What You Can Control vs. What You Can’t Control (When vs. If)

Juniors are cheap now, on average. Many juniors are trading far below their Expected/Intrinsic Value. Especially when considering that the price of their product, which is gold, is selling for $1,587 in US dollars and at all-time-highs in other currencies…

Yet many juniors are currently near multi year or even all time lows.

I would argue that many of them would need to go up 100%-300% in price just to reach levels that could be considered “fair value”. With that said, no one knows when that will actually happen…

This is something we, as investors, can’t control.

What we can control is our due diligence. We can control how much work we put into evaluating what we think a company should be worth today based on its long term prospects.

Even if one is conservative in terms of views of an intrinsic value range there sure is many juniors out there that are priced way below this intrinsic value range. Despite this, it’s obvious that many are scared to buy because they are so fearful that they believe everything might go to zero. Not even during World War 2 did stocks go to zero and I don’t expect them to go to zero this time around either. Buffet says that in the short run the market is a “voting machine” and in the long run it’s a “weighing machine”. Meaning that sooner or later the value of a given company will be reflected in the price of said company. Again, we won’t know and can’t control when this ought to happen. We can only try to buy something below fair value and then wait, and sometimes wait much more, until a revaluation of the company has indeed happened.

Even though I know share prices can go anywhere in the short term, and that there have been a select few times when juniors are even cheaper (like some in 2015), I have a hard time not wanting to buy them today. Some juniors were trading at or even below cash in 2015. The difference today is that gold is not priced at $1,050 but instead (remarkably) trading much higher at close to $1,600. This fact alone will of course hike up the intrinsic value of a company even though the long term intrinsic value is affected by much more than what gold trades today.

Some savvy, contrarian investors had the fortitude to buy common stocks during the depths of the bear market in 2008/2009. This was a time of peak despair and many companies were value as if they would all go bust withing a year or two. Basically, valuations assumed that the world would end, and end soon. However said contrarian investors realized that the world would not end and that the prevailing valuations were unsustainable. They didn’t know when the final bottom would be in though. They only knew that some day the shares would get revalued higher. There could be a further 30% decline in any given stock before the pendulum started to swing and the revaluation would happen. If one rightly assumed that a stock would need to revalue 100% higher to reach anywhere near fair value, but it continued to decline 30%, it would mean that the contrarian investor would see a 30% paper loss before the position finally showed a 100% paper gain. Most people can’t stomach the thought of a 30% loss so they will wait, wait and then wait some more until sentiment is better and it feels “safe” to buy the ever decreasing bargain.

In reality, most people can’t stomach a short term 30% decline so they won’t buy something that is on track for an inevitable 100%+ return within say 6-12 months. At best they might be able to stomach something that looks to have 30%-50% left until reaching fair value, long after the bottom is in.

You can never pin the exact bottom and it’s around the bottom where the swings will be wild. You can buy something that is extraordinarily cheap and still see it go down 30%-50% before the final panicked seller has sold out.

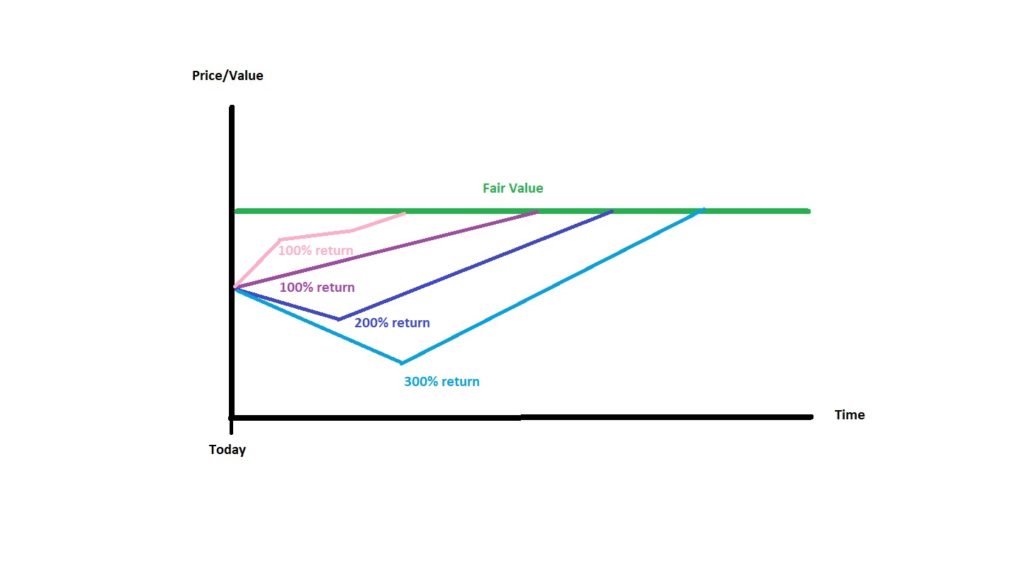

In the graph below I show four different future scenarios for a random stock’s share price:

The graph above assumes that this random stock will need to revalue 100% higher from today’s levels just to reach a “fair value”. If we are near a bottom today, then the pink and purple scenarios will result in a doubling of your money in a given time frame. If we are not at a bottom yet, then there is further downside ahead as per the dark- and light blue scenarios, and the eventual revaluation will be even larger in percentage terms. The important take away is that a 100% return, even if it takes 2-3 years, is a very very good return. If one is wrong about timing of the bottom then there is potentially a lot of further downside ahead. BUT, the stock should still result in a 100% gain, although it will take longer and it will first show a severe paper loss. If one is too scared or too greedy then one would try to wait for the two blue scenarios to happen and buy the bottom. The thing is that there are no guarantees that any of the latter scenarios will happen since this is out of your control. If you are wrong, then prices will start to head up from here and your future 100% return will have decreased. You can only control what you think a company is worth and at what price you buy relative to said worth.

… This is why I catch falling knives all the time, which is something you hear a lot of people saying you should never do. I simply start buying when I think something is at least 50% undervalued relative to perceived intrinsic value. To be honest, I think there are many juniors that are much more undervalued than that today. If I am right, and the company’s fundamentals develop as I expect, then any and every purchase will show a positive return in the end. If I am wrong in terms of timing then any and all purchases might show a negative return in the not too distant future, before they show positive returns. In this case the loss is related to TIME and is NOT PERMANENT.

If you can buy something cheap enough, which currently trades at levels that are unsustainable in the long run, then you are a value investor. It does not mean that you won’t show a potentially fat paper loss before your investment pays off and shows a positive return though. The REAL DANGER is buying something that is not undervalued because then your position might never show a positive return and the loss is permanent and not timing related.

I had no idea when the late 2015/early 2016 valuations were going to be rectified. I had no idea that a 45% loss on paper was going to turn into a massive gain in just a few months. All I knew was that prices were much lower than the value of the companies and that some day they would be significantly more aligned.

In short; If the world doesn’t end then I expect most if not all of my current investments to be very profitable within a year or two but in the meantime they might be blood red, depending on short term sentiment.

Sitting on a paper loss doesn’t mean you are wrong or that you are a bad investor. It might just mean that you are early in identifying an opportunity. What you should be focusing on is not to be the “last sheep” who sells his shares at the bottom and possibly foregoing a future return which many could only dream dream of.

The more undervalued something becomes, the more intense my buying becomes, assuming I have any dry powder.

Having some dry powder can be extremely profitable. Lets say you have 5% in cash and the pink and purple (in the graph above) scenarios play out. Then your 5% cash position will not be able to attain 100% returns, but if the latter scenarios happen then your 5% cash position will be super charged if you are able to buy it low enough to capture 200%-300% returns. Assuming you buy the dark blue scnario at the bottom, your 5% position will show the same return as a 10% position of your previous purchases. If you buy the purple scenario at the bottom then it will have the same return as a 15% position of your previous purchases (3X). In contrast, if you wait and buy the pink and purple scenarios until there is “only” 50% upside then the 5% cash position will perform like a 2.5% position of your previous purchases.

In other words: There is an symmetrical pay off profile.

- Scenario 1: A 5% cash position bought when expected returns are 50% will trade like you had employed 97.5% (2.5% decrease) of all your money from the start.

- Scenario 2: A 5% cash position bought when expected returns are 200% will trade like you had employed 105% (5% increase) of all your money from the start.

- 7.5% difference relative to Scenario 1.

- Scenario 3: A 5% cash position bought when expected returns are 300% will trade like you had employed 110% (10% increase) of all your money from the start.

- 12.5% difference relative to Scenario 1.

Meaning: Knife catching, assuming you are right, can materially affect your long term returns.

Even a small top off at lower prices can affect your future returns materially, and the lower it goes, the more affect it will have. If you are right about a stock returning 100% within a given time period then knife catching will act like leverage to your base case return scenario. With that said, I’m not rich enough to to afford to totally forego 100%+ expected returns, in hopes that I MIGHT get the chance to get 200%+ or whatever. If a stock is cheap enough, then a good return should be a matter of IF not WHEN, and that should do wonders in the long term even if I don’t prick anywhere near the exact bottom. If I sell everything and end up being wrong, as in a bottom is already in place or close to it, then my expected 100% return on a given stock might have decreased to 50% before I get back in… And that’s gonna cost you in the long run. Greed is good, but too much greed can cost you dearly.

NOTE!: It is all important that you are right and that the paper loss is TIME related and not PERMANENT. This is why knife catching should really only be done in high quality companies when no negative change to the company’s underlying fundamentals has taken place. Catching a falling knife when the drop is related to negative developments is a totally different matter.

Lastly, an example of some micro scale knife catching:

In the slide above you can see some frantic knife catching in Irving Resources which took place a few days ago. As price went lower, the buying intensity went way up. No one could know when the bottom was finally in, all one can (try) to “know” is if price is cheap at any given time. Interestingly, all the buys showed a paper loss at one point in time, while almost all showed a paper gain near the end of the day. This is a perfect example of how quickly things can change and the important thing is not WHEN it changes, but that it WILL CHANGE at some point in time. It can be days, it can be months or it can be years, but if you return 100% within two years then you are already absolutely crushing the market. Again, if you buy something that will be up 100% within two years but it dips 30% tomorrow, then that was still a good buy even though it won’t feel like that at first!

Since nothing really has changed for Irving, company fundamentals wise, I considered any tick lower to be an opportunity to super charge my long term results. With that said, it can of course go lower, but that also means that it would require small and smaller amount of dry powder to still supercharge the future returns. I still think Irving will be taken over by Newmont and some Japanese miner in the end (at higher prices). Thus, I see short term corrections as getting a potential discount on that final buy out price tag.

If we see further turmoil in the market then any and all stocks can be taken down further. That’s just how it is. A market in panic is not rational and prices can undershoot value by a mile (which is very very good if you have dry powder). But again, what is important and what is the only thing you can control is to try and buy something that is cheap and that will SOME DAY be priced higher. It could take a month, 6 months, 12 months or even years… But irrational things don’t last forever.

I personally wouldn’t be surprised to see my whole portfolio down 30% from here if shit hits the fan even harder, but I still can’t justify selling shares that I consider to have 100%-300% upside to reach fair value in hopes of picking whatever potential bottom for 2X those returns. I’m greedy, but I’m not THAT greedy.

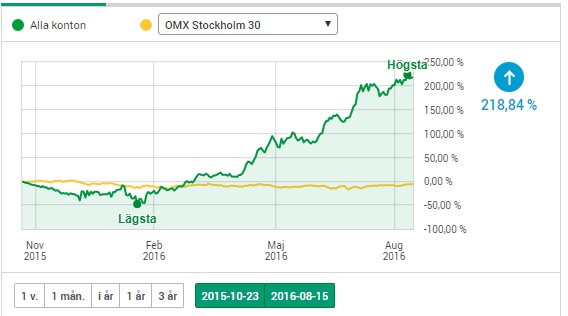

This is how my portfolio performed between late 2015 to late 2016:

… I considered miner valuations to already be very low in October of 2015 but they still proceeded to hit even more ridiculous valuations at year end.

My portfolio, which I thought was made up of juniors which were already incredibly cheap, went down 45% from October 2015 to January 2016. That’s a real blood bath in just a few months! Interestingly, this too passed, and miners rocketed higher from the bottom. Thankfully, I did NOT SELL OUT at the bottom and just 8 months later my portfolio was up 218%. Think about that for a minute…

At one point I was staring at a 45% paper loss in my portfolio, all within a 2-3 months time frame, but at the end of the day I was up close to 219% within less than a 12 month time frame. You better believe that I was buying all the way down which then super charged the returns on the way up!

I know, I know, looking at a 45% loss is not fun and it feels like something extraordinary would need to happen just to get back to even. But that’s how it is supposed to feel near capitulation bottoms. It feels like nothing can move your favorite stock higher and that nothing will. Then all of a sudden, everything changes and you can see multiple +10% moves in a row.

Fear a Drop in Value, Not a Drop in Price

The only time you should fear a drop in price is when you have no cash to super charge your future returns. In other words; Fear a drop in price when you can’t take advantage of the increased disconnect between price and value. Oh, and you of course have to be able to ride out the volatility so don’t invest money you might need in the next 12 months and I am not a big fan of leverage since it can force you to sell when expected future returns might be immense and you should be buying instead.

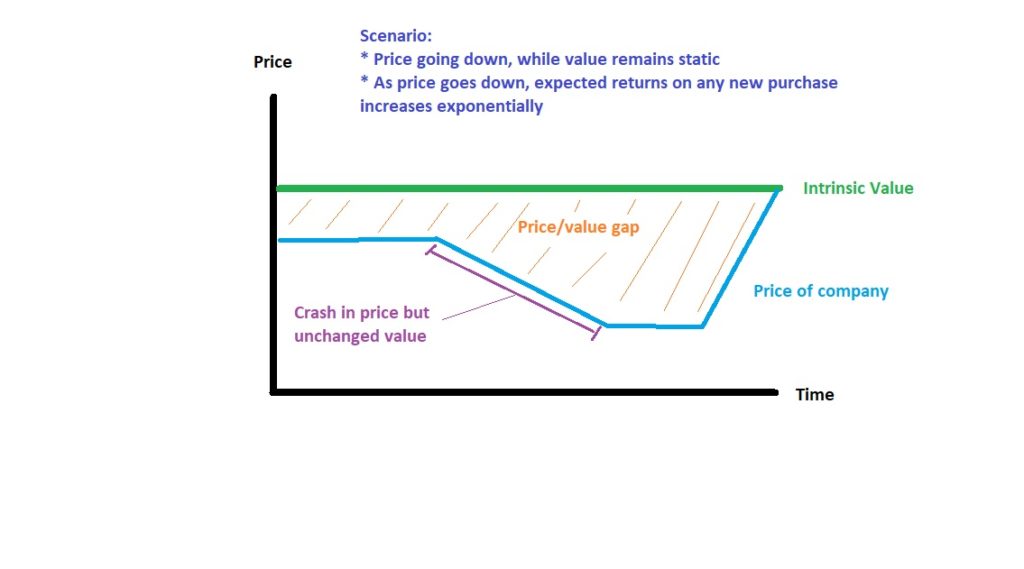

What you should welcome, assuming you have dry powder, is a drop in price when value is static or is increasing. That is the required circumstance for out sized returns in the future. The lower PRICE goes relative to VALUE, the more bang for your buck. The more bang for your buck, the more uncomfortable it will be to buy. When a stock is crashing on little else than a change in sentiment, the time to be calm and rational is upon you. Just try to remember this; The world will not end this time around either. The best thing for your decision making would probably be to just stop reading the headlines and have an informed opinion on what you think any given stock might be WORTH. THEN you look up what the PRICE is for the stock and make a decision accordingly. When you get influenced by the panic around you, it will be hard to make a rational decision. The more people panic, the harder it is to resist the herd mentality.

Examples of scenarios which are providing you with an opportunity:

- Good: When price decreases/crashes and intrinsic value stays the same:

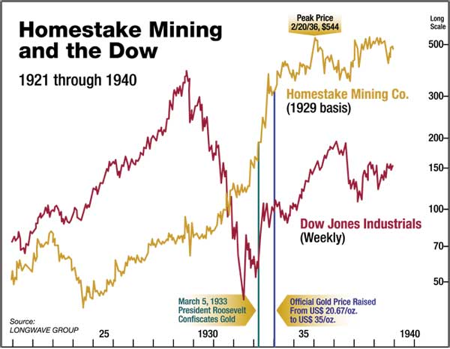

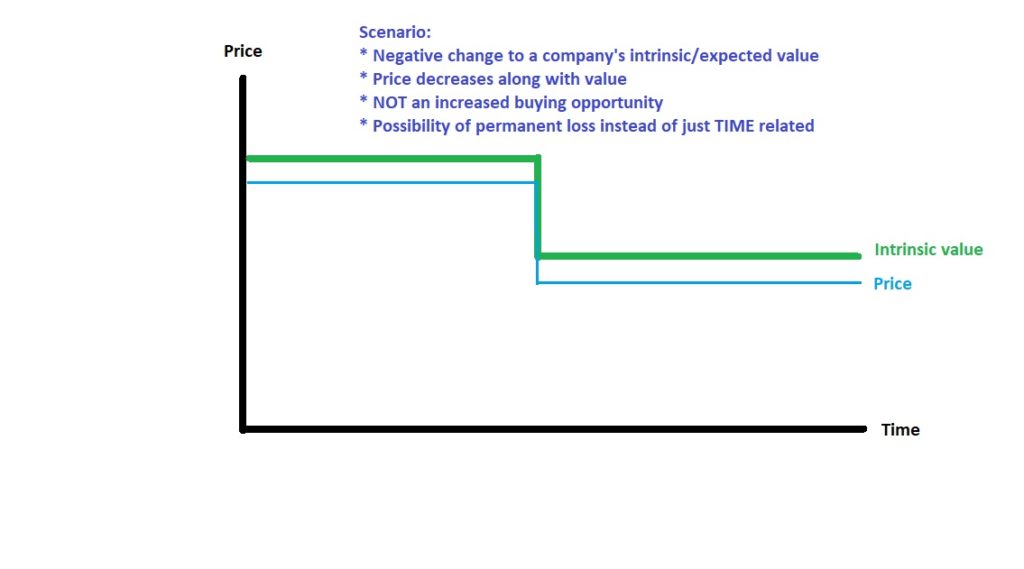

… I would argue that this is what mostly has taken place in the mining space with the wild PRICE declines in Lion One Metals and Irving Resources as perfect examples. PRICE went straight down, while the intrinsic VALUE of both companies remain at their highest levels ever. And sure, we might be heading for a lot more turbulence but I doubt that gold will decrease a lot in value and the price of gold is what the gold miners produce and the juniors are looking for. If there is one asset which I believe would do well even during a prolonged depression, it would be gold and gold miners. Again, Homestake Mining was one of the best performing stocks during the great depression:

I would urge people to read the article in the link above. Sure, no time period is exactly the same as another. Back then they US was on a gold standard and the world wasn’t as globalized, digitalized and I bet the global leverage ratios wasn’t as high as today. Meaning, there could be more collateral damage to gold and miners in the short term this time around if we get a liquidity event and more margin calls. With that said, since there is no fixed price of gold today, we might have a rising gold price at our backs this time around.

A snippet from the article:

… Note that this article was written in 2009 and it pretty much played out exactly like what was hypothesized based on what happened during the great depression. In other words; Gold and miners first dipped and then started to rip both during the great depression as well as during the great financial crisis. History does not repeat but it does rhyme and I don’t dare to bet that it will be different this time around. Thus, history is giving thumbs up to the strategy of catching falling knives in the precious metals and miners during turbulent times when everything is selling off at the same time.

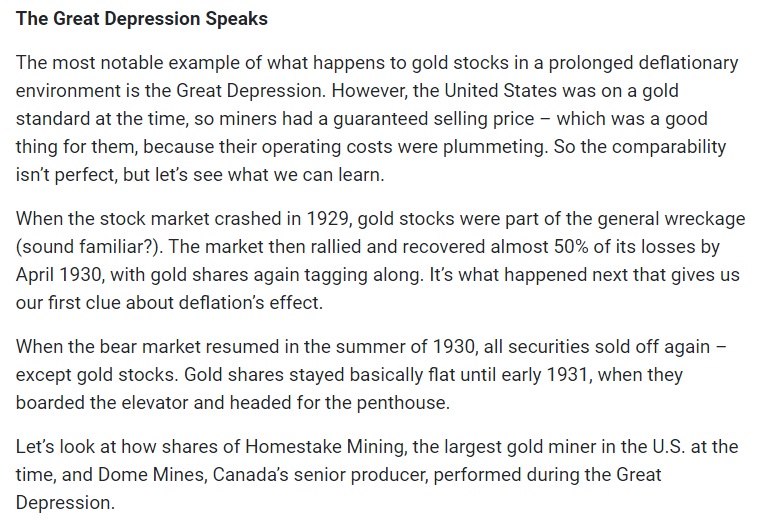

- Good: Another example of when future returns can be super charged is when intrinsic/expected value is going up but price is either static or even declining:

One of the best examples of this type of opportunity playing out is Novo Resources in my opinion since I would argue that Novo Resources has released a bunch of net positive news over the last 12 months. Case in point is the seemingly incredible efficiency improvements in ore sorting technology. I have no idea how much even a one percent improvement in ore sorting will affect Novo’s Expected Value but I believe it is substantial, and according to the latest news release was way more than a one percent improvement in implied efficiency. Honestly, those kind of result on Egina type lag gravels were beyond obscene. If you are a “sheep” that wants the share price to act as a guide and a substitute for due diligence then forget everything I just said. You will scream sell as the opportunity increases and scream buy as the opportunity decreases.

A scenario when which is not providing you with an opportunity:

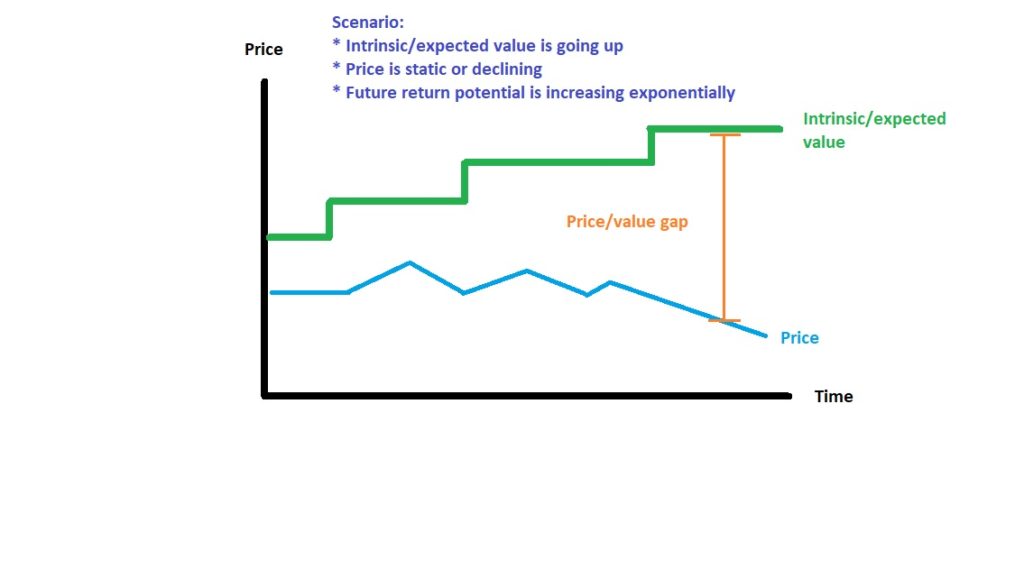

- Bad: When a drop in price is not good is when price drops alongside intrinsic/expected value:

… The scenario above is pretty much the only scenario which can make my stomach turn since expected value decreased and the paper loss might be permanent and not just time related. Meaning; positive returns is now more a matter of IF not WHEN since fair value has gone lower and patience alone is not enough for an expected positive return. Selling a stock that is down 30% can be the right decision if intrinsic/expected value has gone lower than the price of the company. Selling a stock that is down 30% with no corresponding change in fundamentals might be a very bad mistake.

Closing thoughts

Miners under-performing like this will NOT LAST FOREVER BUT IT CAN GET WORSE BEFORE IT GETS BETTER. The important thing is to have exposure for WHEN it changes, because then we will probably see something similar to the 2016 rocket ship. NOW is the time to do the work. NOW is the time to put in a lot of time and energy into Due Diligence in order to spot which HIGH QUALITY miners are selling at unsustainable prices for the long term. Now is NOT the time to stick your head in the sand, when Due Diligence and hard work has the highest implied ROI since the 2015 bottom. I am personally putting in a lot of time dusting off my spread sheets and trying to figure out what names to buy which should see a 100%-300% return as soon as sentiment gets better. This is the time to start putting in stink bids (with money you can afford to see a fat paper loss on before it turns around)!

Since it might get worse before it gets better you should only invest capital that you can comfortably see up to a 50% write down of before you see a 200%+ return.

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own shares of all companies mentioned which I have bought in the open market and am thus biased. Novo Resources and Lion One Resources are passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Great article. Continued success.