Musings: Agnico Eagle And The Finland Gold Juniors

Below are some personal musings on what is going on in Finland and what might be in the works…

Companies Mentioned in This Article

- Rupert Resources

- Aurion Resources

- Valkea Resources

- Finex Metals

- Mawson Finland

- Oijärvi (First Nordic)

Setting The Scene

Agnico’s Kittilä mine in Finland, which is producing ~200 Koz per year and is the largest primary gold mine in Europe, is expected to run out of ore in 2035. Ten years sounds like a long time but as many will know nothing moves quickly in the mining space. Thus Agnico needs to decide if they want to let Kittilä run its course and take all the reclamation costs etc or if they want to stay in Finland for the long:er run. If they choose the latter they need to start thinking about filling the Kittilä mill and would probably want to expand. On that note it seems that Agnico showed some cards as it was just announced that the company is putting money in Rupert again (pro rata) and now want one of their people on the board:

RUPERT RESOURCES CLOSES $28.451 MILLION PRIVATE PLACEMENT AND APPOINTS NEW DIRECTORS

Snippets from the news release:

In connection with the Private Placement and the recently completed bought-deal equity financing undertaken by the Company, Agnico Eagle Mines Limited (“Agnico Eagle”) exercised its participation right to subscribe for 2,602,500 Shares, resulting in Agnico Eagle retaining approximately 14.0% interest in the Company on a non-diluted basis upon closing of the Private Placement.

In addition, pursuant to its rights under the investor rights agreement between Rupert Resources and Agnico Eagle dated February 11, 2020, Agnico Eagle has designated Carol Plummer as its nominee to be appointed, or nominated for election, to the Board. As a result, Rupert Resources will nominate Carol Plummer for election as a director at the upcoming annual general meeting of the Company’s shareholders. Carol Plummer is Executive Vice-President, Sustainability, People & Culture at Agnico Eagle and has extensive operating experience, including in Finland, where she was previously the General Manager of Agnico Eagle’s Kittilä mine, located approximately 50km away from Rupert Resources’ Ikkari project.

Musings

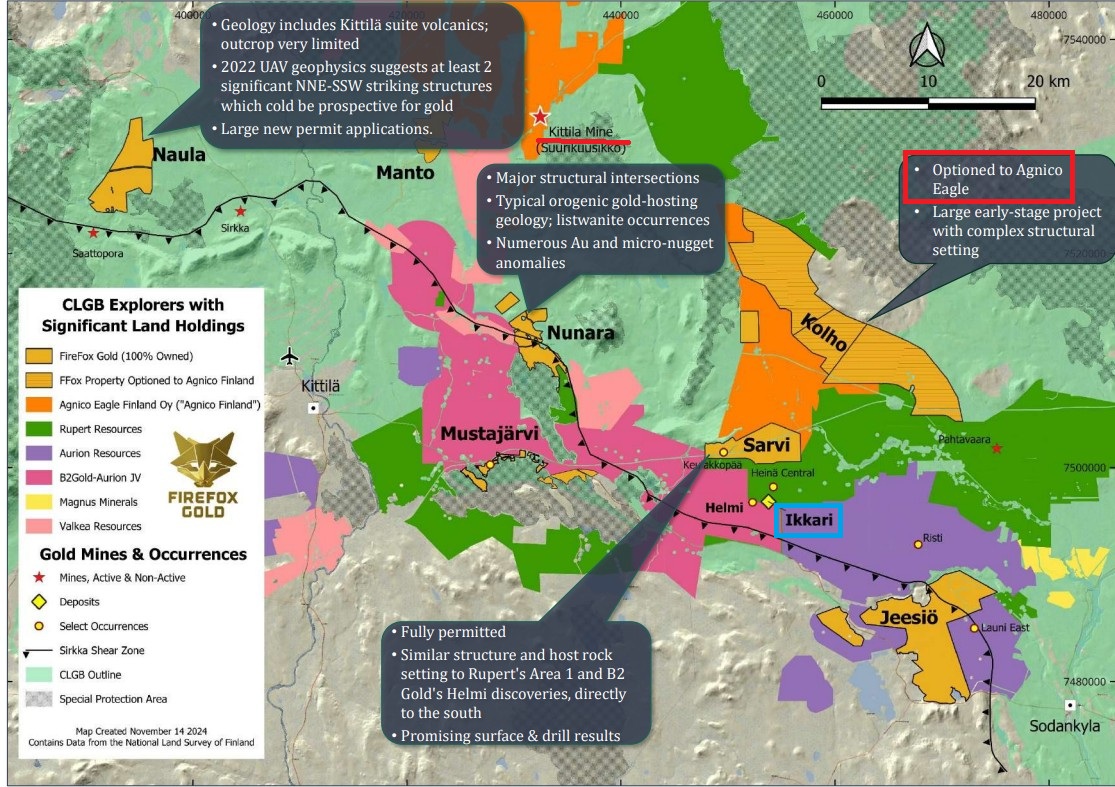

First of all lets look at the region around the Kittilä mine:

… The slide above if from FireFox Gold who have the “Kolho” project which Agnico Eagle is currently earning into since December 2023. This earn in with FireFox was already a signal that Agnico at least entertained the idea of being in Finland for the long haul. This latest news from Rupert suggests that it is looking more and more likely that Agnico will consolidate this region in my opinion. Thus I expect this region to heat up one of these days.

Part 1: Consolidation of “Ikkari”

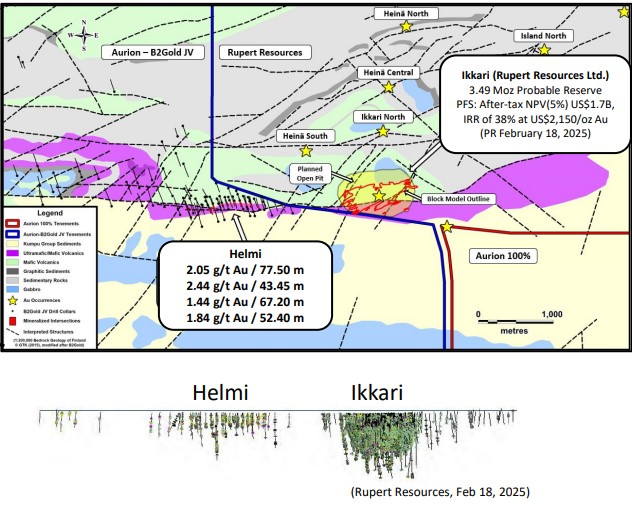

There are several interesting cases involved in this Finish gold rush. The lowest risk would be Rupert Resources ($1 B in MCAP) who has a Tier 1 project in hand and is by far the most advanced and de-risked junior which also now has refreshed interest from Agnico. Aurion Resources ($106M in MCAP) is another interesting case. The company is heavily backed by David Lotan, has a large land package, a few discoveries, and perhaps more importantly has ground that Rupert Resources (or anyone who would want to mine the Ikkari deposit) would want in order to maximize the value out of the Ikkari deposit. Aurion has also confirmed mineralization next to Ikkari through their JV with B2 Gold at the “Helmi” target:

(Note how the Ikkari deposit basically touches the claim border)

A lot of people believe here is only a matter of time before Aurion/Rupert/B2 Gold make some kind of deal and I think they are right. I mean it makes total sense for both parties. The problem, and reason for why it has not happened yet I guess, is probably that due to the unique situation which makes negotiations a bit complicated. Obviously the end game for a player like Agnico would be to control both an unencumbered Ikkari deposit as well as all potential satellite feed in the area (like the “Helmi” target belonging to Aurion/B2 Gold). Thus I think it is only a matter of time before a) A deal between the parties are done, b) Ikkari gets bought (By Agnico if I had to guess), and c) Agnico eventually acquires the nearby ground as well that currently belongs to Aurion/B2 Gold one way or the other.

In summary: I do not think Ikkari alone might be enough for a company as large and as forward looking as Agnico Eagle. However, if one includes all the discoveries and targets belonging to different juniors, in the area around Ikkari, then I believe we have a picture that even Agnico would be interested in. The picture above showing Aurion/B2’s “Helmi” discovery right next to Rupert’s “Ikkari” deposit is perhaps the most obvious example of how could consolidate two different projects into one larger pie.

Part 2: Filling “Kittilä”

It is easy to see how consolidation of the Ikkari deposit and nearby ground could create something that would interest even a company the size of Agnico Eagle. But if they end up doing that and have a mining “Hub” centered on Ikkari they will probably want to prolong the life of their Kittilä mine as well since one would assume that they would be active in the country past the mine life of their current operation at Kittilä. To keep the Kittilä mill running for maybe decades to come, or at least while the Ikkari region would be producing gold, they need to secure feed and there are a few juniors in the area who could potentially fill that need. First of all we already know about their earn in on FireFox’s “Kolho” project which is located around 20 km from both Kittilä and Ikkari. But there are other juniors in addition to FireFox, with projects that are quite close to the Kittilä mine, and could potentially be providers of ore…

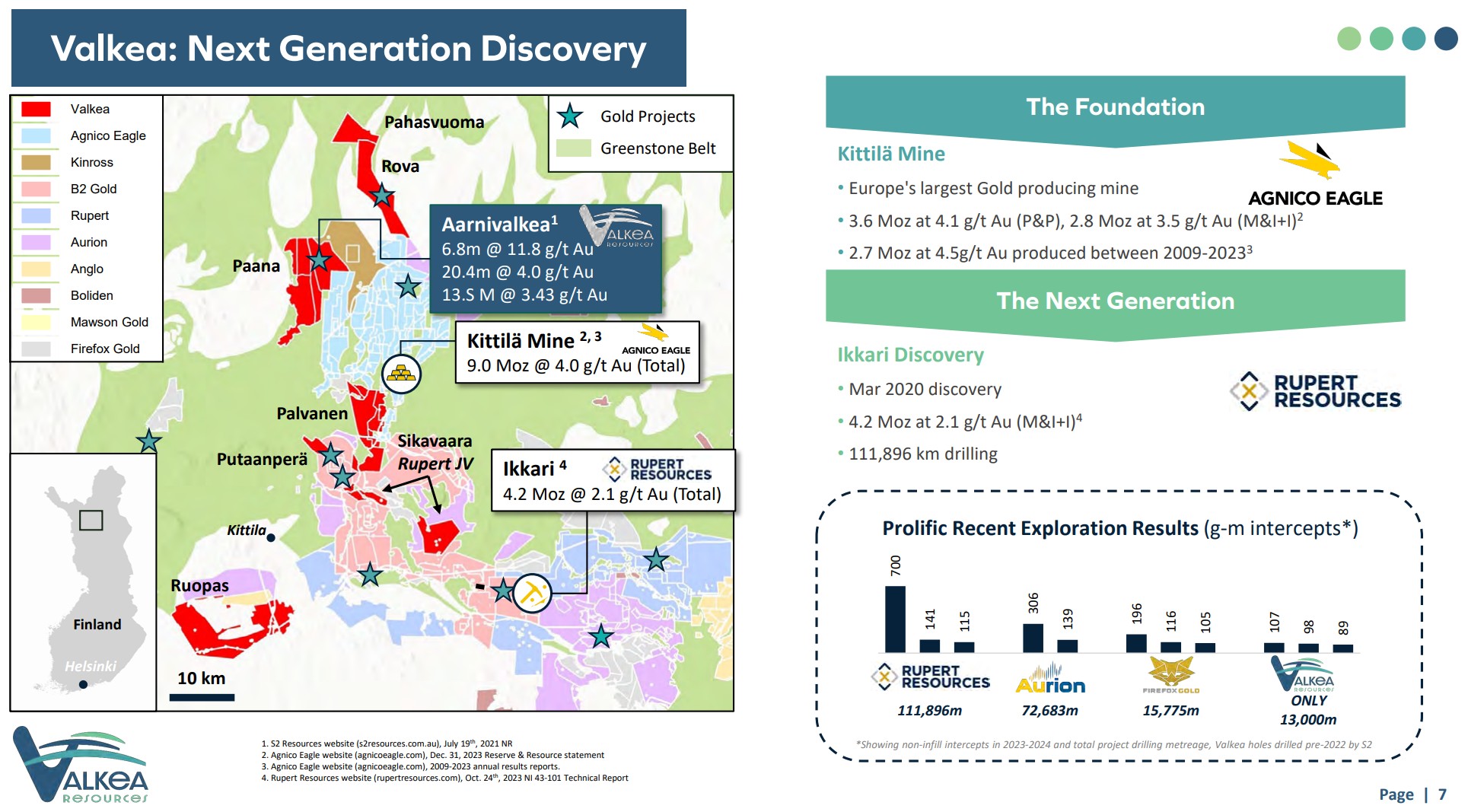

One is Valkea Resources ($11 M in MCAP) which is a pretty new, unknown story:

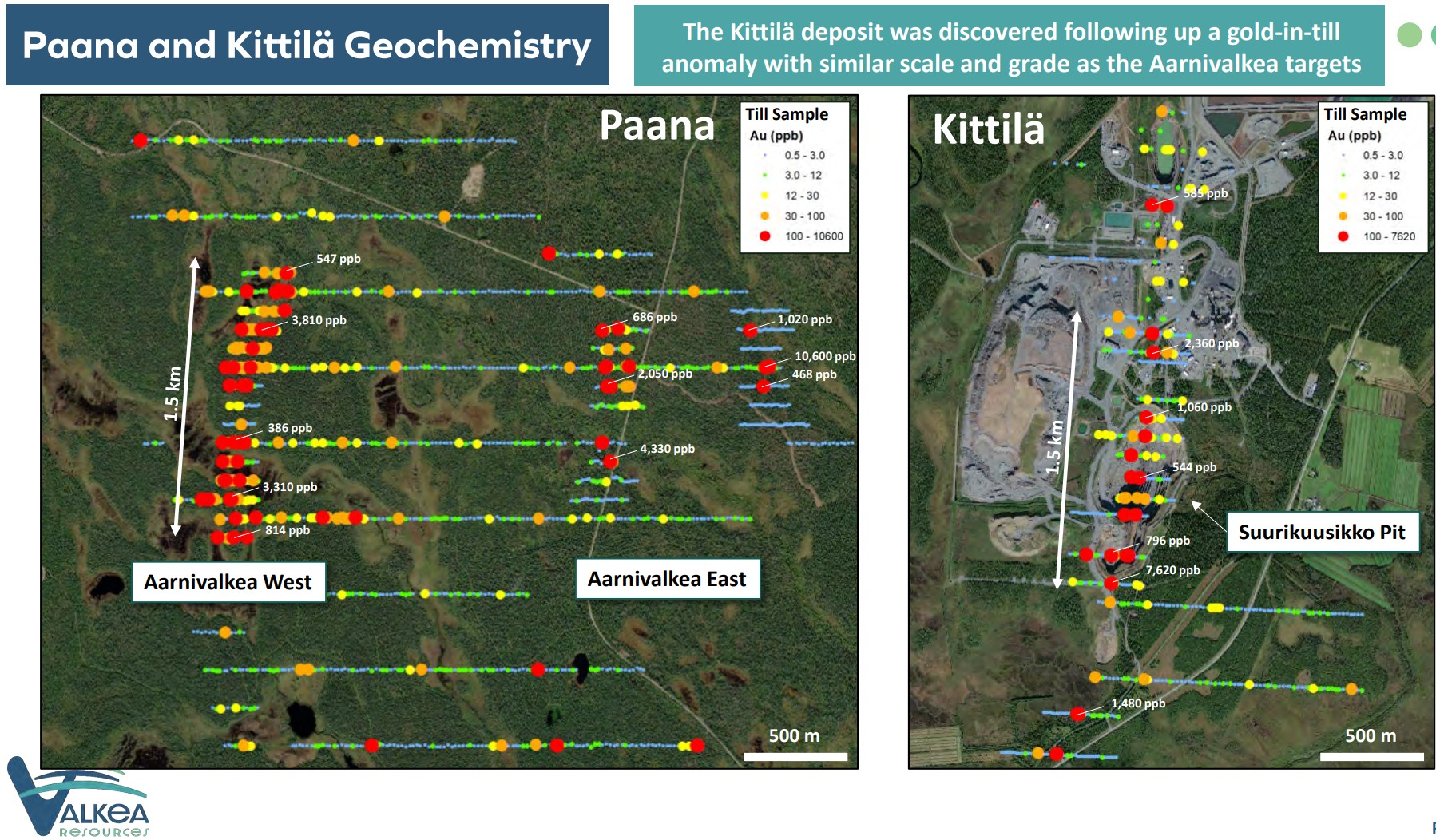

… Note that Valkea has a JV with Rupert Resources on their “Sikavaara” project where Rupert has opted to enter Phase 2 which sees them spending $3 M. However, Valkea’s flagship project is “Paana” which contains the “Aarnivalkea” discovery and is, as one can see above, not that far from the Kittilä mine:

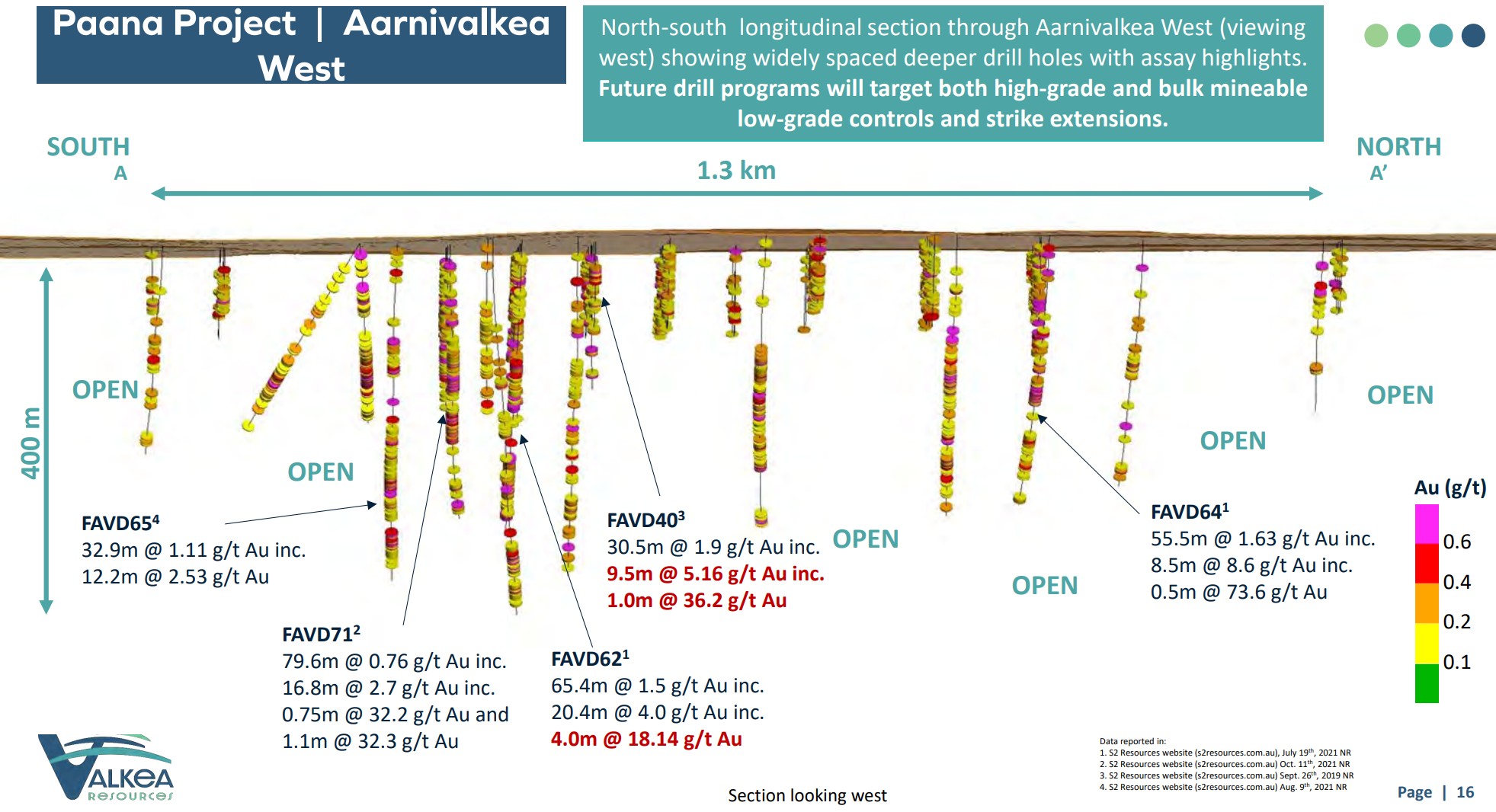

… Aarnivalkea shows encouraging assay results over an impressive strike length. The hopes are that this turns into a discovery story akin to Kittilä:

Obviously finding another Kittilä type deposit is a longshot but hey, given the $11 M in Market Cap, one would probably be handsomely rewarded if it were to happen. Thankfully I think that a much smaller deposit than a new kittilä could be of interest to Agnico in a “fill the mill” strategy and would thus lower the threshold for success. I mean the drill results show some very high grade hits (1.1m @ 32.3 gpt, 4m @ 18.1 gpt and 1m @ 36.2 gpt etc) surrounded by lower grade mineralization so theoretically I could see a scenario where the high grade stuff could easily be trucked to the mill if nothing else.

It is worth noting that George Salamis, who was Vice President of “Riddarhyttan”, recently joined Valkea as Independent Lead Director. Riddarhyttan was the Swedish listed junior company that proved up the Kittilä deposit and got acquired by Agnico Eagle in 2006:

Other quite famous industry people who are involved with Valkea would include Crai Parry (Of Vizsla Silver and Inventa Capital fame) as well as Mark Bennet (Of Sirius Resources, Nova-Bollinger fame).

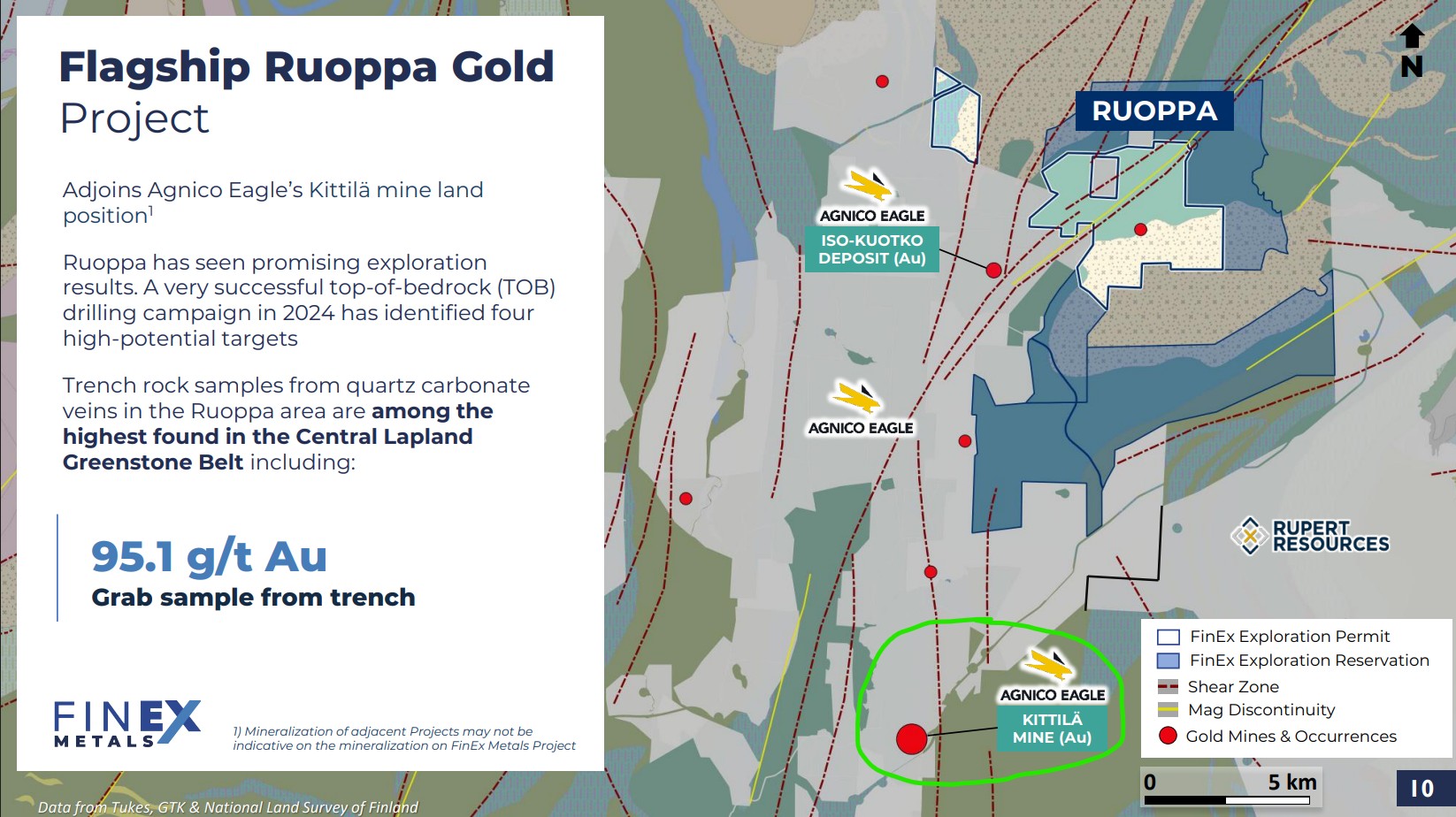

There is another kid on the block which is currently a Private company but has plans to go public this year and that is Finex Metals. It is a Newquest Capital company so you know it is the real deal. It is the most early stage of all companies mentioned in this article but with that said they have one of the most fascinating targets. The flagship project is the “Ruoppa” gold project which is located not far away from the Kittilä mine:

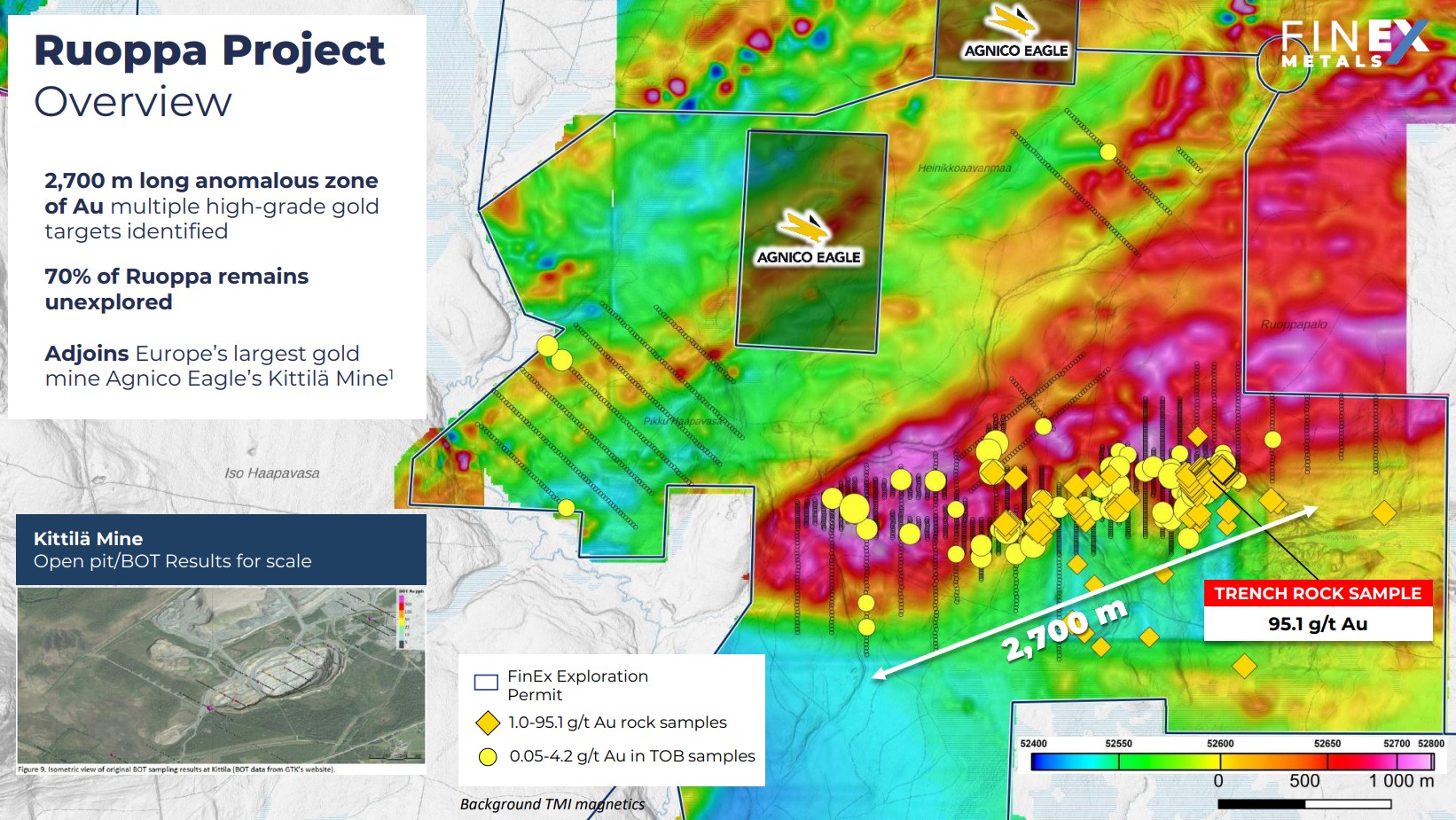

At Ruoppa a gold target with impressive size was delineated via BOT-drilling:

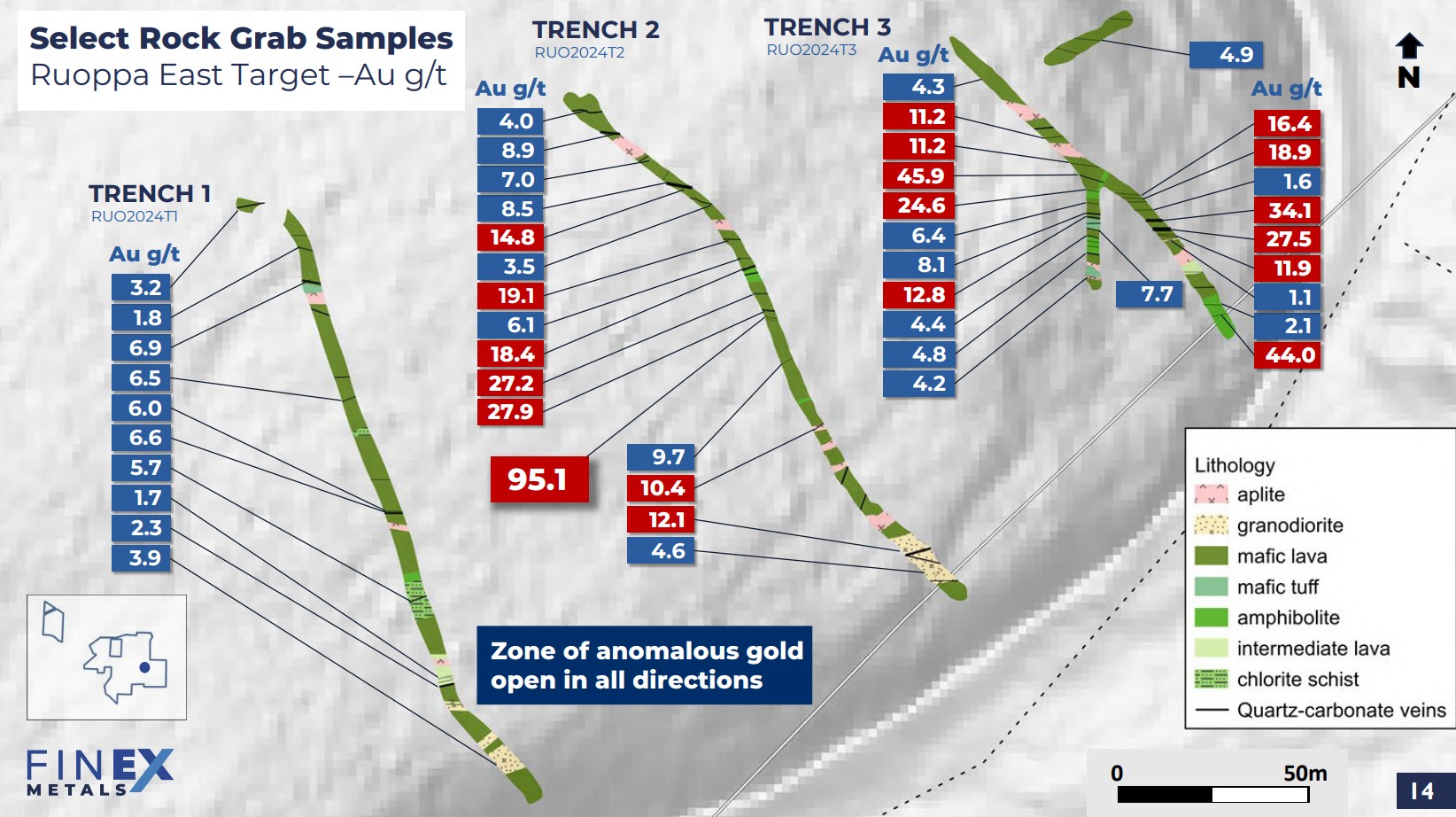

The company then opened up a few trenches in the eastern parts of the anomaly and the results sure were interesting to say the least:

The trenches exposed numerous veins and high-grade to even bonanza-grade gold assays were produced from a grab sample exercise. To my understanding this type of mineralization is akin to Kittilä where there are numerous high-grade veins that get mined in bulk and the result is an average (bulk) grade of 3-4 gpt. The idea of there being these high-grade vein swarm in the ground over say a 2.7 km strike sure is intriguing. And as one remembers from the Kenorland study; The earlier stage a target is the more impressive any significant results are… And these are the first ever trenches, with no drilling having been done yet, and the results appear to be highly significant.

Honorable Mentions

Two other stories that are not maybe as relevant to Agnico’s potential plans for consolidation are Mawson Finland and First Nordic Metal’s Oijärvi project who are both in Finland but not as close to Kittilä or Ikkari.

Closing Thoughts

I simply think that it looks more and more likely that Agnico Eagle sees this part of Finland as a place they are going to want to stay in for the long haul. After all Agnico constantly says they like to be in areas that they could be active in for decades to come and how they start with getting up a production base (Like Kittilä and a future mine at Ikkari) and then just drill, drill and drill… Prove up more ounces and add years or decades of mine life to the regional operational hubs:

(Slide from Aurion Resources. I have added the stars that mark Kittilä and Ikkari as well as done some artistic circles that are supposed to symbolize that there are many prospects that could provide feed for the two hubs)

If this ends up happening I expect Rupert and Aurion to consolidate Ikkari and then see Agnico buying Ikkari (and maybe Aurion… Or heck, maybe even both and consolidate it internally). I also think that any junior’s success around especially Kittilä could be of great interest to Agnico even if the discoveries are not standalone mines as they could provide feed for the Kittilä mill. The downside I guess is that Agnico could end up being the only big player which reduces the chance of bidding wars for assets.

From an investor perspective Rupert and Aurion are obviously the lower risk bets thanks to their stakes in Ikkari (directly and indirectly). For 10+ bagger potential I guess one would have to take risks in Valkea, FireFox and Finex Metals.

Note: I own a bit of all companies and am thus biased. This is not investing advice I do not have a crystal ball. Juniors are risky! Valkea is a banner sponsor so consider me twice biased in that case!´.