NEVADA KING INTERCEPTS 9.9 G/T AU OVER 27.4M INCLUDING 17.6 G/T AU OVER 12.2M AT ATLANTA, WITHIN A BROAD INTERVAL OF OXIDE GOLD AVERAGING 3.6 G/T AU OVER 82.3M

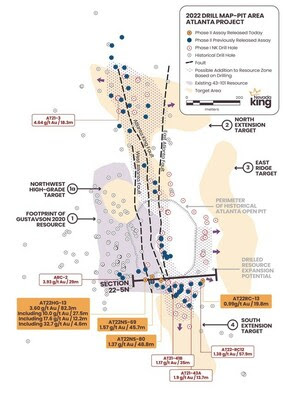

VANCOUVER, BC, Jan. 12, 2023 /CNW/ – Nevada King Gold Corp. (TSXV: NKG) (OTCQX: NKGFF) (“Nevada King” or the “Company“) is pleased to announce assay results from four vertical reverse circulation (“RC“) holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. This drilling is designed to expand drill defined gold mineralization eastward and westward from holes drilled in 2021 and early 2022 south of the historical Atlanta pit (Figure 1) and connect into the southwestern edge of Gustavson’s 2020 resource zone across the Atlanta Mine Fault Zone (“AMFZ“).

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

| AT22HG-13 | 109.8 | 192.1 | 82.3 | 3.60 | 11.0 |

| Including | 147.8 | 175.3 | 27.4 | 9.92 | 30.9 |

| Including | 161.6 | 173.8 | 12.2 | 17.59 | 33.0 |

| Including | 167.6 | 172.2 | 4.6 | 32.47 | 50.0 |

| AT22NS-69 | 89.9 | 135.7 | 45.7 | 1.57 | 8.5 |

| AT22NS-80 | 80.8 | 129.6 | 48.8 | 1.37 | 6.6 |

| AT22RC-13 | 0 | 19.8 | 19.8 | 0.99 | 7.4 |

| Table 1: All holes released today. The Company has not yet estimated true widths for individual intercepts. |

- Vertical RC hole AT22HG-13 was positioned to confirm a thick high-grade intercept reported by Goldfields from its angle core hole ARC-2, which returned 3.93 g/t Au over 29m (Table 2). This gold intercept in ARC-2 was substantially higher-grade than any of the surrounding historical holes, suggesting the hole may have cut across a higher-grade, high-angle “feeder” fault. Nevada King’s AT22HG-13 was collared west of the Goldfields intercept to test for greater thicknesses of higher-grade gold mineralization on the hanging-wall side of the suspected fault. The hole intersected 82.3m of 3.6 g/t Au, including 4.6m averaging 32.47 g/t Au.

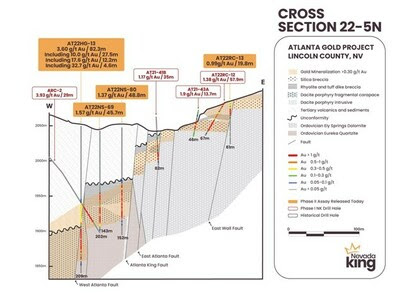

- As shown in Figure 2, AT22HG-13 drilled vertically down through the Atlanta West Fault (“AWF“), which explains the mineralization in volcanics and sediments above the unconformity and the wide, high-grade intercepts, particularly within the Eureka Quartzite. Understanding the geometry of this high-grade structure will aid in testing mineralization along strike to the north and south.

- Based on its current interpretation, the Company also anticipates encountering additional high-grade gold mineralization in the volcanic/sedimentary package and dacite porphyry on the west side of the fault. New drill sites are currently being prepared surrounding AT22HG-13 where potential high-grade mineralization remains untested north, south, and west, as no drilling has been conducted in the immediate vicinity (Figure 1).

- In between the AWF and the Atlanta King Fault (“AKF“) hole AT22NS-69 returned 45.7m of 1.57 g/t Au while AT22NS-80 returned 48.8m of 1.37 g/t Au. Uniform in both grade and thickness, the mineralization in these two holes is hosted within the silica breccia horizon that was intruded by a fine-grained tuffaceous porphyritic dacite and by rhyolitic tuff-dikes and tuff-dike breccia. Both intrusive units are variably mineralized and intrude silicified dolomite that overlies the Eureka Quartzite. Gold mineralization does not generally extend very far into the quartzite, but some of the highest gold grades are often found within 10m of the contact.

- Gold mineralization occurring east of the AKF is also hosted in silica breccia intruded by rhyolitic tuff-dikes, but the mineralized horizon overlies massive, Ely Springs Dolomite, as opposed to Eureka Quartzite west of the fault. The AKF is a pre-caldera structure that pre-dated mineralization but strongly influenced the north-trending direction of later, caldera-related faults responsible for localizing the Atlanta hydrothermal system. Starting at the East Atlanta Fault (“EAF“), a series of north-south near vertical faults produced a series of narrow fault blocks progressively down-dropped to the west. Nevada King’s 2021 drilling revealed this step-down fault pattern and a new structural model was developed that is guiding the current drilling program.

- As part of its program designed to expand the current resource zone, the Company will drill deeper to the west and shallower to the east. Angle hole AT22RC-12 at the east end of Section 22-5N clearly shows both the silica breccia horizon and silicified tuff-dike to be trending eastward along a near-horizontal replacement zone within the dolomite unit, with gold mineralization occurring in the silica breccia and tuff-dike as well as in weakly decalcified dolomite above the tuff-dike sill. This is a well mineralized hole, averaging 1.38 g/t Au over 57.9m (41m true thickness), exhibiting replacement-type mineralization within the carbonate host. This flat-lying replacement horizon continues east of the EAF but higher up the slope and into the East Ridge Target (“ERT“) – an area that has never been drill-tested but hosts strong gold-in-soil and rock anomalies (see Figure 1). The Company is currently preparing to drill this target.

Cal Herron, Exploration Manager of Nevada King, stated, “This latest group of holes, together with the four holes released last week along Section 22-6N, provide us with a much more complete picture of the Atlanta Mine Fault Zone’s internal structure and of the controls on the gold mineralization. AT22HG-13 is a very important hole since it not only pegs the location of the AWF, which is rapidly shaping up as the main gold control at Atlanta, but with a core intercept of 3m averaging 37.45 g/t Au (1.2 oz/t) we now see potential for finding multi-ounce gold mineralization. Nevada King’s high-grade intercept also validates several historical drill holes that reported intervals exceeding 32g/t Au, so we now have several other locations within the resource zone in which to intiate a search for high-grade mineralization. Our exploration strategy will be the same – step out gradually to define geometry, then follow the interpreted trend. We have a great starting point on the AWF with AT22HG-13, and now we’ll simply follow the high-grade mineralization 700m northward to the Company’s 2021 high-grade hit in AT21-3 within the North Extension Target. This same high-grade potential may possibly extend southward as well, but additional drilling is needed to test this. It is important to remember that the AWF more or less bisects the Gustavson 2020 resource zone, so establishing a cohesive, higher-grade corridor through the middle of this resource zone should have a strong impact on future resource evaluations.

“The Atlanta target envelope is now open in more directions and over greater dimensions than at any time in the past, with drilling showing mineralization continuing westward to depth and eastward toward the large ERT. At the same time, the Company continues to see significant increases in both grade and thickness compared to historical drill results. As such, Nevada King will continue to follow its current strategy. The team is excited by the progress and looks forward to further unravelling the Atlanta model, and to the next assay results.”

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

| AT21-41B* | 38.1 | 73.2 | 35 | 1.173 | 11.3 |

| AT21-43A* | 19.8 | 33.5 | 13.7 | 1.9 | 18.6 |

| ARC-2 | 155.5 | 184.5 | 29.0 | 3.932 | 27.5 |

| AT22RC-12 | 0 | 57.9 | 57.9 | 1.38 | 14.0 |

| Table 2: Other holes used in Section22-5N. The AT21/22 series holes were drilled by Nevada King. ARC series of core holes were drilled by Goldfields in 1990. *Denotes hole that bottomed in mineralization. |

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 (“NI 43-101“).

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. In 2016 the Company began staking large project areas hosting significant historical exploration work along the Battle Mountain Trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include the 100% owned Atlanta Mine, located 100km southeast of Ely, the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and the Iron Point project, located 35km east of Winnemucca, Nevada.

The Company is well funded with cash of approximately $10.2-million as of January 2023.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

NI 43-101 Mineral Resources at the Atlanta Mine

| Resource Category | Tonnes (000’s) | Au Grade (ppm) | Contained Au Oz | Ag Grade (ppm) | Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

Please see the Company’s website at www.nevadaking.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company’s exploration plans and the Company’s ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

SOURCE Nevada King Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/

View original content to download multimedia: http://www.newswire.ca/en/

Looks promising – soon the share consolidation with 1:10 and then further projects can be financed better.