I’m Still Very Much a Contrarian

Just thought it would be fun to see what an undisclosed Canadian “broker” thinks about my top 3 at this point in time. You know, just to make sure I’m still a contrarian.

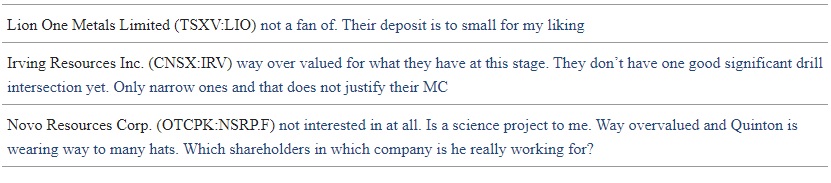

Here are the comments:

… Perfect!

Pretty in line with what I was expecting. Now, given that I don’t think this particular “house” has a stake in any of the shares above, I would assume that it is not really in their interest to sounds particularly bullish on them anyway.

My simplest forms of rebukes would be:

LIO: Not buying it for the current deposit but for the tier 1 exploration potential.

Irving: 21 veins intercepted in the first ever hole into a boiling zone within one out of three systems. Also, seems to be unaware of the whole business model (selling the silica in the surrounding rocks as smelter flux for $50-$100/t) which attracted the interest of Newmont and Sumitomo in the first place.

Novo: “Not interested in at all” might be the best contrarian signal yet. Basically meaning that he/she has no clue as to why Sumitomo Corporation would be interested and won’t even bother to try and figure it out. Probably forgets that his “hats” in NFG, KZR and E3 etc are directly related to Novo’s stakes in said companies to boot.

… These comments jive with those of MinTwit in general. Which I see as a good sign since it as per usual completely disregards the reasons for why I have them as my top 3. Exploration potential is not accounted for with LIO. Business model is not accounted for with IRV. And finally, no accounting for why one of the largest companies in the world would be interested in Novo. If the market isn’t accounting for it, then it probably means that not much of my upside case is priced in. This is exactly what I am striving for: Buying stuff that is not priced in with the hopes of reaping good rewards at a time when said stuff is beyond obvious and everyone finally agrees with me. With that said there are no guarantees that what I hope will take place actually takes place, but if I’m not paying much for the opportunity than the Risk/Reward becomes too good for me to pass up on. Hence, I’m betting heavily against MinTwit and this “broker”, who doesn’t look to have the faintest idea of what the investment cases really are all about for any of the three companies. I will either prove to be very arrogant and foolish or very brave and smart at the end of the day.

When the majority agrees on something then the path of least resistance is in the opposite direction.

When everyone “clearly” sees something, it means that it’s already fully priced and vice versa.

Note: I am shareholder in all three companies mentioned. Novo and Lion One are also banner sponsors. Do your own due diligence and make up your own minds!