Pacific Ridge Exploration (PEX.V): Reports Last Drill Hole from the 2021 Drill Program at the Kliyul Copper-Gold Porphyry Project; Announces Plans for an Expanded Drill Program in 2022

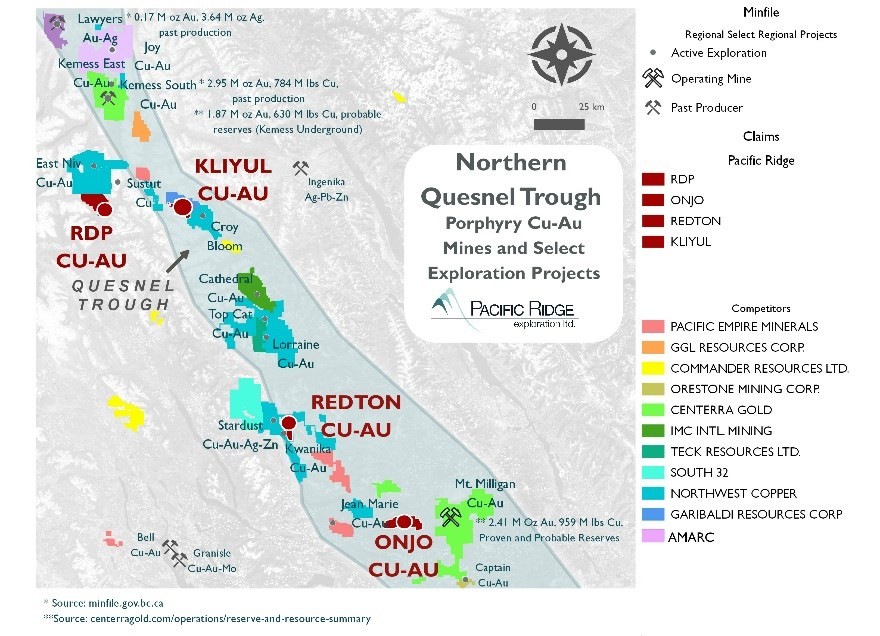

Vancouver, British Columbia–(Newsfile Corp. – February 15, 2022) – Pacific Ridge Exploration Ltd. (TSXV: PEX) (OTCQB: PEXZF) (“Pacific Ridge” or the “Company”) is pleased to announce assay results from drill hole KLI-21-038 (see Table 1), the third and last diamond drill hole (“DDH”) completed in 2021 at the Kliyul copper-gold porphyry project (“Kliyul” or “Project”), located in the prolific Quesnel Trough in Northwest B.C. (see Figure 1).

Table 1

2021 Kliyul assay results summary

| Hole | From (m) | To (m) | Width (m) | Cu (%) | Au (g/t) | CuEq (%) | AuEq (g/t) |

| KLI-21-036* | 12.0 | 449.0** | 437.0 | 0.22 | 0.60 | 0.61 | 0.96 |

| Includes | 12.0 | 65.0 | 53.0 | 0.22 | 0.83 | 0.75 | 1.17 |

| And | 12.0 | 33.0 | 21.0 | 0.34 | 1.30 | 1.17 | 1.84 |

| And | 47.0 | 65.0 | 18.0 | 0.22 | 0.89 | 0.79 | 1.23 |

| Includes | 143.3 | 435.0 | 291.7 | 0.28 | 0.74 | 0.75 | 1.18 |

| And | 294.0 | 435.0 | 141.0 | 0.36 | 1.11 | 1.07 | 1.68 |

| KLI-21-037* | 12.3 | 579.0** | 566.7 | 0.20 | 0.44 | 0.48 | 0.76 |

| Includes | 12.3 | 329.0 | 316.7 | 0.30 | 0.70 | 0.75 | 1.17 |

| And | 62.0 | 73.0 | 11.0 | 0.42 | 1.22 | 1.20 | 1.88 |

| And | 90.0 | 122.0 | 32.0 | 0.52 | 0.88 | 1.08 | 1.70 |

| And | 146.0 | 161.0 | 15.0 | 0.39 | 1.19 | 1.16 | 1.81 |

| And | 238.8 | 288.1 | 49.4 | 0.66 | 1.50 | 1.62 | 2.53 |

| And | 243.9 | 268.0 | 24.1 | 1.09 | 2.21 | 2.50 | 3.92 |

| KLI-21-038 | 9.0 | 516.0** | 507.0 | 0.15 | 0.39 | 0.40 | 0.63 |

| Includes | 9.0 | 351.0 | 342.0 | 0.17 | 0.50 | 0.50 | 0.78 |

| And | 9.0 | 43.0 | 34.0 | 0.27 | 0.72 | 0.73 | 1.15 |

| And | 108.0 | 136.0 | 28.0 | 0.21 | 0.60 | 0.59 | 0.93 |

| And | 153.1 | 186.0 | 32.9 | 0.24 | 0.78 | 0.73 | 1.15 |

| And | 261.0 | 349.0 | 88.0 | 0.26 | 0.84 | 0.80 | 1.25 |

*Previously reported

** End of hole

CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x $Au x 0.032151)) / ($Cu x 22.0462)

AuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x $Au x 0.032151)) / ($Au x 0.032151)

Commodity prices: $Cu = US$4.00/lb and $Au = US$1,750/oz.

Factors: 22.0462 = Cu% to lbs per tonne, and 0.032151 = Au g/t to troy oz per tonne.

Recovery is assumed to be 100% – there has been no metallurgical testing on Kliyul mineralization

Click on the link below for complete assay results from hole KLI-21-038.

https://pacificridgeexploration.com/site/assets/files/5873/kli_21_038_assays_cu_au.pdf

Highlights of the 2021 DDH Program:

- Successfully extended mineralization at the Kliyul Main Zone (“KMZ”) to the west and to depth; mineralization at KMZ remains open to the west, south, southwest, southeast, northeast, and to depth.

- Every DDH returned significant copper-gold mineralization, notably better than the copper-gold mineralization returned in historic drill holes (see Table 2).

- Encountered values up to 4.0% Cu and 5.8 g/t Au over select intervals, some of the highest-grade intercepts encountered in deep drilling at KMZ.

- The presence of bornite in KLI-21-036 and KLI-21-038 is encouraging as it commonly occurs in the core of porphyry systems and its presence can be used to vector towards the porphyry centre.

“We are extremely pleased with the results from our maiden drill program at Kliyul,” said Blaine Monaghan, President and CEO of Pacific Ridge. “We encountered significant copper-gold mineralization in every drill hole and materially enhanced the mineralized footprint at KMZ with a limited amount of drilling. The results from 2021 lay the foundation for a significantly expanded drill program in 2022.”

Discussion of DDH KLI-21-038

KLI-21-038, drilled vertically from the same drill pad as KLI-21-037 (see Figure 4), was designed to test for mineralization at depth. KLI-21-038 returned 0.15% Cu and 0.39 g/t Au over 507 m, from the top of bedrock (9 m) over its entire length, but had to be terminated at 516 m before reaching its target depth due to technical difficulties. This is an important DDH as it refines the mineralization geometry and target concept. The strongest Cu-Au mineralization encountered occurs within a zone of moderate to strong magnetite-chlorite-quartz +/- epidote-albite alteration. Sulphide minerals occur as pyrite and lesser but significant chalcopyrite and bornite, which are hosted within veins of quartz-magnetite, anhydrite-quartz and epidote-quartz cross-cutting the volcaniclastic andesite of the Late Triassic Takla Group, as well as diorite intrusions. This provides important characteristics of the mineralizing system and it’s paragenesis. Near the bottom of the KLI-21-038, Cu-Au values both increase and are associated with increased anhydrite and epidote veining which could indicate proximity to another zone of higher grade mineralization.

2022 Kliyul Exploration Plans

Pacific Ridge is planning to drill a minimum of 5,000 m at Kliyul in 2022. The focus of the drill campaign will be expanding KMZ along strike and at depth. The Company also plans to test the Kliyul East and Kliyul West targets (see Figures 6-9), which have never been drill tested. Both targets have high chargeability and moderate to high resistivity signatures, similar to KMZ. While Kliyul West is hidden under till cover, porphyry-style alteration and encouraging geochemical pathfinders are observed in outcrop at Kliyul East. In addition to drilling KMZ, Kliyul East and Kliyul West, an IP survey, possibly followed by drilling, is planned at Bap Ridge, one of five interpreted porphyry centres that occur along a 4 km mineralized trend (see Figure 10). Pacific Ridge is also planning an airborne magnetic survey to help delineate the structure, geology and alteration over this highly prospective trend.

Figure 2: Plan view of 2021 drill hole collars and traces projected to surface, selected historical drill highlights projected to surface (see Table 3), and the IP chargeability inversion (interpreted as a guide to mineralization)

Figure 2: Plan view of 2021 drill hole collars and traces projected to surface, selected historical drill highlights projected to surface (see Table 3), and the IP chargeability inversion (interpreted as a guide to mineralization)

Figure 3: Plan view of 2021 drill hole collars and traces projected to surface, selected historical drill highlights projected to surface (see Table 3), and DCIP resistivity inversion

Figure 4: Cross-section of 2021 drill holes, selected historical drill intercepts (see Table 3), and the IP chargeability inversion

Figure 4: Cross-section of 2021 drill holes, selected historical drill intercepts (see Table 3), and the IP chargeability inversion

Figure 5: Cross-section of 2021 drill holes, selected historical drill intercepts (see Table 3), and DCIP resistivity inversion

Figure 5: Cross-section of 2021 drill holes, selected historical drill intercepts (see Table 3), and DCIP resistivity inversion

Figure 6: KMZ IP plan view showing Kliyul East and West Targets

Figure 6: KMZ IP plan view showing Kliyul East and West Targets

Figure 7: KMZ IP cross-section showing Kliyul East and West Targets

Figure 7: KMZ IP cross-section showing Kliyul East and West Targets

Figure 8: KMZ DCIP resistivity inversion plan view showing Kliyul East and West Targets

Figure 8: KMZ DCIP resistivity inversion plan view showing Kliyul East and West Targets

Figure 9: KMZ DCIP resistivity inversion cross section showing Kliyul East and West Targets

Figure 9: KMZ DCIP resistivity inversion cross section showing Kliyul East and West Targets

Figure 10: Kliyul target areas

Figure 10: Kliyul target areas

About the Kliyul Project

Over 60 sq-km in size, Kliyul is located 50 km southeast of Centerra Gold Inc’s Kemess mine and 5 km from the Omineca mining road in one of the most prospective areas for copper and gold porphyries in the prolific Quesnel Terrane. The Project contains five main target areas: KMZ, Bap Ridge, Ginger, M39, and Paprika, each representing an interpreted porphyry centre over a 4 km strike length (see Figure 10). KMZ is the most intensely explored of these, with 36 drill holes (7,068 m) drilled since 1974, most of which targeted a near-surface copper-gold magnetite zone (drill holes KL-5 to KL-93-5). Deeper drilling in 2006 and 2015 encountered a porphyry copper-gold system (drill holes KL06-30 to KL-15-035). See Table 2 for selected historical drill results.

The Project displays classic porphyry copper-gold deposit alteration and mineralization patterns. Geological interpretation, supported by a variety of geophysical surveys, including IP, magnetics and magnetotellurics, suggest the potential to significantly expand the size of the Kliyul mineralized system.

Pacific Ridge has the right to earn a 51% interest in the Kliyul and Redton projects from AuRico Metals Inc., a wholly owned subsidiary of Centerra Gold Inc., by making cash payments totaling $100,000, issuing 2.0 million shares and spending $3.5 million on exploration by December 31, 2023. The Company then has the right to increase its interest in the properties to 75% by making additional payments totaling $60,000, issuing 1.5 million shares and completing an additional $3.5 million in exploration by December 31, 2025.

Table 2 – Selected historical drill results

| Ref | Hole | From (m) | To (m) | Width (m) | Cu (%) | Au (g/t) | CuEq (%)* | AuEq (g/t)** |

| A | KL-5 | 10.8 | 68.3 | 57.5 | 0.32 | 0.99 | 0.95 | 1.49 |

| B | KL-6 | 30.1 | 78.9 | 48.8 | 0.31 | 1.33 | 1.16 | 1.82 |

| C | KL-7 | 20.0 | 71.0 | 51.0 | 0.17 | 1.19 | 0.93 | 1.46 |

| D | KL-93-4 | 46.0 | 102.0 | 56.0 | 0.34 | 0.89 | 0.91 | 1.42 |

| E | KL-93-5 | 16.0 | 76.0 | 60.0 | 0.26 | 1.34 | 1.11 | 1.75 |

| F | KL-06-30 | 22.0 | 239.8 | 217.8 | 0.23 | 0.52 | 0.56 | 0.88 |

| G | KL-06-31 | 346.0 | 378.0 | 32.0 | 0.21 | 0.62 | 0.61 | 0.95 |

| P | KL-15-033 | 32.5 | 194.9 | 162.4 | 0.20 | 0.26 | 0.37 | 0.57 |

| H | KL-15-034 | 37.5 | 90.0 | 52.5 | 0.24 | 0.17 | 0.35 | 0.55 |

| I | KL-15-034 | 123.0 | 368.0 | 245.0 | 0.18 | 0.53 | 0.52 | 0.81 |

| J | Including | 280.6 | 301.0 | 20.4 | 0.39 | 2.55 | 2.02 | 3.16 |

| K | KL-15-034 | 426.0 | 465.7 | 39.7 | 0.20 | 0.66 | 0.62 | 0.97 |

| L | KL-15-035 | 331.0 | 380.0 | 49.0 | 0.16 | 0.22 | 0.30 | 0.47 |

| M | KL-15-035 | 399.5 | 462.8 | 63.3 | 0.26 | 0.28 | 0.44 | 0.69 |

| N | Including | 414.0 | 433.5 | 19.5 | 0.43 | 0.56 | 0.79 | 1.23 |

| O | KL-15-035 | 474.7 | 502.0 | 27.3 | 0.11 | 0.18 | 0.22 | 0.35 |

*CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x $Au x 0.032151)) / ($Cu x 22.0462)

**AuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x $Au x 0.032151)) / ($Au x 0.032151)

Commodity prices: $Cu = US$4.00/lb and $Au = US$1,750/oz.

Factors: 22.0462 = Cu% to lbs per tonne, and 0.032151 = Au g/t to troy oz per tonne.

Recovery is assumed to be 100% – there has not yet been metallurgical testing on Kliyul mineralization.

QA/QC

Pacific Ridge’s 2021 exploration program was managed by Equity Exploration Consultants Ltd. of Vancouver, B.C. The drill contractor was Atlas Drilling Ltd. of Kamloops, B.C. Drill core was crushed and pulverized and analyzed for 48 elements using a four-acid dissolution followed by ICP-MS (ME-MS61), with a 30 g sample analyzed for gold by fire assay and atomic absorption finish (Au-AA23). Half-core HQ (63.5 mm) or NQ (47.6 mm) sawed samples from continuous intervals throughout drill hole KLI-21-038 were sealed on site and shipped to ALS Minerals preparation lab in Kamloops, BC. Fire assay and multielement analyses were completed at ALS Minerals analytical laboratory in North Vancouver. Blanks and commercially certified reference materials were inserted blind into the assay lab sample preparation stream.

About Pacific Ridge

Our goal is to become one of the leading copper-gold exploration companies in British Columbia. Pacific Ridge’s flagship project is the Kliyul copper-gold project, located in the Quesnel Trough, approximately 50 km southeast of Centerra Gold Inc’s Kemess mine. In addition to Kliyul, the Company’s project portfolio includes the RDP copper-gold project (optioned to Antofagasta Minerals S.A.), the Onjo copper-gold project, and the Redton copper-gold project, all located in British Columbia. Pacific Ridge will continue to search for projects that offer discovery opportunity in our regions of expertise.

On behalf of the Board of Directors,

“Blaine Monaghan”

Blaine Monaghan

President & CEO

Pacific Ridge Exploration Ltd.

Corporate Contact:

Blaine Monaghan

President & CEO

Tel: (604) 687-4951

www.pacificridgeexploration.com

https://www.linkedin.com/company/pacific-ridge-exploration-ltd-pex-

https://twitter.com/PacRidge_PEX

Investor Contact:

G2 Consultants Corp.

Telephone: +1 778-678-9050

Email: ir@pacificridgeexploration.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information contained within this News Release has been reviewed and approved by Gerald G. Carlson, Ph.D., P.Eng., Executive Chairman of Pacific Ridge and Qualified Person as defined by National Instrument 43-101 policy.

Forward-Looking Information

This release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts, that address exploration drilling and other activities and events or developments that Pacific Ridge Exploration Ltd. (“Pacific Ridge”) expects to occur, are forward-looking statements. Although Pacific Ridge believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. These statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, that one of the options will be exercised, the ability of Pacific Ridge and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Pacific Ridge’s proposed programs on reasonable terms, and the ability of third party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Pacific Ridge does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.