- “Retail Investor Euphoria Sign of Looming Market Bubble” – Schiffgold.com

- “Deep Subprime Auto Loans Are Surging“ – Bloomberg.com

- “Foundation – Fall of The American Galactic Empire” – Theburningplatform.com

- “Two Fed Presidents Warn Markets Getting Frothy, Valuations May Come Down” – Zerohedge.com

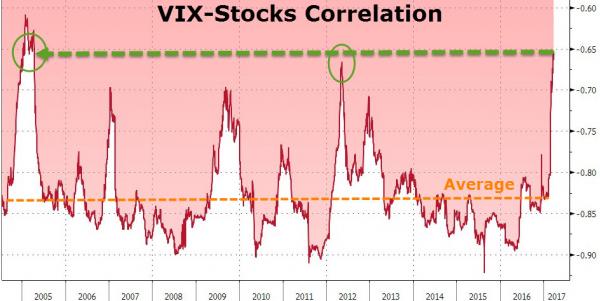

- “Something’s Broken In The VIX-Stocks Relationship“ – Zerohedge.com

- Comment: VIX the so called “Volatility Index” can be regarded as a thermometer for the stock market. If VIX is going up, the market is becoming more fearful of a potential for big swings in the near future. Considering the US indices are at or very close to their all time highs, one can assume that a rising VIX at this point in time would stress out a lot of investors. However, since Trump won the election, the VIX index has started to dislocate from the “standard” relationship with the stock market. The odd behaviour of VIX can be seen in the two charts below:

VIX

VIX-Stocks correlation