Pacific Ridge Exploration (PEX.V): Multiple Copper & Gold projects in BC, Canada

In a time where the world is becoming more unstable, and tensions between east and west are rising, I think it makes sense to at least include exposure to some of the better western jurisdictions. I mean exploration is risky to begin with, and the Reward side in the Risk/Reward calculation sure benefits if there is a higher premium on a given degree of success, as well as a higher likelihood of keeping said success. This article will be about Pacific Ridge Exploration (PEX.V) which is one of my many High Risk/High Reward plays, which brings exposure to copper and gold, that I think has 10-bagger potential. The high reward potential comes with high risk and that is why it is one of many smaller bets I have. The reasoning is simply that a “small” position is not a big deal in case things do not play out well but even a small position can have significant positive impact to the portfolio if things go well (or really well). Note that I own shares of Pacific Ridge and the company is a banner sponsor so assume I am biased and DYODD!

Coming Catalysts

- Assays (Drilling Now)

Pacific Ridge (Copper/Gold)

If you like the idea of copper and gold in BC, Pacific Ridge is a solid high risk/high reward play in my book. Is a big success with >10 bagger returns guaranteed? Absolutely not. It never is. But with some $7 M in cash and a Market Cap of $30 M (At $0.245/share) the stock is not pricing in anywhere near a critical success across any of its #5 project strong portfolio:

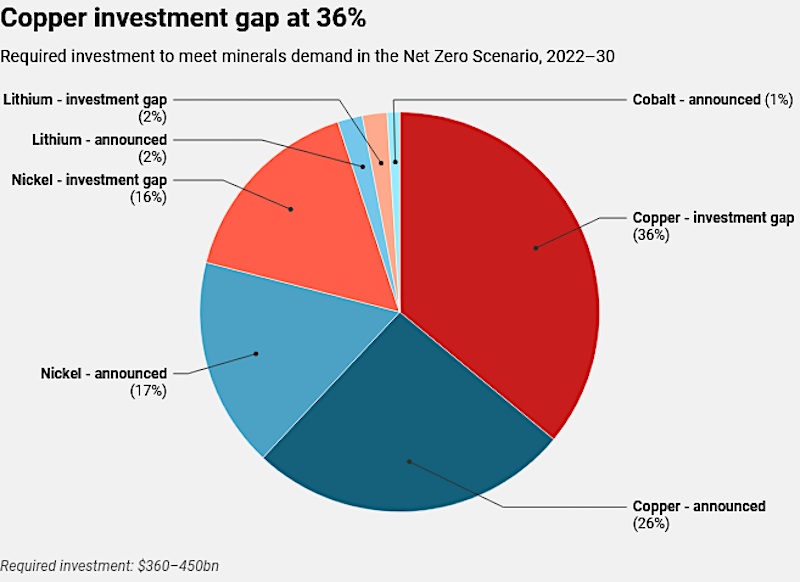

Personally I love the idea of a copper/gold exploration empire given that especially copper seems to be one of the most critical metals long term with a very favorable demand/supply picture…

“BHP expects the world to need twice the amount of copper presently produced by 2030, and four times the current supply of nickel” – Source

“The looming copper shortage may also explain why BHP’s Xplor is only interested in copper and nickel projects for now. Xplore has a more short term focus says Scarselli although BHP’s strategy has always been to identify and monitor commodities in which the company can build a market profile from a strategic point of view.”

We also have even the largest gold companies in the world turning to copper in the recent past. One example is Newmont’s bid on Newcrest Mining which owns the enormous tier 1 copper/gold mine Cadia and Barrick very recently tried to acquire First Quantum which is a copper focused major miner…

I can’t find the video right now but I remember an interview with Pierre Lassonde where he basically says the best asset to own is a long life copper gold porphyry. With that said here is one of many videos where the legendary “gold bug” describes copper as being possibly the most high conviction commodity pick today.

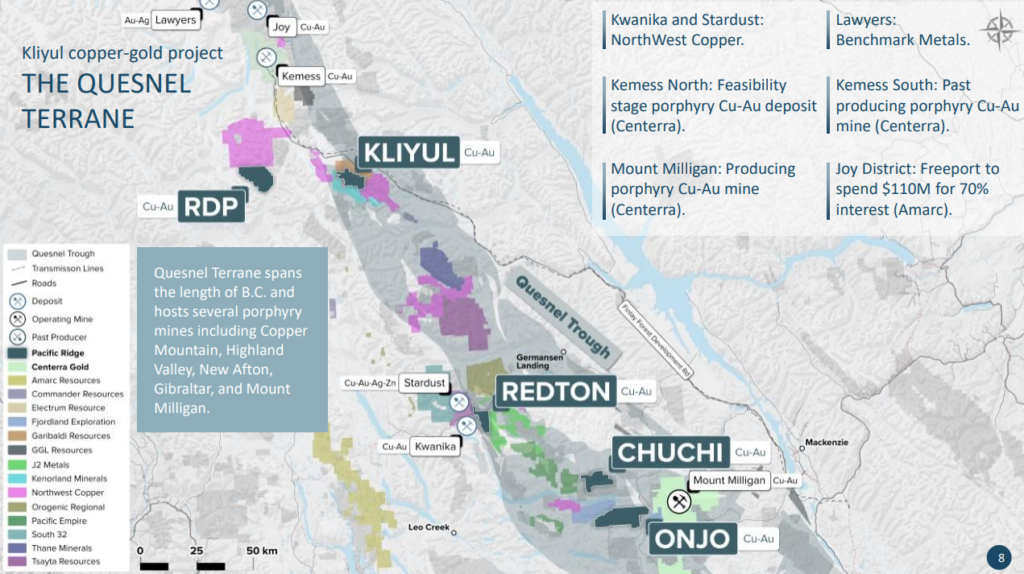

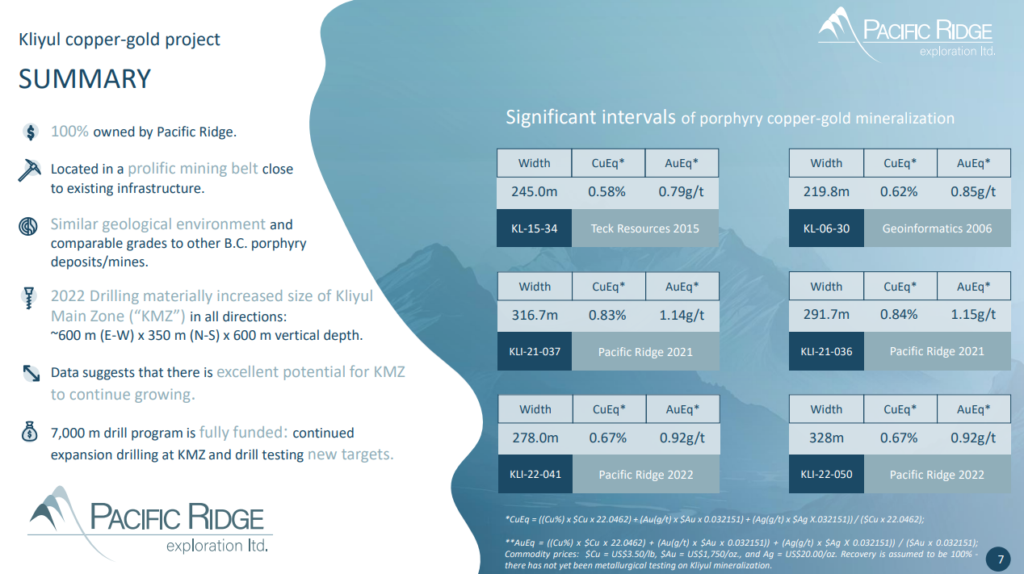

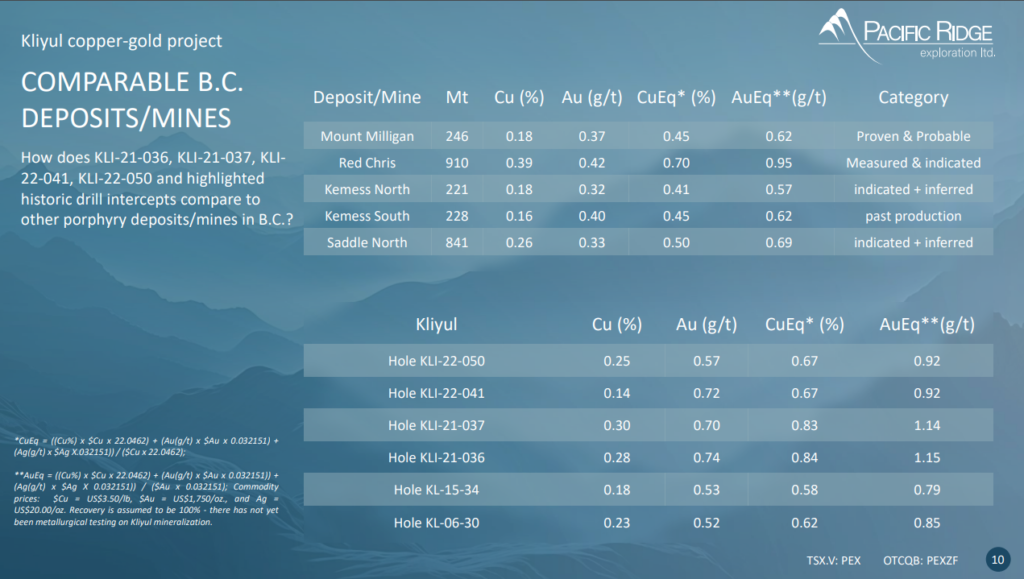

Thus hoarding copper (and gold) projects in a tier 1 jurisdiction might not be the worst strategic decision by any means. Kliyul is Pacific Ridge’s current flagship project and we already know this project can produce robust intercepts of copper and gold:

Despite limited drilling the highlighted holes stack up quite to other notable copper/gold porphyries in BC:

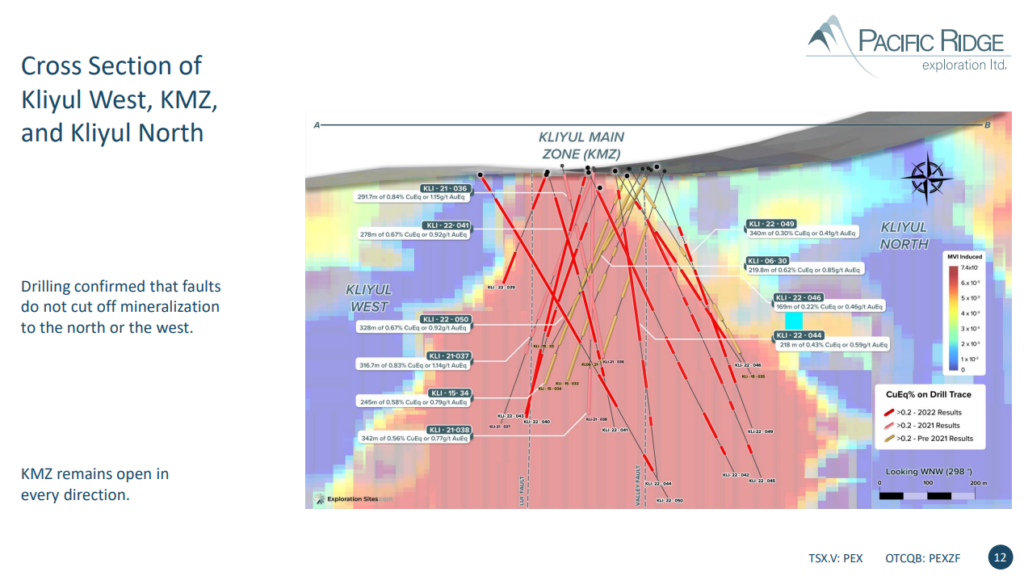

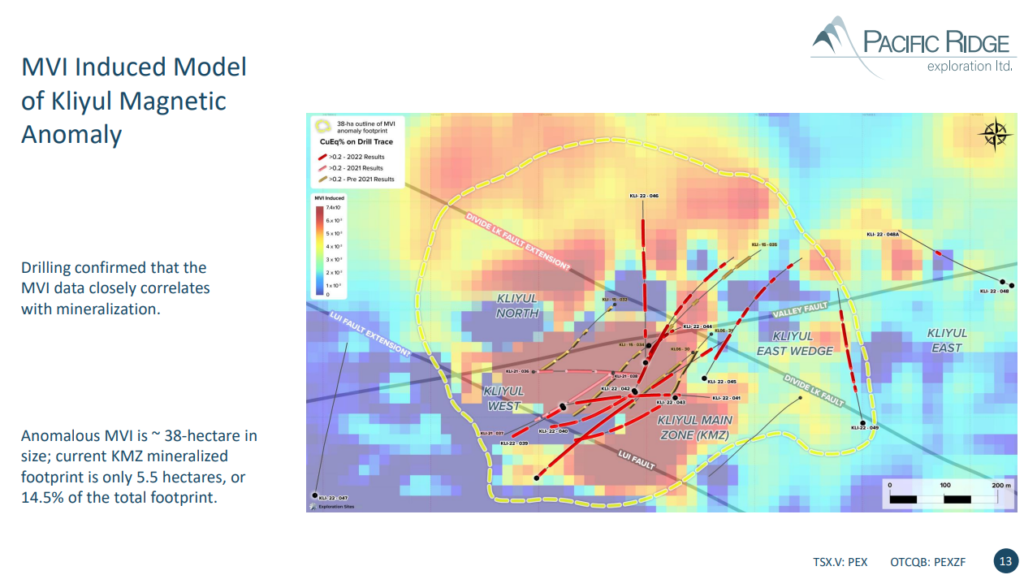

The currently known footprint limit via drilling is up to ~600 m X 350 m X 600 m and at face value such a volume of rock would amount to around 340 Mt. Obviously this is not to say that there is 340 Mt worth of ore already but rather to show that it appears Kliyul has the potential for scale. An MVI induced model suggests the same:

Does Kliyul has a shot of ending up as a valuable copper/gold deposit in British Columbia, Canada? I think so. Am I 100% sure? No. I just know that at $30 M in MCAP it is pricing in considerably less than 10% of a $500 M deposit and <5% of a $1 B deposit etc. And that is if we assumed zero value for all the other projects in Pacific Ridge’s portfolio to boot. Pacific’s goal is to try and prove up at least 250 million tones as discussed in this interview. I think that is considered to be the threshold of critical success and I do personally think the chance of that happening is greater than the depressed market is currently pricing in.

Beyond Kliyul Main Zone

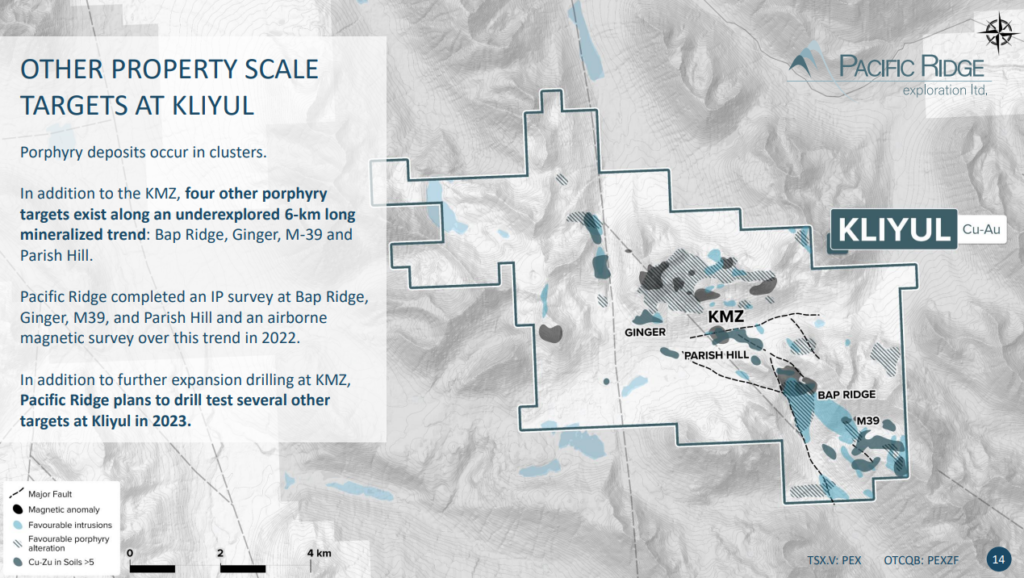

“KMZ”, or the “Kliyul Main Zone”, is the name of the target just described and it is just one of many targets within the greater Kliyul project:

As you can read above the company has done an IP survey at several targets and plan to actually drill test several of these in 2023. In other words this year’s drill campaign will not only be to expand the Kliyul Main Zone but also dry and make additional discoveries. This opens up the potential that if no single target, like KMZ, is enough to warrant building a mine there is a chance that additional (satellite) deposits are found which could help make the project reach “critical mass”.

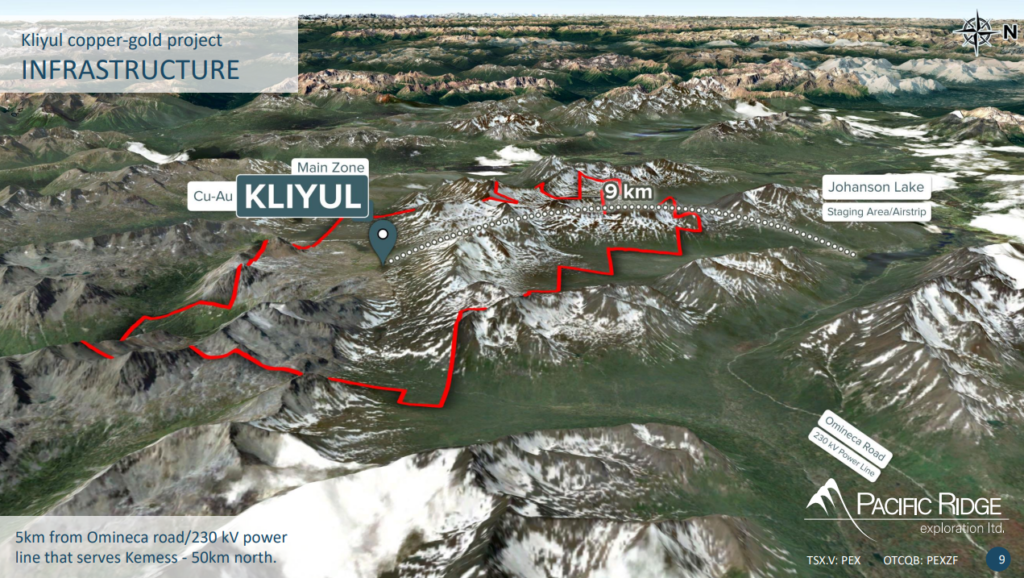

For a BC exploration target I would say that the infrastructure situation is relatively good for Kliyul given that there is a road and a powerline nearby:

Lets not forget that the better the infrastructure situation, the lower the critical threshold is for success, by default.

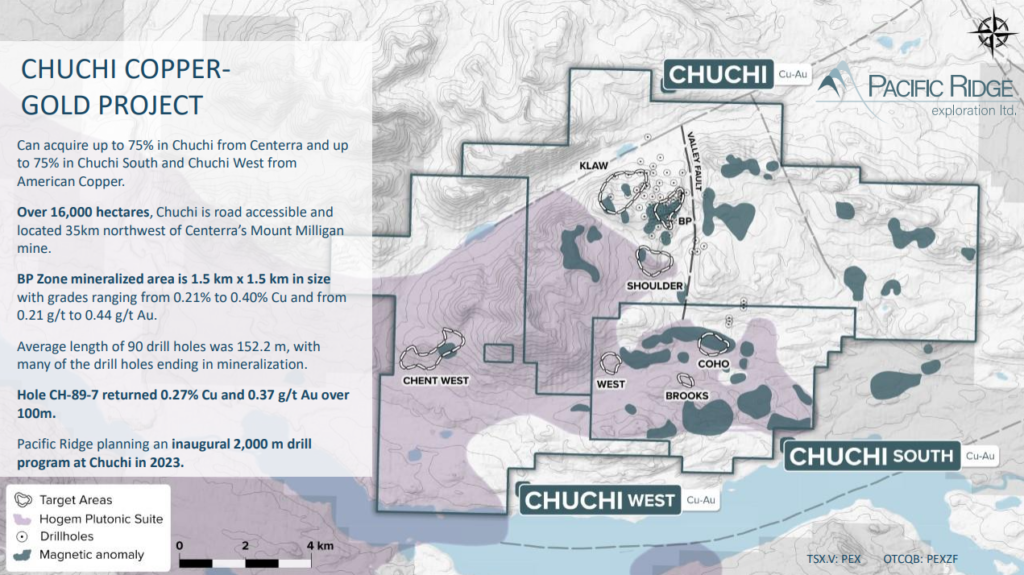

Then there is the Chuchi Copper-Gold Project, which has seen some historic drilling, and currently hosts several targets within the 16,000 claim block:

2,000 m of drilling is allocated to Chuchi this field season. There is smoke… Will they find fire? TBD.

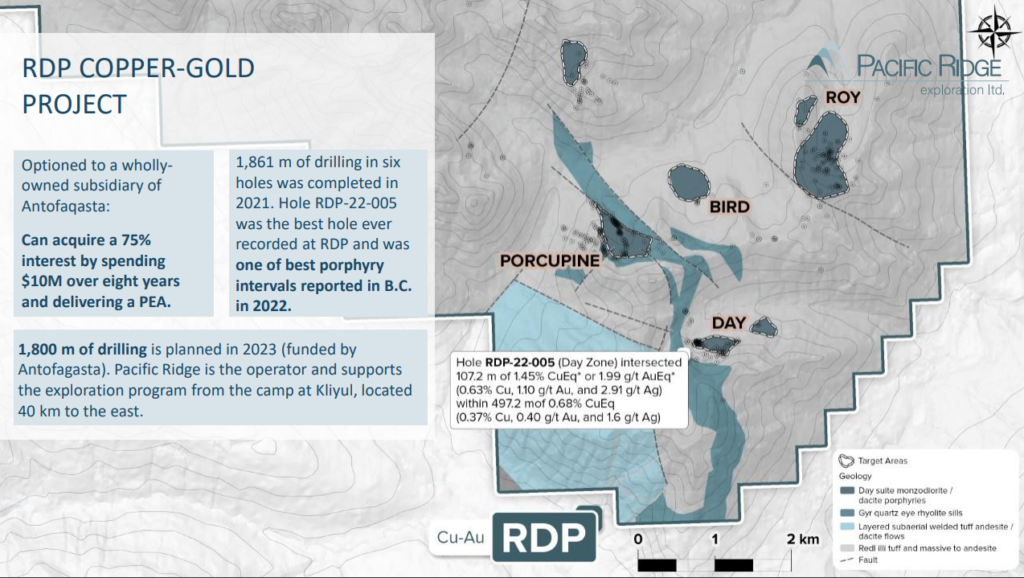

Then there is the RDP COpper-Gold Project which is optioned out to the major mining company called Antofagasta. Antofagasta can acquire a 75% interest by spending $10 M and delivering a PEA. 1,800 m of drilling is planned this field season. Last year hole RDP-22-005 hit an impressive 107.2 m of 1.45% CuEq within 497.2 m of 0.68% CuEq:

Pacific Ridge in summary

- #5 project strong copper-gold portfolio in BC, Canada

- #3 projects to be drilled this year (fully funded)

- $7 M in cash

- Basic MCAP: C$30 M (at $0.245/share)

With Kliyul and RDP there is already two different stages of discoveries in hand. If none, one, or both will amount to company makers remain to be seen. The downside is always theoretically -100% and the upside can be a lot more than 100%. Given that Pacific Ridge’s valuation is at $30 M, despite the success at Kliyul and RDP, I would think there is a realistic shot that this might look very cheap one day. If the stars align the company will prove that there is at least one significant copper-gold resource within the portfolio in time for the favorable supply/demand picture for copper to kick in. In that case I would not rule out a >>10 bagger. This is of course a speculative bet but I think a depressed Mr Market is pricing this bet way too low currently. Since it is a high risk/high reward story I am not betting the farm on PEX. If things do not turn out well it will not be a big hit but if things turn out well, or really well, then even a smallish starter position can have high impact.

This year’s drill campaign has the potential to both increase the footprint of Kliyul, make new discoveries as well as following up on a potential discovery such as RDP.

Amateur TA

For what it’s worth it looks like the stock is consolidating to me:

Note: I am not a financial advisor and this is not investing advice. I am not a geologist nor a mining engineer. I own shares of Pacific Ridge and it is also a banner sponsor so consider me biased and do your own due diligence. Always make up your own mind. I share neither your profits or losses. Assume I may buy or sell shares at any time without notice.

Best regards,

The Hedgeless Horseman