US stock market euphoria

Setting the scene… ( S&P500):

As the US stock indices have almost gone vertical I thought it might be interesting to map just how euphoric investors are today…

- Yesterday the largest S&P500 ETF saw the second biggest inflow in over 5 years.

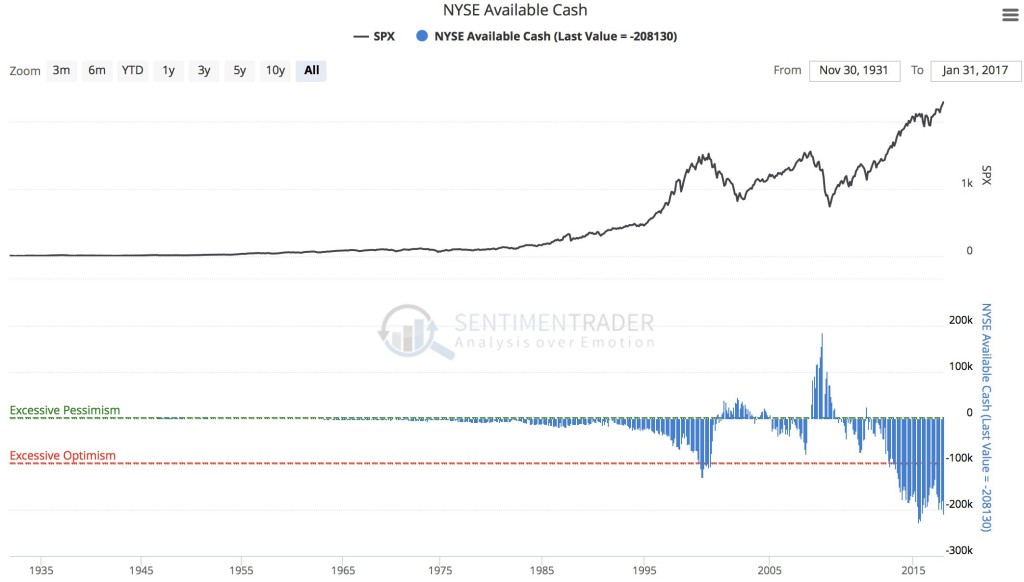

- Cash held in NYSE margin accounts are near record low ( ie. “all in” and then some).

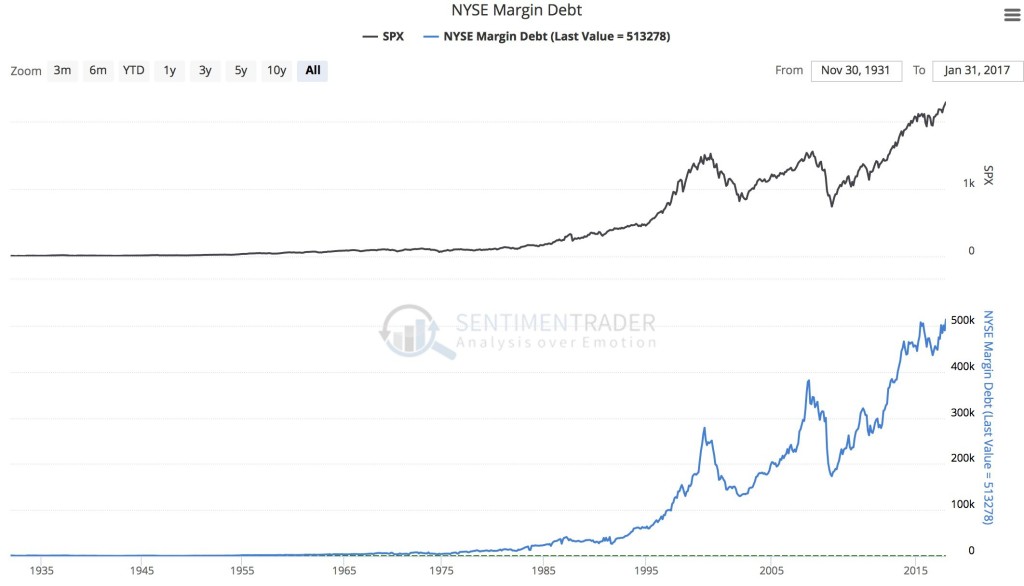

- NYSE margin debt is at an all time high (ie. Never before has investors borrowed this much to leverage up on stocks).

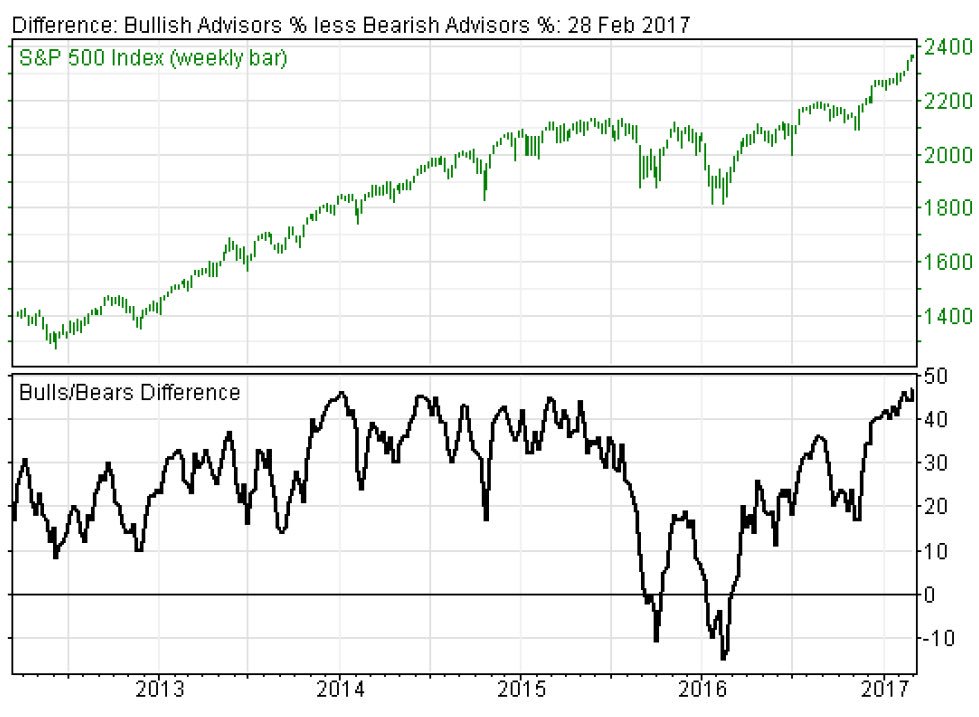

- Bull/Bear sentiment ratio is the highest in 30 years.

As always, the market can remain irrational for a very long time. Going long now is going long with the biggest horde of bulls perhaps ever. If we get inflation rising even further, we may not have a real bear market in stocks for years to come. Thus, I do not want to short stocks at this time, even with sentiment and valuations near record high.