Continue reading » April 1, 2017 admin Market Flash No Comment I believe that there will be some huge moves in the precious metals in the near future since we are nearing the end of some critical wedge patterns in both gold, silver, the silver/gold ration as well as the mining stocks. The direction of the...

Continue reading » March 29, 2017 admin Silver & Guld 1 Comment “Retail Investor Euphoria Sign of Looming Market Bubble” – Schiffgold.com “Deep Subprime Auto Loans Are Surging“ – Bloomberg.com “Foundation – Fall of The American Galactic Empire” – Theburningplatform.com “Two Fed Presidents Warn Markets Getting Frothy, Valuations May Come Down” – Zerohedge.com “Something’s Broken In The...

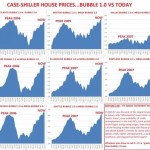

Continue reading » March 29, 2017 admin Market Flash No Comment With the FED opening the easy credit spiggot (again) in the aftermath of the last financial crisis, a lot of assets has seen valuations skyrocket. Again we see real estate prices being pushed up around the world thanks to; 1) Record low interest rates for...

Continue reading » March 27, 2017 admin The Economic Depression No Comment I believe the coming months will be very interesting…

Continue reading » March 25, 2017 admin Silver & Guld No Comment The two charts below are adjuster for inflation and thus reflects the real prices of silver & gold all the way from year 1720 expressed in today’s dollars: As you can see, gold and especially silver has pretty much NEVER been as cheap...

Continue reading » March 23, 2017 admin Silver & Guld No Comment Note: Real rates are calculated by taking the rate of inflation and subtract interest rate. If real rates are negative, it means that your purchasing power declines even if you deposit your currency in a “savings” account. Precious metals love negative real rates because of...

Continue reading » March 19, 2017 admin Market Flash No Comment Stocks and metals popped after the FED decision to hike rates on March 15. AS of now the metals and miners seem to be undecided where they want to go. GDXJ (Junior Miners) maybe saw some profit taking today as it is nearing the end...

Continue reading » March 17, 2017 admin Market Flash No Comment This is what you get with ultra low to negative rates. Real rates are even worse in many developed countries. Noone wants to save in a bank when you can buy real assets with maximum leverage at record low rates. When rates go up,...

Continue reading » March 17, 2017 admin Market Flash No Comment With only a few short days away from three potentially big catalysts, it is interesting to see that gold and the miners are poised for a big move… Gold is reaching the end of a multi year wedge formation GDXJ (Junior Miners)...

Continue reading » March 13, 2017 admin Uncategorized No Comment