THH – Inflection Resources (AUCU.CN): “ANT”… a Game Changer?

This article will discuss Inflection Resources in light of the new ANT technology being applied. I own shares of Inflection Resources and the company is a banner sponsor. Thus consider me biased. I cannot guarantee the accuracy of the information in this article. Always do your own due diligence. There will be speculation and forward looking statements. These are my personal views.

Re-Cap of recent events

- Oct 11, 2023:

- An “experimental” Ambient Noise Tomography (ANT) survey initiated at Duck Creek – Source

- April 8, 2024:

- The ANT survey completed by Fleet Space Technologies was considered successful and

clearly highlights several previously unknown features of interest in the prospective basement

sequence – Source

- The ANT survey completed by Fleet Space Technologies was considered successful and

- May 2, 2024:

- Early execution by AngloGold on converting “Duck Creek” to a Phase 2 target – Source

- May 29, 2024:

- Kincora secures $50 million earn-in deal with AngloGold Ashanti – Source

- June 12, 2024

- Inflection Resources and Fleet Space Initiate 1,800 Km² Ambient Noise Tomography Survey Across Portfolio of Projects – Source

- July 8, 2024

- “Fortescue just put together one of the largest tenure positions in British Columbia staking up 180 km (3576 km2) of the Quesnel Arc for porphyry Cu-Au.“ – Source

- July 9, 2024

- Barrick taps Fleet Space’s technology to advance copper exploration at Reko Diq – Source

Setting The Scene

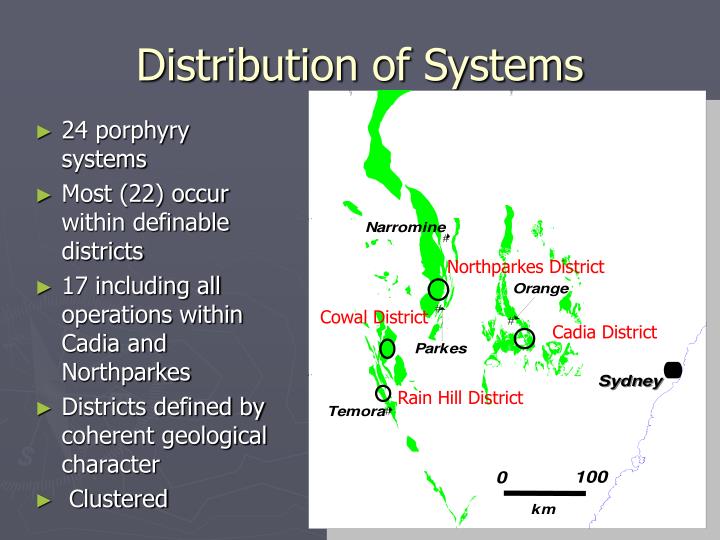

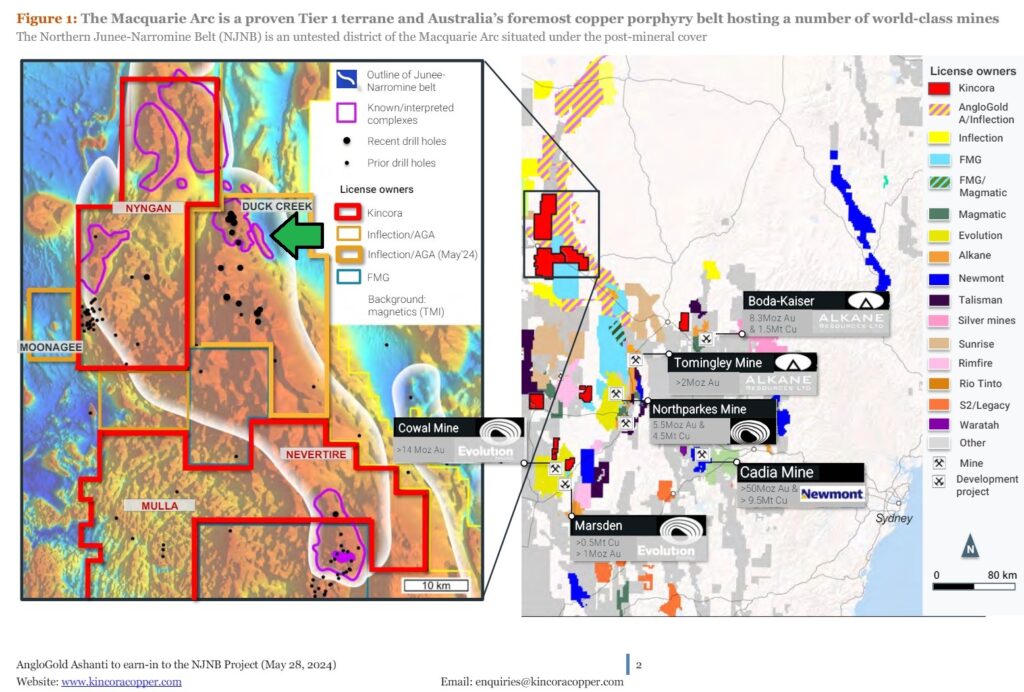

Inflection Resources is exploring for copper-gold porphyrys in the famous Macquarie Arc region of NSW, Australia. This part of Australia sports three world class porphyry systems (Cadia, Northparkes and Cowal) as well some some smaller ones:

… The green areas are different, prospective belts. The thing with this area is that the majority of the prospective bedrock is covered by a sequence of younger gravels which have seen little systematic exploration (For various reasons such as the obvious lack of outcrops, assumed drilling difficulties & geophysical survey challenges etc). In light of this all the world lass porphyry discoveries so far have been made in the parts of the belts that have little to no cover rock…

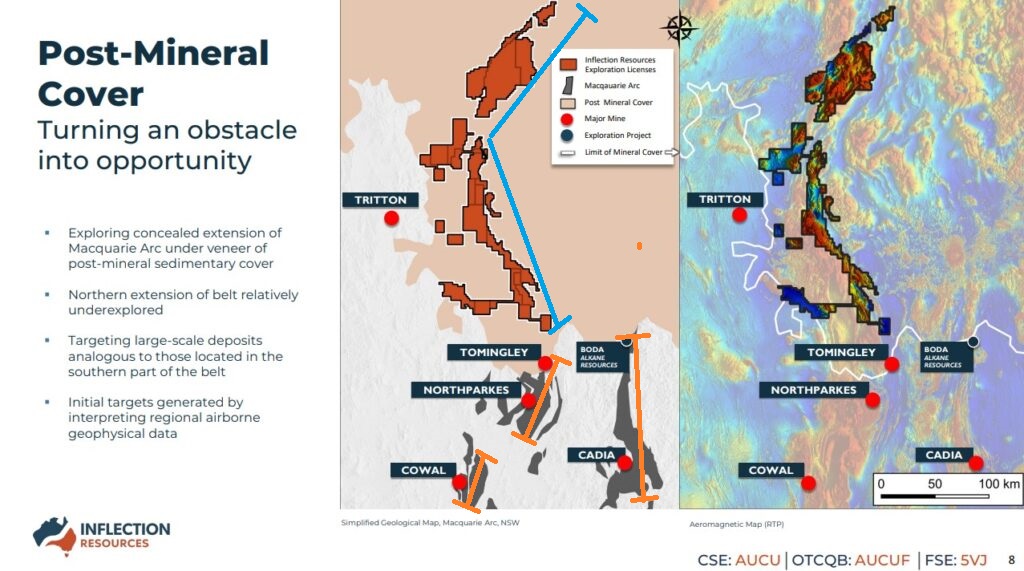

Note in the picture above how have far north the belt extends past the “Northparkes District”. And now look how relatively little of the prospective belts in that area are “outcropping” in slide below as well as noticing that these outcropping areas are already known to host three world class deposits:

(Drawing on the left added by me)

Now there is no obvious reason why the outcropping parts of the belts should be better than any of the sub cropping parts of the belts. For all we know the best parts of the belts might actually be located in areas where there is gravel cover. We can see that Inflection’s land package has a longer strike length than the combined strike length of the outcropping areas that host Cowal, Northparkes and Cadia. Assuming Inflection has indeed been able to mainly stake ground which does indeed host the extensions of these belts, just from a simple balance of probabilities perspective, one could argue that there could/should be at least three world class porphyry systems hiding somewhere within the land package…

Furthermore it is worth noting that Inflection has not just staked ground “willy nilly” but rather the staking has been guided by one of the most impressive technical team I have seen in any juniors. Not only that but the “filter” has been to only go after geophysical features/targets that the team belives have tier #1 potential. In other words they staked a massive 300 km of strike that covers areas where the geophysics suggests there is potential for BIG targets.

“We are targeting very very large copper-gold porphyries and that is an important point to really stress… The scale of the targets which we’re testing… We’re truly looking for tier one scale discoveries”

– Source

Macquarie Arc characteristics – Source

The deposits are not uniformly distributed throughout the volcanic belts and extreme clustering is evident at all scales. The location of the known systems is heavily skewed toward four productive districts. These districts occupy approximately 11% of the explored volcanic belts but contain 92% of the known systems. Two of the districts contain all of the known economic and feasibility stage systems. These districts can be distinguished to a certain extent from much of the remaining Macquarie arc, but no single or combination of features can definitively distinguish them.

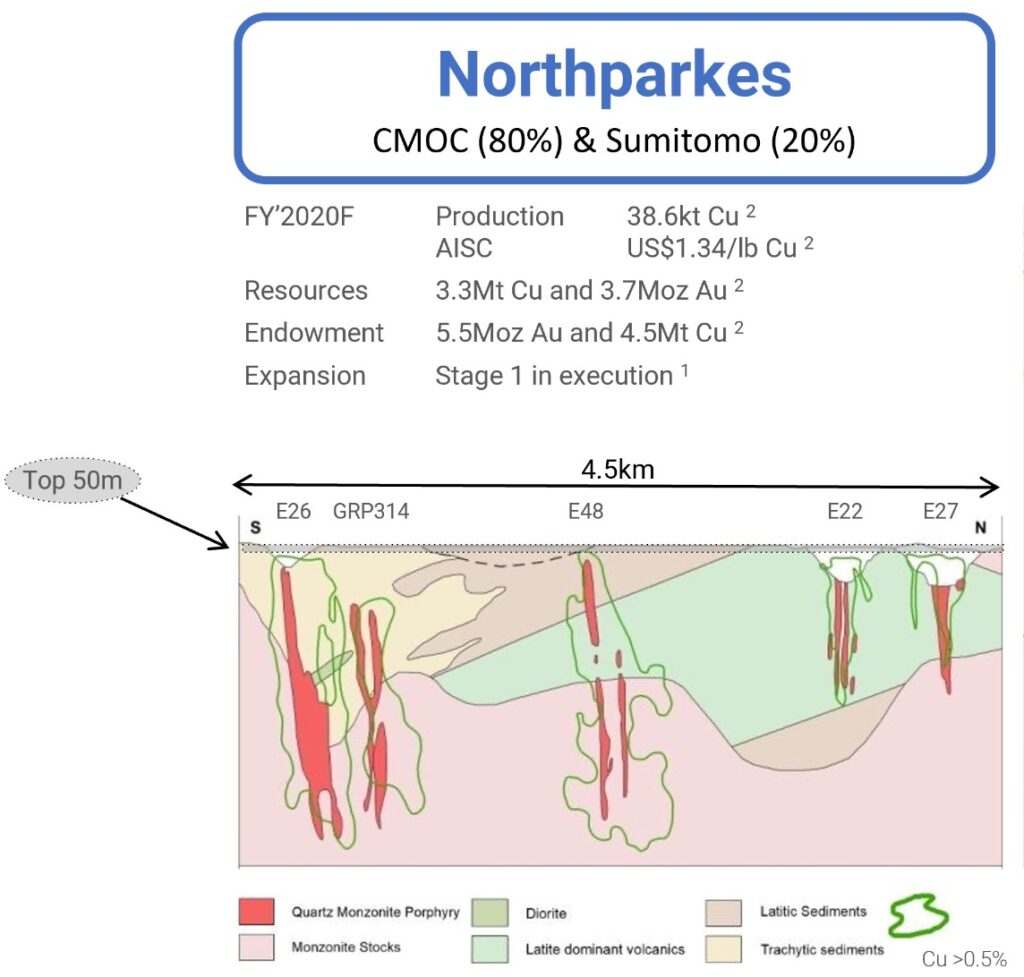

Northparkes and Cadia – Source

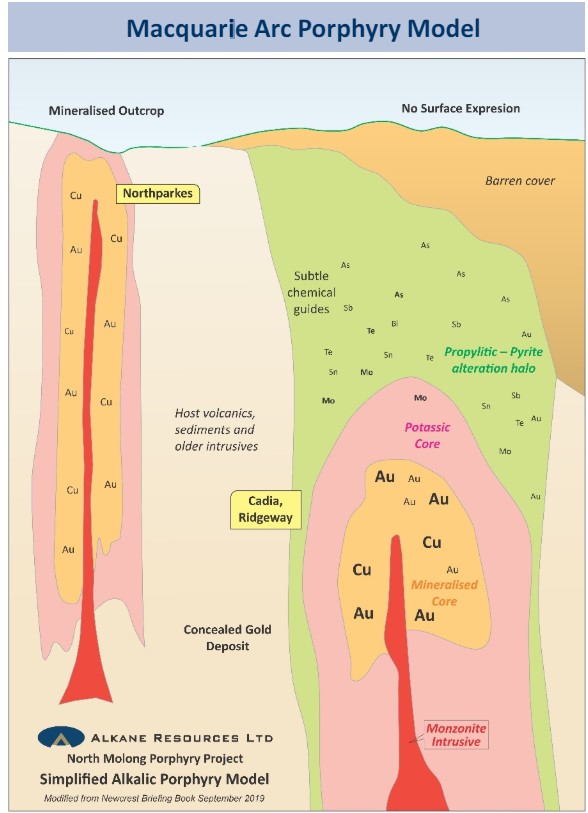

“Macquarie pencil porpheries”

Northparkes cluster of pencil porpheries (source):

Northparkes cluster of pencil porphyries top view (source):

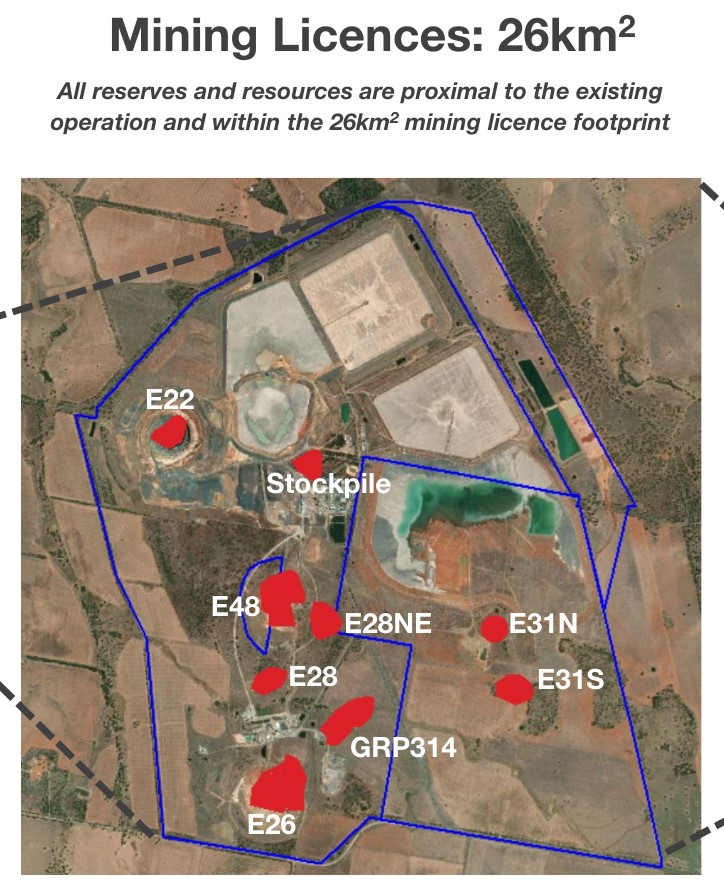

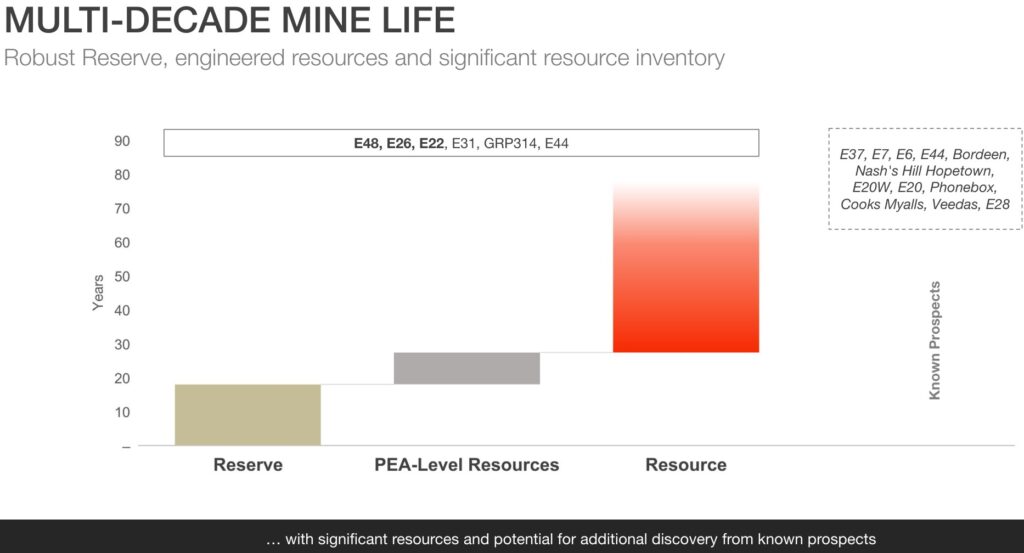

Northparkes – Possible a century long mine (source)

… This stuff is what makes me really excited… The idea of finding a generational discovery of porphyries which could produce metals for many decades or more. That is some exciting wealth creation. In contrast many lets say gold projects might have 10-15 year mine lives and that’s it.

Lets look at some core which suggests that Inflection might already be close to a discovery, at one of the 30 targets, called “Duck Creek”…

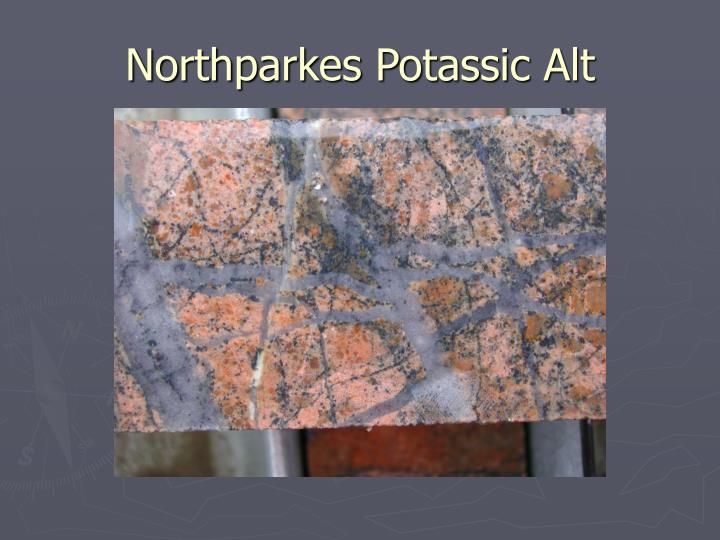

Northparkes Alteration:

Photo of Ridgeway core from the publicly accessible NSW Londonderry Core Library:

Some Duck Creek core:

… As the title says the drill bit has already proven there is “strong porphyry-type alteration”.

Ambient Noise Tomography (ANT)

Now to focus in on what this article was actually going to be about which is a new experimental geophysical technology called “Ambiet Noise Tomography” aka “ANT”. Below is the description from the inventor called Fleet Space Technologies:

ExoSphere streamlines data acquisition, processing, integration, and AI insight delivery into a single end-to-end solution. This enhances the quality, speed, and precision of onsite decision making with real-time access to AI-powered, 3D subsurface insights at scale. By deploying our smart seismic sensors, high-quality 3D Ambient Noise Tomography (ANT) data is processed into actionable insights by our satellites in real-time – radically simplifying data operations for remote onsite teams.

Another description:

“Ambient noise tomography is a way to get a subsurface image by using an ambient noise source. When we have multiple stations in an area, we can cross-correlate them to one another, resulting in an impulse wave. This impulse wave is called the Green’s function. With multiple green’s function covering a certain area, we can do a tomography to generate a subsurface image.” – Source

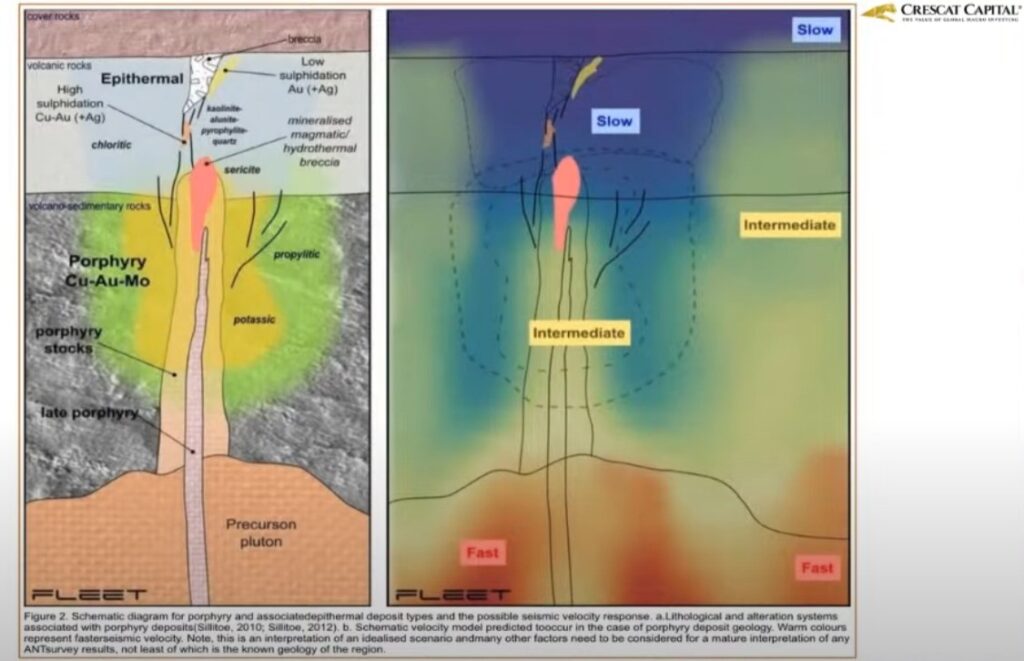

In short its a new geophysical technique that can generate a “seismic image” of the subsurface. The idea is that it could delineate a porphyry system since the core, halo and surrounding rocks would have different responses and the deposit model is known. Furthermore this might be especially impactful for Inflection given that the, at times very thick cover rock sequences, makes the usual geophysics techniques less effective.

Below is a short clip posted on Inflection’s Youtube channel:

The Duck Creek ANT survey

Since the Macquarie Arc is known for hosting “pencil porphyries” one would hope that the ANT survey would be able to generate seismic images that literally delineates such porphyry bodies. Well early indications are that it might actually work…

General geological cross section to the left and ANT readings on one of Inflection’s Duck Creek targets on the right:

(Note the obvious “pencil” shape surrounded by a “halo”)

… That indeed resembles one of those pencil porphyries if you ask me. One can also see a schematic on the left which is the theorized alteration/geology. Note that this is not a guarantee to be a pencil porphyry. Nor that if it is a porphyry that it will be mineralized since there can be different intrusion events (some might be mineralized and some may not). With that said Inflection has already confirmed very favorable geochemical/geological signs…

“Favourable hydrothermal alteration, interpreted to be associated with an alkalic copper-gold porphyry system has been intercepted in deeper drill holes in the Duck Creek target. Drill hole DCKDH017 intercepted an extensive zone of inner propylitic hydrothermal alteration dominated by well-developed fracture-controlled to pervasive hematite – epidote – chlorite ± calcite alteration with lesser and variable amounts of magnetite, tourmaline, actinolite, pyrite, chalcopyrite and locally, bornite mineralisation.” – Source

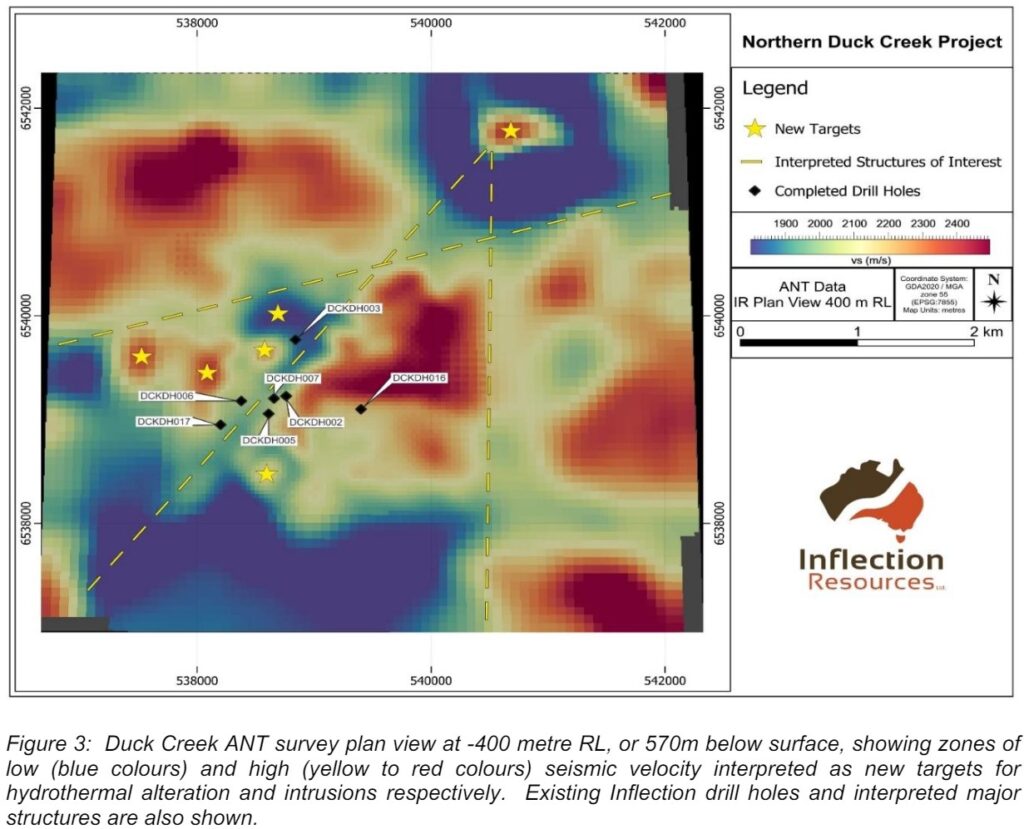

As per the discussion of Macquarie Arc porphyries, earlier in the article, they tend to show up in clusters as per the “Extreme clustering” characteristic seen in the belt. Well, the ANT survey at Duck Creek came up with a cluster of targets. Namely six of them…

Duck Creek cluster of ANT targets:

It is also worth noting that Fleet Space Technologies seem to put a lot of weight on the Macquarie Arc as well as their work with Inflection Resources…

Here is an article dated June 14, 2024: Porphyry Copper Exploration: Reflections From the Macquarie Arc

Fleet Space Technologies has even done a “Case Study” on Inflection Resources which can be accessed at their website:

Lets just say that I view this “promotion” of their work in the Macquarie Arc and Inflection Resources specifically as highly encouraging. If the company believed that their ANT technology was NOT showing promise I doubt they would do this type of “promotion”.

In Fleet’s Duck Creek Case Study one can read the following:

“The ANT provides compelling indications for the presence of kilometre scale intrusive bodies in the survey area. Several high velocity features above 3,000 m/s have been imaged at ~1.3km depth. As these occur in the geologically complex northeast trending zone, where multiple drillholes have intersected porphyry-style alteration, this zone may potentially represent an important control on mineralisation.”

… This is music to any Inflection shareholder’s ears of course. A cluster of very large “intrusive bodies”, aka potential porphyries, is exactly the type of world class potential that Inflection’s staking was guided by. Does this mean that Inflection is about to discover a Northparkes type cluster of mineralized porphyries? No, but there is obviously potential to do so given what has been seen in the core in terms of geology/geochemistry as well as the ANT survey suggesting the presence of kilometer scale intrusive bodies… Besides, Inflection has a total of #30 target areas to test, and we only need to get “lucky” once.

On that note some people might be aware that not long after the ANT results for Duck Creek were published Inflection allowed AngloGold to do an EARLY conversion of Duck Creek into one of the Phase 2 projects. Not much later after this Inflection announced:

… When you double down on something in a big way, after an initial test, it obviously means you think it looks to be working as you hoped.

Conclusions And Implications

- Macquarie Arc is known to have extreme clustering of porphyries which means that where there is one there should probably be more around.

- Inflection has already confirmed porphyry alteration and seen chalcopyrite and bornite in the drill core at Duck Creek.

- The ANT survey is showing at least one pencil like feature which rhymes with it possibly being a typical Maqcuarie Arc “Pencil porphyry”.

- The ANT survey highlighted a cluster of #6 intrusive targets which rhymes with “Extreme clustering”

If ANT works well and a discovery is made at Duck Creek…

- It should mean there are indeed more porphyries nearby (Implied multiplier impact affect from the first discovery)

- It could mean that ANT surveys will work in terms of highlighting pencil porphyries in the Macquarie Arc

… Which means that not only might the ANT survey help the company make ONE porphyry discovery but given the characteristics of the best it could also mean that there will be SEVERAL more discoveries since the district shows “extreme clustering”. Not only that but it may also turn out to be somewhat of a “silver bullet” in identifying porphyries at depth in at least this kind of environment/target type within the Macquarie Arc. Now given that Inflection Resources staked not only Duck Creek, but rather a 300 km long stretch of the northern extension of the belt, this could mean that a technical success at Duck Creek has extreme leverage to making more discoveries across the #29 known target areas.

Here are Quinton Hennigh’s thoughts on the ANT survey results from Duck Creek:

If ANT works AND one porphyry discovery is made at Duck Creek it ought to result in:

-> More discoveries nearby

-> Higher chance of success and quicker discovery cycle across the entire porphyry portfolio

In contrast, if there was no new technology like the ANT survey that helped make a discovery at Duck Creek, it would “only” mean that there should be more discoveries nearby but it would have less of an implied impact/leverage on the entire portfolio:

… With this in mind I think the recent move by AngloGold is very exciting:

May 28: “Kincora Copper: AngloGold Ashanti to earn-in to the NJNB Project” – Source

Obviously AngloGold were not willing to wait for an actual “discovery hole” before grabbing even more of the Covered parts of the belt with this deal. I think this move might both signal confidence in Inflection’s strategy to look for deposits under cover within the Macquarie Arc as well as (maybe) confidence that ANT might be a very efficient tool in the discovery process of said covered deposits.

Anglogold getting even more aggressive in the (covered) Macquarie Arc is not the only intriguing move that has happened recently. Less than two weeks ago I saw this tweet from Kingfisher Metals CEO:

(Yellow ground = “Chilcotin Basalt Cover”)

Note these comments by the CEO Dustin:

“… the majority of their tenures are covered with Chilcotin flood basalt cover. This part of BC (and further west on the Chilcotin Plateau) was covered by recent basalt eruptions similar to the Columbia River basalts south of the border.”

“It will be interesting to see if they are able to see through these basalts where no one has before – Do the Aussies know something we don’t? Maybe they will get Fleetspace to fly an AMT survey over the belt to model the basalt thickness and see if this is even viable.”

… So you have a major Australian miner with a Market Cap of $68 B all of a sudden stake a whopping 180 km of strike across the Quesnel Arc (Known for Au-Cu porphyries). But that is not what is interesting as an Inflection shareholder, but rather the fact that the majority of ground staked is covered by a basalt cover, that apparently has made this ground a “no go zone” for porphyry explorers. If this is prime porphyry land in BC, that has a sequence of basalt cover which makes it incredibly difficult to explore, then that would explain how Fortescue could stake such a large land position in the first place…

Well that is basically why Inflection Resources was able to stake a whopping 300 km of the Macquarie Arc ground which is prospective for porphyries… No one bothered to explore due to that ground having a sequence of cover it making exploration difficult.

So is it a huge stretch to think that this might be a big, wild optionality bet that Fleet Space and their ANT technology might be a breakthrough for covered porphyry exploration? Well I want to think that is not a huge stretch and I would note that Fortescue should be very aware of Fleet Space and their work with Inflection Resources given that Fortescue is literally one of Inflection’s neighbors:

To summarize the encouraging events that points to Fleet Space Technologies’ ANT technology having the potential to transform porphyry exploration:

- AngloGold does a JV deal with Inflection’s neighbor

- Fleet Space and Inflection executes a 1.800 km ANT survey

- Fortescue Metals (Inflection’s neighbor) “suddenly” stakes 180 km of covered “porphyry ground” in BC, Canada

Closing Thoughts

The drilling being done at Duck Creek should have extreme leverage on the risk-adjusted value of the company.

Inflection Resources currently has a MCAP of C$18 M and the company currently has #30 Target Areas within the 300 km stretch of covered ground that is included in the AngloGold Join Venture. That equates to C$18/30 = C$0.6 M per Target Area being reflected in the valuation of the company. In other words one could say that one is paying C$0.6 M in reflected potential per target area. Now given that Northparkes, Cowal are probably worth a few billions, while Cadia had a NAV of around $10 B in a Credit Suisse research report that I once read, one can arguably say that Mr Market’s pricing suggests that there is “no chance in hell” that Inflection will end up with “even” one meaningful discovery…

If AngoGold fully earns into one project (which would be in case of a significant discovery), then Inflection would be funded to a PFS, which could cost more than $100 M. If that happens Inflection would would own 25% of the selected project and retain a 1%-2% NSR on top. From what I have been told about NSRs, a “rule of thumb” is that a 1% NSR, roughly equates to 5% of the value of the project…

So on a $1 B discovery Inflection’s stake could arguably be worth $300-$350 M. With that said, as I pointed out earlier, a new Cadia for example would be worth many billions of dollars. Furthermore people might be aware of Greatland Gold that has a 30% minority interest in the Havieron deposit, which is a large underground deposit in Western Australia, reached a Market Cap of some $1.3 B.

We know that the company is strictly targeting areas where geophysics suggest there could be potential for large, tier 1 porphyry systems…

With #30 live Target Areas that will all be drill tested, and the apparent success of the ANT survey, coupled with the already known smoke at Duck Creek, I wonder if Mr Market’s price of C$18 M MCAP is reasonable(?). On that note ponder the lack of revaluation on any of the news/events tied to the ANT initiative. At face value Mr Market is suggesting that the risk-adjusted value of Inflection’s entire portfolio is basically, totally unchanged. In what world does that make sense? Given the scale of the targets, even a 3% increased chance of success would be material, especially for company valued at ~C$18 M.

Now it is no surprise that when the junior sector is depressed one typically can buy a junior’s flagship project for a steep discount while getting any peripheral assets for free. The thing is that most juniors’ peripheral assets are not worth much and most of them have no “threat of monetization”. Meaning that they are either not getting drilled (which has the threat of leading to a shock revaluation, even when one gets the potential for free, in case a discovery is made) and/or have no real hope of being sold for example (directly monetized).

In Inflection’s case Duck Creek as well as the #29 other target areas are all live as they are all planned to be tested. At face value the market might only put some value at Duck Creek while any of the other targets could still produce a discovery. In other words the “underappreciating” Mr Market might get punished, unlike a case where there is no real threat of a peripheral asset surprising, to the upside.

Lastly I would say that I am quite picky when it comes to pre-discovery plays in a market where one can buy proven success for pennies on the dollar. I simply think Inflection Resources is one of select few that offer a Risk/Reward function that is unusually favorable. The fact that there are #30 cans to kick before means that its more diversified than any other pre-discovery I know of both to the downside and upside.

Amateur TA

Well, something could happen soon…

Note: This is not investment advice. I am not a financial advisor. Juniors are risky and one can lose ones entire investment. Never invest money you cannot afford to lose. Assume I may buy or sell shares of Inflection at any time without notice. Never invest in anything just because someone else is invested. Do your own due diligence!

/THH