Magna Mining Announces Signing of Definitive Agreement to Acquire Lonmin Canada and Announces a Private Placement Offering of up to C$20 Million of Subscription Receipts

Sudbury, Ontario–(Newsfile Corp. – August 16, 2022) – Magna Mining Inc (TSXV: NICU) (the “Company” or “Magna“) is pleased to announce that the Company has entered into a definitive share purchase agreement (the “Purchase Agreement“) to acquire 100% of Lonmin Canada Inc. (“Loncan“), including the Denison Project and the past producing Crean Hill Ni-Cu-PGE mine.

Magna’s CEO, Jason Jessup, commented: “The Crean Hill Mine was a significant producer in the Sudbury basin for more than 80 years and we believe the Denison Project has potential to add tremendous value through development of the remaining historical mineral resources and additional exploration on the property. The successful closing of this transaction will be transformative for Magna and has several potential synergies with Magna’s fully permitted, advanced stage Shakespeare Project.”

Denison Project Highlights

- Past production of 20.3 Mt grading 1.3% Ni, 1.1% Cu, 1.6 g/t Pt+Pd+Au

- Significant high-grade exploration and development potential

- Brownfield site with substantial supporting infrastructure in place

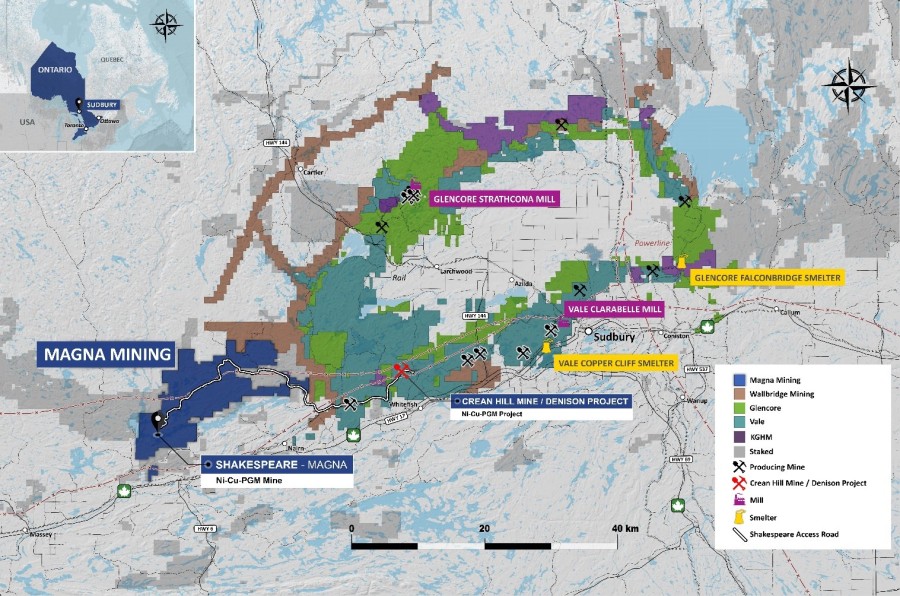

Under the terms of the Purchase Agreement, Magna will acquire 100% of the issued and outstanding shares of Loncan (the “Acquisition“), whose core asset is the Denison Project. The Denison Project is located within the Sudbury Basin mining district, 37 kilometres east of Magna’s advanced Shakespeare Project (Figure 1) and covers the past producing Crean Hill Mine (Figure 2). The Crean Hill Mine operated during three separate periods, from 1906 to 2002, with past production totaling 20.3 Mt grading 1.3% Ni, 1.1% Cu, 1.6 g/t Pt+Pd+Au. Prior to 2018, several zones of low-sulphide, high PGE footwall mineralization were discovered and defined. In addition to diamond drilling, detailed mapping, geophysical surveying, mineralogical and metallurgical studies, and geotechnical test work were completed, significantly advancing the understanding of this style of mineralization. In 2018, subsequent to the mine closing, Loncan entered into an agreement with Vale Canada Limited (“Vale“) regarding the transfer and development of the Denison Project.

Figure 1: Map Showing the Location of the Denison Project in Relation to the Shakespeare Project.

Figure 1: Map Showing the Location of the Denison Project in Relation to the Shakespeare Project.

Figure 2: Map Showing the Denison Property and Local Geology. Source: WSP 2020.

Figure 2: Map Showing the Denison Property and Local Geology. Source: WSP 2020.

Exploration Potential and Synergies with Shakespeare

- High grade exploration potential on the Denison property has been demonstrated by Loncan during the most recent period of exploration from 2005-2017. A total of 91,390 metres of diamond drilling in 279 drillholes were completed, intersecting both low sulphide, PGE rich footwall mineralization and high grade Ni-Cu contact mineralization. Certain assay results are illustrated in Figure 3 and Figure 4.

- The majority of recent drilling was focused on the immediate footwall of the historically mined nickel contact mineral bodies, above the 300 m level.

- The Denison Project has potential to provide feed to extend the life of mine at the Shakespeare Mine or operate in the near-term through toll milling or a combination of both.

- Exploration targets on the property include additional footwall exploration for low sulphide PGE rich mineralization as well as extensions of the known contact Ni-Cu zones (Figures 3 and 4).

Figure 3: Denison Project Longitudinal Section Showing Diamond Drilling Composites Greater than 0.8% Ni Equivalent1 over Greater than 10 feet Core Length. Selected Lonmin Diamond Drillhole Intercepts are Highlighted.

Figure 3: Denison Project Longitudinal Section Showing Diamond Drilling Composites Greater than 0.8% Ni Equivalent1 over Greater than 10 feet Core Length. Selected Lonmin Diamond Drillhole Intercepts are Highlighted.

Figure 4: Denison Project Vertical Section Looking West, Showing the 109 FW Zone and Diamond Drilling Composites Greater than 0.8% Ni Equivalent1 over Greater than 10 feet Core Length. Selected Lonmin Diamond Drillhole Intercepts are Highlighted. Section Location Shown on Figure 3.

Figure 4: Denison Project Vertical Section Looking West, Showing the 109 FW Zone and Diamond Drilling Composites Greater than 0.8% Ni Equivalent1 over Greater than 10 feet Core Length. Selected Lonmin Diamond Drillhole Intercepts are Highlighted. Section Location Shown on Figure 3.

(1) NiEq grades are based on metal prices of $8.50/lb Ni, $3.75/lb Cu, $22.00/lb Co, $1000/oz Pt, $2000/oz Pd and $1,750/oz Au and metal recoveries of 78% for Ni, 95.5% for copper, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au.

Proposed Transaction

The Acquisition will be completed pursuant to the terms of the Purchase Agreement entered into between the Company, Loncan and the current shareholders of Loncan, being Sibanye UK Limited (formerly Lonmin Limited, and a subsidiary of Sibanye Stillwater Limited), Wallbridge Mining Company Limited and certain other minority shareholders of Loncan (collectively, the “Vendors“). The aggregate purchase price for the outstanding shares of Loncan is equal to $16,000,000, comprised of a closing payment of $13,000,000 in cash and a deferred payment of $3,000,000, payable pro rata to the Vendors. The deferred payment is payable on or before the 12-month anniversary of the closing of the Acquisition. The Company will use commercially reasonable efforts to settle the deferred payment also in cash, but may, at its option, settle the deferred payment in common shares of the Company priced at the time of issue in accordance with the rules of the TSX Venture Exchange (the “TSXV“). As ongoing security pending the settlement of the deferred payment, the Company has agreed to grant a pledge of the shares of Loncan in favour of the Vendors. The Company will inherit Loncan’s existing commercial arrangements with Vale, including access rights and the NSR royalty referred to above. Certain other arrangements including Loncan’s joint venture arrangements with Wallbridge will terminate concurrently with closing.

Completion of the Acquisition is subject to the satisfaction or waiver of a number of customary closing conditions, including the approval of the TSXV.

Concurrent Private Placement

To fund the cash component of the purchase price for the Acquisition, as well as ongoing exploration and development activities at the Denison Project, the Company proposes to undertake a private placement of up to 74,074,074 subscription receipts of the Company (the “Subscription Receipts“) at a price of $0.27 per Subscription Receipt to raise aggregate gross proceeds of up $20,000,000 (the “Private Placement“). It is expected that the Private Placement will be non-brokered or a combination of a non-brokered and brokered financing, with the brokered portion being subject to the Company negotiating and entering into a definitive agency agreement with one or more agents, which will provide for, among other things, the payment of customary fees and may include the issuance of broker warrants of the Company convertible into either common shares or Units (as defined below) at an exercise price of $0.27 per broker warrant.

The Subscription Receipts will be issued pursuant to and governed by a subscription receipt agreement between the Company and Computershare Trust Company of Canada in its capacity as agent for the Subscription Receipts (the “Subscription Receipt Agent“). On closing, the gross proceeds of the Private Placement (less any fees or commissions payable to any agents in connection with the brokered portion of the Private Placement) will be deposited into escrow with the Subscription Receipt Agent pending satisfaction of certain escrow release conditions, consisting primarily of the satisfaction of all of the conditions to the closing of the Acquisition, other than the payment of the cash purchase price. Upon satisfaction of the escrow release conditions: (i) the gross proceeds of the Private Placement, less certain fees and expenses of the Subscription Receipt Agent, will be released to or as directed by the Company, and (ii) each Subscription Receipt will be automatically exchanged, with no further action required on the part of the holder, for one unit of the Company (each a “Unit“). Each Unit will consist of one common share of the Company (“Sub Receipt Share“) and one-half of one common share purchase warrant (each whole common share purchase warrant, a “Warrant“). Each Warrant will entitle the holder thereof to purchase one common share of the Company at a price equal to $0.405 per common share for a period of 3 years following the date of issuance of the Warrant. The Subscription Receipts, Sub Receipt Shares, Warrants and common shares underlying the Warrants, broker warrants (if any) and securities underlying the broker warrants will be subject to a statutory four-month hold period following closing of the Private Placement and the policies of the TSXV.

In connection with the Private Placement, the Company has received subscription agreements from a number of private investors. The Company may pay cash finder’s fees to certain finders in respect of subscriptions received from private investors on the non-brokered portion of the Private Placement, subject to entering into customary finder’s fee agreements with such finders.

The closing of the Private Placement is expected to be on or around August 30, 2022. Closing of the Private Placement is subject to to the satisfaction or waiver of a number of customary closing conditions, including the approval of the TSXV.

Advisors

Desjardins Capital Markets is acting as financial advisor and Bennett Jones LLP is acting as legal counsel to Magna.

Qualified Person

The scientific and technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is an employee of KingGeoscience and is a qualified person under Canadian National Instrument 43-101.

About Magna Mining Inc.

Magna is an exploration and development company focused on nickel, copper and PGM projects in the Sudbury Region of Ontario, Canada. The Company’s flagship asset is the past producing Shakespeare Mine which has major permits for the construction of a 4500 tonne per day open pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180km2 prospective land package. Additional information about the Company is available on SEDAR (www.sedar.com) and on the Company’s website (www.magnamining.com).

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Senior Vice President

Email: [email protected]

Cautionary Statement

This press release contains certain forward-looking information or forward-looking statements as defined in applicable securities laws. Forward-looking statements are not historical facts and are subject to several risks and uncertainties beyond the Company’s control, including statements regarding the closing of the Acquisition, the terms and closing of the Private Placement, the potential of the Denison Project, production at the Shakespeare Mine, the economic and operational potential of the Shakespeare Mine, potential acquisitions, plans to complete exploration programs, potential mineralization, exploration results and statements regarding beliefs, plans, expectations, or intentions of the Company. Resource exploration and development is highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

The securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any U.S. state security laws, and may not be offered or sold in the United States without registration under the U.S. Securities Act and all applicable state securities laws or compliance with requirements of an applicable exemption therefrom. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.