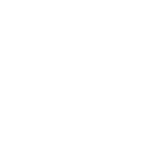

Lets take a look at the correlations during the time period 2017-03-01 to 2017-05-01: Data Observations GDXJ correlation with gold literally went down the drain, with a coefficient of only 0.06! Probably a lot to do with the GDXJ rebalancing. Gold saw...

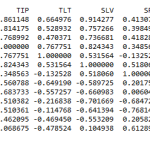

Continue reading » May 2, 2017 admin Market Flash No Comment I was interested in examining the changes in cross-asset correlations for the months leading up to the elections versus the correlations after the election, ergo before and after “The Trump Hype” aka “The Reflation Trade”. Additional background reading: “Morgan Stanley: A ‘correlation crash’ is happening in...

Continue reading » April 8, 2017 admin Gold, Gold & Silver Stocks No Comment Note: Real rates are calculated by taking the rate of inflation and subtract interest rate. If real rates are negative, it means that your purchasing power declines even if you deposit your currency in a “savings” account. Precious metals love negative real rates because of...

Continue reading » March 19, 2017 admin Market Flash No Comment Stocks and metals popped after the FED decision to hike rates on March 15. AS of now the metals and miners seem to be undecided where they want to go. GDXJ (Junior Miners) maybe saw some profit taking today as it is nearing the end...

Continue reading » March 17, 2017 admin Market Flash No Comment This is what you get with ultra low to negative rates. Real rates are even worse in many developed countries. Noone wants to save in a bank when you can buy real assets with maximum leverage at record low rates. When rates go up,...

Continue reading » March 17, 2017 admin Market Flash No Comment