THH – Western Alaska (WAM.V): Abnormally High-Grade CRD (Silver+) Mineralization And 73,000 Acres Land Package

I have owned shares of Western Alaska Minerals (WAM.V) since their IPO and it has nowadays become one of my larger positions (Top #10) in the wake of continued exploration success. It is also a top #10 position in the HODL (low maintenance) portfolios I help manage. I am also happy to say that the company came on as a banner sponsor recently. I have talked to Kit, Joe and Vanessa from the company and I got a very good impression. Although it’s not a strict requirement I really do prefer to potentially win big with people I want to see win big as well. And in the case of Western Alaska the (good) people who are running things have an extreme amount of exposure to the performance of the stock.

As always my investment case for Western Alaska contains a lot of forward looking statements, personal opinions, and I cannot guarantee the accuracy of the statements in this article. Assume I am biased, do your own due diligence, and make up your own mind. If you don’t understand or can’t “see” the merits of a case, then you should never invest money, because you will end up making mistakes when short term volatility comes around (which it does often in this space).

Investing highlights

- 35% Insider Ownership (~C$49 M at risk @ $3.05/share)

- Management

- Kit Marrs, CEO

- Ex Anaconda Minerals, Kennecott & Penoles etc

- In 1981, he was the project geologist for the Illinois Creek/Round Top Project for Anaconda (Same project that WAM is working on today)

- Joe Piekenbrock, Chief Exploration Manager

- Ex Vice President of Exploration for NovaGold Resources, Senior Vice President of Exploration for NovaCopper (now Trilogy Metals), member of the Cominco Alaska exploration team responsible for the discovery of the Whistler Cu deposit, the Sleitat Sn deposit, the Shotgun Au deposit, and the giant Pebble Cu-Au deposit & After joining the Nova group companies in 2003, he was instrumental in leading a series of major discoveries including the Donlin Creek Au and the Bornite Cu deposits in Alaska, and the Galore Creek Cu-Au porphyry deposit in British Columbia. He was awarded the Thayer Lindsley medal for International Discovery in 2009 for his role in the discovery of the Donlin Creek deposit, and the Colin Spence award for International Discovery in 2015 for his contributions to the discovery of the South Reef deposit at Bornite.

- Alex Tong, CFO

- Ex Director of Finance at Lucara Diamond Corp. Mr. Tong also held senior finance roles at development resource public companies Energy Metals and NovaGold

- Kit Marrs, CEO

- Technical Advisors

- Dr. Peter Megaw, Ph.D

- World-renowned expert on CRDs – Instrumental in numerous discoveries: Platosa, Juanicipio, Cinco de Mayo

- Darwin Green, B.Sc, M.Sc, P.Geo

- HighGold Mining (Founder, CEO), 20+ yrs Alaska experience

- Dr. Peter Megaw, Ph.D

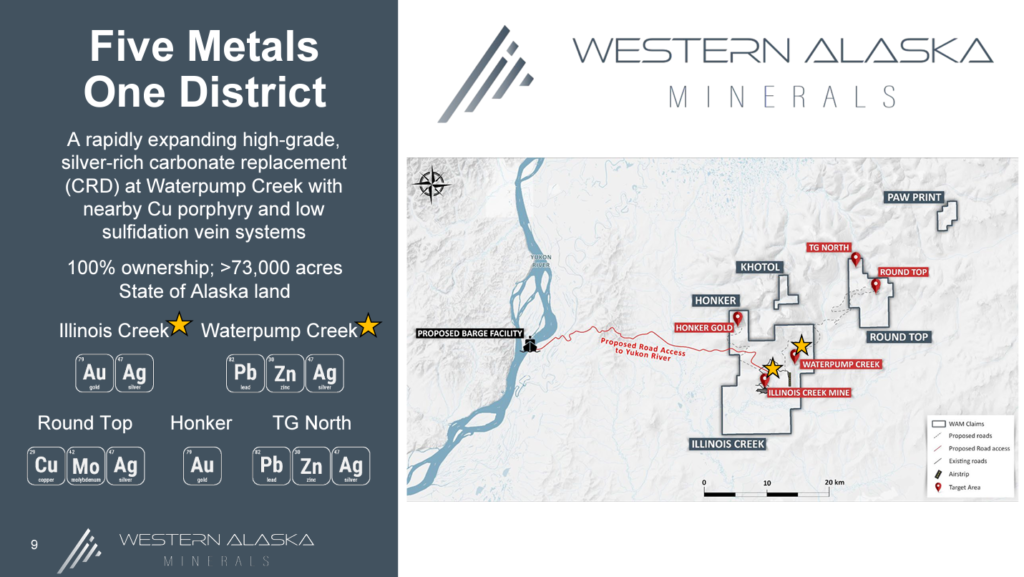

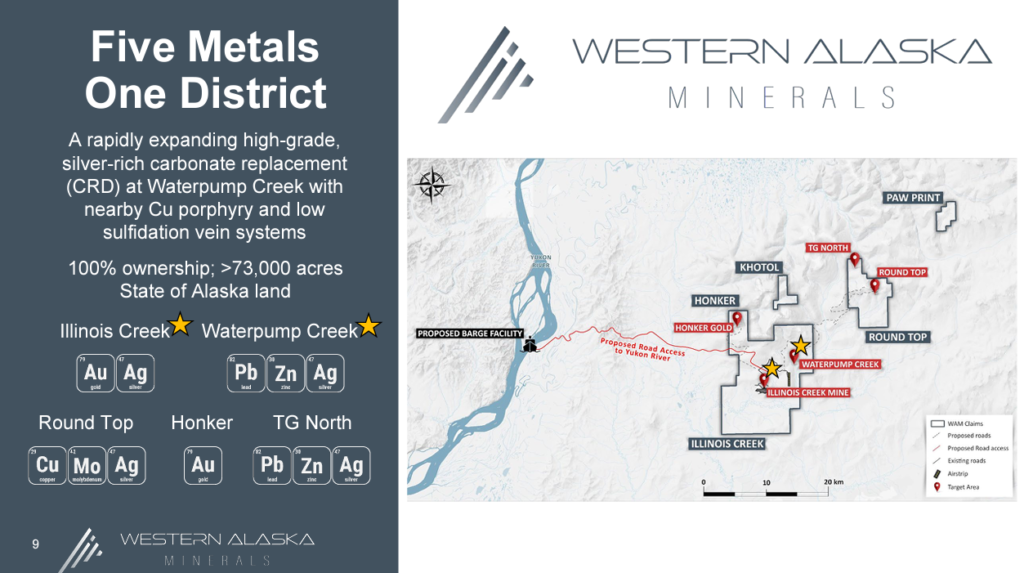

- 100% owned, 73,000+ acre Illinois Creek District, Alaska USA

- Being a past-producer, Illinois Creek District contains significant infrastructure including a 4,400 ft airstrip, a camp, fuel storage and a core logging facility.

- The Illinois Creek District contains multiple deposits, originally discovered by Anaconda Minerals in the 1980s, which have been consolidated by Western Alaska’s management team over the past 10 years. The portfolio of five high-grade mineral deposits contains gold, silver, copper, lead, and zinc at varying stages of exploration and deposit styles, including a silver-rich Carbonate Replacement Deposit (CRD) and a NI 43-101 oxide gold resource at the Illinois Creek deposit.

- Cashed up and appears to have good access to capital

- Strong backing

- Crescat Capital

- Commodity Discovery Funds

My case for Western Alaska

A true district scale exploration opportunity with several known targets, a small gold resource (“IC Oxide Gold”, 525 Koz AuEQ & historic producer 1997-2002) and a discovery of a bonanza grade CRD system (“Waterpump Creek”) which is wide open. Insiders which includes an award winning mine finder, a CEO who knows the district very own a whopping 35% of the company which today means that they have an extreme amount of skin in the game. Add the fact that Peter Megaw who is the “god father” of CRD systems is a Technical Advisor and you end up with a brain trust that few juniors can compare with. I think the flagship target which is the Waterpump Creek CRD system could very well be a company maker as it appears to be a remarkably high-grade system. The CRD system has already produced drill intercepts up to 101.7 m grading 544 gpt AgEq. Not only could the remarkably high grades produce above average value per ounce, thanks to the potential margins, but there is also potential for it to be very large. The unusually high grades ought to make it unusually insensitive to lower metals prices since a bonanza grade deposit could work in almost any metal price environment. Given that Western Alaska’s land package boasts a past producing gold mine, there is a lot of infrastructure in place already; including a 4,400 ft airstrip, a camp, fuel storage and a core logging facility, which I think are big value adds.

Insiders have huge incentive for value creation given the amount of $ at stake and there are obviously potential for synergies since all the company’s targets are relatively close to one another. The former is a factor which one learns to greatly appreciate the more one sees in this business.

In short

- World class team of ore finders

- Insiders have an extreme amount of skin in the game

- Will have more incentive to lie awake at night thinking about WAM than you or me

- Bonanza grade CRD system with probable growth and a very long runway for potential growth

- High Margin potential (economic value)

- Potential to be a valuable project even in a low metal price environment

- Potential to be a relatively low CAPEX/OPEX operation

- Multiple additional targets across a 73,000+ acre land position

- 525,000 Oz AuEQ at a past producing mine in hand

- Considerable infrastructure in place and is located in Alaska, USA

- Aggressive:

- Owns #2 drill rigs and recently put down a deposit for #3 more – Source

- … #5 operating drill rigs next season

Key value proposition points in my opinion:

- Grades (Potentially high-margin)

- Insensitive to metal price fluctuations to the downside

- Low footprint and drilling needed to prove up something valuable

- Rapid value creation potential

- a stated goal for a >4 Mt inferred resource (>120 Moz AgEq) in 2023

- Extremely high insider ownership

- Incentives very much aligned with shareholders

- Includes mine finders

- The project is NOT in remote Alaska and there is already some infrastructure in place

- Plus there has been historic production within the main project

- Probable Growth & Very High Long-term, Blue Sky Potential in a Tier #1 Jurisdiction

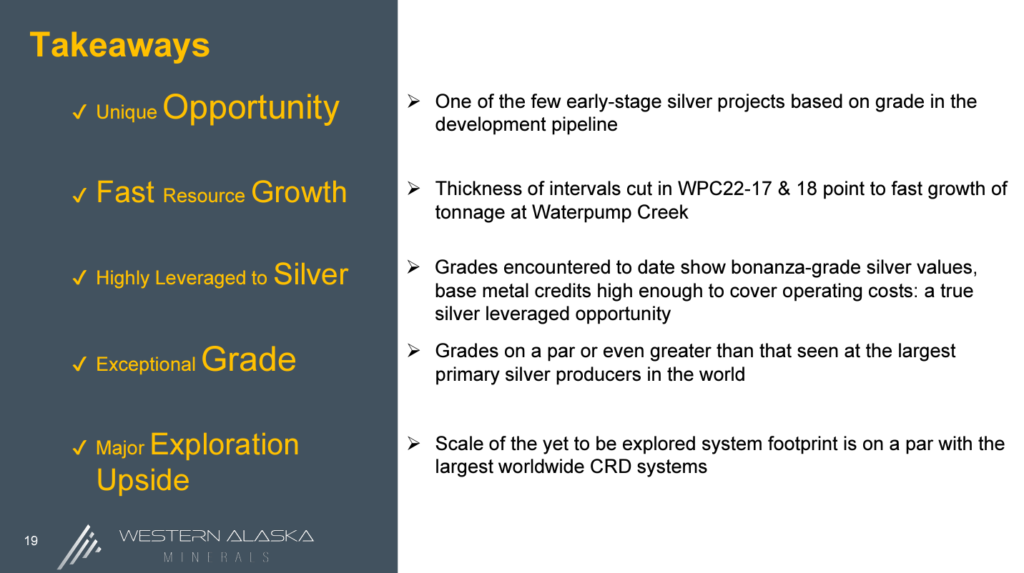

Highlights in the words of the company:

Consider what these points mean in terms of ROI and long term blue sky potential:

… Those are some good competitive advantages for a junior. Especially in a tough market.

Quinton Hennigh of Crescat Capital interviewing Joe Piekenbrock:

Expectations

Western Alaska is currently a high octane exploration/growth story (Alpha). The grades in the Waterpump Creek CRD system appears to be abnormally high and the company recently announced massive sulfide intercepts of up to 40 and 100 m thick. Thus, I think the pace of value creation via the drill bit might be abnormally high and so far the company has only drilled the CRD system for around 400 m (with the latest holes sporting a lot thicker mineralization) and until further notice there is multi-kilometer strike potential left to explore along the current CRD trend alone.

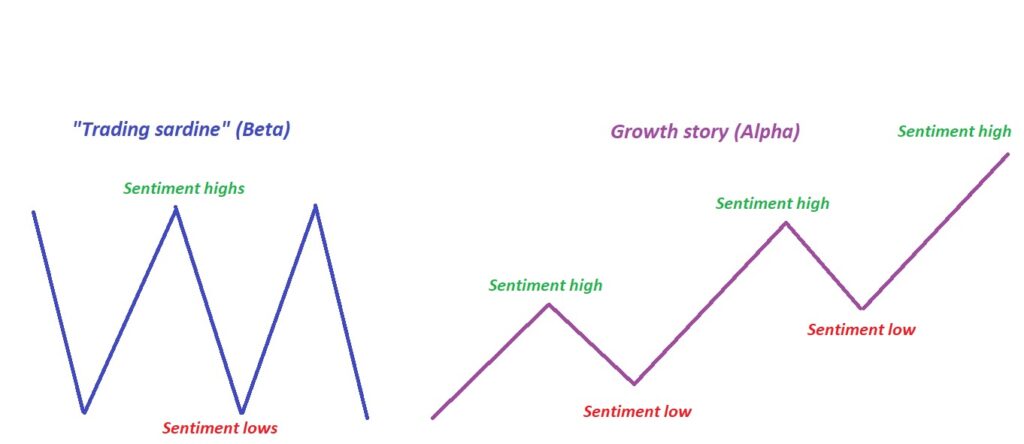

As many will probably know by now my main focus is to find “fire and forget” stories in the form of probable growth stories where I can potentially just buy and HODL years. This makes investing very low maintenance and I get “paid to wait” assuming the value curve is indeed positive. Furthermore if things go well it can solved the issue of “market timing” (aka Beta) and allow me to just “sit on my ass”:

Log chart of Western Alaska when I was starting to write this article:

Log chart of Western Alaska just a few days ago:

Western Alaska became a large position due to me pretty much just HODL:ing. As the company saw increased success with the drill bit the odds of a favorable long term result kept increasing and the risk of not finding anything of value decreased at the same time. I think the story is better now, at a higher share price, than when I bought my first shares around $0.70-$1.00. I have around 300% more exposure to the story today relative to what I had near the lows because I think the odds of the company ending up with something truly significant has increased more than the share price.

Now lets look at a few presentations…

Joe Mazumdar of Exploration Insights presenting his case for why he invested in Western Alaska

Resource Talks interviewing Western Alaska – Aug 15

… A lot of good stuff in those videos including a discussion of theoretical mining costs. Remember, a deposit is only as valuable (if it is valuable at all) as the economic value of recovering the ounces within it. 3 Moz in the Swan Zone at Fosterville is/was worth billions of dollars and there are 3 Moz deposits that probably have an economic value of zero today. Kit and Joe mention that the sulphides have averaged around $800/t so far and theorize that mining costs could potentially come in at around $120/t-$140/t. Furthermore “all in OPEX” could be less than $200/t. Note that these are very forward looking statement (But at least benchmarked from other Alaskan mines). If those numbers are even somewhat close then one could see a very profitable mine emerging, granted the grades stay this high, and the tonnage increases…

On that note the following slide was also discussed:

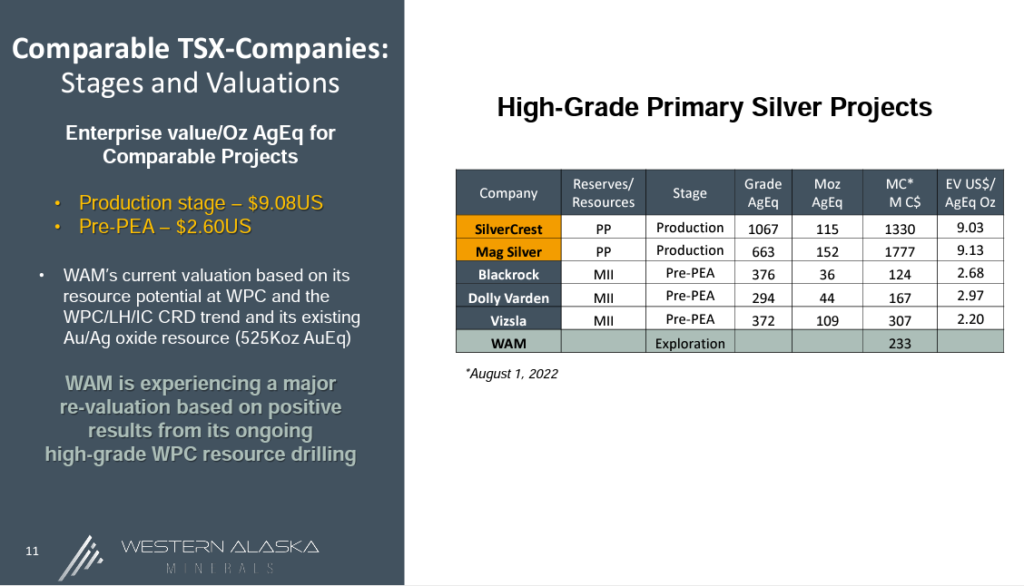

High grades can typically lead to high margins and thus a profitable business. SilverCrest had a Market Cap of almost $2 B just a few months ago and and Mag Silver traded closer to $3 B within the last 12 months. Both companies have their flagship projects in Mexico and they are, as you can see, very high grade mines.

To put the upside potential into perspective. Western Alaska would have to trade up to $28.7/share in order to have the same Market Cap as SilverCrest in the slide above. Note that this is basic market cap and excludes dilution(!):

Kit and Joe stated that “tonnes and grades will be the story” and that they do not yet have an answer to that. With that said the grades seen so far out of Waterpump Creek are give or take around 800-1,200 gpt AgEQ. Thus, as discussed earlier, Western Alaska has the potential for very economically valuable ounces…

Examples

Lets say the AISC (All in sustainable cost) is $200/t…

- If one is mining bonanza grade ore with an average value of $800/t then the operating profit is $600/t and the “margin” is 75%

- If the average value of the ore is $400/t then the operating profit and margin decreases to $200/t and 50% respectively.

Thus mining rock with a face value of $800/t leads to 200% higher operating profits and is thus, all else equal, worth 200% more than the mine with $400/t rock. At the end of the day a mine is only as valuable as its economic value. A deposit with 10 million ounces of silver could be more valuable than a deposit with 100 million ounces…

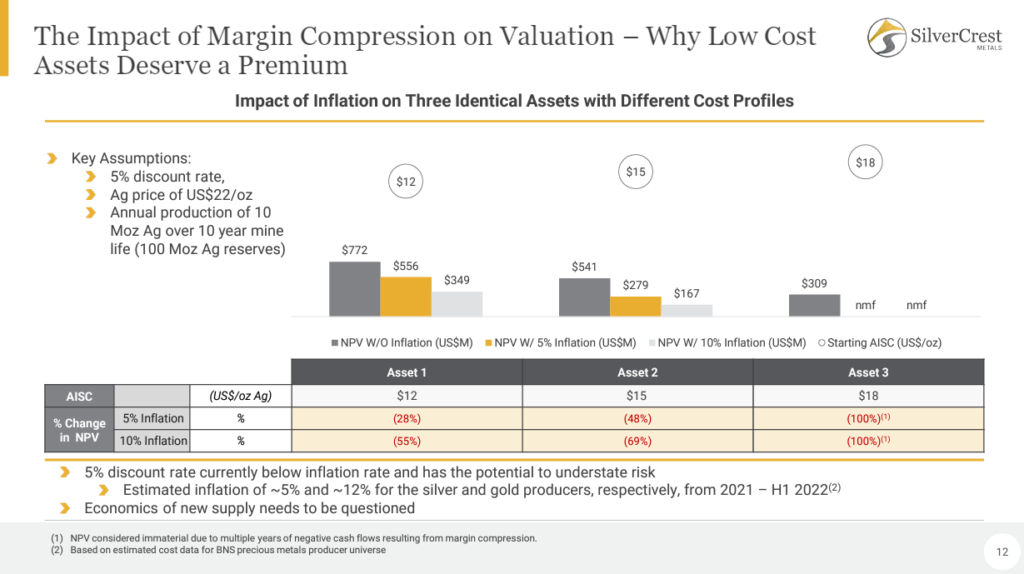

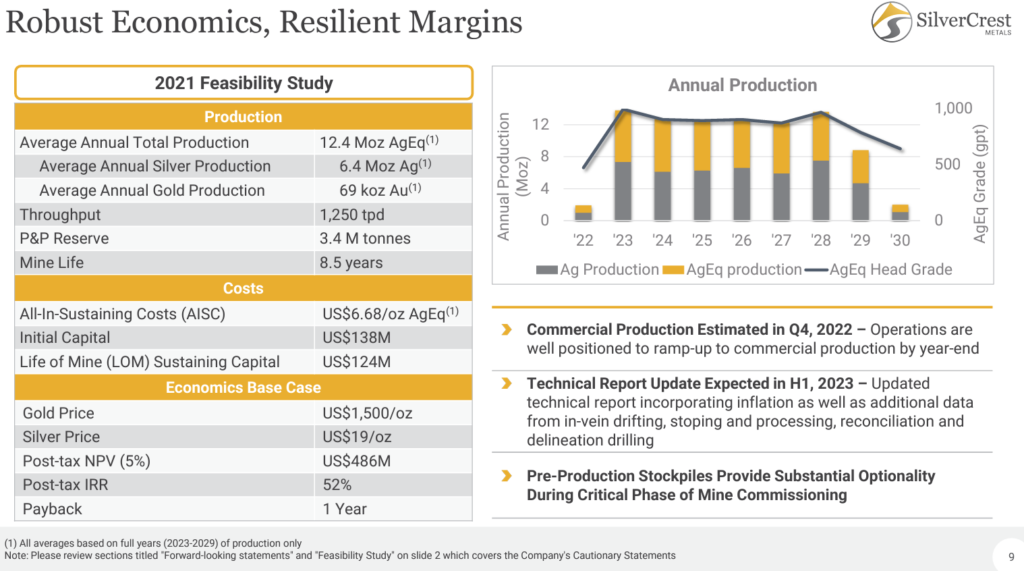

SilverCrest highlights why high-grade (high margin) ounces deserve a premium, especially in today’s inflationary world, in their presentation:

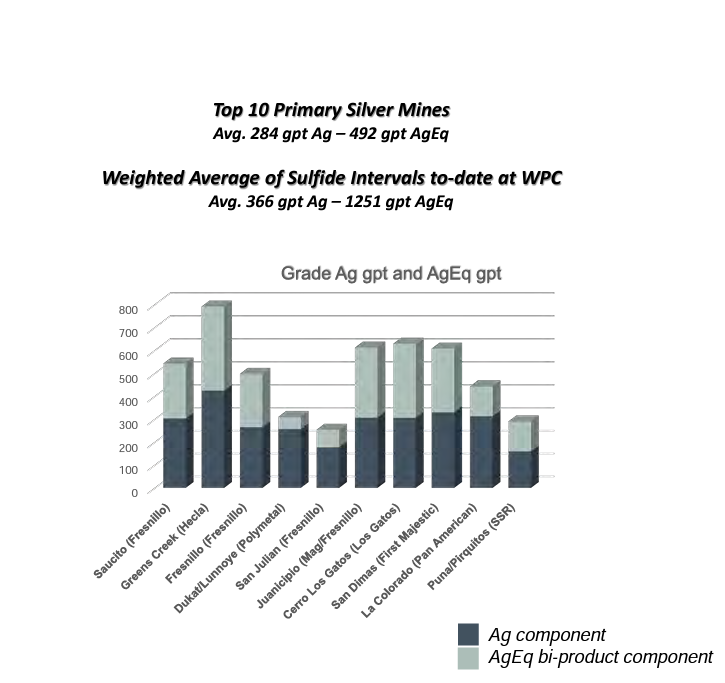

Furthermore, as Joe states in an interview there are not many high-grade silver plays around. Blackrock, Dolly Varden and Vizsla are the main ones in the pipeline and their grades are sub 400 gpt AgEQ. Again, compare that to Western Alaska which so far appears to have grades closer to 800-1,200 gpt AgEQ. Thus, Western Alaska might be the premier high-grade (bonanza grade in this case actually) pre-development silver + zinc + lead play around really. Don’t get me wrong, I think Vizsla and Dolly Varden are really good silver stories, it’s just that Western Alaska is a bit more unique in my opinion.

A real life example that shows just how valuable ore at these grades could potentially be comes via SilverCrest Metals (The company that was valued at around $2 B not too long ago). Silvercrest’s Feasibility Study shows “just” 3.4 M tonnes, throughput of 1,250 tpd (small operation), but with a head grade of over 1,000 gpt AgEQ the economics are incredibly robust:

… CAPEX in the case of this small operation is only US$138 M and yet said operation is stated to have a post tax NPV of US$486 M at $1,500/oz gold and $19/oz silver. There are not many projects out there that are that cheap to build nor do they have as robust economic numbers. This is the power and value of very high-grade (~1,000 gpt AgEQ), low throughput mines. On that note I present the following slide which shows the “weighted average of sulfide intervals to-date” at Waterpump Creek as well as the grades of the top 10 primary silver mines:

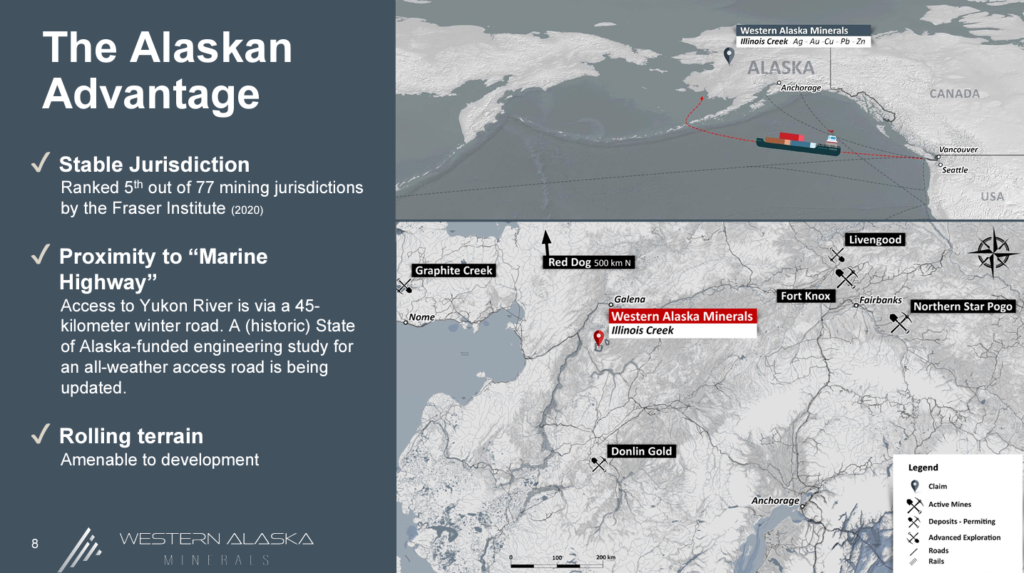

Kit and Joe also emphasize the fact that “This isn’t remote Alaska”. There is a winter road connecting the project and the Yukon river. There could theoretically be a barge facility there which could be used for transportation of equipment as well as concentrates. The fact that there is a historic mine on the project proves that one can indeed mine there. The company has also initiated work on the metallurgy which is another sign that these guys, as well as the project, is for real. Then again if you are an insider with considerable skin in the game you want to know as quickly as possible just how good the project might be.

Big Picture

Place: Alaska, USA

Western Alaska’s project portfolio is located near the western coast of Alaska (US) with access to the Yukon River nearby:

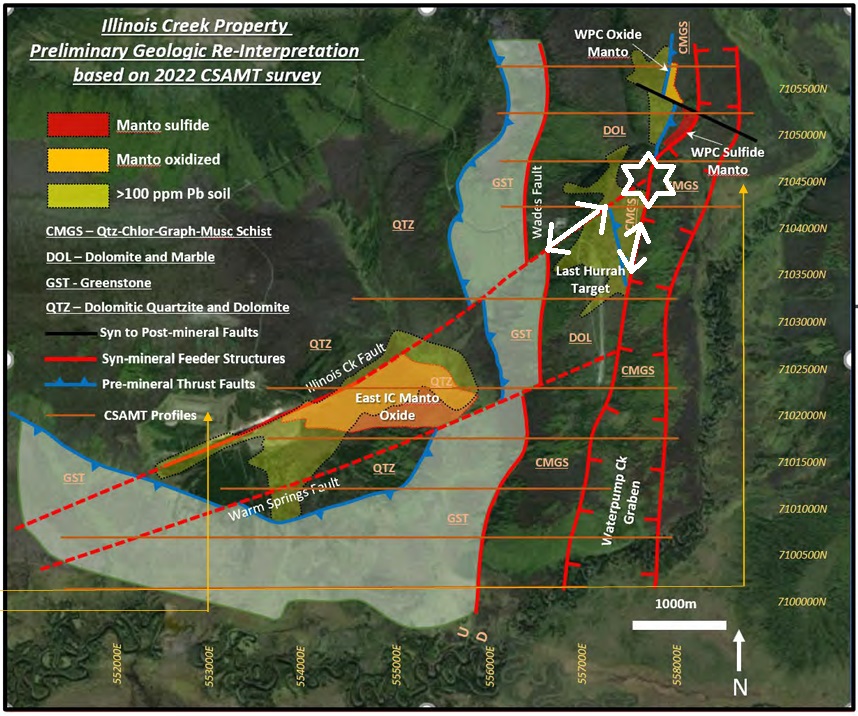

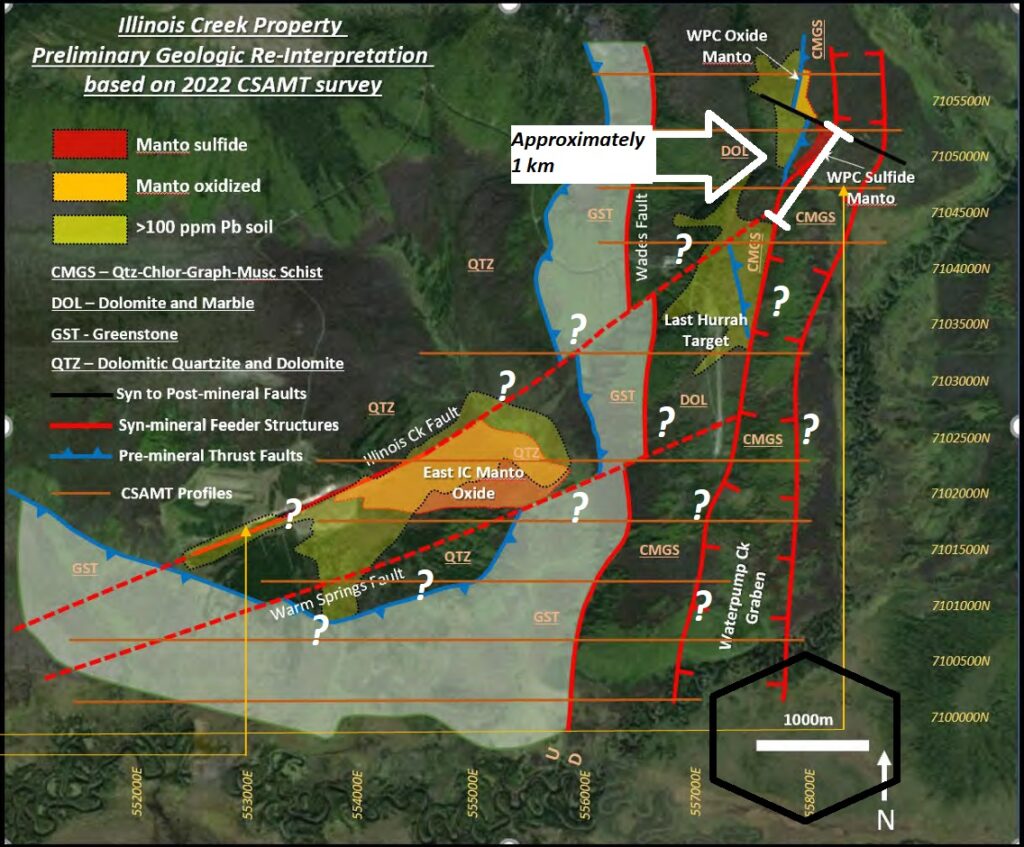

Although the company controls a very large land package to the tune of 73,000 acres of State Land, which includes multiple projects and multiple metals, the focus of this article will be on the remarkable CRD discovery (“Waterpump Creek”) within the greater Illinois Creek project:

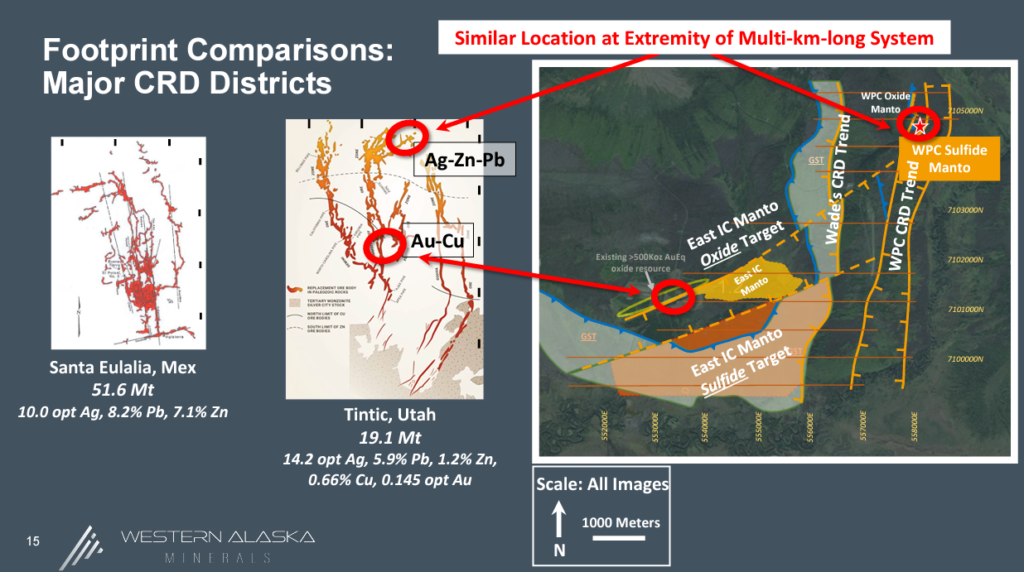

Long Runway

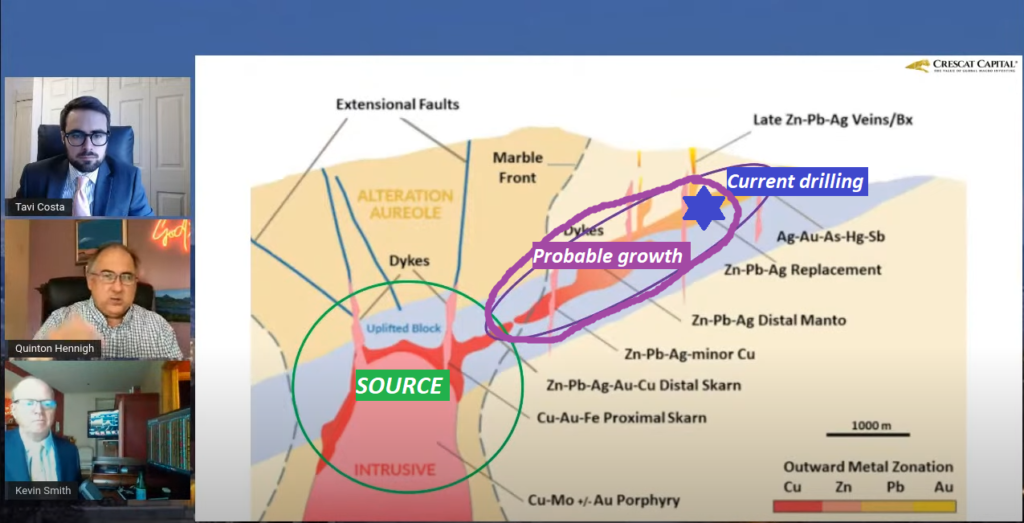

“Where we are drilling at Waterpump Creek is clear out in the margin of this system” – Joe Piekenbrock

The metal bearing fluids that form a CRD system comes from the source which is typically a porphyry body. Thus, if one hits mineralization far away from the source aka “clear out in the margin of this system” then logic dictates that the system extends all the back to the source. Why? Because the fluids did not jump from the source to the margin, but also went through the rocks between the source and the margin, on its way to said margin:

(Drawings added by me)

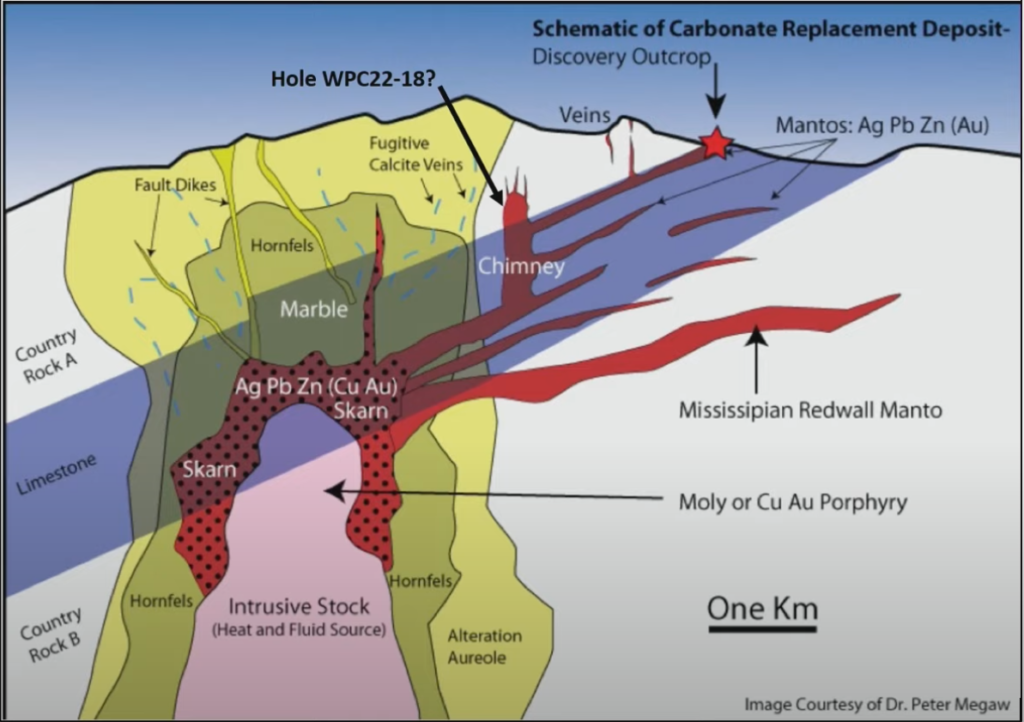

The following schematic is the one Joe Mazumdar used when he presented his case for Western Alaska:

“So the whole system itself is kinda 8 by 8 kilometers… We have drilled a 400 m stretch clear out in the extreme north-east corner of this” – Joe Piekenbrock

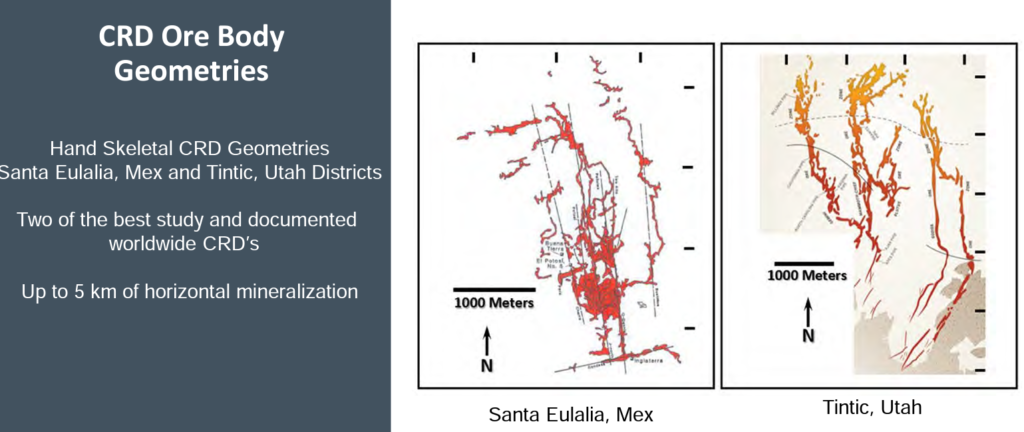

Since CRD systems can have immense strike, but tend to be relatively narrow and can “twist and turn”, the tricky part is to be able to track it back towards the source. I guess that in some places it might be just a few tens of meters wide for example and yet the strike might be multiple kilometers. Furthermore there might be multiple mineralized CRD trends aka “snakes” coming off one “mother source”:

What really caught the market’s attention was the news release form July 20:

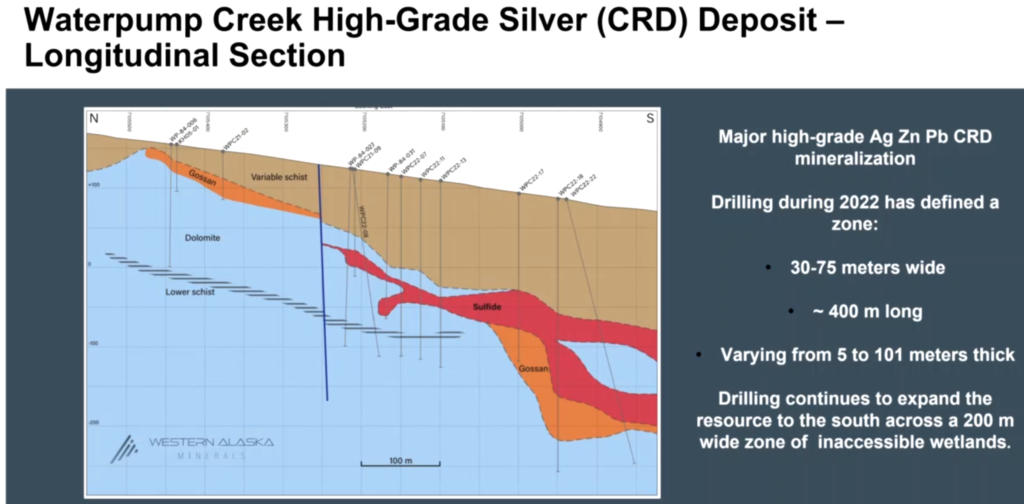

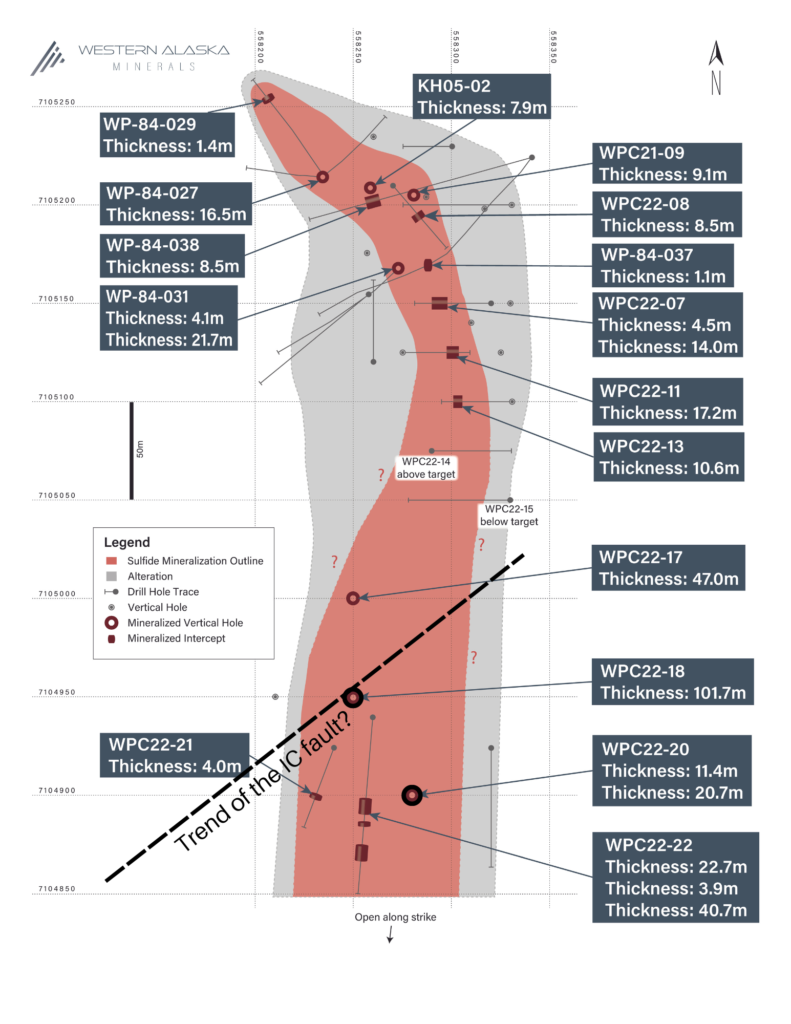

I actually remember having to re-read the news release a few times just to make sure that the 47 and 101.7 meters were not for example the depths that the intercept started because these are intercept widths of massive sulfides that I don’t think I have come across before. Thankfully these numbers were actual thicknesses so it appears the CRD mineralization here blew out for for real:

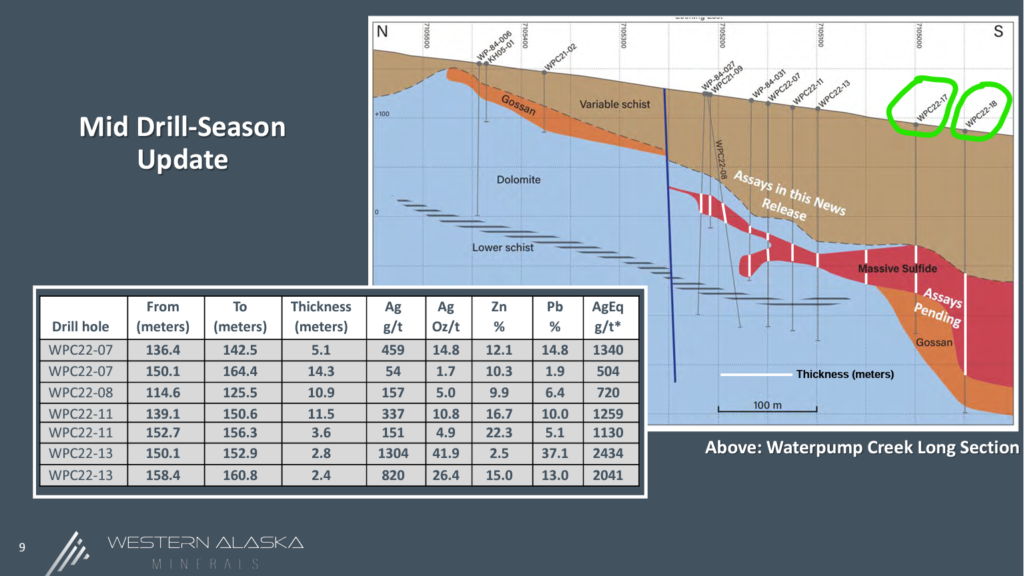

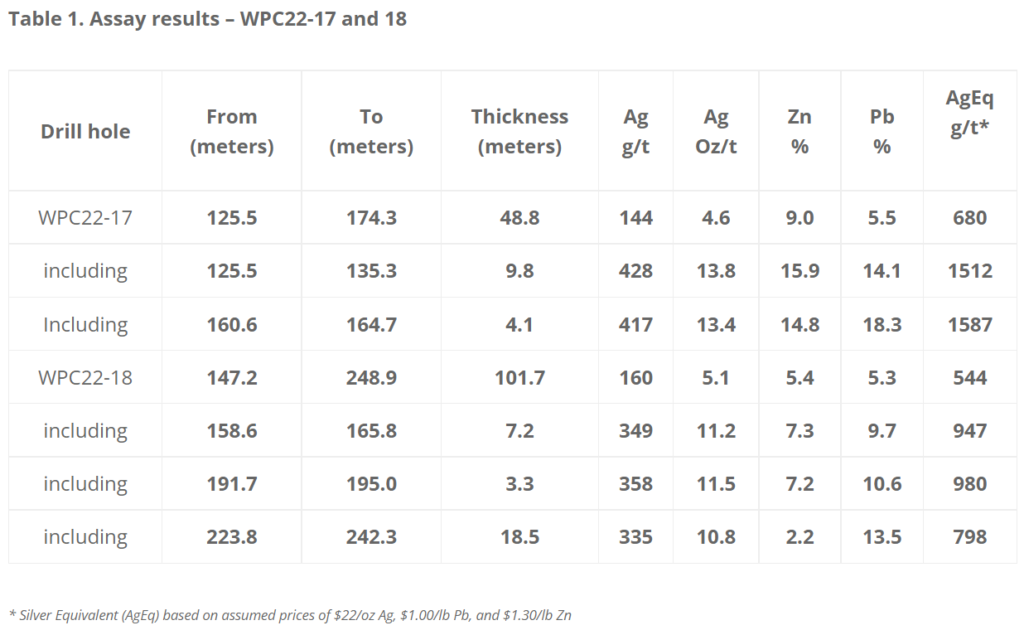

Fast forward to September 22 and we got the results from holes 17 & 18 which had the very thick intercepts of massive sulfides:

That’s a whopping 101.8 m of 544 gpt AgEQ in hole 18 and 48.8 m of 680 gpt AgEQ in hole 17. Unsurprisingly Western Alaska easily topped the “Top silver intercepts” list for canadian companies that week:

(Via @Minerdeck on twitter)

Since I am primarily a gold guy I have an easier time appreciating drill results if I calculate them into gold equivalent. So, using the spot prices of the metals as of Sept 22 the assays from the two holes translates to 101.7 m of 6.3 gpt AuEQ in hole 18 and 48.8 m of 7.8 gpt AuEQ in hole 17. These are grades that most vein miners would be happy to see, let alone if they get thicknesses like this. Bear in mind these hits are believed to come from a so called “chimney”:

(Slide from Joe Mazumdar’s presentation)

Quinton of Crescat Capital discussing the news release:

Moving on. During the recent Beaver Creek presentation we got to see an updated slide which included hole 22. This hole was drilled farther to the south and ended up intersecting two separate CRD horizons:

When Joe was interviewed by Quinton he mentioned that they think that holes 17, 18 and 22 were drilled into an intersection between two separate CRD trends. One along the Illinois Creek Fault and one along the Waterpump Creek Graben. In other words these holes might have been drilled near this area I have outlined with a white star if I am not mistaken:

Why I think this is exciting:

“Following progressively thicker and more complex mineralization encountered in WPC22-17 and 18 and then seeing it thin again as we drilled further southward along the WPC graben strongly suggests we hit a feeder chimney located at the intersection with the Illinois Creek Fault,” said Joe Piekenbrock, Chief Exploration Officer. “Combining this with the extensive historical mining five kilometers to the southwest along the Illinois Creek Fault strongly reinforces our interpretation that it is one of the major mineralization controls in the district and increases the importance of drilling along it, especially where it intersects other similar structures now seen in the CSAMT survey.” – Source

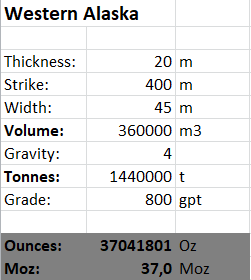

Kit Marrs recently stated in an interview with “Miningstockdaily” that their goal is to define some 120 Moz AgEQ from the Waterpump Creek trend (“Snake”) alone. That would be, as Kit mentions, comparable to Silver Crest (the company which I discussed earlier). Are there any guarantees that this will come to be? No. But given how large the system appears to be, that where they are drilling the Waterpump Creek trend is thought to be long ways from the source, and how CRD systems work I would certainly not rule that out. On that note Kit laid out some numbers on the dimensions of the Waterpump Creek trend which has been drilled so far;

- Strike: ~400 m

- Width: ~30-60 m

- Thickness: ~20 m

- Grades: ~20-30 oz/t

If we take the approximate means from all those inputs and use a specific gravity of 4 we get a theoretical resource of:

So lets say that based on what we know so far about the Waterpump Creek “snake” that this CRD trend packs around 37 Moz AgEQ per 400 m strike. In this theoretical scenario every 1 km would pack around 92.5 Moz AgEQ. You can then see that there is quite a bit of potential in this district:

Obviously these are crude estimations but precision is not the important point. The district scale potential where the company could miss blue sky by a mile and still have a big success story is the point:

“Aim for the stars, hit the moon”

On October 31 the company released two additional thick, high-grade mineralized intervals from the Waterpump Creek trend in hole WPC22-020:

The upper intercept cut 1.1 meters grading 883 grams/tonne (“g/t”) Silver (28.4 ounce/tonne (“oz/t”)), 45.2% Lead and 12.2% Zinc within 11.4 meters grading 284 g/t Silver (9.1 oz/t), 10.9% Lead and 14.8% Zinc. The lower intercept cut 2.7 meters grading 297 g/t Silver (9.5 oz/t), 10.6% Lead and 2.8% Zinc within 20.7 meters grading 171 g/t (5.5 oz/t) Silver, 5.8% Lead and 9.4% Zinc.

- WPC22-020 is located 50 meters south and 25 meters west of WPC22-018, which cut 101m of massive sulfides interpreted as a feeder chimney (See News Release of September 22)

- The WPC22-20 high-grade intercepts appear linkable to high-grade zones in the interpreted WPC22-018 chimney

- Both intercepts show classic multi-phase CRD-style massive sulfide mineralization with silver-rich lead mineralization stages cutting earlier zinc-rich stages (See Table 1)

- Similar mineralization has now been cut at similar elevations in 10 drill holes indicating a continuous elongate body 30 to 75 meters wide and 400 meters in length (See Figure 2)

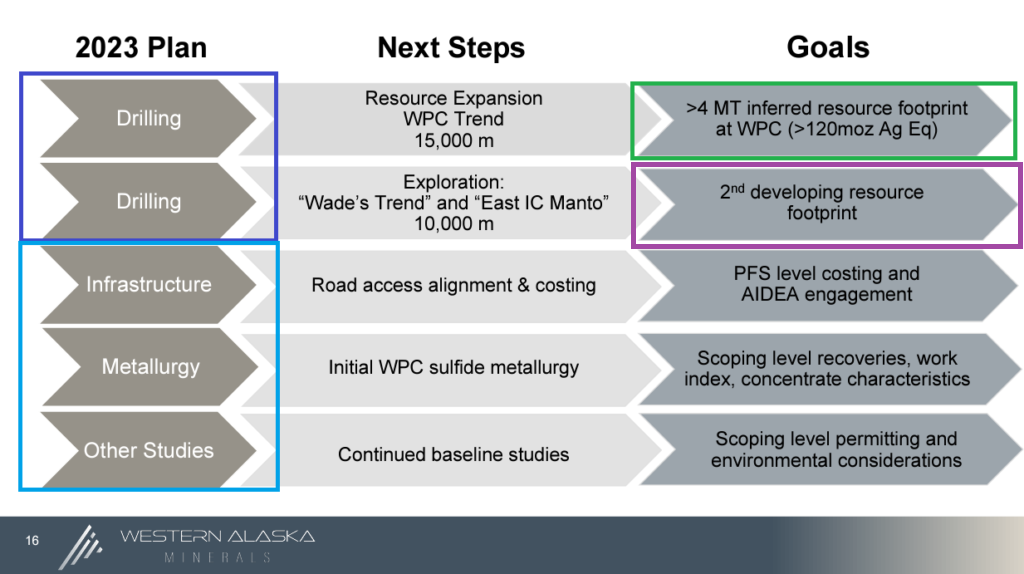

Looking ahead

The company has very ambitious goals for next year which highlights the potential for significant value creation (Alpha):

Discussion

If the company gets close to the stated goal of inferred resource after the 2023 campaign then that means Western Alaska could rival the reserves of >$1 B MCAP SilverCrest Metals, in just about 12-18 months time, with similar grades to boot. Another goal is to have developed a second resource footprint in addition to the current trend. You will also note the many initiatives beyond simply drilling up ounces. A lot of studies are planned which you typically don’t see in an average junior for the simple reason that a) It costs money, b) They typically don’t even have good projects, and c) They don’t want to get answers to necessary questions that might risk endangering the allure of the projects which would affect their pay. In the case of Western Alaska the insiders have so much skin in the game that a big success for shareholders, including themselves, eclipses the value from their salaries. In other words insiders have extremely high incentives to push the project(s) towards either a cash flowing business (mine) and/or a buy out. The decision to go up to #5 rigs should also be seen in light of the huge insider ownership as it means quicker answers in exchange for a hike in expenditures. Obviously increased pace of drill risk is seen as very much worth it in light of expectations for many positive answers.

Since there are never any guarantees of anything we take on risk in exchange for potential rewards. If Western Alaska achieves favorable results from the many planned initiatives and goals for 2023 then there is potential for significant rewards.

“Margin of Safety”

Western Alaska is currently a high octane exploration story with no banked resource and as such it would typically be deemed to be a very high risk/high reward case to most. I would however point out that even though there is no resource there is a reasonable chance that mother nature has endowed the known strike of around 400 m with perhaps around 37 Moz AgEq of high-grade mineralization. This would be on part with around 1/3rd of SilverCrest Metal’s reserves. Thus this is an exploration story with possibly many valuable birds in the bush and lets 1/3rd of a potentially very valuable bird in the hand already.

I have found that the easiest way for me to gain conviction, and to keep conviction through the short term volatility, is to visualize the long term Risk/Reward:

(Not it is not risk-adjusted nor accounting for dilution)

The market tends to be very short term orientated coupled with oscillating between greedy and fearful. Right now the market is very fearful and nobody feels good about taking risks in almost anything. Hence I think this is a perfect time to be willing to take on “risk” because when appetite for risk is low the real (valuation) risks tend to be low. Furthermore I think there is a very good “time arbitrage” between today’s price and the risk adjusted value of the Waterpump Creek post 2023 season. In my opinion Western Alaska is undervalued on a risk-adjusted basis given what is known about the first 400 m of strike coupled with the obvious upside potential across the entire ~8 x 8 km2 system footprint. This does not even factor in the >0.5 Moz oxide resource or the other targets across the immense >73,000 land package which has been assembled:

Note: This is not investing advice and I am not a financial advisor. I own shares of Western Alaska and the company is a banner sponsor. Assume I am biased. Do your own due diligence and make up your own mind. I share neither your profits or losses. Assume I may buy or sell shares at any time. Never invest in a stock if you don’t know why your are investing.

Best regards,

The Hedgeless Horseman

Dear Erik,

do you have any insights to share about the recent share price decline of WAM despite the private placement and Biden’s actions on drilling in Alaska, which should from my understanding only be related to oil and gas exploration?

Thanks & best regards!

WAM already clarified that their land position is on state land. So, they are not affected by any of Biden’s actions on drilling in the US.