Irving Resources (IRV): Buried Sinter, Hidden Dragon

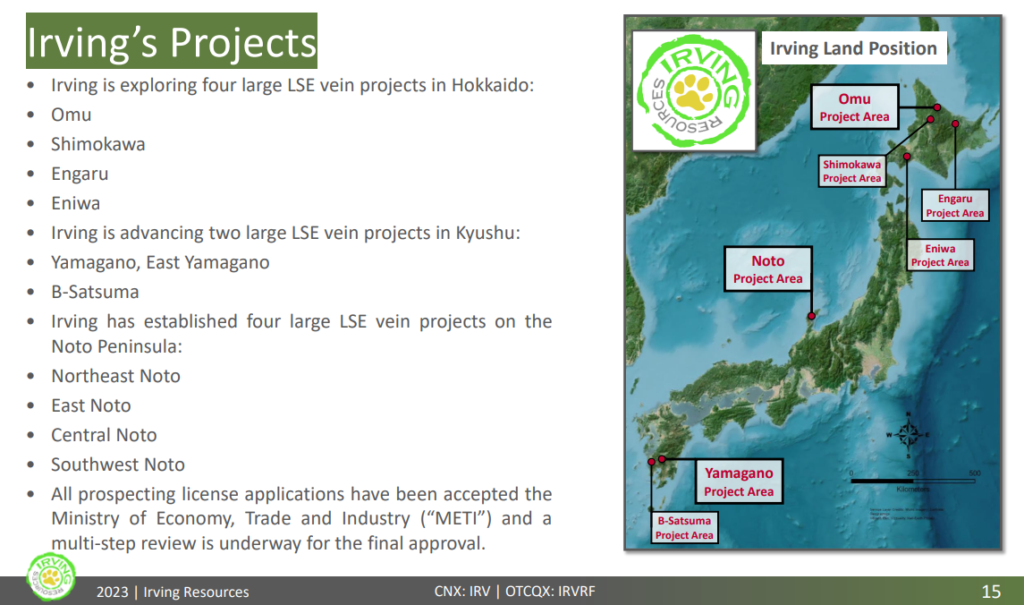

It is time to re-visit an old favorite of mine which went into hibernation for around two whole years “thanks” to COVID. The company is Irving Resources which is looking for low sulphidation epithermal deposits (“LSE”), on the Japanese Islands, with a goal of direct shipping silica rich ore to smelters across Japan. Recently the company put out some very exciting news which it does not appear that anyone actually read. In this article I will explain why I have gotten increasingly bullish on the story since said news item. I own shares of Irving Resource so consider me biased and do your own due diligence. As any exploration story this should be considered high risk/high reward.

TL;DR

The Goal And Competitive Advantages

- Discoveries of Hishikari type Low Sulphidation Epithermal deposits that could be direct shipped to smelters

- Potentially high grades with high margins

- Potentially very large systems ala Hishikari

- Potentially low CAPEX since no infrastructure for processing would be needed

- Paid ~$30/ton for the Silica (host rock) and ~95% for all metals

The case and recent events in short

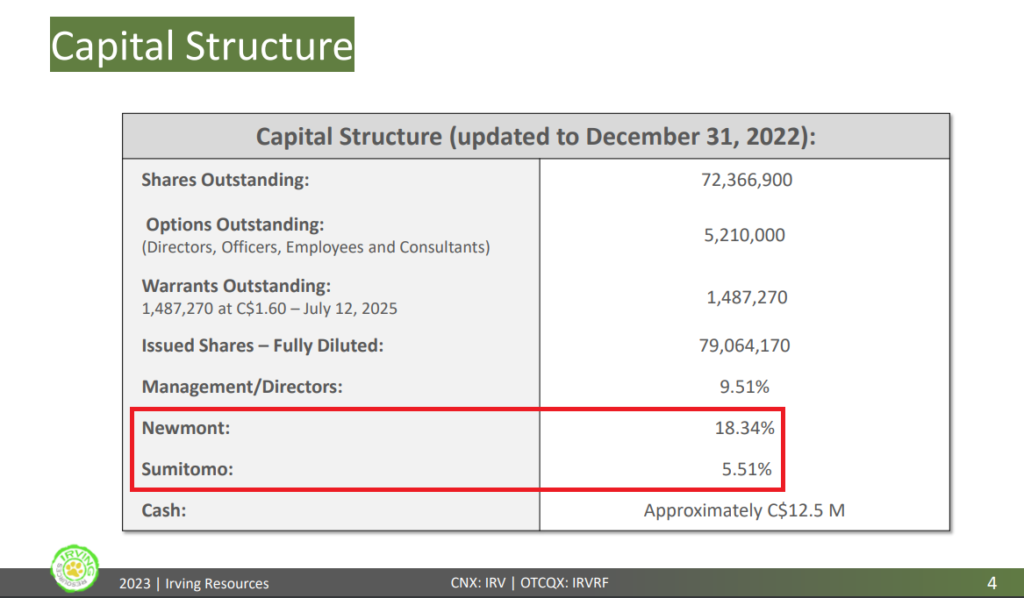

- The company has #10 LSE project in Japan and is backed by Newmont and Sumitomo

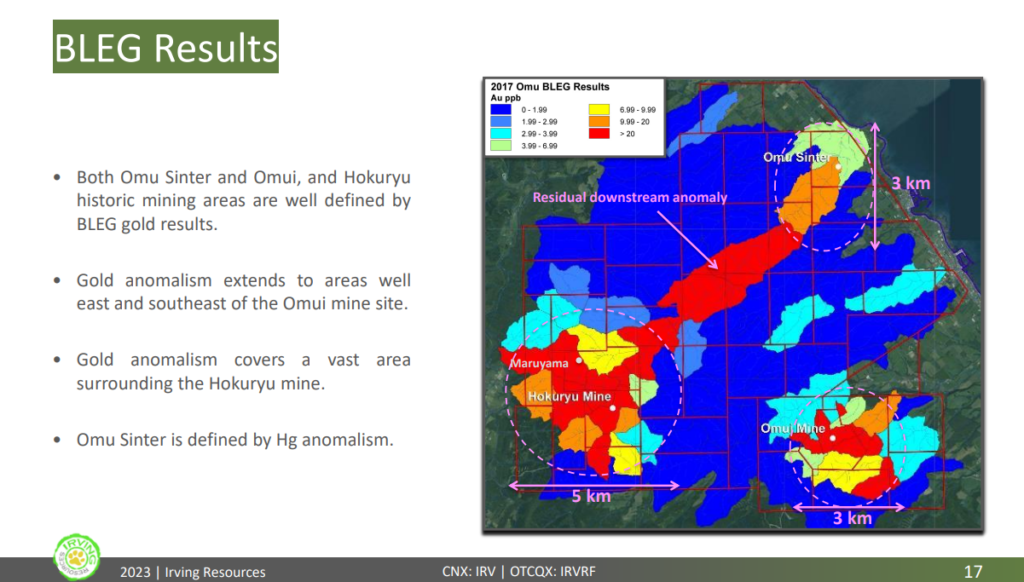

- The company has confirmed high-grade mineralization at four targets; Honpi, Nanko, Hokuryu and Omu Sinter

- The company only had one drill rig and could barely do any work since COVID hit

- The company plans on taking the rig count from #1 to #3

- The company has just drilled two deep holes at Honpi and Nanko with probably the best visuals yet

- … The market does not even seem to have read the last news release.

In short Irving has been quite boring for around two years but that might shortly change given the encouraging visuals from deep drilling at both Honpi and Nanko coupled with the rig count possibly tripling this year.

Possibly up to five projects/targets will be drilled this year:

- Honpi (Discovery, on a mining lease)

- Nanko (Discovery, on a mining lease)

- Hokuryu (Discovery)

- Omu Sinter (Discovery)

- Yamagano (No drilling yet but brownfield exploration)

Short Term Catalysts

- Assays from deep hole at Honpi

- Assays from deep hole at Nanko

Setting The Scene – Hishikari

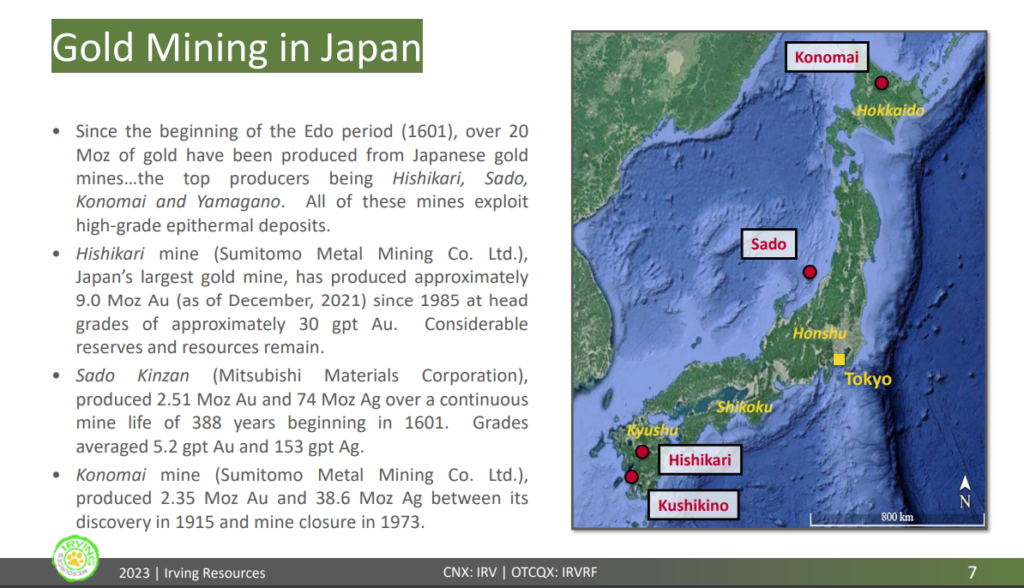

For whatever reasons Japan has been blessed with some pretty remarkable potential for low sulphidation epithermal (“LSE”) deposits. Although modern exploration is almost non existent there have been some spectacular deposits of said kind found:

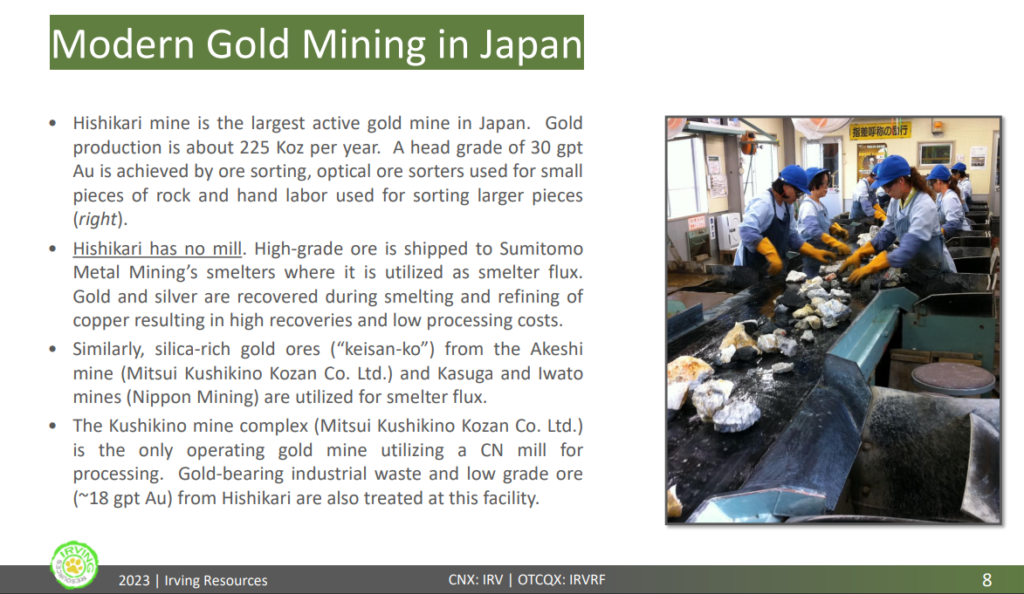

The most recent and best example of a Japanese LSE deposit is the Hishikari mine which, as is described above, has produced over 9 Moz of gold at a head grade of 30 gpt:

Apparently the All in Sustaining Costs (AISC) is as low as $400 per ounce. In other words it is basically a “Fosterville” type mine but much larger. Furthermore, even though Sumitomo does not publicize much information, it has been said that the mine still has several decades worth of production left (in addition to the 9 Moz that have already been mined). Suffice it to say that Hishikari probably is one of the most valuable gold mines ever found, thanks to both the abnormal grades, and the abnormal metal endowment for a LSE system. Just a quick calculation using lets say an AISC of $600/oz, a gold price of $1,800 and annual production of 225,000 ounces results in an annual pre-tax profit of $270,000,000…

No wonder Sumitomo has kept it for so long and no wonder the largest gold miner on earth (Newmont) and Sumitomo Corporation are investors in Irving Resources:

It goes without saying that corporations of that size, especially if they think about potentially sharing a mine, would probably need to see multi-billion dollar potential to even bother with any paper work.

So we know Japan can produce billion dollar LSE deposits and Irving Resources has #11 projects and more individual targets than that:

The Sleeper Must Awaken

To make a long story short Irving Resources basically has done very limited exploration work for almost two whole years due to COVID. Well it was not that quick paced to begin with given the company only had one drill rig and had to get drillers all the way from Canada. But when COVID hit things slowed down even more. Then add seasonality thanks to weather and you have the perfect (boredom) storm.

We all know that perception and sentiment are very strong factors in this sector overall. That of course goes for individual stories as well. In Irving’s case I would argue that the story might be on the cusp of getting a lot better and a lot more interesting…

Why?

- The rig count is set to go from #1 to #3

- Several drillers from Chile have been brought over to operate the drill rigs

- … Which allows much quicker exploration pace

Thus the plan for 2023 is more ambitious than ever:

“We are getting everything in place to pursue exploration more aggressively,” commented Dr. Quinton Hennigh, director and technical advisor to Irving Resources. “We are delighted to secure a team of Chilean drillers to join our growing Japanese drill crew. We expect to be able to pursue year-round drilling as we move forward. This year, we will test all four mineralized systems at our Omu project, and by late year, we hope to be drilling at Yamagano. Things are shaping up nicely for Irving to pursue its ambition of making the next great gold discovery in Japan.”

… In other words this ought to be a very different company going forward in terms of news flow and excitement.

With all of the above said I think the latest news release might be the most exciting one yet in the history of the company. We already know Irving has already made three high-grade discoveries at Omui (Nanko & Honpi), Hokuryu and Omu Sinter within the greater Omu project:

(Check out the website for the actual assay results)

Before I go into the latest news release lets wind back the clock to 2016 and refresh our memory on things many (and I) probably have forgotten:

“Irving Resources Samples High-Grades at its Omui Gold-Silver Project, Hokkaido, Japan”

At the Honpi (“Main Vein” in English) occurrence, rock chip samples collected from float boulders of vein material returned exceptional assays including 480 gpt gold (“Au”) and 9,660 gpt silver (“Ag”), 143.5 gpt Au and 2,090 gpt Ag, 67.6 gpt Au and 1,060 gpt Ag, 55.6 gpt Au and 290 gpt Ag, and 48.2 gpt Au and 1,030 gpt Ag (See Figures 1 and 2). A further 14 samples assayed >10 gpt Au and 13 samples assayed >200 gpt Ag.

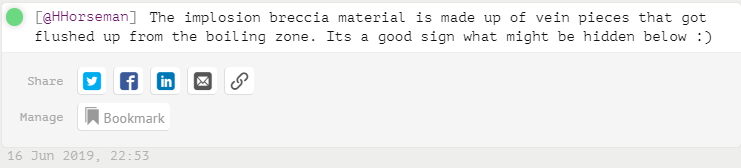

So these bonanza grade samples at surface were thought to be pieces of “implosion breccia”. This is what I wrote in 2019 when it was still fresh:

(CLICK HERE to read an article by Bob Moariarty done in 2018 where you can see some samples of implosion breccia.)

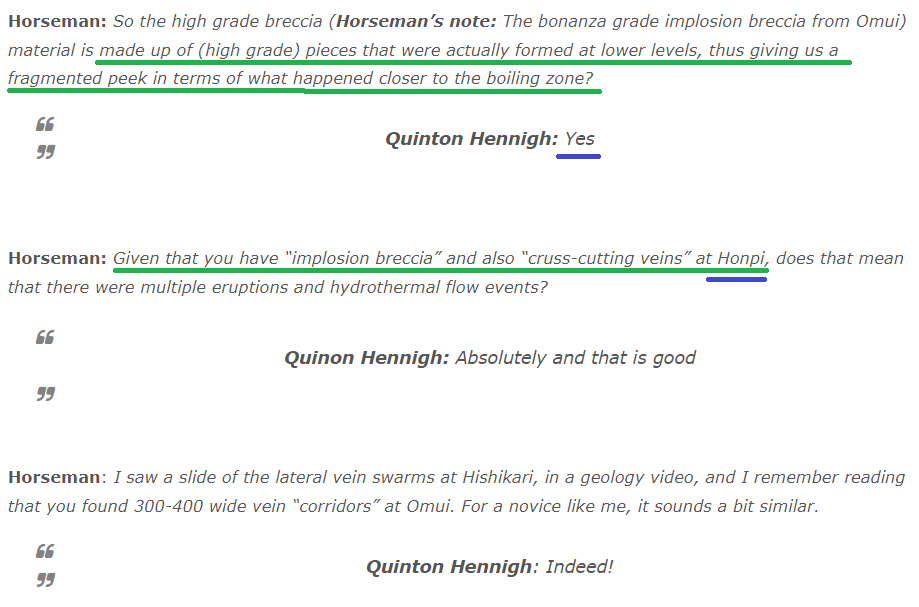

Anyway, around the same time (A few years ago now!) I sent a few question to Quinton Hennigh and published it in an article:

(Especially note the comments about Honpi)

In Summary

The highest grade samples taken from “Honpi” and “Nanko” within the greater “Omui” target, which in turn is within the greater “Omu Project”, have been believed to be fragments of vein material, that broke off from the boiling zone (main pay zone in LSE systems), and got flushed to surface when the system “blew” once again.

Even though high-grade to bonanza-grade intercepts have been produced from “Honpi”, which is a sub-target within “Omui”, the source of the ultra bonanza type vein material found at surface has not yet been intercepted with the drill bit…

The plot thickens

On December 13, 2021 we received the following news release:

“Irving Resources Discovers New, Buried Hot Spring System at Omui Mine Site, Omu Au-Ag Vein Project, Hokkaido, Japan”

Snippets:

(Bold and color added by me)

Irving Resources Inc. (CSE:IRV; OTCQX: IRVRF) (“Irving” or the “Company”) is pleased to announce it has discovered a new, buried hot spring system immediately beneath areas previously targeted with shallow drilling at the Omui Mine Site, part of Irving’s 100% controlled Omu Au-Ag Vein Project, Hokkaido, Japan.

- Further evidence for potential high-grade mineralization at depth comes from fragments of dark banded silica found in some Honpi vein samples. Such dark silica fragments sometimes bear abundant fine particles of electrum, a natural Au-Ag alloy, and silver sulfosalt minerals. The source of these fragments is believed to be somewhere below Honpi, but until now, a viable source could not be rationalized. It is possible that these fragments were ripped up from the lower hot spring system by hydrothermal activity and carried upward into Honpi vein where they were incorporated into later quartz veining.

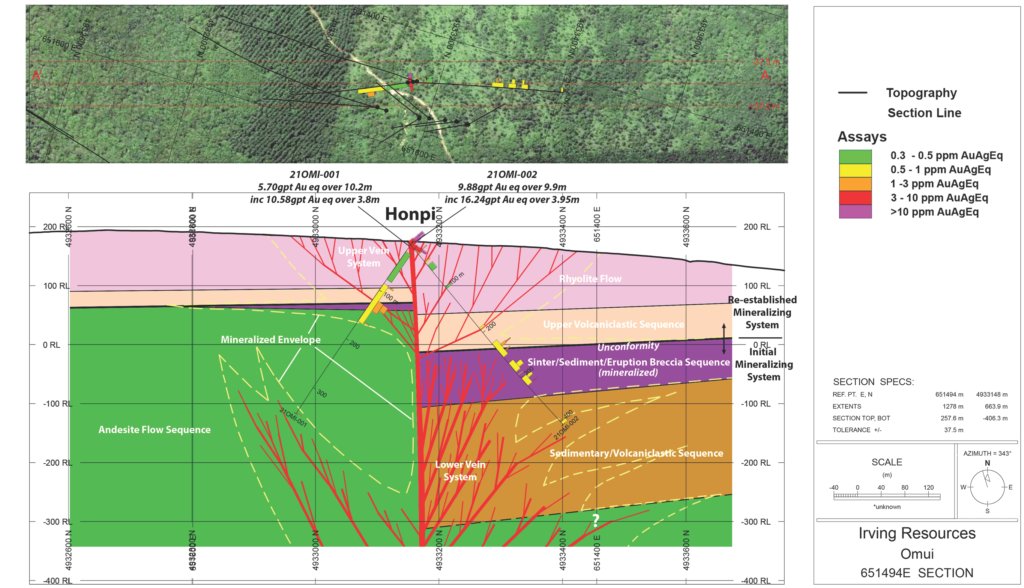

- The presence of this new sinter horizon suggests the presence of an older, extensive hot spring system buried underneath Honpi (Figure 4). This raises the exciting possibility that the feeder for this sinter may lie at deeper levels below Honpi. Hole 19OMI-010, a deep hole drilled by Irving in 2019, encountered numerous deep high-grade vein intercepts that might be part of the feeder system for this lower hot spring deposit.

“The discovery of a new, older hot spring system beneath Honpi raises exciting possibilities,” commented Quinton Hennigh, technical advisor and director of Irving. “We appear to have an entirely new level to test. Hole 19OMI-010 encountered multiple high-grade veins at depth, ones that are somewhat distinct from those encountered at shallow levels around Honpi. Until now, we have been challenged to understand this dichotomy. We have also been challenged to point to the source of Au- and Ag-rich fragments of silica found trapped in Honpi vein material. It could be the answer is right below our feet. Because this is an exceptionally important target, we are making plans for follow up drilling at Omui beginning in February of next year. We are very excited what might be discovered.”

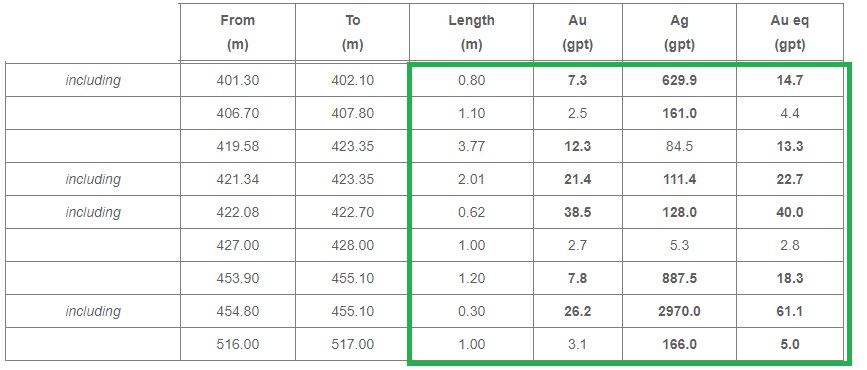

Hole 19OMI-010 which was mentioned above encountered 21 significant veins including the following assay results near the end of the hole:

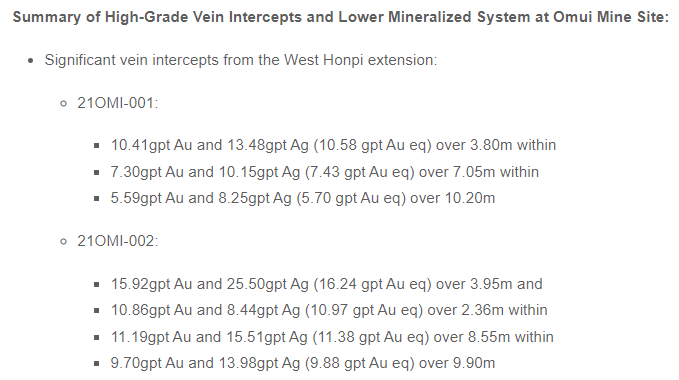

Two other holes that were drilled at Honpi encountered the following as per the March 2, 2022 news release:

Snippets from the same news release:

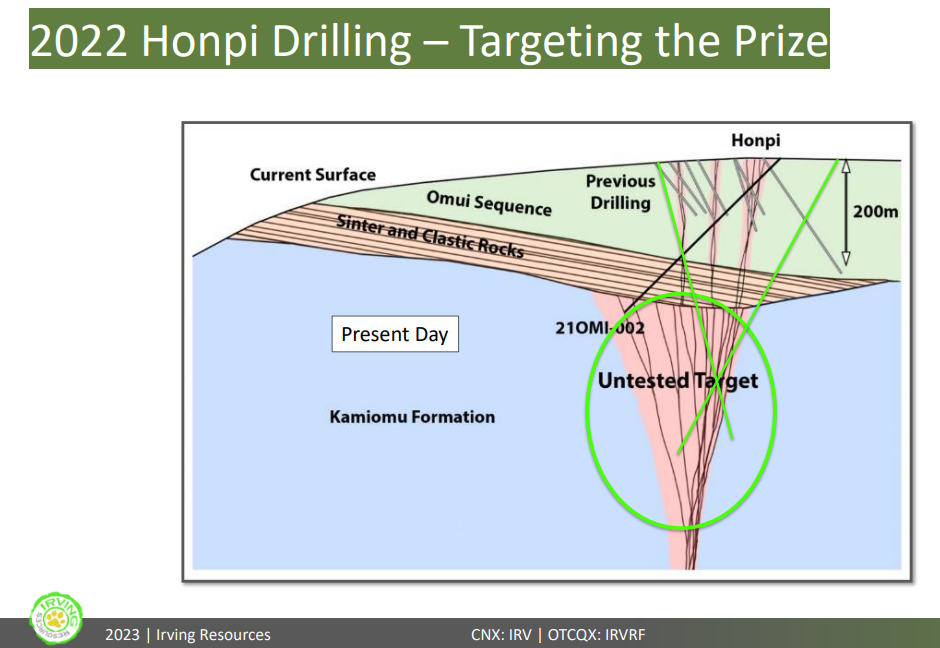

- As reported in the Company’s news release dated December 13, 2021, hole 21OMI-002 encountered a thick sequence of siliceous sinter interbedded with various sedimentary and volcaniclastic rocks beginning approximately 200m beneath surface

- Layers of sinter in hole 21OMI-002 contain significant Au and Ag (Table 1), a strong indication this is a fertile hot spring system. Individual sample intervals assay as high as 3.55gpt Au and 565gpt Ag. Pathfinder elements including arsenic, antimony, mercury and selenium are also highly enriched in these rocks.

- Irving believes that the structure that hosts Honpi was a feeder for this lower hot spring system, one that is capable of hosting significant high-grade Au-Ag veins. Drill testing this area is a very high priority for Irving.

Lets Recap

The source of the bonanza grade samples of implosion breccia material found at surface near Honpi has not yet been tracked down. Irving has been able to hit high-grade silver and gold from shallow drilling but not really the ultra bonanza type stuff as just mentioned. Later on the company realized that what the company was drilling at Honpi might just have been the tip of an ice berg, since a brand new (buried) sinter was encountered a few hundred meters below surface, which suggests that the big prize might be at depth. A prize that perhaps is the source of the bonanza grade implosion breccia fragments, that were flushed up from the deeper system, and can now be found at places near surface within the younger system. What is quite remarkable is that the buried sinter has shown to host appreciable gold and silver even though sinters are typically barren of any precious metals.

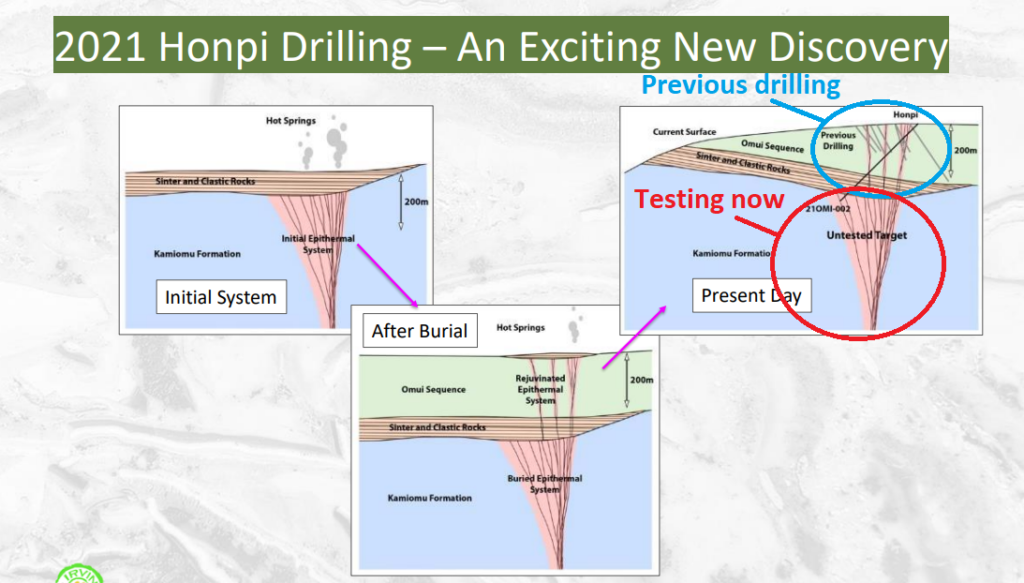

After doing a lot of thinking the company came up with a new schematic of what the team thinks is going on at depth at Honpi:

And to help people to understand what has happened up until the present day there is a simplified illustration in the latest presentation:

(Red and Blue added by me)

Now we can finally get into the latest turn of events…

Sleeping Dragon

So around two weeks ago, on March 6, we got perhaps the most exciting news release in a long time:

“Irving Resources Intersects New High-Grade Au-Ag Veins at Hokuryu and Encounters Significant Vein System at Depth at Omui, Omu Project, Hokkaido, Japan”

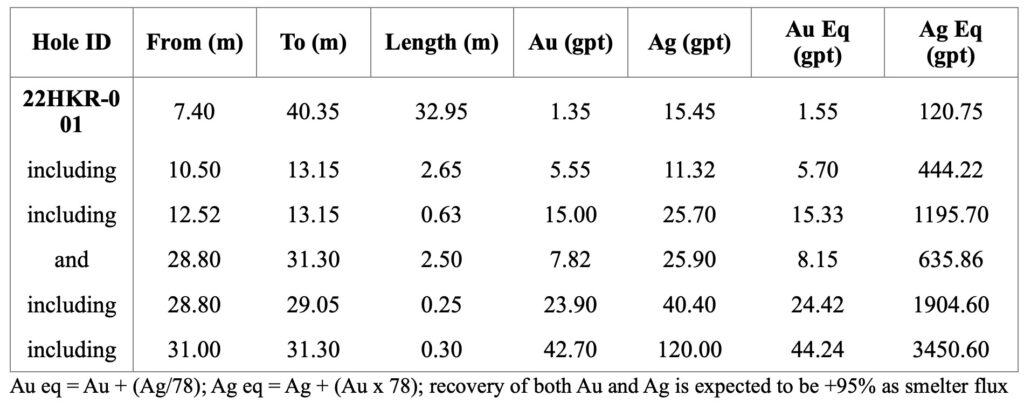

First of all a new vein system was Discovered at Houryu which brings further upside potential and lower risk for the story overall:

Major New Vein System Discovered at Hokuryu Historic Mine Site:

Hole 22HKR-001 completed at Hokuryu in late 2022 encountered a new high-grade Au-Ag vein system nearly 300 m west-northwest of know underground mine workings (Figures 1 and 2). Results are summarized in the table below:

Accompanying comments:

“We are thrilled to see new high-grade veins appear in just our second ever hole completed at Hokuryu,” commented Dr. Quinton Hennigh, technical advisor and a director of Irving. “Any doubts that Hokuryu might be a vein system with limited potential can be dispelled by this discovery. We already see strong merit in following up on these results with more drilling later this year…”

… Importantly, the lowest vein intercepts encountered in 21HKR-001 lie nearly 200 m beneath historic mined areas indicating considerable upside is present at depth….

Good enough, Hokuryu might be a company maker, but here is where it gets REALLY interesting in my opinion…

So Irving did indeed slam a deep hole into both the Nanko… and of course the Honpi target to test the buried system:

What are they seeing so far in the core you ask?

“A second hole, 23OMI-002, similarly drilled from north to south, is currently testing areas deep under Honpi where numerous drill holes completed between 2019-2021 encountered a complex, extensive network of high-grade veins. Notably, hole 23OMI-002 was designed to pierce through a deep level silica sinter system discovered by drilling in late 2021. Irving is pleased to announce that the current hole successfully cut through the sinter starting at about 120 m and appears to have encountered a significant epithermal veins underneath. The hole is currently at a depth of around 300 m and will progress until it is fully past this zone of veining. Once complete, this hole will be logged, split and sampled, then submitted for assay.”

So we know even the SINTER had appreciable gold and silver as per previous news releases. Now they seem to have gone into the sinter at 120 m depth and passed through it right into a vein zone. I don’t know exactly how thick the sinter interval is but even if it is say 50-100 m thick that leaves 80-130 m of vein zone that has been intercepted SO FAR.

Things Coming Together

With the recent realization of a deeper (buried) system, coupled with the latest core visuals, Quinton’s comments from three years ago are really getting me excited today:

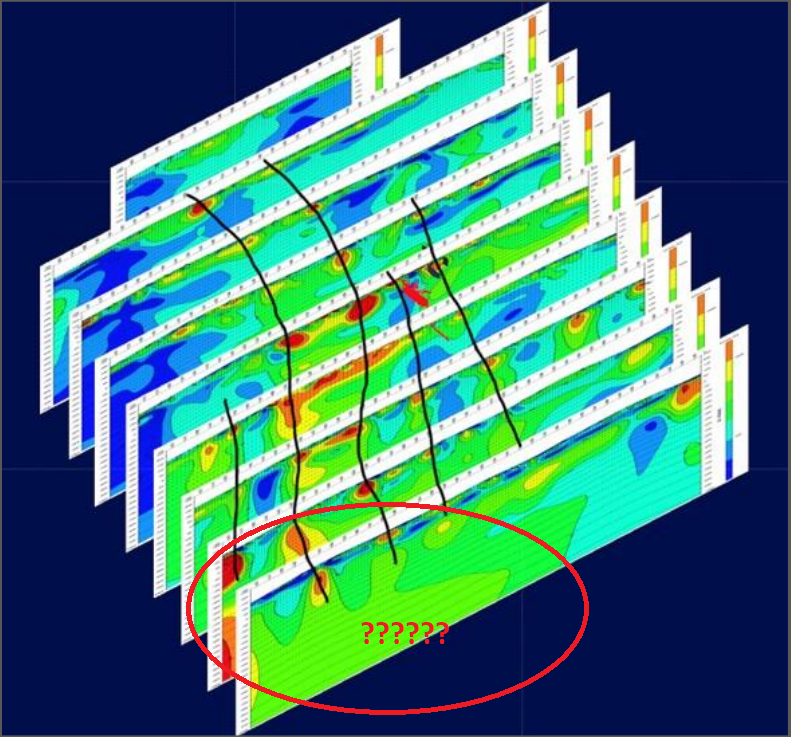

From the presentation above which was done BEFORE the company discovered that there is an older LSE system buried at depth at Honpi:

“Notice how massive the thing appear to be at depth… That is kinda strange… That is a big system.“

(Omui CSAMT results. Red drawings added by me)

It all makes a lot more sense now given that this appears to have been a very long lived system, with multiple pulses, and that maybe the bulk of the prize got trapped below today’s surface level. Also, remember the comments earlier about implosion breccias and cross-cutting veins? Well to me that sounds like something which could explain the blow out in the CSAMT readings at depth.

In Summary

- We know that the shallow system at “Honpi” (Omui) hosts gold/silver bearing quartz veins

- We know that high grade material found near surface must have been flushed up from below (Perhaps from the buried system)

- We know that the deep holes like hole 10 hit high grades at depth quite a bit away from the other shallow hits

- We know that the buried sinter itself contains appreciable gold/silver

- We know that the geophysics in the area suggests it might be a very large system given the CSAMT readings at depth

- We know it is a complex system with multiple vein generations and even cross cutting veins

… All of the above leads me to believe that a) The highest grade material is yet to be found and could either be coming from deeper down in the shallow system or the buried system, b) The buried system appears to be mineralized…, c) There was at least two episodes of mineralization that both contained precious metals…, d) There is a possibility for a multi-phase (minimum 2 events) system, and e) CSAMT reading suggest something massive at depth at Omui.

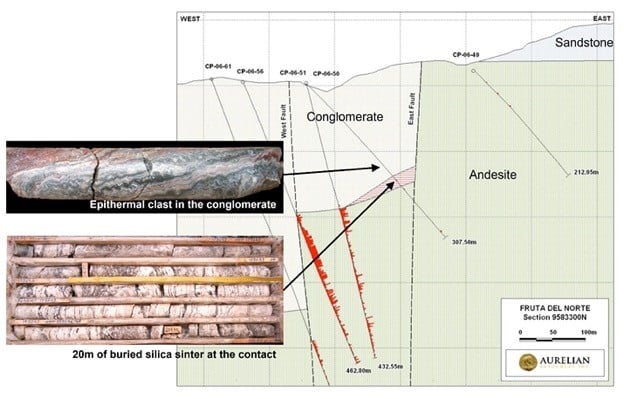

All this is very encouraging since you would want a multi-phase system and you would want overlap either via telescoping at the same depth and/or mineralization getting trapped in the same place. Below is a cross section from the Fruta Del Norte discovery which was a world class, buried sinter system in Ecuador made by Aurelian Resources:

As you can see the mineralization started immediately below the buried sinter and this was also a multi-phase system. So with this in mind lets re-read the latest news from Honpi:

A second hole, 23OMI-002, similarly drilled from north to south, is currently testing areas deep under Honpi where numerous drill holes completed between 2019-2021 encountered a complex, extensive network of high-grade veins. Notably, hole 23OMI-002 was designed to pierce through a deep level silica sinter system discovered by drilling in late 2021. Irving is pleased to announce that the current hole successfully cut through the sinter starting at about 120 m and appears to have encountered a significant epithermal veins underneath. The hole is currently at a depth of around 300 m and will progress until it is fully past this zone of veining. Once complete, this hole will be logged, split and sampled, then submitted for assay.

Note the words used which are “Zone of veining” and not “multiple veins”. And yet again, remember the comments earlier about implosion breccias and cross-cutting veins at Honpi. I am open to the possibility that this lower system might show more of a high-grade bulk type deposit rather than the typical narrow vein style ala Hishikari.

While doing this article I sent a few questions to Quinton Hennigh asking about primarily Honpi:

Q: Do you think the boiling zone for the shallow LSE system at Honpi is around the level of the buried sinter or slightly below? I’m wondering if there is a possibility that the upper boiling zone is overlapping with the poorer/high parts of the buried sinter system?

A: Good question. I’d say it is likely below since we do not really see well banded veins anywhere yet

Q: Do you think the later pulses all got up to the surface easily or might some fluids have been trapped at depth and just enriched the older system?

A: The latter is likely correct.

This sounds rather mind blowing to me. They are getting these high-grade hits even though it appears they have not yet even hit a single boiling zone (not in the upper nor in the lower system). So what will they find in the actual boiling zones? Also, it sounds like there might indeed be an overlapping system at depth where multiple pulses enriched the same area(!). This sounds very promising to me.

Now I don’t know if this will end up being a major discovery hole in the buried system but I would be quite surprised if that big ole vein zone came out barren or almost barren. Just confirming that there is indeed a major extension at depth would be good enough to conclude that Omui, or at least Honpi, could be a large system given that high grade gold/silver has already been confirmed near surface.

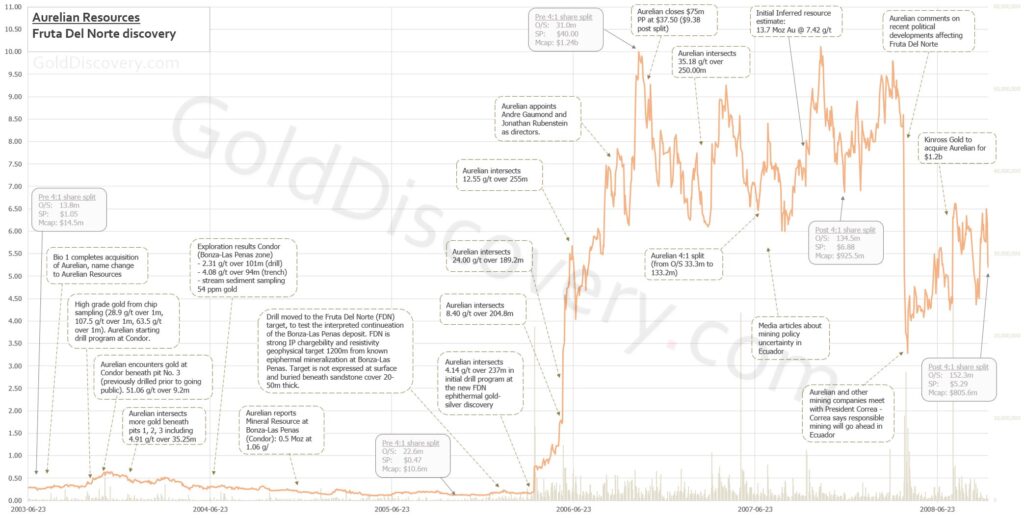

The Story of Aurelian Resources

For those who don’t know Aurelian was one of the success stories that a lot of people remember to this day. The stock went from around $0.50/share to $40/share within 8 months of the discovery hole at Fruta Del Norte. The jurisdiction was highly sketchy at the time but the company ended up being acquired by Kinross acquired for C$1.2 B:

(Via golddiscovery.com)

Today it is the flagship asset of Lundin Gold and is one of the best gold mines in the world. I would not rule out such potential for Irving. The best part is that Irving already has discoveries to follow up at Hokuryu, Omu Sinter and Omui (Honpi & Nanko) and Japan is a much better jurisdiction than Ecuador I would say. The question is how big any of these targets will get.

Nanko

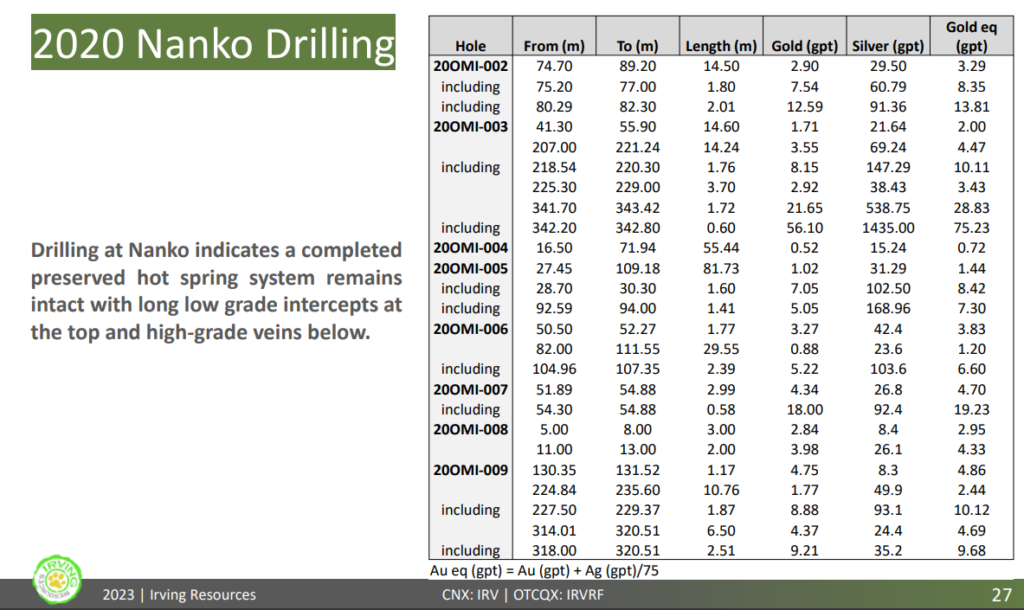

So there weren’t only good news out of Hokuryu and Honpi in the latest news release but from Nanko as well. Limited drilling has been done at Nanko so far but high-grade to bonanza-grade gold/silver has already been confirmed all the way from near surface to a few hundred meters depth:

Anyway, as mentioned earlier, Irving drilled one deep drill hole here as well and the visuals are very encouraging as per the latest news release:

Since mid-January, Irving has been diamond drilling at the Omui Mine Site. One hole, 23OMI-001, drilled from north to south and tested deep areas underneath the Nanko vein target where, in 2020-2021, the Company discovered an extensive high-grade vein network. This new hole intersected multiple veins, some with visible sulfides thought to be ginguro, silver sulfosalt minerals. Notably, the deepest vein intercept occurs near 700 m vertically below surface. Assays are awaited from 23OMI-001.

To put this into context the company has hit 8.42 gpt AuEq over 1.6 meter less than 30 m from surface over at Nanko. And now they have hit multiple vein intervals and the deepest vein intercept occurred around 700 m vertically below surface. In other words this hole might be the first to confirm high-grade mineralization at Nanko with vertical strike profile of several hundred meters.

Quinton’s comments on Honpi and Nanko:

“At Omui, at long last, we are now testing the deeper parts of the Honpi and Nanko vein networks with remarkable visual success. Our two holes from 2023 both show very strong promise. There is clearly a major zone of hydrothermal upwelling and potentially high-grade mineralization under the deep sinter target. While it is early to conjecture what we might have, we are quite encouraged and eagerly await results from holes 23OMI-001 and -002.”

Is there anyone out there?

In light of this latest news release containing one new vein discovery at Hokuryu and possibly the first two deep, and most visually exciting holes out of both Nanko and Honpi yet, one would think that the reaction would be immediate and violent…

But then again after a 2 year bear market there is almost nobody left in this sector and the few who are left do not seem to bother reading the news anymore. I mean if you look at the stock price chart it’s like the news release didn’t even happen. The share price has only revalued slightly higher and on miniscule volume to boot:

This is why I keep saying that this sector is super easy right now. It’s like being an insider because one can buy significantly positive news AFTER the fact without even paying up really. It’s like playing poker with the opponents hand turned over. It’s incredible and it is during times like this that the Risk/Reward gets absurd simply because one can almost pay the same price as before any news without taking any risk in terms of the content of the news release. In short it’s like legal daylight robbery.

Tactical (Short term) Risk Reward

First lets go through the immediate avenues for potential upside:

- Nanko (Discovery)

- Honpi (Discovery)

- Hokuryu (Discovery)

- Omu Sinter (Discovery)

- Maruyama (TBD)

- Yamagano (Brownfield exploration)

- … Plus many other projects

As I see it the coming assays from Nanko and Honpi have no way of killing the story, or even make it overvalued, but on the other hand there is potential for the story to awaken for real. In other words I would argue that the tactical, short term, risk/reward at these price levels going into the assay results is highly asymmetrical in a positive way. Sure, if for some reason the tens of meters of vein intervals come out nearly barren there will likely be a negative price reaction in the short term albeit an unwarranted one from a price to value perspective as the Enterprise Value is only C$62 M right now at $1/share. Any of the multiple targets could be company makers and four of them have already proven they are high/bonanza grade LSE systems. So again, can these two holes theoretically lower the intrinsic value of Irving Resources to below C$62 M? I think not. Can it further increase the value and more specifically wake up the market? I think so.

In short: I don’t see the current Price of Irving as being in danger of looking too high regardless of what the results are but I can see the current Price look way too low in case the results are as interesting as the visuals suggest.

Long term Risk/Reward

The Enterprise Value is only C$62 M (at $1/share) for god’s sake.

Note: This is not investing advice. I am not a financial advisor. I am biased. DO your own due diligence. Juniors are very risky etc etc. Do not invest money you cannot afford to lose. I may buy or sell shares at any time. You are responsible for your own decision!

Best regards,

The Hedgless Horseman

Great report again, Horseman. I have lost money on this stock two different times and still own 10,000 shares. Perhaps a third turn this time will make up for the other two losers. I am still contemplating. Regards

Wow- nice write up! Can I tweet this article?

Thanks Jonathan! Of course!

Remarkable article. My goodness, I can only imagine how much time you spent putting this together.. Thank you very much. I used to get the press releases, but they stopped coming to my email. So this was a great surprise to read.

I’ve held my shared since 2018. So it’s looking like we have finally some news and activity that should revalue those share to the upside.