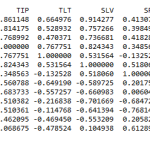

The US dollar still rules the day, which opens up for a correction in gold if we get that bounce in the dollar. Negative correlation to VIX is still somewhat high. Overall, most of the correlations that have at some points been pretty strong...

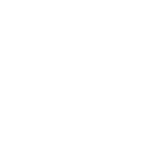

Continue reading » February 20, 2018 admin Chart of the Day, Gold No Comment Lets take a look at the correlations during the time period 2017-03-01 to 2017-05-01: Data Observations GDXJ correlation with gold literally went down the drain, with a coefficient of only 0.06! Probably a lot to do with the GDXJ rebalancing. Gold saw...

Continue reading » May 2, 2017 admin Market Flash No Comment I was interested in examining the changes in cross-asset correlations for the months leading up to the elections versus the correlations after the election, ergo before and after “The Trump Hype” aka “The Reflation Trade”. Additional background reading: “Morgan Stanley: A ‘correlation crash’ is happening in...

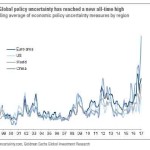

Continue reading » April 8, 2017 admin Gold, Gold & Silver Stocks No Comment Global policy uncertainty: Never before in “modern times” has there been this much policy uncertainty around the world. Never before has central banks printed this much FIAT currency. Never before in HISTORY has there been negative nominal rates. We are right in the middle of...

Continue reading » February 22, 2017 admin Market Flash, Monetära systemet No Comment