Lion One Metals: Site Visit Part 1

So, I just got back from a site visit to Lion One Metals down in Fiji yesterday and I thought that I would update my case for the company based on the latest information in the first part of the site visit series. First of all, the site visit was beyond awesome and I am very grateful that the company was so kind to cover all the expenses in order to get me down to Fiji. In my experience, the people I meet is the best part of any site visit and this time was no exception. I might be old fashioned but I usually have a need to like the people involved in a company in order to invest any meaningful amount of my money. I want to want the people involved to succeed and I would certainly not have Lion One on as a sponsor if I didn’t like the people involved and believed that they were honest people that wants to succeed WITH shareholders (Investing Truth: People, people, people). Since I am no geologist nor a mining engineer I had tonnes of questions and everyone was more than happy to explain things (sometimes over and over hehe). I also ran into some problems during the return trip from Fiji and the company was quick to help me out so I could get back home (Much appreciated!).

Ps. If anyone wants to know what paradise looks like, then go visit Fiji…

The Hedgeless Horseman standing on an extinct volcano:

As per usual, at least nowadays, I will start off with some comments on my investing strategy and how that ties into Lion One which has been a core holding of mine for quite some time.

Setting The Scene

You will see a lot of newsletter writers etc talk about what juniors COULD go up a lot. Such content mainly taps into the greed aspect of human nature, which is neither surprising nor factually incorrect. But, I could list hundreds of juniors that COULD go up a lot, and still it wouldn’t mean much. The simple reason for this is that all juniors pretty much has the potential to go up a lot. With that said, I don’t think that angle is optimal when it comes to investing because the COULD usually has a 1% chance of happening in reality.

As many people would probably have noticed by now I tend to focus on the ones that SHOULD go up instead. This is probably the greatest transformation that I have done personally, over just the past year or two, when it comes to investing strategy. Nowadays I simply rather pay up for something that “looks” expensive, compared to the crappy run of the mill juniors, if I believe that a revaluation is PROBABLE instead of POSSIBLE. Furthermore I think it is important to consider the fact that it easier to evaluate junior miners as a non-geologist the more advanced and de-risked an asset is. The average one asset exploration junior will probably have nothing although it could have something. Trying to figure out the chance of success at such an early stage is something I pretty much find impossible and I would only invest in such ventures if the people behind it was world class since such a stamp of approval is enormously more valuable than my personal guesstimate.

In other words: SHOULD > COULD

… Even if that usually means that the super blue sky case for a SHOULD play is lower than that of a COULD play. This just boils down to the law of greater numbers. A $10M MCAP company has a theoretically “easier” time to go to $100 M than a $100M MCAP company has to go to $1B. But with that said, I believe that an ALREADY SUCCESSFUL $100M company has a better chance of revaluing higher than the $10M pure potential play in a given time frame. Why? Because the $100 M company already has something and might have a lot of room left to grow while the $10 M company has a very slim chance of even finding something that would be worth anything in reality.

Now, given how greed and the law of big number works, you will often hear that companies are cheap just based on their MCAP or god forbid their actual share price. This is a totally irrational way to go about it in my humble opinion.

What makes something cheap is not dictated by PRICE alone, but what PRICE you pay for the intrinsic VALUE of a company. This is just classic Fundamental Value Investing but it really seems to be a rare way of thinking in the junior mining space. All of the factors that I just mentioned are the basis for why I have been harping on about why I think banked success has been, and still is, on sale.

Another example of confusing PRICE with VALUE is the fact that a lot of people are very reluctant to buy a stock just because it has run up on the back of a discovery whatever. This isn’t really a surprise since nobody wants to feel like one has already “missed out on the opportunity”. Basically it’s a common, automated, human reaction to not want to buy something that has gone up say 100% because one is afraid of being “the sucker”. But if one thinks about it, it’s obviously much more complicated that that…

Let’s say a random junior explorer has a 1% chance of finding a deposit that will some day turn into a profitable business and it is trading for $10M. If said junior then makes a “discovery”, and the price of the company proceeds to jump 100%, is it automatically a buy at that point? Well, what if the chance of success jumped from 1% to 20% due to the discovery hole? That’s a 20X increase in chance of success but only a 2X increase in price.

A crude example:

Company X has a 1% chance of finding something that will be worth $500 M at the end of the day and is trading for $10M.

The actual Expected Value for company X (pre-discovery) is $5 M but it’s selling for $10 M.

Then lets say that company X drills a couple of good holes and is on to a discovery which puts the chance of success closer to 20%

That would mean that the updated Expected Value of the company is $100 M, which is 10 times more than what the company was selling for prior to the discovery.

If the share price, and thus the price of the company, jumps 100% then it’s only up to $20 M.

In other words, it would be a much better buy at $20M after a 100% rise in share price (post-discovery) than it was at $10M prior to discovery.

… It was in fact a BAD buy at $10M but a GREAT buy at $20M in this example. Yet, it is my humble opinion that a minority of people in the junior mining space are even cognizant of this simple truth.

Simple mental mistakes like this is why I spend 95% of my time and energy on looking for de-risked companies, which already have some degree of success banked, because they will more often than not be cheaper than the juniors that are selling for 1/10th of the price (from an Expected Value stand point). If one goes back and read my articles on investing over the last 6-months or so, one would probably notice how I have tried to communicate concepts such as this.

Don’t get me wrong, I am looking for home runs (aka 10+ baggers). I just think that there is a higher chance of finding them in the companies that look expensive (on surface) compared to the pure potential micro caps that are trading for 1/10th to 1/20th of the former companies market cap.

Investing Truths

- A company is only a growth company if it HAS SOMETHING TO GROW

- A junior that has yet to find anything of value only has the POTENTIAL to become a GROWTH company.

The Case For Lion One Metals

Lion One Metals has been a core position of mine for over a year and it all goes back to everything I just discussed and have discussed in articles over the past year. It’s a company with banked success already and which I also think has a long run-way for growth.

Some of the success which is already banked:

- Serially successful management team that has done it before

- Mining Lease

- Good Jurisdiction

- Good Infrastructure

- ~1Moz of resources

- Controls an entire Alkaline Gold System (10Moz+ potential)

- PEA based on a postage stamp of the footprint with very high IRR

- Cashed up

… How many junior do you think fit that description? I personally can’t think of a single one.

Almost every Major Mining Company has an Alkaline Gold System as a cornerstone asset. Barrick has Porgera, Newmont Goldcorp has Cripple Creek, Kirkland Lake has Macassa and Newcrest has Lihir. Most of these mines have been mined for decades and have provided an immense amount of value. These are all giant mines and every Major mining company desperately wants large and long lived assets such as this. These systems are incredibly rare and I think Lion One Metals is the only junior in the world that currently controls 100% of such a system:

The neighboring Vatukoula mine is also an Alkaline Gold system and has been mined for over 80 years if I remember correctly and it’s still being mined today. Just think about the cumulative value that these mines will have created until the day that they are finally mined out? We are talking about company making operations that could sustain a gold producing business over decades, which is becoming rarer and rarer by the day. It’s so rare that most of the wheeling and dealings by the majors lately has just been about reshuffling control over legacy mines. These types of deposits are simply unique. This is an important point. Few juniors will ever found anything that anyone would put into production, even fewer will ever hope to find anything that could become a cornerstone asset for a mid tier or major producer.

So OK, Lion One already has a small deposit on a mining lease that could already be worth close to Lion One’s Enterprise Value of US$157 M. That’s a good START since it means that there is a sturdy base case in place. But in order for Lion One to be a core HODL case for me I want a long run-way to boot and I would argue that the company has a very long run-way.

The next slide shows the Mining Lease, the current (shallow) Tuvatu Resources and outcropping Monzonite (which is the host rock):

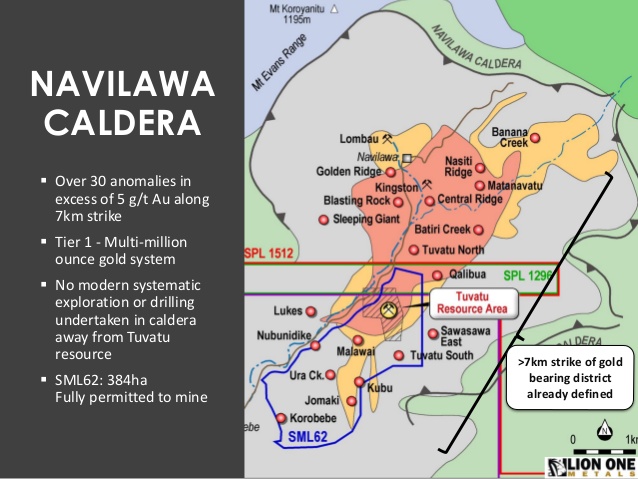

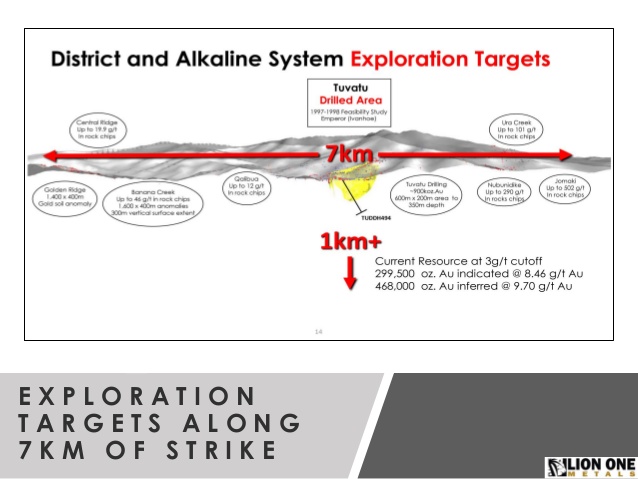

… The slide gives a sense of how big the lateral pie might be. This next slide highlights this as well:

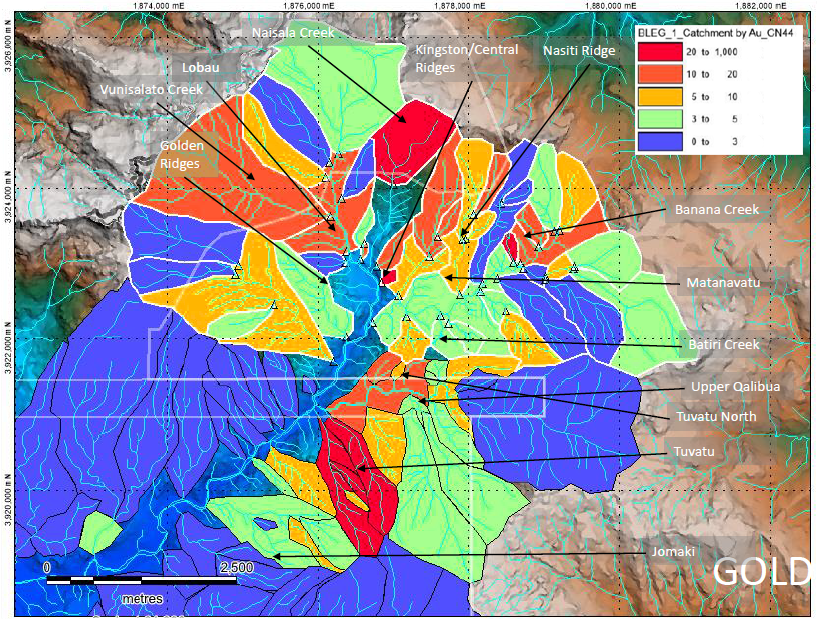

… So surface sampling and geological context sure is hinting that the gold system is laterally way more extensive than what has been explored to date. Then we add on the BLEG sample results:

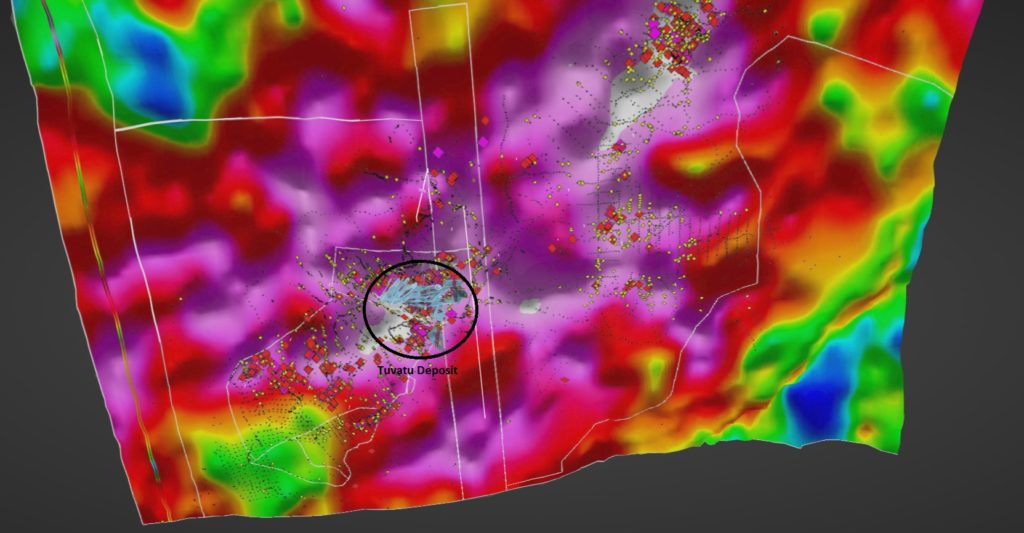

… Sure enough, the BLEG data is suggesting that the lion’s share (pun intended) actually seems to be to the north. Now, let’s look at the Potassic Alteration which is another clue as to where alkaline fluids have penetrated the rock:

… Yet another clue which further confirms all the previous clues. The thing is that all these slides have been highlighting the lateral potential of this Alkaline Gold System. Then we add on the fact that systems such as this can extend for over 1km at depth…

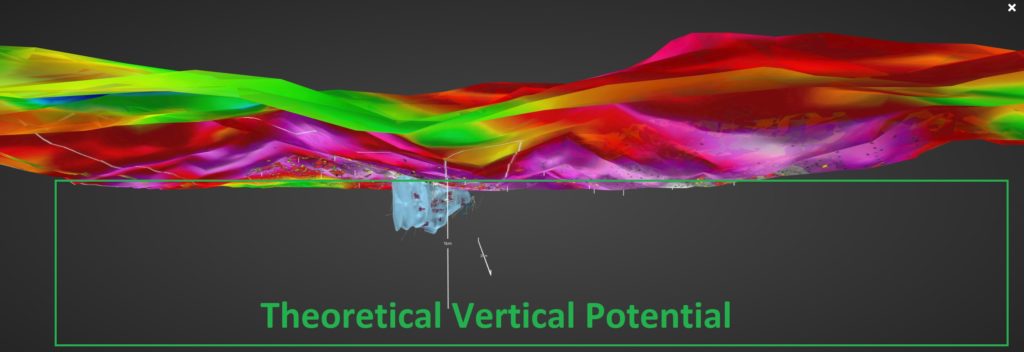

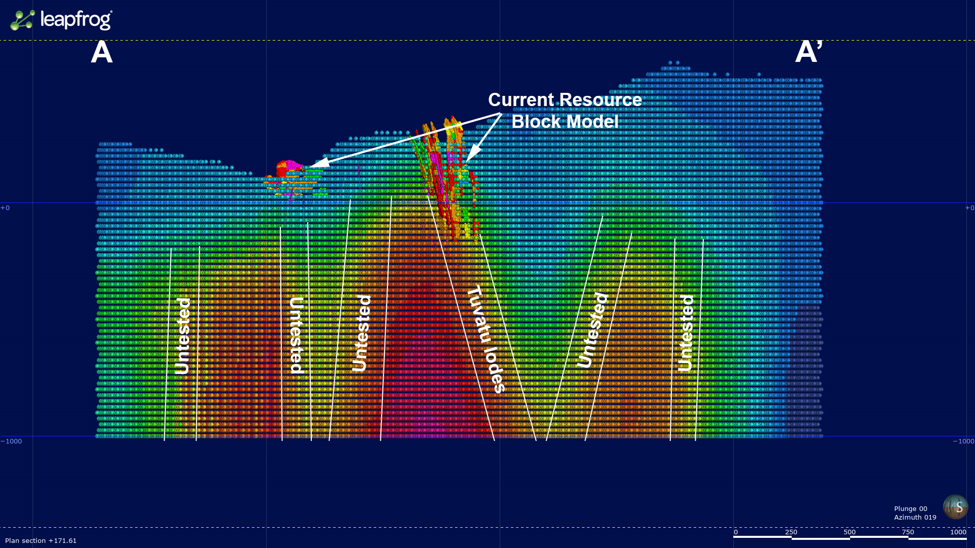

… OK, so it has been said that theoretically the Tuvatu Deposit with it’s countless lodes could extend further down. In order to “confirm” this, the company has been doing CSAMT surveys led by the specialist Tom Weis, who also did the CSAMT surveys for Irving (which is already reaping rewards). Lo and behold, the initial data from the CSAMT surveys is suggesting that the depth potential is indeed fully on the table:

… Note that the slides above are from the area around the Tuvatu Deposit which is of course just one part of the entire Navilawa Caldera. Now play with the thought that the Tuvatu deposit could extend say 3X+ times deeper and that there might be multiple more lode clusters in the surround area as suggested by the CSAMT surveys. Then play with the thought that the lateral extend of the system could be up to 7km and that the northern part might even be better. What kind of absolute potential are we talking about then? I don’t want to put numbers on it but consider that the Tuvatu Resources is around 1Moz and do the math. Furthermore, the PEA on that “postage stamp” suggests a NPV of around US$150 M at a gold price of $1,500 (Reminder: Lion One’s current Enterprise Value is US$157 M). Even though PEAs are usually overly optimistic I think it’s fair to say that Lion One is one of those cases where one is not paying much more than the value of the bird in the hand and one gets all the birds in the bush for free. This kind of highly asymmetric risk/reward is what makes this company one of the few “no brainers” in my mind. This wouldn’t be possible if the market wasn’t confusing uncertainty with risk and not effectively pricing in the exploration potential. Sure, the exploration upside is uncertain in terms of range… Is Navilawa hiding 2Moz, 5Moz or 15Moz+?. Impossible to know at this time but not pricing in much of the upside because the upside spectrum is wide is irrational to me (hence the opportunity in place IMHO).

Conclusions

BLEG sampling, rock chip sampling, legacy mining, Alkaline Gold System characteristics as well as geophysics are all pointing to exploration upside being probable and not just possible in my opinion. Each (additional) one of these aspects are exponentially enforcing/confirming all the other ones. A single aspect could be considered an anomaly but together they become a pattern. Again, there is a big difference between possible and probable upside scenarios, and they should not be priced the same As this theoretical pattern probably/hopefully gets translated into reality by the drill bit, uncertainty will decrease, and the (in my opinion) overly discounted theoretical potential should start to be reflected in the share price with time. Given that Lio One has stated that they are scrambling to get more rigs on site I can see a potential revaluation of this venture happen sooner rather than later. In fact, I think all that is needed is a few solid hits which confirms the very encouraging CSAMT survey results could light the stock on fire in a hurry, since that would mean that we would have proof of concept.

… This is exactly what I am looking for in a junior. A de-risked project, with a margin of safety and a lot of room for growth.

I think Lion One could explore the Navilawa Caldera for 10 years and still have lots left to explore. The system looks THAT big. However, I think this is already become apparent and I would be surprised if a larger entity would not have taken the company over within say 2-3 years. Majors miners are OK with taking operational risk, but they hate uncertainty. In other words, they are happy to pay up for all the de-risking efforts done by a junior in terms of exploration. This is exactly why I like these kinds of juniors. The ones who have PROBABLE growth ahead that a major will gladly pay up for, later.

I personally hope to own Lion One all the way up to a natural exit (a take over) so it doesn’t matter to me what the price does today or tomorrow. If a natural exit would to occur, I would not be surprised if it would come at a premium at all time highs, which is why Lion One is one of those rare companies that I am happy to HODL through out the short and medium term volatility.

To Sum Up

My case for having Lion One Metals a core position is actually rather straightforward (I like to look for simple “no brainers” if you haven’t noticed):

- Great people involved

- Increases the chance of (further) success

- Good jurisdiction

- Increases the intrinsic value and the likelihood of a take-over

- De-risked project which provides a margin of safety

- Decreases downside risk

- Enormous blue sky

- Lots of upside potential and a real shot at a world class asset

- Cashed up

- Lots of tools to work with and create further value

… Only a tiny fraction of juniors could say the same.

Lastly: Do your own due diligence and make up your own mind, as I have. We are all responsible for our own investment decisions and one should never risk capital that one can’t afford to lose. This is a high risk/high reward business.

Bonus picture: Into the belly of the beast…

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Lion One Metals which I have bought in the open market and am thus biased. Lion One Metals is a passive banner sponsor on my site and the company was kind enough to pay for the trip. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Don’t forget about the Olary Creek Royalty. I forget who it was that mentioned this streaming agreement could over the long-haul generate $200M in income.

“This agreement has the potential to deliver considerable future income to the Company through this royalty stream. The Olary Creek project currently contains a JORC and 43-101 compliant resource of 510 million tonnes of high grade magnetite with low impurities”

Put me up in the No-brainer Club please! Love this Story… only wish I listened to Bob Moriarty and bought sooner, but LIke you said de-risked is always better. lol maybe that NVO/IRV/LIO party can be in FIJI that sounds like a great idea. Thanks for the write up

-Sasha K in san diego

Off topic, but why is Novo stock doing so poorly? Even last three days with gold going up, Novo has been very disappointing. Is there some bad news out there that you are aware of?

Yeh no kidding! Getting face bashed!!! Looks like a sale $$$