… And we have a product that immediately is glass… We don’t have to process it… You just throw it in the furnace basically speaking… So we have a product that already can fill that glass mandate and now we’re working on new technologies to create a product that is not dirty in its processing that can fulfill the other mandate which is the silicon side” – link

If Homerun were to sell solar glass for $600/t which is much cheaper than the alleged prices of the Chinese then it would be a win-win for both the customer and Homerun. The customer would get significantly lower input prices and Homerun would get a willing customer that is probably ecstatic to save $250/t on solar glass.

Key value drivers

- Brazil investing massively in green energy and solar

- Homerun’s high purity silica deposits being located in Brazil where the demand for solar and green energy investments are booming

TL;DR: If you and me both sell the same product, have the same production costs, but I was closer to the customer in a business where transportation was a big added cost driver, then I would still have a much better business just by having my production closer to the customer.

“… Obviouslt what I just stated is a big benefit… The other is…You know the plan is… That we will have very close proximity to where they will be located…” – source

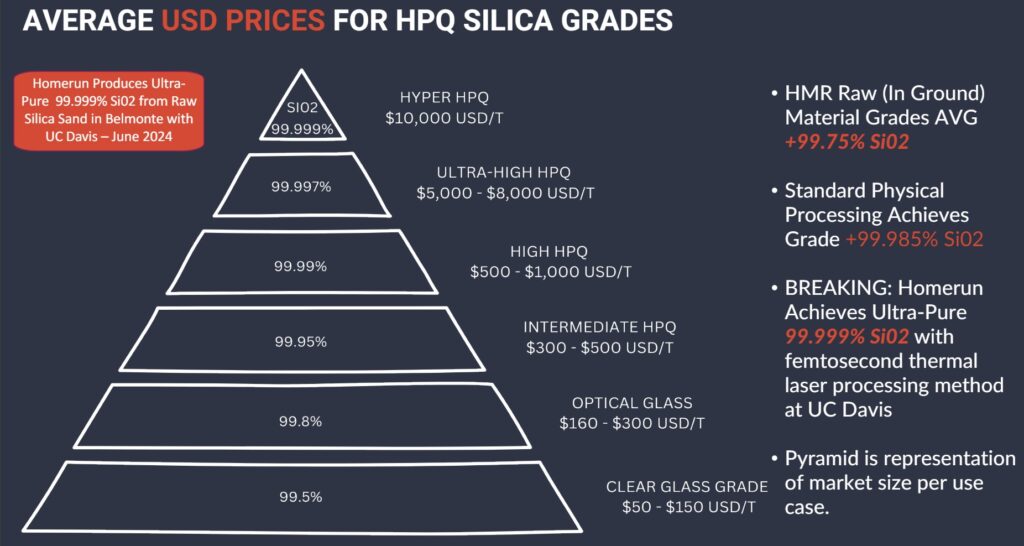

Purity – The second major competitive advantage

Not only does Homerun have a built in competitive advantage simply from the location of the deposit(s) but the company is also spoiled with having exceptionally high purity silica sand to begin with. This competitive advantage is pretty easy to understand. Below is the value pyramid from Homerun’s presentation:

… The higher the purity, the higher the value.

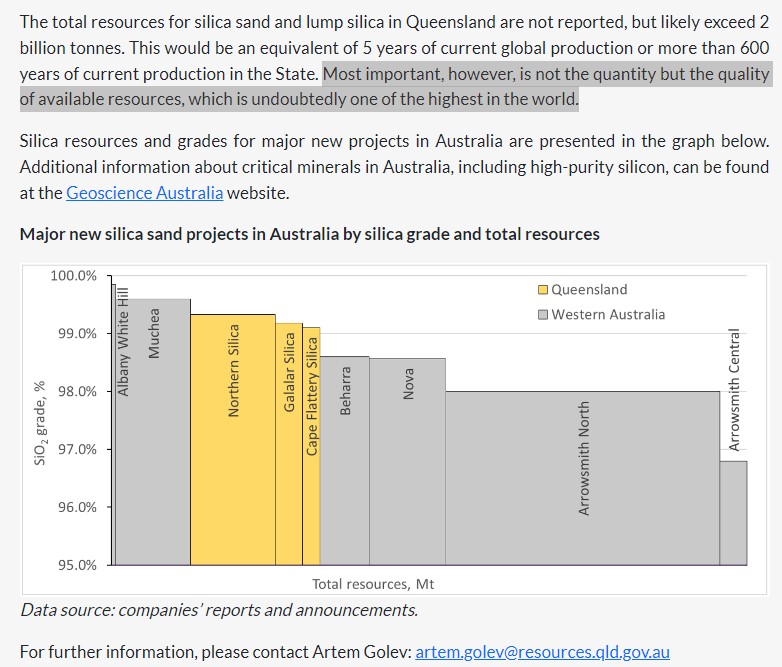

If I start off with a higher purity than a competitor then I will likely have a competitive advantage, because it costs my competitor more to reach a certain purity, all else equal. Homerun’s average, raw (in ground) purity is 99.75% which stacks up very well compared to for example some Australian silica sand deposits:

In other words Homerun has a competitive advantage relative to most silica sand companies because their raw, starting purity is exceptionally high. The higher the purity the less steps and costs ought to be required in order to reach even higher purities and thus higher values per tonne.

Homerun’s Raw, in ground, material averages 99.75% in purity. Compare that purity with the table above and one realizes that only one of the Australian silica sand deposits rivals that purity (and perhaps would have equally as low processing costs to reach the purity required for use in optical glass manufacturing for example). BUT even if the costs were similar to upgrade it to a given grade, it is not factoring in any of the transportation costs, which could be significant if the customer is in Brazil for example (The first major competitive advantage).

“To find what we have in Brazil sitting on the ground… At surface… Is an anomaly… It literally is an anomaly on this planet” – link

Brian on undercutting the competition due to “zero processing cost” – link

Combining the two

The beauty of these natural, inherent competitive advantages is that they cannot be engineered away. Chinese suppliers cannot relocate their deposits closer to Brazil for example and the purity of any deposit is not changing anytime soon. The proximity advantage is of course tied into the fact that Brazil is turning into a major solar and green energy hub. If Homerun sprung up 15 years ago, when these circumstances were not present, then the case would not be as good…

- If there was no solar boom in Brazil then Homerun would have the natural advantage from its exceptional purity, but the margin potential from said advantage could be lessened, in case the silica had to be transported a long way.

- If the purity was not exceptional, then there might be a pressure on margins if some competitors with higher purity could suffer higher transportation costs and still undercut Homerun.

- If there was no solar boom in Brazil and the purity was low then it would potentially be very hard for Homerun to gain any market share and have a business worth much due to transportation costs.

When you combine the current Boom in Brazil with the Proximity to Brazil AND the exceptional Purity… I think you have a perfect storm.

Right time. Right place.

Note that the discussion above is in mostly centered around the Base Case “Commodity” side of things. In other words I think this is key when considering the Risk side of things. The verticals would probably benefit a lot from these advantages as well but the verticals could be free optionality anyway.

If we jump a bit in one Vertical such as the production of Solar Glass, instead of just providing the raw material for Solar Glass, I visualize the potential value of the Advantages as follows:

In Summary

Firstly I think the “Commodity Business” Base Case is good enough to be positive on Homerun. I also think the Base Case has a relatively high chance of success (being monetized) due to the inherent competitive advantages. Lastly I think this combined with the multitude of known upside potential, from verticals such as the production of solar glass with Si&Mex, really puts the Homerun into the exceptional Risk/Reward category in my view.

Some other initiatives whose potential I have not even tried to quantify are;

- NREL – Energy Storage

- MOU with the Oman government

- Halocell – Perovskite vertical

- UD Davies – The green laser processing techniques

- … And more

The CEO has stated he wishes to one day see 2 Mt of production from Homerun’s silica deposits, and that maybe 1 Mt would be sold as a commodity, with the other half would be used in Homerun owned verticals. Again, why I like Homerun is because I think the inherent Competitive Advantages are enough to make sure that Homerun ought to have a valuable “commodity business” as a Base Case, and that the question would then be how much more value could be squeezed out of the sand, from different verticals:

As discussed in the intro I will not be diving deep on the many potential verticals and thus blue sky scenarios. Suffice it to say I view the Commodity Selling aspect together with the Si&Mex LOI to to be exciting enough already when thinking about the upside potential.

Just the LOI Si&Mex news contained a bunch of “food for thought” in that department:

Further partnership opportunities include:

- Joint Patents and IP in High Purity Silica Crucible manufacturing.

- Innovative Solar Module and Solar Glass manufacturing techniques.

- Optimization and development of new technology routes for glass applications in the Solar Supply Chain.

- Cooperative exploration of overseas opportunities.

Anyway I had some fun during the weekend and did a Spreadsheet to help myself wrap my head around the Risk/Reward. I only did crude scenarios for 500,000 t of annual production of Raw Silica (Good enough to be input in solar glass) and 365,000 t of annual production of actual Solar Glass (Based on the Si&Mex LOI). You can see what average selling prices and cost estimates I used. I also included a crude valuation formula based on 8 X the theorized EBITDA. It also included what % is priced in of both production scenarios on a fully diluted basis. Lastly, I took both scenarios and discounted them by 60% in order to get a “conservative” value estimate for myself. As always I do not want to need precision in a good case. I think a good Risk/Reward case should look good based on what I think are conservative estimates otherwise I don’t necessarily consider it to be a good case. Anyway I came up with a “conservative” value of around $8/share fully diluted (but excluding any further dilution):

… I might end up looking completely wrong on Homerun and end up losing my money. But all I can ever do is bet on what I think are good bets in light of the Risk vs Reward that I see.

Visualized this is the Price/Value gap I am betting on (With no guarantees it will be closed and a closing would happen over time):

Closing Thoughts

I think Homerun is worth something and probably will end up being worth more than the current Market Cap. I also think Homerun COULD end up being worth multiples of the current valuation in a year or two.

Note: Due your own due diligence. I do not share your profits or losses. All stocks are risky and can go down to zero. Do not invest money you cannot afford to lose. Assume I may buy or sell shares at any point in time without notice. Never invest money in a case that you do not understand.

/THH