Novo Resources – Investing 101: “What if…”

What happens at every top regardless of security type?

People start forgetting about risks and start focusing on, and pricing in, all the blue sky scenarios. At the same time the RISKS to the downside are actually INCREASING and risks to the upside are diminishing. This is exactly why around 95% of market participants will never beat an index in the long term. They simply add exposure when the Risk/Reward calculation is TERRIBLE. Since no tree grows forever, and every leg up is followed by a leg down, it usually results in the 95% losing money

What happens at every bottom regardless of security type?

When PRICE is low, 95% of market participants tend to focus on RISKS, without realizing that majority of risks are already priced into the stock. When this happens it means that upside potential is increasing and downside potential is decreasing. In other words the Risk/Reward calculation aka opportunity is getting exponentially better.

Case in Point…

A recent article that covered financing risks and the financing risks only pretty much. By default there is no way in hell that any reader will read that article and not leave with negative emotions towards Novo as a potential investment case. It’s akin to writing an article which only covers the upside potential during a time when most if not all upside potential is already priced in. Such an article will by default leave a reader bullish even though the actual opportunity might be poor despite all things being true.

I am not even saying the author is wrong or is making outlandish assumptions per se but looking at ONE tree and forgetting the FOREST is NOT how one should form an investment case. The risks, such as the ones discussed in the article, should stand juxtapose to the risks to the upside. All the content within said article coupled together will ALL the risks to both the DOWNSIDE and the UPSIDE is how one can begin to form a view of the merits of an investment.

This fresh interview with Quinton Hennigh which was uploaded today is well worth a watch!

It covers cash, financing, Beaton’s Creek and a lot of other stuff.

Novo Resources – The Current Picture

Right now the naysayers, bears, shorters and the 95% are very effective in “leading” the discussion towards a 100% focus on risks. Negative scenarios that could have varying degrees of chance of happening are talked about like they are certainties. Why? Because PRICE is down and that “must” mean that risks have increased. Sometimes the market is rational and a cheaper valuation is rational to see. However, what tends to happen is that A RISK captures the narrative and that negativity gets translated across the board. Meaning that the discussion has a tendency to steer into a narrative where it suddenly sounds/feels like ALL RISKS have increased simultaneously. Factors that have little to no relation to one risk aspect suddenly gets drawn with the same brush. Inevitably it leads to an overreaction and a negative price spiral. What this results in is a Risk/Reward picture aka opportunity that is getting exponentially better but which goes over the head of 95% of market participants.

I have recently seen a whole slew of negative comments about almost every project under the Novo umbrella. Did Karratha, Egina, Mosquito Creek, Elementum 3D, Malmsbury, Virgin Creek, Contact Creek, potential for Hemi discoveries and so on suddenly turn for the worse?

NO, New Found Gold looks better than ever and I would say the same goes for Elementum 3D and Malmsbury. Egina is being delayed by Aboriginal agreements and assays from Beaton’s Creek understandably taking 100% priority in an environment where assay labs are already backlogged till kingdom come. Furthermore, Karratha is scheduled to see its nuggety gold tested by a state of the art, custom made ore sorter which has been purchased from Steinert.

The actual questions one should ask oneself when 95% are looking at risks to the downside is…

What are the risks to the upside?

- What if Beaton’s Creek does indeed get up to speed running at full capacity without any more capital needed?

- What if the grade surprises to the upside due to the nugget effect?

- What if the margins are higher than expected due to said nugget effect?

- What if “Skyfall” and “Beaton’s Extended” can be mined as well?

- What if Talga Talga is explored?

- What if Mt. Elsie is explored?

- What if New Found Gold keeps on trucking higher and gets acquired?

- What if Elementum 3D keeps on growing?

- What if the drilling done around Mosquito Creek is successful?

- What if the assay lab backlogs go away?

- What if the ore sorters work as well on site as they did during the trial tests?

- What if we get Egina up and running with Sumitomo and it is as high margin as I think?

- What if there is indeed a bunch of “Eginas” across thousands of km2?

- What if Kalamazoo gets Block 4 and/or makes a discovery and/or grows the Ashburton project a lot etc?

- What if Malmsbury is indeed “another Fosterville”?

- What if we find a Hemi type discover near the original one?

- What if a large portion of the entire >12,000 km2 is indeed mineralized?

- What if ore sorting works works as well as we hope and can be applied to any nuggety deposit we might find?

- What if Beaton’s Creek start throwing off good cash flow and we can even invest in more projects like NFG?

- What if ore sorting and Chrysos tech together with Free Cash Flow can see Novo unlock more conventional deposits?

- I could go on name-dropping all of our prospects but I think you get the picture…

(FWIW 99.9% of people who comment on Novo have no idea about all of the above)

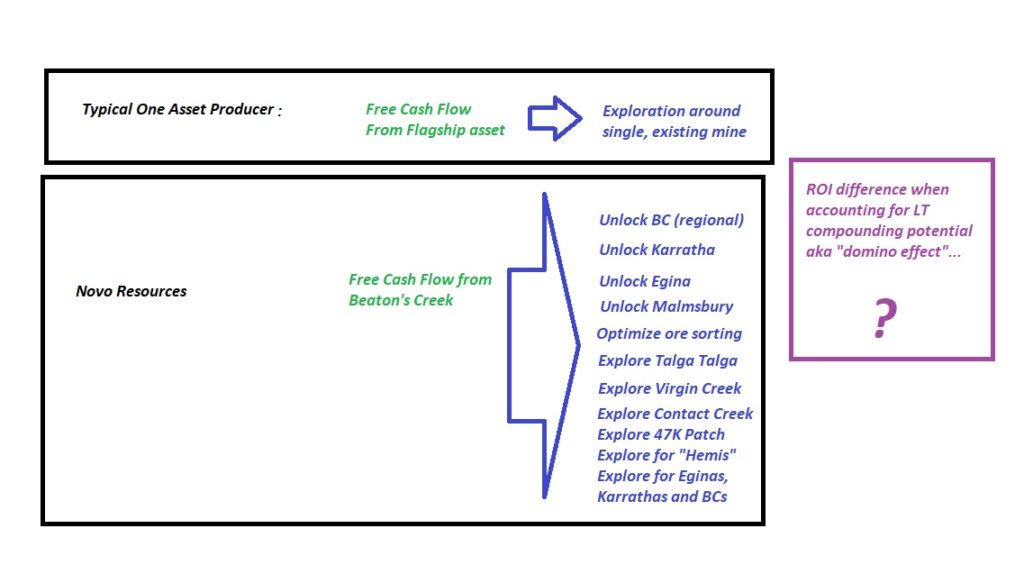

Beaton’s Creek getting ramped up over the coming months and ending in Free Cash Flow would be worth a LOT more to Novo Resources than the mine’s NPV at face value. Why? Because whereas a typical maiden producer typically has a low ROI on Free Cash Flow, due to a lack of high ROI growth prospects, Free Cash Flow from Beaton’s Creek can be used to any and all of the projects mentioned above. In other words I see a “fork in the road” where a positive outcome at Beaton’s Creek would in time multiply its value through a multi faceted “domino effect“…

(FWIW 99.9% of people including shorters, bears, naysayers and rabble rousers have no clue about this concept)

In short I would gladly (well, relatively of course) pay >>C$50 M or whatever in additional dilution if that is what it would take to optimize Beaton’s Creek because the result would help unlock something so much bigger than the the value of Beaton’s Creek itself. Another way to put it is that Beaton’s Creek’s Expected Value is fore sure a lot higher than its NPV on paper since it does not account for the domino effect in terms of the potential ROI on Beaton’s Creek’s cash flow.

… These are ALL aspects that should be considered, together with an any all downside risks, when one is trying to appreciate the Expected Value of Novo . Every possible scenario, both negative and positive, should be weighted and combined. Then it should be compared to the most important thing at the end of the day which is PRICE (Enterprise Value of the company).

However, you will not see the 95%, bashers, naysayers, bears or overall haters entertain the questions above, which by default puts them in one or more of said categories just FYI. With that said we humans can’t keep this many thoughts in our heads at the same time for very long. God knows I get sucked into the single minded narrative in the chatrooms a lot and forget about the 99% outside of Beaton’s Creek for example. Anyway I don’t know about you but I have no plans to join the 95% and their investment returns anytime soon. I didn’t beat poker because I only looked at what could go wrong (or right). I beat poker because I weighed the downside potential and upside potential relative to the odds of different scenarios happening. At a certain price the “pott odds” are good enough to warrant going all in with 27 off suite vs AA and I think that sums up Risk/Reward pretty well actually. I think this mindset is why I have also beaten the market as well (buy low and sell high and all that).

As always this article is not buy or sell recommendation. It’s purpose is to educate people of how our minds work and how I personally think one should go about investing. Novo continues to be, for better or for worse, one of the best examples as it pertains to market psychology.

Bottom Line

- When the PRICE is LOW the focus should be on what could go RIGHT

- When the PRICE is HIGH the focus should be on what could go WRONG

Fresh comments from an ex De Beers gentleman:

“Dear Erik, You are so right. Investors easily lose sight of the big picture when problems arise. At BC at present there is so much latent talent, so much opportunity, so much ambition, but because it is new, there is no experience of this particular project. Sure those involved have experience gained elsewhere, but zero experience as to how BC mill behaves under different circumstances. With all the focus from outside, the pressure and stress can become so much that it is difficult to think straight, with everyone involved having their ideas as to how to fix any problems. Remember, there are no other operations running elsewhere providing support and back-up. BC is the first and only project of Novo in action. In time the operators will learn of the quirks of the mill and what to do and what to avoid. At the moment there is no cushion from successful operations elsewhere in the company. They don’t have a well-oiled team yet. They are a bunch of talented individuals learning very quickly and finding each other to form a team. They are not there yet. Investors are naïve in the extreme to think there will be no start-up issues. It goes with the territory, especially in the first operation. All problems are magnified. The Novo team are bedding down for the first time in solving operational problems. There is a huge difference between planning and operation. And, as always, luck plays a role. Making a pp when the market has just fallen is pure bad luck. One mustn’t forget, that compounding the felony are the weather and the bloody virus. Novo has just come through a tough, very hot season with severe storms. The cooler, more pleasant Southern winter lies ahead. One has to assume that with the imaginative talent available, with the total commitment to achieving success, with experience gained elsewhere by individuals on other projects, BC will be an outstanding success, allowing the company to develop their other opportunities. It is fortunate for them to have consultants working on their behalf quietly behind the scene away from the frenetic action, who can advise on critical aspects of planning. On a different subject, one can imagine the frustration felt by those trying to negotiate with the aboriginals concerning Egina. The lack of action must be driving them crazy. I wish I had more capital to invest in this project. I would love to be a fly on different walls of this company. One can try to appreciate the frustration felt by the trolls, who just don’t understand what is going on and have no idea.”

Lastly, for what it’s worth, the chart looks like one mother of a bull flag and/or a mother of a reverse head and shoulders pattern. If/when it breaks to the upside we should see quite a move. Something to think about while contemplating the “What ifs”…

Note: This is not investment advice or trading advice. I am a shareholder of Novo Resources and the company is a banner sponsor of my site. Therefore assume I am super biased. Do your own due diligence and make up your own mind.

Best regards,

Erik Wetterling aka The Hedgeless Horseman

I believe an ASX listing would be beneficial. It helps make Novo more of a “local” company.

I am aware of the upside potential, the only thing what makes me feel uncomfortable is that novo does not communicate start up hickups at BC. I watch every video of Quinton available, he never addresses what the issue is. I can stand the truth without selling my big position, now I start losing confidence because I am not told what exactly is going on. This is just my experience from other events in my life , regarding this type of novos communication. Please address what’s going on exactly and I am grown up enough to weigh the risks verse the chances. Once I lose confidence I will be a seller…

just compare the novo news releases in the past months regarding progress in BC to other companies.

The Q&A with RH on this page are outstanding as well, I know of no other company with such a transparent communications policy.

Things like “they broke the mill” as BM highlighted in his article the other day would probably have created a share price disaster of epic proportions if reported in real-time. So why report such issues, if they are normal during ramp-up and can be fixed anyway?

What is going on exactly has been declared by QH extensivley in his latest interview: they need to drill several hundreds, if not thousands of holes in virtually no remaining time to make mining permission after the first 1.5 years possible.

the only valid Question imho is: why is novo so surprised about this fact? and thus: why has the money and efforts for this not been addressed earlier, when gold prices were higher and would have allowed better financing conditions? wasn’t that known before?

anyway, sometimes shit just happens. the potential and probable upside does justify that tiny bit of dilution. regarding the market’s overreaction including personal insults of QH… I leave that to everybody to judge on their own.

The simple reason Novo price fell is they did not deliver on previous expectations set with the market. They had insisted repeatedly they had all the financing required to ramp up production at BC. They were wrong. Additionally, they discovered they had no good mine plan to ensure continuity of grade going forward, which seemed to be a big surprise to them. In both cases, management was poorly prepared and had no contingency. that is why the stock fell- breached of confidence and trust with the market. It is repairable, but the stock price may be impaired until confidence returns thru good results.

>>they discovered they had no good mine plan to ensure continuity of grade going forward<<

One would think that Sprott would have done some due diligence in that regard before lending these mining hacks millions for a previously failed mine. What I believe happened is that Sprott overly trusted QH based on his previous work and performance. The fact that Sprott reduced its loan by $5 million means they were blindsided by their own ineptness in underwriting the loan and are now in protection mode.

Sprott is bearish on Novo. I’ve communicated recently with both Rick Rule and Steve Todoruk at Sprott and they believe Novo is a science experiment with a lack of focus, a bloated share structure, and is overvalued. Quinton’s decision last week unfortunately helped make their case. I believe Novo can eventually prove Sprott wrong, but they need to improve decision-making and focus to succeed.

excellent article, HH – as always

isn’t an important part of this story the fact that most of NOVO’s resources are unique (layers of gravel and Gold nuggets vs hard-rock)

it isn’t possible to estimate these resources using traditional methods so obtaining permits to mine the resources could be quite challenging

one of the keys to obtaining permits is to satisfy the concerns of the people who will issue those permits

in the recently obtained PEA NOVO was told (given a recommendation) to perform 20×20 meter drilling to increase the fidelity of the resource estimate

if NOVO chose NOT to perform the drilling, they would have to explain during all ongoing permitting processes why they didn’t follow the recommendations in the PEA

I’m suggesting that part of the decision to do the equity raise and drilling is motivated by “go along to get along”

as a foreign (Canadian) mining company NOVO needs to do everything possible to grease the skids of the permitting processes in Australia – ignoring the recommendations of the PEA would be the opposite of “go along to get along” and might also send the message that NOVO thinks they are smarter than everyone else in the industry

I think that “go along to get along” is another aspect of what you are suggesting, HH – NOVO is focused on the big picture here – a Gold-rich mineral deposit that is potentially 13K square kilometers in size

I don’t fully understand why the Golden Eagle Mill will be profitable when Millennium Resources went bankrupt running it with ore from a similar area. First it was said this ore was refractory or sulfide, then we were told the Millennium ore was not as refractory as originally thought. Was not the Millennium ore, conglomerates sourced from a similar area?

This is addressed in Bob’s book. Millennium was using the wrong mill for the deposit, and Quinton didn’t want to spend 100 million building a new one.

Hi, new to this site. Do you ever recommend a stock that is not a sponsor?

Do you ever make a “first visit” to a site without asking a loaded question right off the bat?

Username checks out

Thanks for the update, HH ! Can you comment on the costs of in-fill drilling to provide grade

control during mining compared to the additional income provided by processing ore that is

(for example) .5 g/t richer going into the mill? The payback time may not be great.

erik granted i am becoming a doubter and the continued selling is not good. At some point

you may really like to buy so have at it but remember QH is not batting very well and some

decisions are quite questionable on all of his gotta havs. We will see, buy the dips is one thing

but this escapes me now because i felt $1.50 was bad enough so we will see

The real problem is Quinton is spreading himself too thin; he needs to focus on Novo exclusively for, say, the next 6 months and tell everybody else who wants/needs his advice/insights, “Sorry… later!”

Get Novo into something close to steady-state production from Beatons… it really won’t take that much; THEN… he can start being Quinton The Magician for all these other wanna-be’s.

And then, of course, he will always have the “baggage” of being hated forever by certain geologists in WA who will hate him – forever – for having seen and then ACTED on what they couldn’t see right under their G/d, smug-arrogant, Not-Invented-Here noses.

NSRPF: It excels at promises and lifting expectations; and often delivers on disappointment. Despite an apparent nuggety gold surface, one that even roadcrews can exploit during their free weekends, NOVO has yet to produce even a small, continuous gold stream. Why even consider holding this co when alternatives such as NFGFF or ELRFF are available. There is no apparent reason, for me, that I can find.

Further to the post above:

01-Dec-11 $PRG Precipitate Gold Corp. Director

12-Feb-15 $TSG Tristar Gold Inc. Director, now Technical Advisor

23-Sep-15 $IRV Irving Resources Inc. Director

24-May-16 $NVX NV Gold Corp. Director

06-Jun-17 $NVO Novo Resources Corp. Chairman

01-Mar-19 $LIO Lion One Metals Ltd. Appointed Technical Advisor

17-May-19 $ECC Ethos Gold Corp. Appointed Technical Advisor

11-Sep-19 $ESK Eskay Mining Corp. Appointed Technical Advisor

14-Jan-20 $HAN Hannan Metals Ltd. Appointed Technical Advisor

12-May-20 $NUG Nulegacy Gold Corp. Appointed Technical Advisor

15-Jun-20 $ELO Eloro Resources Ltd. Appointed Technical Advisor

19-Jun-20 $CN Condor Resources Inc. Appointed Director

23-Jun-20 WRM:ASX White Rock Minerals Ltd. Appointed Technical Advisor

12-Aug-20 $NFG New Found Gold Corp. Appointed Director

21-Aug-20 $NRN North’n Shield Resources Inc. Advised Crescat on investment

15-Sep-20 $TBR Timberline Resources Corp. Appointed Director

24-Sep-20 $FFOX Firefox Gold Corp. Appointed Technical Advisor

01-Oct-20 $KUYA Kuya Silver Corp. Appointed Director

27-Oct-20 $YTC Yuntone Capital Corp. Appointed Technical Advisor

20-Nov-20 $VMX Victory Metals Inc. Appointed Director

01-Dec-20 $GOT Goliath Resources Ltd. Appointed Technical Advisor

15-Dec-20 $RKR Rokmaster Resources Corp. Advised Crescat on investment

21-Dec-20 $LAB Labrador Gold Corp. Appointed Technical Advisor

08-Feb-21 $JUGR Juggernaut Exploration Ltd. Appointed Technical Advisor

08-Feb-21 $ALTA Altamira Gold Corp. Advised Crescat on investment

17-Feb-21 $MEK Metals Creek Resources Corp. Appointed Technical Advisor

02-Mar-21 $SGD Snowline Gold Corp. Appointed Technical Advisor

02-Mar-21 $JNC JNC Resources Inc. Key Shareholder, Tech Advisor??

02-Mar-21 $TBLL Tombill Mines Ltd. Appointed Technical Advisor

-Thanks to JustJT on the CEO.CA NVO board

This is simply incredible and definitely concerning. His time and focus are all over the place in different capacities. When you spread yourself thin like this, the risk of making mistakes goes up significantly, as demonstrated with the recent decision to sell a stake in Novo for dirt cheap and dilute shareholders at a high cost. And, more concerning, the Board at Novo did nothing to stop the mistake, suggesting that either they are incompetent at cost of capital calculations or just not even paying attention since they all probably have tons of different roles/capacities as well. Thanks for posting this – very eye opening indeed!

Novo, it appears, has hit the bottom of the Lassonde curve. It was bound to happen, one way or another. The fundamental story is intact, no change here at all, parts of the narrative are gone, however. Not the first time a quality company and quality team stumbles. Hodlers of Novo’s patience might be put to a tough test in the coming weeks and months. QH and team will weather these difficulties, I don’t envy them for having to have taken this decision.