Miners have been in a 3+ month correction and I think we shouldn’t be far away from the start of the next leg up. Make no mistake, mining shares are incredibly cheap right now, especially the gold juniors. I see some valuations that might belong...

Continue reading » November 23, 2020 admin Gold, Gold & Silver Stocks, Horseman's Portfolio, Silver 3 Comments There will always be short term noise so it’s good to take a step back and look at the big picture: … What’s all the fuzz about?…

Continue reading » October 6, 2020 admin Chart of the Day 1 Comment We are seeing a mining sector with “artificial” pricing right now. Price is not reflecting value at all, across the board. It might even diverge further even though even the producers look cheaper than the 2015 bottom. Nothing makes sense right now. Theoretically this price...

Continue reading » March 14, 2020 admin Gold & Silver Stocks, Horseman's Portfolio, Investing Strategies 1 Comment CLICK HERE to listen to my recent interview with Cory Fleck of Kereport.com. We discussed how to navigate stock forums and touched on some things to think about when investing in junior miners. Cheat sheet: If someone pretty much only talks in terms of absolutes...

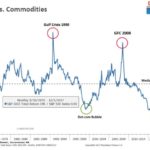

Continue reading » November 28, 2019 admin Gold & Silver Stocks, Kereport, Podcasts/Interviews No Comment Major support and resistance breaks in this chart has signalled major trends in gold and the miners during the last couple of years. We seem to be on the cusp of another perhaps important break down. Last time the GVI/GLD ratio broke major support,...

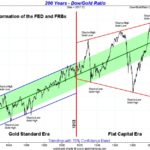

Continue reading » January 11, 2018 admin Chart of the Day No Comment The following chart is very interesting to say the least. We should be near or at the green trend line that has been a resistance/pivot zone multiple times during the this “FIAT only” regime. Sure, gold is not as cheap as when it hit the...

Continue reading » January 4, 2018 admin Chart of the Day, Gold No Comment Goldfinger compiled a great article on lessons learned during 2017 from some of the more prevalent posters on CEO. At first it was hard to come up with definite lessons since I personally feel my investing strategy has changed so drastically in just one year...

Continue reading » January 1, 2018 admin Investing Strategies No Comment “Contrarian investing” description via investopedia.com: Contrarian investing is a type of investment strategy distinguished by buying and selling against the grain of investor sentiment during a specific time. A contrarian investor enters the market when others are feeling negative about it and the value is...

Continue reading » December 13, 2017 admin Gold & Silver Stocks 1 Comment First price chart trend line broken. MACD has broken first trend line. RSI has broken two trend lines. Hopefully this turns out like the scenario I described a few months ago: Blood bath phase breaking all technical supports exactly like before the huge Q1 rally...

Continue reading » October 25, 2017 admin Chart of the Day, Gold & Silver Stocks No Comment This past week ended on a negative note for the mining indices since GDX and GDXJ seem to have been rejected at the down trend ceiling once again (even though some big individual names have pretty bullish charts): GDXJ:GDX Isn’t looking that great...

Continue reading » August 5, 2017 admin Chart of the Day, Gold & Silver Stocks No Comment