Common Investing Mistake: Confusing Risk And Uncertainty

Confusing risk and uncertainty is probably the most common mistake I see investors doing. Confusing risk and volatility is another big one.

- Risk is not where the share price will go in the short term (unless you are purely a short term trader).

- High uncertainty means that the spectrum of outcomes is very broad in terms of possible future valuations

- Risk is pretty much overpaying for something that ends up not being true

Risk example = A stock priced to perfection

- Company A has a great project, on paper, and is almost fully valued according to the theoretical NPV.

- Company A puts the project in production and shit happens.

- Company A’s project is de facto worth less than the forward looking theoretical value

- … Which leads to permanent loss of project value and probably capital as well

Uncertainty example = A stock where almost no potential is priced in

- Company B has a large, prospective, greenfield exploration land package, great team, C$5 M in cash and a Market Cap of C$12 M

- People will justify the currently low Enterprise Value with “Of course it is low, they have not proved up anything yet, which makes it very risky!”

- n this one UNCERTAINY is high but RISK might be much lower compared to an advanced developer with an iffy project because almost nothing is priced in

Why is buying cheap (“low”) and selling expensive (“high”) so rational but hard to do for most?

If company A which is a grassroot explorer goes from $50 M down to $20 M, on no change in company fundamentals, many people will have a hard time buying (and might be even more likely to sell).

Why?

Because it suddenly feels “risky” as evidenced by the (PAST) major drop in PRICE.

What is ironic about that is that the drop has made the stock LESS RISKY since LESS UNCERTAIN POTENTIAL is PRICED IN.

What has been kept constant is the UNCERTAINTY in terms of what the company might or might not end up discovering.

One of the best examples out there that I know of is Novo Resources since everyone and their mother seems to be confusing uncertainty with risk on that one.

Is Novo Resources highly risky and certainly not something one should invest in as per most people on MinTwit etc?

Well if you consider a fully funded, with more funds probably coming (Calidus Resources), equity stakes to the tune of C$80 M, an already built mill, a high-grade, near surface, open pitable project with great metallurgy as relatively “risky”?

… If the case for Novo Resources was Beaton’s Creek and Beaton’s Creek ONLY I could at least take such a stance seriously…

But when you invest in Novo Resources, or any other stock, you are buying EVERYTHING that the company owns; Cash, claims, projects, prospects and equity positions etc. So when one understands that the current Enterprise Value might pretty much be reflective of the Expected Value from Beaton’s Creek one should realize that one is paying a penny on the dollar for everything else… Which goes back to the whole risk vs uncertainty thing…

Novo is highly UNCERTAIN to the point of probably being the most UNCERTAIN stock in the entire junior sector because;

- No one knows if the Egina typ gravels will be worth $0 or billions.

- No one knows if all the Mt Roe conglomerates will be worth $0 or billions

- No one knows if all the Hardey Formation conglomerates will be worth $0 or billions

- No one knows if the equity stakes will be worth $80 M or hundreds of millions

- No one knows if the Malmsbury project will be worth $0 or millions or billions

- No one knows if the E3 investment will be worth $10 M or $100 M or higher than that

- No one knows if Beaton’s Creek will be worth multiple of what it might be worth today thanks to exploration (Skyfall, Beaton’s Creek West etc)

- No one knows if Millennium’s tenements will be worth $0 or millions or billions

- No one knows if Mt. Elsie will be worth $0 or millions or billions

- NO ONE KNOWS ANYTHING to quote Bob Moriarty

Novo does not have high (relative) RISK because beyond Beaton’s Creek next to nothing of the potential above is PRICED IN.

This is what very few investors seems to grasp. Which by extension is why I realized early on that it was best to do my own due diligence and always make my own decisions.

To Sum Up

As PRICE decreases, and de-risking efforts are more advanced as in the case of Novo, the RISK is decreasing with it. Yet most people will see this as “evidence of risk” and confuse uncertainty (which is still there) with actual risk. This is why you can immediately tell who understand the VERY important DIFFERENCE between the two just based on their actions/comments during corrections. The ones who do get it realize that RISK has DECREASED (Risk/Reward has gotten better all else equal) while the majority who does not get it believe that RISK has INCREASED simply due to volatility appearing and uncertainty still being in the picture.

There is a big difference between understanding geology, mining engineering and being a good mining investor. Preferably one would be great at all three subjects but the most important one is actually understanding investing in my opinion. On that note I am not surprised that the best mining investors on MinTwit are not actually geos or mining engineers for what it’s worth.

- Risk is usually positively correlated with Price (all else equal)

- Risk is something that should be limited

- Uncertainty is not risk and a very uncertain case can be the best risk/reward opportunity around thanks to the average investor usually confusing uncertainty with risk

Opportunities That Might Come Along

- Investors confusing uncertainty as risk and treating it as such

- Investors getting colored by volatility and treat it as proof of increased risk even though;

- Risk has actually decreased (all else equal)

- Risk/reward has actually increased (all else equal)

Visual Example

Lets imagine a company where absolutely nothing has happened in terms of changes in company fundamentals (Uncertainty is constant) but where the stock price (valuation of the company) is in a “correction”.

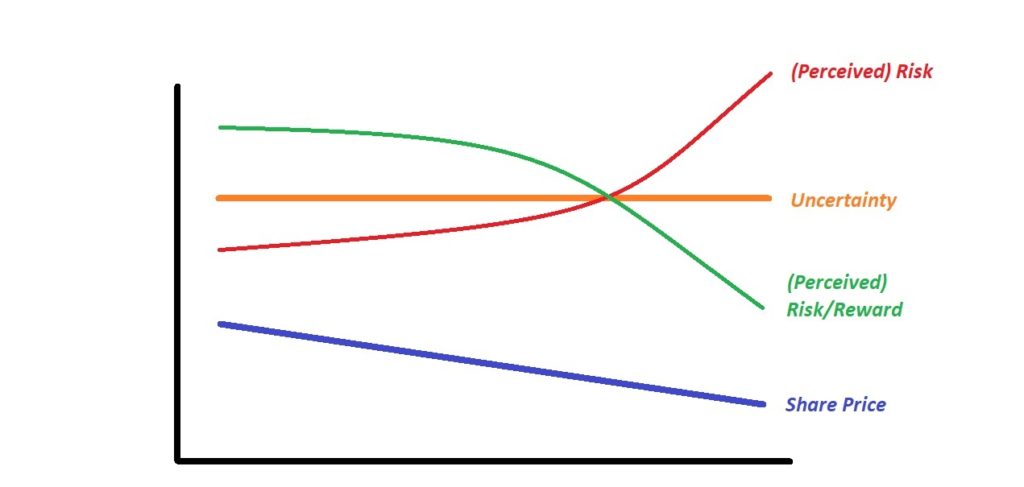

This is the impulse/feeling that majority will have:

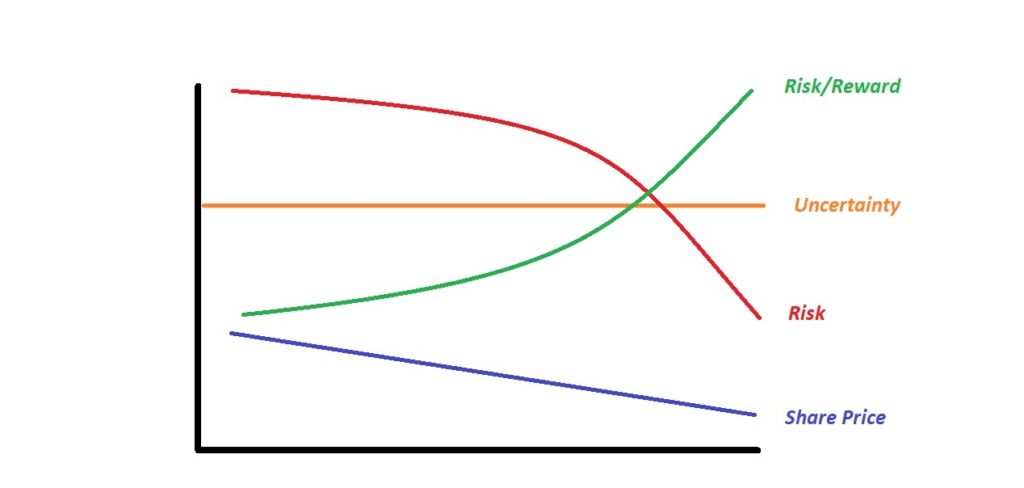

This is what actually is happening:

The typical investor will:

- Confuse volatility to the downside with increased risk

- … Thus “feel” like risk is increasing and the risk/reward is decreasing instead of increasing

The smart investor should take advantage of this irrationality by:

- Fight the urge to have volatility to the downside “feel” as increased risk (or uncertainty for that matter)

- … Thus also fight the “feeling” that the risk/reward is decreasing instead of increasing

… Pretty simple concepts but I get quite a few emails etc from people who asks what I think they should do because stock X has gone down and they are tempted to sell even though the case has not changed at all usually.

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Novo Resources in the open market and I was able to participate in a private placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Great Article. This is a corner stone to the Public always buying when they should sell and selling when they should be buying. Just add in forces that understand what you just stated about perceived risk

(feelings) now add manipulation in stock price and news. If you are holding a real gem of a stock, you are uninvited and unwelcome to the party. I am not talking about the company but wealthy investors who know what they are doing and why. This is why when you do what (feels) natural in stocks , it is usually wrong.