Yahoo Finance’s Julia LaRoche spoke with DoubleLine Founder and CEO Jeffrey Gundlach about the Federal Reserve, inflation, stimulus, cryptocurrencies, and the economy.

Continue reading » May 17, 2021 admin Gold No Comment Earlier this month the US Treasury released its plan to flood the financial system with cash by reducing its balance on its general account at the Fed by $1.229 trillion by not renewing an equivalent amount of T-Bills. Separately, the Fed will continue with its...

Continue reading » February 26, 2021 admin Gold No Comment What happens when Central Banks and Governments around the world print trillions of dollar equivalents at the same time that the global supply chain is heavily disrupted? 1.3 billion Indians were recently put under lock-down, thus joining an increasing number of countries around the world...

Continue reading » March 25, 2020 admin The Economic Depression No Comment These are interesting times… We see mine after mine getting shut down due to the Corona Virus while some of the largest gold refiners in the world have also shut down. This is of course a limiting factor to the physical gold supply. Furthermore, it...

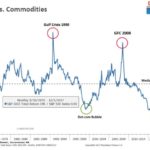

Continue reading » March 23, 2020 admin Gold & Silver Stocks, Horseman's Portfolio, The Economic Depression No Comment At this moment, cash is king. It is outperforming stocks, (paper) gold, commodities and mining equities. What we are seeing in the world economy is highly deflationary. The thing is that neither the banking systems, economies, nor Central Banks can stand deflation. Given the record...

Continue reading » March 16, 2020 admin Gold & Silver Stocks, Horseman's Portfolio, Investing Strategies No Comment “Contrarian investing” description via investopedia.com: Contrarian investing is a type of investment strategy distinguished by buying and selling against the grain of investor sentiment during a specific time. A contrarian investor enters the market when others are feeling negative about it and the value is...

Continue reading » December 13, 2017 admin Gold & Silver Stocks 1 Comment I have been reading a bunch of negative comments regarding gold lately. This Isn’t that surprising since first of all, the COT -report showed managed money (semi dumb money) pushing up their net long positions past recent highs: Friday also delivered a VERY ugly “shooting...

Continue reading » August 20, 2017 admin Chart of the Day, Gold, Silver 1 Comment No one could have escaped hearing financial media pundits talk about how bad rate hikes are for gold. What is interesting is the fact that since the start of FED’s latest hiking cycle in late 2015, gold has actually rallied right after each hike (Potentially with the...

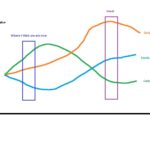

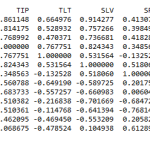

Continue reading » June 20, 2017 admin Gold, Gold & Silver Stocks, Silver No Comment I was interested in examining the changes in cross-asset correlations for the months leading up to the elections versus the correlations after the election, ergo before and after “The Trump Hype” aka “The Reflation Trade”. Additional background reading: “Morgan Stanley: A ‘correlation crash’ is happening in...

Continue reading » April 8, 2017 admin Gold, Gold & Silver Stocks No Comment The two charts below are adjuster for inflation and thus reflects the real prices of silver & gold all the way from year 1720 expressed in today’s dollars: As you can see, gold and especially silver has pretty much NEVER been as cheap...

Continue reading » March 23, 2017 admin Silver & Guld No Comment