Perhaps you have heard about the issues Van Eck have had in regards to GDXJ, in that the ETF has experienced such big inflow volumes that it started to push 10%+ ownership in some miners. This has led to operational problems and can lead to...

Continue reading » April 20, 2017 admin Gold, Gold & Silver Stocks, Horseman's Portfolio, Silver, Silver & Guld No Comment Background In the last couple of days, some of my best performers have been Novo Resources and Orca Gold. These two companies performed pretty well despite gold posting a minor decline. I have personally found that the mentioned shares seem to trade somewhat differently compared...

Continue reading » April 19, 2017 admin Gold, Gold & Silver Stocks, Silver, Silver & Guld No Comment Bought some more shares of Sage Gold, Southern Silver Exploration as well as Kootenay Silver. Sold a small percentage of Golden Arrow Resources. Also added a small position in JDST (A 3x leveraged gold junir bear ETF) for hedging purposes. I think the next few days...

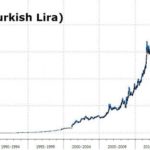

Continue reading » April 18, 2017 admin Gold & Silver Stocks, Silver & Guld 1 Comment Turkey today is a good example of what I believe we will see happening in most countries in the coming years. Namely surging inflation along with heightened worries about the solvency of entire nations. Oh and to every MSM financial pundit that can always be...

Continue reading » April 13, 2017 admin Uncategorized No Comment Gold popped on Trump’s comments about wanting a weaker dollar as well as a low rate environment going forward: Miners yawned. Especially the junior miners index (GDXJ) that was yet again capped at the “You Shall Not Pass” Trendline: The...

Continue reading » April 12, 2017 admin Gold, Gold & Silver Stocks No Comment Gold and silver are having one of their best days in quite some time, while the mining indices GDX and GDXJ are underperforming. Why is this…? When gold and silver is up 1.5% and 2.0% respectively, the rule of thumb is for miners to be...

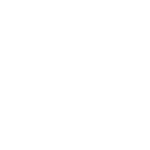

Continue reading » April 11, 2017 admin Gold, Gold & Silver Stocks, Silver, Silver & Guld No Comment Company profile: Dolly Varden Silver Corp. Fully diluted market cap: 20 MUSD (April 10) Fully diluted share count: 43.3M Number of projects: 2 Flagship project: “The Dolly Varden Project” Project size: 8,800 hectare (wholly owned, 2% NSR) Main product: Silver Grade: High (300gpt+) Bi-products: Lead &...

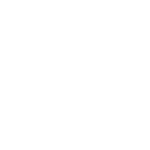

Continue reading » April 11, 2017 admin Gold & Silver Stocks, Horseman's Portfolio 3 Comments With my main thesis that we are in the beginning stages of a precious metal bull market, my portfolio has a slight overweight towards primary silver companies (although few actually have more than 50% of their revenue from silver at these prices). This focus on...

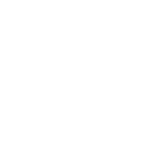

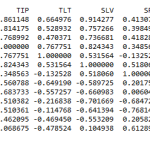

Continue reading » April 9, 2017 admin Gold & Silver Stocks, Horseman's Portfolio No Comment I was interested in examining the changes in cross-asset correlations for the months leading up to the elections versus the correlations after the election, ergo before and after “The Trump Hype” aka “The Reflation Trade”. Additional background reading: “Morgan Stanley: A ‘correlation crash’ is happening in...

Continue reading » April 8, 2017 admin Gold, Gold & Silver Stocks No Comment Gold futures are currently trading just above the it’s very significant 200 Day Moving Average: As you can see in the graph above, the 200 daily Moving Average has been a very important support/resistance point for gold in the last couple of years....

Continue reading » April 7, 2017 admin Uncategorized No Comment