THH – Magna Mining (NICU.V): The Most Advanced Nickel (+ PGM) Junior in Canada is Unknown & Undervalued

– Oct 17, 2022

Magna Mining (NICU.V) is my preferred Nickel and PGM play (Plus it has some copper and gold). In fact I think the Risk/Reward is so good in light of recent developments that it has recently become a top #5 position, despite me being primarily a gold & silver focused investor. The story has been a true sleeper given that I have only seen a handful of retail investors talk about it despite the company already having an MOU with the multi billion dollar Mitsui corporation and considerable backing from smart money. I also think it will be the only high-grade nickel + PGM focused junior located in Canada (or perhaps even in the whole North America) which has “near term” cash flow potential. It also has a stellar team with a billion dollar success on the resume.

This article will have forward looking statements and my personal, subjective opinions. I own a lot of shares of Magna Mining and I have had the company come on as a banner sponsor some time ago so assume I am biased. Always make up your own opinion on a case since I share neither your profits nor losses. If you don’t understand a case you should never buy shares because you will end up making mistakes due to having low conviction and you cannot borrow other people’s conviction. I cannot guarantee the accuracy of the content in this article so I urge you to do your own Due Diligence.

This article will focus a lot on the new Denison Project hosts the Crean Hill Mine. Magna Mining is expected to complete the acquisition of this asset shortly (Meaning the deal has not yet closed!). In other words this article basically front running a transformational change I see in Magna Mining. The case is pretty much that Magna can probably go from very undervalued to extremely undervalued any day now. It’s a simple case (I think all good cases should be simple) but the article is long because there is so much interesting historical information to go through for both the team and the Denison Project (Crean Hill Mine).

- Company website: LINK

- Latest video interview:

Setting the scene

The Big Drain…

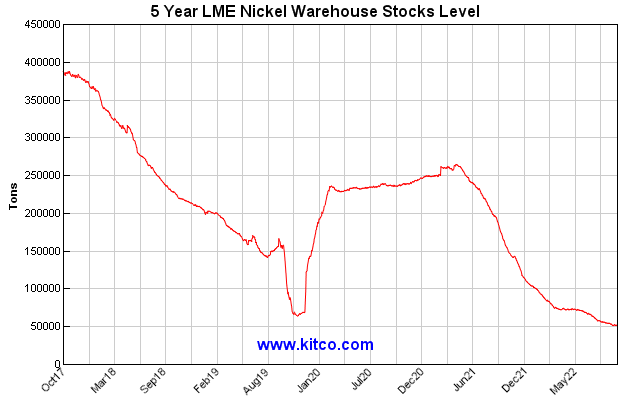

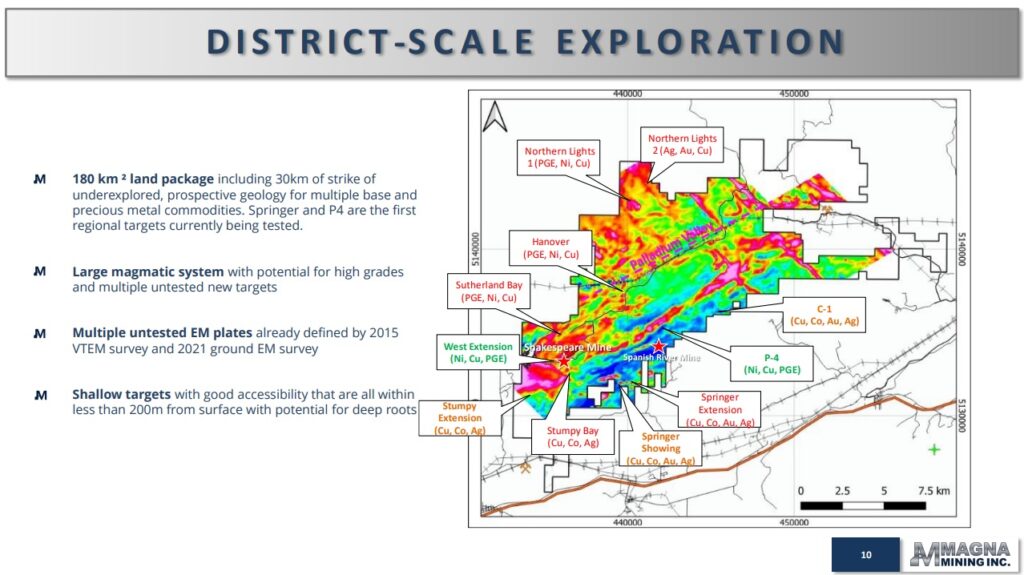

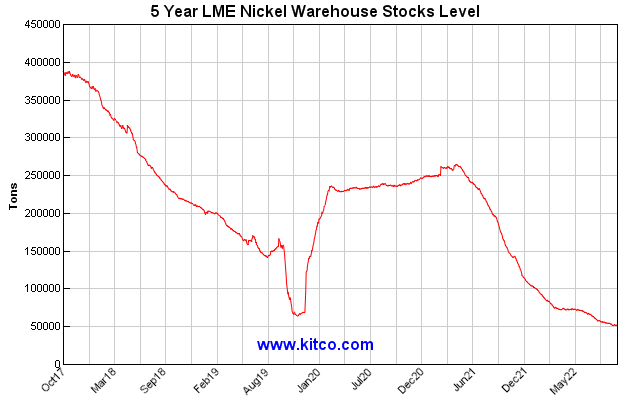

Lets start off with a quite remarkable 5-year chart showing the inventory of Nickel on the London Metals Exchange:

That chart shows a huge drop in inventories, from close to 400,000 tons in 2017, to a bit over 51,000 tons today. In other words a depletion of Nickel inventories of almost 75% as we are seeing the lowest levels in at least the last five years. As you might be aware there was an epic short squeeze on Nickel in February/March of this year which resulted in the Nickel Price shooting up some 300% over just a few weeks time. Interestingly the LME inventories are even lower today than they were then.

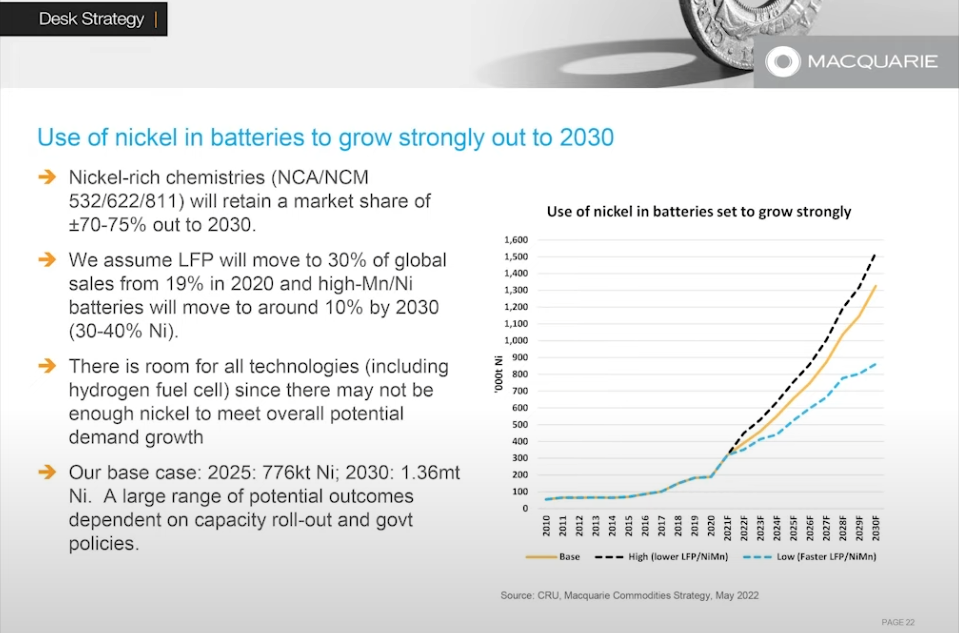

Macquarie Bank expects immense growth in Nickel demand from battery production as more Nickel increases battery life.

Then add the fact that Nickel is becoming a “Critical Metal” in North America and that we have seen very large companies scramble to secure supply (Further evidenced by Mitui’s MOU with Magna Mining). To have Magna’s projects in Sudbury, Canada of all places a fact that appears to becoming increasingly valuable. It also has the ESG aspect covered to boot…

On that note: “AUTOMAKERS’ ESG WOES GROW OVER INDONESIAN NICKEL” – source

Indonesia also happens to be the country that provides around 30% of the world supply today and some analysts it also has the highest supply growth potential. In other words the source with perhaps the highest potential in terms of closing the future supply shortage also happens to be the “dirtiest” source.

Palladium and especially Platinum appears to be reaching quite critical levels at the COMEX to boot:

Open interest as a % of total / registered inventories, per CME on Sept 29:

- Platinum: 1,628% / 4,062%

- Palladium: 962% / 1,157%

As far as I am aware those numbers have primarily ballooned due to some hefty withdrawals of especially Platinum just within the last month or so.

If I was a long term Nickel and PGM bull and had a lot of money to put together a company of my own, I would probably want to…

- Buy an advanced project or two

- In a true tier 1 jurisdiction where such commodities would be deemed Critical/Strategic

- In a tier 1 region for such deposits in said tier 1 jurisdiction with a solid mining culture, skilled labor & good infrastructure

- Lastly I would want to put in place a management team, with experience and proven success of mining exactly that, in this exact location

Enter Magna Mining (NICU.V):

- 33% insider ownership (pre raise dilution)

- MOU with a multi-billion dollar corporation (Mitsui) on it’s Shakespeare Deposit

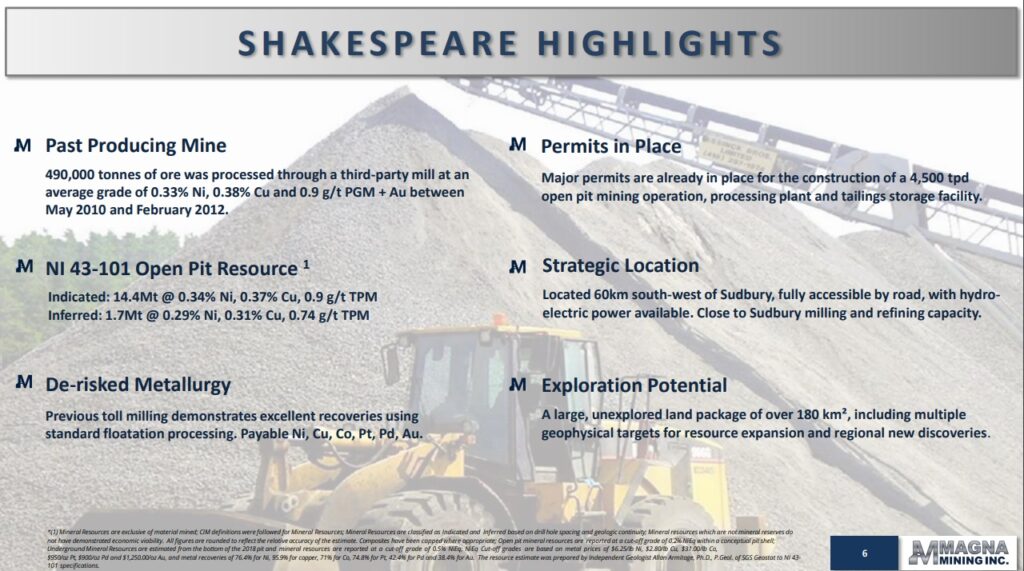

- 16.3 Mt Open Pit resource in Indicated and Inferred

- Major permits in place

- Set to acquire a high-grade past producing Crean Hill Mine (Denison Project) which used to be owned by Inco (Vale)

- New resource coming

- Major permits in place

- A few highlighted historic drill holes (in AuEq for simplicity & excluding recovery losses):

- 93.0 m at 8.7 gpt AuEq

- 74.0 m at 10.0 gpt AuEq

- 44.0 m at 8.9 gpt AuEq

- 42.3 m at 16.7 gpt AuEq

- 41.3 m at 10.2 gpt AuEq

- 32.4 m at 14.8 gpt AuEq

- Both assets Technically de-risked given they have been in production before

- Several ex members of Sudbury focused FNX Mining, which went from $0.25/share, to a peak of $40/share (Ended up being sold for $1.8 B)

- Acquired #5 past producing mines from Inco (Vale) akin to the Denison Project

- Potential for short runway to production via toll milling

- David Elliot (Haywood) big shareholder

- Dundee is a big shareholder

- Internal diversification via metals mix

- Considerable sunk costs:

- Major permits in hand at Shakespeare Deposit & Denison Project

- Which would take years, millions of dollars and no guarantees of success to replicate

- Both assets are past producing mines which de-risks them further

- Major permits in hand at Shakespeare Deposit & Denison Project

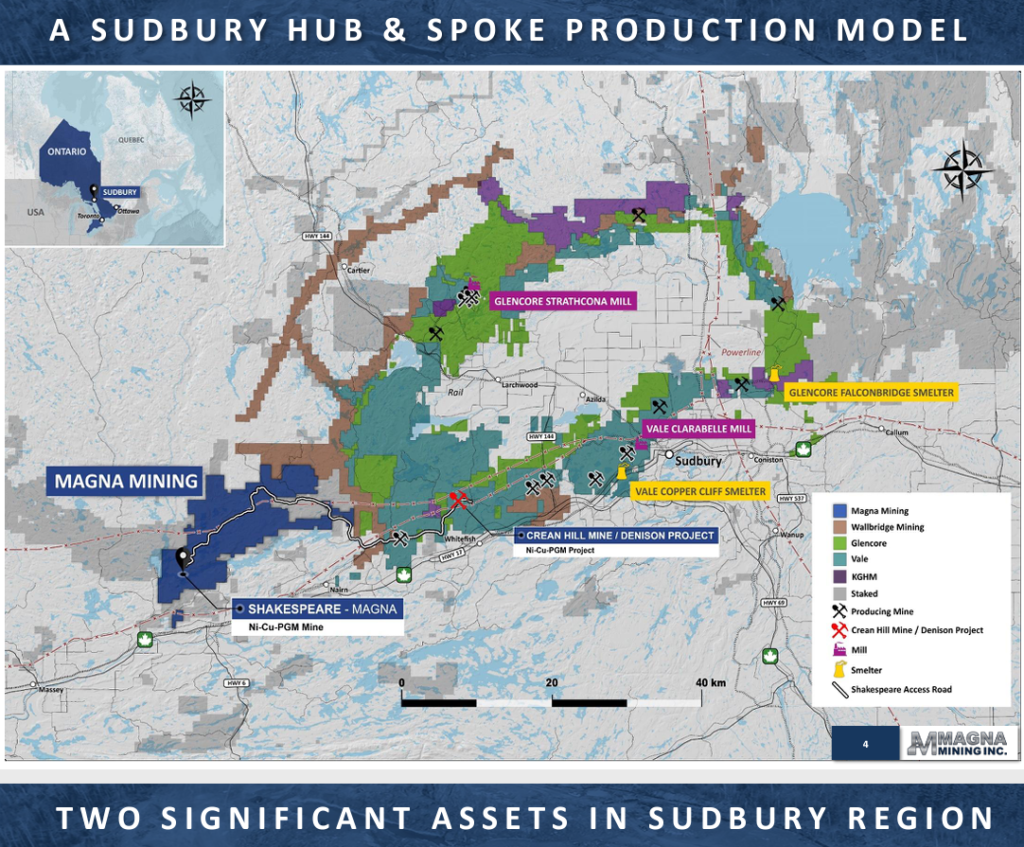

…. Two projects, both having been past producing mines, with major permits in place, with potential for near term cash flow from the Crean Hill Mine, and lots of exploration potential at both projects all located in the legendary Sudbury camp. Magna Mining is the only serious junior play in the Sudbury camp, with majors Glencore, KGHM and Vale controlling most of it, which makes Magna pretty much unique:

I don’t remember the last time I saw a junior check as many boxes as Magna:

- Preferably Margin of Safety

- Lowers risk

- Years of runway for growth

- Less need for good timing

- High insider ownership

- They will lie awake worrying about the company more than you do

- Competent management

- Time is the friend of a good management team

- Good access to capital

- Allows for higher value creating pace and less dilution

- Near term cash flow potential

- Possibility for high-grade production and by extension self funded growth in the medium term

Magna Mining 2.0

– Good is becoming great

I started buying Magna Mining over a year ago because I considered it very undervalued. A lot of things have changed for the better since then…

Fast forward to today and Magna recently completed a $20 M raise in order to fund the acquisition of the “Denison Project”. The money will be released to the company once the acquisition is finalized pretty much. Assuming the deal is closed, and the money received, the Basic Market Cap will be around C$48 M at $0.33/share and the Enterprise Value will be ~C$43.1 M (US$31.4 M).

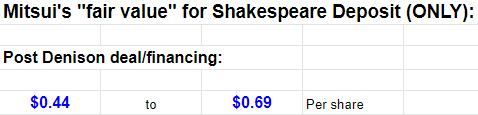

So first thing’s first. As mentioned earlier the Mitsui MOU put an implied value on 100% of the Shakespeare Deposit at C$64-C$100 M. Again this is not coming from me but from a multi billion dollar corporation. Oh and despite the crash in Nickel, following the epic +300% short squeeze, the price of nickel is pretty much back to the same price as it was on the day the MOU was announced.

So assuming this Denison deal goes through Magna Mining would still, according to Mitsui, be some 48% to 132% undervalued based on the Shakespeare deposit alone (If the MOU gets turned into a deal then Magna’s stake would in the deposit would be 87.5%-90% in exchange for cash) . That is some considerable Margin of Safety for shareholders, and I dare say that the Denison Project looks even better than the Shakespeare Deposit, which I will discuss later.

My Case For Magna Mining in Short:

“A company the size of Mitsui is only interested in a company like Magna because they see this growth potential and potential even for further consolidation in the Sudbury camp“ – CEO, Jasson Jessup

If one believes that Mitsui might not be far off the mark in terms of a risk adjusted “fair value” for the Shakespeare Deposit (ONLY) then one is by default paying LESS than zero at face value for the Denison Project (at $0.33/share assuming the deal closes). Plus one gets all the exploration potential within the greater Shakespeare Project as well as any potential value adding synergies between the two projects for free to boot.

(Excluding cash and possible 10%-12.5% dilution)

Personally I think the Denison Project (Crean Hill Mine) is easily worth at least C$109 M. My rationale for this will be explained later on in the article. The significant value of Denison might be pretty obvious as soon as the deal closes, and the Maiden Resource is out, which might just be a few weeks from now. As for blue sky potential I would say it is in the range of several hundreds of millions to perhaps a billion over the coming years.

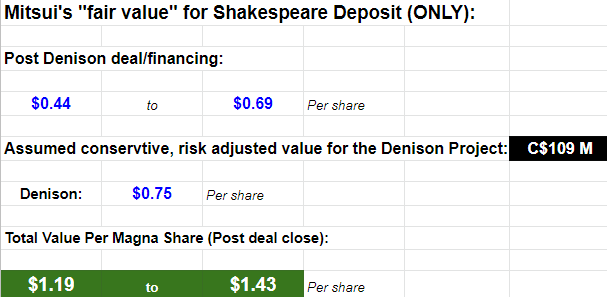

My personal, and in my opinion conservative, risk-adjusted valuation for Magna Mining post deal close:

(Basic Valuation. This also excludes cash, possible Mitsui dilution and added value via synergies between the projects)

Thus I personally see a Price to Conservative Value gap (Expected Return), of between 260% to 333%, which does not include any Blue Sky scenarios.

Best part: If the deal does not go through then I think Magna Mining is still significantly undervalued. If the acquisition goes through then I would consider Magna Mining to be EXTREMELY undervalued. As a matter of fact, according to Mitsui’s MOU, one would not be taking ANY valuation risk for the Denison Project (Crean Hill Mine) nor the greater Shakespeare Project up to around $0.44-$0.69 per share. Another way to look at it is like buying Shakespeare at a nice discount to fair value and getting the Denison Project as a cheaper than free option.

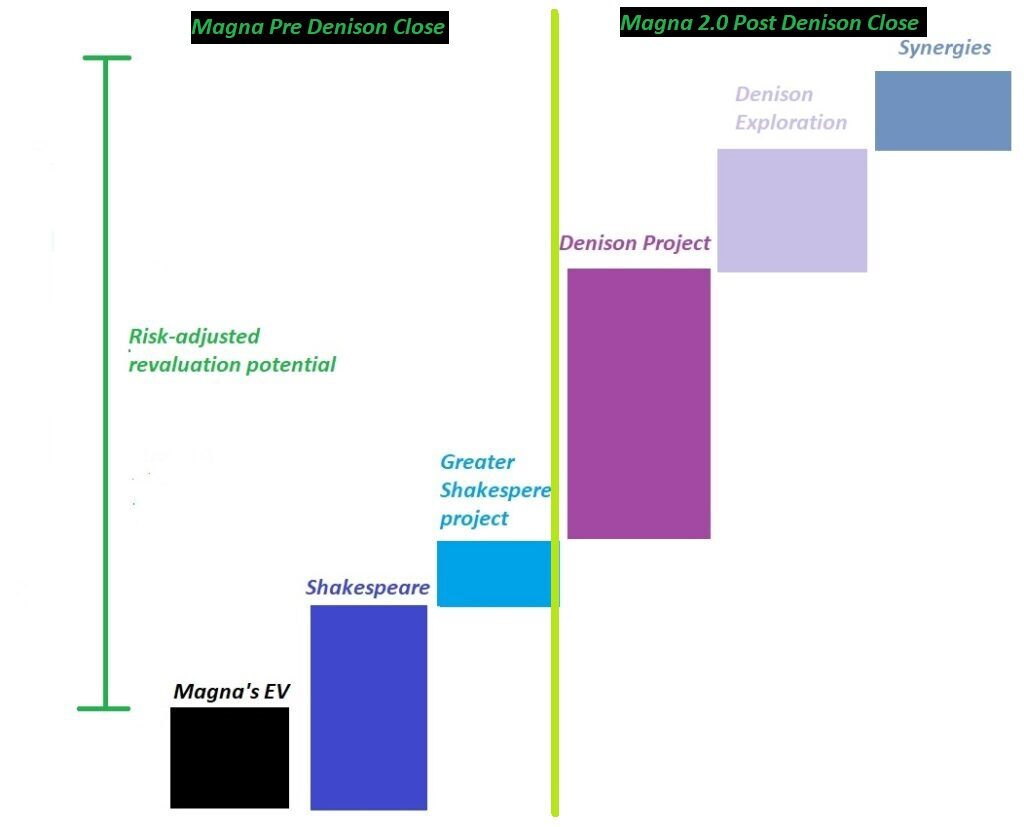

A somewhat less conservative, but in my opinion a more realistic look at Magna Mining, which shows the Margin of Safety and my totally subjective Risk-Adjusted Upside Potential:

Note that the total Blue Sky Potential is obviously higher than what is crudely visualized above;

- Growth at Shakespeare.

- More discoveries within the Greater Shakespeare Project could materialize (The “P-4 Project” for example)

- The Crean Hill Mine could grow a lot via both more Contact and Footwall style mineralization to the tune of several hundreds of millions.

- The company might do more value adding acquisitions

- Synergies might be quite a bit higher as well etc.

And then add the fact that inventories of Nickel and PGMs appear to be nearing critical levels which could spark some impressive short squeezes. I don’t mind having that as a backdrop when I believe Magna Mining is starting off as incredibly undervalued at today’s metals prices.

As discussed earlier Magna Mining also has two competitive advantages:

- Strategic source/Critical metal aspect thanks to being located in Sudbury, Canada

- ESG friendly aspect thanks to being located in Sudbury, Canada

I am not sure how to quantify the value of the above in dollar terms but suffice it to say that Magna ought to have an inherent premium due to “Not all nickel being created equal”.

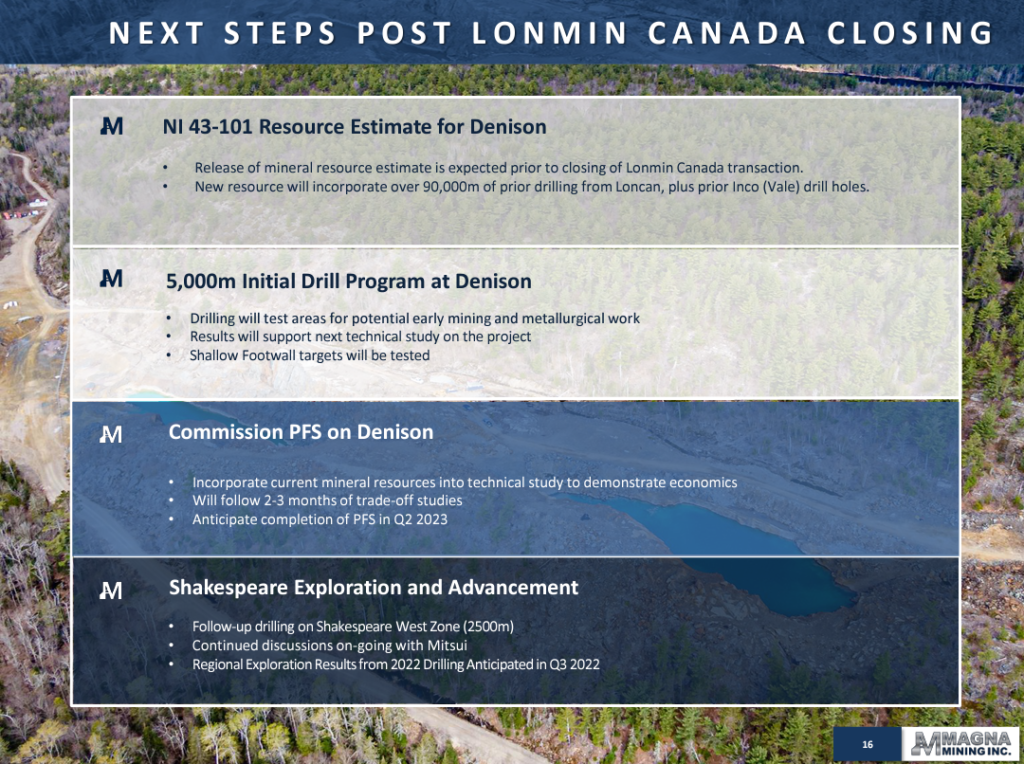

Upcoming Catalysts post acquisition close

With the expected imminent close of the acquisition of the Denison Project Magna is set to hit the ground running:

A resource is expected shortly for the Crean Hill Mine and to me this is a massive catalyst given that all of a sudden there will be tangible value in black and white colliding with a share price that in my opinion is currently pricing in a value of ZERO for this asset. Next up will be drilling, and later in this article I will show you some of the incredibly good drill holes that have come out of the Crean Hill Mine, some of which will be the basis for the coming resource. Magna is also set to commission a PFS study which might also incorporate the Shakespeare deposit to see just how much added value via synergies could potentially be unlocked. Lastly the company will also keep drilling at the Shakespeare deposit, continue discussions with Mitsui and we are also waiting for the last drill results from the 2022 campaign.

I very much look forward to looking back at Magna Mining in a few years and see how far they have come.

The two major catalysts to watch for:

- Resource Estimate for the Crean Hill Mine (Expected imminently)

- Denison Project (Crean Hill Mine) deal close (Expected imminently)

Magna Mining = FNX Mining 2.0?

Magna recently announced the appointment of David King as Senior Vice President, Technical Services:

“Mr. King previously advised and worked with TMAC Resources Inc. for 8 years before the company was sold to Agnico Eagle in early 2021. Prior to working with TMAC, he was the Senior Manager, Geoscience and Mineral Resources for KGHM International Ltd. Mr. King gained extensive experience in the Sudbury Basin after joining FNX Mining Company Inc. in 2002 and then holding positions of increasing responsibility within FNX and Quadra FNX until the company was sold to KGHM in 2012. During Mr. King’s tenure, FNX Mining was successful in exploring for, discovering, and developing several mines in Sudbury that are geologically similar to the Crean Hill Mine and Denison Project.“

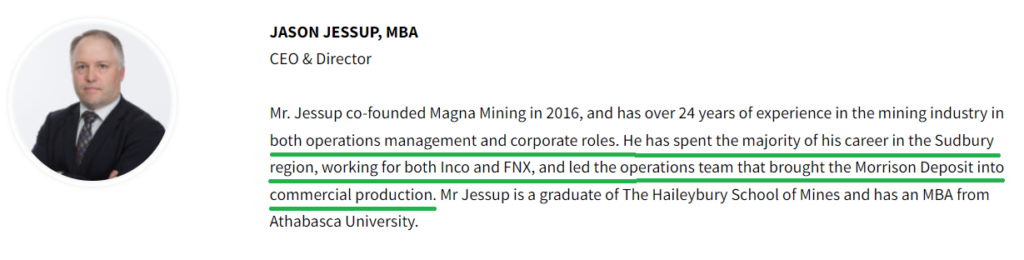

This is the nth member of the Magna Mining team that used to work for FNX Mining. Other members include Jason Jessup, the CEO, who owns over 10,000,000 shares of of Magna Mining:

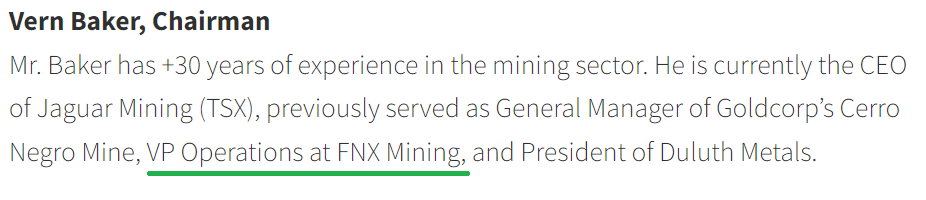

Vern Baker, Chairman:

Gord Morrison, Strategic Advisor:

There are more people from FNX Mining which you can check on their website at your own leisure.

So what’s the deal with FNX Mining?

Well, FNX Mining just happens to have been the only junior that I am aware of that was able to come into the HIGHLY competitive Sudbury Basin (which has been full of majors for ages) and create one of the biggest success stories in modern times.

Lets rewind the clock by looking at some excerpts from some articles…

“Company of the Year (51+ Employees): FNX Mining Company Inc.” – source

“From penny stock to powerhouse, FNX Mining Company Inc.’s journey to a leading player in the world-famous Sudbury Mining Camp is one that’s captured the imagination of investors and geologists alike.”

… In fact, the company has been profitable from its very first quarter of production – an unheard-of feat, given that most producers often require years to break even…

…“It’s interesting, because in 2001, the share price was $0.25. If someone were to have purchased $10,000 worth of our stock at that point, it’d be worth over $1 million today.”…

“Finance, business and geological expertise strike it big in the Sudbury Basin” – Source

Strategically, 2002 was a wise time for FNX to acquire the mines. Nickel was still recovering from its lowest recorded price and the Bre-X scandal was in full-swing and created an atmosphere of caution amongst investors. In the depressed market, FNX was able to pick the most desirable properties and people. The result was the creation of one of the biggest and most innovative exploration teams. Within a few years, FNX boosted its mineral resource inventory by more than four times, to about 43 million tonnes.

“Mining breakthrough in Sudbury” – source

The Sudbury Joint Venture (SJV) is the business to study for any company that wants to be a profitable mineral producer. Partners FNX Mining (75%) and Dynatec (25%) hit the ground running and have done nothing but grow since the first ore was shipped.

Together, FNX and Dynatec are a winning team. FNX acquired five deposits from giant Inco Ltd. in 2002. The deal included the former McCreedy West, Levack, Norman (now named Podolsky), Victoria and Kirkwood mines. FNX brought its exploration expertise to the partnership. Respected contract miner Dynatec, which brought its operating skills to the SJV and gained for itself an ownership position, does the mining. The venture was created in January 2002. Less than two years later it turned a $5-million operating profit in the first quarter of production, and $24 million in its first year of operation.

All the properties optioned from Inco were former nickel-copper-PGE producers. They were known to contain numerous remnants and extensions of ore beyond the limits of earlier development and mining. The SJV identified five near-term production targets and another 12 advanced exploration targets.

See the relevance? FNX Mining was a mind numbing success story, in the form of a small nickel focused junior located in Sudbury, that started from scratch by acquiring “non core” assets from the major miner Inco (Vale). Fast forward to today and you have multiple key members of the FNX Mining set to do it all over again in Magna Mining. The insider ownership at a whopping 33% coupled with major backing from Dundee and Haywood suggests that both insiders and big pocketed smart money are pretty confident that they can pull something similar off again.

A Good Case Should be Obvious

From a due diligence perspective it doesn’t get much easier than this. If someone pitched me this story and said;

“Hey, you got several members that helped build FNX Mining into one of the biggest billion dollar success stories with Nickel in Sudbury are doing it again. Insiders own 33% of the company, they soon have two very advanced Nickel/PGM/Copper assets in Sudbury that are pretty much fully permitted, and a multi billion dollar corporation in the form of Mitsui already signed a MOU on their first asset. Same company suggests Magna is undervalued by 48% to 132% TODAY only based on the Shakespeare deposit alone. That undervaluation is excluding the larger land package at Shakespeare and the new Denison Project which looks even better than Shakespeare. Oh and Canada has deemed Nickel to be a critical metal and a bunch of major miners and care makers etc are scrambling to secure supply (in Canada).”

… Personally I think Magna Mining is one of the most unique cases I have come across in the last seven years. The incredible Margin of Safety, coupled with the significant upside potential, makes the Risk/Reward look extremely good in my book. Typically one can get one of those things; An early stage exploration story might have significant upside potential but comes with extreme risk. A mature “value case” with significant Margin of Safety typically comes with little growth prospects etc.

Would one need to be a nickel or PGM expert to piece that together? Heck no if you ask me. The investment case looks pretty damn obvious to me.

Magna has been flying under the radar ever since it got listed not too long ago. Even the recent news this junior being able to raise $20 M in a market like this, and acquiring what appears to a stellar second asset, seems to have flown under the radar. After a call with management and digging deeper into Denson I turned from bullish to super bullish on Magna. I started buying more shares as soon as the trade halt was lifted and it appears retail is nowhere to be found as I think I have stood for almost 40% of the volume since it started trading (and we’re not talking millions here). The institutional/smart money interested is evident via insiders/Dundee/Haywood and Mitsui etc. But again, the retail interest has been non existent, and given how tightly this company is held there is no way for any big money to buy it in the open market (But said big money just put $20 M into the company via the PP).

Risk aspect – Can it get much better than this?

- A team that literally has done what they are doing now which ended in a billion dollar success

- Same metals

- Same place

- Same starting position

- Jurisdiction = Tier #1 (Canada)

- Location = Tier #1 (Sudbury, Canada)

- Infrastructure = Tier #1

- Nickel & Copper deemed Critical Metals for Canada

- Major permits in place already at both projects

- Proximity to #2 Smelters and #2 Mills belonging to Glencore and Vale

- Near term production potential from the Crean Hill Mine via toll milling (Two smelters nearby)

- Fun fact: FNX Mining got sold for $1.8 B and they only did toll milling(!)

- High-grade nature of the Crean Hill Mine suggests robust margins that can weather lower metals prices

- Diversified metals mix

- Nickel & Copper (Battery metals)

- PGMs + Gold (Precious metals)

- Good backing and access to capital as evidenced by Mitsui, Haywood, Dundee and the C$20 M raise

- Insiders own 33% and will be thinking about Magna at nights a lot more than you or me

The only real short term risk I see is a crash in Nickel price due to a global recession and/or Indonesian supply glut. With that said the PGM side of things might counter act a fall in base metals and Magna has the benefit of two competitive advantages:

- Strategic source/Critical metal aspect thanks to being located in Sudbury, Canada

- ESG friendly aspect thanks to being located in Sudbury, Canada

Even though I think one could wrap up the required Due Diligence right there lets take a look at what they company has…

#1 The Denison Project – “The Crean Hill Mine”

The Denison Project includes the Crean Hill Mine and is the second flagship asset that will be 100% owned by Magna Mining as soon as the deal is closed.

Lets start off with a few very valuable characteristics which I found on Wallbridge Mining’s (former owner) website:

- Advanced stage property, near-term to production with a current closure plan;

- Historic shaft (4,000-ft Crean Hill Mine Shaft) and underground infrastructure in place; – Source: Wallbridge

The property, which is located in the southwest corner of the Sudbury Basin (Figure 3), hosts multiple, well-defined PGM-rich zones that were discovered since operations were suspended. Significant exploration potential remains and the next step are to update the resources with new drilling information and work to move the project forward by completing an economic study.

There are a few things that stand out. First of all it means that the “Crean Hill Mine” pretty much has all permits for production in place already as it was a producer not too long ago. In today’s world where permitting typically takes many years, have no guarantee of success, and costs a lot of money it would be foolish to ignore how valuable it is to have a permitted project. The mine also has a closure plan and a lot of infrastructure in place as well. Lastly, there are multiple “well-defined” PGM-rich zones that were discovered after operations were suspended and I know management agrees with Wallbridge that there is “significant exploration potential” to boot.

More about the Crean Hill Mine

In one of Magna’s press-releases, the company said that the Crean Hill mine operated during three separate periods, from 1906 to 2002, with past production totaling 20.3 Mt grading 1.3% Ni, 1.1% Cu, 1.6 g/t Pt+Pd+Au. The Crean Hill mine is located 37km east of the company’s Shakespeare project in the Sudbury mining region.

THH: 20.3 Mt at those grades is equivalent to around 4.9 Moz AuEQ at an AuEQ grade of 7.55 gpt

(I encourage you to do the calculations yourself with whatever metals prices you think are appropriate at the time)

CEO Jason Jessup stated, “The Crean Hill mine was a significant producer in the Sudbury basin for more than 80 years and we believe the Denison project has potential to add tremendous value through development of the remaining historical mineral resources and additional exploration on the property. The successful closing of this transaction will be transformative for Magna and has several potential synergies with Magna’s fully permitted, advanced stage Shakespeare project.”

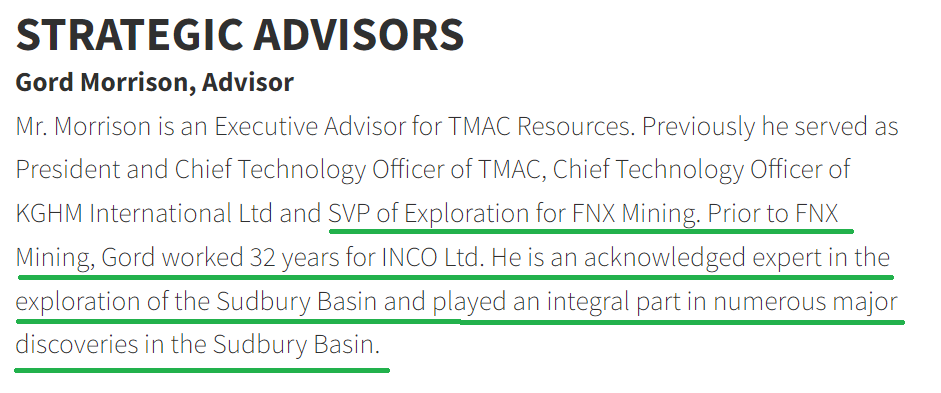

This is basically what management sees in the new Magna Mining post deal completion:

Again, two advanced assets (one with a respectable resource already), major permits already in place at both, significant exploration potential at both, potential for NEAR TERM CASH FLOW at Denison via toll milling, located in Sudbury, Canada and headed by ex members of FNX Mining…

What is all that plus all the risk-adjusted potential worth? $100 M? $150 M? $200 M? $300 M?

Well no one can know the exact numbers but as we know Mitsui puts a value of up to $100 M for Shakespeare alone and Mr Market is giving away ownership of the whole company for C$43.1 M (EV) with a MCAP of C$48 M at $0.33/share.

Do You Like Grade?

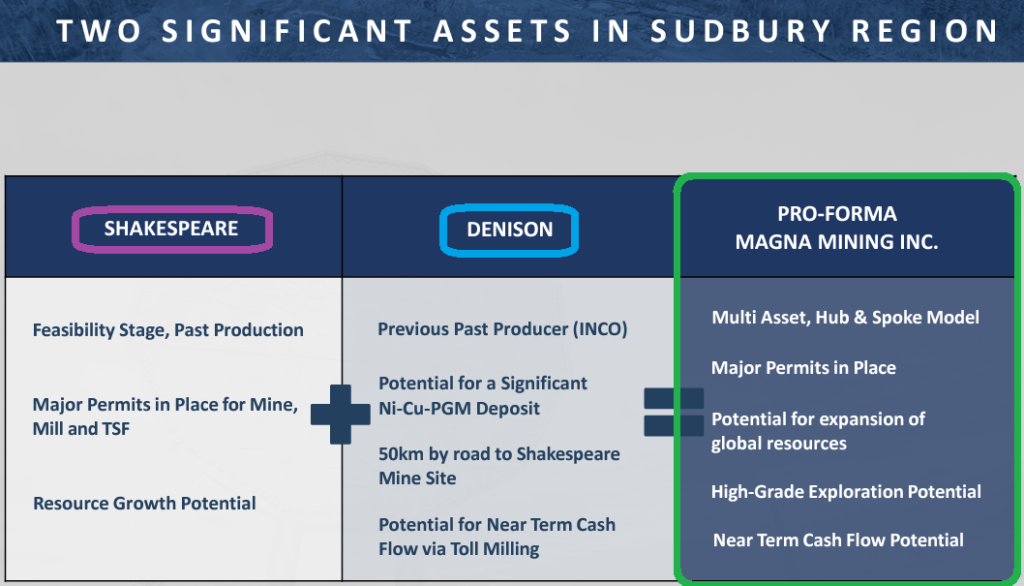

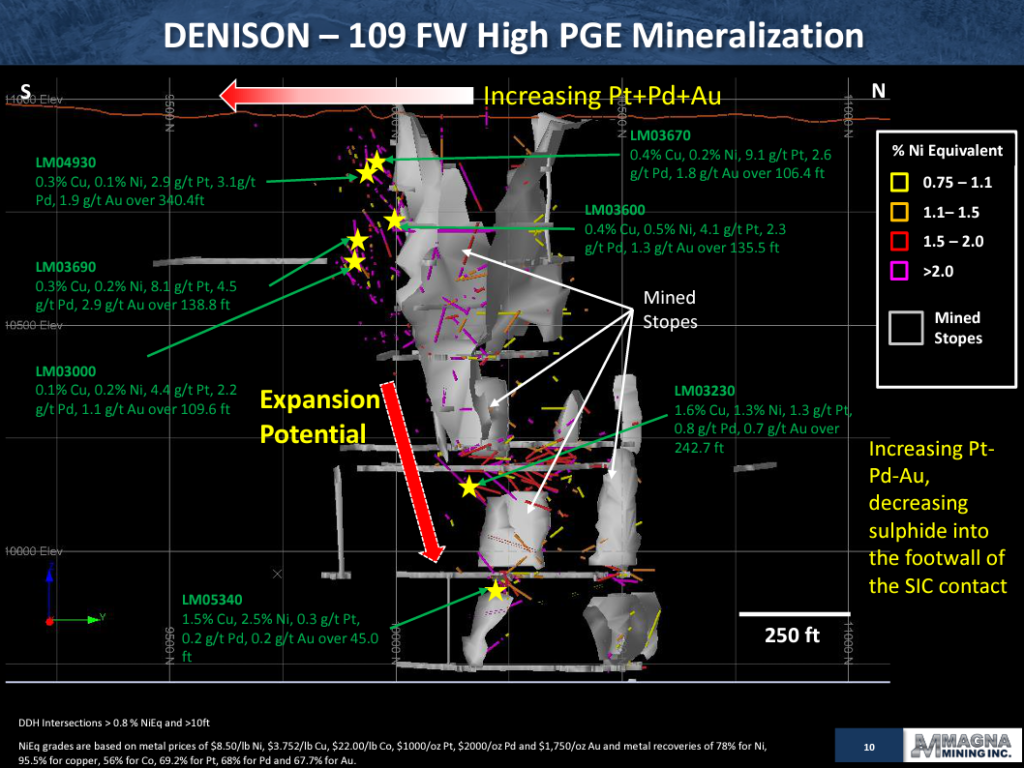

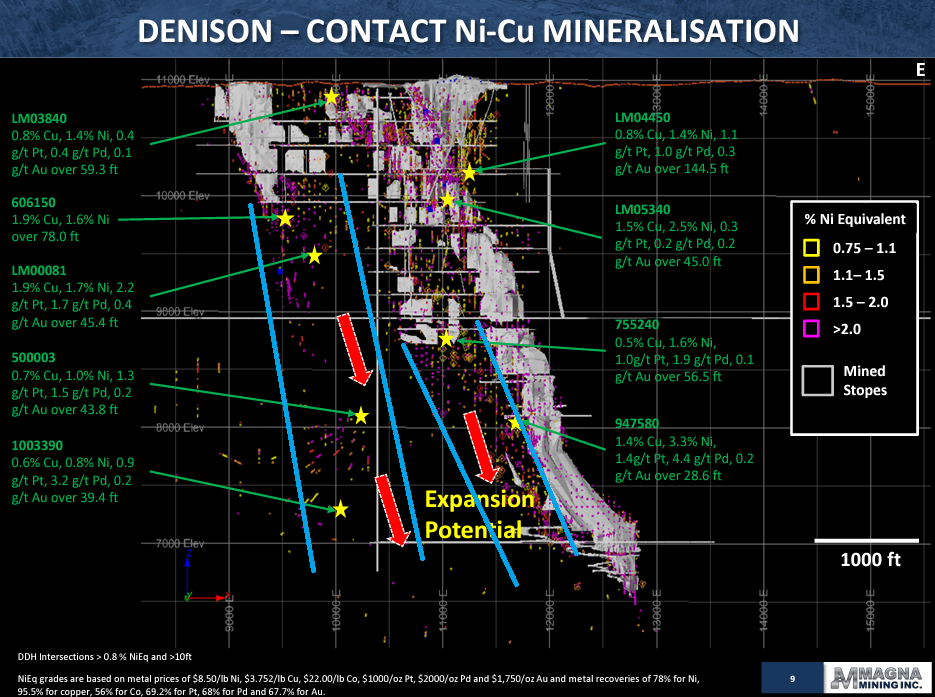

Well the Denison project saw 91,390 m of drilling done by the previous owner Lonmin and Inco did some drilling before that. To give you an idea of what intercepts these companies produced at Denison I present the following two slides from the latest Magna presentation:

First of all lets just consider the value of the drilling (plus assaying etc) done by Lonmin alone. If we assume a all in costs of $250/m then 91,390 m of drilling would cost around 91,390 x $250 = C$22.8 M to replicate today. That alone would be more than 50% of the current Enterprise Value of the whole company. Moving on…

Since these intercepts include include several metals and is calculated in feet I thought it would be fun to convert it to AuEQ and meters in order to better understand what I am dealing with…

Metals price assumptions:

- Gold: $1,726/oz

- Copper: $3.43/lb

- Nickel: $9.78/lb

- Platinum & Palladium: $1,726/oz (Equal to gold for simplicity. You can do more accurate calculations if you want.)

(Some holes were not even assayed for PGE)

“Contact Ni-Cu Mineralization”

- LM03840 0.8% Cu, 1.4% Ni, 0.4 g/t Pt, 0.4 g/t Pd, 0.1 g/t Au over 59.3 ft

- 18 m at 7.4 gpt Au

- 606150 1.9% Cu, 1.6% Ni over 78.0 ft (Did not even test for PGE)

- 23.8 m at 8.8 gpt Au

- LM00081 1.9% Cu, 1.7% Ni, 2.2 g/t Pt, 1.7 g/t Pd, 0.4 g/t Au over 45.4 ft

- 13.8 m at 13.5 gpt Au

- 500003 0.7% Cu, 1.0% Ni, 1.3 g/t Pt, 1.5 g/t Pd, 0.2 g/t Au over 43.8 ft

- 13.4 m at 7.8 gpt Au

- 1003390 0.6% Cu, 0.8% Ni, 0.9 g/t Pt, 3.2 g/t Pd, 0.2 g/t Au over 39.4 ft

- 12 m at 8.2 gpt Au

- LM04450 0.8% Cu, 1.4% Ni, 1.1 g/t Pt, 1.0 g/t Pd, 0.3 g/t Au over 144.5 ft

- 44 m at 8.9 gpt Au

- LM05340 1.5% Cu, 2.5% Ni, 0.3 g/t Pt, 0.2 g/t Pd, 0.2 g/t Au over 45.0 ft

- 13.7 m at 12.5 gpt Au

- 755240 0.5% Cu, 1.6% Ni, 1.0g/t Pt, 1.9 g/t Pd, 0.1 g/t Au over 56.5 ft

- 17.2 m at 9.9 gpt Au

- 947580 1.4% Cu, 3.3% Ni, 1.4g/t Pt, 4.4 g/t Pd, 0.2 g/t Au over 28.6 ft

- 8.7 m at 20.7 gpt Au

“High PGE Footwall Mineralization”

- LM04930 0.3% Cu, 0.1% Ni, 2.9 g/t Pt, 3.1g/t Pd, 1.9 g/t Au over 340.4ft

- 93 m at 8.7 gpt Au

- LM03690 0.3% Cu, 0.2% Ni, 8.1 g/t Pt, 4.5 g/t Pd, 2.9 g/t Au over 138.8 ft

- 42.3 m at 16.7 gpt Au

- LM03000 0.1% Cu, 0.2% Ni, 4.4 g/t Pt, 2.2 g/t Pd, 1.1 g/t Au over 109.6 ft

- 33.4 m at 8.61 gpt Au

- LM05340 1.5% Cu, 2.5% Ni, 0.3 g/t Pt, 0.2 g/t Pd, 0.2 g/t Au over 45.0 ft

- 13.7 m at 12.5 gpt Au

- LM03670 0.4% Cu, 0.2% Ni, 9.1 g/t Pt, 2.6 g/t Pd, 1.8 g/t Au over 106.4 ft

- 32.4 m at 14.8 gpt Au

- LM03600 0.4% Cu, 0.5% Ni, 4.1 g/t Pt, 2.3 g/t Pd, 1.3 g/t Au over 135.5 ft

- 41.3 m at 10.2 gpt Au

- LM03230 1.6% Cu, 1.3% Ni, 1.3 g/t Pt, 0.8 g/t Pd, 0.7 g/t Au over 242.7 ft

- 74 m at 10.0 gpt Au

Those are obviously some mind numbing drill holes that you pretty much see no junior pull off today. Not only is the mineralization very high grade but it is also thick and starts at surface(!). The margins and free cash flow potential should be obvious. Now you have an idea what Magna Mining gets with the acquisition of the Denison Project and in the not too distant future we will have the first resource from the historic drilling done at the Crean Hill Mine.

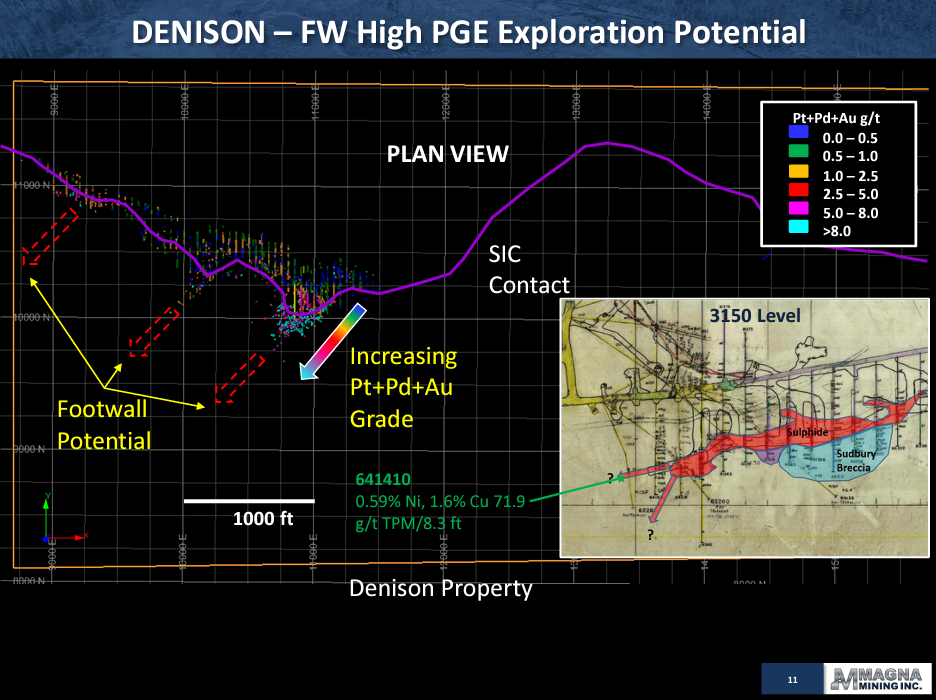

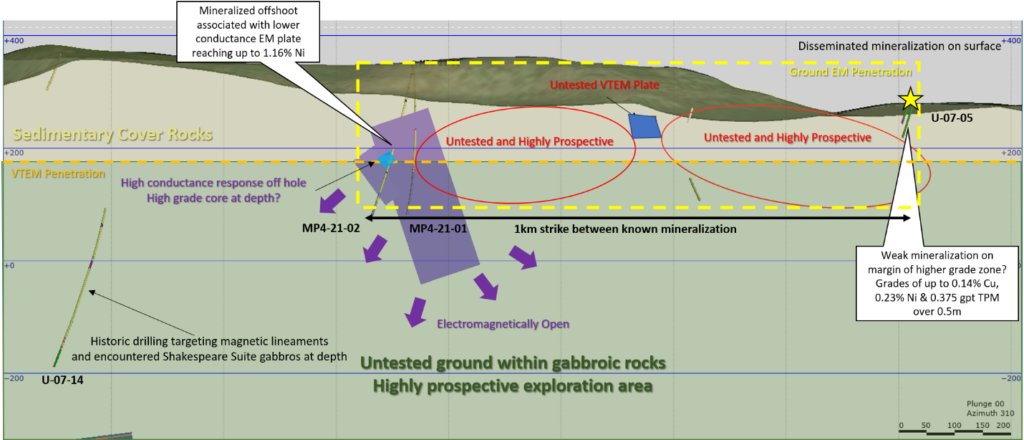

Apparently these types of deposits in Sudbury can also have very high grade PGM rich “conduits”. The Magna team encountered those conduits when they worked for FNX Mining and Inco so they are well aware what the Crean Hill Mine could get a lot more valuable. On that note here is a slide where they show thee areas where they suspect these conduits might be located:

The sketch in the bottom right of the slide is from the time when Inco owned the project I believe. Furthermore I think Gord Morrison, who is a strategic advisor and considered number #1 when it comes to Sudbury geos, used to work at the Crean Hill Mine. Apparently these can be extremely high grade and provide some of the most valuable ore in the world. Here you have Jason Jessup talking about these types of zones and their experience with them at FNX Mining:

Some context for these high-grade Footwall deposits and Gord Morrison who is an advisor for Magna Mining:

ONTARIO – FNX Mining of Toronto has renamed the Levack footwall deposit to honour Gord Morrison, the company’s senior VP of exploration. He led the team that discovered the deposit in 2005. One of FNX’s outstanding assets, the deposit is being readied for commercial production in mid-2010.

Morrison was employed for 32 years by Inco as an exploration geologist in Sudbury and globally. While at Inco, Morrison and his exploration team found several significant deposits, including the company’s 153 and Victor footwall deposits plus several nickel contact and offset deposits. He retired from Inco in 2003 and joined FNX.

Morrison has been instrumental in assembling and mentoring the FNX exploration team which is recognized internationally for their exploration success in the Sudbury Basin. Since 2002, he and his team have made nine discoveries on the FNX properties, five of which have been successfully put into production, including the Inter Main, 2000, Main Depths, Levack footwall, and the recently discovered Victoria offset deposits.

The Morrison deposit is a typical Sudbury Basin, high-grade copper-precious metals-nickel occurrence which has, from a limited part of the deposit, current NI 43-101 probable mineral reserves of 1.2 million tonnes at 7.4% Cu, 1.5% Ni, and 6.86 g/t Pt-Pd-Au. The Morrison deposit is open in most directions and is being expanded with ongoing drilling from newly established drill platforms as the in progress development of the deposit expands at depth. – source

Probable Potential

So how much “probable potential” might there be from the standard Contact Style mineralization which Inco used to mine? Well we know around 20.3 Mt was mined from the Crean Hill Mine (shown in grey in the slide below) and there is obvious exploration potential given there are many hits outside what was mined:

(I have drawn blue lines to show two theoretical corridors of expansion potential)

If the grey area is around 20.3 Mt I wouldn’t say it is a stretch to say that there is certainly exploration potential for at least 5 Mt of this primarily Contact style, nickel rich mineralization. This would be in addition to the bonanza-grade, PGM rich Footwall potential.

Digging deeper…

– What was once split is now whole

Wallbridge Mining has a very interesting page on the Denison project on their website which is still up –LINK

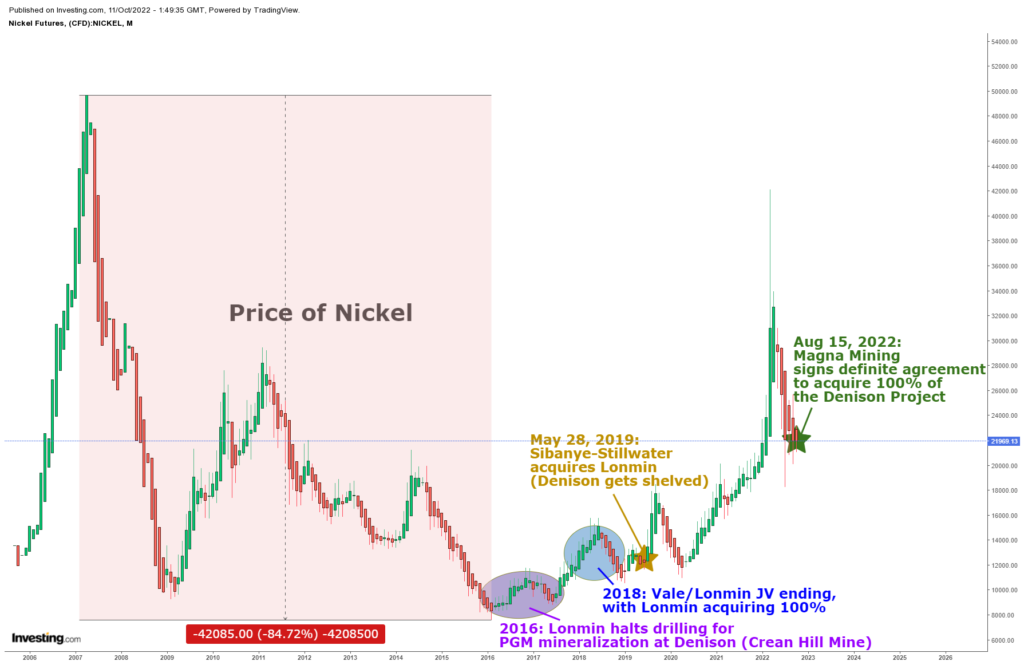

Lonmin Canada (Which Magna is acquiring along with the Denison Project) was restricted to exploring for the PGM + Au rich zones only, as the typical Contact Style (Nickel heavy) mineralization which formed the bulk of the historic mining, was pretty much off limits. In case significant Contact Style mineralization would be delineated the company would risk Vale (formerly Inco) taking back the project. Thus one could say that Lonmin was handicapped in the sense that it was forced to only focus on PGM + Au rich mineralization, even though it was primarily the high grade nickel/copper Contact Style mineralization, which was the foundation this world class mine (which produced for over 80 years). This “split” (and thus hindered) approach to unlocking the Crean Hill Mine potential started in 2003 with the Lonmin/Vale JV, and ended in 2018, when Lonmin finally acquired 100% of the project. The project itself has not seen any drilling since 2016, as Lonmin was still struggling financially, years after the bull market top in PGMs. Lastly, only a year after Lonmin was fortunate enough to acquire 100% of Denison during the depths of the bear market, the company’s financial problems were still in place and the company was gobbled up by Sibanye-Stillwater:

LONDON, May 28 (Reuters) – A majority of Lonmin’s shareholders approved on Tuesday the takeover of the platinum producer by South Africa’s Sibanye-Stillwater at a meeting in London.

Lonmin was hit hard by the drop in platinum prices and has had to cut spending and jobs in order to retain a positive balance sheet, a condition of Sibanye’s proposed offer.

When Stars Align

– A recipe for opportunity…

- 10 year long bear market in Nickel and PGMs

- 2016: JV operator Lonmin is struggling financially and stops drilling for Footwall (PGM) mineralization at Denison

- 2017: “Brazil’s Vale to cut capex, eyes net debt goal of under $15 bln” – Source

- 2018: Lonmin acquires 100% ownership of the Denison Project

- 2019: Lonmin, which is still struggling, gets bought out by Sibanye-Stillwater and the Denison Project ends up on the shelf of a major

- 2022: Magna Mining signs definite agreement to acquire 100% of the Denison Project

How Magna Mining could be able to purchase such a high quality asset on the cheap is starting to make sense in light of the above. After a 10 year slide in Nickel prices the JV appears to have stopped working the project and in 2018 Vale let Lonmin get full control of the asset. Despite Lonmin achieving 100% ownership it seems the damage had already been done as the company appears to have been unwilling and/or unable to re-start exploration. The brutal bear market in Nickel allowed Lonmin to get 100% ownership of such a high quality project, but somewhat tragically Lonmin was unable to harvest, as the struggling company and got put out of its misery and was gobbled up by Sibanye-Stillwater shortly after.

In short:

From 2003 to 2016 was only periodically explored for strictly PGM rich mineralization by Lonmin. After Lonmin acquired 100% interest there was not additional drilling done for either PGM, nor Nickel-rich, mineralization. Magna Mining will be the first company since at least 2003 which a) will have 100% interest in all types of mineralization at the Crean Hill Mine, and b) Will actually have the focus and means to explore and unlock all pieces of the historic mine.

Back to Denison and The Crean Hill Mine

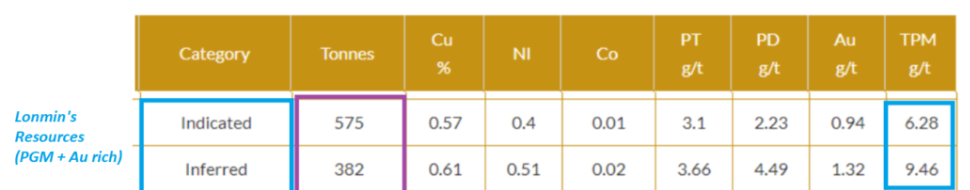

Wallbridge Mining which briefly had a minor interest in the Denison asset, via a small take in Lonmin (Subsiduary of Sibanye-Stillwater), still has a compilation of “Mineral Resources (historic)” for the Crean Hill Mine up on the site. Now this is extremely interesting reading as it highlights the significant potential of the Crean Hill Mine. Remember how Lonmin was strictly limited to PGM + Au rich Footwall Style mineralization? Well two “Historic Lonmin Internal Non-NI-43-101 Resource Estimates” from two different zones are presented. One historic resource was done in 2015 for the “109FW” zone and the other was done in 2017 for the “9400” zone. You can see the combined tons and grades for both indicated and inferred resources in the slide below:

(Note the very high PGM grades and perhaps more importantly the OVERALL grades):

(Note: TPM = Total Precious Metals)

Lets just see what the AuEQ grades would be for the two different resource categories:

(Assumptions: Cu = $3.44/lb, Ni = $11/lb, TPM = current gold price of $1,673 and I have excluded Cobalt for simplicity)

- Indicated: 575,000 tons grading 8.9 gpt AuEQ (1.97% NiEq)

- Inferred: 382,000 tons grading 12.6 gpt AuEQ (2.80% NiEq)

That is some high grade ore albeit not big tonnage (yet). Keep this Lonmin “starter resource” in mind as we look at more of the data. These resource numbers also comes with an interesting footnote:

(THH: Bold and underline added by me)

The resource estimates generated by Lonmin are internal company reports and do not follow the format required by NI-43-101. The resource estimate were carried out to the highest industry standards, however only focus on Pt-,Pd- and Au-rich mineralized domains and potentially ignore significant base metal rich mineralization. Therefore, the qualified person(s) is not confident that the historic estimate is relevant and additional modelling and interpretation is required to update the historical estimate as current. A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or reserves; therefore, the quailed person(s) is not treating the historical estimate as a current mineral resource or reserve.

This footnote obviously highlights the fact that Lonmin was handicapped in the sense that the typical Nickel (base metals) Contact Style mineralization was a no go. In other words the company had to literally ignore Nickel rich (base metals) mineralization which would probably go to Vale anyway. Again I will stress the fact that Magna Mining should soon control it all and be able to go after all styles of mineralization.

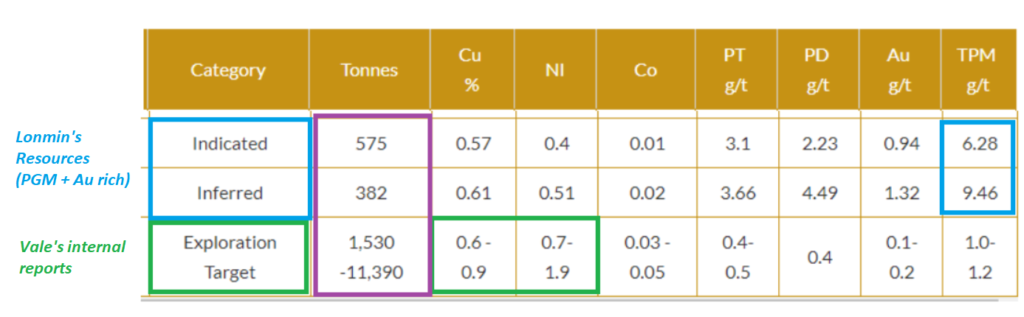

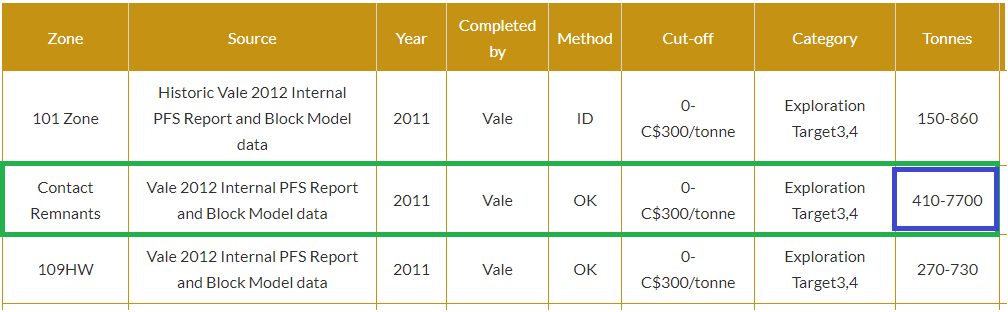

Wallbridge Mining’s summary also includes older reports labeled as “Historic Vale 2012 Internal PFS Report and Block Model data” which are obviously internal estimations done by Vale in 2012. The footnotes to these reports are as follows:

There is insufficient information available for the qualified person(s) to validate these internal company estimates in light of NI-43-101 requirements. The potential quantity and grade is conceptual in nature as the qualified person(s) has not done sufficient work to define a mineral resource and that it is uncertain if further work will result in the target being delineated as a mineral resource.

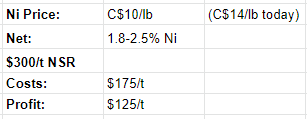

The potential quantity and grade are based a block model generated by Vale for the different zones and provided to Wallbridge by Lonmin. The upper tonnage and lower grade range is the value with not cut-off of each respective zones. The lower tonnage and higher grade range reflects a C$300/tonne cut-off using C$8.37/lbs Ni, C$3.79/lbs Cu, C$43.87/lbs Co, C$1,108/Oz Pt, C$1,233/Oz Pd and C$1,651 Au and assuming recoveries of 85% Ni, 90% Cu, 40% Co, 66% Pt, 74% Pd and 73% Au.

First of all these are internal reports and not NI-43-101 compliant resources. The second footnote described a range of grades and tonnages. Note the metals price assumptions coupled with the C$300/tonne cut-off for the “higher grade” which INCLUDES recovery loss. A cut-off of C$300 based on today’s gold prices (US$1,673), and assuming 100% recovery, equates to a cut-off grade of over 4 gpt Au. And just look at the metals price assumptions. Nickel is closer to C$14/lb than C$8.37/lb. Palladium today is trading at C$3,017/oz, which is close to 200% higher, than what was used to calculate the cut-off value per ton in the report…

In other words the lower tonnage range would contain very high grades.

Now lets look at the summarized tonnage and grade range for Vale’s internal “Exploration Target” estimates:

I read this as Vale’s internal models showing 1,530,000 tons, grading what you see in the third row, while using a cut-off value of C$300/t. Furthermore I read it as showing an upper tonnage limit of 11,390,000 tons, grading what you see in the bottom row, while using no cut-off value or grade…

Assuming this is correct we have a Low Tonnage/High Grade to High Tonnage/Low Grade internal “Exploration Target” of:

- “Higher tonnage”/”Low grade”: 11,390,000 tons grading ~5 gpt AuEq or 1.11% NiEq (Excluding cobalt and recovery loss)

- Equates to 1.8 Moz at 5 gpt AuEq

- “Lower tonnage”/”High grade”: 1,530,000 tons grading ~11 gpt AuEqor 2.44% NiEq (Excluding cobalt and recovery loss)

- Equates to 541 Koz at 11 gpt AuEq

Note that AuEQ numbers assume 100% recoveries which will not be the case in reality and that I have not included the value of cobalt. Anyway since I wasn’t sure if this “Exploration Target” was almost completely hypothetical or if it was based on actual drilling or other such means I sent Jason Jessup the following question:

Q: “I am no resource modeler so I do not know if that makes it a pure speculative target or if the 1,530 Kt to 11,390 Kt target is well founded via their historic drilling etc(?) If the latter then that gives immense strength to the case and on that note I wonder if any of that can be included in the coming resource?”

His response:

A: “The exploration target is founded in historic drilling and will be included in the upcoming resource.”

The combined “Exploration Target” is made up of three different zones. The bulk of the tonnage comes from a zone called “Contact Remnants”:

As the name suggests this would be Contact Style mineralization which was off limits to Lonmin but will be fully owned and usable for Magna Mining. As such the first Resource on the hopefully soon to be 100% Magna owned Crean Hill Mine will be able to include data from both Lonmin’s and Vale’s reports as well as whatever portion of Lonmin’s >90,000 m of drilling that was not previously included:

What was once a deposit that was split between Lonmin (Au + PGM heavy) and Vale (Nickel + Cu heavy) is now being consolidated and hopefully soon entirely controlled by Magna Mining.

If we summarize the Resources from Lonmin and the low tonnage/high grade Exploration Target from Vale we get:

- Indicated: 575,000 tons grading 8.9 gpt AuEQ (1.97% NiEq)

- Inferred: 382,000 tons grading 12.6 gpt AuEQ (2.80% NiEq)

- “Lower tonnage”/”High grade”: 1,530,000 tons grading ~11 gpt AuEq or 2.44% NiEq

= Total “inferred” endowment for Crean Hill Mine: 2,487,000 tons with a weighted grade of 2.39% NiEq

In essence:

- I think Magina Mining will have at least ~2.5 Mt of high-grade, Contact Style Mineralization, with plenty of upside beyond that.

- Magna Mining and the company’s Sudbury experts believe there is very good potential for bonanza-grade Footwall Style Mineralization similar to what FNX Mining discovered at the Levack Deposit (Later renamed the “Morrison Deposit” after Magna Mining’s current Technical Advisor Gord Morrison who was VP Exploration at FNX Mining at the time) etc.

What makes the Crean Hill Mine even better is the potential for near term production via toll milling. I don’t think it would take a long time or a lot of capital to at least start up a trial mining operation since the major permits are in place and there is mineralization starting at surface. This is pretty much what FNX Mining did. From what I understand they even put one of the old Inco mines into production without a PFS for example. This is a very comforting thing to me because it shows just how good the FNX team was at execution.

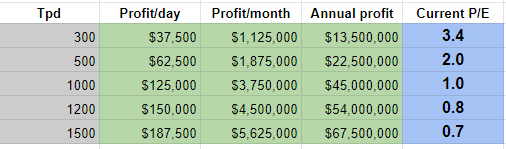

I took the time to calculate some trial mining to commercial mining scenarios…

Assumptions:

Pre-tax profit potential in different throughput scenarios:

Assuming those assumptions are somewhat accurate a 500 Tpd operation could be enough to have a pre-tax profit (Before sustaining capital) of half of Magna’s current Market Cap. If you compare that to some producers out there you get a sense of just how valuable such a cash flowing operation could be. For example Fortuna Silver Mines has a Market Cap of $1.2 B and is expected to show a pre-tax profit of $72 M and an operating profit of $81.9 M this year. A single small mine can be more valuable than two large ones simply due to the small one being high margin. Anyway, it’s not apples to apples but gets the point across I think. A production scenario like this could very well be a reality within 12-18 months in my book and I wouldn’t expect CAPEX to be much more than $20-$40 M depending on throughput. The reason this could be possible is of course because Magna could to it via toll milling and would thus not require to build a mill. In a scenario of commercial production of say 1,200 tpd I could see this operation be worth a few hundred million dollars easily. Even a small trial mining operation of 300 tpd at the Crean Hill Mine would probably make Magna Mining look cheap after including potential financing dilution.

Comparable

There are not many advanced nickel/PGM juniors in North America. Furthermore I don’t think there is a single junior around which has such advanced staged Nickel/PGM project as Magna and Magna has two(!). As such is is not easy to find a good comparable but lets give it a try…

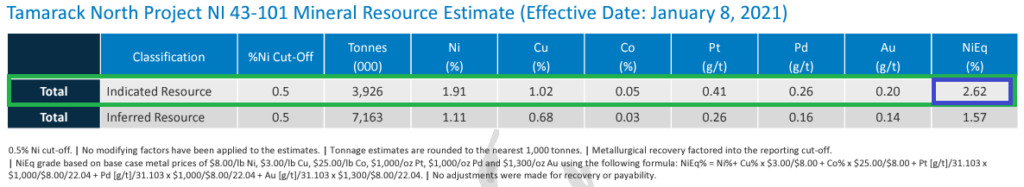

Talon Metals which famously struck a deal with Tesla, and has Rio Tinto as a JV partner, owns 51% of the Tamarack North deposit:

- The term of the agreement is six (6) years or until a total of 75,000 metric tonnes (165 million lbs) of nickel in concentrate has been produced and delivered to Tesla. The agreement is conditional upon: (i) Talon earning a 60% interest in the Tamarack Nickel Project; (ii) Talon commencing commercial production at the Tamarack Nickel Project; and (iii) the parties completing negotiations and executing detailed supply terms and conditions. Talon will use commercially reasonable efforts to achieve commercial production on or before January 1, 2026 at the Tamarack Nickel Project, which may be extended by the agreement of the parties for up to 12 months following which Tesla has a right to terminate the agreement and Talon may elect to sell to other parties.

Given that Talon Metals currently owns 51% of the Tamarack North Project, the high-grade Indicated resource which currently is attributed to Talon Metals, comes out at: 2,002,26o tons grading 2.62 NiEq.

- Magna’s Crean Hill Mine “High-Grade starter potential”: 2,487,000 tons with a weighted grade of 2.39% NiEq

- Talon Metals High-Grade (Indicated): 2,002,26o tons grading 2.62 NiEq.

In light of Talon Metals having a Market Cap of ~C$400 M I think Magna Mining just looks absurdly undervalued given a Market Cap of C$48.1 M for what soon should be two very advanced Nickel, copper PGM projects in Sudbury of all places.

Why?

- Magna Mining is much more advanced/de-risked with major permits in hand at both the Shakespeare Deposit and Crean Hill Mine

- Magna Mining will own 100% of both assets

- Magna Mining’s assets are both in Sudbury, Canada, with great infrastructure in place and are close to smelters

- Magna Mining could potentially be a producing at Crean Hill Mine and/or Shakespeare long before Talon might even have permits

- Magna Mining has a proven team who were apart of building FNX Mining’s billion dollar success story in Sudbury, Canada

- Mitsui suggests Magna Mining would still be 48% to 132% undervalued based on the Shakespeare deposit alone (post deal close at $0.33/share)

Talon Metals does have a big land package and a lot of exploration potential as evidenced by impressive drilling success outside the current resource. With that said Talon is probably several years away from acquiring the permits needed to even begin thinking about financing/constructing a mine and there are no guarantees the company will even even get the sought after permits. On that note, there already seems to be some “local friction” in this regard, according to a recent article in the New York Times:

“US EV Battery Supply Chain: Talon Metals Hits 29.39 Meters Grading 2.21% Nickel Equivalent at the Tamarack Nickel Project” – Source

“Today’s announcement demonstrates that we continue to find more thick, high-grade nickel-copper mineralization in the CGO West area, which is located outside of the Tamarack Nickel Project’s defined resource area. More specifically, drill hole 21TK0369 contains an extremely thick 29.39 meter interval grading 1.71% Ni (2.21% NiEq). This represents one of the thickest intercepts encountered in the CGO West area to date.

This 29.39 m intercept grading 2.21% NiEq is lauded as one if the best intercepts to date still does not beat some of the highlighted holes drilled by Lonmin and Vale at the Crean Hill Mine. I think this speaks to the quality of both Talon’s and Magna’s projects.

Discussion

For discussion’s sake lets say C$200 M of Talon’s Market Cap is attributed to the growth potential outside the current total resource (~5.5 Mt attributed to Talon) and C$200 M is attributed to the current resource. Said resource is approximately what I think Magna is very likely to at least have on paper one day from the Contact Mineralization alone. Now lets say the coming Maiden Resource at Crean Hill Mine will show around 2 Mt. That would be around C$200 x (2/5.5)= C$72.7 M of implied value to Magna Mining using Talon Metals valuation as a base. Now lets adjust for the incredibly de-risked nature of said resource (Permits, infrastructure, proximity to smelters and short timeline to potential production etc) and hike up the value by 50%. That would given an implied value of 1.5 x C$72.7 M = C$109 M…

Now lets also take into account the implied value of the Shakespeare Deposit according to Mitsui: C$64-C$100 M

In light of these assumptions (and assuming the Denison deal closes) one would be paying a Price of C$43.1 M (Magna’s EV at $0.33/share) for C$173 M to C$209 M in value in my opinion.

Bottom Line

Another way to look at it is that one would be paying -C$20.9 to -C$56.9 M for the Crean Hill Mine at 0.33/share. Maybe it’s just me but I find it quite attractive to theoretically be able to buy an asset, which I think will at least measure up to Talon Metal’s current high-grade, Indicated resource, for less than free while Talon Metals has a Market Cap of ~C$400 M.

As discussed earlier Talon Metals has obvious growth potential but so does Crean Hill (albeit not district scale) and any additional resources there will benefit from the infrastructure, permits & proximity to smelters etc as well.

Now I do not know exactly what a coming Maiden Resource on the Crean Hill Mine will show but if I am not paying a cent for it at face value then I could argue it’s all free upside anyway (As in upside with no valuation risk at face value).

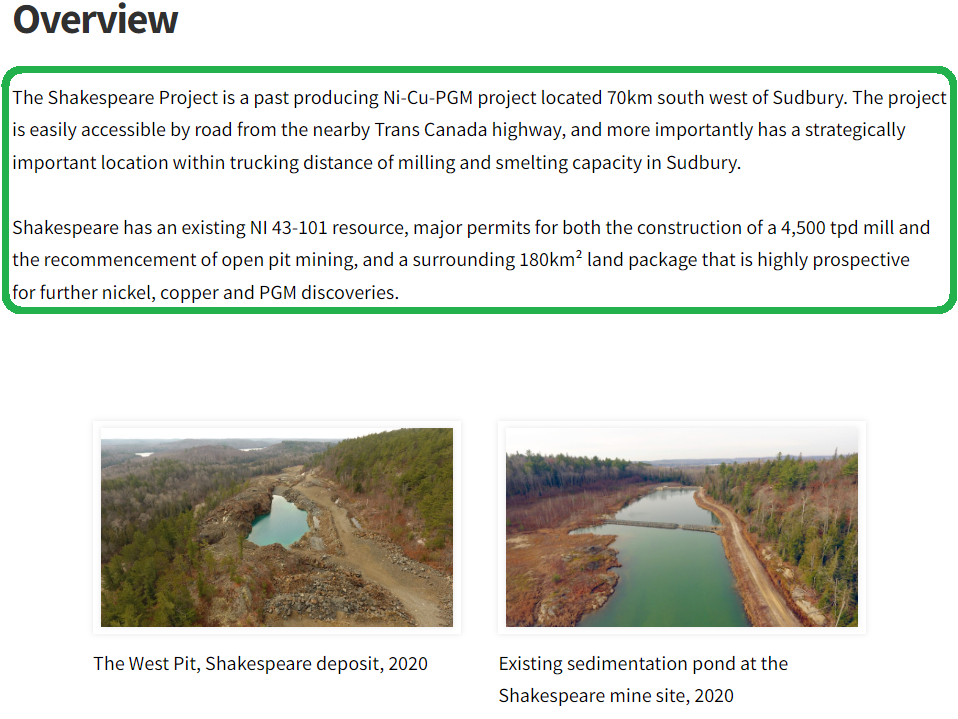

#2 Shakespeare Project

The Shakespeare Project hosts the Shakespeare deposit and is the first flagship asset belonging to Magna Mining. Note that Mitsui’s MOU covers the Shakespeare Deposit only and not the whole Shakespeare Project.

The Shakespeare deposit itself hasa NI 43-101 Open Pit Resource of 16.1 Mt in mostly the Indicated Category:

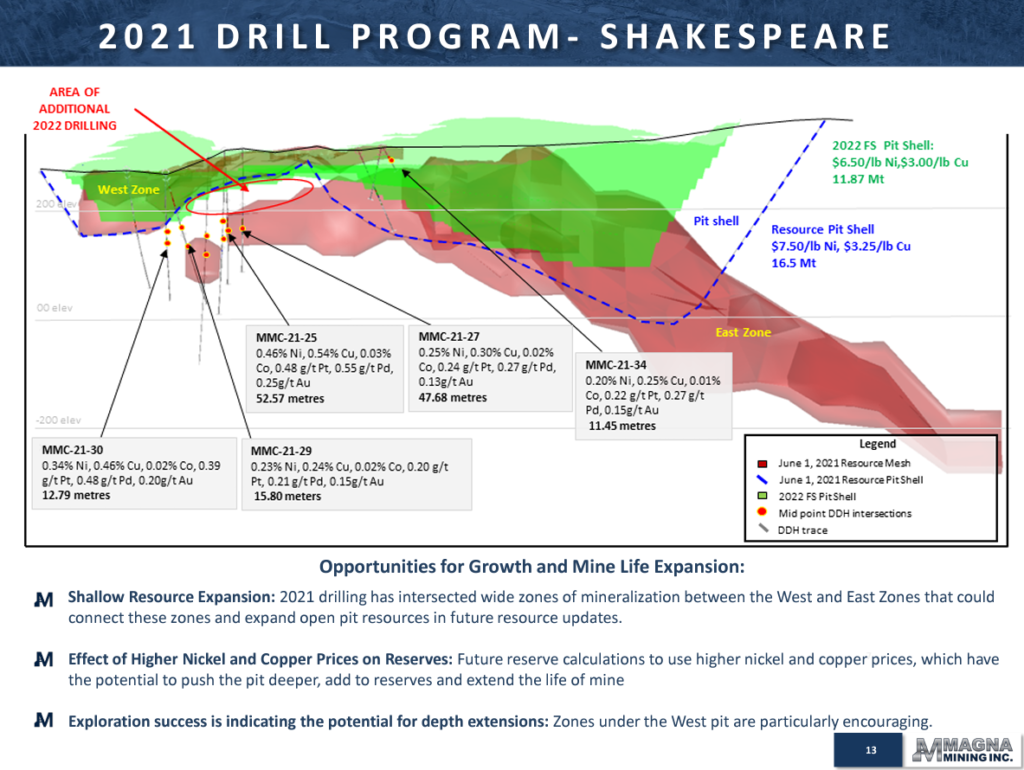

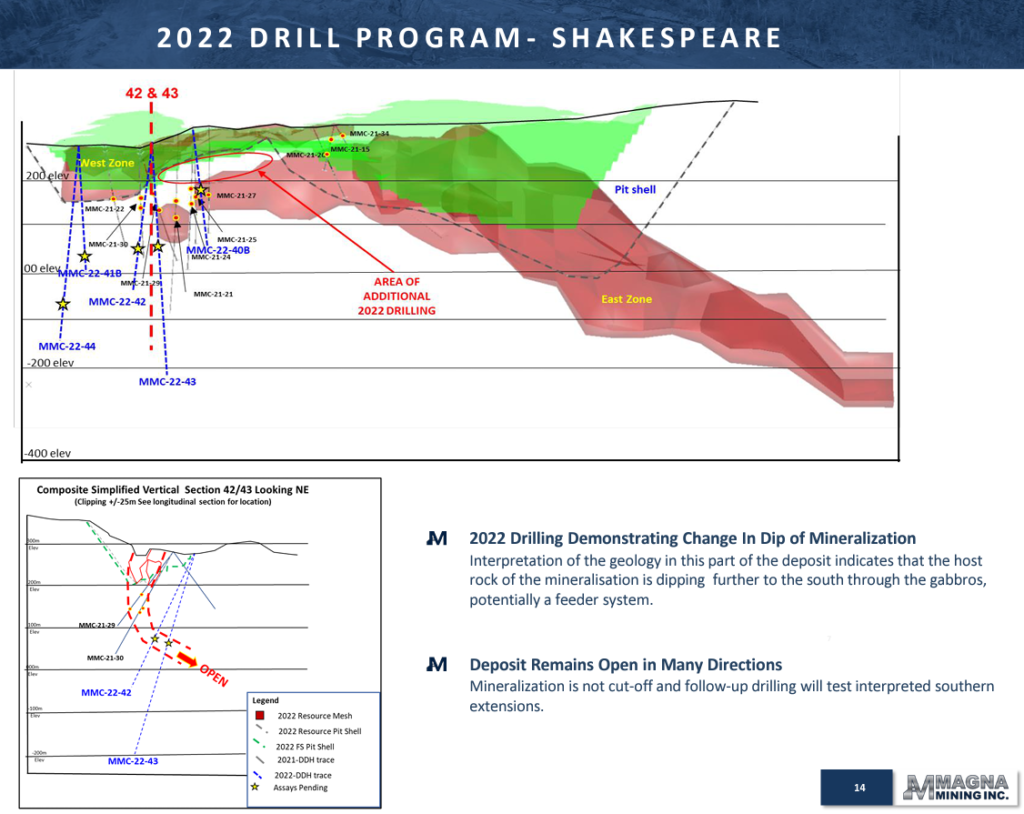

The deposit is still open in most directions and there are some obvious gaps which could get filled in and be a part of a larger open pit:

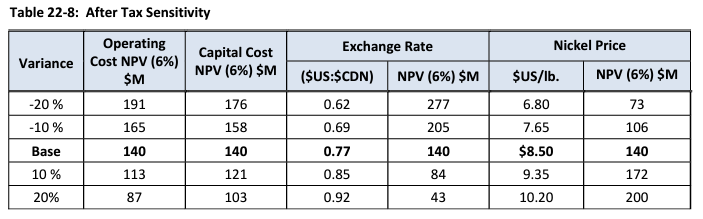

The Deposit (same that Mitsui entered a MOU on) has the following economic sensitivity analysis according to the Feasibility Study:

Note that the current Nickel price is US$10.2/lb and the exchange rate is 0.73. But lets say for simplicity that the project is at least worth $200 M on paper and the IRR would be higher than the Base Case scenario which showed 21.5%. On paper the deposit has a greater economical value than is suggested by Mitui’s MOU but I think the case is already extremely strong based on Mitsui’s MOU numbers anyway.

Exploration Potential

Although I reckon a lot of the exploration focus in the short to medium term will be focused on the Crean Hill Mine there are a bunch of targets within the greater Shakespeare Project. These targets, and any discoveries at said targets, would belong 100% to Magna Mining:

This includes the “P-4 Discovery” which is described as such:

The P-4 discovery is completely open for expansion and located in a similar setting to the Shakespeare deposit. The P-4 discovery holes, located 950 metres from mineralized historic intersections, support the thesis that P-4 could be part of a system with a significant geographical footprint.

The large, untested region of gabbroic rocks in contact with sedimentary rocks at P-4 represents a significant prospective area for the discovery of further mineralisation. In the area surrounding the P-4 discovery there is over 3km of strike length of Shakespeare style rocks. The area surrounding the P-4 discovery represents repetition of the Shakespeare geological setting, and the 3km strike length identified so far indicates that the system could host another deposit of similar size to Shakespeare. – Source

You can read more details about Magna Mining 1.0 in the first article I did on the company HERE.

Synergies

This is good and all but the company is also thinking of doing a PFS which would look at a combination of the Shakespeare Deposit and the Denison Project. The Shakespeare deposit will grow no doubt and if a mill would be built there that would also take very high-grade ore from the Crean Hill Mine then I think the NPV of that scenario would get hiked up by perhaps several hundred millions of dollars. I mean the CAPEX wouldn’t be much bigger for the combined operation but the cash flow might be increased substantially. Another idea could be to bootstrap the Crean Hill Mine into production and use the cash flow to finance the second mine (and possibly a mill) at Shakespeare. Thankfully there is no better group of people to figure out the best way forward for Magna than the team in place and the CEO has over 10,000,000 reasons to come up with an optimal solution for shareholders.

I asked Jason Jessup to share some additional insights on how he thinks about the possible synergies in Magna Mining 2.0 post close…

Q: Just thinking about the possible synergies between Denison and Shakespeare and the importance of a possible mill. Could you describe what value you see in terms of the synergies and how possible having a mill of your own would change Magna overall both in its current form as well as future scenarios?

The potential benefits from having permits to build a mill at Shakespeare for both Shakespeare and Crean Hill:

“At a toll mill, most likely the material would be blended and the reagents and process will not be designed to maximize our recoveries. We experienced this while at FNX. Also, there is opportunity to incorporate a gravity recovery circuit to potentially increase recovery of PGM’s and gold.”

“From a more intangible perspective, we have much more negotiating power by having our own mill (or even the permits to build it) when talking to companies. This could result in better smelting terms and/or better toll milling terms.”

Big picture and growth:

“From an M&A perspective, having the mill (permits) allows us opportunity to potentially make deals on properties/deposits that don’t “fit” well into either of the mills in Sudbury.”

To summarize:

“Needless to say, we see a lot of synergies and benefits to having Shakespeare and the ability to build our own mill. It gives us a lot of options and solidifies our business plan.”

Nickel – Supply & Demand Picture

“AUTOMAKERS’ ESG WOES GROW OVER INDONESIAN NICKEL” – source

Nickel Briefing: Outlook and Fallout from Nickel’s Exceptional Year – Macquarie Bank:

LME Nickel inventories are at the lowest levels in at least 5 years:

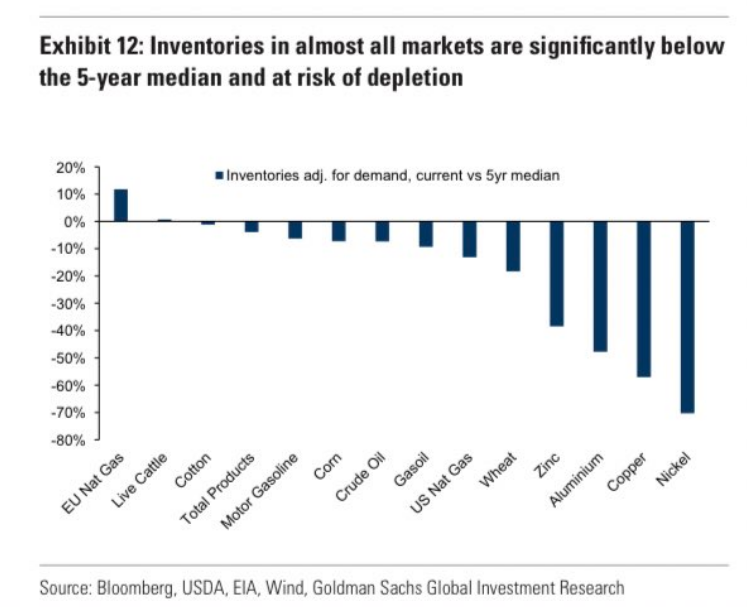

Nickel appears to have the highest “risk of depletion” according to this report:

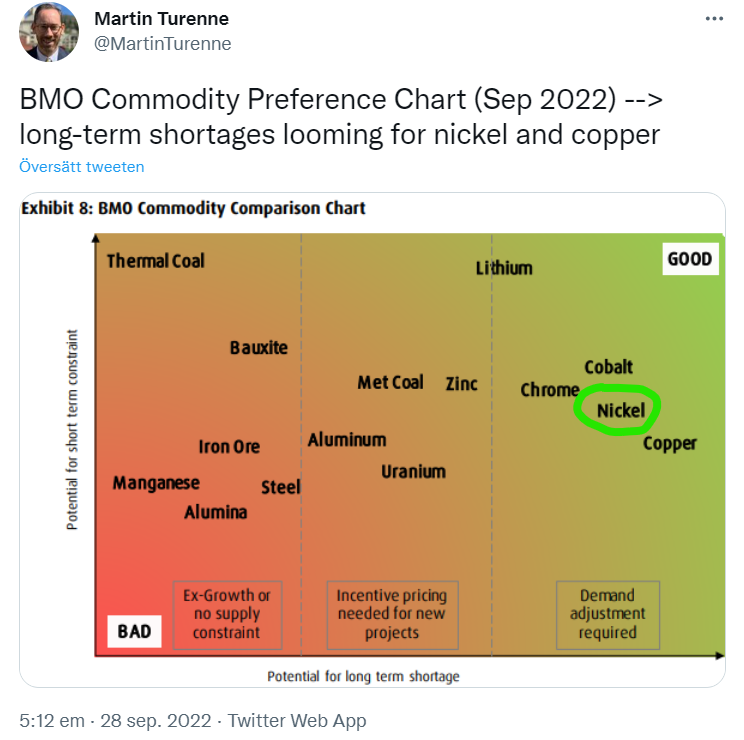

Nickel Supply Shortage Looming according to BMO:

Article: “Vale seeks to sell metals stake as battery demand soars” – Source

Brazilian mining company Vale is in discussions to sell a $2.5bn minority stake in its metals business, as it seeks to boost its copper and nickel output to meet growing demand for the energy transition.

Global demand for copper and nickel is forecast to soar as a result of the energy transition, while supply will be constrained because of a scarcity of new mines.

Tesla this year signed an offtake agreement with Vale for nickel from Canada, a sign of how the carmaker is working to secure raw materials supply chains outside China.

Nickel demand is largely driven by stainless steel production but car companies and battery producers use high grades of the metal for the most powerful lithium-ion batteries with longer range. More than half of the world’s nickel mines are Chinese-owned.

Nickel faces the largest absolute increase in demand by 2030 out of the battery metals, which also include cobalt, lithium and graphite, according to the International Energy Agency.

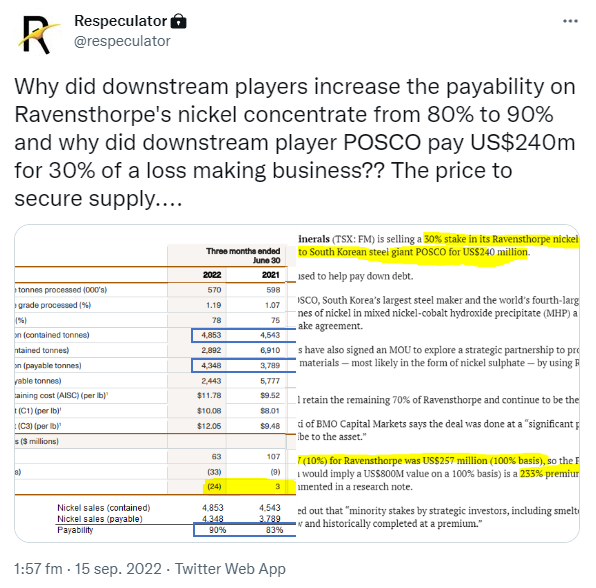

“The price to secure supply” according to a smart fellow on twitter:

Article: “A Penny for Your Thoughts” – Source

Battery-powered cars will make up 59% of global automobile sales by 2035, according to Boston Consulting Group projections. Consumer uptake is as sticky as it is significant: roughly two-thirds of EV-owning households that bought a new car in 2022 opted for another EV, according to US registration data collected by S&P Global.

The battle for nickel, the material expected to face the largest absolute increase in demand of all the battery metals, is political as the two nations that dominate the market butt heads with the rest of the world. Over 60% of the world’s nickel mines are Chinese-owned, analysts tell the FT, while over 80% of nickel processing is based in China. Russia supplies about 16% of the world’s high-grade nickel, leading to a massive surge in prices in the wake of the war in Ukraine.

The net-net has been a red-hot market for nickel deals:

Vale, the largest nickel supplier outside of China, has hired Goldman Sachs to unlock value for the division — which owns both copper and nickel mines in Canada and Indonesia — and raise capital to ramp up mining activities.

Earlier this year Tesla agreed to a long-term deal to buy nickel from Vale mines in Canada. Vale has also discussed long-term supply contracts with Ford, GM, and Volkswagen.

BHP on the future (Nickel, copper and potash):

Our CEO, Mike Henry, spoke openly about how we are planning to grow at BHP's recent shareholder Q&A session.

— BHP (@bhp) September 12, 2022

Platinum – Long term chart:

Note: This is not investing advice. I am not an investment advisor. Consider me biased and always do your own due diligence and make up your own mind. I share neither your profits or your losses. Junior miners can be very risk. Assume I may buy or sell shares at any time. Never invest money you cannot afford to lose. I was no paid to produce this article but Magna Mining is a passive banner sponsor, so again, consider me biased.

Best regards,

The Hedgeless Horseman