The Power of Compounding, Risk And Opportunity Cost

In this article I will discuss what I think are perhaps the most important concepts for an investor to understand, and that is the power of compounding, risk and opportunity cost…

“Rule number number one, don’t lose money. Rule number two, see rule number one” – Warren Buffet

“Compounding is the most powerful force in the universe” – Albert Einstein

… You can’t compound something that does not exist.

“Focus on the downside, and the upside will take care of itself” – Mark Sellers

… It takes a 100% return to reach break even from a 50% decline.

What is risk?

- Loss on paper at any given time aka volatility?

- Permanent loss of capital?

… Consider the difference.

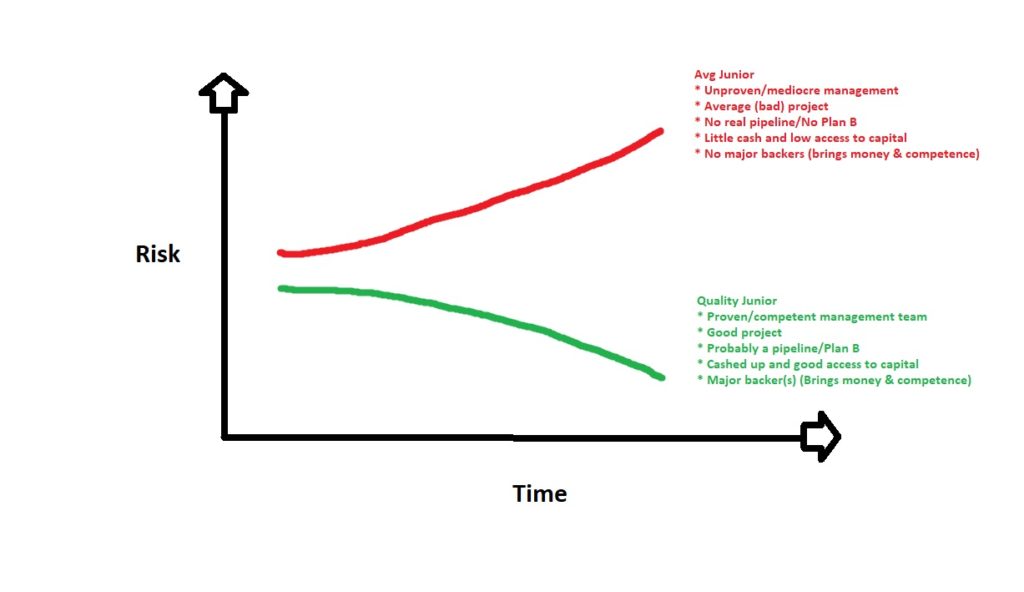

Time and Risk

Is for example Irving low risk on a one month or three month time frame?

I would say so, but not if “risk” is defined as a loss on paper at any given time.

If we expand it to a 1+ year period and put it in a drawer (HODL:ing) then?

I would argue yes. Within 12 months I would expect three major targets having been tested and I doubt each and every one would be a failure. More targets tested means more chances to win.

If we look at 3-5 years instead then?

Well given that Irving has 6 more projects I could see work being done there with the backing of Newmont and possibly Sumitomo Corporation as well. This longer term scenario rests a bit on the Omu Project being a success though (which I see as being likely). All in all I would say that the likelihood of Irving having found something valuable is relatively high. Exploration is a process that gets more accurate with time.

Conclusions:

The longer I draw out a theoretical holding period where I wouldn’t be allowed to sell for Irving, the less risky it becomes in my mind. This is primarily due to a) Great management that is not in the business of screwing shareholders, b) The large amount of good targets, c) The large pipeline of projects and d) The quality and deep pockets of the current backers. With more time, there are more opportunities for something to go right given the previously mentioned factors.

Good management solves problems and create value. Bad management creates problems and destroys value.

The Lundins are for example famous for not leaving shareholders behind. Even if one of their usually high risk ventures fail, the Lundins tends to find another venture for its shareholders (Africa Energy is a good example). The thing is that one sometimes would be forced to HODL for years before this new venture would be ready, so if one sells before this and never comes back then it becomes a permanent loss in reality. Another more personal example would be Miramont Resources which failed to hit the bulls-eye at Cerro Hermoso but still has cash and a management team led by Quinton Hennigh who is currently looking for the “next ticket” to scratch which could revalue the shares.

Can you say the same for the average junior? I would say no…

The average junior has an average management team, average projects and not a big pipeline of projects. In other words it’s all crap for all intents and purposes. Nor are they cashed up with Majors backing them (Probably for good reasons).

What does that mean in reality?

That time is not the friend of shareholders in an average junior exploration company. The company needs success and needs it quickly. Furthermore, the amount of quality targets are usually very limited and thus there are few winning tickets in the lottery. Lastly, there is usually no Plan B.

In short:

(Note that the “Risk in the chart below is the risk of a permanent loss of capital)

A personal example of this would be my biggest loser in 2019 which was Aloro Mining. Now, I think the Aloro management team is above average and I consider their target to be above average as well. Furthermore, they were backed by Agnico-Eagle which is one of the best majors around. With that said, everything pretty much rested on the first drill campaign showing some promise. Sadly the drill campaign only resulted in some miniscule smoke and no fire. Thus, the ONE decent ticket turned out to be a loser and the company has basically gone silent since then. There was no credible plan B and the company did not have committed backers nor good access to capital.

… Do you see how one critical UN-checked box resulted in Aloro being my worst investment of 2019?

Conclusions:

In other words, the failure of ONE drill campaign down in Mexico led to a seemingly permanent loss of capital (Well that became a fact since I sold out and am thus not able to participate if things turn around). I will never recover that money and it becomes even more catastrophic when you consider that my main portfolio ended +95%. All my major holdings ended up and on average one could say that the opportunity cost of Aloro turned out to be 195% of the actual loss (assuming I didn’t “gamble” and instead used the money that was lost spread over the rest of my holding)… Yiikes!

It gets even more painful when one extrapolates this loss further into the future. Let’s assume I lost $1,000 which could have instead become $1,950 if it was invested in the rest of the portfolio holdings. Then lets assume that I would have averaged 25% annually over the coming 10-year period. The 2019 loss in Aloro would then have amounted to an opportunity cost of $18,160 eleven years later… Crazy!

Reflecting on the failure of Aloro made me appreciate the criteria mentioned earlier. My investment in Aloro did NOT check all the boxes which meant that there was a substantial risk of permanent loss of capital. Especially in a poor market environment. I mean lets be honest, what’s the success chance of a grass root drill campaign? Usually slim to none. In other words I was accepting a high probability of a permanent loss of capital because the criteria that could warrant a large position were not met.

Imagine what the cumulative cost might be for this failure if I didn’t learn anything. If I would have keep taking over-sized positions in juniors that didn’t check all the boxes I would sooner or later end up bust. My snowball would never be able to steadily grow due to frequent permanent losses of capital. As time goes by the resulting long term opportunity cost of the permanent losses of capital I suffered in Aloro would readily look insignificant relative to the accumulating opportunity costs if I just kept on betting big on long shots.

LESSON LEARNED: DECREASE THE RISK OF A PERMANENT LOSS OF CAPITAL LIKE THE PLAGUE BY STAYING DISCIPLINED

Now, lets instead look at Irving and their current drill campaign at Omui as an example. If Omui would come up with 100% dusters (we already know it won’t but anyway), then there is still plenty of cash left for the other targets to save the day and we already know these systems were mined back in the day so all targets can be considered to be quite de-risked already.

To Sum Up

The most important take-away from this article would be to avoid permanent large losses of capital like the plague. So how would one go about doing that?

- Make sure the junior has SOME meat on the bones and is NOT dependent on the success of ONE single event (like one drill campaign).

- More “lottery tickets” makes permanent loss less probable since it diversifies risk

- Realize the value of Plan Bs and make sure that the company has means of turning to Plan B.

- SP might never recoup after a failure at a company’s flagship project if there is no way for the company to draw another lottery ticket.

- Make sure the company can raise money so they have tools to create value.

- Put more focus on being protected on the downside since the opportunity cost resulting from any permanent loss of capital will compound and be worse the better of an investor you become

- Think what a permanent loss today of say $10,000, would have cost you in 20 years, if you averaged 20% returns per year starting tomorrow…

- The answer is that the $10,000 would have been worth $393,376 !

- Think what a permanent loss today of say $10,000, would have cost you in 20 years, if you averaged 20% returns per year starting tomorrow…

When you fully understand what the REAL long term cost of a permanent loss is, I think you will begin to look at most junior mining companies very differently.

With that said, I don’t even fully appreciate this since I actually do own some risky stocks, where a permanent loss is far from out of the question. In other words it’s very hard to do what you know you should do at all times. I do however have much smaller positions in such cases than I used to (Shout out to the Aloro experience). Lastly, I would argue that almost no one actually knows that this is the best strategy and if they do know it, they don’t have the discipline to fully put it in practice. Well the “Rule number one, don’t lose money. Rule number two, see rule number one” guy does and he just so happens to be one of the richest people in the world. Go figure.

How is this thinking reflected in my portfolio today?

Well, all of my largest gold holdings GOT SOMETHING already, and all got a lot of room to grow. When the downside has some cushion I make sure there is upside which often comes in the form of growth potential. Is this THE BEST strategy? Well, probably not to be honest. One could argue that there are cases which are possibly much less risky (like some prospect generators, royaly and streaming companies) that not only have a very low risk of permanent losses of capital but with some upside potential as well. For better or for worse, I am a bit greedy and try to really outperform the mining indices and I guess my chosen strategy could be characterized as “aim for the stars, hit the moon”. This strategy basically means that I think the upside potential is so broad that a company could realize say 20% of a given “blue sky scenario” and I would still make out okey or even better. In other words I accept more risk than can be found in the best royalty companies for example but the inherent upside potential (and the characteristics of said upside potential) in my core positions eclipses the streamers (Not that I said POTENTIAL).

Some personal examples (Yeah, I know you have heard these names X times before, but bear with me. I am trying to drive home some points ):

Lion One Metals

- Got a mining permit

- Got a lot of cash

- Got a resource

- Got a PEA

- Got excellent management with a long history of success

- Got a potentially HUGE Alkaline Gold System to explore for that upside potential

Novo Resources

- Got a mining permit at Beaton’s Creek

- Got a resource

- Got mining leases at Egina

- Got a lot of cash

- Got good and honest management with added input from Major corporations

- Got major backing/funding from Sumitomo Corporation

- Got a project pipeline that is enough for a couple of juniors, and that’s potentially just the start

- Got large chunks of an entire 600×300 km Archean Craton to explore

Irving Resources

- Got a mining permit at Omui Mine Site

- Will soon start to ship bulk samples for revenue

- Got world class hits from drilling blind at Omu Sinter

- Already hit at Omui as well

- Got three major targets within their main project that also has seen historic mining

- Cashed up

- Backing/funding from Newmont Goldcorp

- Got 6 additional projects

- Potentially will see Sumitomo Corporation come in as an additional major backer

- Got good and honest management

(I could have included a couple more examples off the top of my head like TriStar Gold, GFG Resources etc that I think fit the criteria as well)

Blue sky for Novo is so obscene that 5% of said scenario might still see Novo outperform big time, and they have multiple systems with obscene blue sky potential to boot. Lion One seemingly has a huge system and the current Enterprise Value is basically underpinned by what is already banked. Thus, I could argue that pretty much all of the potential in that large Alkaline Gold system is “free” upside, in theory at least. Irving has three major targets and 6 additional projects and the company needs to find ONE decent to good deposit in order to do OK. Meanwhile they have already hit high-grade to bonanza-grade gold and silver at Omui Mine Site which also happens to be located within a mining permit.

What are the odds of seeing PERMANENT loss of capital in those companies? Relatively low in my opinion. Especially when compared to the average junior. Not only that, but the potential for value growth is much higher than your average junior as well. Are there juniors out there with more upside potential? Sure, there are plenty of micro caps out there who are drilling. Do these juniors have a high risk of creating permanent losses? I would say hell yes since only a fraction of juniors will ever find something truly valuable and the majority does not check all the boxes I presented earlier, thus making a permanent loss of capital pretty likely (all else equal). Does the average junior have both a low risk of a permanent loss as well as somewhat probable upside? No way.

The difference between a company having NOTHING but could have SOMETHING to SOMETHING BIG, versus a company having SOMETHING that could also have SOMETHING BIG, is infinite.

Closing Thoughts

A loss can never be compounded. Capital preservation means that there WILL be ammo left when a real OPPORTUNITY presents itself. Let’s say you played it “safe” and only returned 5% per year with minimum risk. Sure it’s not great but at least your capital has grown and it also means that there is plenty of dry powder to deploy in case one of those very rare opportunities presents themselves. Forcing yourself to go for worse and worse plays because you ware obsessed by beating the market handidly despite a lack of good Risk/Rewards will probably result in worse LT results than just playing it safe and waiting for fat pitches. I personally “hide out” in my favorite plays because I think their Expected Value over time is not reflected by the market. In other words I see them being more valuable and hopefully being priced higher in the future. As I said I hide in these companies, with most of my money, most of the time… Until I find a better long term Risk/Reward case (hasn’t happened yet) or there is a “special situation”. These special situations are often juniors that I find totally miss-priced given the potential. Now, I don’t consider them to have the kind of long term risk profile which I would require for a LT core holding, but they are just simply way too cheap. Gatling Exploration was the best example from last year. It started out trading at some ridiculous Enterprise Value which did not reflect a fair value at all in my opinion. More recently we have GFG Resources which was trading like the positive NR which described the recent drilling at Rattlesnake Hills did not exist. With such cases I am willing to go pretty big because I think there is very little risk of a paper loss in a given time frame and when/if it starts to revalue you just take money off the table since the no brainer has become less of a no brainer. I still have good chunk of GFG (possibly too much), but I also think that case got more de-risked by the latest Timmins NR which helps offset the rise in price.

(Note: These are not buy or sell recommendations. This is not investment advice. I am not a geologist nor a mining engineer. Always do your own due diligence. I own shares of Novo Resources, Lion One Metals, Miramont Resources and Irving Resources which I have bought in the open market and am thus biased. Novo Resources, Miramont Resources and Lion One Metals are passive banner sponsor on my site.)

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My Channel

I can’t thank you enough for your editorials. I wish you were around 20 years ago. Your advice would have saved me lots of money. When GATA started up I went with their recommendations which I now know was wrong. I lost money because I didn’t pay attention to the things you now have pointed out.

Thanks again. I look forward to each and every article you put out!!!

WELL DONE

Hi David,

You’re very welcome! I hear ya, I wish that I a) started invest earlier and b) understood these concept from the get go… But I think almost no one in the world starts off being a good investor. Heck, even Buffet made some terrible investments early on :). I just try to get a little bit better every year, because if I become say 1% better at investing every year, that’s also gonna compound for the rest of my life! Writing these articles hopefully helps both myself and others to become just a little bit better, and that’s why I do it. Thanks for the kind words and good luck out there!

Thanks Eric! I got sucked into the bad info that GATA was spewing in 2011 And subsequently lost $500K!! Now I follow Martin Armstrong’s

Writings for the trends. If Novo pays off then I will be ok. Thank you for your wise words!

Hi Allan,

It seems you are not the only one judging by the previous comment! I can’t comment on their info since I have never been a subscriber of theirs but I’m sad to hear that you lost a great deal of money (You can be sure you were not alone!). I read Armstrong now and then but honestly I try to focus on just finding the companies that should do decent-to-good regardless of where gold goes. The gold price is so volatile that it just leads to more noise and rash decisions when I should be focusing on finding plays that I expect to play out over years not days etc. Fingers crossed that Novo becomes a low cost producer that should do well at any gold price!

Best regards

What do you think of nevada copper?

Hi Danny,

I really haven’t looked at it so I can’t give you any meaningful insights. I don’t know much about the copper business either, which doesn’t help hehe.

Sorry I couldn’t be of more help!

Best regards